What is a cryptocurrency ICO

The abbreviation ICO stands for Initial Coin Offering , translated into Russian as the initial placement of coins. And translating into public language, ICO is the release by developers of a certain amount of cryptocurrency with a certain cost per unit, for its sale and obtaining funds for the implementation of ideas. Even simpler: this is a new type of crowdfunding.

Example: a certain team of programmers has an idea, but no money to implement it. Then they launch an ICO - they issue a certain amount of their cryptocurrency, set the price per unit and launch it all for free sale for real money. In addition, the team promotes its cryptocurrency in terms of advertising.

The next step is for potential investors to find a project, invest money and receive tokens (coins, cryptocurrency). Using the collected funds, developers implement their idea and release their coins on crypto exchanges, for example on Binance, Cryptopia, Yobit, Poloniex, Bittrex.

Yearn.finance

Yearn.finance is a protocol that seeks to maximize the yield of users in the liquidity pool. It searches the credit markets with the best returns and then transfers users' funds into their liquidity pools so that they always receive optimal returns.

This project was founded by Andre Cronje and is built on the Ethereum network. And since it is a pretty great protocol, many other DeFi projects have become partners with it, including Akropolis, SushiSwap, Pickel and Cream.

YFI is the native token and governance token of this protocol. The market capitalization of this coin exceeds $1 billion a month and a half after its launch in 2022.

Interestingly, in many cases, the YFI price outshone the BTC price results:

- In 2022, BTC was worth $10,000 and YFI was worth $43,000.

- In 2022, BTC reached an all-time high of around $64,863, while YFI was worth $93,435.

- You can view the chart here.

Of course, this is due to YFI's limited supply of 30,000 coins and unique token distribution.

What is the benefit for the investor?

- Let's imagine an example: the money collected by the developers was spent on creating a store. Then for these tokens the investor can receive discounts, bonus goods, etc.

- Now let’s imagine that the money was spent on creating a new technology (example: medicine). Then the investor gets the right to use this technology. But over time it can become very rare and will be valued very dearly!

- In both cases, when entering the exchange, the investor can sell his coins. But after the ICO of the cryptocurrency is completed and it enters the stock exchange, the price can jump two, four, or much more times.

PancakeSwap

PancakeSwap is undoubtedly a giant in the decentralized exchange space. This is a decentralized exchange - an automated market maker based on Binance Smart Chain (BSC).

It is also the first decentralized application on BSC to reach a billion dollars in transaction volume and TVL. PancakeSwap is designed to make it easy for traders to exchange BEP-20 tokens.

It also has several liquidity pools where liquidity providers can be rewarded with CAKE and LP tokens. Unlike Uniswap, PancakeSwap offers very fast transactions and low token exchange fees. This explains its popularity!

The native CAKE token does not have a fixed supply. However, as of July 17, 2022, Coinmarketcap lists the current supply as 197,193,934.21 CAKE. The CAKE token is one of the coins that has grown exponentially during the 2021 bull run.

In addition, CAKE has a built-in manual coin burning mechanism to ensure that the token remains deflationary and valuable. Also, the current ratio of CAKE's market capitalization to TVL suggests that the coin is still undervalued. This means that CAKE has a greater chance of rising in price.

Underwater rocks

Based on the stories above, you might think that everything is perfect here, everyone is in profit: the wolves are fed and the sheep are safe. Just take it and earn money. But no! You can get fabulously rich and lose a lot from ICOs. That's why:

- ICO has no legal regulation; the law cannot say anything about it.

- It follows from the first point that 90% of all ICOs are deliberately fraudulent projects created by developers to collect money from investors and leave.

That is, failure to fulfill promises, not implement ideas, not release coins to the stock exchange. A scam of a certain kind, as in HYIP projects. In this case, deceived investors receive absolutely worthless coins.

That is, failure to fulfill promises, not implement ideas, not release coins to the stock exchange. A scam of a certain kind, as in HYIP projects. In this case, deceived investors receive absolutely worthless coins. - You can lose even if the developers have fulfilled (or are fulfilling) their promises. This can happen due to hackers who can break into the network and steal the developers' money or your coins.

This can also happen due to the initially inflated price of the coin. Example: developers sell coins at the rate of 0.1 ETH = 1 coin. But when entering the exchange, the price turns out to be too high, everyone sells coins and the price drops to 0.01 ETH.

Outright scammers often don’t even have plans for development!

Chainlink

Chainlink (LINK) is a blockchain oracle that offers an amazing and unique use case for the blockchain network. It was created by Sergey Nazarov and Steve Ellis, owners of SmartContract.com.

Chainlink aims to connect smart contracts on various blockchains with off-chain data in the real world. Many companies such as Swift, Google, Theta, Aave, Synthetix and Huobi have entered into partnerships with Chainlink. This certainly increases the project's likelihood of succeeding in the blockchain space.

LINK is Chainlink's native token used to reward node operators for their efforts on the platform. It is worth noting that LINK is an extremely popular token with a long history of exponential price growth.

Moreover, it has a high daily trading volume on major exchanges - $781,365,813 as of July 17, 2022, according to Coinmarketcap. According to experts, buying LINK in the $17.4-$17.8 range in 2022 will yield 100-300% returns during the next bull run.

Finally, Chainlink will remain relevant for a long time, so it is worth considering hodling the LINK coin. The fact is that a decentralized oracle is of paramount importance to the blockchain ecosystem.

How to choose a cryptocurrency ICO

So, you have read up to this point and you have a question: how to choose an ICO to make money? The answer is simple:

- There must be a worthwhile technology behind coin collection, and not just a “one-of-a-kind system” without a specific description of it. How to view the technology? Just. On the website of competent ICOs there is a “White Paper” item - this is a white sheet with text that describes the essence of the project, the business model, and the principle of its operation.

White paper of Bitcoin, written by Satoshi Nakamoto himself!

- In addition to technology, an ICO must also be backed by a team of developers with an untarnished reputation and who are not afraid to go offline.

- Transparency of cryptocurrency ICOs. Competent promotion and universal recognition.

- Ready working prototype, registration (a controversial point) of the company itself.

By the way, I advise you to treat ICOs as HYIPs: here you can make money, but you can lose everything! In some cases, the probability of losing is even higher than in HYIPs. A list of upcoming ICOs is maintained on the Icoalert website.

Unregistered securities

Security is, first of all, the presence of an investment contract. And even now, albeit outdated, but still effective, the Howey Test allows you to determine what an investment contract involves and what it does not.

Test questions:

Is this an investment?

Yes, investing in an ICO is an investment of money.

Is there an expectation of profit from the investment?

Yes, an ICO investor expects to make a profit. Although, some ICO organizers, apparently, oddly enough, do not think so and still do not have a product, demand, users or anything else material.

Is this an investment in a common enterprise?

Yes, the decentralized platform is a shared enterprise, and investors own internal utility tokens to prove it. And even a business that has used this potentially illegal method of raising capital to invest in an enterprise that it 100% owns still falls under the designated classification.

Is any profit dependent on the efforts of the promoter or other third party?

Yes – ultimately, the project must enter the market and create demand for the token. Otherwise, the price of this token will inevitably fall.

Despite all statements to the contrary, companies that conducted ICOs always, in fact, sold tokens only for the purpose of speculation, and profits were naturally expected.

And this is a fact - otherwise an entire marketing industry would not have formed around the promotion of tokens. Only the two largest advertising platforms (Google and Facebook) wisely banned the sale of unregistered securities for a period of time.

But, nevertheless, profit, first of all, depended on the promotion and efforts of the main business, which received funds for development through the ICO.

In addition, the ICOs clearly sold more tokens than there were potential users for them, and yet they knew that they were trading in unregistered securities. Also, by and large, the buyers of these tokens were never “users of the platform.” These platforms did not exist and most still do not exist. Statements about the nature of utility tokens are 100% false, misleading, and ultimately dangerous.

In general, utility tokens do not have any functional value, and if you were told otherwise, then, unfortunately, you were misled by those who wanted to sell them. Once utility tokens are purchased, they must be sold again on the market to make a profit. This means that ICOs should create a two-sided market rather than a one-sided one.

Utility tokens are like “hot potatoes” that have no true value.

Slang expression. Hope + opium. It means that although everything is going to hell, people blindly believe that a disaster will not happen.

Utility tokens generally make little to no economic sense and result in inefficient, unsustainable and simply unnecessary secondary markets that have been proven time and time again to consist of fake trading volumes, bots and market makers trying to trade and overly encourage people to continue gambling and subsidizing their inefficient business model.

In this way, ICOs allow people to raise funds bypassing regulation, giving “projects” that are, in fact, just teams of people, a risk-free, impunity-free and profitable way to raise capital. At the same time, unaffected markets are being launched for products that have not yet been created and, in principle, can exist in the form of centralized services that do not need any blockchain.

Step-by-step instructions: identifying scams among ICOs and cryptocurrencies

These unregulated/unregistered organizations have taken full advantage of weak legal standards and the lack of public knowledge regarding cryptocurrency. They screwed everyone over by selling worthless, extremely high-risk tokens that are, in reality, just securities with no legal rights to own or trade.

How to participate in ICO

You can buy tokens by taking information from the ICO website. Usually, the site counts down the time, after which they give the Ethereum wallet address. After the transfer to this address, over a period of time, the tokens are credited to your Ethereum wallet. MyEtherWallet is suitable for this, you can read more about it in the article “How to create an Ethereum wallet.”

After entering the exchange, you can buy these tokens and sell them, or hold them for a while waiting for the rate to rise. Different ICOs may have different conditions for participation, but in any case, they always have step-by-step instructions.

Maker

Maker (MKR) is the cryptocurrency that powers the MakerDAO ecosystem.

MakerDAO was founded by Rune Christensen as an open-source cryptocurrency project based on the Ethereum blockchain. It is a DeFi protocol that allows users to deposit Ethereum-based assets and then use them to generate the DAI stablecoin.

But let's return to the Maker token (MKR).

MKR holders can determine key MakerDAO parameters such as stability fees, collateral types, and interest rates.

MKR is one of the DeFi currencies worth taking a bullish position on. This is one of the hottest cryptocurrencies of 2022, as its value at one point jumped from $609 to around $6,000. Incredible!

Result and examples of successful ICOs

ICO is a tool for attracting investment for good developers, and a way for scammers to earn money for a yacht. Well, some statistics.

In May 2022, the ICO of the Aragon cryptocurrency was launched. Because of its technology and the PR move of the developers, it raised $25 million in just 15 minutes! And when they entered the exchange, the coins gave their owners a huge profit. And in June 2022, Bancor was launched, which raised almost one and a half times more funds.

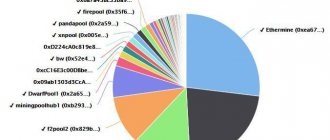

The most successful ICO for investors at the moment is Ethereum; the top of the other most profitable projects is in the picture below (the percentage is the profit from the moment the project was launched).

$50,000 in less than a year . But we should not forget: there are only a few , but there are thousands of failed and failed projects! That's all, I hope you understood the main points. Profit for everyone!

The article was written by user Lev Kalinin and supplemented by me.

Denis HyipHunter Knyazev

Blog creator. Private investor. He has been making money in highly profitable investment projects and cryptocurrencies since 2014. Consults partners. Join the blog's Telegram channel and our chat.

Don't miss other articles from this section:

- 10.06.20208763

Cryptocurrency - what is it, the history of its creation

23.05.2021905

9 Bitcoin Wallets That Made History

- 10.06.20201378

What are nodes in cryptocurrency?

- 09.12.20202577

Yobit net – cryptocurrency exchange | Yobit - reviews. How to work and withdraw money

30.04.2021871

Trezor crypto hardware wallet. What is it and how to buy it?

- 10.06.202047345

How to create a Bitcoin Core wallet and how to use it | Bitcoin cold storage

Compound

Compound Finance , founded by Robert Leshner, is one of the most famous DeFi lending platforms. It is a decentralized protocol based on Ethereum that connects lenders with borrowers, allowing them to earn attractive interest rates.

There are currently 14 Ethereum-based tokens available for lending on Compound.

COMP is the protocol's native token, launched in 2020. COMP is used to incentivize both lenders and borrowers to maintain a high level of activity and participation in the protocol. By holding COMP, you have the right to participate in the management of the protocol.

Additionally, COMP holders can earn passive income by participating in yield farming. COMP has grown significantly since its inception and has soared over 500% during the 2022 bull run.

Compound is also among the DeFi protocols with the highest volume of liquidity, ranking third on DeFi Pulse.