“I won’t invest, otherwise I’ll lose all my money,” many Russians think and take their savings to the bank. It seems that nothing will happen to the assets there, although in fact inflation can easily penetrate the strongest safe. Both deposits and the stock market have their own risks, but in the case of investments, at least they can be managed. No wonder Warren Buffett said that risk comes from not knowing what you are doing. We tell you what threatens investors and how they can insure their savings.

Market risk

How it manifests itself.

A fall in the stock market due to unpredictable factors (the notorious “black swans”) leads to a change in the value of securities: quotes go down and the investor’s portfolio “turns red.”

Example.

The coronavirus pandemic, which gave the world economy a serious shake-up: Boeing shares fell by 73% in February-March last year, Gazprom shares by 30% at the end of the year. Or financial crises like the “dot-com bubble” that burst 20 years ago: then the S&P 500 index lost 49% in 2.5 years.

What to do

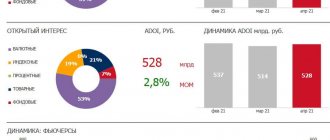

. Include different instruments in your investment portfolio. For example, gold: history shows that the value of this defensive asset rises during crises. Instead of an impersonal metal account, you can choose shares of a gold ETF: the FXGD fund accurately tracks the price of the precious metal on the global market and protects investments from inflation and devaluation in the event of a fall in the ruble.

What else do you need to know

There are other parameters to consider when determining your risk level.

For example, diversification affects the riskiness of an investment portfolio. For example, shares of large companies that pay dividends are usually quite reliable - with them you can get predictable earnings, which, however, will not be very large. But one company can always go bankrupt, but many companies at once are unlikely. Therefore, it is not worth keeping all shares in one basket, because if all the investor’s funds are concentrated in one asset, the likelihood of a negative outcome increases. If there are ten assets in the portfolio, the risk is significantly reduced.

It is also important to analyze the risk level of each asset. If there are different instruments in a portfolio, but all with the same level of risk, this can be dangerous. That is, the chance of a plane crash in general is always low, but many large airlines have had plane crashes. If you only have government bonds in your portfolio, the risks are low, but if they materialize, the consequences will be catastrophic.

The risk is also affected by the investor's planning horizon. If he wants to make a profit very quickly, the risk will usually be higher than with long-term investing.

In any case, it is necessary to analyze not only the probability of a negative outcome, but also the scale of possible losses.

Read reviews, market analytics and investment ideas on the ITI Capital Telegram channel

Business risk

How it manifests itself.

Companies in which the market invests may lose revenue or go bankrupt. Their shares will fall in price and will not bring investors the expected profit; in the event of bankruptcy, they will generally turn into worthless pieces of paper. Such corporate crises happen for various reasons - from the obsolescence of the technology on which the business took off, to reputational losses.

Example.

To Elon Musk’s words on Twitter that Tesla shares were overvalued, the market immediately reacted with their fall, and the businessman’s statements about Bitcoin brought down not only the cryptocurrency, but also the securities of his own company, they immediately fell in price by 8.6%.

What to do.

Diversify your investment portfolio as much as possible by investing not in one company, but in industry (FXIT, FXES), country (FXUS, FXCN) or multi-country indices (FXWO, FXDM). Each of these funds includes shares of hundreds of companies: by combining them, you invest simultaneously in all developed and developing economies and effectively reduce the risks associated with investing in one company.

Identification and analysis of investment risks

Date of publication: December 26, 2016 Author - Kira Kim e-mail

Key words: investment risks, risk analysis, risk identification, risk identification.

Risk identification and analysis is a key element of the risk management process. Their proper organization largely determines how effective further decisions will be, and ultimately, whether the company will be able to sufficiently protect itself from the risks that threaten it. Therefore, studying the features of this area of risk management and taking them into account in the practical activities of a risk manager is an important step in understanding the entire risk management system.

The main goal of risk identification and analysis is to form among decision makers a holistic picture of the risks that threaten the company’s business, the life and health of its employees, the property interests of owners/shareholders, obligations arising in the process of relationships with clients and other counterparties, the rights of third parties and etc. In this case, not only the list of risks is important, but also managers’ understanding of how these risks can affect the company’s activities and how serious the consequences can be. As a result of such a study, a risk management system will be properly organized, which will provide an acceptable level of protection for the company from these risks.

Risk identification and analysis involves conducting a qualitative and then quantitative study of the risks that the company faces.

Qualitative analysis assumes:

- risk detection;

- study of their characteristics;

- identifying the consequences of the implementation of relevant risks in the form of economic damage;

- Disclosure of sources of information regarding each risk.

- A preliminary step in the quantitative risk assessment stage is obtaining information about them. Such information should contain the data necessary to assess the degree of predictability of the risk:

- frequency (probability) of occurrence;

- amount of losses, i.e. distribution of damage;

- other characteristics.

The main step of the quantitative risk assessment stage is processing the collected data. It must serve the purposes of the subsequent risk management decision-making process. To identify risk factors and the degree of their impact, various methods of statistical data processing can be used, including correlation and variance analysis, time series analysis, factor analysis and other multivariate classification methods, as well as mathematical modeling, including simulation.

If necessary, statistical analysis can be used to confirm some of the conclusions of the previous stage, when qualitative analysis is not enough for this. For example, if there is not enough quality information to carry out a detailed risk classification, then a multidimensional classification procedure can be carried out.

Stages of risk identification and analysis:

- understanding the risk, i.e. qualitative analysis, accompanied by a study of the structural characteristics of risk (hazard - exposure to risk - vulnerability) - at this stage, the boundaries of decision-making in the risk management process are set;

- analysis of specific causes of adverse events and their negative consequences - at this stage, a detailed study of individual risks is carried out (causal relationships between risk factors, the occurrence of adverse events and the damage caused by them); such research provides the basis for risk management decisions;

- comprehensive risk analysis - at this stage, the entire set of risks is studied as a whole, which gives a complete, comprehensive picture of the risks that the company faces; this allows for a unified risk management policy. Such a study also includes procedures such as security audits, i.e. a comprehensive study of a firm's business, decision-making methods and technologies used in order to identify and analyze the risks to which they are exposed.

All of the above is completely acceptable for analyzing investment risks.

Thus, there are a number of fundamental positions and methods that are acceptable both for risk analysis in general and for the analysis of investment risks. For this purpose, a comparative analysis of the correspondence between the general theory of risks (G.V. Chernova and A.A. Kudryavtsev) and the theory of investment risk analysis (analysis of numerous sources given in the list of references) was carried out.

1. Information is a key aspect in identifying and analyzing risk, since its availability allows us to make the right decisions in the future under conditions of risk and uncertainty. Its volume and content depend on specific conditions, but are determined by the principles of usefulness, efficiency of risk management, accessibility and reliability of information. These principles are partly contradictory and require reconciliation.[1]

The compliance analysis showed that this position is completely acceptable for the analysis of investment risks.

2. The most adequate information on this risk is past statistics for the corresponding object, i.e. data obtained from internal sources. In some cases, it is impossible to limit oneself only to information from internal sources, so it is also necessary to use external sources that are not directly related to the activities of a given company.6

However, investment activities may not contain statistics from previous years, since investments may be made in a new enterprise. In this case, in accordance with the general theory of risks, it is necessary to use external sources that are not directly related to the activities of this company.

3. For a deeper understanding of risks, various approaches to risk visualization can be used - their visual representation in graphs and drawings emphasizes the significant aspects of the corresponding risks that are important for analysis and subsequent decision-making6.

This position is relevant when analyzing investment risks.

4. Risk identification and analysis is a key element of the risk management process. Their proper organization largely determines how effective further decisions will be and, ultimately, whether the company will be able to sufficiently protect itself from the risks that threaten it.6

This judgment reflects the essence of the analysis of both all existing and investment risks themselves, however, in investment activities, a preliminary risk analysis can also protect a potential investor from a deliberately incorrect investment of funds (for example, an extremely risky enterprise, even with maximum profitability, cannot be a source of guaranteed income and may not be acceptable to the investor).

5. The main goal of identifying and analyzing risks is to form a holistic picture of risks for decision makers. Such a study will make it possible in the future to correctly organize a risk management system that will provide an acceptable level of protection for the company from these risks.6

When analyzing investment risks, creating a holistic picture of risks is difficult if the investment process takes place in a new enterprise (since there is a lack of information and retrospective data), however, it is possible to calculate the riskiness for several investment options and choose the least risky option for investment.

6. Risk identification and analysis involve conducting a qualitative and then quantitative study of the risks that the company faces. Qualitative analysis is the detection of risks, the study of their characteristics, the identification of the consequences of the implementation of the corresponding risks in the form of economic damage, and the disclosure of sources of information regarding each risk. Quantitative analysis involves two main steps: obtaining information and processing data.6

The methodology for analyzing investment risks involves similar approaches for identifying and assessing risks.

7. According to the degree of detail of risk research, three main stages can be distinguished: understanding the risk (qualitative analysis accompanied by a study of the structural characteristics of risk, hazard, exposure to risk and vulnerability), analysis of the specific causes of adverse events and their negative consequences and comprehensive risk analysis (study of the entire aggregate risks as a whole to form a comprehensive picture of the risks facing the firm).6

The first two stages are possible when analyzing investment risks, however, the third stage is necessary, but difficult due to the lack of a full range of information, however, if the investment takes place in an existing enterprise, then the third stage is also possible.

Thus, the analysis showed that if capital is invested in an existing enterprise, then the analysis of investment risks is carried out in accordance with the general theory of risks, but if the enterprise does not exist and the investments are initial, then specific features arise when analyzing forecast investment risks.

[1] G.V. Chernova and A.A. Kudryavtseva “Risk Management”, Prospekt, M, 2003.

Currency risk

How it manifests itself.

Affects all financial instruments denominated in a currency other than the one in which you spend: exchange rate fluctuations may offset the income received from the investment.

Example.

The value of an asset denominated in dollars will fall due to the strengthening of the ruble, even if the price of the security does not change: shares purchased at $50 at an exchange rate of 80 rubles per dollar will become cheaper by 7% if the dollar drops to 75 rubles. And a lower return simply will not pay for such an investment.

What to do.

Buy assets denominated in different currencies and use separate instruments with currency hedging, which neutralizes fluctuations in the currency pair. Some FinEx stock and bond funds have built-in protection (hedging) against fluctuations in the dollar/ruble exchange rate: FXRW, FXMM, FXRB, FXIP.

What are high-risk investments

The Investopedia portal describes high-risk and low-risk investments this way.

In general, an investment is considered high-risk if there is a high probability of significant or total loss of money or less than expected returns. Again, a lot depends on perception here. For example, if you describe an investment as having a 50/50 chance of bringing the expected return, some will consider this risky. If the probability that an investment will not bring the desired profit is at the level of 95%, it will be too risky for almost everyone.

This means that it is necessary to evaluate not only the probability of a negative outcome, but also the scale of possible losses.

Industry risk

How it manifests itself.

Industries develop cyclically: the value of shares of companies in one industry can either rise or fall due to various factors (economic, political, innovation, etc.).

Example.

Share prices of pharmaceutical companies showed explosive growth at the peak of the pandemic, but securities of airlines and cruise companies fell sharply in price at the same time. For example, shares of the world's largest cruise operator Carnival fell from $60 to $12 over the year: the company was faced not only with the inability to sell new trips and a reduction in revenue, but also with tourists demanding that they return prepayments for travel.

What to do.

Diversify your portfolio by industry and buy securities of companies operating in different sectors of the economy. This can be done using an ETF, such as FXUS, whose composition mirrors the index of the largest US companies.

Low risk investments

In turn, low-risk investments not only mean protection against losses, it also means that even if a negative scenario occurs, the consequences will not be dire.

For example, shares of a biotechnology company are considered high-risk. Approximately 85-90% of all drug experiments fail, and as a result, many biotech stocks also end up losing value.

That is, there is a high chance of both a shortfall in profit and a complete loss of money (usually, if a biotech company is doing poorly, the shares lose 95% or more in price).

In contrast, buying federal bonds using an IRA account is a low-risk investment. First, the benefits of such an account (13% tax deduction or income tax exemption on investments) allow you to increase your overall profitability. A high level of reliability is achieved due to the fact that federal loan bonds are state debt. If it refuses to pay, this will mean a default with corresponding consequences for the entire financial system of the country. The chance of this happening is extremely low.

Other low-risk investment options are model portfolios and structured products, where possible losses are also limited.

Interest rate risk

How it manifests itself.

A change in the key rate as part of the monetary policy of central banks affects bonds and preferred shares: they become cheaper if the rate rises.

Example.

Due to the increase in the key rate of the Central Bank of the Russian Federation, the price of some bonds (Headhunter-001Р-01R, Obuv Rossii-001Р-04, Borjomi Finance-001P-01, Gidromashservice BO-03) fell below par in the first half of the year.

What to do.

Keep in your portfolio bonds with different maturities in order to level out the risk over the long term, or bonds with a variable coupon, the yield of which is tied to the key rate. An alternative could be bond ETFs, where securities are not held until maturity, and the composition is regularly rebalanced with new issues: FXTB - short-term US government bond fund, FXFA - corporate bond fund of developed countries or FXRU - Eurobond fund of Russian issuers.

Inflation risk

How it manifests itself.

The investor's capital depreciates or grows slower than the market due to rising inflation.

Example.

If yields remain at 4% and inflation rises to 6.5%, as it did last month (a five-year high), the real value of capital becomes 2.5% below the starting point.

What to do.

In your portfolio, combine a broad stock market (they always outperform inflation over the long term) and “safety” assets, such as gold and TIPS bonds (their face value is indexed by inflation). In Russia, this type of bond can be purchased in the form of an ETF - FXTP or FXIP.

Advantages of investment bonds

High profitability

. If the investment idea is successful, the investor will be able to receive additional profit, several times higher than the yield from the growth of the underlying asset, interest on deposits and ordinary bonds.

Full capital protection

. The investor is protected from a fall in the underlying asset's price. He will get back 100% of the bond's face value and will only lose the broker's commission for purchasing the bond.

Current investment idea

. Bank analysts react to stock market trends and formulate investment products with potentially high returns. Investing in them is often easier than directly analyzing assets.

More on the topic:

Learn to invest

October 27, 2021 High yield bonds: pros, cons and risks 7 minutes

Geopolitical risk

How it manifests itself.

The return on investment may suffer due to political instability, sanctions, or changes in political course.

Example.

Brexit caused the British pound to fall to its lowest level since 1985. And the inclusion of Chinese companies in the US sanctions list brought down the stock market: Xiaomi shares, for example, fell by 11.8%.

What to do.

Diversify your portfolio by country. Assembling a multinational collection of assets for a novice investor can be expensive, so it is better to use country funds - FXRU, FXDE and FXCN. Or FXWO, which allows you to gain global diversification through the purchase of one ETF share.

The presence of risks does not depend on the type of asset in which savings are stored: both owners of brokerage accounts and those who choose conservative instruments such as bank deposits have them. But not investing is not an option: it is much wiser to understand the dangers and consciously manage capital, protecting the portfolio from possible drawdowns. Anything is better than depositing money in a bank and hoping that it will somehow grow over time.