Investments

03.08.2020

14292

Author: Igor Smirnov

Photo: pixabay.com

Bonds are securities that give the right to receive income from the entity that issued them. Bonds may be resold on the secondary market.

Last news:

I want to trade Tesla and Apple shares: how to do this in Belarus?

Attracted the most investments in 2022: top 7 Belarusian startups

To explain what a bond is in simple words, you can do this:

- Bonds are receipts with an obligation to pay a certain amount on a specified date.

- The amount payable on bonds is greater than the amount spent to purchase them.

- Bonds can be resold, in this case the person obligated to pay does not change, but the recipient of the funds changes.

To better understand the place of bonds, you can compare them with shares of enterprises:

| Bonds | Stock | |

| Income is known in advance | Yes | No |

| Interest payment guaranteed | yes, except for bankruptcy of the issuer | No |

| Possibility of resale | Yes | Yes |

| Additional rights | No | the right to participate in the management of the issuer |

Photo: pixabay.com

Briefly about bonds

A bond is a financial debt instrument. Bonds are issued by companies and governments to attract loans. The buyer of the bond receives interest income for as long as he owns it.

The one who issues bonds is called the issuer, and the one who buys them is called the investor.

Each bond has the following parameters:

- Denomination Cost of one paper. For example, 1000 rubles. When you buy one bond, you are lending the company (or government) an amount equal to its face value.

- Coupon. The amount accrued on one bond for a certain period of time (coupon period). The period can be 6 months, 3 months and 1 month. This means that the bond holder receives from the issuer an amount equal to the coupon once per period simply for being the holder of this security.

- Maturity date. The date on which the issuer undertakes to repurchase the bond, i.e. pay the debt off.

All these parameters are set at the time the bonds are issued and cannot be changed in the future, with the exception of individual cases, which we will not consider in this article.

How bonds work

All bonds have an issuer, par value, coupon and maturity date.

Issuer

is the one who issued the bond. The issuer of the bond can be the state, federal entities, for example, Moscow or the Samara region, as well as state or private companies.

Bonds of the federal subjects in circulation as of March 2022. They can be found in the Gazprombank Investments application using the “Security Type” filter by selecting “Municipal”. In the illustration, the securities are ordered by profitability.

Denomination

— the price of a bond set by the issuer upon its issue. Each bond has its own par price. As a rule, on the Russian market it is 1000 rubles. Sometimes companies issue bonds in dollars or euros, these bonds are called Eurobonds and help companies raise money in foreign currency.

Coupon

is the interest on the bond's face value that bondholders receive. Most often they are paid once or several times a year. The frequency and size of payments is determined by the bond issuer.

If a car wash owner estimates the value of his project and realizes that he can provide investors with a return of 6.24% per annum at maturity, this means that at the end of the bond's life, each investor will receive back the full value of the bonds and 6.24% per annum.

Maturity

- this is the time for which a company or government borrows money. For short-term bonds this figure is 1-3 years, for medium-term bonds - 3-7 years, long-term - 7-30, for perpetual bonds - more than 30 years. The maturity date also affects the yield of the security. Typically, the longer the loan term, the higher the bond's coupon yield. This is due to the fact that over a long period of time, issuing companies have more risks. Therefore, the profitability of the security also includes a premium for the period of holding the security.

In the Gazprombank Investments application, you can sort bonds by several parameters, for example, by the maturity date of the bond.

Market price of the bond

is the price at which the bond is traded on the secondary market, that is, on the stock exchange. If those who buy the bonds of the car wash chain decide to sell them on the stock exchange to other investors, then they will no longer form a nominal price, but a market price for the bonds.

This price can be either higher than the nominal price or lower. For example, a bond with a face value of 1,000 rubles may cost 970 or 1,150 rubles on the market. It is subject to many factors: the interest of other investors in owning this security, the financial condition of the issuer, the economic situation in the country, and so on.

Volume and dynamics of trading in bonds of Gazprom Neft PJSC, RU000A0JWK41. Source: moex.ru

Accumulated coupon income or accrued income

- the amount that has accumulated since the payment of the previous coupon or since the bond was issued. When an investor sells a bond, he receives a portion of the coupon accrued at the time of sale. Thus, even after holding the security for only a couple of days, he earns part of the coupon. The income tax is automatically calculated by the broker and added to the purchase or sale amount.

For example, an investor decided to sell a bond with a par value of 1000 rubles with a coupon of 80 rubles per year. 90 days have passed from the coupon payment date to the time of sale. The investor will no longer receive the next coupon, but the buyer will pay him additionally for 90 days, calculating the accrued income using the formula: accrual income = 80 * 90 / 365 = 19.7 rubles.

The amount of accumulated coupon income can be viewed in the Gazprombank Investments application or on the web version of the service.

Types of bonds

By issuer

- Federal loan bonds (OFZ) are government securities issued by the Ministry of Finance of the Russian Federation. The coupon rate depends on the key rate of the Central Bank at the time of issue. The purpose of the issue is to attract financing to the budget through loans.

- Municipal bonds are securities of Russian regions. The coupon for them is slightly higher than for OFZ.

- Corporate bonds are securities issued by companies. Coupon rates depend on the credit quality of the issuers and vary widely.

- Eurobonds are both government and corporate securities denominated in foreign currency. Most often in US dollars. Issued to attract financing in foreign currency.

By coupon type

- Discount (zero-coupon) bonds. They don't have a coupon at all. Initially placed below par value, the investor's income lies in the difference between buying and selling.

- Bonds with a fixed coupon. Throughout the entire circulation period they have a fixed coupon size.

- Bonds with variable coupon. The coupon size is fixed until the offer date. The issuer then sets a new coupon size based on market conditions.

- Bonds with floating coupon. The coupon rate is tied to some other indicator, for example, to the key rate of the Central Bank, to the consumer price index, to the RUONIA rate, etc.

What is OFZ

Federal loan bonds are debt securities issued by the Russian government.

Countries almost always need financial resources, but it is difficult to attract them from taxes, excise taxes or budgetary funds, so the state turns to investors. It takes money from them for a specified period, within which it guarantees to return the entire amount - the face value of the bond. Investors are also promised coupons - periodic interest payments, essentially similar to the accrual of interest on a deposit. Any private investor can buy OFZ on the Moscow Exchange: these securities are available through any broker. Bonds are placed frequently and there is enough for everyone. For example, at the beginning of 2012, the Bond OFZ-26207-PD / RusBonds 350 million OFZ 26207 was issued. Each paper costs 1,000 rubles. Coupons are transferred twice a year, and they are equal to 8.15% per annum.

The OFZ issuer, the Ministry of Finance, is obliged to publish the main characteristics of the bond: terms, dates, interest rates and much more. Screenshot: Moscow Exchange.

Government debt is considered a safe asset, so bonds are constantly being issued and purchased. For example, such securities are placed by the US Treasury, the UK and China. The first have the highest credit rating - AAA S&P, Moody's, Fitch and BDRS Credit Rating by Country / Trading Economics, the second - AA, and the third - A. The rating agencies believe in Russia a little less - BBB, but it is still a reliable investment.

How to buy a bond

To make bond trades, you need a brokerage account. There are two ways to buy a bond:

- At the time of release, i.e. at the initial placement directly with the issuer. This option is not suitable for new investors. There is often a high entry barrier and other difficulties. If you are reading this article, then most likely you are a beginner. Therefore, we will not dwell on it.

- On the stock market, not from the issuer, but from other market participants who decided to sell these bonds for one reason or another. The entry threshold here is minimal, you can buy at least 1 piece. However, the cost of bonds on the market is not equal to the par value, but can be either higher or lower, it depends on the supply and demand for a particular security. The market price is expressed as a percentage relative to the face value.

If a bond is traded at a price of 103%, and its par value is 1000 rubles, then its actual value is 1030 rubles. If a bond is traded at a price of 99%, and its par value is 1000 rubles, then its actual value is 990 rubles.

Why buy bonds

Bonds are a less risky investment than stocks, so many investors buy them to reduce the risk of their portfolio. The yield on bonds is known in advance - when issuing bonds, the company specifies how much income it will pay and how often.

One way to earn more on bonds than on a bank deposit is to buy bonds on an IIS, choose deduction type A if you have official income, and annually receive an additional tax deduction.

For example, the owner of a car wash issued bonds for 3 years with a par value of 1000 rubles. The total amount of the issue was 5 billion rubles, and the coupon was 40 rubles, which will be paid twice a year. Thus, investors will receive 40 rubles per paper twice a year, and at the end of the bond’s circulation period they will return their face value - 1000 rubles per bond.

By collecting a portfolio of bonds, you can count on income from coupons several times a year, as well as a return of the face value. If an investor uses an IIS with deduction type A and replenishes the account with 400,000 rubles per year and does not withdraw money, he can also count on a tax deduction of up to 52,000 rubles. Thus, the profitability of such a portfolio will consist of coupon payments, return of bond par value, as well as 13% of the money that the investor contributed to the IIS. Brokerage account holders cannot receive a tax deduction, but can count on a number of benefits, such as the long-term stock holding exemption.

An example of calculating bond yield when using deduction opportunities on an individual investment account.

Another option is to buy bonds at par on the day of issue and sell them on the stock exchange at any time for the price that investors will be willing to repurchase. If interest in the issuer's bonds is high, then the price of these securities on the stock exchange may rise.

When the car wash owner issued bonds with a yield of 6%, deposit rates were 5% and investors were happy with that. But then deposit rates became 4%, and the entrepreneur’s bonds became more attractive to investors, since the coupon gives an income that is already 2% higher. Now many people are ready to buy his bonds on the stock exchange, and the price of the paper is already 1010 rubles. The amount of the entrepreneur’s debt does not change, but the essence of the game changes: now the investor can resell the securities for 1010 rubles. And if deposit rates rise, then the price of the bond will drop to 990 rubles, then the investor can buy it: after all, its face value will not change, and on the maturity date he will receive 1000 rubles for it.

In the web version of the Gazprombank Investments service, you can see the current bond price in the upper right corner. The Yield to Maturity line tells you how much an investor will earn if he holds the bond to maturity. The “Paron” line indicates the face value of the bond. Investors will be interested in the “Spread” parameter; it shows how actively a security is traded on the exchange.

Investing in bonds is considered a conservative investment method because their returns are more predictable than the returns on stocks.

NKD - accumulated coupon income

Despite the fact that the coupon is paid once per coupon period, it is accrued every day. Thus, the daily coupon size is equal to the sum of all coupons for the year divided by 365.

Cd=S

365

Cd

— daily coupon size

S

— the sum of all coupons for one year

Accordingly, the NKD is the amount accrued but not yet paid since the last coupon payment (or from the date of placement of the bond, if there have been no coupon payments yet).

NKD = S × t

365

S

— the sum of all coupons for one year

t

— the number of days from the beginning of the coupon period.

When a bond is sold, its price increases by the amount of the current NKD. This means that you can sell the paper at any time, and the accrued interest will not expire. Also when purchasing, the cost of the bond for the buyer will be higher by the amount of the accrued income tax.

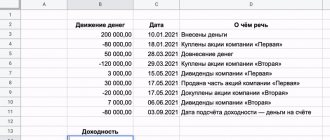

Profitability

The price of a bond on the market is not that important. To assess the attractiveness of a bond, the yield parameter is used.

This is the return that the paper holder receives, expressed as a percentage per annum. There are a number of scenarios in which the yield on the same bond can be different. For example:

- You bought the bond at the initial offering and held it until maturity.

- You bought a bond on the market at a price different from its face value and held it until maturity.

- You bought a bond at the initial offering and sold it after some time on the market.

- You bought a bond on the market and soon sold it on the market.

Since the market price of a security is not constant, but depends on supply and demand for it, for each of these scenarios the profitability of the same security will be different.

Let's figure out what types of returns there are, how they are calculated and in what cases they are used.

How not to lose money on OFZ

All calculations above are nominal returns. In reality, it will almost always be a little lower, because there are expenses that cannot be avoided.

Distinguish the nominal rate from the effective rate

Bonds are a market instrument: they are traded on an exchange, and their price is constantly changing. For example, the nominal value of OFZ 26207 is equal to one thousand rubles, but in 2022 the paper could be bought for 979.5 rubles, and in 2020 - for 1173.8.

In addition, the investor must pay the “accumulated coupon income” to the previous owner of the paper. For example, on August 16, 2022, you will have to pay 1069.3 rubles for the bond itself and another 13.4 for coupons.

Above is the price of the bond according to the last transaction, as a percentage of the par value. NKD is the accumulated coupon income that will have to be paid to the previous holder of the paper. Screenshot: Moscow Exchange.

In fact, the investor will pay not a thousand rubles, but 1082.7 rubles. Because of this, the effective yield of the security will automatically fall from 8.15 to 6.83%.

Take into account losses on commissions and taxes

In addition to market costs, the investor will have to take into account broker commissions. On average, organizations take 0.3% from each transaction. Let’s assume that an investor bought 10 pieces of OFZ 26207 - they will cost 10,827 rubles, and taking into account the commission - 10,859.

Then you will have to pay taxes - in Russia they are paid by brokers; there is no need to submit separate declarations. But real yields are also declining. From January 2022, all bonds in Russia are subject to Federal Law of April 1, 2022 No. 102 “On Amendments to Parts One and Two of the Tax Code of the Russian Federation and Certain Legislative Acts of the Russian Federation”, Article 2, paragraph 4.3 with tax on coupon income - earlier government bonds were exempt from this. At the end of 2022, the investor will receive 812.8 rubles in coupon income. They will have to pay 13% tax, that is, 105.7 rubles.

Nominally, an investor could earn 812.8 rubles from coupon payments alone. In fact, he will receive 687.1 after deducting commission and tax.

Coupon yield

It is also called the coupon rate. This is the ratio of all coupon payments for the year to the face value of the bond.

Ykup = CN

Y

- profitability, from English.

Yield C - the sum of all coupons for the year N - the par price of the bond

If you buy a bond at a price of 100% of the par value and sell it at the same price, or hold it until maturity, then the yield received during the period will be the coupon.

Example:

The face value of the bond is 1000 rubles. The coupon is paid 2 times a year in the amount of 24 rubles. Ykup = (24 × 2) / 1000 = 4.8% per annum.

The coupon yield is more used as a benchmark for comparing the yield of the issuer's bond issue with the issues of other issuers. Because it is not always possible to buy paper on the market at 100% of its face value. And if the price deviates from the nominal value, then this also affects the profitability.

The following types of returns take into account the purchase and sale price.

Bond yields for all occasions

The problem of calculating a particular bond yield often makes an investor inexperienced in mathematical calculations think. In this material, we have collected the most popular types of bond yields and the formulas that can be used to determine them.

Coupon yield

In essence, this is simply the value of the coupon. If the coupon on a bond is 7%, then the coupon yield will be similar.

If you are faced with the task of calculating the coupon yield using data from QUIK, then you can use the following formula:

Note: Here and below, the result obtained must be converted to percentage form by multiplying by 100%. For ease of understanding, this step has been excluded from the formulas.

Current yield

Current yield denotes the ratio of the accrued coupon to the current market price of the bond. It can be used in cases where investments are being considered for a short period of time. In this situation, the change in market price can sometimes be neglected. The formula is as follows:

In this formula, “price” means the percentage value of the price, and “market price” means the absolute value, in monetary units.

Modified current yield

This indicator is the ratio of the annual coupon to the “dirty” price of the bond, including the NKD. This type of return can be used in the case of short-term investments, when the investment horizon is within one coupon period. Calculation formula:

The “dirty” price of a bond is the total purchase price, including the ACD paid. The price without tax accrual is sometimes called the “net” price.

If this yield is divided by the number of days in a year (365 or 366) and multiplied by the number of days that the investor plans to hold the bond, then the expected percentage of return on the investment can be obtained. Using OFZ 25083 as an example: dirty price = 997.78 rubles, annual coupon 70 rubles. (7%). We will hold it for 35 days.

Since the bond is trading below par, MCY (7.02%) was higher than the coupon yield. And the investor’s income for 35 days, provided the market price remains unchanged, will be 0.67%.

Simple yield to maturity

Simple yield to maturity (sometimes called "simple yield") takes into account both the coupon income and the profit/loss due to the difference between the purchase price and the maturity price.

Example: let’s take the issue of OFZ 25083.

Today is 03/01/2019, there are 1020 days left until maturity, which can be quickly calculated in Excel by subtracting the current date from the maturity date. During this period, the holder will receive 6 coupons of 34.9 rubles, in the amount of 34.9 * 6 = 209.4 rubles. The simple return calculation would look like this:

This formula can be used when the investor plans to withdraw all payments received on the bond and spend it on his own needs. It can also be useful if an investor wants to roughly calculate the amount of taxes that will have to be paid on income. For some bonds, the tax on the coupon income and the tax on the difference between the purchase and redemption prices varies. To account for this difference, you can multiply the amount of the relevant income by the factor (1-tax rate).

Note: the formula is suitable for ordinary coupon bonds, and can also be applied to securities with a variable coupon, where the coupon interest rate is fixed only until the offer date. In this case, the yield should also be calculated not at the maturity date, but at the offer date. This formula is not suitable for floater linkers and other securities with floating returns.

Effective yield to maturity

The most popular and most reliable estimate of bond yield. You can often find it under the abbreviation YTM (Yield to Maturity).

Compared to the previous formula, it takes into account the reinvestment of coupons at the same yield over the entire period of holding the bond. It also allows adequate consideration of the benefit to the investor from debt amortization to maturity. Its value is determined by solving the following equation:

Here: r is the required profitability; P is the current “dirty” price of the bond; C is the payment received on the bond (coupon or coupon + depreciation); F - final payment (face value or unpaid balance of face value, in case of depreciation); t is the number of discounting periods before receiving payment C; n is the number of discounting periods until the final payment is received.

Of course, doing such calculations manually is quite expensive. But this is usually unnecessary, since this parameter is available in the QUIK terminal.

However, sometimes you may need to do your own calculations. To do this, we will give an example of how you can do this using Excel.

By default, for such purposes, Excel has a special function INCOME(), as well as its inverse function PRICE(), which searches for the market price based on a given profitability. The functions have the following syntax:

YIELD (purchase date; maturity date; coupon rate; dirty price; redemption price; coupon payment frequency; basis)

PRICE (purchase date; maturity date; coupon rate; yield; redemption price; coupon payment frequency; basis)

Unfortunately, the INCOME() and PRICE() functions very often give a significant error, as in the case shown in the picture (yield to maturity in QUIK is 7.81%). Therefore, we can propose another method of calculation, more labor-intensive, but more accurate.

For example, let’s take the same OFZ 25083. First, we build a table in Excel of all payments on the bond that will be received by the holder starting from the moment of purchase. On the maturity date, do not forget to add the face value to the coupon. At the beginning, you need to add the purchase date, under which the “dirty” price of the bond will be indicated with a “minus” sign. Next, we use the NETIROW() function as follows:

In this example, the result was 7.79%, which differs from the QUIK yield of 7.81%, but is much closer to reality. This construction can be used as a pocket yield calculator, and can also help in modeling the yield on securities with a floating coupon.

You can also use the NETNZ() function, which allows you to similarly determine the market price based on a given profitability and payment flow. In this case, cell B2 should have a zero value, and the first argument in the function should add the rate of return

This can help in assessing the bond's sensitivity to changes in market interest rates, as well as estimating the cost of selling the bond in the future if the investor does not plan to hold the security to maturity.

Note: When using the NETINDOW() and NETNZ() functions, you should not round the numbers too much. The more decimal places are specified at the input, the more accurate the result will be at the output. For clarity, you can choose a display format with rounding, but the cell should store the most accurate value.

Start investing

BCS Broker

Current yield

It differs from coupon in that instead of the par price, the current market price of the bond is taken into account:

Ytech = CP

C - the sum of all coupons for the year P - the market price of the bond

The current yield implies that the purchase and sale price of the security will be the same. This practically never happens in market conditions, so this formula can be used for short-term investments. However, if the price at the time of sale changes, the profitability will be different.

The higher the bond price relative to the par value, the lower the yield and vice versa:

Example:

The face value of the bond is 1000 rubles. The coupon is paid 2 times a year in the amount of 24 rubles. The current price of the bond is 105% of the par value. Current = (24 * 2) / 1000 * 105 / 100 = 4.6% per annum. We see that the current yield is below the coupon, despite the fact that the bond price is higher than the par value.

What are OFZs?

They differ in maturity dates, yields, and frequency of coupon payments. The latter are also different: four types are available to everyone on the Moscow Exchange, and another one is offered only by some banks.

With constant coupon income

Briefly called OFZ-PD, this is the most popular and widespread type of government bonds. It is easiest for private investors to understand them, because the principle of operation is similar to a regular deposit in a bank: the schedule and size of payments are known in advance, the profitability does not change.

For example, OFZ 26207 from the beginning of the article belongs to this type - until 2027, every February and August, the investor will receive a coupon for 40.64 rubles from the bond.

With variable coupon income

Known as OFZ-PK: the size of all coupons is announced in advance, but the percentage changes over time. It is cleverly calculated depending on the key rate of the Central Bank: if it is raised, then the bonds become more profitable following it. But this works in the opposite direction.

For example, OFZ 24020 was issued Parameters of the federal loan bond SU24020RMFS8 / Moscow Exchange in the summer of 2022, and every four months it receives a coupon. When the key rate was higher, investors received 6.2–6.8% per annum. Then it fell, and after it the bond yield - to 4%.

Future OFZ-PK coupons are unknown, but the issuer publishes the rate and ruble value of coupons already paid. They change following the Central Bank rate. Screenshot: Ministry of Finance of Russia.

Now the key rate, and with it the profitability, are rising, but the future is unknown. Therefore, bonds of this type are suitable for those who are ready to analyze the market and try to catch trends.

With indexed denomination

Or OFZ-IN. The interest on the coupon remains the same (low), but the denomination is indexed to inflation every year. For example, OFZ 52001 was issued by the Ministry of Finance of Russia in 2015 with a par value of 1000 rubles and a coupon rate of 2.5%. If the investor had bought it at the very beginning, he would have received 25 rubles from one security per year.

The Ministry of Finance calculates the monthly indexation of bonds for the year ahead - at this horizon, the investor can calculate how much he will receive from each security. Screenshot: Ministry of Finance of Russia.

But a purchase in June 2022 would have brought more - in a few years the denomination increased to 1,305 rubles. The nominal yield at the same coupon rate is 32.6 rubles. And this is even with fairly low inflation - the higher it is, the more profitable it is to hold securities of this type.

With debt amortization

Briefly - OFZ-AD. In addition to coupons, the state also returns the principal debt in installments. This is like a regular loan payment, when a third of the amount is interest, the rest is borrowed money.

For example, OFZ 46022 has been applying for an auction for the placement of OFZ / Bank of Russia since 2008, and it will be repaid in 2023. The face value of the bond was initially equal to 1000 rubles, and the coupon rate was 7.5%. The investor is paid 37 rubles twice a year, but on July 20, 2022, half of the face value will be returned: the person will receive 500 rubles and a coupon for another 27.42. After this, the two remaining coupons will arrive, but only 13.71 rubles each - because they will be credited to the debt that has been halved.

It is difficult to calculate even the nominal yield on such securities. When you factor in market fluctuations, fees, and taxes, things get even more complicated, which is why amortizing bonds are slowly disappearing from the market.

With "nationality"

OFZ-N type papers appeared several years ago; they are intended only for individuals - hence the “N” in the name, which officially means “people’s”. In fact, these bonds are closest to OFZ-PD: the coupon payment dates, the maturity dates, and the rates are immediately known - which change upward over time. But you can’t buy such a paper on the stock exchange, only an Information message about the start of placement of OFZ for individuals, issue No. 53008RMFS / Ministry of Finance of Russia in one of four banks: VTB, Sberbank, Promsvyazbank and Post Bank.

For example, OFZ 53008 issued Order of the Ministry of Finance of Russia dated July 29, 2021 No. 351 “On the issue of federal loan bonds for individuals, issue No. 53008RMFS” at the beginning of August 2021, there will be six coupons twice a year: in February and August. But the rate on them should increase from 5 to 8.87%: if an investor buys a bond at the very beginning, then for the first coupon he will receive 27.12 rubles, and for the sixth - 44.23.

Effective yield to maturity

It differs from a simple one in that it involves reinvesting coupons. Due to this, it is always slightly higher than the simple yield to maturity. To get such a yield, you need to buy more of the same bonds each time you receive a coupon. This can be compared to the capitalization of interest on a bank deposit, when accrued interest is not paid to the depositor but is added to the deposit amount.

YTMe = (N - P) / n + Cg (N + P) / 2 × 100%

N

— denomination

Сг

— amount of coupons for the year

P

— purchase price (excluding cash accrual)

n

— years until maturity

This formula is simplified and calculates an approximate value. The exact calculation is quite complicated and makes no practical sense, since the effective yield implies reinvesting coupons at the purchase price of the bond, which is impossible in practice since the price of the bond is not constant.

The QIUK trading terminal in the yield column shows exactly the value of the effective yield to maturity.

Things to remember

- OFZs are securities with which Russia borrows money from investors. In return, she promises to pay a percentage for use and return everything back at an agreed time.

- There are many OFZs that differ in terms of maturity, frequency of interest payments and the size of the latter - everything affects the profitability for the investor.

- The choice of specific bonds depends on the goals, age, available money, risk tolerance and other characteristics of the investor. Some people are better off building their own portfolio from individual OFZ issues, while others find it easier to invest in ETFs.

- The investor can earn on coupon payments, the difference between sales and purchase prices and tax benefits.

- It is important to consider the effective yield of OFZ - market fluctuations, broker commissions and taxes can reduce the result by several percent per annum.

What is an offer

An offer is the right to present a bond for redemption on a predetermined date. For example, a bond issue for a period of 10 years may have an offer 3 years after placement. In this case, the coupon rate is set only until the offer date, and then the issuer sets a new rate. The investor has the right to demand the redemption of securities by the issuer at par on the appointed date if he does not want to hold them longer. Why does the issuer need this? In order to be able to set a new coupon rate that will be valid after the offer date. Why change the coupon rate? If rates in the economy decrease or the credit quality of the issuer improves, then it can reduce the size of the coupon without risking the investment attractiveness of the security.

Due to the fact that the coupon rate may change after the offer, yields are calculated based on the offer date, and not on the maturity date.

In order to submit a bond for an offer, you need to contact the broker with a corresponding application on the eve of the offer date. The broker may charge a fee for this service.

Extract from the prospectus. As can be seen from the prospectus, the coupon rate at the placement stage is determined only up to the offer date.

Formation of a bond portfolio

Now that we have explained the mechanism of price formation and yield management, let’s say a few words about portfolio formation and comparison of bonds with each other. All bonds traded on the market are different. We divide the entire set of bonds into homogeneous risk groups using the Arsagera Asset Certification ranking system. The ranking takes into account indicators such as liquidity and credit quality. The first and second groups are the most reliable and liquid bonds, the third and fourth are the second tier, the fifth and sixth are high-risk bonds. Each investor builds a portfolio taking into account his own appetite and attitude to risk.

Arsagera Management Company, within each group, as well as when managing a stock portfolio, builds a hit parade of bonds based on potential profitability. For each bond, the potential yield is calculated taking into account the current value, future value (predicted taking into account our expectations for changes in interest rates), interim payments and offers (the issuer's obligations for early repayment).

As part of the investment declaration, limits are established for each group of bonds and for one issuer in each group. This sets the requirements for diversification. The company’s task is to create and maintain in the portfolio a set of bonds that have the maximum potential return, and also to change the structure of the portfolio when the level of interest rates changes.