Hello, dear readers of our financial resource!

Have you ever thought about the settlement mechanism on the stock market after you pressed the Buy button in your terminal? Do you know when you cease to be the legal owner of Gazprom shares by selling them on the market?

So: all transactions on the stock exchange with shares are carried out in spot mode (from the English spot - “on the spot”). Spot is a form of trading operations “here and now” or in a short time (usually up to two business days). It is during this time that all settlements for shares in the stock section of the Moscow Exchange are carried out.

What is a spot trade

A sophisticated trader may disagree with me: he sees that securities appear in the portfolio instantly after purchase. What does this have to do with delivery after a certain period of time?

Hurry up to take advantage of the doubling of the tax deduction until December 31, 2022.

There is no contradiction here: trading contracts are displayed in the terminal almost immediately, but the actual delivery of assets to the client’s account occurs after 2 days.

When there was no computer support on the exchange, all settlements under contracts were made manually. Banks and brokerage companies needed time to register the change in ownership of securities in the depository, as well as to add an entry to the register of shareholders.

Computing power and transaction processing speed have increased millions of times, but the tradition of such delivery remains.

Where is it used?

Calculation using the spot method is carried out on all stock and commodity exchanges, as well as on the international Forex currency market.

Basic concepts and terms in trading with leverage

- Long or Buy.

Bet on exchange rate growth, purchase order. Long because the beginning of growth is not a quick process. - Short or Short.

A bet on a fall in the exchange rate, a sell order. Short because the fall is rapid. - Order.

An order to buy or sell cryptocurrency. For example, an order to long 20 ETH is an order to buy with subsequent sale when the rate of 20 Ether coins rises. - Positions.

This is the name given to a group of buy or sell orders. - Equity.

Indicator of available funds on the account at the moment. It also takes into account the money that is in open positions. - Margin Level.

Account health indicator. It is calculated as the ratio of available funds to used margin. The higher the number, the better. When the level drops below 25%, the position is liquidated. - Liquidation.

It’s scary, painful, unpleasant, but it’s necessary so that the trader doesn’t lose big money.

the exchange itself forces the closure of positions Serves as a security mechanism that allows the trader to keep the apartment in the event of an unfortunate set of circumstances. - Bearish trend.

The bear has crushed the market: prices are falling, shorts are rejoicing, longs are suffering. - Bullish trend.

The market has been thrown into turmoil: prices are rising, short sellers are crying, long sellers are rejoicing.

Take Profit orders

and

Stop Loss

, as the most important components of margin trading.

- Take Profit.

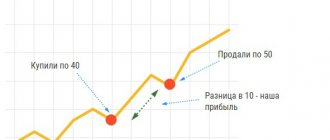

Orders have conditions. Take Profit is the condition “Sell some asset when its rate is such and such” for an order.

For example:

in February 2022, the trader opens a long position of 20 ETH at a rate of $1,620. The trader understands that he cannot follow the sharp movements of the exchange rate, but wants to sleep peacefully. He sets the Take Profit condition at 1700, and when the rate breaks through this bar to 1701 and above, the exchange closes the deal with a profit for the trader of $80 for each ETH. In the morning, the trader can only gnaw at his elbows, because the order closed the position completely, and an hour later the currency rate rose to 1770.

- Stop Loss.

Without it, you don't open a trade. Condition in the order for risk management. Literally: “To avoid losses, sell such and such an asset when the price falls/rises to...”. Allows you to avoid huge disadvantages.

For example:

in February 2022, a long position of 20 ETH is opened at a rate of 1620 USD per coin. The trader does not want to lose money on this trade, given the volatility of the cryptocurrency market. Having calculated the risks, he places a stop loss order for $20. Now, when the rate falls to 1600 USD, the deal is closed automatically, and the trader loses only 20 dollars.

Without a Stop Loss mechanism, a trader can lose his entire deposit in just a second and end up in a debt hole if the liquidation does not keep up with the exchange rate. Yes, liquidation may not keep up with the rate

, if the trading speed is too high. Take this into account and set Stop Loss to buy more Lambo, rather than sell the apartment.

Types of markets, their similarities and differences

Delivery of the purchased financial asset can be carried out either spot or after a certain time. Such contracts with a distant execution date (more than two days) are traded on the derivatives market.

Urgent

Here forward and futures transactions are concluded, as well as options are traded.

I note that these financial instruments are closely related to spot prices. As a rule, a stock futures price is higher than its shares on the spot: the bank interest rate is added to the price of the derivative instrument, calculated in proportion to the delivery time.

An important advantage of the derivatives market is that it provides ample opportunities for hedging (insurance) positions on spot.

Speculators have identified another advantage of derivatives trading - the ability to construct synthetic leverage and earn much more than on traditional financial assets.

Spot

The basis of all markets, the historically established method of calculation and delivery. Quotes of securities on the spot reflect current dynamics, imbalances in supply and demand, while the price of derivatives contracts (futures, forwards and options) is influenced by expectations of the future and market prospects.

Risk reduction

To minimize possible negative consequences, banks:

- prescribe the possibility of revising conditions during the execution of actions;

- use gold backing of the currency;

- establish a direct relationship between the volume of funds and the dynamics of the exchange rate, etc.

Conversion transactions are a special type of financial manipulation carried out among participants in the foreign exchange market. Their intended purpose is to bring banknotes of different countries to a common value (exchange). Transfer or receipt of funds is carried out by prior agreement within a specified time period. In addition, the completion date and the volume of transferred monetary units are established.

In other words, these are transactions for the acquisition and sale of currency that are carried out by banking organizations.

Also, it should be noted that a number of banks have a limit on conversion transactions (which includes spot and forward transactions). Which means the ability to execute a limited number of contracts by a set amount. For example, two financial companies under a 3-month forward agreement can enter into transactions for no more than $10 million.

For the convenience of clients and ensuring secure access to accounts, MORSKY BANK provides the possibility of a remote banking system via Internet banking.

Features of trading on the spot market

For most traders, the spot trading mode in the stock market is not that important. In general, what difference does it make when the shares are delivered: now or in 2 business days?

The exception is dividends. The right to receive dividends on securities are those exchange players who have shares at a certain point - the cut-off date.

It is in this case that execution “in 2 days” can play a fatal role - a novice investor may get confused or forget that shares do not arrive in the portfolio instantly. And by an unfortunate accident, deprive yourself of dividends.

And this is the only drawback of calculating transactions in this mode on the stock market.

Terminology

Conversion is the process of exchanging monetary units from different countries (for example, rubles into dollars or euros). As a rule, the leading purpose of such transactions with money is the upcoming payment of payments under agreements concluded with partners from abroad.

All transactions using a bank account are carried out by financial companies (banks), which play an intermediary role between enterprises engaged in foreign economic activity and their foreign partners.

Please note that conversion operations do not imply the usual exchange of one currency for another, most often carried out by ordinary citizens, but its direct use in the future. After changing the currency value, payment of contractual obligations is mandatory. This is relevant in any situation where organizations do business with legal entities or individuals who are not listed as residents of a particular state. In this case we are talking about foreign firms or companies registered in other countries.

So, for example, if you need to conduct a transaction for the supply of goods from the United States to Russia, payments will be made in different currencies. Accordingly, representatives of cooperating enterprises need to bring banknotes to a common meaning. Which is exactly what conversion is for.

It is produced at a set time. The day the finances are transferred to the current account (r/s) is the value date. The designated period indicates exactly when the money will arrive.

SEA BANK offers to carry out currency exchange at the most favorable rate (close to the exchange rate). Our financial institution's cash desks are guaranteed to have the amount you need. The conversion takes place in two clicks via online banking.

You can also issue a customs card and carry out transactions around the clock.

How does the deal work?

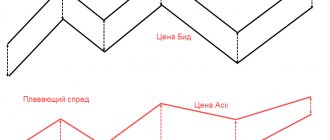

The difference between types of transactions can be clearly seen in the foreign exchange market. You can buy dollars using three types of contracts: TOD, TOM and SPT (spot).

The most profitable way to do this is by purchasing TOD contracts - there is no premium included in the price. While TOM will be more expensive by the bank rate divided by the number of days in a year, the spot contract will be even more expensive.

Therefore, it is best to buy dollars under the TOD contract (delivery will be carried out on the same day), and sell under the SPT or TOM contract. In this case, the rubles will be credited to your account tomorrow or the day after tomorrow.

In the stock market, although we are dealing with spot, there is no premium there - such a settlement mechanism with a delay of 2 business days has developed historically.

Spot Forex

In the Forex currency market, trading takes place in spot mode. The speed of computer algorithms allows the order to be executed instantly, but banks and brokers adhere to the traditional deadline to eliminate errors and reduce risk.

Sometimes, in relation to Forex, the expression “spot rate” is used, that is, the price of the currency of one country expressed in units of the currency of another country.

Differences from swap

A swap is the transfer of a trading position to the next day. A dealing company or intermediary bank performs the following operation: closes the current spot after 24 hours and immediately opens a new one. The amount of the swap depends on the difference in interest rates of the currency pair in which the position is held.

What risks do banks take when conducting conversion operations?

Of course, the greatest danger in economic terms for banking organizations is represented by currency fluctuations. It is impossible to be one hundred percent sure in which specific direction the course will deviate (worse or better). The possibility of incurring financial losses is always present.

In addition, calculating the approximate cost of exchange in the future is quite problematic. Which, again, should be considered a potential threat to stability.