Tinkoff Investments allow you to make transactions on the Moscow Exchange: buy shares, bonds, ETFs, currencies, sell them at a higher cost and receive additional profit from the difference in price. To trade on the stock exchange, a financial institution offers to open a brokerage account, connect to one of three tariffs and begin building an investment portfolio after replenishing the balance. Sell currencies and shares after their value increases and lock in the profits.

Brief overview of the Tinkoff Investments service

Tinkoff Bank has developed the best service, according to Global Finance - Tinkoff Investments. It provides for receiving additional income immediately after opening an account and starting trading. You can count on profit when investing in shares in the sectors of healthcare, electricity, real estate, mechanical engineering, information technology and others, funds, bonds and currency.

The bank offers more than 11,000 securities and guarantees instant withdrawal of money to the card - in rubles or foreign currency. The catalog contains securities of the world's largest companies from the Russian Federation, the USA, Japan, China, Great Britain, Germany, South Korea, and France.

Program structure

I decided to split the project into 3 modules (.py file) and a separate .txt file with account data.

The main.py module is the main program module that we run. In it, classes of objects are created, calculations occur and objects are formed, filled with the received data. Parses only exchange rates for different dates from the API of the Central Bank of the Russian Federation.

The data_parser.py module contains only two functions, the first parses account data from a text file, and the second from Tinkoff Investments, and the program does not return to this again.

The excel_builder.py module is a large module that does not count anything, it just takes data from main.py and builds a huge beautiful table.

What to invest money in to generate income

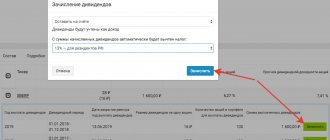

- Shares are shares in a company. How to make money on them: receive dividends (part of the income from the company’s activities) or, after the price rises, sell the shares and make a profit. When choosing stocks, look at whether the company pays dividends to shareholders and how often (once a year, every 6 months, 3 months, etc.)

- Bonds are securities, of which there are more than 100 in the Tinkoff catalog. When issuing bonds, the state or company borrows them, then returns the cost with interest.

- Exchange Traded Fund (ETF) – fund property in the form of bonds, shares, commodities. For a private investor, an ETF is the safest instrument, since the size of the possible loss for an investor is usually a fraction of a percent

- ILI – investment life insurance. You spend money to purchase an ILI policy, and the insurance company invests in the purchase of securities. If the value of securities increases during the insurance period, the investor will be able to return the money (after the end of the term) spent on purchasing the policy and earn additional money

→ Open a brokerage account

Additional costs

Regardless of whether or not it was possible to earn something, the client bears certain costs. Firstly, this is not the smallest brokerage commission on the market. According to the basic tariff plan, it is 0.3% of each transaction, no matter whether it is successful or not. That is, by buying and selling shares, the client will pay Tinkoff 0.3 plus 0.3, for a total of 0.6 percent.

For servicing a “black card,” as already mentioned, the system will write off 99 rubles.

When the profit is made, the state will want to take its share - 13 percent of the personal income tax. This tax can be avoided if you open an IIS, but then it will be impossible to withdraw the money even partially for three years.

What you need to start investing - 11 simple steps

- Apply to open a brokerage account, IIS or premium account. To do this, indicate on the website which account you want to open, enter your phone number or login (if you are a bank client). Receive a confirmation code, log in and open an account without filling out an application. If you are not a bank client, enter your full name and phone number, fill out the online application (you need a passport and phone number)

- The bank will open an account on the same or the next trading day. Documents for signing will be delivered by courier if you have not previously cooperated with the bank. Clients can enter into an agreement online by confirming their consent with a code from SMS

- Receive notification by SMS or email about account opening

- Select a tariff: Investor (for beginners), Premium or Trader

- In your personal account in the mobile application or after logging in on the website, select “Replenishment of a brokerage account” and indicate the amount. Funds will be debited from the Tinkoff Black card balance and credited to your open account

- Take the free training course “How to Invest”

- Choose the direction in which you want to invest. To do this, the dynamics of each issuer are kept, there are lists of the best and worst dynamics, an analysis of ups and downs, world stock indices are given, and a list of leaders has been prepared

- In the Tinkoff Investments application or on the bank’s website, go to the “What to buy” section and select an asset to purchase from the catalog (currency, shares, fund shares, bonds)

- Indicate the source of purchase - the account whose balance you topped up

- Specify the number of lots (at least one) - this is the minimum number of assets available for purchase or sale. For ETFs and bonds, 1 lot = 1 security; for stocks, you can trade in large lots of 1000, 100, 10. You can sell and buy currency from one unit. The page indicates the market value, which additionally includes a commission

- To confirm your purchase, click the virtual “Buy” button and confirm the transaction with an SMS code, after which a commission will be debited from your account in accordance with the selected tariff

Possible problems when investing

The deal is not opened.

If there is enough money on the balance, the transaction may not be opened due to a change in the asset price by 0.3% or more. To remove this restriction, create a market or limit order.

The transaction was closed, but the balance was not updated.

Sometimes the exchange does not immediately send money to the account, so the funds arrive with a delay of 2 - 3 days.

The Tinkoff Investments application is frozen.

Restart the application. If the problem persists on a particular step, please contact support.

Error: “The limit for the Tinkoff Investments instrument has been exceeded.”

Perhaps there is simply not enough money on the balance sheet. If there are funds in the account, the reason may be a software glitch. Most often the problem occurs in the mobile application. Try to make a deal through the web version of your personal account or terminal. If all else fails, contact technical support online chat.

How to sell currency or securities and withdraw money

- Log in to your personal account or mobile application

- Specify the required asset and click the virtual “Sell” button. Before confirming the sale, choose from two offers - this can be selling at the current highest market price or submitting an exchange order. In the latter option, the broker will be instructed to sell the asset after reaching the price specified in the application

- Check whether money has been credited to your account

To withdraw funds, just make a transfer to a bank account from a Tinkoff Black card in the application or on the website. In one transaction, you are allowed to withdraw up to 50 million rubles or their equivalent in euros or dollars. To do this, go to the “Investments” – “Portfolio” – “More” – “Withdraw” tab and select the card to be credited. The money will be credited to your account instantly.

A robot that recommends what to buy depending on your goals

If you need help putting together a balanced portfolio that suits your goals and objectives, you can use the services of a robot. This is an algorithm that is accredited by the Central Bank and helps to automatically select stocks based on your requests.

In the app this is called “Build a Briefcase”. You will need to answer several questions, indicate the desired amount, and the algorithm will select a ready-made portfolio. If you like it, you can buy it. This is a good way to build a core set of stocks without taking too much risk.

Training for beginners at Tinkoff Investments

Recommendations on the procedure for forming a portfolio, information on risk protection, and long-term strategies can be obtained in the basic course for novice investors. There are 10 lessons in total, each lasting about 10 minutes. The training ends with a test, and the knowledge gained is subsequently useful in practice.

The training course is available for free in the mobile application. Subscribe to it to receive emails with links to lessons. The peculiarity of the course is the absence of complex terms and obtaining a minimum knowledge base to start investing and receiving income, so you:

- Find out how investing can help you save money

- Understand the basic concepts: stocks, bonds, ETFs, OFZs, dividends, IIS

- You will hear a lot of useful information about strategies, risks, real profitability

- Be prepared for price collapses

The lessons were compiled by experienced investors together with the editors of T-Zh.

Podcasts

If you don’t have time to read or you generally perceive information well by ear, listen to the “Greedy Investor” podcast. It can be found on all popular platforms:

- Apple Podcasts;

- Google Podcasts;

- Castbox;

- Anchor;

- Yandex.Music;

- SoundCloud.

The presenters, together with analysts and experts, discuss the hottest trends, hype around new companies and other useful things for beginners and not so investors. The format is small: only about 20 minutes. So it’s convenient to listen while driving or while taking the bus to work.

Terminal Tinkoff Investments

The Tinkoff Investments web terminal works in any operating system and allows you to view everything you need in one window - lists of securities, charts, order book (asset quotes) and other tools.

It has wide functionality:

- Expands into 6 browser tabs to track different market sectors

- Works on any tariff for 0 rubles

- Allows you to easily manage widgets - link them into separate groups, add new ones or delete them, move them on the screen.

- Does not require additional registration, is located immediately in your personal account on the bank’s website or application

The terminal displays all transactions on current accounts, settings, current news and changes are available. Here you can sell assets and place orders, view charts, track quotes and much more.

Tinkoff Investments tariffs for brokerage services

| Rate | Investor | Trader | Premium |

| Monthly service fee | 0 ₽ | 290 ₽ or 0 ₽, if you have a Premium card, no trade, turnover of more than 5 million ₽ for the previous period, as well as for portfolios from 2 million ₽ | 3000 ₽ or 990 ₽ for portfolios 1–3 million ₽ (0 ₽ from 3 million ₽) |

| Commission fee per transaction | 0,3% | 0,05% / 0,025% | 0.025%, 0.25–4% for transactions with foreign securities over-the-counter |

| Withdrawal and replenishment of accounts | For free | For free | For free |

| Commission for opening and closing an account | No | No | No |

| Commission for making a forward transaction | 10 ₽ for 1 contract | 5 or 10 ₽ for 1 contract | |

| Margin trading | 0 ₽ or from 25 ₽ per day if there are uncovered positions at the end of the day in the amount of over 3000.01 ₽ | ||

| Support | Consultations by phone and chat | Personal manager services | |

Which tariff to choose

- If you plan to trade less than 116 thousand rubles per month, select the “Investor” tariff

- “Trader” is suitable for those who plan to trade more than 116 thousand rubles

- Premium is designed for large investments

By default, the new brokerage account will be connected to the “Investor” tariff. If necessary, select a different rate in your account.

Ready investment portfolios

For those who do not want to immerse themselves heavily in investing and speculative practices, learn to trade over short distances, and crave reliability, ready-made investment portfolios are suitable.

The option could well be called “Feel like Warren Buffett,” who is considered a long-term investor who likes to invest money for the long term. You can invest your funds in Tinkoff Capital Exchange Traded Funds. This is a fairly conservative and maximally safe option with stable historical returns.

Reviews about the Tinkoff Investments service

Despite many positive reviews from investors, there are also negative reviews online. All of them are related to the fact that Tinkoff updates securities quotes late, and that there are no thought-out tools for setting their prices.

Among the reviews there is information about the occurrence of technical failures, which result in confusion in transaction currencies and even debiting money from the account. In most cases, the problem is quickly resolved after the bank employees fix the problem.

You can get acquainted with the stories of real transactions of other investors, read or share your success stories, and find out the latest news in the field of investments on the Pulse social network from Tinkoff Bank.