I started investing in bullion coins in 2006. I bought my first coin, the “Sower” chervonets, in mid-2006 at a price of 4,650 rubles. Now I can sell it for 41,000 rubles. Over 15 years, Sower has grown by 782% (52% per year).

I made one of the last transactions to purchase coins - “St. George the Victorious” - in August 2022. I bought a coin for 26,000 rubles. Now I can sell it for 38,500 rubles. The profitability for a year and a half of ownership was 48.07%.

In total, I bought 10 gold investment coins, spending 260,000 rubles on it, if today I decide to sell them, then my total income will be 125,000 rubles (48.07%).

My experience clearly shows that over the long term you can make good money on investment coins.

Commemorative coin

Investment coin “St. George the Victorious”

What are investment coins

Bullion coins are made from high quality precious metals. In Russia - from gold and silver, in other countries - also from platinum. Technically, these are small gold and silver bars that are a way to store money.

The price of coins changes daily - it depends on the value of the metal from which they are made. At these prices they are bought from banks or organizations that engage in buying and selling.

Investment coins have a simple design: denomination, year of issue, fineness and metal content, thematic symbols. The obverse and reverse depict a coat of arms, historical figure, animal, mythical character or other symbols of the country. For example, in Russia - St. George the Victorious, in the USA - a golden eagle, a bison, in Armenia - Noah's Ark, in China - a panda.

Investors buy coins, hoping to sell them profitably in the future. Especially if the price of metal starts to rise. “They are produced by the mints of St. Petersburg and Moscow,” says Venera Shaidullina, associate professor at the Financial University under the Government of the Russian Federation.

Coins issued for the 2014 Sochi Olympics

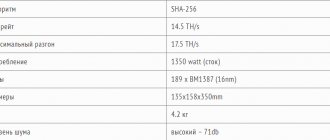

Minted in quantities from 100 to 300 thousand. Fifty-ruble ones weigh 0.25 ounces, and hundred-ruble ones weigh 0.5 ounces. Produced from 2011 to 2013.

On the one hand, a small circulation guarantees an increase in value not only due to the metal, but also to the rarity of the samples; on the other hand, the price of these banknotes will be inflated already upon purchase. Therefore, the profitability of investing in items with Olympic symbols depends on the price at which they are offered.

What are investment coins?

The two main types are gold and silver. Gold is better for investment, as gold rises in price faster than silver.

Coins come in different weights and qualities. The global standard is 1 ounce (31.1 grams). In Russia they also mint quarter-ounce coins (7.89 grams).

Coins may be new or previously circulated. For example, the royal chervonets of the era of Nicholas II still have the status of investment. New ones are assigned the quality “Excellent condition” or “AC” (from English UNC, Uncirculated).

There are also coins in “Proof” quality (improved quality), when the surface is made mirrored, inlaid, etc. “Most often, the Central Bank mints commemorative coins in this capacity,” says Alexey Vyazovsky, vice president.

Foreign

Capitalist countries, much earlier than our country, became concerned with the minting of gold investment coins. Therefore, many of them have their own samples, some in a rich assortment. Many foreign copies are also very successful among collectors.

I'll name the most popular ones.

Krugerrand South Africa

The Republic of South Africa was the first to issue this type of investment asset. This happened in 1967, and it was named “Krugerrand” in honor of President Kruger, whose portrait is depicted on the obverse. The reverse contains an image of an antelope. Sample 917.

It was with the release of this coin that the gold standard of 1 oz (1 troy ounce) was adopted. From now on, they tried to produce coins with exactly this weight, and they are called ounces.

The Krugerrand is the most common investment coin in the world, so its liquidity is very high.

American golden eagle

One of the two most popular bullion coins in the United States. On its obverse is the face of the Statue of Liberty, and the reverse is decorated with an eagle sitting in a nest with an olive branch in its beak. An eagle sits in a nest with eaglets.

Available in 1/10 oz, ¼ oz, ½ oz and 1 oz 916 fine weights, $50 denomination.

American Buffalo

The obverse contains the head of an Indian by sculptor Fraser. On the reverse is an image of an American buffalo - buffalo. Made from 1 oz sterling gold, valued at $50.

It went on public sale only in 2006.

Austrian Golden Philharmonic

A famous Austrian bullion coin, the obverse of which depicts the organ of the Vienna Philharmonic (hence its name). It was the first to be minted in European currency. Denomination – 100 euros, weight – 1 oz, 999 fineness.

Canadian maple leaf

A coin widely known in investment circles with the profile of Queen Elizabeth II on the obverse. The reverse features a maple leaf, the symbol of Canada. One ounce coin, 50 Canadian dollars, 999 fine.

Chinese panda

This panda has long spread far beyond China. It is recognized as one of the most successful bullion coins of the 1980s.

Its obverse depicts the greatest landmark of the Celestial Empire – the Temple of the Sun. The reverse is occupied by a giant panda, the symbol of China. The denomination is 500 yuan, the weight ranges from 1/20 oz to 1 kg of pure gold.

Its peculiarity is that the Chinese changed the design every year in order to maintain increased demand. Some types of “pandas” even began to be used in collections.

Australian kangaroo

Produced by Australia's oldest mint. The obverse features a portrait of Queen Elizabeth II. On the reverse is a kangaroo, the famous symbol of the Australian continent. Like the Chinese "pandas", the image of the kangaroo is new every year. Denomination 100 Australian dollars, weight 1 oz.

This gold coin is commonly referred to as a “nugget”, as the 2007 issue featured the inscription “THE AUSTRALIAN NUGGET”. The nickname is firmly attached to the coin, and all over the world it is known as such.

Differences between commemorative and bullion coins

Minting: Investment - regular (uncirculated) AC quality. They have simple embossing without complex elements, minor damage is allowed. Memorables – improved (proof) quality.

Circulation: Investment papers are produced in large quantities, tens and hundreds of thousands. Therefore, they are not valued by collectors. Commemorative items are produced in limited quantities: from several hundred, rarely more than 25,000. They are immediately interesting to collectors, and over time their price increases. Selling price: The real price of an investment coin is equal to the metal exchange rate. Rarely does it have a collectible value added to it - unless it is from a small batch, is old, or was released by a no longer existing state. A commemorative coin can only be sold at a real price to a collector.

“Commemorative items are minted in small series. Their price is influenced by supply and demand, and not by stock exchange quotes for the metal. The price of a commemorative gold coin can rise even when the price of gold on the stock exchange falls” - Alexey Vyazovsky.

It will be useful!

——————-

Mini-course “How to choose the best American ETFs.” Get step-by-step instructions with dozens of screenshots of how I choose ETFs for myself (!!!) and for clients. ETF is exactly the tool that allows you to earn from 10-20% (and more) in dollars per year! Price - only 1,800 rubles! Find out more here.

——————-

Where and how the MoneyPap family invests (successfully) (PDF) . In this document, I honestly tell you what profitable instruments my family invests in. Download the PDF for free - here.

——————-

20 Financial Forms, Tables and Calculators for Independent Total Financial Management. I have been creating these shapes for many years. I'm giving it away for the price of a couple of cups of coffee - 179 rubles! Best-seller! See here .

How to determine the value of investment coins

In Russia the formula is simple. The price is the sum of the world price of gold or silver multiplied by the dollar/ruble exchange rate. Plus mint and dealer markup (+5-6%)

To calculate the value of a coin, you need to know its weight and circulation. This information can be viewed on the Central Bank website. The larger the mass and the smaller the circulation, the more expensive it is.

Let's calculate the price using the example of the Sable silver coin.

“Sable” is made of 925/1000 silver. This is indicated by the Ag 925 mark on the coin on the left. This means that it contains 92.5% silver.

The weight of chemically pure valuable metal is 31.1 grams of the total weight - one ounce. This is also confirmed by the number “31.1”, which is printed on the coin.

The circulation of "Sable" is very large - 1,000,000 pieces. Therefore, the coin does not yet have a collectible value. Its price is affected only by the exchange rate of silver.

As of January 10, 2022, the cost of one gram of silver at the Central Bank exchange rate is 36.25 rubles. Accordingly, the price of metal in Sobol is 1,127.37 rubles. The rest is the markup of the manufacturer and seller of the coin.

It is better to look at the prices of commemorative coins in the Fcoins.ru catalog. If you are not an expert, it is difficult to determine the cost yourself.

History of the development of gold prices over 100 years.

Gold price by year compared to the Dow Jones Industrial Average, inflation and factors affecting the price

| Year | Gold prices ( Gold fixing ) | Dow Jones Industrial Average (Dec 31) | Inflation (Dec) | Factors influencing the price of gold |

| 1929 | $20.63 | 248.48 | 0.6% | Recession |

| 1930 | $20.65 | 164.58 | -6.4% | Price reduction |

| 1931 | $17.06 | 77.90 | -9.3% | Depression |

| 1932 | $20.69 | 59.93 | -10.3% | Depression |

| 1933 | $26.33 | 99.90 | 0.8% | Roosevelt takes office |

| 1934 | $34.69 | 104.04 | 1.5% | Height. US Foreign Exchange Act |

| 1935 | $34.84 | 144.13 | 3.0% | Height |

| 1936 | $34.87 | 179.90 | 1.4% | Height |

| 1937 | $34.79 | 120.85 | 2.9% | Roosevelt cut spending |

| 1938 | $34.85 | 154.76 | -2.8% | Reduction until June |

| 1939 | $34.42 | 150.24 | 0% | The end of the “dust storms of the 30s” |

| 1940 | $33.85 | 131.13 | 0.7% | Height |

| 1941 | $33.85 | 110.96 | 9.9% | USA enters World War II |

| 1942 | $33.85 | 119.40 | 9.0% | Height |

| 1943 | $33.85 | 135.89 | 3.0% | Height |

| 1944 | $33.85 | 152.32 | 2.3% | Bretton Woods Agreement |

| 1945 | $34.71 | 192.91 | 2.2% | Recession after World War II. |

| 1946 | $34.71 | 177.20 | 18.1% | Height |

| 1947 | $34.71 | 181.16 | 8.8% | Height |

| 1948 | $34.71 | 177.30 | 3.0% | Height |

| 1949 | $31.69 | 200.13 | -2.1% | Recession |

| 1950 | $34.72 | 235.41 | 5.9% | Height. Korean War |

| 1951 | $34.72 | 269.23 | 6.0% | Height |

| 1952 | $34.60 | 291.90 | 0.8% | Height |

| 1953 | $34.84 | 280.90 | 0.7% | Eisenhower ended the Korean War. Recession |

| 1954 | $35.04 | 404.39 | -0.7% | The Dow returned to its 1929 level. |

| 1955 | $35.03 | 488.40 | 0.4% | Height |

| 1956 | $34.99 | 499.47 | 3.0% | Height |

| 1957 | $34.95 | 435.69 | 2.9% | Growth until August |

| 1958 | $35.10 | 583.65 | 1.8% | Reduction until April |

| 1959 | $35.10 | 679.36 | 1.7% | Height. Rising interest rates |

| 1960 | $35.27 | 615.89 | 1.4% | Recession. Lower interest rates |

| 1961 | $35.25 | 731.14 | 0.7% | John Kennedy takes office |

| 1962 | $35.23 | 652.10 | 1.3% | Height |

| 1963 | $35.09 | 762.95 | 1.6% | Lyndon Johnson takes office |

| 1964 | $35.10 | 874.13 | 1.0% | Goldfinger Unveils Plan to Control US Gold Vault |

| 1965 | $35.12 | 969.26 | 1.9% | Vietnam War |

| 1966 | $35.13 | 785.69 | 3.5% | Height. Rising interest rates |

| 1967 | $34.95 | 905.11 | 3.0% | Height |

| 1968 | $38.69 | 943.75 | 4.7% | Height. Rising interest rates |

| 1969 | $41.09 | 800.36 | 6.2% | Nixon takes office. Height. Rising interest rates |

| 1970 | $37.44 | 838.92 | 5.6% | Recession. Lower interest rates |

| 1971 | $43.48 | 890.20 | 3.3% | Height. Wage and price controls |

| 1972 | $63.91 | 1020.02 | 3.4% | Height. Stagflation |

| 1973 | $106.72 | 850.86 | 8.7% | Abolition of the Gold Standard |

| 1974 | $183.85 | 616.24 | 12.3% | Watergate scandal. |

| 1975 | $139.30 | 852.41 | 6.9% | The end of the recession. Stocks rise, gold falls |

| 1976 | $133.88 | 1004.65 | 4.9% | Height. Lower interest rates |

| 1977 | $160.45 | 831.17 | 6.7% | Height. Carter takes office. |

| 1978 | $207.83 | 805.01 | 9.0% | Height |

| 1979 | $455.08 | 838.71 | 13.3% | Federal policy characterized by alternating restrictions worsens inflation. |

| 1980 | $594.92 | 963.99 | 12.5% | The price of gold reached $850 on January 21. Investors are looking for safety. |

| 1981 | $410.09 | 875.00 | 8.9% | Reagan tax cuts |

| 1982 | $444.30 | 1,046.54 | 3.8% | The end of the recession. Garn-Saint-Germain Law |

| 1983 | $389.36 | 1,258.64 | 3.8% | Height. Reagan increased spending |

| 1984 | $320.14 | 1,211.57 | 3.9% | Height |

| 1985 | $320.81 | 1,546.67 | 3.8% | Height |

| 1986 | $391.23 | 1,895.95 | 1.1% | Height. Reagan cut taxes |

| 1987 | $486.31 | 1,938.83 | 4.4% | Height. "Black Monday" |

| 1988 | $418.49 | 2,168.57 | 4.4% | Height |

| 1989 | $409.39 | 2,753.20 | 4.6% | Savings and Loan Crisis |

| 1990 | $378.16 | 2,633.66 | 6.1% | Recession. |

| 1991 | $361.06 | 3,168.83 | 3.1% | End of recession |

| 1992 | $334.80 | 3,301.11 | 2.9% | Height |

| 1993 | $383.35 | 3,754.09 | 2.7% | Height |

| 1994 | $379.29 | 3,834.44 | 2.7% | Height |

| 1995 | $387.44 | 5,117.12 | 2.5% | Height |

| 1996 | $369.00 | 6,448.27 | 3.3% | Height. Investors are moving into stocks |

| 1997 | $288.74 | 7,908.25 | 1.7% | Height |

| 1998 | $291.62 | 9,181.43 | 1.6% | Height |

| 1999 | $282.37 | 11,497.12 | 2.7% | Height. "Problems of the year 2000" |

| 2000 | $274.35 | 10,786.85 | 3.4% | Stock market peak in March |

| 2001 | $276.50 | 10,021.5 | 1.6% | Recession. Tragedy of September 11 |

| 2002 | $347.20 | 8,341.63 | 2.4% | Height. 9-year gold bull market starts. |

| 2003 | $416.25 | 10,453.92 | 1.9% | Height |

| 2004 | $435.60 | 10,783.01 | 3.3% | Height |

| 2005 | $513.00 | 10,717.50 | 3.4% | Height |

| 2006 | $632.00 | 12,463.15 | 2.5% | Height |

| 2007 | $833.75 | 13,264.82 | 4.1% | The Dow peaked at 14,164.43. |

| 2008 | $869.75 | 8,776.39 | 0.1% | Recession |

| 2009 | $1,087.50 | 10,428.05 | 2.7% | The end of the recession. The price of gold reached $1,000 per ounce on 20.02. |

| 2010 | $1,405.50 | 11,577.51 | 1.5% | Dodd-Frank Act |

| 2011 | $1,531.00 | 12,217.56 | 3.0% | Debt crisis. Gold breaks record $1,895 on 05.09 |

| 2012 | $1,657.60 | 13,104.14 | 1.7% | Height. Gold is falling. Stocks are rising. |

| 2013 | $1,202.30 | 16,576.55 | 1.5% | |

| 2014 | $1,154.25 | 17,823.07 | 0.8% | Dollar strengthening |

| 2015 | $1,061.00 | 17,425.03 | 0.7% | Gold falls to $1,050.60 at 12/17 |

| 2016 | $1,150.90 | 19,762.60 | 2.1% | The dollar is falling |

| 2017 | $1,302.50 | 24,719.22 | 2.1% | The dollar is falling |

| 2018 | $1,281.65 | 23,327.46 | N.A. | The dollar is strengthening |

Note: Average annual gold prices are used between 1929 and 1969. In 1970, monthly December average gold prices were used from 1920 to 1999. The last working day of December is used for the year 2000.

How to make money on investment coins

Buying this asset as a way to invest money is close to buying precious metals. But coins are easier to store and transport than, for example, bullion.

To make money, you need to sell coins for more than you bought them. The main strategy is to buy for long-term storage, at least 5 years.

It is more profitable to invest in gold coins:

- First, the gold rate increases faster than the silver rate. Silver is a vulnerable metal during economic crises.

- Secondly, gold retains its presentation better, while silver oxidizes in air. Over time, patina appears on silver coins - a film of different shades.

“When selling coins, the price is affected by their condition,” says Vladimir Maslennikov, vice president of the investment company QBF. Even minor damage or greasy stains will lead to a discount. In jars they are sold in capsules or tubes, which are not recommended to be opened.

Investment coins are a long-term investment tool. Precious metals slowly but always increase in price. They bring tangible profitability in no less than three years. Taking coins for a period of 1-2 years is not advisable. There is no guarantee that the value will rise even to such a level as to recoup the costs of the transaction.

Dynamics of the gold rate over five years. Yield 21.72%.

Dynamics of the silver rate over five years. Yield 15.14%

An exception is if investment coins were purchased during a period of sharp decline in prices for precious metals, followed by an increase in value. Overall, this is an asset with low liquidity and high growth potential in the long term.

According to Venera Shaidullina, “the price of gold coins, on average, increases by 5-10% every year. This is one of the most stable and low-risk assets.”

A rare option for making money is selling investment coins to collectors. If their circulation is small, then the asset may have additional collectible value. Numismatists are often interested in coins that are thematically related to sports or animals. For example, now there is a demand for banknotes issued for the Olympics in Sochi.

The price of collectible coins is increasing more than the price of investment coins, but it is difficult to predict the growth. Collectibles are also more difficult to sell than investment ones: financial institutions buy them in accordance with the cost of the metal from which they are made. You can make profit on collectible coins only on the numismatic market, but this requires connections and knowledge.

“It is worth investing in coins regularly, with every major income. Analysts recommend investing up to a quarter of your investment portfolio in precious metals,” says Alexey Vyazovsky.

Advantages of the investment method

An investor who wants to realize and increase his capital analyzes each toolkit so as not to make mistakes and get the expected result. Investing in monetary units has its pros and cons. It is necessary to study each argument and determine whether it is interesting to you or not.

For many, the tangibility of investments and their visual perception remains important. A numismatic unit in this direction will be more important than an impersonal metal account in a bank. In addition, the invested “penny” is not taxed, which often attracts capitalists. The monetary units are in your safe and not in the bank, which increases the reliability of the deposit and protects against the sudden insolvency of a commercial organization. The availability of money ensures its acquisition anywhere in the world, and purchasing investment coins at any bank allows you to get acquainted with a wide range of collections at any time.

but on the other hand

Are you almost convinced that this is the best investment tool and are you ready to send it to the nearest bank? Take your time, you always need to objectively perceive not only the advantages, but also the disadvantages.

Purchasing an investment unit from a bank does not require payment of VAT, but the difference between the purchase price and the sale price will have to be calculated. Some banks have very large spreads, which does not suit many investors. To avoid excessive spending, you should be well aware of when and where to buy assets, and patiently wait for the moment to arrive. Many consider storing and transporting an asset a disadvantage: home conditions may not always be the most reliable. The liquidity property of assets is directly related to its overall state. Thus, it is not recommended to purchase monetary instruments without a case, and slight damage or fingerprints left on the surface will significantly reduce the value.

Where to buy investment coins

Investment coins are purchased from banks, pawn shops, online stores or from coin dealers. To purchase from a bank or other financial institution, you need a passport.

The bank is the safest place to buy. But due to the fact that this is not a core activity, the transaction commission may be higher than that of a coin dealer.

A modern option is to purchase on the website. But in this case, proceed carefully: study the reviews, make sure that the transaction will be transparent and legal. In a secure location, upon sale, the buyer is given a certificate of authenticity. True, this is not a 100% guarantee, because the coin does not have a number.

Services for those who want to buy a coin:

- Online store "Transstroybank" - a catalog of 400+ Russian investment coins.

- "Derzhava" is a non-banking company that sells investment and commemorative coins of the Russian Empire, the USSR, the Russian Federation and other countries.

- Troy Standard is a St. Petersburg company that helps private investors diversify their portfolio with investment coins.

- "Sberbank".

Adviсe

To get the best return on investment:

- Realistically assess your own financial capabilities when choosing;

- focus on weight from 4 grams , since they have the most optimal price-to-metal ratio;

- monitor exchange rate changes on the domestic and global markets;

- study related topics (numismatics, auctions) to increase the profitability of investment coins in the future;

- increase your own education in everything related to investments.

Modern commemorative coins of the Russian Federation are the most popular type of investment coins

How to sell investment coins

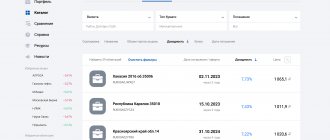

The same companies that we mentioned as platforms for purchase are engaged in the purchase. For example, Transstroybank is ready to buy gold “St. George the Victorious” for 24,600 rubles.

If the coin has additional numismatic value, the best place to sell it would be online collector's auctions: "Rarity", "Conros", "Numismatic". The product can be displayed on Avito or Yula, but due to the non-target audience, you may have to wait a long time for the buyer.

“Before selling a coin, check what price is offered in different sources and make an assessment. It is important to take into account that when you take the coin to a pawnshop, the price will be the lowest, since the pawnshop takes it as scrap. That is, the metal is simply assessed, other factors are not taken into account” - Venera Shaidullina.

Read: Why invest in Russian blue chip stocks

General information

Even within the framework of this blog, I have already written quite a lot about investment options. Today I want to focus on the topic of investing in precious coins. This method is not so common, since it is more conservative, but it also has its significant advantages.

Let me remind you of the important rules of investing:

- We invest only our own funds, no loans from friends, credits, and even less applications to microfinance organizations. Only your own free funds.

- The money you invest should not be your last, set aside for an important business or purchase, or vitally necessary. You must understand that if you lose them now, you will be able to live in peace without compromising your quality of life.

- There is no guarantee that your investment will be profitable. Even if you invest in stable and reliable government bonds or bank deposits, there is no guarantee that this will actually be the case.

- Before investing your own money in a particular instrument, you should carefully study it and evaluate the possible risks and potential profitability. As a rule, risks are proportional to projected income. The higher the profitability, the greater the risks. But there are exceptions to this rule.

- In order to make a decision on investing money in a particular financial instrument, it is important to evaluate it according to the following key characteristics - possible risks, projected profitability, payback periods, minimum investment amount, advantages and disadvantages of investing for yourself.

- The available amount for investment must be distributed over several different instruments, that is, risks must be diversified. Investing your entire capital in one instrument is a rather risky step, which can lead to the loss of everything at once, especially if you have chosen a rather risky instrument with a high return.