During times of instability and panic in stock markets, gold remains one of the most attractive defensive assets. It is durable, in demand and allows you to preserve capital during a crisis. In this article we will tell you what ways there are to invest in gold and what determines the value of this precious metal.

Pros of investing in gold

Investing in gold is beneficial for 3 reasons:

- Capital protection. During times of crisis, the popularity of the precious metal increases, as investors prefer to wait out the financial storm.

- Liquidity. Metal is easy to sell if the need arises.

- Reliability. The rise or fall in the value of the precious metal does not depend on the economic state of any country.

Other tax features of exchange trading in gold and silver

Trading operations with precious metals are associated with another tax for a private individual - personal income tax. It is 13%. In this case, the brokerage company is not a tax agent, as happens when selling securities, but only prepares the documents required for filing a declaration in accordance with Form 3 of personal income tax.

If you own gold or silver for more than three years, you have the right to a property deduction with an exemption from personal income tax.

The rules for the sale of precious metal from bank accounts, provided for by Russian tax legislation, are identical to those used for the sale of other material assets.

Buying bullion

You can purchase bullion at a bank, on a stock exchange or from specialized companies. The minimum entry threshold is 1 gram, and the spread (the difference between buying and selling) can differ by 5-10%. The purchase procedure includes weighing and issuing a certificate.

The main advantage of bullion is the physical presence of a rare precious metal. This option is well suited for long-term investment if you have a secure place to store your bullion.

Receiving precious metals purchased on the exchange

Spot precious metal trading on the exchange allows you to deposit and receive physical gold and silver. Based on the results of trading sessions, the metal asset located in the exchange storage facility in the required quantity is entered into the trader’s TBS (trading bank account), which is opened at NCC.

The deposit or receipt of precious metals by the trading participant is carried out using a correspondent account, through an authorized Moscow storage facility. For brokerage clients, this procedure is determined by contractual agreements.

Withdrawing gold and silver from the exchange involves what are called storage costs. At the same time, the quality and liquidity indicators of the gold precious metal may be lower than stated. The standardized bars issued by the vault usually weigh from 11 to 13 kilograms or 1 kilogram.

Buying coins

You can purchase coins at a bank, at an auction, from a specialized company or in a numismatic store. There are 2 types of coins: investment and collection. The cost of coins of the first type is close to the cost of metal, while collectible coins have artistic value, which makes them more expensive.

A coin is a tangible object that is well suited for long-term investment. However, it is important to remember that any physical impact on the surface of the coin reduces its value, so a safe place for storage is required.

Basel III: the global financial revolution

On March 29 of this year, Basel III, developed by the Basel Committee on Banking Supervision, came into force, returning gold to its historical significance. In short, about 40 years ago, the same committee abolished the gold backing of the dollar, making US currency and Treasury obligations virtually the only valuable instrument in the world. How and why this happened is a long and dark story. Gold was simply turned from a universal equivalent into a market commodity, like oil or cotton. In bank reserves, gold can now be accounted for only at half its value, which means that it is unprofitable to purchase and store it, since it is possible to issue loans and money into circulation only at half its market value.

Despite this, today it is the US Central Bank that has the largest official gold reserves in the world - 8,133 tons. For example, Germany, second on the list, has more than two times less gold - 3,369 tons. Russia, with all of last year’s increase, ultimately has 2,119 tons of gold in its reserves. So, Basel III says that from now on gold is a full participant in group 1 of assets, equal to the dollar.

This means that the interest of states, banks and private investors in it should also increase. For example, instead of dubious dollars and treasury bonds of other countries, countries can store their entire funds in real, shiny, highly liquid bullion. In our own vaults, under full control, and not increasing the influence of other countries through demand for their currency and securities.

Experts explain the long-term decline in the value of the metal (from approximately 2012 to 2016) precisely by the global game in the market, through which prices were artificially lowered in order to buy large volumes at a low price - after all, the entry into force of Basel III was known already in 2011.

Buying gold jewelry

You can buy jewelry in jewelry stores. This method of investing money is the most controversial, because the cost of the product is influenced by many factors. Among the advantages of the method is the ease of purchase and transportation. However, there is a high risk of purchasing a counterfeit or low-quality product if it is purchased from a private person.

To make jewelry, an alloy with other metals is used, rather than pure gold; the cost increases due to the work of the jeweler and markup of the price during the trading process. At the same time, historical or artistic specimens have high value and value.

The second reason

Protection from wars and revolutions

If you are so pessimistic and afraid that war cannot be avoided, again buy gold. But this time - in the form of bars or coins.

But here another problem arises - where to store them? If it is in a safe deposit box, then you are unlikely to be able to pick it up if there is military action on the street. Therefore, there is only one option left - to bury it on your site.

As I have already said at seminars, you will not be able to legally become the owner of gold by visiting a factory or company engaged in its mining. You will need intermediaries - exchanges or banks. As a private investor, you have access to gold bars, coins (investment, collectible), and jewelry. I’ll tell you briefly about the advantages and features of the listed types of assets.

Jewelry

The most accessible asset is jewelry, which can be bought at a pawnshop, jewelry store, even online. Surely women will appreciate such an investment item - both beautiful and practical. But is it worth investing in jewelry? As an experienced investor, I will outline only some of the pitfalls:

- When purchasing, VAT will be included in the price of the product. And when you sell, no one will return the VAT;

- You are not buying pure gold, but an alloy. Typically, jewelry is made from 585 gold. For you, this means that the product contains about half of valuable metal;

- in its pure form, precious metal is cheaper than jewelry, so you sometimes pay more for a “beautiful picture” than it deserves;

- There is a risk of purchasing a fake. Yes, this happens even in jewelry stores. The purity may not correspond to the alloy, or even instead of gold they sell a cheap gold-plated alloy.

The main disadvantage of jewelry is its low liquidity. To whom and where to sell them? You will have to take it to a pawnshop for half the price or at the cost of scrap. Therefore, I do not recommend this method of investment. The exception is professional collectors who understand rare and valuable jewelry.

Ingots

Unlike jewelry, metal bullion has a purity of 999. The weight of the ingot varies from 1 g to several kilograms. Bullions from precious metals can be bought in banks. But before you rush out to buy, keep the following in mind:

- the cost of the bullion includes VAT if the purchased bullion is not stored in the bank’s vault;

- storage costs and risk are high - the bullion can be stolen;

- binding to a specific bank: it is easier to sell the bullion to the exact bank where it was purchased, since banks are reluctant to purchase “other people’s” bullion. And if they buy it, then there may be costs for authentication examination, or the bank will purchase “someone else’s” gold cheaper than “its own”;

- Banks are reluctant to even buy back their bullion. By and large they are sales oriented.

So, what we have: a loss in the form of VAT (20% of the price), and also the spread, which I already mentioned above. By analogy with currency exchange, there are always 2 rates - for buying and for selling. I may surprise many: the spread on gold bars can reach 25–40%. The smaller the size of the ingot, the less profitable it is to purchase. Therefore, if it is worth investing in bullion, then only if you have significant amounts and for a very long time.

Golden coins

This is another way to invest in gold. If you have heard how “friends of friends” successfully bought several collectible coins for 5 thousand rubles ten years ago, and now their price is 5-10 times more - do not delude yourself. It is not that simple.

Will explain. Can you predict with a high degree of probability which bottle of wine (painting, brand) to buy today, so that in a couple of decades its value will increase? If you are not an expert in this field, definitely not. Same with collectible coins. Some increase in price over time, others do not. And this is subject to the same circulation, mass, mintage, year and country of issue. To understand this issue and understand the reason, you need to dig through a lot of professional literature. And even after this, with highly specialized knowledge, there is no guarantee that you will buy “the same coins.”

Let's say you buy a coin. Where are you planning to sell? Banks don't often buy back their coins. See for yourself: the price list for coins is presented on the Sberbank website. Of the more than 3 thousand put up for sale, the bank buys only 200, and even then almost half the price of the sale. There are still collectors, but they will only buy coins if the price is low.

Investing in coins is only suitable for experts and those who purchase gold for a small amount as a souvenir or as an inheritance for descendants.

Perhaps it’s worth asking the question: why do you need these coins at all? If the goal is to get some income in the long term, weigh how much time you will have to spend studying the issue, how much to invest, and most importantly, how much you can get in ten years. Is it worth it?

Opening an impersonal metal account

Compulsory medical insurance is an impersonal metal account in a bank where capital is stored in metal equivalent. The client tops up the account by purchasing metal, but there is no physical purchase, which means there is no need to worry about a safe storage location. There is no need to pay VAT for transactions.

There are 2 types of compulsory medical insurance:

- Perpetual or current. Compulsory medical insurance is limited in profitability by the increase in the price of gold. Cash out is available at any time, however VAT will be charged at the time of account closure.

- Time or deposit. Income is generated in two ways: by increasing the exchange rate of gold and interest. Replenishment or early withdrawal is not possible, otherwise payments will be lost.

Clearing operations

The currency exchange and the precious metals exchange use a common clearing mechanism and joint risk management. Failure to perform under contracts is governed by general rules.

When entering into any partially collateralized contracts and using updated or existing settlement codes, the client has the right to use the general ruble collateral provided by the brokerage firm and the exchange.

In the domestic domestic market of gold and silver, the role of the main counterparty and clearing operations was assumed by the organization NPO NCC, part of the association. At the same time, the taken into account risk coefficient for exchange and over-the-counter transactions reaches 5%, and not 20%.

Shares of gold mining companies

This is an indirect option for investing in precious metals. However, it is important to consider that the growth of shares of gold mining companies does not always depend on increases in world gold prices. If a company suffers losses for any reason, the value of its shares may decline. When choosing a company to invest in, pay attention to the cost of metal mining. The lower the cost, the higher the profitability from production, and vice versa.

You also need to pay attention to the company's profitability, because this indicator directly affects the price of shares. It is recommended to avoid buying shares of companies that do not have their own gold reserves and violate their production plan. You can invest in shares of gold mining companies such as Lenzoloto, Buryatzoloto, Polyus, Seligdar, Polymetal.

Third reason

Maybe you think that gold is just a good asset that is constantly growing, and should always be bought, and not just in those cases that I mentioned? This is wrong. Indeed, gold has had value since ancient times. But, like all commodity assets, it is not capable of generating income in the form of coupons or dividends. At the same time, gold performs well as a protective asset and rises in price during times of market cataclysms, so it makes sense to hold it for those who want to insure their portfolio against market fluctuations.

Remember that over the long term, the price of gold is only a fraction of a percent higher than inflation.

And the main thing: gold, like stocks, bonds and real estate, fluctuates in value, and you may lose part of your capital if you buy it.

For example, if you bought gold in 1980 at its peak price of $850 an ounce, you would then watch it fall in price and then stand still for a long time. And the price per troy ounce of gold, which was in 1980, recovered only 28 years later in 2008.

I don’t think any investors had the patience to wait for this moment.

Futures

A gold future is an agreement between a buyer and seller to purchase a precious metal at a predetermined price and quantity on a future delivery date when settlement occurs. The dynamics of gold on the world market and the futures rate are identical, and income or loss depends on the difference between the cost of buying and selling a contract. A brokerage account is required to trade.

Futures contracts are a potentially highly profitable and highly liquid instrument. Trading opens up opportunities for strategies and speculation that are not possible when trading gold bars and coins. However, this is a risky instrument, and successful trading requires knowledge and experience. The option is not suitable for long-term investment.

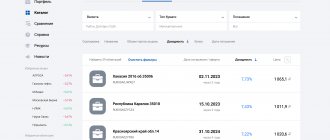

Procedure for purchasing precious metals

Transactions with precious metals on the Moscow Exchange are concluded in the currency section. The contract deadline is the next day. For direct trading, a personal account is used on the website of the brokerage firm with which the investor works, or special software.

The purchase and sale of gold and silver lasts from 10.00 am to 23.50 at night. Contracts must be completed by 20:00 pm.

A long trading session allows you to cover the period of operation of Asian and European exchanges, which is extremely important, as it makes it possible to take into account the price dynamics of foreign precious metals exchanges when making large transactions.

Difficulties and disadvantages of investing in gold

Investors may face 5 disadvantages of investing in precious metals:

- Difficult to store. The price of bars and coins depends on their condition; the slightest scratches reduce the value, so it is important to preserve their original appearance. You can store the precious metal in a safe deposit box, which costs an additional fee, or in a home safe.

- Big spread. Bullions, coins and unallocated accounts have a large difference between the sale and purchase prices of metal.

- Lack of compulsory medical insurance. Compulsory medical insurance is not covered by deposit insurance, which increases the risk of loss of funds if the bank ceases its activities.

- Long-term profit making. A noticeable effect from investing in gold appears within 10-15 years, so this type of investment is not suitable for short-term profit making.

- No interest on having the physical equivalent of gold. Income is possible only after the sale of the metal; the owner does not receive any other interest from storage, unlike, for example, from bank deposits.

First reason

Protection from the global economic crisis.

If the global economy goes into recession, stock markets fall. At this time, investors are moving from stocks to safe bonds and gold. Accordingly, the price of gold tends to rise.

And if you expect a recession, buy gold. But not bars and coins, but funds.

Compulsory medical insurance, mutual funds and ETFs are all so-called “paper gold”, which differs from real gold in that your rights to the precious metal are recorded in a computer and on paper, which means you will not be able to “touch” your asset. To make it easier for you to decide where to invest, I will briefly introduce the essence and differences of these instruments. Considering the interest of many clients in gold, it is useful for all future investors to know how to invest money in this precious metal in Russia.

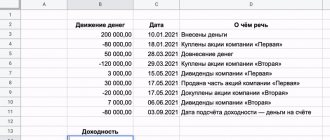

Compulsory medical insurance - impersonal metal account

By opening it, you do not acquire metal, but an account of its ownership. Moreover, the bank’s quotes are set taking into account the Central Bank exchange rate and a certain markup (since the bank also wants to make a profit from metal purchase and sale transactions). If at the time of opening compulsory medical insurance the cost of gold is 2,500 rubles per 1 g, then if you have 10 thousand, you buy 4 g. If the cost increases to 3,000 per 1 g, the sale will bring a profit of 2 thousand. Simple arithmetic.

Compared to purchasing in bullion, the price of gold for compulsory medical insurance transactions is the same for all investors, regardless of the volume of investment. There is no need to buy multiple grams; you can invest an amount equivalent to 37.1 or even 0.5 grams of the precious metal. The main advantage of compulsory medical insurance is that the bank does not charge a storage fee, even if you keep the account for 20, 50 or more years.

It may seem that compulsory medical insurance is the most profitable option for investing in gold. There are no problems with liquidity, since gold can be quickly sold at the current rate to the bank. But therein lies the main drawback. This is a spread - the difference between the purchase and sale prices.

Let me give you an example.

You decided to buy precious metals by opening compulsory medical insurance. First of all, choose a large bank with the best offer. Great. You open an account and buy precious metals for a certain amount. What's next? When you need to sell gold, who should you offer it to? To the same bank where it was purchased. Please note that the bank independently sets the buying and selling rate, and if the exchange price for gold changes significantly, the spread can be significantly increased. And this is where the buyback rate may not be so attractive. It turns out that in the end, regardless of your choice, you lose significantly on the sale. Therefore, when choosing a financial institution, do not look for the lowest cost, but pay attention to the size of the spread, which varies from 2-3 to 10-12% in different banks.

Use Internet banking, this will help you avoid queues and save your time, and also take into account the time for buying and selling. On holidays and weekends, the buying and selling rate is less favorable, since banks insure themselves against force majeure in the market.

And don’t forget about taxes when you plan to open a compulsory medical insurance. If the account provides for interest, you will have to pay 13% of the income received on it. When compulsory medical insurance is closed, 13% of the income received from the increase in the value of the metal will also have to be transferred to the tax office. When closing the compulsory medical insurance and withdrawing funds from the account in the form of bullion, you will also have to pay VAT - 20%, which the bank will include in the sale price.

What we have as a result: compulsory medical insurance is not very good for short-term speculation, but is suitable for medium- and long-term investing. Even if the spread is high, costs will decrease over time due to free accounting of the precious metal at the bank.

Mutual Funds - funds that invest in gold

This is the next option for investing in “paper gold”. In this case, you have to make the right choice of fund. You will choose from those that invest in gold, or mixed ones, where only part of the money is invested in precious metals, and the rest in other instruments. Let’s take the average cost of a share for a new investor to be 5 thousand rubles. Additional shares are purchased at a price starting from 1 thousand. Typically, funds invest in 4 metals at once - gold and silver, platinum and palladium. What you get as a result:

- minimum requirements for the initial investment amount;

- the opportunity to buy and sell shares at any time at market prices.

This all sounds great, but what's the catch? Will explain. As I said above, the compulsory medical insurance spread can reach 10–12%. In the case of mutual funds, you will overpay about 1–3% when purchasing a share, and when selling (if you own the share for less than 3 years), you will be charged another 1–2%. As a remuneration and to cover other expenses, the management company will take about 3-5% per year. Now consider: subject to a 5% commission for 10 years of owning shares of the fund, you leave half of the capital to the management company. In addition, you will lag behind the market by about 3-5% annually. If gold becomes more expensive by 10% in a year, you will make a profit of about 5-7%. What if the price remains unchanged? Then expect losses equal to the amount of the commission.

To understand how much gold mutual fund shareholders are not receiving, it is worth comparing the dynamics of the exchange rate over a certain time and the profitability of the funds. For example, over 3 years, gold increased in price by 24.2%. Statistics on mutual funds show that the best profit result was an increase of +20.3%, and the worst was +16.5%. But does this mean that you should completely ignore mutual funds? You, as an investor, should consider their positive aspects:

- If you own shares for longer than 3 years, you will no longer have to pay personal income tax. Let me remind you: income from transactions with securities is taxed at a rate of 13%.

- You will be able to exchange shares within the same management company without taxes. If you sell mutual fund shares in one management company to buy shares in another, you will be required to pay 13% on the profit from the transaction.

Let me summarize: I don’t recommend investing in mutual funds for precious metals, but if you do decide, it’s better to do it over a period of 3-5 years, getting the maximum benefit from tax breaks and the opportunity to exchange shares (at seminars I give practical advice for those who invest money into gold using mutual funds, so that participants can decide for themselves whether it makes sense to choose other methods).

Gold ETFs

This is one of the preferred options for investing in gold. Gold ETF shares can be freely bought and sold on the exchange. Why I Like Gold ETFs:

- Low costs compared to other investment methods such as gold bullion, coins or OMC.

- Exactly following the index, which is based on the price of gold.

- Ease of access - you can buy and sell funds online through a broker.

- Simplicity and liquidity - trades like a stock, with liquidity provided by a professional market maker.

- Transparency - the most complete disclosure of information, the net asset value (NAV) of the fund is available throughout the day.

- Accessibility – An investor does not need to qualify to purchase gold ETFs.

I will give examples of five gold ETFs. The first four funds can be purchased on foreign exchanges in the English way, through a foreign broker or bank. The FXGD fund can be purchased through Russian brokers.

- The most popular gold ETF is SPDRGold. It can be purchased through your account from a broker or from a foreign insurance company. This fund buys gold bullion to back the issued shares. The bars are stored at HSBC Bank (London).

- iShares Gold Trust, IAU. This fund also issues shares backed by gold bullion. IAU stores its gold in vaults around the world. The fund's low price and expense ratio appeal to a wide range of investors.

- ETFS Physical Swiss Gold. SGOL stores gold exclusively in Swiss vaults in Zurich.

- ZKB Gold ETF Fund. This fund is traded on the Swiss SIX Exchange and invests exclusively in gold. All assets are kept in Switzerland. Investors can sell ETFs on an exchange at any time. Each share is approximately equal to 1 ounce of gold. When redeeming shares, you can receive an equivalent in physical gold that is a multiple of 12.5 kg (the weight of one bar). Investors can purchase the fund in multiple currencies of their choice (CHF, USD, EUR or GBP).

- FinEx Gold ETF (USD). FXGD is the only gold fund that can be purchased on the Moscow Stock Exchange. The investment instrument in gold protects investments from devaluation, since the asset currency is the dollar. The difference between the purchase and sale prices on the exchange is minimal; 20% VAT is not paid upon purchase. Exchange quotations on the exchange are available in rubles and reflect both changes in the value of gold and exchange rate differences in the foreign exchange market. With many Russian brokers, gold ETFs can be purchased in an Individual Investment Account, which gives a tax advantage to the investor. This is the most affordable investment instrument. The price of a share of this exchange-traded fund is 633 rubles (December 2022). Another advantage is that all tax benefits apply (IIS, 3-year tax deduction).

Thus, a gold ETF helps a private investor protect his capital from inflation in times of crisis and is suitable for medium and long-term goals over a horizon of 5 years.

An exchange-traded fund is liquid and easy to buy and sell at any time with minimal costs. By investing up to 10% of your capital in gold funds, you can not only diversify your portfolio, but also reduce its volatility.

Investments in gold mitigate losses in the currency and stock markets and offer effective protection against inflation, market shocks and crises.

When to buy?

Gold is considered to be a defensive asset - investor interest in it usually grows during economic crises and depreciation of the national currency. There are 3 key prerequisites for an increase in the exchange rate of the precious metal: the emergence of hyperinflation, the deterioration of the country’s economic condition, and a reduction in the Central Bank rate.

During a crisis, investing in gold will show its profitability, but it is recommended to buy it gradually, without investing all your funds in the precious metal at once. Different purchasing rates minimize the difference in costs.

How could possible “dedollarization” affect the price of gold?

Since 2008, the US has increasingly abused its financial position. The status of the USD as a single reserve currency is no longer satisfactory to many. At the moment, a number of countries are already looking for an alternative to green American paper, and the central banks of Russia and China are actively increasing the share of the yellow metal in their own reserves. In the Russian Federation, this share has already exceeded 20%. If you believe the forecasts of prominent analysts, the volume of investment in gold by the central banks of a number of countries will only increase over the years. Of course, this will lead to an increase in capitalization and, consequently, to a significant increase in value.

Factors influencing price rise or fall

Changes in the price of gold depend on several factors:

- Inflation. Hyperinflation is one of the main reasons for buying precious metals. When a currency depreciates, the demand for a more reliable object for storing savings increases.

- Conjuncture. Gold has the properties of a protective asset that investors turn to in turbulent times.

- U.S. dollar. The American currency determines the world rate of the precious metal. When the US dollar rate increases, the precious metal rate decreases, and vice versa. However, if an increase in the US dollar depreciates the national currency, then the rate of the precious metal begins to rise.

- Central Bank rate. When the Central Bank raises interest rates, the price of gold begins to decline because money becomes more expensive and classic assets, such as bank deposits, begin to generate higher returns.

Currency wars

It is quite possible that in the foreseeable future we will be lucky enough to witness a real war between the currencies of different countries. This will significantly increase the volatility of financial markets and create good opportunities for effective trading. The cause of currency wars may be the world's heavy debt burden. It is known that the total GDP of all countries cannot exceed 80 trillion USD per year. At the time of writing, global debt is estimated at $400 trillion, which is 5 times the maximum possible total GDP. By the way, the lion's share of this debt (more than 70%) lies on the shoulders of the United States.

The reason for the formation of such debt was a loyal mortgage policy, as well as the credit system as a whole. Of course, these 400 trillion US dollars are unsecured pieces of paper. Sooner or later, this bubble will burst, which will lead to a large-scale devaluation of all world currencies. With this development, the price of gold will obviously increase at a breakneck pace.

Analysis of the exchange rate, supply and demand for gold

People have been mining gold for over 6,000 years. During this time, approximately 195,000 tons were extracted from the bowels of the earth. Scientists believe there are still about 52,000 tons left. It will last for a long time, because the gold that has already been mined also does not disappear anywhere, but is used in jewelry, bars and coins, and industrial parts. Maybe not all 195 thousand tons, but definitely most of it is still in circulation.

Complete information about current strategies that have already brought millions of passive income to investors

Since 1919, the price of gold has been determined daily on the London interbank market using the Gold Fixing method in US dollars per troy ounce (1 troy ounce = 31.1 g). It is the global benchmark for contracts for the supply of physical gold.

Our Central Bank daily fixes the price set in London, recalculates it at the rate into rubles per gram and publishes it on its official website.

Over the past 50 years, the price of gold has increased by more than 5,300%, and by 25% during the crisis year of 2022. The graph below clearly shows all the ups and downs:

- 2000 – dot-com crisis and increased demand for gold;

- 2008 - the mortgage crisis in the United States, which then developed into a global financial crisis, investors save their capital in gold assets;

- 2012 – economic recovery and investors leaving the safe “golden” haven for riskier assets; in this wave, prices fall;

- 2019 – growing expectations of another global crisis and a new rise in prices;

- 2020 and so far the first half of 2022 - pandemic, lockdowns, economic slowdown, uncertainty, which again leads to a flight of investors into protective assets.

More than 100 cool lessons, tests and exercises for brain development

Start developing

The 50 year gold price chart is in the image below.

Why gold has become a protective asset for millions of investors during periods of crisis:

- Rarity. Although there are reserves, they are not unlimited, and all easily mined metals have already been extracted from the earth. What remains are the hard-to-extract ones, which require modern technologies and substantial costs for subsoil development.

- Story. Many investors believe that the craze for paper or electronic money will one day pass, but gold has always been, is and will be a universal means of payment.

- Liquidity. Gold is valued in all countries and at all times, so it is always easy to sell, no matter where you are.

- Safety. Gold is not subject to corrosion, is resistant to chemical processes, and therefore does not lose its value for centuries.

Demand structure over the past 10 years:

- From 2010 to 2013, central banks of countries actively increased gold reserves, then a decline began, in 2018–2019 there was an increase again, and in 2022 there was a decline.

- Demand for jewelry began to fall in 2022. In 2022, it was at its lowest level in 10 years.

- Demand in industry is also gradually decreasing: from 460.7 tons in 2010 to 302.2 tons in 2022. The maximum volume is consumed by electronics: 248.3 tons in 2022.

- But in gold investments, most of all is concentrated in ETFs. In 2010 it was only 388.9 tons, and already in 2022 - 877.1 tons. In 2020, the demand for investment gold reached a maximum in 10 years - 1,773.8 tons.

The top 10 largest gold miners are presented in the table.

| Place | A country | Production, t |

| 1 | China | 383,2 |

| 2 | Russian Federation | 329,5 |

| 3 | Australia | 325,1 |

| 4 | United States | 200,2 |

| 5 | Canada | 182,9 |

| 6 | Peru | 143,3 |

| 7 | Ghana | 142,4 |

| 8 | South Africa | 118,2 |

| 9 | Mexico | 111,4 |

| 10 | Brazil | 106,9 |

Supply structure over the last 10 years:

- from 2010 to 2022, production (mine production) grew from year to year, but in 2022 there was a decline that has not yet been overcome;

- The supply of processed gold, on the contrary, has been growing over the past 3 years.

[

Mutual Fund Gold

Mutual funds have two main advantages. This, again, is the possibility of registration even for a baby, and also the legal protection provided by the law “On Investment Funds”: in accordance with this law, the property constituting a mutual fund is separated from the property of the fund’s management company, the property of unit owners and other property in trust management from this management company. That is, a mutual investment fund can be compared to a safe in which investors’ assets are stored: money, real estate, securities, shares in an LLC, etc. You can buy or sell assets, but the one who sells or buys (that is, the management company) cannot take anything from the safe. This is overseen by a specialized depository company, independent of the management company. She keeps records of everything that is and happens “in the safe” so that the management company cannot take anything from it. At the same time, they are monitored by the “police”, that is, the regulator - the Central Bank of the Russian Federation.

It turns out that in the case of compulsory medical insurance, investments are directly affected by the bank’s problems, and in the case of a mutual fund, the management company cannot appropriate the gold in the fund.

For long-term investing (over 10 years), it is worth choosing mutual funds for gold, and not for ETFs of foreign futures management. Because if something happens to a foreign management company or if you don’t buy futures again, then investments in the precious metal will also be ruined.

If you keep money in a mutual fund for more than 3 years, you will also be provided with a personal income tax investment tax benefit.

The disadvantages of mutual funds are high commissions: they can range from 1.2% to 6.5%.