Childhood and youth

Robert Kiyosaki is Japanese by blood. Four generations of the millionaire's ancestors lived in the USA; Robert was born in April 1947 in Hawaii. Marjorie's mother worked as a nurse. Father Ralph had a PhD, studied at the University of Chicago, Stanford, and served as state secretary of education.

Businessman Robert Kiyosaki

Of course, my son went to the best school in the state. There Kiyosaki met a boy named Mike, whose father awakened business thinking in Robert. This man dropped out of school at the age of 13 and went to work, eventually becoming one of the richest Hawaiians.

Kiyosaki graduated from school in New York, in Great Neck. Upon completion of his studies, the young man did not want to leave the business capital of the United States and turned his attention to the Merchant Marine Academy. In 1969, an academy graduate got a job on an oil ship for Standard Oil of California (since 2005 - Chevron). Robert traveled across the seas and oceans for three months.

Robert Kiyosaki as a child with his family

Then Kiyosaki changed his life dramatically and entered the US Marine Corps. Robert participated in the Vietnam War as a combat helicopter pilot and was discharged from the army only in 1973. He was awarded the Air Medal for distinguished service.

The next step in Robert’s biography was business courses at the University of Hawaii. But the future investor did not stay there, because he did not want to waste time on an empty theory. After taking a short course in investing, Kiyosaki worked for three years as a sales agent at Xerox. Having accumulated start-up capital, in 1977 Kiyosaki opened his own business - manufacturing leather and nylon products. This business did not bring a lot of money, but it enriched me with experience in earning it.

Robert Kiyosaki in his youth

In the early 80s, in the wake of the popularity of rock music, Robert was engaged in the licensed production of T-shirts for rockers, at the same time he played on the stock exchange, and invested the proceeds in real estate. However, there is no exact information about which objects.

But this business also failed. At some point, Kiyosaki even lost his house and owed creditors almost $1 million. As the businessman’s wife Kim recalled, 1985 was the most difficult year in his life. There was no money, we had to spend the night in a car or with friends.

Literature about wealth

Many authors have written books and articles about ways to achieve wealth quickly. Some of them themselves seriously improved their own well-being through the publication of such literary works. There are also very real millionaires and even billionaires who decided to share their successful business experience, and their experience is especially valuable. In all these works, as a rule, there are similar features. To get rich, you need knowledge, skills, passion, hard work, perseverance, talent, desire for leadership, courage, optimism and many other traits of an outstanding personality. The authors of books about personal success seem to unobtrusively emphasize their own exclusivity, which bores the reader, who already thinks that all these millionaires-billionaires are the same. Kiyosaki is different, he breaks stereotypes and shows completely different paths to wealth. This is what attracts and repels at the same time.

Business

The success story of billionaire Robert Kiyosaki began, oddly enough, with complete bankruptcy. After analyzing the mistakes made, Robert came to the conclusion that they were typical for any businessman. At that time, already married Kiyosaki, together with his wife Kim, decided to share their secrets and conclusions with people. As a result, the ambitious couple opened the first school of financial literacy, which for 10 years taught those interested in the basics of financial management. Having later sold the company, the couple secured a comfortable life for themselves.

Robert and Kim Kiyosaki

The first one was replaced by the international educational company Rich Dad`s Organization. As part of this business, the Kiyosaki couple launched vigorous teaching activities, coupled with the distribution of the fruits of writing.

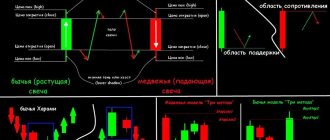

In his classes, Kiyosaki used audio and video materials, coaching, seminars, and workshops. Particularly famous are the business board games Cash Flow 101 and Cash Flow 202, which teach investment strategies. The game is used in educational programs of economic universities, and managers of large companies do not hesitate to play it.

Robert Kiyosaki and his book

The key achievements of education “according to Kiyosaki” include the concept of the cash flow quadrant and the interpretation of assets and liabilities, which stand out from the concepts of classical accounting.

To be fair, it should be noted that Kiyosaki’s investment experience in specific areas - oil, gas, securities and real estate - is not quoted in serious financial circles. By and large, Robert Kiyosaki is a pioneer in making money in the information business.

Robert Kiyosaki

Robert himself had already become so selective in matters of making a profit that he had earned substantial capital and allowed himself not to work. By this Kiyosaki does not mean idleness, but the absence of the need to earn a living. In other words, financial freedom is not working if you don’t want to.

But the businessman did not abandon his educational path - he writes books, two of them co-authored with Donald Trump.

Robert Kiyosaki and Donald Trump

Robert Kiyosaki's most popular work, “Rich Dad, Poor Dad,” has long been a bestseller in financial administration. It’s hard to imagine, but at first not a single store took the book; Kiyosaki sold it anywhere.

The prototype of the “poor dad” was Robert’s own father. While his son was serving in the army, Kiyosaki Sr. participated in the election of the lieutenant governor of Hawaii, lost and left his job. Then he bought a restaurant franchise, but went bankrupt. But “rich dad” is a generalized image of people who have achieved success, their experience, achievements, including Robert Kiyosaki.

Robert Kiyosaki with a book

In the book Rich Investor, Fast Investor, Robert explains how and why you need to increase your level of financial self-education. In “Success Stories of Rich Dad's Students,” the author gave stories of people who took advantage of his advice and guidance.

The main idea of the businessman's books is not only about making money, but also about the fact that even if you fail, you need to find the strength to get up and continue on your way.

Learn from mistakes

But Robert did not lower his head. This fall served as an important lesson for him. It was during that period, having reached financial rock bottom, that Robert promised himself not to suffer any more failures. He decided to follow the path of his calling - teaching.

Robert began conducting financial seminars with the Marshall Thurber Excellent Business Schools team. Robert eventually bought the business from Thurber. Subsequently, the school grew into an international educational company.

Personal life

In November 1986, Robert married Kim. At the beginning of her career, the woman worked as a manager in an advertising magazine. Then she switched to organizing trade in women's clothing. In 1989, she started investing on a big scale - she bought a house in Portland and began renting it out.

The future millionaires met in Honolulu through a mutual friend, Karen. At the same time, Karen met Robert 8 years before. Kim refused a date for six months, not being sure that her close friend did not have feelings for Kiyosaki.

Robert Kiyosaki and Kim Kiyosaki

At first, Kiyosaki appreciated the appearance of his future wife. The first date took place at the best restaurant in Honolulu and continued with a night walk on the beach with a bottle of champagne. Kim later admitted that thanks to this plan, Robert immediately won her over.

When the couple began to communicate closer, it turned out that Kim is a smart woman. His wife supported Robert in all his endeavors, participated in the work of her husband’s educational company, and steadfastly endured difficult periods in his life. According to Kiyosaki, his wife turned out to be a much more successful and competent investor than himself.

Robert Kiyosaki and his wife Kim

Kim Kiyosaki wrote an investment guide, “The Rich Woman,” guided by the fact that in money matters, men and women behave differently - depending on traditions, the perception of others, the psyche, and the emotional component. Kim emphasizes that financial independence is important for a woman (by the way, Mrs. Kiyosaki earned the lion's share of her own millions from independent projects).

The couple live in Bisbee (Arizona), travel a lot, and Robert shares photos from his trips on Instagram.

Exponential calculation

Net worth itself is not an indicator of wealth or poverty. It only reflects the instantaneous (current) financial condition. After all, if you earn 8 million a day and spend little, then minus 80 thousand is unlikely to affect your financial situation. To assess financial situation, you need to read a report on his income and expenses.

What does a balance sheet look like? Personally, I use it as a table. Take this template and fill it out for your specific situation. In the comments to this article, please answer a couple of questions:

- Is your emergency fund larger than your expenses for 3 months?

- Do you have an investment fund - a guarantee of a secure old age?

- What proportion are “other assets”?

- How does Fortune compare to your annual income?

- What is the percentage (%%) of your total liabilities compared to your annual income?

I will write in the next article which answers are correct.

Robert Kiyosaki now

In 2016, Robert Kiyosaki became a guest speaker at the Russian Investment and Export Forum. The investor predicted an increase in the Fed rate in January 2017 and, as a result, a weakening of the ruble and other currencies.

Robert Kiyosaki in 2022

In addition, Kiyosaki announced sensational news that caused confusion: the businessman withdrew capital from real estate and invested $300 million in insurance.

Experience No. 1: successful

Robert Kiyosaki's first experience as an investor and businessman in one person was associated with the sale of a product that was popular at the time - nylon wallets for surfers. The company was founded by him in 1977. The success of the young entrepreneur was based on two main factors that Robert mentioned more than once in his interviews. The first factor is a popular product, which began to gain popularity at a “viral” pace and made Robert a wealthy person. The second factor is the considerable experience in sales that Kiyosaki gained while working at Xerox. The author of “Rich Dad” describes this period in his biography as a time of rapid rise and equally rapid decline. What led to the collapse? According to Robert himself, improper handling of money and lack of financial literacy turned a recently successful young man into a debtor and a failure.

Education

As the owner of a company engaged in financial education, Robert Kiyosaki should, logically, welcome the acquisition of any knowledge, but in this matter he takes a non-standard and original approach. He argues that success in the study of economic theories and even high professionalism have nothing to do with the process of acquiring wealth. The whole secret lies in the ability to “manage cash flow”, which successful people possess. Those who do not have control over this mysterious phenomenon cannot earn much. How and where to learn this? Of course, not in ordinary business schools, from which tens of thousands of graduates graduate every year who know nothing. The Rich Dad Company is a different matter. The course there is expensive, but that's okay. Money can be borrowed, as mentioned earlier. This is an investment.

Applied significance of the theory

Robert Kiyosaki does not hide the fact that, of course, he considers network marketing to be the best and most accessible means of investing after studying at his Rich Dad Company. You should start with small turns, and then gradually expand your capabilities, reaching “gold”, “diamond” and other levels designated by epithets, most often used by professional fortune tellers. If something went wrong, and the entire apartment is littered with purchased goods, this means that the unlucky investor simply did not study well, and he needs an additional course, paid, of course. Rich Dad is always there to help.

Game "Cash Flow" - effective training in investment strategies

When Kiyosaki was writing the book “Cash Flow Quadrant,” he came up with a brilliant idea: to create an educational game based on his work. He called it CashFlow, which translated into Russian means “Cash Flow”.

In one of the articles in our magazine, I have already talked in detail about the game CashFlow (Cash Flow) in every detail. Let me remind you here that this is a truly effective and exciting method of teaching profitable investing and the rules of successful business.

The game helped me personally earn much more and understand the principles of how money works.

I guarantee that once you start playing, you will change your attitude towards real finance. The game is a kind of training that will allow you to evolve from an employee to a business owner and investor.

How should we feel about this?

The question of whether the advice contained in Kiyosaki’s books should be taken as a guide to action is something that each reader must decide for himself. If someone wants to believe in the omnipotence of his investment method and his ability to “control cash flows,” then it is possible that he will be able to curb the elements of the market, pay off his debts and earn large sums every month. Others should think twice before taking out loans to pay for an expensive business school. After all, if everyone becomes a millionaire, who will work?

Found a violation? Report content

Classes

Robert Kiyosaki conventionally divides all people into hired workers, forced to participate in the constant “rat race” for a place in the sun, and masters of life, who independently manage their own (or rather, and preferably, borrowed) money. In such a division of society into classes one could see shades of Marxism, if not for the contemptuous epithets with which the author generously rewards representatives of the working class. They do not understand the difference between saving and investing, are afraid to live in debt, and display other shameful signs of a “peasant” psychology. No matter how much money you give them, they will eat it all up (squander it) and ultimately remain poor.