In the stock market, as well as forex, there are situations when a trader opens a deal based on the signals of the main indicators, but after a few points it changes direction and brings a loss instead of the predicted profit. To avoid such incidents, you need to learn how to read indicators of support and resistance levels for MT4, which will help determine when the price will turn and in which direction.

What is support and resistance

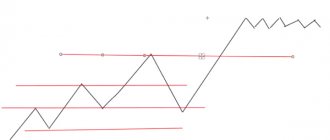

The support level is considered to be the position of the chart below the zero axis. The monitor shows how the price line grows, reaches the red line and bounces back. After some time, the price may break through the zero axis and go up. However, with the same probability, the trend can end and leave the monitor.

On the charts of the resistance zone, the opposite situation is observed. The price movement is located above the axis and when it comes into contact with it, it bounces up again.

Such situations may be due to the following trends in the stock or foreign exchange market:

- the chart cannot break through the axis due to a large number of open orders against an increase (decrease) in price;

- There are no open trades outside this axis.

The use of indicators of areas of resistance and support has a number of advantages:

- makes it possible to evaluate your levels from the outside and compare them with other systems;

- saves time and effort on creating personal schedules;

- We use precise mathematical calculations of Pivot Daily and ATR values, which are not built manually;

- equipped with sound alerts about favorable transaction conditions.

Settings

- BackLimit — maximum number of bars to be analyzed

- TimeFrame - the period from which the levels will be calculated (0 - current, 60-hour, 1440 - 4 hours, etc.)

- Color_ — line colors, you can change them at your discretion

- Zone_show_weak - display weekly levels

- Zone_fuzzfactor - Fuzz factor (level filtering)

- Zone_solid — true/false — filling the zone with color

- Zone_linewidth — thickness of levels

- Zone_Showinfo — information about zones (broken, tested, not broken)

- Zone_Alerts - signal when a new zone or breakout appears

Trading using levels

Using indicators of support and resistance zones allows traders to make good money on transactions. However, the technique will bring positive results only to those who learn to understand it and apply it in practice.

There are several basic rules that allow you to make a profit from trading using indicators:

- sell orders are opened only when the price has reached the resistance level;

- currency purchases must be made only after the price chart touches the border of the support area;

- it is not always necessary to wait for complete contact with the axis; if the line does not reach 1-9 points, then orders can still be opened;

- stop losses need to be set 25-30 points from the line, the exact number depends on the time intervals.

The most difficult task in a trader’s work is considered to be the correct determination of the position of the zones, so stock market specialists have developed various indicators that will help analyze the situation.

Settings

- Showinfo — true/false show information on the chart about levels and settings

- Autoset - automatic setting of parameters

- showlines — show vertical lines (formation points)

- TimeFrame1 - the first timeframe on which the lines will be drawn

- TimeFrame2 - the second additional timeframe on which the lines will be drawn

- TimeFrame3 - the third additional timeframe on which the lines will be drawn

Egor Belyaev / author of the article

Financial analyst. Prefers to work in the foreign exchange market. 6 years trading experience. Expert of the site ForexGid.Ru.

Support and Resistance Levels

The indicator resembles an advanced version of the previous tool, the functionality has been expanded significantly. Can build not only horizontal levels, but also inclined trend lines.

This is what the chart layout looks like with the trend line plotting mode disabled

When activating the mode for constructing trend lines, we get the following picture

The indicator builds trend lines adequately, although there are too many of them and misses some. You can't do without manual filtering.

The method of using the Support and Resistance Levels indicator is standard - we take into account the position of levels and trend lines. If we get a confident reversal pattern when the chart approaches them, we conclude a deal. If a breakdown occurs, we expect a retest.

Math System Murray

This is where things start to get more fun, and we have an indicator that bases the construction of levels on Murray’s levels. In fact, it is a classic indicator, where everything is simple, easy and largely understandable. Of course, you won’t have to expect mountains of gold from the tool, however, it itself is efficient and that’s a fact. Murray levels have been used by traders for many years, with some using it quite effectively. Of course, it is not worth basing entries on these kinds of levels, and it is better to filter them, and also wait for patterns to appear at these levels. In this case, you will be able to get the clearest entry points with a high percentage of completion.

Breakouts on oscillators

This class of strategies is based on the breakdown of levels in the readings of a particular oscillator. An example of such a strategy is the Rustle of Morning Stars for the H4 period, which is based on a breakdown of the levels of the Awesome Oscillator indicator by Bill Williams.

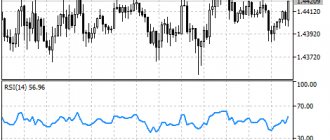

Another option is a breakdown of overbought/oversold levels:

This example uses a breakout of the 100 and -100 levels of the CCI indicator. A moving average is used to determine the trend and filter trades against it. For this class of strategies, it is not very important which oscillator to choose; what is much more important is the most effective way to determine the direction of the current trend.

The idea here is exactly the same as for all other breakout trading strategies - if the price has broken through the overbought or oversold level, it is very likely that this movement will continue.

To exit a position, as a rule, it is recommended to focus on the reverse crossing of the previously broken level by the oscillator.

SR Lines

One of the mass of standard indicators that build zones based on local and absolute High and Low. The tool is free and works well for visual filtering of constructions.

This is what the construction of the SR Lines indicator looks like

Like other instruments of this type, SR Lines has a number of unnecessary constructions. During a flat, the indicator builds a lot of unnecessary levels; we ignore them.

Consider what is happening in the market. Filter chart reversals using patterns, assess trend strength using the three white soldiers and the three black crows pattern. Levels are just guidelines at which a stop can occur.

If you use SR Lines in your work, select zones between closely spaced levels. This way you will reduce the number of plots on the chart by several times and get a more adequate idea of what is happening on the market.

A lot of levels have been reduced to several zones. They can be extended to the right and work depending on the behavior of the chart when approaching them

As for the settings, SR Lines has only one parameter “lineindex”. When it is increased to 2 and higher, the levels begin to be displayed from higher timeframes, when the value is 1 – from the current one.

Barry indicator

Next on our list is an indicator called Barry. To tell the truth, I don’t quite understand what he’s doing on the chart; I would say that what he’s drawing isn’t levels at all. He stupidly marks any peak and trough of the market on the chart. In my understanding, trading at these kinds of “levels” is simply not possible.

In this case, there will simply be too many levels, as a result you will simply get confused in them, which will inevitably lead to a deterioration in trading results. In summary, this indicator seems to me to be absolutely meaningless in its essence and I don’t see much meaning in it.

Classification of breakdown systems

I don’t say how true this will be, but within the framework of this article, let’s agree to call the type of system a set of different systems that are identical in their basic idea: trend, reversal, breakout. That is, the type of trading system answers the question “What will we trade?” We will call a system class a set of trading systems within one type that use a common approach to finding trading signals. A more appropriate question here is “How will we trade?” So, what classes can there be within this type of system as a breakdown system?

ADX Trend Filter

One of the problems with using breakouts is that there is a tendency for extreme sawtooth trading to occur if the system detects a breakout and no real trend follows. One possible solution is to use a trend indicator to filter out breakout signals. Many traders use the popular ADX indicator.

Eliminating markets where there is no trend, “sawtooth” trading and protracted transactions will somewhat improve the results of the system. ADX is used to filter breakouts according to White's research (White, 1993). A trend is considered to exist when ADX, calculated over the last 18 days, reaches a new six-day high. Entries are made only when there is a trend.

But is filtering by ADX really useful? We already clarified this in the article to which I gave a link above. I will only add that for breakout systems, the use of ADX can still slightly improve the final result.

Breakout of moving averages

The SMA and EMA lines, especially the standard set with periods of 20, 50, 100, 200, are the strongest price levels, and their breakdown means leaving the average value zone and forming a new trend. In general, there are many ways to calculate moving averages, as our forum member Pavel888 wrote about in this article.

Typically, a signal is generated by a close above the high or below the low of a breakout candle. However, this class of systems in its basic version currently brings quite a lot of false signals - the markets have changed a lot with the advent of such a phenomenon as online trading and with the ability to carry out complex mathematical calculations literally instantly. Therefore, this class of systems, like other classes, began to evolve. But unlike other classes, it has turned into a completely new class of systems - volatility breakdown, which we will talk about a little later.

Despite the fact that this approach is considered outdated, there are a huge number of different moving average indicators, and even if you cannot build a profitable strategy of this class, its development will give you a lot of useful experience. There is a set on the forum, also compiled by Pavel, containing more than 600 different moving average indicators for every taste.

In fact, there is no need to use moving averages specifically. You can easily work with an indicator such as Envelopes, taking buy trades when the upper limit of the indicator is broken and vice versa for sells. In essence, this will remain the same class of trading systems, just slightly modified.

Volatility Breakout

Newer and more complex are volatility breakout models, where the points whose crossing triggers a signal are based on volatility boundaries. Volatility boundaries are located at a certain distance from the current price (for example, the closing price), and the distance is determined by the current market volatility: when it rises, the boundaries move further from the current price, when it falls, the boundaries narrow.

Most often, the ATR or Std Dev indicator is used to measure volatility in this class of systems. Thus, to calculate the channel boundaries using the standard deviation, the Bollinger Bands indicator was built, and the Keltner Channel indicator was built for ATR.

The underlying statistical idea is that if the market is moving in a given direction more than expected from a normal swing (as reflected in volatility), then there may be some force involved, i.e. a real trend. Buy when the price rises above the maximum volatility limit, sell when it falls below the lower limit.

Many of this class of systems were very popular in the late 80s, but are now quite rare. Personally, I have never been able to get satisfactory performance from systems in this class, but perhaps I am simply unable to design effective filters to minimize false breakouts. Or maybe the modern market really isn’t suitable for such systems. This assumption is also supported by many market researchers and their independent tests of a class of similar systems for the foreign exchange market.

conclusions

There is no psychological component to technical indicators, and resistance support levels are a rather subjective concept. With experience, the trader begins to visually “feel” the points where supply/demand are maximally balanced, and the market can slow down before choosing a direction - then it is really easier to select the necessary price zones manually. However, this does not negate the use of technical indicators of resistance support levels; any automatic constructions can be adjusted, and the time saved can be spent, for example, on additional market analysis. The main thing is without fanaticism.

Shved demand supply

Last on the list is the Shved Demand Supply indicator. In my humble opinion, this is the best profile indicator for building levels. It has a huge number of different settings, but it draws the levels itself quite well.

Super Dot Signal Strategy

I think that a novice trader mastering trading by levels should pay attention to this indicator. Yes, of course, sometimes I may not agree with the levels that this indicator shows. However, I believe that this particular indicator is more worthy of attention and can become a faithful assistant.

Market entry methods

Models based on a breakout may also differ in the method of entering the market. Entry can take place at the open or close of the day, or intraday entry using orders at boundary levels. More sophisticated methods allow you to buy or sell at the border, i.e. try to enter the market on a pullback, when, after breaking through a certain border, prices briefly return to it.

The simplest option - entering at the opening of a new candle, allows you to test breakout systems quite quickly and accurately, because for such options the movements occurring inside the candles of the selected timeframe are not important.

When working with stop or limit orders, it is very important to use tick data and testers that support changes in the spread value during testing, because an inaccuracy of just a couple of tenths of a point can lead to the activation of a pending order or, conversely, to missing certain transactions. At the same time, it does not matter at all for what period the trading system is being developed - it will still be very demanding on the quality of testing and trading results for different brokers may differ radically.

That's why I personally do the following:

That is, after the candles break through a certain level, the strategy involves, for example, placing a pending stop order slightly below the shadow of the breakout candle. Instead of placing an order, I simply start tracking the deferment level and as soon as the candle closes below it, I enter a trade on the market at the opening of a new candle. This eliminates the need for me to use tick data and overall increases the reliability of the system, albeit at the cost of a slightly delayed entry.