Mining is a kind of cryptocurrency mining that can be earned by loading your computer with a specific task. But many believe that making money from mining is already a thing of the past, and now the trend is forging or exchange trading in general. We figured out how mining works, why it is needed and how much you can earn from it in 2022. And most importantly, how the state treats him. Experts from the world of cryptocurrencies also shared their opinions with our readers.

How and why are cryptocurrencies mined?

The first cryptocurrency Bitcoin appeared in 2009, although the concept of “cryptocurrency” itself began to be used only in 2011. Their idea was (and remains) very progressive - this is a decentralized network where you can carry out transactions using a special currency

. Cryptocurrencies are built on blockchain technology - in it, all transactions are combined into blocks, for each of which a key (hash) is calculated. The key is to ensure that it is simply impossible to forge a transaction.

At the same time, transactions (as well as the existence of the entire cryptocurrency) are ensured by its participants - to confirm a transaction in the Bitcoin network, you need to receive 120 confirmations. Each participant must generate many keys, obtain a given one, and then compare the results obtained with the results of other participants in the system. All this requires computing resources and, accordingly, requires additional costs for the operating time of the processor, video core and electricity.

And so that the participants in the system have some incentive to spend their resources, they are rewarded for this - and with the same cryptocurrency. Accordingly, the process of confirming transactions is called mining (from the English word meaning the extraction of ore in a mine). More scientifically, the process is called Proof-of-Work (PoW) - or literally “proof of work.”

But here a problem arises - the flow of people wishing to receive “coins” for operating their computer is becoming too large

. And then, in accordance with the law of supply and demand, the requirements for hardware power increase, and the reward decreases. In general, in the Bitcoin network, the reward is received by the participant who generated the next block of transactions - accordingly, there is a probability of receiving or not receiving a reward (and the more participants in the network, the greater the chances of not receiving it).

In addition, the system itself begins to limit miners - if from the launch of the system 50 bitcoins were given for each generated block, then after the formation of every 210 thousand blocks the reward is halved. So, since 2012, each block gives 25 bitcoins, since 2016 - 12.5 “coins”, and the last “halving” occurred in May 2020 - now the reward for each block is only 6.25 bitcoins

. From 2031 there will be no emission at all - that is, then Bitcoin mining will become meaningless.

They started mining cryptocurrency from its very launch - for example, from 2009 to 2010, only one person mined bitcoins and mined about a million of them (now the equivalent of 60 billion dollars), but since 2012 it turned out that household computers are no longer suitable for this - they consume more electricity than they produce results.

Since then, mining has become profitable only on special systems - ASIC (application-specific integrated circuit - special-purpose integrated circuit). Essentially, this is an assembly with a power supply, processor, memory and many graphics cores. Another option is “farms” of many gaming video cards or ASICs, or even pools (several farms of different miners).

The fact is that for more efficient mining, computing tasks must be parallelized (that is, each core needs to be “assigned” a separate task) - and GPUs are best suited for this.

Pools allow you not only to divide tasks into parallel threads (in order to optimally load the equipment of each miner), but also to then divide the reward - after all, miners receive rewards literally in random order. Nowadays, most of the large pools (and indeed a significant share of all mining) are represented by participants from China.

By the way, you can get cryptocurrency not only through mining - there is also forging (when the reward actually “drips” only for the fact that the user has cryptocurrency in his wallet) and ICO (when the founders of the network sell the currency). In the future, forging (aka Proof-of-Stake, or PoS) may become a key area, says Maxim Yudichev from the Coin-Galaxy cryptocurrency exchange

. According to him, blockchains that require mining farms will gradually become a thing of the past, so it is worth paying attention to other formats of earning money.

What are Bitcoins in simple terms?

Essentially, Bitcoin is an ordinary computer program. Only it is not located on any single computer or server, but on millions of computers at once, which directly communicate with each other through this program.

Torrents work on a similar principle. You install a program on yourself, and someone else does the same. You can then transfer files directly to each other, without the involvement of any servers, and with virtually no control. It is this feature that has made torrents the main breeding ground for piracy on the Internet.

The Bitcoin system works exactly the same way. The only task of this program is not to transfer files between users, but to give them “virtual glasses”.

Is mining profitable?

It’s easy to start mining cryptocurrency - you need to have equipment (a computer or ASIC), more or less fast Internet, register an electronic wallet, join a pool of miners (without this, the chances of earning money tend to zero), and you can register on an online exchanger. True, if you do all this with a home computer, it will make a little less sense than not at all.

The fact is that mining on a processor has not brought any income for many years - it’s just that more money will be spent on electricity than you can earn

. The compromise option is a gaming computer with a powerful video card, but video cards now cost a fortune (precisely because of this). An even more advanced option is to buy an ASIC, but such systems cannot be used except for mining cryptocurrencies.

In any case, mining costs will be high:

- the equipment is expensive. For example, an ASIC for 20 TH/s (terahash per second) will cost from 55 thousand rubles, but for more or less serious mining you need much more expensive equipment. And buying an assembly with a powerful video card is now not only very expensive, but almost impossible (which, by the way, is why gamers suffered). It has reached the point of absurdity - miners began to buy ready-made gaming PCs just for the sake of video cards;

- you need to equip the place and provide cooling. If the heat generated by a conventional computer itself is dissipated in the room, then several ASICs or an entire farm will require separate cooling (which is expensive and consumes electricity). You also need to spend money on sound insulation - dozens of fans will annoy neighbors, who may complain to the competent authorities;

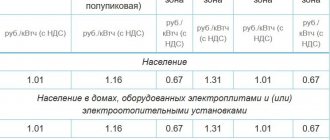

- expensive electricity. If we are talking about mining in an apartment, then if you wish, you can mine more actively at night (with two- and three-tariff meters), and in general the tariff will not be very high. But if it is a garage, office, warehouse or hangar, you will have to pay according to tariffs for legal entities - which is about 5 rubles per kilowatt hour. In addition, you can be held liable for the inappropriate use of energy capacity.

Therefore, those who want to organize mining by placing the farm “on the balcony” may encounter a lot of problems. Experts believe that a more or less adequate option is cloud mining, when the user rents a server that “mines” virtual coins. But you should understand that rental costs will be higher than the cost of electricity.

But even more serious problems begin with income - the situation is such that it becomes difficult to make at least some forecasts.

Even 5 years ago, industry representatives complained that mining bitcoins and the altcoins closest to it was becoming unprofitable

even on professional equipment and even in countries where electricity is very cheap (for example, if in Russia you connect directly to the main network). True, since then the cost of major cryptocurrencies has increased many times, but has it become easier to make money on them?

In terms of amount, the situation is complex: if a farm with 8 video cards consumes approximately $100 worth of electricity per month

, then a farm of 3 containers with 192 devices each will cost 320 thousand rubles per month just for renting space, security and maintenance.

Income so far allows us to cover expenses. For example, back in December (that is, before the start of Bitcoin’s record growth), the equipment paid for itself in six months to a year:

- Whatminer M 21S with a maximum hashrate of 56 TH/s cost 120 thousand rubles, but brought 12.5 thousand net rubles per month - accordingly, it paid for itself in a little less than 10 months;

- Antminer T19 (hash rate 84 TH/s) cost 270 thousand rubles, and with a net profit of 21.7 thousand rubles per month, it paid for itself in more than a year;

- a used Antminer T17 (hash rate 58 TH/s) for 97.5 thousand rubles brought in 14.3 thousand rubles per month, and paid for itself in 7 months

.

Now it is almost impossible to buy equipment without waiting in line and at a normal price. And a future miner, wanting to buy an ASIC or an assembly with video cards, must calculate all the parameters in advance - the complexity of mining, electricity costs and possible deviations in the cost of cryptocurrencies.

The experts we interviewed advised us not to look at popular cryptocurrencies at all - for example, Nikolay Korinets from TradingView, Inc

.

advised to pay attention to cryptocurrencies that limit the use of special equipment for mining. And Vladislav Akelyev from the ECOS company

believes that the “home” format of mining in 2022 makes virtually no sense.

Features of using video cards

Initially, there was no special equipment; accordingly, video cards became the best device for mining both Bitcoin and other cryptocurrencies. They always gave good results.

In addition to the fact that it is well suited for mining from the technical side, there are other aspects. So, video cards are relatively inexpensive, so anyone can buy them and get into mining.

They actually do not require special knowledge. If you monitor the process and the condition of the equipment, you will not encounter errors that will have to be corrected. These two factors indicate the accessibility of mining for many.

However, there are several disadvantages. So, you will have to invest a lot in paying bills. Just think about it: when mining, the video card operates at full capacity, which means it consumes a lot of resources. They themselves require a lot, and such processes require a lot of kW.

Again, running at full power means high temperatures. No matter how well the cooling system works, you will encounter the fact that the room will become quite hot. In addition, as mentioned above, they will make a lot of noise.

They say mining is illegal. Is it so?

Like any other area with super-profits and a high level of risk, the state has become interested in cryptocurrencies. And if at first the conversation was about somehow taking their turnover under control (which is basically impossible for a decentralized system), then later the government took up mining.

It all started with an attempt by the Ministry of Finance to regulate the use of cryptocurrencies. In particular, the law allows the existence of digital currencies, but prohibits their use to pay for goods and services. True, in the original version of the bill there was administrative and criminal liability for transactions with digital money, but then they were excluded. Just as they excluded the possibility of bequeathing cryptocurrency, collecting it in bankruptcy or in enforcement proceedings.

At the same time, the experts we interviewed unanimously claim that mining in Russia is legal. So Timofey Semenov from Intelion Mining

told us the following:

- the state does not refuse to cooperate with miners – on the contrary, it conducts an active dialogue with them. For example, at the Blockchain Life forum in October 2022, State Duma deputy and chairman of the financial committee Anatoly Aksakov was present;

- The law on digital financial assets allows the issue, purchase, sale of cryptocurrency and other transactions with it. The only restriction is that Russian citizens cannot pay with cryptocurrency;

- those who own cryptocurrency will in the future be required to file returns (this will happen after appropriate amendments are made to the Tax Code). The declaration will need to indicate both the fact of ownership and transactions with it;

- It is prohibited to advertise cryptocurrency.

The state did not ban mining, and thereby legalized it. On the other hand, Maxim Yudichev believes, the state will now more actively control cryptocurrencies, including income from its mining. Already in 2022, it is worth understanding that mining is an income-generating activity, so all participants will have to declare income and pay taxes on it. Accordingly, tax costs are added to electricity payments.

However, mining is becoming a full-fledged type of business in Russia

. This makes sense - for example, in the regions of Siberia there is cheap electricity and a fairly cool climate, which can reduce the cost of mining itself and cooling equipment.

And recently it became known that the largest batch of equipment was imported to Russia - in the city of Bratsk, Irkutsk region, a large farm was organized in a data processing center. In total, 14 trucks of equipment were imported - that’s 20 thousand devices that consume a total of up to 70 megawatts

(which corresponds to the energy consumption of a city with a population of 150 thousand people). The equipment cost up to 60 million rubles, and will represent more than 1% of the entire global Bitcoin network.

How much Bitcoin shines when using video cards

Bitcoin is almost 10 years old, and a lot has changed over the years. So, at the beginning of his era, an old computer was enough for mining, since the complexity of the network was very low. You could earn several coins a day. But then they were worth nothing.

Today the reward is 12.5 BTC, which is equivalent to more than 100 thousand dollars. However, it is impossible to receive such an award alone. Even the best mining rigs are already having a hard time coping with the Bitcoin network.

Accordingly, earnings on a home computer will also be far from the maximum reward. According to bitinfocharts, the average profit per day is half a dollar per 1 THash/s. And this is much less than one Bitcoin.

Is it even worth doing this?

Despite the fact that Bitcoin has broken through the $60,000 mark and is confidently moving up, experts advise thinking very carefully when starting mining. First of all, it’s too late to buy equipment - video cards have risen in price so much that there’s no hope for a return on investment yet, and there are very few ASICs left on sale and also at exorbitant prices.

Mining the popular Bitcoin and Ethereum is now almost useless

– with such a number of miners, this will not bring any benefit. True, if you focus on Chinese network participants, you can catch a good point - when it starts raining in China, solar power plants do not generate energy, its cost in the network rises and miners turn off their equipment. And if there are fewer participants in the network, the difficulty of mining may decrease.

Our experts also gave their recommendations for potential miners:

- periodically monitor the mining profitability graph. As Vladislav Akelyev says, now the profitability of mining is growing, and in the future we should expect the same:

- pay attention to cloud mining. The expert believes that this is not the worst option - in it, a large company assumes all the risks associated with the equipment, while the mining efficiency will be maximum. Considering that the cost of renting a server can change dynamically, it should be periodically compared with the mining profitability graph - and if the second figure is higher than the first, this is a good chance to earn money literally “out of the blue”;

- focus on cryptocurrencies that operate on the PoS principle (that is, they use forging). Maxim Yudichev believes that such currencies are more environmentally friendly and do not require additional equipment and costs. In fact, this is an analogue of a deposit - virtual coins grow in volume simply because they are in the user’s wallet. For example, the Ethereum network (ETH 2.0) is moving to this format;

- Nikolai Korinets advises choosing a cryptocurrency with “cheap” mining. According to him, the most suitable cryptocurrencies in this regard are ZCash, Monero and Ethereum Classic. This also makes sense - after all, at one time, 10,000 bitcoins could only buy 2 pizzas, because the difficulty of mining was low.

As for the option of buying cryptocurrency on the exchange, this is an extremely risky asset

, there are significantly more risks associated with it than with more familiar shares of large companies. On the other hand, higher risk is compensated by higher income. However, in general, cryptocurrency is an extremely unpredictable asset, so investing in it (especially taking out loans for this) is a very bad idea.

Making the right choice is the main task

It is very difficult to choose the right video card for Bitcoin mining. For a very long time, the leaders on the market have been the Nvidia GeForce GTi 1080 and Radeon Fury X. They are very fast, however, and consume a lot of energy resources. That’s why their payback period is a little longer.

Good performance is given by cards such as the Radeon RX 470, 570 and 580, as well as the Nvidia GeForce GTi 1050, 1060 and 1070. Of course, the higher the generation, the better the performance. However, for many, the average was enough.

When choosing a video card for Bitcoin mining, you should pay attention to the number of shaders, speed and type of memory, type of power supply and amount of video memory. Also, do not forget to pay attention to the cooling system.

Setting up an electronic wallet

After you have chosen the mining method, you need to find and set up an electronic wallet on which you will receive profits. If you consider this type of activity as an investment and do not intend to spend the profits in the near future, you can go to sites that generate “paper” wallets. This will be a kind of “public address” to which you can receive your payments.

The balance can be checked in secure mode on the Blockchain.info website. It will be enough to simply enter the public key code. Don't let anyone know your wallet password because this could give unauthorized people access to your virtual coins.

If you plan to regularly cash out bitcoins or make payments, it is better to choose a dedicated client. For example, the lightweight Electrum wallet is suitable for all operating systems created for desktop PCs, as well as Android. After creating a wallet, Electrum generates a list of a dozen random words, which are used as a private key. This means that if something happens to the computer, the wallet can be restored.

The Electrum wallet can be installed on a machine that is not connected to the network. This will be an analogue of “cold storage”, protected from hackers. This program also allows you to run your wallet in observation mode, you will be able to view the daily balance, but you will not be able to make payments from it.