Reliability rating

| Index | Position of Tinkoff Investments in the ranking |

| Number of active clients on MICEX | 1 of 43 |

| Number of registered clients on MICEX | 1 of 41 |

| Number of IIS on MICEX | 3 out of 30 |

| Rating based on reviews of traders - individuals | 20 out of 130 |

| Total volume of transactions on MICEX | 19 of 38 |

Pros and cons of Tinkoff Investments

Advantages

- The best investment platform in the world according to Global Finance

- More than 1,000 exchange instruments from different countries are available - stocks, bonds, currencies, funds, ETFs

- Works with the Moscow and St. Petersburg exchanges, which also trade foreign shares from the NYSE, NASDAQ and LSE exchanges

- Even housewives can figure it out

- Multi-currency brokerage account - you can make transactions in rubles and foreign currencies

- There are recommendations from experienced analysts at Tinkoff Bank

- Intelligent robo-advisor

- Instant replenishment and withdrawal of funds around the clock

- 24/7 specialist support

- Margin trading for free during the day

- Convenient submission of applications

- Trading with leverage and short

- Stop loss and take profit

- Depth of Market and candlestick charts

- Tinkoff Investments has a social network “Pulse for Investors”, where more than 10,000 participants exchange experiences, ideas and opinions, current news is posted and it is possible to follow the actions of other investors.

- Bailiffs cannot seize an investment account because it is not equivalent to a bank account, which can be seized.

- There is a depository where investors' rights to securities are stored - the investor can request and receive a corresponding extract.

- Protection against unprofitable transactions: if during confirmation the price changes for the worse by more than 0.3%, the transaction will be automatically canceled.

- There is an Investment Bank - this is an account into which money will be automatically deposited, which will then be invested. The piggy bank is not directly related to the service and works in conjunction with a bank debit card.

- A report is provided with detailed movements, which reflects cash flows, transactions, as well as balances on securities and currency.

Tinkoff Investments – what’s the “catch”?

- The risk of not receiving the expected income and losing money.

- Service fees are charged for the billing period, which lasts a month and begins on the date of account opening or tariff change.

- Trust management of assets is not supported.

- The exchange's opening hours are from 10:00 to 23:49 Moscow time on weekdays.

- There are technical problems when not all tools disappear for a while or are displayed.

- Interest is charged for “Overnight” - depending on the amount of uncovered positions at your tariff.

- Unprofitable scalping trades that are designed for a small price movement.

- Premium tariff clients who have the status of a qualified investor can invest in IPOs - shares of companies when they go public.

VIDEO Review

conclusions

Who is Tinkoff Investments suitable for ? First of all, the services of such an online broker are suitable for novice investors who want to get acquainted with the world of trading and investment, make their first trading operations, and make their first investments. The “Investor” tariff with free service is perfect for this. For more serious financiers, paid plans are worth considering. Well, for those who make money from scalping or other professional trading, Tinkoff Investments is suitable only as an auxiliary mobile solution.

If you are wondering which application is best for you, read the Fintolk review, where we have collected the top applications for investment.

Brokerage account of Tinkoff Bank – Terms and cost

- Tinkoff Investments allows you to invest money in stocks, bonds and ETFs. On the exchange you can buy, sell and exchange currencies.

- All new accounts are set to the basic “Investor” tariff, which is optimal for a novice investor with a monthly transaction volume of up to 116,000 rubles.

- The “Trader” tariff is recommended for a turnover of more than 2,000,000 rubles or you are a holder of a premium bank card - then the service will be free.

- The Premium tariff is suitable for large investments.

All plans include free of charge:

- Opening

- Depository services, including its maintenance

- Operations with shares of Tinkoff Capital

- Free replenishment from cards of other banks

- Analytics

- Robo-advisor recommendations

- Mobile app

- Trading terminal

- Exchange order book

- Instant 24/7 withdrawal of money, including currency

Open a brokerage account online

Conditions of the “Investor” tariff plan

- Commission for a transaction, including the purchase or sale of currency, Russian and foreign shares, bonds and ETFs – 0.3%

- All conditions of the “Investor” tariff in PDF format

Terms of the “Trader” tariff plan

Service is free if:

- No trading

- If you have a premium series Tinkoff Bank card

- If the turnover for the previous billing period exceeded 5,000,000

- Balance 2,000,000+

In other cases, the service fee is 290 rubles

- Turnover - the volume of transactions made on the exchange for a certain period

- Transaction commission – 0.05%

- Reduced transaction commission – 0.025% (valid after your daily turnover exceeds 200,000 and until the exchange closes)

- All terms and conditions of the “Trader” tariff in PDF format

Premium tariff

- 24/7 support from a personal manager

- Individual recommendations from Tinkoff Bank analysts

- Support in obtaining the status of a qualified investor

- Help in creating an investment profile

- Access to securities of world exchanges

- Over-the-counter financial instruments

- Market Reviews

- Additional investment ideas

- Company reports

- Advanced trading app features

- Premium card as a gift

- 24/7 Prime concierge service

- Access to Lounge Key business lounges

- Free travel health insurance for the whole family with coverage up to $100,000

- Transaction commission 0.025%

- Commission for transactions with over-the-counter foreign securities – From 0.25% to 4%

Service cost:

- 3,000 rubles per month for portfolios up to 1,000,000 rubles.

- Free for investment portfolios from RUB 3,000,000.

- 990 rubles – for portfolios from 1 to 3 million rubles

- Full terms and conditions of the Premium tariff

Tariff change at Tinkoff Investments

- In your personal account on the official website.

- In the mobile application.

- You can confirm the tariff change via SMS.

- The new tariff plan starts working in a few minutes.

- Each time the tariff is changed, a new billing period will begin.

- After the first transaction in each billing period, the monthly service cost is debited.

What is the commission?

- The Tinkoff broker's commission for a transaction is calculated depending on the tariff at the exchange exchange rate.

- The write-off takes place in Russian rubles.

- If you pay for foreign shares in rubles, they will be converted into the transaction currency at the bank’s exchange rate.

Leverage

Margin trading usually refers to making trades that require a loan from a broker. The same thing can be done on the stock exchange: buy securities on credit and use them as collateral. Transactions with leverage are those operations whose volume exceeds one’s own funds.

- Leverage shows how many times the amount you can spend is greater than what you actually have.

- Typically, the available leverage is already calculated in the trading terminal.

- The size of the shoulder depends on the tools used, your financial status and desire.

- The cost of leverage is determined by the tariff.

On the “Trader” tariff:

- Free if you have open positions at the end of the day up to 3,000

- from 25 rubles per day if there are uncovered positions at the end of the day in the amount of 3,000+

ETF

A brokerage account allows you to contribute part of the funds for funds, including actual equity participation in America. The scheme of action provides good opportunities even without the presence of significant capital. You can also diversify your portfolio, since when you invest in shares, you automatically provide shares in different companies. Reviews for such investments are usually good, because different organizations should not go bankrupt on the same day. According to average statistical data, it is possible to increase capital by 20% over six months.

Registration and connection to Tinkoff Investments

- Fill out the online form, indicate your Russian passport details and phone number.

- Submit an application to open a brokerage account.

- Download the Tinkoff Investments application.

- Within 30 minutes, specialists will check the application and open a brokerage account.

- You will receive an SMS confirmation and an email.

- If you have a deposit or a bank card, you can sign documents online using a code from an SMS.

- If you are not yet a client of the bank, the manager will contact you to agree on a time and place of meeting.

- After signing the documents, you will be able to work on the stock exchange.

Only a Russian citizen over 18 years of age who has tax resident status can open an investment account with Tinkoff Bank.

What time does it open?

- If you have an agreement with a bank for a product, an investment account is usually opened online within 30 minutes.

- If the current day is a weekend or holiday and the exchange is not working, then the brokerage account will be opened on the next trading day.

- If you are just starting to work with Tinkoff, then you need a meeting with a bank employee to sign an agreement - in this case, opening an account takes 1-3 days.

Get +2000 upon registration

Is it possible to use Tinkoff Investments without a card?

- You can register and trade in Investments without a card, but to withdraw funds you will need a Tinkoff debit card.

- If you don’t have a card yet, a bank representative will bring it and give it to you when signing the documents.

Does Tinkoff Investments have a demo account?

There are no demo accounts, but you can open an investment account with a special offer from the bank and use it for 1 month completely free of charge.

At what age can you invest?

- You can use Tinkoff Investments from the age of 18.

- A child from 14 to 18 years old can carry out transactions on the stock exchange with the written permission of one of the parents.

Summary

In the press, Tinkoff's proposal is sometimes called a solution for housewives, hinting at a simplified entry into the stock market . We can agree with this. Anyone, even a schoolchild, can figure out how to use the Tinkoff Investments application. Working with shares is simplified to the limit .

On the other hand, the question of how to make money is not getting any simpler. Just because the process of buying shares has become easy does not mean that everyone can make a profit. The key problem remains - you need to be able to analyze the market and select instruments that can provide profit in the future.

The Tinkoff investment service is a convenient tool. But the final result depends on you ; the broker will not select the composition of the portfolio for you and monitor its efficiency. So, before making serious investments, I recommend improving your financial literacy and understanding the principles of working in the stock market. We will be happy to answer any remaining questions in the comments; if you have experience working with Tinkoff, please share it. The service is not bad, but it is young, problems are constantly being fixed and functionality is being added.

Don't forget to subscribe to my blog updates . Subscription guarantees that you will not miss new publications.

If you find an error in the text, please select a piece of text and press Ctrl+Enter. Thanks for helping my blog get better!

Investments for beginners in 10 steps from Tinkoff

- Tinkoff School offers free training for beginning investors.

- The online course explains how a beginner can start investing.

- At the end of the course, students take an exam.

- School students are given a textbook and step-by-step instructions on where to start and how to trade from scratch.

Upon completion of the course you will:

- You will learn how basic instruments work: IIS, shares, bonds, OFZs, dividends, ETFs.

- learn how Investments help save and protect money from inflation;

- try to collect your portfolio;

- learn to assess transaction risks and calculate probable profitability;

- watch a video about how to invest long-term and safely;

- Read about existing trading strategies and try to build your own.

Official page of the free online course “How to start investing”.

How to invest correctly?

- All Tinkoff Investments traders have access to a free robo-advisor that will tell them where to invest money and what to buy for a novice investor.

- The robot will create a personal stock portfolio and provide a report on the dynamics of their prices over several years.

- For experienced investors, the robot will help find new investment ideas.

- To buy a portfolio put together by a robo-advisor, you need a brokerage account. By law, you can only pay for securities using it.

- If it doesn’t exist yet, you can open it for free by leaving a request on the website or in the mobile application according to the instructions.

Analytics

- Forecasts and charts can be useful for finding new investment ideas.

- Analytics from Tinkoff Investments specialists are available only to registered users.

The work of analysts is as follows:

- Studying news and company reports

- Assessment of prospects for growth in the cost of instruments

- Making forecasts for dividend payments

- Preparation of recommendations for actions with securities and currencies: buy, sell or wait for changes in the market

Any trading participant needs to understand that it is impossible to predict the future state of the market with 100% certainty.

Which tariff to choose

- If you plan to trade less than 116 thousand rubles per month, select the “Investor” tariff

- “Trader” is suitable for those who plan to trade more than 116 thousand rubles

- Premium is designed for large investments

By default, the new brokerage account will be connected to the “Investor” tariff. If necessary, select a different rate in your account.

How much can you earn by investing in Tinkoff?

It’s quite possible to make money, Tinkoff is an exchange provider, so everything depends more on you, and not on the platform.

There are 2 main ways to earn money:

- Buy shares that pay dividends and do not sell them until the closing date.

- Buy shares and sell them later. If the price goes up, you will make money.

- Focus on past dividend yield. Indicators for the last 3 years are available online on the MICEX.

- You can use both methods at the same time.

- Monitor supply and demand, apply technical analysis and evaluate price movements

Cashback +1000 upon connection

How to short: Video instructions

- You can make money on the stock exchange both by rising and falling prices - “short trading”.

- The meaning of short trades is that the broker lends you virtual shares or bonds.

Trading terminal Tinkoff Investments

Tinkoff Investments has mobile applications for trading on the stock exchange and a convenient web terminal for working from a computer.

App APK and App Gallery

- iOS app

- Android app

How does the application work?

- Download and install the application on your phone.

- Choose an instrument, place a bid and buy.

- Set up a notification when the desired price is reached for the stocks you are interested in.

- The app also has a technical support chat.

QUIK terminal program for computer

- Tinkoff Investments can only be used in the bank’s mobile applications or from a computer through the web version of the trading terminal.

- The broker does not support third-party programs like Quik.

Web terminal

- The web version of the terminal allows you to trade from any device via a browser - all you need is the Internet.

- The web terminal supports many different widgets that can be placed in a convenient location on the screen.

Login to your broker's personal account

You can log into your personal account at: https://www.tinkoff.ru/login/?redirectTo=/invest/

Reviews

In general, users are loyal to Tinkoff Investments. The application regularly receives useful updates that improve its performance and add new features, and new investment instruments appear on the trading platform from time to time.

However, there are those who were dissatisfied. They mainly complain about high fees (which is fair) and not very responsive technical support (I have not encountered this problem).

It is worth remembering that no service is perfect, and in the case of Tinkoff, most users are satisfied.

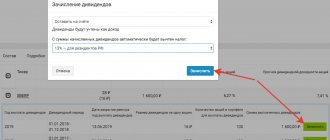

Taxation of brokerage and individual investment accounts

- If you make a profit from trading on the stock exchange, dividends or coupon income, then you need to pay taxes.

- If you trade in rubles, your income will consist of the exchange rate difference between the purchase and sale prices of securities.

- If you trade currencies or securities in currencies, then the difference in the exchange rate is taken into account for tax purposes.

- Almost always, the broker will calculate and withhold income taxes.

- The depositary itself pays taxes on dividends from Russian shares.

- If you use an individual investment account (IIA), you can receive a tax deduction - you can return up to 52,000 rubles per year or 13% of investment income, for this you need to submit an application for a deduction to the tax office.

- Tax on coupons and dividends is withheld automatically - you receive them minus personal income tax.

- Tax on income from the sale of securities is written off during the year when withdrawing money to the card.

- If you suffer losses after paying the tax, the broker will return the excess tax written off to your account.

- If you signed Form W-8BEN, U.S. company dividends will automatically be subject to 13% U.S. and Russian tax withholding. If you do not sign Form W-8BEN, U.S. stock dividends will automatically be subject to a 30% U.S. tax deduction.

- The commission reduces the amount on which you need to pay tax.

Tax amount:

- 13% from income from the growth of the exchange rate on the MICEX, NASDAQ, NYSE and LSE;

- 13% on income from coupons from bonds and from dividends from the Moscow Exchange;

- 13% on income on Eurobonds.

You are required to submit a declaration yourself in the following cases:

- Receiving dividends from a foreign company;

- Lack of tax amount on the balance sheet at the end of the year;

- Earning income from currency trading.

Where to start as an investor?

Leave a request to open an IIS

Unless you have extensive investment experience, do not use aggressive strategies - this almost always leads to losses. If you want to preserve capital and are not prepared to take a lot of risk, follow the recommendations of a robo-advisor or manager. When planning your portfolio yourself, give preference to shares of stable companies with good dividends or reliable bonds. High-risk assets should occupy a smaller portion of the portfolio.

The worst strategy is investing by feel, based on fragmentary market knowledge and analyst recommendations. If you are very lucky, such trading can bring profit, but over time the balance will inevitably begin to decrease.

A return above the inflation rate is considered a good result. Profits of tens of percent per annum indicate either great luck or high risks. Few manage to maintain returns above 20% per year over the long term.

Tools Tinkoff Investments

List and Instructions - how to buy shares?

- A share is a share in a company. By purchasing it, an individual becomes a shareholder, receives rights to dividends and participation in management.

- You can pay for securities using a brokerage account or any Tinkoff debit card.

- Shares of foreign companies can be paid for in rubles with conversion at the exchange rate or in dollars if you top up your brokerage account with foreign currency in advance.

Deferred and limit orders - what is the difference?

- If you want to place an order without a price limit, a market order is suitable for you.

- In order not to monitor quotes manually, you can leave a deferred limit order - indicating to the broker what security or currency, how many lots and at what price you are willing to buy or sell.

- As a rule, the exchange limits the price that can be specified in the application to the extreme offers in the exchange order book.

- Applications can only be submitted for entire exchange lots.

- For each security or currency, you can simultaneously open several orders for both purchase and sale.

- The application is valid for one day - until the exchange closes, then you need to create a new one.

How to sell?

- If the current price on the stock exchange does not suit you, then you can sell your assets right now.

- If quotes change sharply, the bank will suspend the operation until your decision.

- If you are not satisfied with the current bid, you can leave a pending sale order indicating the desired price.

Buying, selling and exchanging dollars

- With the help of the Tinkoff broker, you can buy, sell and exchange 8 world currencies on the exchange: euro, US dollar, pound sterling, Swiss franc, Chinese yuan, Japanese yen, Hong Kong dollar, Turkish lira.

- There are no restrictions on the minimum volume - you can buy from 1 unit.

- For the purchase of currency, a standard commission is charged in accordance with the tariff.

How to buy futures?

A futures is an agreement between a buyer and a seller to buy/sell an asset, for example, oil, after a certain period of time at a pre-agreed price.

Bonds

- A bond is a debt security in which a government or company borrows money and pays it back with interest.

- Until the money is returned, the owner of the bond will receive coupons (interest) for it.

- The Tinkoff broker's catalog includes more than 100 bonds.

- The main risk of buying bonds is default, in which case bondholders will not get their money back.

Trading on the stock exchange through funds

- When trading on the stock exchange, you can buy both stocks and bonds, as well as sets or funds, which are formed by market professionals, reduce risks and simplify trading for a private investor. You can also invest in metals (gold and silver) either directly or through appropriate funds.

- An Exchange Traded Fund (ETF) is a collection of stocks and bonds that can be bought and sold on an exchange. There are also funds for oil, gold and silver.

- The Eternal Portfolio Fund is a joint project of Tinkoff Bank and the Moscow Exchange, including investments in gold, shares, and bonds.

Brief overview of the service

Convenience

The service has a simple interface and provides information in a convenient and understandable form

Conditions

If there are no transactions, account maintenance is free

Reliability

Tinkoff maintains a fairly high level of reliability

Availability

A brokerage account can be opened quickly and in any region of the country

Advantages: A Tinkoff client can connect to Investments in a few minutes. For new users, an account opens in 1-3 days.

You only need to pay for transactions with assets and maintaining an account if there are transactions. In all other cases, using the service is free.

In Investments you will find detailed instructions, reference materials and investment ideas. There is a built-in service that will automatically select the optimal portfolio of securities.

Tinkoff itself will pay personal income tax on investment income, as required by the state. He will also help you obtain an investment tax deduction.

All stocks and bonds you buy in Investments belong to you. If the service suddenly stops working, you can transfer them to another broker.

Disadvantages: A Tinkoff Black debit card is required to access the service. You can top up your account and withdraw money from it only using this card.

The commission for each transaction is 0.3%, which is higher than many other brokers. There is a tariff with a reduced commission, but its maintenance is more expensive.

Tinkoff may update stock quotes with a delay or publish irrelevant news. Therefore, it is worth checking information about securities with different sources.

Tinkoff does not provide many tools popular with professional traders - for example, margin trading or setting your own price. Perhaps they will appear in the future.

Various failures and malfunctions are possible in the operation of the service. Tinkoff tries to correct them as soon as possible after they are discovered.

Go

How to top up?

- You can top up your balance in advance with the required amount that you plan to use on the exchange.

- You can not replenish your account, but pay for the purchase of securities immediately upon purchase using a Tinkoff Bank debit card.

- If you plan to buy foreign securities, you can exchange rubles for dollars in advance through a brokerage account.

How to withdraw money from Tinkoff Investments?

- Money (rubles, US dollars and euros) can be withdrawn at any time to a Tinkoff Bank card without restrictions or commission.

- If you need to withdraw to a card or account of another bank, this can be done by transfer from a Tinkoff card using the details, the operation is free.

Alternatives

You need to choose a broker in such a way that the conditions are as favorable as possible for you. Therefore, I advise you to read my reviews of brokerage houses other than Tinkoff.

Reliable Russian brokers

| Name | Rating | pros | Minuses |

| Finam | 8/10 | The most reliable | Commissions |

| Opening | 7/10 | Low commissions | Imposing services |

| BKS | 7/10 | The most technologically advanced | Imposing services |

| Kit-Finance | 6.5/10 | Low commissions | Outdated software and user interface |

Is it worth investing in Tinkoff Investments?

- Trading on the stock exchange is always a risk, so it's up to you to decide.

- It is quite possible to make money on the stock exchange, as well as to lose all the money invested.

- The platform is modern and convenient for trading; it has many advantages compared to other services.

- Tinkoff Investments has all the necessary licenses from the Central Bank of Russia.

How is an IIS different from a brokerage account?

- IIS (individual investment account) is a special account for individuals with restrictions that allows you to trade on the stock exchange and receive additional benefits.

- You can only have one IRA at a time.

- For IIS, unlike a brokerage account, there are two types of tax deductions.

- The maximum amount that can be deposited into an IIS is 1,000,000 per year. If you exceed this figure, use a brokerage account.

- You cannot replenish an IIS in foreign currency.

- It is also prohibited to pay for a purchase using a ruble bank card. But you can buy currency on the stock exchange and use it to pay for foreign securities.

Qualified Investor Status

To obtain the status of a qualified investor in Tinkoff Investments, you only need to fulfill one of the conditions:

- Own assets or have in accounts from 6,000,000 rubles (there are restrictions).

- Have 2 years of experience in a specialized organization that is a qualified investor, and 3 years in other cases.

- Receive an economic education at a university, have a certificate of a financial market specialist or one of the CFA, CIIA, FRM certificates.

- Over the last year, trade on the stock exchange with a turnover of 6 million rubles.

- Make at least one transaction every month.

- By law, only a qualified investor can purchase any securities and invest in all financial instruments.

- To obtain the status of a qualified investor, send supporting documents to your personal manager.

- Your application will be reviewed within 5 business days, and if you meet the requirements, you will be assigned the status of a qualified investor free of charge.

Analogs

Almost every bank has similar services - Sberbank Investor, Alfa Direct, VTB My Investments, etc. Each of them has its own pros and cons. For example, at Sberbank only domestic securities are available for purchase; at Alfa, money can be withdrawn only on certain days and times and there is absolutely no information about dividends; VTB has a large commission, which becomes acceptable only with a turnover of 1 million rubles.

Tinkoff Investments also has a high commission for transactions, but this minus is compensated by many advantages that will especially appeal to beginners. However, if for some reason this service still does not suit you, you can try Alpha Investments. In my opinion, this is a good analogue (although in the end I preferred Tinkoff to it).

Help, support and contacts

- Official website of the broker: https://www.tinkoff.ru/invest/

- Address for submitting applications for extracts: 123060, 1st Volokolamsky proezd, 10, building 1.

- Support phone number

- Technical support chat is available in your personal account or mobile application.

- Help and solving problems with errors: https://help.tinkoff.ru/trading-account/

- Broker agreement – https://www.tinkoff.ru/about/documents/disclosure/