So, you have decided to invest your finances in something. This is the right decision, especially for those who already have their own home, a car, and can afford to travel a little. And those who are just starting to achieve success should also learn to invest their free funds in profitable dividend stocks in Russia. In light of the changes in 2021 associated with the coronavirus pandemic, the usual attitudes have changed significantly. Now you need to invest money with great caution.

Here are the Top 11 most profitable stocks in Russia in 2022. Study the data to form your own opinion about where you should and shouldn't invest. Even now, amid quarantine and a pandemic, many stocks continue to grow. And this means that it is important to understand where to invest money right now in order to receive constant growing profits later.

How to make your income passive using stocks

If you learn to do correct technical analysis of the stock market, you can constantly make profits. We advise you to study the combined method of technical and fundamental market analysis.

Isn’t it a dream to make your income completely passive? You will enjoy life, travel to different countries, and your income will grow at this time!

But for beginners it is always difficult to decide where to invest money so as not to make a mistake.

The first and most important advice: never invest the money that is intended to buy vital things: food, housing, medicine, clothing. Spend on stocks only what you will already live without.

Shares of companies that always make a profit

Of course, it’s quite difficult to say so unambiguously. Because even experienced traders know that any stock can collapse unexpectedly. And even the most reliable companies cannot guarantee stability and ever-increasing prices. The capricious market is so volatile that any investment is a big risk. And you must take this into account. We have selected for you a list of the most stable companies whose shares are always in price. And on which you can really make money.

As you remember, when planning to buy shares of a company in which you have trusted, you must consider:

- its position in the market;

- the trust of buyers and users, which you can read about or watch videos on the Internet;

- feedback from other shareholders;

- the percentage of dividends this company pays;

- prospects for its development, regarding the timing of its presence on the market;

- analytical forecasts of experts.

And this is not a complete list of the conditions that must be met in order to receive stable profits. But with experience, you will learn to determine which companies can be trusted and which cannot. Of course, losses accompany almost everyone. And you must be prepared for the fact that some of the money may not return to you. But only experience, technical knowledge and developed intuition will help you learn to do without losses.

How to calculate dividend yield

The size of dividends for the billing period is fixed, but the price of shares on the stock exchange changes. This means that the cheaper an investor bought a share, the larger percentage of it will be dividends. The ratio of dividends to the market price of a stock is called dividend yield. This is how investors compare dividend stocks.

Source: Gazprombank Investments service

Let's say two investors each bought one share of a company that pays dividends once a year. The first one bought a share in January for 1,000 rubles, and the other in October for 1,300 rubles. At the end of the year, investors receive dividends of 150 rubles per share. The first investor will receive 15% income from 1000 rubles, and the second one will receive a little less - (150 rubles / 1300 rubles) × 100% = 11.5%.

The dividend yield of such a share will be equal to 13.04% - 150 rubles of dividends from the average price of 1150 rubles. Shares from large companies with high dividend income are in high demand in the market.

More on the topic:

Special project

September 23, 2021 How to build an investment portfolio with reduced risk: 5 tips for investors 7 minutes

No. 2. Sberbank shares

By purchasing Sberbank shares, you can be sure of the right choice. This bank is extremely reliable. Cash flows from all over Russia flow here. Sberbank stock quotes rarely fall into a downward trend. The dividend payment policy is such that the overwhelming majority of shareholders are regular customers. There is also a large influx of new holders.

The price of Sberbank shares as of January 2022 is approximately 282 rubles.

Sberbank's forecast dividend yield for 2022 was about 8%. And about 8.5% - for 2022.

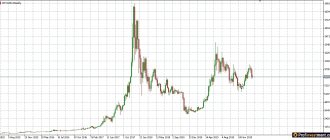

On the projected profitability graph you will notice that:

- the average risk of buying shares is 27%;

- “Buy” forecast is given by half of the experts;

- high dividends - 9%.

However, one cannot fail to note a slight drop in share prices in November-December 2022. This is clearly visible in the graph:

Look at the approximate calculation of the return on Sberbank shares:

And here is the forecast for 2022. Quotes are expected to increase by 37%. Until the end of 2022, the price of Sberbank shares will fluctuate around 255–265 rubles. Many European analysts forecast an increase in their cost to 300 rubles. Therefore, it is recommended not to pay attention to temporary drawdowns. If funds allow, then it is better to hold Sber shares. They will only grow.

For example, JP Morgan predicts an increase in Sberbank shares by 38%. And the American investment bank expects to see a price of 510 rubles per share.

Is it worth buying Sberbank shares? You decide!

When a company does not pay dividends

There is a long list of reasons why a company may not pay dividends legally:

1. The company did not make a profit

. No profit - no dividends. Requirements for the amount of profit are prescribed in the dividend policy. Exceptions: Shareholders may decide to pay dividends even without profits. For example, if the company previously earned so much that after paying taxes and dividends it had funds left over. Dividends for the unprofitable period will be paid from these funds.

2. The company does not pay dividends on shares, and this is reflected in the dividend policy

. Companies that grow quickly use profits to grow even more. For example, Yandex and Mail.ru Group do not pay dividends.

3. The profits were not enough to pay all the investors.

. Dividends are paid in order, depending on the type of share:

- preferred shares with priority in priority for receiving dividends;

- preferred shares with a fixed dividend rate in the charter;

- preference shares;

- ordinary shares.

If earnings are low, common stockholders may not receive dividends. Nazar Shchetinin talks more about the difference between preferred and ordinary shares in the article “How much is your voting right worth?”

4. The investor owns preferred cumulative shares

. For such shares, dividends can be accumulated for several years and then paid out at once.

5. The company is bankrupt

. By law, dividends are not accrued if the company has signs of bankruptcy or such may appear after the payment of dividends. For example, a company does not pay salaries to employees for more than three months.

6. Shareholders voted against dividends

. Shareholders can refuse to pay dividends and use profits to develop the business: release new products, buy equipment and real estate assets, pay off debts, etc.

7. The investor provided incorrect data for crediting dividends

. The company will write a letter to the shareholder about this, call and try to find out the correct data. If a shareholder does not update the data and does not respond for more than three years, then the dividends expire. They will return to the company's reserve fund.

No. 3 - Shares of Beluga Group

Another Russian company that can boast of stable profit growth. Leader in the production of strong alcohol in Russia. Founded in 1998. Unites six distilleries producing vodka under the brands Beluga, Belenkaya, Arkhangelskaya, Myagkov, Tsar, brandy Zolotoy Reserve and Bastion, Fox & Dogs whiskey, premium still wine Golubitskoe Estate, sparkling wine Tete de Cheval.

The cost of one share is 3,409 rubles. In a year, it is planned to increase the cost to 5,000 rubles.

Let's look at the dividends:

The graph clearly shows the dynamics of changes:

No. 4 - Mechel

The metallurgical industry also allows you to have no doubt about the profits from purchasing shares. The cost of one share is quite low and amounts to about 242.80 rubles. The return for the year was 230.34%. Dividends 5%.

However, forecasts assure growth:

No. 5. Rosneft

The cost of one share is approximately 526 rubles. More than 70% of all oil production in Russia belongs to Rosneft. It is the world leader in the amount of oil produced. Therefore, the trust in this company is enormous! Rosneft stock forecast for 2022 and 2023 is in front of you:

Let's compare the number of dividends by date:

Do you think it is worth investing in shares of Russian companies?

No. 6. "Lukoil"

Next on our list is the Lukoil concern. The cost of one share here is quite high and amounted to 5,265 rubles a year ago. In December 2022, the cost had already reached 6,541 rubles. The yield is 5.83%. On average, the annual increase in dividend payments is 15.64%. One of the distinguishing features of this company is the constant growth of dividends, which will increase no less than the rise in inflation.

Let's look at the forecast for Lukoil shares for 2022, 2023:

As can be seen from the graph, the largest increase in quotations is planned by January 2023. During this period, you can sell shares to make significant profits.

Lukoil is one of the largest oil and gas companies in the world. Just think that it accounts for over 2% of global oil production. And about 1% hydrocarbons worldwide.

Dividend Aristocrats and Dividend Kings

Companies that have gone through a strong growth phase can focus on distributing profits to shareholders. Companies that regularly increase their dividends are called dividend aristocrats.

In the United States there is an index of dividend aristocrats, the S&P 500 Dividend Aristocrats. To get into it, the company must:

- be included in the S&P 500 index;

- increase dividends every accounting year for the last 25 years;

- have a capitalization of more than $3 billion;

- have an average daily trading volume of more than $5 million.

In 2022, the index consists of 65 Dividend Aristocrats. These are well-known American companies: Coca Cola, IBM, AT&T, Colgate-Palmolive and others.

Source: Gazprombank Investments service

More on the topic:

Learn to invest

July 20, 2021 Correction: how to preserve capital when stocks fall for 5 minutes

Dividend Kings

- companies that have increased dividends for 50 years in a row. For example, the dividends of 3M, the company that invented tape and disposable respirators, have been growing for 63 years.

In Russia there are no clear requirements for dividend aristocrats. Most often, aristocrats are companies that have increased dividends for five years in a row and whose shares are traded on the Moscow Exchange.

The famous Russian dividend aristocrat is. It is engaged in exploration, production and supply of gas in Russia. Its dividends have been growing for 15 consecutive years. During this time, they increased 21.5 times - from 1.1 to 35.56 rubles.

No. 7. Tatneft shares

The price of one Tatneft share is about 458 rubles (as of mid-December 2022). Analysts predict that the stock price will increase.

For comparison:

No. 8. "Surgutneftegaz"

The share price is about 40 rubles. But let's look at a forecast that could come true by next year 2022:

As you can see, the cost can almost double.

Estimate the size of dividends:

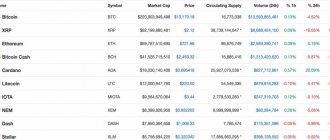

List of some of the best dividend stocks in Russia in 2021

Dividend stocks of large companies are among the lowest risk assets, especially if they are stocks of dividend aristocrats. But the market situation can change at any time - the company will reduce the size of dividends or stop paying them altogether. Analysts at the Gazprombank Investment service selected the 10 best dividend stocks in Russia from different sectors of the economy to diversify the portfolio. The average dividend yield is 10.14%.

Source: Gazprombank Investments service

№ 9.

Norilsk Nickel has a good chance of returning to fourth place in the MSCI Russia index in February 2022. The key driver in Norilsk Nickel securities is dividends for 2022, which will amount to 2,800 - 3,000 rubles. per share. The cost of these shares is perhaps the highest: 21,088 rubles.

Norilsk Nickel shares forecast for 2022, 2022 and 2023

Also note the steady increase in dividends:

Analysts advise investing in a company that produces nickel and palladium. The dividend amount increased by 43%!

No. 10. NLMK Group

The price of shares of the NLMK group is about 200 rubles. But dividends are constantly growing.

Dividends are 6.4%:

But, I would like to note that the company’s debt has grown to 900 million rubles. NLMK shares fell 6% on the eve of the dividend cutoff. By 2023, the demand for launching new enterprises is expected to decrease. Therefore, it is planned to reduce the cost of coal and steel.

How to receive dividends

The company selects one day in the billing period on which to compile a list of shareholders. This day is called the registry closing date or cut-off date. To receive dividends, an investor must own at least one share after the close of trading on the cutoff day.

The cut-off date is known in advance - it is determined by the meeting of the company’s shareholders, after the decision on the payment of dividends. This information is open.

Sometimes demand for dividend stocks rises a few days before the cut-off date and the stock price rises, only to fall when trading opens the next day. This jump in price is called a dividend gap.

For example, Novatek has set a cut-off date of October 10, 2022, which is Saturday. The last trading day on which the share register will be compiled is Friday 9 October. Trading on the Moscow Exchange is conducted in T+2 mode. This means that the investor receives the shares in two days. Five days before the cut-off date, Novatek shares rose in price by 6%. Immediately after the close of the register, shares fell 13.7% in 17 days.

No. 11. Chain of stores "Lenta"

It is impossible not to note the stable growth in the share price of everyone’s favorite chain of stores “Lenta. The cost of one share in December 2022 was 192 rubles. And by March 2022 it is expected that it will increase to 296 rubles. By the end of 2022, the cost will probably drop slightly to 286 rubles.

The cost of one share is relatively inexpensive (about 200 rubles). Therefore, everyone, even a novice trader, can afford to buy several. According to experts, stock prices will rise.

However, it is worth comparing the price of these shares with the shares of other stores. For example, shares of Magnit cost 5,643 rubles, and the X5 Retail group of stores cost 2,024 rubles.

Magnit shares have lost a little value due to a change of owners in 2022. But since then, momentum has picked up. Now the management of Magnit has expressed a desire to buy 100% of the shares of Lenta. At the same time, a fall in Magnit's quotes and an increase in Lenta shares are predicted. If the deal is successful, the level of income of the combined companies will exceed the total income of the X5 Retail group. This will allow the company to become a leader among all similar chain stores.

This review only gives you a rough idea of which stocks are worth paying attention to. Of course, everyone will prefer to invest money in what they trust. But before you buy shares of any company, be sure to study the market. Read analyst reviews and forecasts. And then your income will always be consistently high.

Bank deposits

The method is well-known, reliable and even guaranteed by the state. Although in recent years deposits have been bringing in less and less, they are subject to negative rates, i.e. this is actually storing money in a bank for a fee

But when the deposit rate exceeds inflation, such an investment becomes a very reliable investment, because the return of the deposit is guaranteed not only by the bank, but to a certain extent by the state.

What are the advantages of deposits?

- a deposit is easy to open, at any bank branch or online;

- usually the client knows in advance the income from the bank deposit;

- the deposit does not require any effort at all from the owner of the money.

Photo: pixabay.com

Buying bonds

Buying bonds is in many ways an alternative to bank deposits. Essentially, bonds are promissory notes issued by some organization or government agency. The person who issued the bond agrees to buy it back at a higher price.

For convenience, the difference between the initial and final prices is expressed as a percentage. There are also discount bonds, which are sold at a discount (discount) and bought back at full price. There are many other aspects of the issue, circulation and earnings on bonds, but now we will name only two that are important for private investors.

- The advantage of bonds is that they can be resold to others.

- The market price of bonds changes, so you can make money by speculating on these securities.

- But bonds, unlike deposits, are not guaranteed by the state.

Government bonds usually have the lowest yield; for Western Europe and North America, rates of up to 2-5% are realistic. But these bonds are also the most reliable.

The highest income can be obtained from commercial bonds, but the risk is significantly higher.

Buying shares

Shares are securities that give rights to a share in the ownership of a commercial enterprise (joint stock company), the right to manage this enterprise and a part of the income from it. Many people own shares, but real ownership and management rights go to those who have a controlling stake or a large stake in the total shares. Other shareholders are called minority shareholders, and their benefit consists primarily of income per share.

Stock returns are typically higher than bond returns, but for well-performing companies the return is not that great. For example, Apple’s is slightly below 6%. The maximum income comes from shares of only growing companies entering the market.

Real estate

Real estate has always been considered a stable option for preserving capital. Standard apartments have a safety margin for 100-150 years of operation; houses, with timely repairs, are even more durable. Housing in more or less prosperous settlements is always in demand, i.e. can be sold at some market price.

But is buying property an investment or just saving?

Residential and non-residential real estate: houses, apartments, etc. become an investment in two cases:

- when it can be rented out and receive income from it;

- when real estate increases in value.

In the long term, real estate becomes more expensive because money becomes cheaper (inflation). With economic growth this happens faster. The rental price usually changes following the sales prices.

To make money, you should invest a large amount in real estate, and usually for a long time.

Photo: pixabay.com

Investment funds

An investment fund is a way of attracting client money for joint investment in securities, shares and other profit-generating projects. The fund invests money in other people's assets, these assets generate profits that go to the fund's investors.

Professional managers are directly involved in investments and charge a certain fee (commission) for this. Therefore, investing in an investment fund is less profitable than directly purchasing the same assets, but in most cases it is more reliable.

Those who are ready to invest at least 30-50 thousand dollars for a long term should think about the services of an investment fund. To influence the work of an investment fund, you must invest a significant amount, often millions of dollars or euros.

Exchange Traded Fund

However, some funds operate on the open market. In particular, ETF (Exchange Traded Fund). They, like other funds, invest in securities: stocks, bonds and various kinds of obligations. ETFs then issue their shares, which in price and yield repeat the average index of securities from their investment portfolio. Thus, an ETF that buys shares of high-tech companies brings an average return on the shares of these companies.

Investments in non-bank credit organizations

Investments in various types of mutual loan funds and other similar enterprises are difficult to describe in a few words, because... these can be very different organizations.

These could be associations of residents of a locality. But often these are organizations that provide loans to individuals and entrepreneurs. Their borrowers are from risk groups, with a bad credit history, a precarious financial situation, who cannot get a bank loan.

The only thing that can be said about such investments is that the promised income on them is higher than with other investments, they say about 15-20% per year. More income is simply payment for risk.

Purchasing foreign currency

Purchasing and holding foreign currency does not bring dividends. However, during times of shocks in the foreign exchange market and crises in the economy, monetary units of different countries change in price differently. In certain periods, it was possible to make money by buying the Swiss franc or the Japanese yen. It can be profitable to buy the currencies of developing countries when they fall. If these countries successfully overcome the crisis, then their currency can quickly rise against the dollar and euro by 10-15%.

However, cash currency could be considered an investment only if it constantly rose in price in relation to all other currencies and goods. Which doesn't happen in practice.

Buying gold and jewelry

You can buy gold, silver and platinum bars, special investment coins made from these metals and certified diamonds.

However, the price of gold within the country depends on world prices for this metal. At the beginning of January 2000, the price of gold on the London Stock Exchange was slightly higher than $282 per ounce, and at the end of December 2019 it was almost $1,515. More than 5 times. Now this difference is even higher. But gold may fall in price, and then those who bought it find themselves at a loss for years to come. The same applies to other jewelry.

Photo: goldmania.ru

Buying jewelry is unlikely to be an investment. If they are not antiques and have no value for collectors, then they will have to be sold for much less than the purchase price. The precious metals used to make jewelry can be half the price of the item or less.

Other investment options

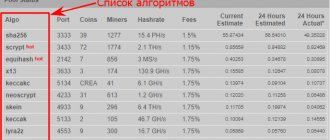

There are plenty of other investment options worth considering, but they won't be suitable for most first-time investors. These are operations on exchanges and over-the-counter markets, Forex, binary options, cryptocurrencies, tokens, etc.

In all these ways you can earn considerable sums, but everywhere you need knowledge, personal effort or hiring professionals who will do all the work.

Where to invest $5,000?

With such an amount, it is easier to look for passive income options, such as buying several bonds or stocks.

You can try investing in an investment fund. But this will be more of a work for the future; such amounts do not promise large incomes, especially if the fund chooses a conservative strategy and invests in reliable assets with low income.

You can buy ETF shares or other stocks. There is a chance to earn a lot if it turns out to be shares of a rapidly growing new company.

Where to invest $10,000?

Ten thousand can yield a return on bonds and a comparatively greater return on an ETF investment. With this amount you can profitably buy gold when prices fall, although there is unlikely to be a quick return here.

- The expected net return on a conservative investment will likely not be higher than 5% if the entire amount is invested long-term. You won’t be able to live on interest, but it will be enough for a “safety cushion for a rainy day.”

- With $10,000, you can try more aggressive strategies - buy securities on your own or through a proxy when prices fall and sell when prices rise.

Where to invest 50,000 - 100,000 dollars?

With this amount you can do everything described in the previous options. However, other possibilities arise:

- 50 thousand can be invested in an investment fund with better conditions.

- You can look for investment options in real estate and receive rental income.

- 50 thousand dollars is the amount with which you can enter Forex and not lose everything on the first transactions.

- With 50 thousand you can buy shares for resale and dividends.

The last two options are from the area of risky investments, but an income of 50-100 thousand dollars already allows you to pay something to consultants, and this reduces risks.

However, it will not be possible to make money on 50-100 thousand dollars quickly, a lot and with moderate risk. Large-scale speculation requires much larger sums.