Greetings, readers of my blog! Today I decided to pay attention to the issue of volatility and the tools with which it can be determined. A volatile market allows you to take more profit from each trade, the price travels a greater distance, which means the potential profit is greater compared to a calm market, the size of stops also depends on this parameter. The volatility indicator allows you to assess the potential of the market, identify for yourself those currency pairs or stocks that can give the maximum profit , so this information will obviously not be superfluous.

Understanding the terminology

Wikipedia gives the following definition of what volatility means - this is an indicator characterizing variability . In relation to markets, we can say that the greater the distance the price travels over a certain period of time, the more volatile the asset.

Maximum volatility is observed at the time when the majority of players trade, that is, during the operation of European and American exchanges. The most popular pairs show maximum progress at this time. It is advisable to carry out work during trading in the markets of Europe and the USA.

On the chart of any currency pair, you can distinguish periods of high and low volatility. When the market is calm, the potential of transactions decreases; instead of, for example, 70-90 points per transaction, it is possible to take only 20-40, and even then not always, the stop also decreases. There is even a separate term “ volatility risk ” - the probability of incurring losses while having an open trade as a result of a strong movement.

As examples of pairs with high volatility, I will give GBP/JPY , EUR/JPY - passing 150-200 points per day is not a problem for them. I discussed this issue in more detail in a separate article - the article on what volatility is is entirely devoted to it.

Please note that volatility increases greatly even in the case of a gap on the chart. For example, in the ATR , the calculation algorithm does not take into account breaks on the chart. Read about GEP and its use in my article.

MT4 has indicators to determine this indicator, but this is not the only way to evaluate the activity of trading participants . The so-called VIX volatility index , but it is only suitable for the stock market . For trading, for example, EUR/USD or any other currency pair, it is not of much use. Traders also call it the fear index .

This volatility ratio has been calculated since 1993 by the Chicago CBOE . The initial data for calculation is options on SPX .

The volatility index is an expectation index

As you already know, the price in the market moves under the influence of expectations. To understand how “calm” and confident market participants are in the economic prospects, as well as to measure the impact of fears about the future and changes in risk appetite, volatility indices are used.

These indices are measured as percentages and are usually calculated for an annual period. Their growth is a sign of market unrest, while low values indicate stability and high risk appetite.

Thus, the volatility index is an indicator of whether there is panic in the market or not. Consequently, its dynamics may be a hint about periods of rising or falling prices for the so-called safe haven assets: gold, yen, and at times the US dollar.

ATR is the first volatility indicator

It is this indicator that traders most often use in their work; it appeared almost 40 years ago. In 1978, the first mention of ATR was found in the book by Welles Wilder . The development turned out to be so popular that this indicator is integrated into almost all modern trading terminals. You will find it in MetaTrader, TOS, and QUIK.

ATR is used in many other volatility indicators, so I will dwell on the algorithm for calculating it in a little more detail. ATR values are calculated using the following algorithm:

- The true range is calculated, the maximum value of the three is selected

- The True Range is then averaged by a simple moving average.

On the chart in MT4 it is displayed in a separate window (drawn in the “footer”). The wavy line shows the range averaged over a certain number of candles. Can be used:

- To assess the state of the market , the higher the ATR value, the higher the volatility. During a pronounced trend, the line rises rapidly. The higher the ATR value, the higher the probability of a reversal . A growing ATR indicates a trend; if you prefer to trade in the direction of an established trend, take this into account. I have already considered the question of how to trade with a trend in more detail.

- To set a stop;

- As a filter . A threshold volatility value is set; if the ATR value is lower, then trading is not carried out. Such filters are often used in trend trading strategies when high volatility is important.

The indicator is rarely used as the basis of a trading strategy; much more often, it is used as a filter .

Factors influencing volatility

Current and future volatility can be significantly influenced by a number of factors, the main of which are described below:

- First of all, future volatility is influenced by its value in the past, that is, historical volatility. The greater the value of historical volatility, the greater its expected values in the present and in the future;

- Important political and economic events may have a significant impact on stabilizing or destabilizing the prices of entire groups of financial instruments;

- Market participants' expectations before the release of important economic news can also significantly affect post-release volatility;

- Changes in the level of liquidity of a particular financial instrument also, as a rule, on the volatility of its price;

- Time periods also have their effect. For example, volatility may vary depending on the day of the week or over time during a single trading session. For example, in the Forex currency market, a surge in the volatility of certain currency pairs is usually associated with the opening of financial institutions in the countries representing them.

- Technical support and resistance levels also have an impact on volatility. A breakdown of these levels, as a rule, is always accompanied by a noticeable surge in volatility.

Useful volatility indicators

In addition to ATR, you can list dozens of other indicators (many of them are obtained by combining several standard algorithms) by which you can judge activity in the market. I will list some of them below.

Standard indicators

All of the following algorithms are available in most trading terminals. You can judge the activity of traders by:

- Bollinger Bands – when the channel lines diverge, this coincides with a strong movement of the chart. If they continue to diverge, then there is a revival in the market, a pronounced trend or impulse movement.

- Keltner channel – exchange rate volatility does not affect it as much as BB, but you can still understand that activity in the market is growing. During surges, the price goes beyond the channel; the channel itself, by its direction, indicates a trend.

- CCI (commodity channel index) – when the oscillator line goes beyond the boundaries of the ±100 range, we can say that volatility is increasing.

You can list several more indicators from the standard category. But they have one thing in common - they help determine volatility only in general , without giving specific values.

iMACD ATR

The indicator window displays the MACD histogram, as well as a line shifted by the ATR value. When the histogram is above the zero level, the line moves down, and below the zero level, it moves up. The main advantage of this instrument is that volatility trading is possible:

- Trades are opened when the histogram crosses the zero level - a risky approach ;

- You can wait until the histogram column turns the appropriate color and enter the market after that. This happens when both the line and the histogram are on the same side of the zero line .

Due to the fact that the line is shifted by the amount of ATR, the histogram bars are colored red/green with a large lag . If the movement was impulse, then the indicator gives a signal closer to its completion.

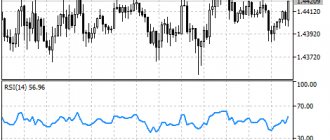

ATRMA_SS

An unusual indicator, in fact, a ready-made trading strategy . The algorithm uses:

- ATR with period 14;

- A smoothed moving average averaging its values .

Trading is carried out at the intersections of lines. For the convenience of the trader, these situations are indicated on the chart by arrows , and the moments for exiting the market are also marked.

Some traders also use it on small timeframes, up to M5 , trying to work not only on Forex, but also with binary options. On small time frames, the speed of order execution , so choose your broker wisely. For example, the Exness broker looks good from this point of view; even during strong movements, slippage is minimal .

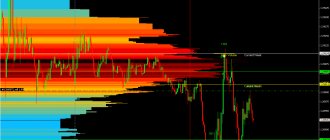

ATR levels

There is a whole set of indicators that build support/resistance levels depending on the current volatility and the range of chart movement in the past. They can be used, for example, when placing a stop or take profit . Sometimes such levels work even better than levels built based on local maximums/minimums. Read about what resistance and support levels are in one of the previous articles.

In the screenshot above, the levels are plotted using the Body_ATR . They can be used when working on lower time intervals.

Another interesting indicator from this category is Ku-Klux . He calculates the position of the levels based on the activity of traders over the past day. The general direction of the trend is also taken into account. If you supplement it with readings, for example, Stochastic or RSI , you will get a good basis for a trading strategy.

Importance for investors

For investors, the value of volatility is very important for at least five reasons listed below:

- The wider the range of fluctuations in the price of an investment object, the greater the potential risk and the more anxiety this causes for the investor

- The level of volatility of a financial instrument can affect the size of its position in an investment portfolio;

- If cash proceeds from the sale of securities may be required at any particular point in time, the high volatility of these securities may cause a shortage of these funds (due to the fact that most of the securities can be sold at the lowest phase of their price fluctuations);

- Price volatility makes it possible to buy cheap and sell high when assets are revalued;

- The high volatility of the securities included in the investment portfolio negatively affects its compound annual growth rate (CAGR).

How to use volatility in trading

Market volatility is information that helps not in finding entry points, but in assessing the market and deciding whether to trade at all. Most indicators that work with this market characteristic use the standard ATR ; some of these algorithms can be used as an independent trading strategy.

I can identify 3 ways to use volatility in trading:

- As a filter in trend trading strategies. If volatility is below a certain value, trading is simply not carried out; at this time the market is calm, and trend trading tactics will bring only losses.

- To place TP and SL orders, this can be done using the standard ATR.

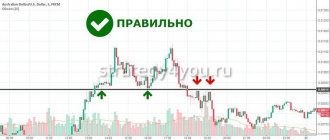

As for how to calculate volatility for setting a stop, you simply take the value corresponding to the signal candle and move it away from the entry point or using a modified indicator. Such instruments display lines on both sides of the candles on the chart. It is for them that the feet should be carried out. - As a basis for a trading strategy. As an example, I will give a TS based on the intersections of ATR lines of different periods. An example of such a switchman is in the screenshot below.

Sometimes the signals turn out to be promising, but there are also a lot of false entries. When working on small timeframes, there are a lot of signals, most of them are unprofitable. Even if transactions are concluded without slippage, for example, the just2trade broker provides almost instant execution of orders , you will still not be able to make a profit from such signals.

Personally, when trading, I use volatility data solely to determine the size of stops and evaluate the market as a whole .

How to calculate volatility in the Forex market. Volatility table and calculator.

Calculating volatility for a Forex currency pair is quite simple. For example, daily volatility is the difference between the daily high and the daily low. Let’s say the minimum for the EURUSD pair for a particular day was at 1.0808, and the maximum was 1.0958. Then the volatility was:

1.0958-1.0808=0.0150=150 points per day.

The fact that volatility is not constant can be seen if you study the table or volatility calculator. This calculator is very easy to use. Select a currency pair and time interval. After which you will see charts of this currency pair with volatility in pips (by hours, by days, etc.). You can calculate volatility for all currency pairs. Using such a calculator, you can choose the most effective trading method.

You can also use the currency pair volatility table.

Currency pair volatility table (online)

However, even such a table is not always convenient to use. In this case, volatility indicators for MT4(5) come to the rescue. By using them on the chart, you can see at what hours and days of the week the pair is most/least volatile.

Summarizing

Information on volatility allows you to assess the state of the market (not only forex, but also the stock market). If traders' activity is high, then the likelihood of strong movements increases. It is not necessary to use this data as the basis for a trading strategy, but it will not be superfluous .

I hope that after reading this material you will begin to take more seriously such a characteristic of the market as the volatility of price movements. This is where I will end this short review. Don't forget to subscribe to my blog updates . This is not the last useful material on trading and financial markets. See you soon!

If you find an error in the text, please select a piece of text and press Ctrl+Enter. Thanks for helping my blog get better!

Popular volatility indices

For different markets, their own volatility meters were created: the VIX index for the stock S&P 500, VXD for the Dow Jones Industrial Average, VXN for the American technology Nasdaq Composite.

There is also such an index for the Russian market. It's called RVI and stands for Relative Volatility Index.

What are these indicators? They were created for the Chicago Board Options Exchange (CBOE). Their values reflect market expectations of what the price of options on major stock indexes will be.

The named indicators of the volatility index are not a complete list. However, the VIX remains the most popular and frequently used. Let's consider its properties separately.

Russian volatility index

We looked at American volatility index instruments. However, as already mentioned, such an indicator also exists for the Russian PTC index. It is called the Relative Volatility Index (RVI), and it is calculated by the Moscow Exchange.

It is based on option quotes on the RTS, and the values are used by traders to determine periods favorable for buying and selling stock assets.

Here are some basic guidelines on how to use RVI:

1. The growth of the Relative Volatility Index indicates that it is necessary to prepare for buy transactions. The first entry into a long position can be made when the index value has consolidated above the level of 50. The next signal to buy will be a consolidation above the level of 60. 2. Closing purchase transactions must be carried out after the Relative Volatility Index falls below the level of 40. 3. The RVI index decreases below the level 50 indicates a good time for sales. Fixing the volatility index below 40 is considered a positive signal for opening short positions. 4. Closing sales is appropriate when the index moves to growth and consolidates above the value of 60.