Today our post will be devoted to a topic around which many copies have been broken and which still remains a subject of controversy among investors and traders. This is the so-called “portfolio rebalancing”, or more precisely, questions about how often to carry it out, what principles to follow and whether it is needed at all.

A competent approach to the formation of long-term investments implies diversification, that is, the distribution of investments across various assets, which reduces the risk of losing funds as a result of the purchased securities falling in price or even losing value. In order to be less dependent on the dynamics of instruments, the prices of which are subject to strong fluctuations, the portfolio includes various types of assets - not only stocks, but also bonds, non-ferrous metals, etc. Selecting the ratio of investments that will provide the best balance of reliability and profitability is portfolio balancing.

The classic ratio of securities in a portfolio is considered to be 50/50 - half in reliable bonds, the other half in riskier, but also potentially higher-yielding instruments, usually in long-term investments these are stocks. But the specific balance of your portfolio can be anything - if saving is more important to you than increasing, it will be mixed in favor of bonds and deposits; if the main thing is high profit, increase the share of stocks and derivatives. But over time, asset prices change—for example, stocks can rise or fall in price. Accordingly, your portfolio may become riskier - it will become more dependent on market fluctuations. Rebalancing is, in simple words, bringing the ratio of assets in a portfolio to its original form.

What is an investment portfolio

People who have savings want to increase them as quickly as possible. But, as a rule, you cannot quickly increase your capital, but reset it to zero. How to be? What should you do to invest correctly? The answer is to build a portfolio. This is also not a panacea for all problems, but still.

How to invest and not go broke: investments for beginners

An investment portfolio is a collection of all assets that are owned by a particular financial tycoon. These can be either securities: stocks, bonds, derivative financial instruments (derivatives), or real estate, cash, anything. There are a huge variety of types of investment portfolios. But their main difference from each other is the risk/reward ratio. Most often, conservative, moderate and aggressive investment portfolios are distinguished.

The task of the conservative is to limit risk and stable income. Investors who prefer such a portfolio will buy OFZs, blue chip stocks and defensive instruments such as gold.

A moderate portfolio is slightly riskier than a conservative one. Here, investors can not only afford OFZs and blue chips, but also allocate a small share of their capital to derivative financial instruments.

An aggressive portfolio is the most dangerous, but also the most profitable. Here, in essence, investors can buy any type of volatile asset. Be it futures for currency pairs, risky stocks, cryptocurrency, or other derivative financial instruments.

In order to show who each type of portfolio is suitable for, we give a clear example :

Vadim, Gleb and Yuri have known each other for many years. They have different investing experiences. Vadim has been working at the Moscow Stock Exchange for a long time and has extensive experience in trading various financial instruments. Vadim is a professional, so his portfolio includes both risk-free OFZ assets and investments in extremely volatile cryptocurrency. Gleb is new to finance. He works as a surgeon and has no time to monitor the economic situation. In this regard, a conservative portfolio is suitable for him. Gleb won’t earn much, but he won’t make huge losses. Yuri has been working as a financial consultant at a bank for two years. He doesn't have much experience, but he deals with the stock market every day. Yuri does not risk buying cryptocurrency. However, he is already trying to invest part of his capital in oil futures. Yuri composes his portfolio according to the moderate type.

Thus, the choice of one or another type of portfolio will depend on :

- your experience;

- having free time to understand all the intricacies of the stock market;

- your personal perception and readiness for losses in the moment.

Putting your eggs in different baskets is a useful tool for investors. However, diversification (spreading your capital among several assets) has both its pros and cons.

Sergey Makarov, Accent Capital:

— Before rebalancing, you need to take the first step in the form of compiling your investment portfolio and filling it with different securities, based on the investment period, your age, the level of your risk profile, additionally taking into account country risks and the division of assets in different currencies. Proper asset allocation is a major factor in risk and return. Target asset allocation determines future long-term returns.

The concept of rebalancing and why it is needed

First, let's go back to the basics of portfolio construction. Its formation is part of the investment strategy and represents the distribution of assets that would meet the financial goal, the time frame for achieving it, the attitude towards risk and other individual parameters of the investor.

Complete information about current strategies that have already brought millions of passive income to investors

The investor must determine for himself the shares in the total cost of capital:

- each asset – stocks, bonds, funds, precious metals, etc.;

- a specific country - Russia, USA, China, Germany, etc.;

- specific industry - financial, oil and gas, construction, energy, etc.;

- specific currency - dollars, euros, rubles, pounds sterling, etc.

Now imagine a situation where the original composition is broken. A simple example: an investor follows a conservative strategy. His portfolio consists of 70% bonds, 20% stocks and 10% gold. Over the year, stocks rose while gold bonds fell. Consequently, the shares of assets have also changed. The portfolio has ceased to be conservative, the risk on it has increased, and the investor’s goal may not be achieved if everything is left unchanged. In such a situation, rebalancing is needed.

Rebalancing means bringing the asset allocation back to its original position, which is consistent with the investor's investment strategy.

The investor rebalances in the following cases:

- changes in quotes of stocks, bonds, funds;

- changes in exchange rates;

- withdrawal of part of the assets from the portfolio;

- change in investment strategy (for example, for a pension portfolio, as retirement approaches, the strategy becomes more conservative);

- changes in fundamental indicators of securities that no longer meet investor criteria;

- external factors (for example, bankruptcy of the issuer, sanctions, defaults, changes in market conditions).

Passive and active investors construct and manage their portfolios differently. Let's see what goal each of them pursues when rebalancing:

- A passive investor tries to achieve an asset allocation that would reduce the volatility of the portfolio and increase its stability during crises. He doesn't look for entry or exit points, buys mostly index funds, and doesn't intend to monitor the portfolio on a daily basis. Rebalancing helps you manage risks in the long term and stick to your chosen strategy.

- An active investor achieves portfolio diversification by purchasing stocks and bonds from different issuers. Conducts fundamental and technical analyzes to find promising securities and buy them at competitive prices. Regularly monitors the market and changes the composition of the portfolio if necessary. Rebalancing helps reduce the risks of dependence on one or more companies/industries. As dependence increases, a fall in the prices of such companies/industries can lead to significant capital losses.

It turns out that in both passive and active investing, the main goal of rebalancing is risk management.

Benefits of Diversification

The main advantage of portfolio investing is liquidity , that is, the ease of turning your assets into cash. Shares can be sold faster than the same real estate.

In the case of portfolio investing, profit can be received in a variety of forms. For example, have passive income in the form of coupons on bonds, dividends on shares. Or raise money based on the growth of rates of certain assets.

In addition, portfolio investments are relatively easy to manage. You can stupidly buy OFZs and shares of dividend aristocrats and not twitch at all. Bonds will pay you 100% coupons. And the management of the dividend aristocracy will definitely allocate funds for payments (unless, of course, the unexpected happens - the company suffers losses).

“Three enemies of the investor: greed, passion and ignorance.” Irina Argentova on a balanced portfolio

Commissions and taxes

Of course, there are costs to consider when rebalancing:

- brokerage commissions,

- stock spreads

- taxes.

In graphs and hypothetical calculations, the listed costs may not be taken into account, but in practice they affect the result. Therefore, we need to try to do as few operations as possible.

To reduce costs, you can rebalance using:

- Planned portfolio additions. After transferring money to the brokerage account, buy the asset that has fallen in price.

- Dividend income and coupons. For example, American ETFs pay dividends “in hand”. The downside is that a tax arises, but it cannot be avoided.

- During withdrawals from the portfolio. For example, when achieving goals or approaching retirement. Make the withdrawal in such a way that rebalancing occurs by itself.

Additionally, there are methods for reducing taxes when using IIS type “B”. On this type of account, any transactions and in any volume are not subject to tax. Therefore, if you use several brokerage accounts in your portfolio and one of them has such tax benefits, then it is better to conduct transactions in this account (IIS).

In the case of type “A” IIS, there is also an advantage - you will defer paying taxes until next year. That's not bad either.

Expert opinion

Dmitry Dunyashev

Blogger, private investor, project manager real-investment.net

For example, I use a Russian brokerage account (IIS) and a foreign one. The second is needed to purchase assets that cannot be purchased on Russian exchanges. The proportions may vary depending on your preferences and portfolio components.

Disadvantages of Diversification

The main disadvantage of portfolio investments is risk . Any asset can depreciate in value: Bitcoin can immediately fall by several tens of percent, in stocks a correction can take years, any company can go bankrupt, a country can default, all OFZs can go bankrupt, and so on.

Also, the disadvantages of portfolio investing include its unsuitability for beginners . It is unlikely that a person without minimal knowledge will fly in on both legs, take a bunch of assets and begin to earn millions.

Choosing the right moment to buy on the stock exchange: what is wave analysis

Also, the investment portfolio requires constant analysis . You need to keep your finger on the pulse, follow the news, waste your time (and nerves). And not everyone has the ability to do all this. Analysis is necessary not only to create a portfolio, but also to correctly adjust it by rebalancing.

How to rebalance a portfolio

Rebalancing is the restoration of the original structure of an investment portfolio. For clarity, here is an example :

Andrey does not like to take risks. But he likes money. To increase his capital, he decided that it would be advisable to invest all his cash in securities. Andrey took out OFZs for 50% of his assets with debt amortization. With the remaining money, I purchased blue chip shares from the Moscow Exchange. Over the year, the price of securities of Russian companies has increased significantly. This led to Andrey’s investment portfolio becoming skewed towards stocks (their share was 65%, and the share of bonds was 35%). Since our hero is not satisfied with this situation, he buys more OFZ. As a result of operations, Andrey’s portfolio again contained 50% of bonds. This is rebalancing .

Recording of the webinar

The information in this article is taken from the GlavInvest Academy webinar. We looked at what rebalancing is, what benefits it provides and what methods there are. You will find even more information in the webinar recording:

- more research on the Russian market;

- research on dynamic and combined rebalancing, clear conclusions about which is better;

- when (in which month or quarter) is it better to carry out;

- An excel table was provided for self-rebalancing;

- how to combine rebalancing with portfolio replenishment.

Get the webinar recording

Types of rebalancing

There are different strategies, but most often the following types of investment portfolio calibration are distinguished:

- by threshold - when the investor independently sets the limit by which his assets can change. For example, up to 20%. If the share of stocks in the portfolio has increased by 15%, then you don’t need to do anything. But if it’s 21%, then you need to rebalance;

- by time - the portfolio is checked at a specific period of time, for example, once a year or six months. The ratio of assets within this period does not matter; only the result at the end is taken.

Marat Mynbaev, founder of Amir Capital Group:

— Imagine that you are standing on a surfboard and balancing on the waves. You stand strong, floating through the waves through the movement of your body, but sometimes you have to change your position, and the process of rearranging your legs is a rebalancing. You stand in one position and float on the waves of the market. And when something goes wrong, you need to “reposition your feet”—rebalance your portfolio. For example, you bought Bitcoin at $30,000 and want to sell at $150,000. But when the price of Bitcoin reached 60,000, you decided not to wait any longer, but to sell it now at 60,000 and buy again when the price drops to 30,000. This too rebalancing the investment portfolio.

Where does the increase in profitability come from?

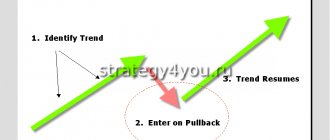

We repeat: when rebalancing, we automatically implement the principle “Buy low, sell high.” At the same time, we don’t need to read the news at all, try to guess the bottom, predict crises, or listen to analysts.

Let's look at the return graph of our portfolio, which contains 60% stocks and 40% bonds over a long period:

Performance of a 60/40 portfolio with and without rebalancing in the US market.

We see that when there is a long period of growth in the US stock market (as we remember from earlier charts), the portfolio without rebalancing begins to get ahead due to an increase in the share of stocks (8/00). At the same time, risks also increase. We see this clearly during the dot-com crash of 2001-2002.

We then see the blue portfolio begin to lag. Towards a new peak, it again begins to catch up with the “orange” one, all for the same reasons, because the share of shares is high. But a new crisis sets in in 2008, after which the “blue” portfolio finally takes the lead.

In total, rebalancing over a long period gave us 2 advantages:

- risk reduction;

- increasing profitability.

Expert opinion

Dmitry Dunyashev

Blogger, private investor, project manager real-investment.net

It would be ideal to rebalance at market peaks, this will allow you to get the maximum benefit from the situation. But the problem is that no one can know the peaks in advance. There's no point in trying to guess them either. So we are exploring methods to improve portfolio performance without this knowledge.

Let's now see what rebalancing would give us in more modern times in Russia:

Rebalancing in modern times in Russia (Arsagera Study)

We see that the green portfolio (50% stocks/50% bonds) with monthly rebalancing produced the same returns as the stock portfolio! At the same time, it is less volatile.

In general, we see that the pattern is repeating itself on the Russian market.

Let's look at an example with more impressive results, when the portfolio contains not only stocks and bonds, but an additional asset is added - precious metals. As a third asset class that has low correlation with both stocks and bonds.

This is a fairly well-known example - the “Lezheboki Portfolio”, first proposed by Sergei Spirin (the popularizer of portfolio theory).

The portfolio has: 1/3 stocks, 1/3 bonds, 1/3 gold. Only Russian assets.

Portfolio Lezheboki and the assets that it includes

We see that Lezheboka performed much better than each of the assets individually. Of course, this happened, among other things, due to rebalancing.

The strong crisis of 1998 played a good role, when gold rose significantly in rubles, and everything else fell. You would have to do a psychologically terrible rebalancing: sell most of the gold and buy cheaper stocks and bonds. In the post-crisis period, securities, of course, rose in price well.

That is, the main part of the growth of “Lezheboki” occurred in the late 90s. According to the graph, we see that the main gap occurred precisely then.

If we exclude the data from the late 90s, then “Lezheboka” still takes the lead compared to individual instruments. Although not so amazing anymore.

Conclusions. You cannot always expect that rebalancing will give an increase in profitability. There will be periods when it will be lower, and others when it will be higher. In general, especially during times of turmoil, a rebalanced portfolio is a good winner.

It is important, as John Bogle said:

- Follow your plan exactly!

- Don't give in to emotions!