When virtual assets appeared on the market, all traders immediately felt their unpredictability, so much so that even a cryptocurrency arbitrage bot has a certain share of negative trades. The local market is filled with various risks that are often absent on other exchanges. And although trading itself implies a certain danger of losing your hard-earned money, cryptocurrency breaks all records for volatility.

Even experienced experts note that when trading digital coins, patterns sometimes easily fall apart, and technical analysis figures sometimes simply do not make sense. However, not everything is as bad as it might seem at first glance. Wild volatility makes it possible to make good money from jumps in the value of various assets. This is where cryptocurrency arbitrage comes into play.

What is cryptocurrency arbitrage

This concept is deciphered as a set of trading operations, the purpose of which is to make a profit on the difference in rates. If we talk specifically about my exchanges for cryptocurrency arbitrage, then such discrepancies in prices may be due to the following factors:

- Lack of centralization and standard management decision-making systems.

- The difference is in volumes. The following principle applies here: the more trading, the lower the value of the asset. The small scale is characteristic of services that have only recently begun their work and cannot yet boast a large volume of assets and the convenience of replenishing an account or withdrawing money from it. The amount of commissions also plays a role.

- Different amounts of the same cryptocurrency on two exchanges. An excellent example is Eksmo. In 2022, due to a sharp increase in the price of XRP, the exchange rate for this coin increased significantly, as users preferred to buy the asset rather than put it up for sale. But there was plenty of this currency on other exchanges. A serious difference in the exchange rate emerged, from which enterprising traders managed to make money.

Moreover, such an imbalance is constantly present. It’s just that sometimes it’s not as big as during strong market fluctuations. To verify this, take a look at the Coinmarketcap resource. Simply select any coin that you like best (I will demonstrate this on Bitcoin), click on the ticker, then go to the asset statistics and click on “Markets”. After this, you can display a list of different currency pairs by ticker.

This is what happened to me. As you can see, a difference in rates immediately formed, from which you can make money if you wish. The more cryptocurrency you have, the higher your income. Moreover, there are no risks as such at all.

You simply buy where it is cheaper and sell where it is more expensive.

That’s the whole trick of this type of cryptocurrency arbitrage.

I'll tell you about one more small nuance. A purchase and sale transaction can only be carried out if both exchanges have a sufficient number of the required coins. Otherwise, the “trick” will fail.

Rules for successful inter-exchange trading

Rules of inter-exchange trading

In short, the main rule of inter-exchange arbitrage comes down to a simple formula - latecomers pay money to those who came first. This strategy requires a lot of effort, hard work and information collection. And you can’t rely entirely on a robot, because a human wrote the algorithm for it.

☝️

However, due to the growth of the market and the number of arbitrage traders, it is almost impossible to act manually.

A trader is simply not able to simultaneously monitor the situation on the market and at the same time quickly respond to changes.

From all of the above, five rules of inter-exchange trading can be noted, based on which a trader can minimize risks and make a profit:

- Automation of the arbitration process using a robot/bot.

- Work on reliable sites. Of course, large differences in rates often appear on not very popular exchanges. But this does not mean that you should blindly run there and buy. Technical work, restrictions on input and output, low transaction speed and, ultimately, low liquidity. All this can significantly affect your earnings.

- Large volume trading. As mentioned earlier, the larger the deposit, the higher the earnings.

- Using cryptocurrencies with high network bandwidth. This is why altcoins are most preferred in inter-exchange arbitrage. After all, Bitcoin is not famous for its speed, and a transaction can take from 10 minutes to an hour from exchange to exchange.

- Enter and exit at the correct time. It is better to use a cryptocurrency arbitrage strategy in a calm market than when it is in a state of chaos.

Types of cryptocurrency arbitrage

There are two types of earnings from virtual asset courses. The first one is called "classic". If a chain consisting of several transactions occurs at the same time, then we are dealing with instantaneous arbitrage. Here is a list of necessary conditions for it:

- you buy a currency a little cheaper on one trading platform, and then sell it on another at a higher price;

- the same actions are carried out on three exchanges;

- work is carried out with 3 or more pairs of assets, but in the context of one resource;

- transactions are carried out on different trading platforms with a single system.

Arbitration is carried out with a time gap when:

- a standard asset is purchased and a fixed-term contract is implemented;

- trading is carried out using interconnected currency pairs when their rates change (for example, one of them sharply becomes more expensive or cheaper in relation to the other);

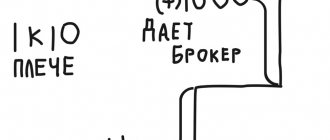

Time-gap arbitrage is a higher-risk method of making money on cryptocurrency. And if you use leverage, you can completely reset your deposit to zero. Therefore, this type is recommended only for experienced players who have an impeccable reading of the market. You simply must clearly understand what actions you are taking and why.

The second type of cryptocurrency arbitrage is called “static”. Here, profit is derived primarily from the inefficiency of the market itself:

- volatility that is very different from historical (high or low);

- from the movement of assets in different directions, subject to a correlation of 50% or more.

These methods of making money on cryptocurrency are considered high-risk compared to classic ones. If you choose this particular direction as a source of profit, you must clearly understand the need to have proper experience in determining positive and negative odds. If it is clear that the probability of a good outcome is much higher than a disastrous one, then you can enter into a deal. This technique is not only applicable to humans.

Sometimes a cryptocurrency arbitrage bot demonstrates much higher efficiency than the most experienced trader. So don’t forget about high technology if you want to increase profits and reduce possible risks.

To make your work easier, use correlation tables. Most of them appear and disappear along with the services on which they were published. However, there are also sources in which such visual graphic aids exist on an ongoing basis.

Correlation tables display the dependence of cryptocurrencies on various external and internal factors, as well as other coins. However, if you pay attention to the charts of Bitcoin and Ethereum, they will seem almost perfectly mirrored. Meanwhile, the correlation between them is only 0.514.

Looking at the table with the currencies Ripple and Bitcoin, it can be seen that their graphs converge or diverge by as much as 20% compared to the previous example. In this case, the correlation level is 0.625.

If you use the XRP/BTC pair, then with proper experience you can detect variations in turning points for the near future. In this case, the instruments are traded separately. The best option is to work against the US dollar, realizing or, conversely, buying up divergences or convergences.

What did I want to say with this little review? No matter how convincing the data from specialized Internet services may be, they are just auxiliary tools for making money. Under no circumstances should they be taken as absolutes. Always soberly calculate all the risks and the chance of winning against a complete drawdown of the account balance.

Types of stock bots

There are only three types:

- Exchange. They can enter into transactions within one trading platform. Earnings come from opening and closing a transaction in different time periods.

- Arbitration. Bots buy cryptocurrency on some exchanges and sell them on others, making money on the difference in the value of the same asset on different crypto exchanges.

- Telegram bots. To search for buyers and sellers in the Telegram messenger.

Each program differs from its competitor in the presence/absence of trading tools and indicators. Some allow users to significantly influence the trading process with flexible settings, others work according to standard trading strategies built into them.

How do you know which cryptocurrency trading robot is best for you?

Cryptocurrency bots are suitable both for simplifying tasks for beginners and for automating trading for experienced traders. What criteria should you pay attention to:

- supported cryptocurrencies;

- integration with trading platforms;

- program price;

- safety.

You should not install programs of dubious origin on your computer, no matter how much profit they promise from trading. Using dubious software, you risk losing capital if transactions are made incorrectly, and such programs can be infected with Trojan viruses that can transfer passwords from your accounts and wallets to scammers.

How to find the right cryptocurrency exchange

At the moment, about 300 official services are regularly monitored. Compared to all the proposals in general, this figure does not seem gigantic. However, among them it is necessary to select the site that best satisfies all the needs of the raider, which usually takes a lot of time. What should you pay attention to here? I will list a few of the most important factors for choosing a reliable crypto exchange:

- Liquidity.

If the resource has a sufficient amount of money supply, you can perform the necessary operation at any time. And this condition is much more important than the most favorable exchange rate. If there are not enough coins, the application will simply hang in the glass for an indefinite time. In the case of digital assets, this is the most valuable resource. To choose a crypto exchange in accordance with this condition, you can focus on various ratings. Also pay attention to the number of visitors and actual volume. Coinmarket gives good ratings.

Exmo is among the 100 largest cryptocurrency exchanges that are popular among Russian traders. This is a reliable project that is chosen by a large number of experienced players with virtual assets.

- Amount of commission.

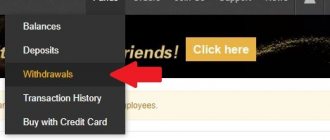

This point will determine your benefit from coin transactions. Be sure to take into account each commission separately: for crediting funds to an account, withdrawing funds from a deposit, performing trading operations, processing fiat transfers. The last option is considered the most expensive for the user. But you can’t do without it, since inter-exchange arbitrage is almost impossible to carry out with pairs that contain cryptocurrency and real money.

Such an operation will not be profitable for the trader even if the exchange codes are used. It all depends on the rate of the actual exchangers. Typically it is about 5% lower than the one used on the Internet resource. To make it easier for you to understand this topic, create a summary table. I recommend making transfers to Ripple, Dagcoin and most other coins that are not included in the TOP 30. And this is what a visual display of commissions using fiat money looks like.

| Currency | Input, % | Conclusion, % | |

| Exmo | RUB USD EUR BTC XRP | 3.49 1,99-3,99 2,99 0 0 | 0.49-1.99 3.99 1 EUR 0.0004 0.02 |

| YoBit | RUB USD EUR BTC XRP | 0 0 — 0 0 | 2-5 1-7 — 0,0012 0,5 |

- Number of available cryptocurrency pairs.

Pay attention to the variety of options containing the largest digital coins that fall into the TOP 100 in terms of capitalization. In order for cryptocurrency arbitrage to be simple and maximally profitable, such pairs must be duplicated on different sites in order to play on the difference in rates.

But what you shouldn’t do is work with assets that cannot boast of large capitalization. This is clearly proven by the indicators presented below.

There are two unpleasant traps here that you can fall into if you do not follow the rules of risk-free arbitrage: an instant change in quotes is not in your favor and the inability to get rid of an existing asset, since there are simply no other potential participants in the transaction.

Remember that simply choosing a working scheme is not enough. It is also necessary to check its effectiveness on small amounts so as not to immediately fall into a big minus.

Reasons for the difference in cryptocurrency rates, pump&dump and trap in Zimbabwe

Here are the main reasons why the rate for the same cryptocurrency differs on exchanges.

| Cause | A comment |

| The situation in the country in which the exchange servers are located | Changes in cryptocurrency regulation or the political atmosphere can significantly affect the rate. To learn about such events, arbitrage traders need to read economic calendars and understand the implications of fundamental factors. |

| Withdrawal methods | Exchanges have a set procedure for withdrawing profits, and if the conversion of cryptocurrency to fiat happens quickly and without problems, this leads to a decrease in the rate. Many people start selling cryptocurrency on this site and immediately withdraw money. |

| Speculation | The simplest and most popular is the pump&dump strategy, that is, “pump and run.” |

It’s worth understanding the pump and dump in more detail, because it affects the profits of all arbitrage traders. You need to know the scheme in order to use it to your advantage and not lose money on it.

The promotion of the course is carried out as follows:

- A coin is selected, usually it is not the most famous altcoin, such as b3 coin cryptocurrency.

- She buys diapers at a low price.

- A lot of news stories, articles and messages are being created about the prospects of this cryptocurrency, about the fact that you can make a lot of X’s with it (increase profits several times).

- Outsiders, that is, people who do not have access to real information, believe these messages and begin to buy the coin.

- The rate is rising, the advertising campaign continues.

- At the peak of the price, pumpers sell their assets at a high price.

- After some time, the information promotion of the coin is stopped.

- The rate begins to fall, people rush to sell cryptocurrency.

- As a result, investors who entered when the exchange rate was rising can no longer win back their investments and sell at a loss.

- In the end, the cryptocurrency rate usually falls even lower than the value it was before the pump began.

Pumpers usually work in groups, but very wealthy investors can work alone.

An arbitrageur can make money from a pump if he buys and sells cryptocurrency quickly and actively and gets rid of it before the rate goes down.

In rare cases, a sudden increase in the price of a cryptocurrency several times is not associated with a pump. A classic example that is useful for all novice arbitrage traders to consider is the situation on the African exchange Golix.

Golix.io.

In November 2022, the Bitcoin rate on it was more than 3 times higher than the market average, at peak moments it reached 34,000 USD per 1 BTC.

Bitcoin rate on Golix.

This created a great stir among arbitrageurs and simply traders who wanted to immediately enter this platform and resell their bitcoins there.

Hyperinflation in Zimbabwe.

Such a high rate was provoked by hyperinflation and the tense political situation in Zimbabwe. While the purchasing power of the local ZWD dollar was rapidly falling, the demand for bitcoins was growing.

However, those wishing to make money were in for a few unpleasant surprises:

- Withdrawal of funds from a verified account on Golix is allowed only to a bank account in Zimbabwe, and opened in national currency.

- To register an account, you need to fly to the country in person.

- Banks do not cash out large amounts due to the catastrophic situation with the local currency, that is, it is impossible to withdraw bitcoins directly into fiat.

- The Swift system is disabled in the country; it is impossible to send a transfer from a Zimbabwe bank account to the account of any other bank.

- The Zimbabwean dollar continues to depreciate.

Those who inadvertently transferred their bitcoins to the Golix exchange encountered numerous technical glitches in the operation of the trading platform.

According to unconfirmed rumors, the exchange was attacked by Chinese hackers, who hacked verified accounts and for some time carried out extremely profitable trading for themselves. In the spring of 2022, the Bitcoin rate on Golix is still 9,500 – 10,000 USD, but there are still problems with the operation of the exchange website.

There are legends on the Internet that some traders managed to make a fortune on Golix. Most likely, the only ones who receive income are the exchange owners themselves and the hackers.

How to make money on cryptocurrency arbitrage

The fact is that there is simply no universal principle for all cryptocurrency traders. Each investor independently selects exactly the trading method with which he is comfortable making money. Moreover, for others, such a scheme may not be suitable at all.

Algorithms quickly become outdated. If someone advised you to turn to a principle that showed excellent results just a year ago, then now such a scheme has probably lost its relevance. Competent and experienced arbitrageurs are always looking for something new and improving existing practices.

How is the price of Bitcoin determined?

Before we can talk about arbitrage (i.e. buying low and selling high), we need to understand what “bitcoin price” actually means.

READ:

What determines the price of 1 Bitcoin?

On any exchange, the price of Bitcoin is determined by the last trade made on that exchange. Since different exchanges have different numbers of buyers and sellers with different preferences, it is natural that prices will not correlate 100%.

You can think of exchanges as closed markets that are not directly connected. Additionally, some exchanges have very little trading activity on them, making the price of Bitcoin on them much more volatile.

As a result, some people try to buy Bitcoins "cheaply" on one exchange and then sell them at a higher price on another.

What is intra-exchange arbitrage

If you operate with futures hedging, you have probably noticed that this technique, in addition to the almost complete absence of any risks, also has a very low profitability. A spot asset is trading significantly cheaper than its counterpart at a future date. The closer the contract execution date, the smaller the price gap. Consequently, your income is also rapidly declining.

If we take Bitmex as an example, then the standard difference between the spot and the closest contract is approximately 130-180 points. When volatility increases, the gap can become 400 points or even more. If you manage to catch a good moment, you can make good money in just a couple of days. Such a strong imbalance usually does not last longer.

And here is a specific example of a positive outcome of a trading operation that lasted almost a day. BTC futures for December gave a profit of -1.

The basic one, purchased at the same time, showed a result of +2.

By superimposing both graphs on top of each other in one window, you can immediately understand their standard difference.

If you need to look at quotes at the moment of opening a position and at the end of its completion, point the scale at the desired candle.

This is how experts in cryptocurrency arbitrage usually understand at what approximate difference between rates it becomes really profitable to trade these assets.

There is another equally effective way to work on one site. This is the sequential execution of transactions with three currency pairs at once, demonstrating noticeable interest gaps.

Here you see that on the Eksmo exchange the imbalance is 0.7%. But for each transaction you will need to pay a commission of 0.2%. Therefore, you will have to pay back 0.6% in total, and the net profit will ultimately be only 0.1%. This is not a very effective strategy.

Useful sites for manual arbitrage

There are several programs that make it more convenient to monitor the market for manual arbitrage.

Cryptoarbitr.com.

The crypto arbiter helps you roughly estimate your profit and highlights interesting options for currency pairs, among which you can see bitcoin gold, the rate of which is suitable for starting arbitration.

Bitcoinity.org.

You can use the arbitration section of bitcoinity.org, the main thing is not to forget to calculate the costs of commissions, they are not reflected in the tables.

Coinmarketcap.com.

Coinmarketcap is another useful tool with which you can monitor rates on exchanges of interest.

Bitinfocharts.com/ru/.

Bitinfocharts.com gives the dynamics of exchange rate changes and shows the correlation.

Cryptocurrency exchanges generally have a positive attitude towards arbitrage; a set of tools is available on the following large trading platforms:

- Cryptopia;

- Poloniex;

- Bittrex.

There are 2 good mobile apps for inter-exchange cryptocurrency arbitrage.

| Name | Official site |

| TabTrader | tab-trader.com |

| zTrader | ztrader.ru.aptoide.com |

You can see the interface in the screenshots.

TabTrader.

zTrader.

Both options work on Android, and TabTrader also on iOS.

Technical support for cryptocurrency arbitrage

It is clear that performing all these operations manually is extremely problematic. Even the most experienced trader may not have time to react in time to a rapid drop or rise in the exchange rate. One of the investor’s assistants that allows you to competently conduct cryptocurrency arbitrage is a scanner. This program is designed to process and timely display the received data on the screen. The second is a special robot that is configured to carry out transactions automatically. Scanners also differ depending on the stock exchange research methodology used. There are several optimal options that have become the most popular among active cryptocurrency investors. I will give a couple of such examples.

Cryptocurrency Arbitrage: Risks and Limitations

Many exchanges impose restrictions on registration and use. Sometimes they require citizenship of the country where the exchange servers are located.

During trading, the crypt needs to be stored on the exchange, which is not very reliable.

Consider the costs: the exchanges themselves charge a commission for all transactions, transfers cost a percentage of the amount.

- To increase income, it will be necessary to increase the size of investments. Small transactions, taking into account all costs, bring virtually no profit.

- Exchanges have limits on withdrawals per day

- High competition.

Many exchanges are faced with a volume of transactions that they simply cannot complete quickly. Therefore, we have to wait a long time for translations.

Spread scanner for inter-exchange arbitrage DayTradingSchool

A very useful program that helps a trader analyze the cost of coins on 37 exchanges, among which there are such large resources as:

- Huobi;

- EXMO;

- Binance;

- Bitfinex;

- Kraken and others.

The price for a similar technical novelty for analyzing inter-exchange indicators at the beginning of 2022 was 24,500 rubles. In general, the amount is not catastrophic, considering how much time it saves its owner. This scanner pays for itself very quickly.

Recommended exchanges and exchangers

magneticexchange.com.

When choosing trading platforms, you need to consider the following nuances:

- Commissions. The lower they are, the less of your profit you will have to give to intermediaries.

- Cryptocurrency rate. It is advisable to give preference to sites with strong volatility.

- Speed of transactions. The faster the exchange can withdraw money and carry out the purchase and sale of currency, the better. A delay in time may result in loss of profits.

- Reviews, work experience, reliability and protection from hacking. The reputation of an exchange is an indirect guarantee of its integrity. There are no 100% safe online platforms, but all other things being equal, it is better to choose exchanges that are rarely hacked.

It is impossible to recommend exchangers for arbitrage, because their commissions have increased by 10-20% over the past year, and the total costs exceed the potential profit. The following are relatively good exchangers:

- Payeer.com;

- F1ex.com;

- magneticexchange.com;

- www.globus.com;

- Arbitrcoin.com.

To monitor profitable exchangers, you can use the website askoin.com.

Askoin.com.

The table shows the best exchanges for trading and arbitrage of cryptocurrencies.

| Site name | Official site | A comment |

| Yobit | Yobit.net | Russian-speaking, with a good live forum. More than 1000 cryptocurrencies, characterized by strong exchange rate volatility. There are currency pairs with the ruble. |

| EXMO | Exmo.me | There is cashback on commissions, order execution is fast. |

| Livecoin | Livecoin.net | Wide range of ways to replenish your account and withdraw money. |

| BTCTrade | Btc-trade.ua | Ukrainian stock exchange, beloved by the Russian-speaking audience. There is a replenishment via Privat24. |

Experienced arbitrageurs prefer little-known Asian exchanges, where there is huge volatility in altcoin rates due to pumps.

What are the types of bots for cryptocurrencies?

In addition to arbitrage techniques for working with digital assets, there are a number of such programs designed for standard work with other markets. Such assistants can be paid (BTC Robot, Cryptotrader, Tradewave) or with free access for everyone to register (a typical representative is the Autocrypto-bot expert).

If you decide to take cryptocurrency trading seriously and are looking at automated experts, I advise you to take a closer look at the following examples:

- Autocrypto-bot.

This is an entire platform that supports several fully automated robots. There are also trading signals here. Moreover, everything is combined into one interface, which is very convenient for the user. In this case, you will have to pay $44 for arbitration. This is the tariff for an advanced trader, allowing him to use all the benefits of the platform for 30 days. The robot currently works with the following exchanges.

- Cryptohopper.

Another good service for making money on cryptocurrency automatically. It has everything that can be useful for an experienced and novice investor: a set of financial instruments, several effective bots and various triggers. The arbitration function will become available after paying for a tariff costing at least $49 per month of use.

And here is the list of cryptocurrency exchanges with which this project actively cooperates.

- HAAS bot.

This option is somewhat more complicated than the previous ones. This robot is designed primarily for advanced users, who can hardly be intimidated by the abundance of graphs and the complexity of the program’s internal settings. HAAS bot is more focused on classic trading. However, arbitrage here is also possible, but only using three cryptocurrency pairs in the context of one exchange.

This application is recommended for trading platforms with a high volume of assets. But this robot shows the best results if the interest in transactions on the part of market participants is low. A striking example was the second and third quarters of 2018.

Currently, the profitability of this bot has dropped sharply due to high competition and almost instantaneous leveling of quotes. In order to earn at least something, you should opt for crypto exchanges with minimal commissions (ideally, zero commissions).

- Zenbot.

This is a program with real artificial intelligence. A truly thoughtful assistant, capable of working with multi-transactions, scalping the market and acting in an arbitrage direction. The main feature of this bot is its open source code.

In addition to its multitasking, the program is also considered one of the most effective compared to many competitors. Based on reviews from real users, Zenbot can generate 1500% revenue in just 1 quarter.

- ApiTrade.

This is a platform designed to work with API keys of the most famous cryptocurrency exchanges. Here you can adjust trading strategies, as well as conduct inter-exchange arbitrage. Moreover, in the latter case, the “Mirror” scheme is used. To use this service you will have to pay half of the profit received. ApiTrade will be very comfortable for beginners to work with. For cryptocurrency arbitrage to be truly profitable, you need to choose assets with the cheapest transactions.

In addition to bots and scanners, there are highly specialized sites and special software designed to analyze cryptocurrency quotes. I can’t say that these are really valuable assistants for traders who work more with arbitrage techniques, since everything is not updated very often (about once every 5-10 minutes). So I wouldn't trust them completely. If you want to try your hand at making money on the difference in quotes for different coins, try first working with assistants who really simplify this not the easiest process. This will help you assess your own strengths and level of knowledge, as well as avoid severe account drawdown at the first stages of investing.

Programs and services

Manually monitoring exchanges is ineffective. For this purpose, programs have been created - scanners and robots. The former process and display information on the screen, the latter are configured to independently conduct deals and transactions.

Scanners

Since scanners do not conduct transactions, but only register opportunities, further actions must be carried out either manually or using additional software.

Spread scanner for inter-exchange arbitrage

Assistant program for scanning prices on 37 major cryptocurrency exchanges, including:

- Binance;

- Huobi;

- Kraken;

- Bitfinex;

- and others.

Website: https://daytradingschool.ru

The cost of the inter-exchange analysis scanbot for January 2021 is 24,500 rubles.

CryptoShock.org

Inter-exchange arbitrage scanner, demonstrates the results in the fxsa.org/threads/8290/ thread.

Bots

There is another category of market participants who trust the process to robots. In addition to arbitrage ones, there are robots with settings for classic trading, paid ones - Cryptotrader, Tradewave, BTC Robot and free ones , for example, Gekko.

Bitsgap

Platform with automated bots, signals and trading on exchanges through a single interface. The arbitrage function between exchanges is available on the advanced tariff for $44 per month.

Supported exchanges:

Link: https://bitsgap.com

Cryptohopper

Service with trading tools, triggers and bots for automatic trading. Arbitration is available on plans starting from $49 per month.

List of supported exchanges:

Link: https://www.cryptohopper.com

HAAS bot

A program with numerous settings, focused on trading. However, it includes the ability to arbitrage trades from three crypto pairs within one exchange.

The HTS 3.0 Interfac internal bot app is recommended for use in high-volume sites.

However, the developers concluded that the robot shows the best results when interest in trading is low, as was the case in the second and third quarters of 2022.

Now, when order books are tightly filled, competition is high and quotes are quickly leveling out, the assistant earns very modest amounts. At a minimum, you should choose exchanges with zero or very low commissions.

Address: https://www.haasonline.com/trade-bots/.

Zenbot

One of the most advanced bots. Artificial intelligence technologies are used to develop and support it. The program is capable of performing multi-transactions, trading using high-frequency strategies and concluding arbitrage transactions. The source code is open source, available at https://github.com/DeviaVir/zenbot.

Some users claim that they received income of up to 1.5 thousand% per quarter.

ApiTrade

A platform for connecting API keys of the most popular exchanges with the ability to configure trading strategies and inter-exchange arbitrage according to the Mirror scheme . The service takes 50% of the profit, suitable for beginners who have no experience with separate software. For arbitrage, it is necessary to select cryptocurrencies with fast, cheap transactions. Official website: https://apitrade.pro.

Read more about bots in the article: Trading bots for crypto exchanges - review of desktop and web versions.

Services for comparison

There are also special sites and software for comparing cryptocurrency quotes. In general, their value is questionable (updates every 5-10 minutes or less), so you shouldn’t completely trust them with all the analytical work:

- Bitcoinity - comparison of Bitcoin quotes.

- Bitinfocharts - comparison of quotes for different cryptocurrencies.

- Cryptowat - correlation and other data, the ability to create a portfolio.

- Bittrex/Yobit Exchange Tool is a free program for finding profitable trading pairs on the Bittrex and Yobit exchanges with the option to purchase a Pro version.

- zTrader is a trading platform for Android.

- TabTrader is a terminal for a smartphone.

Risk reduction

In order to competently manage finances in arbitration and avoid severe account drawdown, you need to take into account several important nuances:

- Once you have decided on a trading platform, your account on it needs to be verified as quickly as possible (if there is such a requirement). Otherwise, problems will arise with the first withdrawal of funds. Most likely, it will be blocked for a long time (usually several weeks).

- Please note that the deadline for receiving money on deposit indicated on the exchange website is only approximate. Often a period of 20-30 minutes is indicated. In reality, even Ripple can appear on the account with a delay. Therefore, you can only find out the exact period in practice.

- Always keep an eye on the amount of exchange commissions. They can be changed frequently without notifying the user. A striking example is Eksmo and Yobit.

- To preserve capital, do not send more than 10% of your account balance in one order. This must be done after passing the minimum investment threshold.

- Working with Bitcoin requires a considerable budget. For example, it will be possible to carry out an operation with a pair with BTC at a rate of $10 thousand per coin only if you have at least $1.5 thousand on deposit.

- Look for lines with the maximum gap in inter-exchange transactions. Ideally, you should consider a difference of at least 5%. In extreme cases, 2% will do if there are no additional commissions and the currency transfer does not cost a pretty penny. Paying attention to a smaller difference is simply unprofitable.

- Don't forget about trading sessions. In the case of digital assets, it is better to visit the exchange when American traders join the work. This way you can experience the highest volatility and take advantage of more arbitrage opportunities.

- Work with liquidity in mind. Identify the average volume of cryptocurrency pairs that will best satisfy the need for speed of order execution, as well as their accuracy. This will help you choose the right trading platform. Usually the volume is indicated in BTC.

If you are still new to the field of cryptocurrency arbitrage, do not forget about the possible risks when using automatic robots. When switching to simple trading transactions, do not remove stops and do not invest all your free days in one asset. This is a surefire way to lose every penny.

A simplified example of cryptocurrency arbitrage trading

Let's take a simple example of arbitrage to illustrate how this happens. For example, the price of Bitcoin on Binance is $35,800, and on Exmo it is $35,899.

The prices differ by $99 and this is a decent arbitrage opportunity. Let's say we buy 100 Bitcoins on Binance at a rate of $35,800 each, and then sell them on Exmo at a rate of $35,899 each.

Let's move on to the calculations:

- Number of Bitcoins purchased on Binance – 100

- The price of each bitcoin is $35,800

- Total expenses – $35,800 * 100 = $3,580,000

- Number of Exmo bitcoins sold - 100

- The price of each bitcoin is $35,899

- Total income – $35,899 * 100 = $3,589,900

- Total profit – $3,589,900 – $3,580,000 = $9,900

You need a relatively large amount of capital to make significant profits through arbitrage.

Scheme No. 3. Intra-exchange triangle

Sometimes arbitrage opportunities arise within the trading platform itself. For example, when there is a divergence in the quotes of several cryptocurrencies. This arbitrage scheme is called intra-exchange or triangular.

Schematically it looks like this:

Arbitration on cryptocurrencies “Intra-exchange triangle”

As a result of such an arbitrage scheme, the profit will be 8235 – 8000 = 235 dollars, excluding commissions that the exchange charges for trading operations.

The second name of the scheme – triangular – is conditional, since there can be more than three assets in the chain.

The disadvantage of intra-exchange or triangular arbitrage is the risk that during the selection of the optimal chain of cryptocurrencies, their quotes may change. To minimize it, traders use unique cryptocurrency trading robots.

In turn, on some cryptocurrency platforms there are special delays for such orders, which may negatively affect the profits from such arbitrage.

Statistical arbitrage – more flexible

Statistical arbitrage is very different from its classic friend. In essence, statistical arbitrage has much more in common with conventional trading strategies that rely on probability calculations. The main task is to identify patterns of price movements of different instruments and use them in trading .

It looks something like this: first, we select a portfolio of dependent instruments, for example, using the correlation coefficient to assess dependencies. Then, having a basket of interrelated instruments, we can determine which of them is currently undervalued and which is overvalued, and make a sale or purchase of one or another instrument.

A particular example of such trading is pair trading, when only two instruments are traded. And although the efficiency of statistical arbitrage is much lower, the strategy itself seems to be much more flexible than trying to equalize prices across different exchanges. The solution often comes down to creating a market-neutral portfolio, the floating profit graph of which moves in a certain channel, allowing risk-free transactions to be made on its boundaries.

In theory, statistical arbitrage allows you to build a stable synthetic instrument using dynamic weights for the size of opened positions. The main problem is finding stable inefficiencies . If the relationship is unstable, the chart will quickly move to the side and the portfolio will no longer be market neutral.

Is this popular in the cryptocurrency world?

Arbitrage has been around for centuries and is starting to gain popularity in cryptocurrency – but the opportunities may be short-lived.

Changes in supply and demand when cryptocurrency moves from one exchange to another can affect prices. Market volatility can mean that an arbitrage opportunity quickly disappears - but at the same time, unpredictable price changes often create new opportunities. With the right approach, you can theoretically earn a decent amount in a short time - and since there are more than two hundred exchanges, discrepancies in rates are inevitable.

Cryptocurrency trading - in miniature. Source: 2Bitcoin

Read on topic: Why 99 percent of traders cannot make money on the growth of Bitcoin and other cryptocurrencies?

There are also new approaches to cryptocurrency arbitrage that do not use exchanges. Paxful is a peer-to-peer Bitcoin exchange that directly connects buyers with sellers and allows you to buy BTC using over three hundred payment methods. It allows users in the US and Europe to be able to sell BTC to those in markets where it is more difficult or costly to buy - at a savings compared to the price on a local exchange.

The possibility of arbitrage on payment methods is also interesting. While it may be cheaper to purchase BTC via bank transfer, there is often a markup when using gift cards. Representatives of the platform claim that this gives the cryptocurrency community the opportunity to take advantage of this difference.

Should I use bots in trading?

This question is individual. It is definitely not recommended to give the adviser complete freedom of action.

In this case, there is a risk of significant losses. Some Forex traders recommend running robots and monitoring their performance.

But in this case, the very meaning of their use is lost. After all, a trader has to constantly be near the computer. Why not make decisions yourself?

In the world of cryptocurrencies, by the way, other problems are added to the problems with analysis. In particular:

- Some bots may transfer profits or a portion of them to the developer rather than the owner. Moreover, this may not happen immediately, but after some time, when a certain amount is collected in the owner’s account.

- Instead of trading, they collect information about the owner and transfer it to the developer.

- They sabotage the trader’s work in every possible way, trade in the wrong assets, and give deliberately incorrect signals.

The main advantages of robots for trading cryptocurrencies

- Speed of decision making . Even experienced traders need some time to analyze the market situation. Beginners do everything even slower. As a result, a trading opportunity may be missed. In order to avoid such situations, many traders prefer to use bots. They analyze everything much faster and make decisions more quickly than humans.

- Ability to analyze an unlimited number of pairs . If we compare a bot with a human in this parameter, the advantage again goes to the former. A person is simply not able to analyze a large number of assets and make an adequate decision. But some are trying to provide this work to bots, using only ready-made results from the work.

- No errors in the algorithm . A person in the process of market analysis can make mistakes. This is due not only to the level of training, but also to the psychological state of the trader. Bots work strictly within the framework of the algorithm. If there is a signal, he will use it.

- 24/7 trading . A person needs rest. Many people cannot devote more than two hours a day to trading. The bot works around the clock, it does not need to write or rest.

- The user has free time . Using bots involves giving a person more free time. After all, he doesn’t need to analyze anything. And many algorithms are configured to fully automate trading from the moment a signal appears until a decision is made.

- Lack of emotions . A person is susceptible to various psychological states. He is passionate, may experience a feeling of fear or become depressed. This affects trading results. The bot does not experience any emotions. He doesn't have passion. It only works within the framework of its algorithm.

- Discipline . Traders often make one serious mistake. They do not know how to manage capital wisely. A bot for the cryptocurrency market will act according to a pre-built algorithm. If the trade size limit is set to $10, for example, the bot will never change it on its own.

Disadvantages of bots for cryptocurrency exchanges

- Templates of actions . This has already been discussed above. Bots are not capable of independent analysis. They cannot understand when the market situation changes. Accordingly, errors begin that can lead to a complete loss of the deposit.

- The absence of emotions is an advantage on the one hand, but on the other hand, it is also a disadvantage. The fact is that a person, after a certain number of unprofitable trades, can decide to end trading for the day, for example. After some time, he may make changes to the system and start working again. The bot will trade until it is stopped by a trader or the funds in the account run out.

- The need for constant monitoring on the part of the trader . This is an important disadvantage that cancels out almost all the advantages. The point is that a robot cannot be left to work on its own. If it is written on the basis of an oscillator, then it should be used during the period of horizontal ranges. If the robot is written on the basis of trend indicators, it is better to use it when there is a clear trend in the market.

Arbitration, long familiar to Forex traders

This strategy should be very familiar to traders on the decentralized Forex market, where there is also no single order book. This method of work allows any broker to give arbitrary quotes, which is why leading and catching up ones begin to appear absolutely naturally, that is, the price of the same instrument can change with a noticeable delay. Naturally, the number of people who want to “restore justice,” that is, to bring prices on all exchanges to equilibrium, is growing, and the difference is gradually equalizing until trading in an instrument completely loses its economic meaning.

Unlike Forex, crypto exchanges are more like traditional exchange offices, since in the end you receive real currency in your hands. Since the cryptocurrency itself has emerged relatively recently, and liquidity on exchanges is not yet high enough, arbitrage situations occur much more often than on instruments with higher turnover. Add here the problems with reverse conversion of funds, that is, withdrawal back into fiat (official) money, and we get market leaders and outsiders that are obvious to the naked eye.

Disadvantages of cryptocurrency exchange robots

An automatic trading program does not always react correctly to sudden changes in the situation, and drives the trader to bankruptcy or leaves him without potential profit. A complete absence of emotions is not always a plus, so people shouldn’t relax. Most cryptobots are quite expensive and difficult for a beginner to set up.

Not all malware immediately steals your deposit; some work quite correctly at first, and the money is drained after the amount has multiplied. It happens that robots transfer part of the profit to the developer without the user’s knowledge or collect data about his digital wallets.