olegas Feb 28, 2022 / 393 Views

These two terms are directly related to trading in the futures market. They both involve the difference between the current price of the underlying asset and its price in the future.

Contango (from the English word contango, translated as a price premium) implies the current price is lower than it will be in a certain time frame. That is, a futures contract (by definition, suggesting the delivery of goods after a certain time) costs more than the current price of the underlying asset.

Backwardation (from the English backwardation - delay) assumes that the current price is higher than what will be in some time. In other words, a futures contract for the delivery of a commodity is cheaper than this commodity (the underlying asset).

A reasonable question may arise here: how can one talk about contango or backwardation of a futures contract if its price in the future is not known for certain? After all, the price value in the future is always just forecasts that may or may not come true. That is, we do not know for certain whether the price will rise relative to its current value or fall. Is it really?

Well, not really. As for futures contracts, here we can talk about whether its price will increase or decrease by the time of expiration.

Let us recall that the expiration date of a futures contract is the date of its expiration (the actual delivery of goods under the futures contract).

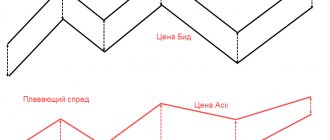

The fact is that at the time of expiration, the futures price is always compared with the price of the underlying asset. Therefore, if at the current moment in time the futures price is lower than the price of the underlying asset, then we can talk about backwardation, and if, on the contrary, the futures price is higher than the price of the underlying asset, then we can talk about contango.

If the above definition seemed too complex or confusing to you, then below are simple examples of contango and backwardation.

What is a contango situation in the futures market?

The futures price is based on the value of the underlying asset. And, for example, if by the time the contract expires the underlying asset is worth $1000 on the spot market, then the futures for it will also be valued at $1000. However, before the expiration date, the price of the asset and the futures may differ, both positive and negative. That is, a futures contract may cost more or less than the underlying asset depending on market conditions. The futures curve will either rise or fall. The growth of the curve is contango.

Contango is a market situation when the price of a futures contract in the future is greater than the price of its underlying asset at the moment. And also when a future with a more distant expiration date (far futures) costs more than a contract with a close expiration date (near futures). Supercontango also happens.

The difference between the price of the futures and the underlying asset (or between the prices of far and near futures) is called the basis.

Contango situations often occur in commodity futures, as well as equity futures.

The term Contango itself originated on the London Stock Exchange as the name for the fee that the buyer gave to the seller if he wanted to extend the expiration date of the transaction. For example, if a buyer purchased a contract for the supply of 1 ton of wheat in September, but later realized that he would only need the grain in October, then he would pay the seller a certain amount to hold the goods for him for another month.

Why is there a difference between the spot price (that is, the price of the underlying asset on the exchange) and the futures price? There are many factors that determine this. For example:

1. The seller's expenses for storing the goods. This is true for commodity assets such as oil, precious metals, and grains. The current price of goods does not reflect these costs, but they are built into contracts for the delivery of these assets in the future. And the longer the product purchased using futures stays in the warehouse at the expense of the seller, the higher the premium will be. That is why distant futures are often more expensive than near futures. 2. Investor expectations. Forecasts rule the market, and if trading participants assume that the price of the underlying asset (be it gold, shares, currency or stock index) will actively rise in the future, then the futures for this asset will rise in price.

Why does contango happen?

Let's list the main reasons:

- Costs associated with storing, disposing and transporting an asset.

- Investor expectations. This point should be discussed in more detail.

We have already given an example with the Dollar/Ruble currency pair, when a trader assumes that the exchange rate of the American currency will rise against the ruble. These expectations are based on economic forecasts and fundamental analysis data.

When an economic crisis approaches, contango often occurs in the prices of gold, which is a protective asset.

Also, futures for dividend stocks with an expiration date on the eve of the payment of income to shareholders are much more expensive than the current (spot) price of the securities.

But investors' expectations may not be met. For example, the issuer may postpone the dividend payment date. As for the contango on the oil market, the price of “black gold” may sharply turn in the opposite direction after the next political decision is made.

And if the upcoming costs can still be somehow calculated before including them in the contract price, then expectations from the market are based only on forecasts. That is why transactions with futures, especially long-term ones, involve considerable risk and are not recommended for beginners, as well as traders with a small amount of capital.

Contango example: how it works in practice

For clarity, consider an example of contango on Brent oil futures with an expiration period of 3 months. There are two parties involved in a transaction: the buyer and the seller. And each of them seeks to get their own benefit:

Salesman:

I am ready to deliver oil to the buyer in 3 months at the price that the buyer and I agree on now. But all this time until the expiration date, he will have to store this oil somewhere. This means that he will have additional costs for maintaining the oil storage facility.

It turns out that if the futures price is equal to the spot price of oil, the seller will suffer a small loss in the amount of storage costs. To cover this expected loss, the seller includes it in the futures price. Therefore, it turns out that the price of a three-month contract for Brent turns out to be several percent higher than the cost of oil itself.

Buyer:

He wants to buy oil at the best price, but only in three months. Now he has no urgent need for this underlying asset, and he has nowhere to store barrels of “black gold”. Therefore, he buys futures to fix a price that is acceptable to him in the future.

But what about the premium (after all, futures will cost more than oil itself)? The buyer believes that market conditions will contribute to a further increase in the Brent rate, and in 3 months the cost of a barrel will be even higher - even more than if you buy the futures at a small premium.

What is supercontango

A contango market situation is characterized by the fact that demand for an asset falls while supply remains unchanged or increases. When there is a very strong or sharp drop in demand, supercontango occurs.

In some cases, buyers are willing to pay a much higher price for an item in the future than to buy it at a discounted price now when they don't need it at all. An example of supercontango is the situation with prices for oil contracts that arose in the spring of 2022. With the start of the global lockdown, the demand for “black gold” fell sharply, as the number of shipments decreased significantly.

It would seem, why not take advantage of this situation and purchase assets cheaply if you have available funds? The fact is that some goods tend to deteriorate, they need to be stored and transported somewhere, which entails costs that are completely unnecessary at the moment. It is much more profitable to purchase a product at a time when it will bring profit, and not lie in a warehouse as dead weight.

Supercontango: when not having is more profitable than having

Typically, there is not much contango between futures with different expirations or between the future and the current price of the underlying asset. However, sometimes exceptional situations arise in the market when the contract is significantly more expensive than the asset itself. Such cases are called “supercontango”.

A striking example of contango marked “super” is the sharp decline in oil prices in the spring of 2022. Due to the coronavirus pandemic, lockdowns have been introduced almost all over the world. No one traveled or flew anywhere, production was suspended, so the economies of the vast majority of countries no longer needed oil. In addition, Russia and Saudi Arabia, members of OPEC+, started a price “war”, which also put pressure on the market.

As a result, on April 20, 2022, a contango situation occurred that will certainly go down in the history of exchange trading: the quote for May oil futures dropped to $0.01 per barrel! “We are giving away oil for free, for just 1 cent, just please take it from us, since we don’t know what to do with it,” this is how one could roughly characterize the current picture.

What happened to the June futures contracts at this time? The cost of futures for WTI oil fell much less compared to May, to $22.7 per barrel (or by 10.4%). And the Brent contract expiring in June fell by 5.5% to $26.6. After all, investors still expected that the lockdown would end, and the demand for oil would gradually increase, and OPEC+ would stabilize the market.

Thus, it turned out to be supercontango, when buyers were willing to pay a noticeably higher amount for oil delivery a month later. Because, having bought the May delivery futures, they would certainly have received for it the entire purchased volume of “black gold,” which at that moment was absolutely unnecessary. And you would have to spend money on placing and storing it somewhere. Therefore, it was more profitable for buyers to pay sellers a good premium in order to save themselves from the worries associated with receiving and storing excess oil.

By the way, in June of the same year there was already a slight backwardation in futures, which later reached record values since 2022. The difference in the price of futures for delivery in April 2022 and in January 2022 was more than $5, and this suggests that the oil market is recovering due to growing demand for raw materials.

Practical example of supercontango

Super contango occurs periodically in the oil market. At some point, there is an overproduction of oil and its price falls. Speculators, knowing that this situation is temporary, stock up on “black gold” and expect a change in the trend.

In turn, holders of oil futures (potential consumers of raw materials) get rid of “near” contracts, purchasing long-term ones, the expiration date of which is later. Thus, the futures curve goes sharply upward.

This is due to the fact that there is too much oil and it will not be possible to use up the entire reserve in the coming months. Regulation of the production of “black gold” is carried out by OPEC. After a reduction in stocks, quotes go up, which often leads to backwardation.

Backwardation and contango: what is the difference between them

As we have already found out, the situation when a future is more expensive than an asset or a late future is more expensive than a contract with an early expiration is called contango. But in the market there is also the opposite situation, when everything is the other way around. This is called backwardation. In stock market literature you can also find other names for this term: backwardation (from the English Backwardation) or deportation.

Backwardation is a market situation when the future price of a futures contract is less than the current price of its underlying asset. And also when a future with a more distant expiration date (far futures) is cheaper than a contract with a close expiration date (near futures).

Deportation is a consequence of the fact that in the future the demand for the underlying asset will predictably decrease. To understand how backwardation works, let’s give a simple and clear example - not at all related to exchanges, but accurately reflecting the essence of the concept:

Let's say you want to rent a house by the sea. In the summer, at the height of the holiday season, booking a house will cost you quite a lot. But when autumn comes and the tourist rush, as expected, begins to fall, then housing rentals will also decline. In futures terms, a long-term house contract expiring in cool September will be cheaper than a near-term contract expiring in hot July. And an even more distant future with expiration in November (when there is nothing much to do near the sea) will be valued even less.

Backwardation and contango are mirror situations. But according to statistics, backwardation occurs less often than contango. We can say that this is a kind of compensation for market risks that pass when purchasing a futures contract from the seller of the underlying asset to its buyer.

Most often, backwardation occurs in the market for raw materials, perishable goods, which in the longer term may lose their value, and therefore distant futures for these assets become cheaper. For example, in the grain market this is a fairly common occurrence, since during long-term storage the grain can rot, and the buyer risks purchasing a lower-quality product and partially incurring a loss from this.

Backwardation has recently become a frequent “guest” in the oil market. True, the reason here is not the damage to the goods, but the risks of overproduction. Since oil countries tend to increase production volumes, it is quite expected that in the future the demand for oil will not cover supply, and the price of this raw material resource will fall.

But in the precious metals market, backwardation almost never happens; contango occurs more often. The reason is that gold and silver are non-perishable commodities and safe-haven assets that tend to rise in value during times of crisis.

What causes backwardation?

Backwardation and contango are opposite concepts. Both terms are related to the balance of supply and demand.

There are several reasons for backwardation:

- seasonality;

- weather;

- stock size;

- logistics costs.

Economists predict that this asset will become cheaper in the future, based on many years of observations and statistical data. Thus, it is known that the vegetables that we buy in winter at inflated prices will cost much less in the fall. The stock will fall in price after the dividend is paid. Finally, equipment will become cheaper because new models are being released.

But the forecasts may not come true due to a bad harvest, postponement of the meeting date, bankruptcy of the company, delay in the release of new products and other unforeseen circumstances. Therefore, making money on futures with backwardation is a kind of lottery.

Breakdown of contango and backwardation

As a futures contract expires, its price gradually “sticks” to the spot price of the underlying asset. That is, the values of the contract and the asset ultimately converge to one point. This reduction in basis is called contango/backwardation decay.

The futures market is designed in such a way that convergence between the prices of the contract and the underlying asset is a normal phenomenon. And the closer the futures closing date, the smaller the basis (difference in value) will be. What is the reason for this phenomenon?

The fact is that there are a large number of buyers and sellers on the market, who regulate the situation with their supply and demand. When there is less time left until the futures expiration date, buyers no longer have an incentive to buy the contract at much higher prices than the underlying asset itself. They are still ready to pay extra for futures, but not as much as, for example, a month or two months ago. Accordingly, because of this, sellers reduce the basis to meet demand from buyers.

Origin of the term[edit]

The term originated in 19th century England [20] [21] and is considered a corruption of "continuation", "continuation" [22] or "contingent". In the past, on the London Stock Exchange, contango was a commission paid by a buyer to a seller when the buyer wished to delay settlement of a trade it had agreed upon. The fee was based on the outstanding interest paid by the seller.

Usually the goal was speculative. Settlement days were held on a fixed schedule (for example, biweekly), and the speculative buyer did not have to take delivery and pay for inventory until the next settlement day, and on that day could "roll over" his position to the next by paying contango. payment. This practice was common before 1930, but became less common, especially after options were reintroduced in 1958. It was distributed on some exchanges such as the Bombay Stock Exchange (BSE), where it is still called Badla. [23] Futures trading, based on specific lot sizes and fixed settlement dates, came to the BSE to replace forward trading, which included flexible contracts. [ citation needed

]

This collection was similar in nature to the current meaning of contango, i.e.

E. The cost of future delivery was greater than the cost of immediate delivery, and the charge represented the cost of the transfer to the holder.

The Commission of the European Communities, in a report on agricultural commodity speculation, defined backwardation and reporting in relation to spot prices: “the futures price may be higher or lower than the spot price when the spot price is higher than the futures price. the market is considered to be in a state of backwardation. This is often called "normal backwardation" because the buyer of futures is rewarded for the risk that he is removing from the producer. If the spot price is lower than the futures price, the market is in contango." [3]

Theoretical price of futures in Forex and other markets

Each exchange-traded asset usually has two prices: one in the real (spot) market and the second in the futures market. Why are there two prices? Because in the physical market, the purchase and sale of assets occurs at the present moment in time, but in the futures market, the execution of transactions is postponed to some point in the future. At the same time, the futures price, like any market quote, is based on objective value, which depends on supply and demand.

In general, the theoretical price of futures on the Forex, stock or commodity markets is understood as follows:

The contract price at which the buyer is equally profitable both by purchasing the underlying asset on the spot market (with its subsequent storage until the time of use or receiving a profit on it) and by purchasing a futures contract for this asset with delivery of goods or settlement in the future.

Here are the TOP 7 factors that affect the cost of futures contracts:

1. The value of the underlying asset in the real market. 2. The “lifetime” of the contract (the period until expiration). 3. Interest rate of the Central Bank. 4. Costs incurred by storing or insuring an asset. 5. Differences in commission costs between futures and real markets. 6. Difference in tax rates. 7. Difference in exchange rates.

Formula for calculating the theoretical futures price

In general, the contract value is calculated as follows:

F = S * (1 + r * T/365)

Where:

- F is the futures price.

- S is the current price of the underlying asset in the real market.

- r is the risk-free interest rate on the underlying asset (or the deposit rate).

- T is the duration of the futures contract in days.

If the futures are open on shares for which dividends are paid, then the futures price formula will be supplemented:

F = S * (1 + r * T/365) – Div

Here Div is dividends.

For contracts on commodity market goods, another variable appears in the calculation formula:

F = S * (1 + r * T/365) + Z

Z value is the cost of insuring the goods and storing them.

If we talk about the price of futures in Forex, then changes are also made to the general formula:

F = S * (1 + r Nat * T/365) / (1 + r In * T/365)

In this formula, r Nat is the interest rate on non-risky assets in national currency, r In is the same annual rate in foreign currency.

Price structure of the futures curve

The formula for calculating the futures price is fair when market expectations regarding the value of the underlying asset are neutral. That is, when it is assumed that the asset price will not change over time. When experts predict an increase or decrease in the value of an asset on the spot market, the actual price of the futures contract will differ significantly from the theoretical (calculated) price. And instead of S (current price), the predicted price of the asset at the time of futures expiration will appear in the formula. Thus, a futures price curve appears on the chart, displaying either contango or backwardation.

The structure of the futures curve varies depending on market conditions. Let's take an example with the oil market - contango and backwardation are especially clearly visible there.

Today, the production capacity of oil-producing countries is so great that the world is experiencing an overproduction of oil: they produce as much of it as they cannot yet consume. And from 2016 to 2019, OPEC+ (an alliance of key countries-) sought production cuts from member states. During this period, contango could be observed, as OPEC's actions inspired belief in a further reduction in supply, an increase in demand and, accordingly, an increase in oil prices.

In 2022, OPEC+ was no longer able to control production so tightly: some countries participating in the alliance did not want to come to a common agreement and decided to produce as much oil as they needed. In addition, the global crisis caused by the lockdown was added, and in the long term, market expectations shifted towards falling oil prices. As a result, backwardation has appeared in the market, when distant contracts are traded cheaper than nearby ones. In this case, the structure of the futures curve is considered reversed (inverted).

Why does a supercontango situation occur?

As already mentioned, supercontango occurs when the market is oversaturated with some product in the absence of demand. Why does glut occur? There are only two main reasons:

- A drop in demand for goods caused by the global economic crisis or a general lockdown (as was the case in 2022). Then the demand for oil fell not due to a drop in solvency, but due to a reduction in the number of freight and passenger transportation.

- The accumulation of large inventories formed during periods of low prices. Speculators buy goods at a low price and expect the price to rise. However, production does not stop. As a result, more goods appear than cannot be consumed. This was the case in 2008–2009, when oil traders filled huge numbers of tankers with “black gold” purchased during bearish periods and expected prices to rise.

Making money on futures: theory vs practice

In theory, the value of a futures contract should be equal to the price of the asset in the future (at the time of its delivery). But due to the fact that it is impossible to accurately determine the future quote of an asset, the value of the contract is determined as the current price of the asset + the investor’s income, which he can receive in the time before the expiration of the futures. This income is generated from investing free funds (after all, a futures contract, unlike the asset itself, is not purchased at full price - only the collateral amount is first deposited) in other risk-free assets.

For example: you want to buy shares for 3 months - a period that is equal to the expiration of the futures for these shares. If the price of the futures and shares (the underlying asset) are equal, then it will be much more profitable for you as an investor not to buy shares now, but to purchase futures on them. You invest the free funds that remain in your hands (after all, the collateral amount is lower than the full cost) in non-risky assets. When the futures contract is executed after 3 months, you will not only have the shares themselves, but also a profit, even taking into account the fact that you “pay extra” for the cost of the futures. After all, non-risky assets will become a source of your additional income with a profitable investment. The benefit is obvious.

But keep in mind that in practice, the value of the contract and the price of the asset are not equal - this is a situation of contango (futures are more expensive than the asset) or backwardation (futures are cheaper than the asset).

In addition, there are discrepancies in price between futures with different expiration dates. And if this discrepancy deviates noticeably from the general formula above, then traders have the opportunity to make money on arbitrage. That is, if the distant futures are more expensive than the near one, then the trader can sell the distant one and buy the near one in order to take the difference in price for himself. And vice versa: when a future with a nearby expiration costs more than one with a more distant expiration, it is more profitable for an arbitrage trader to sell the nearest one and at the same time buy a distant future, and invest the freed funds in reliable assets such as government bonds.

To make money on futures using arbitrage, you need to have certain knowledge and experience. After all, it should be taken into account that the basis (the difference in the price of futures during contango or backwardation) is not static; it changes over time and closer to the expiration date of the futures it disintegrates. This is also influenced by an increase in consumer demand: the more traders consider buying futures profitable to make a profit, the faster the contract price will return to a fair level, and income from arbitrage will decrease.

Contango and deportation on commodity exchanges

The discrepancy between the value of an asset and a futures contract is of particular importance in the commodity market, since grain, sugar, cocoa, cotton are all assets that require physical delivery. And here the futures basis can change not only as the expiration date approaches, but also depending on prices in local markets. Let's show this using a clear example of contango:

Let's say that in Chicago the spot price of grain is $2.38 and the December futures price is $2.58. The basis, accordingly, is 20 points.

However, in the city of Barrington, the local price of grain is only $2.18 (that is, 20 cents cheaper than in Chicago). Because this grain is produced right here, and its price does not include transportation costs. It turns out that for Barrington buyers, the basis between the spot price and the futures price will be not 20, but as much as 40 cents.

If the futures price remains the same, and grain rises in price by $0.2 on the Chicago spot market and the local Barrington market, then the local basis will still drop to 38 cents, but will be higher than the basis in Chicago.

How is a change (expansion or narrowing) of the basis used in a situation of contango or deportation? Hedgers usually follow this pattern:

| Contango | ||

| Basis decreases | Near futures - buy | Long-distance futures - sale |

| The basis is expanding | Near futures - buy | Long-distance futures - sale |

| Backwardation | ||

| Basis decreases | Near futures - sell | Long-distance futures - buy |

| The basis is expanding | Near futures - buy | Long-distance futures - sale |

Global food price crisis of 2007–2008 [Edit]

In a 2010 article in Harper's Magazine

Frederick Kaufman argued that the Goldman Sachs Commodity Index caused a demand shock for wheat and a contango market on the Chicago Mercantile Exchange, which contributed to the 2007–08 global food price crisis. [16] [17] [18]

In a June 2010 article in The Economist

the argument is made that index tracking funds (with which the Goldman Sachs Commodity Index was associated) did not create the bubble. It describes a report from the Organization for Economic Co-operation and Development that used data from the Commodity Futures Trading Commission to support this argument. [19]

How dividend stock futures are traded

Many stock market shares attract investors with dividend payments. And if from the moment of purchasing a futures contract for such shares until the moment of its expiration, dividends are expected to be paid on these shares, then the cost of the futures contract will be adjusted to the amount of dividend income.

Each company issuing shares has its own dividend cut-off date (or closing date of the register) - the day on which settlements with shareholders are made. And if the expiration date of the futures is later than the cut-off day, then the value of the contract will be changed by the size of the so-called dividend gap - a sharp decrease in the stock price. By the way, the gap itself arises due to the fact that investors usually hold shares until they receive payments on them, and when the securities are “gutted,” then the very next day after the dividend cutoff, the shares usually begin to be reset, which leads to their reduction in price.

How does this affect backwardation and contango? Look.

Let's say the dividend cutoff for shares is set for October 10th. And, for example, a futures contract with expiration on October 1 (before the cutoff) and a contract with expiration on November 1 (after the register date) are traded on the market. Because of this, there will be a state of backwardation in the market, when the near futures with expiration before the distribution of dividends will be more expensive than the distant futures for stocks, the expiration of which falls on the date after the cutoff.

But there are different situations in the market, and sometimes backwardation and contango suddenly change places. Let's give a real example with shares of the Russian Sberbank.

In 2022, Sberbank was supposed to pay its shareholders on May 14. But in April, the board decided to move the date to July 16, and this is after the expiration date of the June futures. It turned out that the June contract became more attractive for investors, and during the day the 7.7% backwardation turned into a 0.6% contango. And although Sberbank shares themselves rose in price by 1.2% on the Moscow Exchange, the futures for them with expiration in June jumped in price by 10%.

What is backwardation

When the value of an asset is currently higher than the futures price, this is backwardation. This is possible in cases of purchasing seasonal goods, which will become cheaper at the end of the season. For example, compare the prices of fur coats in winter and summer - the difference is significant.

In the stock market, we can talk about backwardation in cases when the price of shares falls after the payment of dividends. If you buy securities before the register is closed, their cost will be significantly higher than after settlements with shareholders. Therefore, if an investor is not very interested in receiving dividend income, it is more profitable to buy futures on securities.

Making money on contango and backwardation: an example strategy for dividend stocks

Dividend gaps are not the most pleasant phenomenon for investors who trade shares directly on stock exchanges. After all, after the closing date of the register, the stock price plummets, and you can make a loss. But with the help of futures contracts, you can not only break even, but also get a certain profit. To do this, the following strategy is used:

1. The investor finds out the exact dividend cut-off date and the amount of payments. 2. He buys stocks and sells stock futures in proportion. 3. It is important that the futures have a state of minimal backwardation, or better yet, contango (so that the futures cost a little more than the shares). 4. After the closing date of the register, the shares become cheaper and bring the investor a loss in the amount of the dividend payment. 5. A short position on futures for these shares, on the contrary, gives a profit in an equivalent amount. 6. The investor breaks even on the purchase and sale transaction itself. 7. In this case, the transaction with shares in time captured the closing date of the register, and the investor receives profit in the form of dividends.

However, this strategy for making money on contango and backwardation has nuances that must be taken into account in order to gain profit. For example:

- The investor must have a reserve of money in his trading account to cover the negative variation margin in case the stock rises (this is an unfavorable situation for a short position).

- You should be aware of deadlines. For example, if the dividend payout on shares = 5%, and you spend 20% of the total amount on collateral for futures on shares, then, accordingly, your profit from dividends will decrease by the same 20%. Let's say it won't be 5 dollars, but 4 dollars. And in this case, the longer you keep the deal open, the more your profit will decrease, and it is better to close earlier.

In general, trading on deportation and contango is quite complex; it is suitable for more experienced traders, but not for beginners.

About Admiral Markets

We are a global broker and are regulated by various regulatory bodies such as the FCA. We provide access to over 8,000 financial instruments to trade such as Forex and CFDs on shares, indices, bonds, commodities, ETFs and cryptocurrencies, as well as the ability to invest in real shares and ETFs.

With Admiral Markets you can use the most innovative trading platforms such as MetaTrader 4 and MetaTrader 5, as well as the exclusive MetaTrader Supreme Edition plugin, for free.

Start trading on the world's number one platform for trading across asset classes, MetaTrader 5, provided by Admiral Markets. Download MetaTrader 5 for free by clicking on the banner below!

How Contango Affects ETF Investors: The Case of USO

Contango can be quite insidious for the average investor. To illustrate this, let's take the example of the USO (United States Oil Fund) oil fund.

Imagine that you are an investor and the calendar says 2009. In January, the price of oil fell to record (at that time) multi-year lows of $35. But you, as a correct investor, knowing that 80% of corrections end in a subsequent reversal, decide to make money on a price rebound. You urgently buy shares of the USO oil fund because it is much easier than dealing directly with oil futures. Now you are waiting for the price of “black gold” to rise, and at the same time the price of your shares will rise.

Several months passed, and oil prices actually rose. You happily rub your hands in anticipation of a profit on USO shares, but... instead you record a loss. It turned out that the fund was falling despite the bullish trend in the oil market. Thus, in February, the price of oil rose by 7%, and USO shares fell by the same 7%.

Why did it happen so? Blame it on the oil futures contango. In anticipation of a further rise in oil prices, the cost of futures for this exchange asset also began to rise. Contracts with a more distant expiration date began to cost more than those that are executed in the near future.

The USO fund owns oil futures. And when the expiration date of nearby futures expires, they have to be sold and new ones bought - but at a higher price. And it was at the time of purchasing new contracts that the fund lost part of its investors’ funds due to the difference in futures prices. It turns out that your profit was “eaten up” by contango. And the larger it is, the higher the risks for traders who own shares of ETF funds. Conclusion: making money on contango and backwardation is not the best option for investment funds.

Description[edit]

A normal straight curve: the prices of several contracts for the same commodity, but with different maturities, slope upward. For example, a forward oil contract for twelve months in the future is selling for $100 today, while today's spot price is $75. The expected spot price twelve months in the future could still be $75. Buying a contract over $75 involves a loss (the "loss" would be $25 if the contract was purchased for $100) to the agent who "bought forward" rather than waiting a year to buy at the spot price when oil is actually needed. But even in this case, there is a benefit to the forward buyer in the transaction. Experience has shown major end users of commodities (such as gasoline refineries or grain companies that use large quantities of grain) that spot prices are unpredictable. Fixing a future price puts the buyer "first in line" for delivery, even though the contract , as it occurs, will converge on the spot price, as shown in the graph. In volatile markets where end users must maintain a certain amount of inventory at all times, a combination of forward and spot purchasing reduces uncertainty. A refiner can purchase 50% spot and 50% forward, receiving an average of $87.50 for one barrel of spot ($75) and one barrel of forward ($100). This strategy also results in windfall or "windfall" profits: if a contract is purchased 12 months in advance at $100 and the actual price is $150, then the refinery will receive one barrel of oil at $100 and another at the spot price of $150, or $125 on average for two barrels: an increase of $25 per barrel relative to spot prices.

Salespeople love to “sell ahead” because it blocks the revenue stream. Farmers are a classic example: by selling their crops while they are still in the ground, they can lock in a price and therefore an income that helps them currently qualify for a loan.

A chart of the “life of one futures contract” (as shown above on the right) will show that it is approaching the spot price. A contango contract for future delivery, selling today, has a price premium over buying the product today and taking delivery. A backwardation short contract is below the spot price today and its trajectory will take it up towards the spot price when the contract closes. Paper assets are no different: for example, an insurance company has a constant stream of premium income and a constant stream of claims payments. The income must be invested in new assets and existing assets must be sold to satisfy claims. By investing in the purchase and sale of some bonds forward in addition to spot purchases, the insurance company can smooth out changes in its portfolio and expected returns.

Contango for oil storage was introduced to the market in early 1990 by the Swedish oil storage company Scandinavian Tank Storage AB and its founder Lars Valentin Jacobsson, using huge military storage facilities to reduce the "design" cost of storage to create contango. the situation is outside the “flat” market. [9]

Contango is a potential trap for unwary investors. Exchange-traded funds (ETFs) provide an opportunity for small investors to participate in the commodity futures markets, which is very tempting during periods of low interest rates. Between 2005 and 2010, the number of futures-based commodity ETFs grew from 2 to 95, and total assets grew from $3.9 billion to nearly $98 billion over the same period. [10]Since the normal course of a futures contract in the contango market is to decline in price, a fund consisting of such contracts buys the contracts at a high price (in the future) and closes them later at a typically lower spot price. The money received from closed contracts at low prices will not buy the same number of new contracts in the future. Funds can and do lose money even in fairly stable markets. There are strategies to mitigate this problem, including allowing ETFs to create a holding of precious metals to allow investors to speculate on fluctuations in their value. But storage costs will be quite different, for example copper bars require significantly more storage space and therefore storage costs than gold, and are priced lower on world markets: it is unclear how well a model that works with gold will will work with other products.[10] Industrial buyers of staple commodities, especially compared to small retail investors, maintain an advantage in futures markets. The cost of a product's raw materials is just one of many factors that influences its final cost and price. Contango's pricing strategies, which take small investors by surprise, are more familiar to managers of a large firm who must decide whether to take delivery of a product today at today's spot price and store it themselves, or pay more for a forward contract. and let someone else do the storage for them. [eleven]

Contango should not exceed the cost of carry because producers and consumers can compare the price of the futures contract with the spot price plus storage and choose the better one. Arbitrageurs can sell one and buy the other for a theoretically risk-free profit (see Rational pricing - futures). The EU describes two groups of players in the commodity futures market: hedgers (producers and users of commodities) or arbitrageurs/speculators (non-commercial investors). [3]

If there is a short-term shortage, price comparisons are interrupted and contango can be reduced or perhaps even reversed entirely into a condition called backwardation. In this state, near prices become higher than far (i.e., future) prices because consumers prefer to receive the product sooner rather than later (see convenience income) and because there are few holders who can make an arbitrage profit by selling spot and buying future. A market with a sharp pullback, i.e.

E. A market in which there is a very high premium for materials available for immediate delivery often indicates a perception of current

shortages.

in the base product.

Likewise, a market that is in deep contango may indicate a perception of a current oversupply

of a product.

In 2005 and 2006, the perception of impending supply shortages allowed traders to take advantage of contango in the crude oil market. Traders simultaneously bought oil and sold futures contracts. This led to a large number of oil tankers idling in ports serving as floating warehouses. [12] (See: Oil Storage Trading) It has been estimated that this may have resulted in a premium of $10–20 per barrel being added to the spot price of oil.

If this were the case, the premium might end when the world's oil storage capacity was depleted; Contango intensified as a lack of inventory to store excess oil supplies would put further pressure on spot prices. However, as oil and gasoline prices continued to rise between 2007 and 2008, this practice became so controversial that in June 2008, the Commodity Futures Trading Commission, the Federal Reserve, and the U.S. Securities and Exchange Commission (SEC) The SEC) decided to create task forces to investigate whether this took place. [13]

Crude oil contango occurred again in January 2009, with arbitrageurs storing millions of barrels in tankers to profit from the contango (see oil storage trading). But by the summer this price curve had leveled off significantly. The contango demonstrated for crude oil in 2009 explains the discrepancy between the overall increase in the spot price ($35 to $80 per year) and the various traded instruments for crude oil (such as rolling contracts or long-term futures contracts) showing much lower increases prices [14] The USO ETF also failed to replicate spot crude oil prices' performance.

How to trade long and short with contango and backwardation

Intraday traders, as a rule, ignore both backwardation and contango, because when trading on lower time frames, these phenomena are invisible. But traders who trade futures for the long term must take into account the price difference. First of all, this concerns contango, since this market phenomenon is more common.

How to make money on contango/backwardation: Contango Backwardation Long You can lose the size of the basis between the futures and the spot price of the asset. You can make a profit in the amount of the basis. A short trader can earn an amount approximately equal to the basis. The trader incurs a loss in the amount of the price difference.

It turns out that during contango it is more profitable to open long positions in futures, and during backwardation it is more appropriate to short.

Fundamental analysis of the futures market

To understand exactly when to expect backwardation and when to expect contango, you need to conduct fundamental analysis - take into account macroeconomic factors affecting the prices of underlying assets. For example, here's what affects the oil market:

1. Decisions of the OPEC+ alliance on oil production . As we have already said, there has been overproduction in the “black gold” market in recent years. Therefore, in order to prevent a prolonged collapse in prices, OPEC+ periodically holds meetings and decides to reduce raw material production. If the participating countries manage to come to an agreement, then normal contango is possible in the market. And when alliance members do not reach a common decision, backwardation is possible.

2. Data from the US Department of Energy on oil reserves in storage . You will find this information in any economic calendar. Typically, the larger the reserves, the lower the price of oil on the market. Conversely, a decrease in reserves leads to an increase in oil prices.

3. Dollar exchange rate . Basically, all oil payments are made in US currency. Accordingly, when the US dollar becomes cheaper compared to most other currencies, this makes oil purchases more profitable for the issuing countries of these currencies. Because of this, demand increases, and after it the price of a barrel. But an expensive dollar leads to a reduction in purchases, which means lower prices.

In addition to economic factors, politics also affects oil. For example, when the geopolitical situation in the Middle East region worsens, there is a threat of disruption to international oil supplies and prices rise.

Fundamentals are important for all assets, not just commodities. For the Forex market, the following data will be important to you:

- GDP;

- Business and industrial activity;

- Labor market data;

- Central bank decisions on interest rates;

- Inflation;

- Data on the construction of new houses;

- Trade balance.

You will also find all this in the calendar of economic events.

Technical analysis of contango and backwardation

Like other financial instruments, futures are subject to technical analysis. However, the futures market has its own nuances:

High volatility

Due to the fact that futures trading involves the use of leverage, and to make transactions it is only necessary to reserve collateral (not the entire contract amount), there are many short-term traders in the market. Their actions add volatility compared to the charts of the underlying assets.

Uneven movement

Futures contracts have a start and end date; on average, this is six months to a year. However, the bulk of contract trading occurs in the last three months because as the expiration date approaches, the price of futures contracts approaches the value of the underlying asset. During this time, price movements become stronger and less predictable, making technical analysis more difficult.

Different expiration dates for one asset

Due to the fact that futures with different execution times can be opened for the same asset, it is not always possible to clearly analyze on the chart when the price moves from a near to a distant contract.

Open Interest

The number of contracts on the market is not constant: interest on the part of buyers and sellers is constantly changing up or down. In this regard, it is customary for futures to track such an indicator as open interest - the number of active contracts for which settlement has not yet been made. In other words, this criterion indicates liquidity. It is believed that the greater the interest, the stronger the trend will be, and with weak interest (little liquidity), the trend is unlikely to develop.

IMPORTANT!

The most important thing that you will definitely need to work with futures is knowledge of technical analysis of the underlying assets themselves. And here everything is becoming more clear: indicators, levels, patterns, candles - everything that is the basis for any trader.

How to select profitable stocks for futures trading: tips

To successfully trade security futures and profit from both contango and backwardation, it is important to select the most liquid stocks for trading, as well as those for which good dividends are expected. We have collected for you the top resources from Gerchik & Co that will help increase the efficiency of your investments:

1. Webinar by Alexander Gerchik on how to earn dividends for retirement. The legendary trader, who made a multimillion-dollar fortune on the stock exchange, shares his secrets for profitable investing in stocks:

2. Speech by Alexander Gerchik at the online marathon from the Cartel traders club. Take half an hour to watch the video of the master class and find out which dividend securities to select for your investment portfolio:

3. Regular webinars by Sergei Zabotkin on the selection of American and European stocks for trading. A trader and advisor developer with 9 years of experience shows which securities are worth paying attention to. Useful not only for futures trading, but also for CFD trading:

4. Telegram channel “Stock market analysis”. Here you will find daily professional reviews of the stock market, as well as learn about special offers and competitions from Gerchik & Co.

5. Analytics on the Gerchik & Co website. In this section you will find fundamental and technical analysis for various market assets. Including the stock market.

6. Materials in the “Personal Account”. After registering with Gerchik & Co, you will immediately have access to materials for profitable trading in the “Training” section. You will learn the basic principles of successful trading, which will be useful to you not only for futures on stocks, commodities and currencies, but also when working on any exchange.

Register with Gerchik & Co

Please note that all resources are free. Use them to improve your trading and investing skills.

Links[edit]

- ^ a b "Contango vs. normal backwardation". Investopedia. Retrieved June 21, 2022.

- Regli, F. & Adland, R. (2019). Crude oil contango arbitration and floating storage decision. Transportation Research Part E: Logistics and Transportation Review, 122, 100-118.

- ^ abcd Is there a speculative bubble in commodity markets? (PDF). Task Force on the Role of Speculation in Agricultural Price Movements

(Report). Brussels: Commission of the European Communities. November 21, 2008 - John Black; Nigar Hashimzadeh; Gareth Miles, ed. (2009). Contango. Dictionary of Economics (3rd ed.). Oxford University Press. ISBN 9780199237043.

- "Contango". Investopedia. Retrieved July 22, 2013.

- “A non-commercial trader is a trader who is not engaged in a business activity hedged using the futures or options markets (CFTC classification). The non-commercial classification does not include swap dealers, and trading of commodity indices is generally considered commercial."

- ↑

Kaminska, Isabella (8 July 2010).

"This is the BIS". FT Alphaville

. Retrieved September 1, 2010. - Symeonidis, L., Prokopczuk, M., Brooks, S., & Lazar, E. (2012). Futures base, inventories and commodity price volatility: An empirical analysis. Economic Modeling, 29(6), 2651-2663.

- "Understanding the concept of Contango, backwardation, convenience of returns in financial derivatives". Vox. Retrieved August 19, 2015.

- ^ab Carolyn Cui, "Caught in the Contango Trap: A Fad in the Futures Market Could Hurt Commodity Returns if Investors Don't Know It," The Wall Street Journal

, December 17, 2010, pp. C5, C8. - Tatiana Shumskaya and Caroline Kui, “Trader Holds $3 Billion of Copper in London,” The Wall Street Journal

, December 21, 2010, quoting the trader: “Stocking metals ready for delivery on an exchange is not a cheap undertaking for traders, who are responsible for paying insurance, storage and financing.” "The ultimate goal is to find someone who will buy what you already bought at a higher price," Mr. Trekeld says. “The recent boom in metal prices has allowed traders to buy physical metal, sell futures contracts at a much higher price, and still make a profit after paying for storage and insurance.” - ↑

Davidson, Adam (24 August 2006). "Analyst: Investors Blame High Gas Prices". NPR News. Retrieved June 14, 2008. - Mandaro, Laura (10 June 2008). "CFTC Investigates Energy Speculation with Fed, SEC". The Wall Street Journal marketwatch.com. Retrieved June 14, 2008.

- Liberty, Jez. "Crude Oil, Contango and Gross Returns for Commodity Trading".

- ^ ab Morrissey, Bob (January 2009). Derivatives: The Official Study and Reference Guide. London, UK: Institute of Securities and Investment. pp. 72–77. ISBN 978-1-906917-11-1. Archived from the original on October 6, 2008.

- ↑

Food Bubble: How Wall Street Starved Millions and Got Away with It, Frederick Kaufman,

Harper's

, July 2010. - Democracy Now (radio show), Amy Goodman and Juan Gonzalez, Interview with Frederick Kaufman, 2010 7 17

- TRNN - Jayati Ghosh (6 May 2010). "The Global Food Bubble" (PDF). Pacific Free Press. Retrieved July 30, 2010.

- Cleaning Up the Usual Suspects, Buttonwood, The Economist

, 2010 6 24 - Contango from Reference.com

- "York, etc. News." York Herald

: 2. 1803-02-28.

Yesterday was the settlement day in consoles, and Monday is the next settlement day. Due to the great shortage of money, the contango

in both cases is extremely large, almost equal to 15 percent. for money, from account to account. - Mitchell, James (1908). Significant Etymology (or the Roots, Foundations and Branches of the English Language). William Blackwood and Sons. paragraph 302. Contango is probably a corruption of "continue", a stock exchange phrase meaning a sum of money or interest paid to enable a buyer to fulfill the obligation to pay money for a speculative purchase of shares before the next settlement day; contango day, the second day before the settlement day.

- [1] Archived April 27, 2010, at the Wayback Machine.

- Keynes, John M. (1930). Treatise on Money. 2

. London: Macmillan. - ^ a b Robert Kolb; James A. Overdahl, ed. (2010). Derivatives: Pricing and Risk Management. New Jersey: Wiley. ISBN 9780470541746.

- Roger J. Bowden; Peter N. Posch. "Contango versus backwardation: states of disequilibrium and spot-forward balance in commodity markets" (PDF).

- J. R. Hicks (1939). Cost and capital.

- Ilia Bouchouev (2012). "The Inconvenience of Concession, or the Theory of Normal Contango." Quantitative Finance

.

Goods. 12

(12): 1773–1777. DOI: 10.1080/14697688.2012.723463. S2CID 154408201.