What are Eurobonds

Bonds are debt instruments. That is, the buyer and owner of this security “lent” their money to the issuing company at interest. The interest on this instrument is the coupon income. Additionally, you can receive income from the sale, since this security is freely traded on the secondary market, its price rises and falls in the same way as the price of shares.

What you need to know about bonds before buying

Eurobonds or Eurobonds are bonds issued in a currency that is considered foreign to the buyer. For Russians – dollars, euros and other currencies other than the ruble.

When purchasing a Eurobond, an investor essentially receives 4 types of income:

- Profit from exchange rate differences in the event of an increase in the value of foreign currency and a fall in the ruble;

- Income from selling a bond at a price higher than the purchase price (par value);

- Coupon income (interest on invested funds);

- Additional profit from reinvesting coupon income (with the funds received from the borrower you can purchase the same bonds or invest them in other instruments).

Investor reviews

Market participants generally respond positively to this instrument. This is primarily due to the fact that, when compared with bank deposits, Eurobonds look much more attractive, because they not only provide higher returns, but also allow you to save the accumulated coupon income due to the possibility of exchange sales.

Those. It is more advisable to keep money in a stronger currency and with the ability to instantly withdraw accumulated profits and transfer them to other financial assets.

Eurobonds on the Moscow Exchange

In order to become the owner of a Eurobond, you must open a brokerage account or IIS. The Moscow Exchange offers government (issued by the Ministry of Finance) and corporate (issued by private or state legal entities).

By application deadline:

- Perpetual (for example, VTB; such securities do not have a specified maturity date);

- From 2 months (MTS, VEB);

- Up to 17 years old (Gazprom).

The cost of Eurobonds varies from $0.3815 as of March 11, 2020 (for a 10-year Eurobond of the Ministry of Finance) to $1,706.10 (for an 8-year government bond). A 14-year-old Gazprom, for example, costs $1,479.5.

Examples of Eurobonds from Russian issuers:

Some of the securities are traded in lots (for example, a lot of 8-year Ministry of Finance debt instruments is 100 pieces, that is, the minimum purchase at par is $340), however, the bulk of securities of Russian issuers are traded individually (that is, 1 lot = 1 bond).

Yield on 8-year government Eurobonds:

The highest yield on Eurobonds of Russian issuers is 7.71% (Freedom Finance for 2 years 10 months).

The most liquid Eurobonds on the Moscow Exchange:

Full list of government Eurobonds traded on the Moscow Exchange:

https://www.moex.com/s729

Eurobond selection parameters

The choice of a specific security depends on the investment strategy and goals of the individual buyer. For long-term passive investing (that is, without making transactions with securities during their validity period), Eurobonds for a period of 5 years or more, issued by the Ministry of Finance, are suitable. They will bring a stable income with virtually no risk of loss.

If a more active strategy is assumed, then it is worth determining a profitable bond according to the following parameters:

- Reliability of the issuer . Corporate securities are more profitable, but also carry higher risks. You can reduce the likelihood of losses by choosing a stable issuer (for example, a bank with state participation or the oil and gas industry, which is regularly subsidized from the budget even in unfavorable market conditions). To determine reliability, you can use the ratings of specialized agencies (for example, STLC has a credit rating of BB+ from Fitch with a “Positive” outlook (https://www.gtlk.ru/investors/ratings/); Rosneft has a BBB- with a “Stable” outlook » from S&P (https://www.rosneft.ru/Investors/instruments/Ratings/)).

- Liquidity level. Possibility of quick sale without loss in price from the face value (as a rule, this is possible during the first half of the validity period, when the future buyer will have the opportunity to receive a significant coupon income). https://bcs-express.ru/novosti-i-analitika/likvidnye-evroobligatsii-na-mosbirzhe. The most liquid bonds:

- Availability of depreciation . This is the repayment of the face value in installments on the date of payment of each coupon (a kind of analogue of a loan repayment schedule). Such a tool will enable the investor to respond more flexibly to changes in market conditions, transferring part of the invested funds into more profitable or less risky instruments. For example, STLC Eurobonds (RU000A0JY023) have amortization with a payment frequency of 91 days; from government bonds – for 10-year ones (XS0114288789).

- Taxation. Personal income tax is not levied on income from government Eurobonds. For corporate bonds, a tax of 13% on the increase in market value (upon sale) plus 13% on the coupon income may be levied.

- Profitability. The coupon rate is inversely proportional to the level of risk. Based on your investment strategy, it is worth finding the optimal balance between income and the possibility of losses.

- Possibility of default by the issuer in the event of a decrease in equity capital. This parameter is provided for by the release conditions. If such a possibility is provided, then the issuing organization has the right to write off debts in the event of bankruptcy.

How much can you earn

The yield of Eurobonds primarily depends on the issuer issuing the securities. Or rather, on his credit rating. The higher it is, the lower the yield percentage the issuer can place the issue at.

Conversely, companies with a low credit rating (not the most reliable) have to provide an additional risk premium by increasing the size of coupon payments in order to entice investors to buy their securities.

The most reliable securities are government-owned; due to their high credit rating, they can set almost the lowest percentage of profitability.

The largest top companies (Gazprom, Lukoil, Alfa Bank) give a little higher.

Less reliable ones pay even more.

Eventually:

The annual percentage yield of Eurobonds can vary from a modest 2-3% to 8-10%. Exactly in dollars.

The second important parameter is the maturity period. As a rule, securities with a longer maturity have higher yields.

The most profitable Eurobonds are shown in the table. This refers to the yield to maturity.

An example of choosing a specific security for a portfolio

Let’s imagine that a hypothetical investor with a ruble portfolio worth 1,500,000 rubles (that is, it contains shares, OFZ bonds in rubles, and deposits). The stock portfolio is diversified by industry:

The portfolio consists of more than 60% shares of Russian companies, so the investor plans to reduce the total risk by investing $20,000 in Eurobonds. The table below provides a comparative analysis of possible options from different industries for 2020:

| Industry | Denomination, $ | Coupon, % | Profitability, % per annum | |

| Lukoil | Oil | 1000 | 6,66 | 2,93 |

| Alfa Bank | Bank | 1000 | 7,75 | 2,26 |

| Norilsk Nickel | Metal | 1000 | 6,62 | 3,17 |

| OFZ2030 | — | 0,38 | 7,5 | 4,1 |

| STLC | Leasing | 1000 | 5,95 | 2,41 |

Wherein:

- Lukoil has the lowest debt burden in the industry, has government support and depends on energy prices;

- Alfa Bank is a systemically important bank and shows stable performance indicators;

- Norilsk Nickel bonds have potential for growth in value due to limited reserves of copper and palladium;

- Government Eurobonds are not subject to personal income tax;

- STLC is engaged in leasing of vehicles and equipment. Due to high tensions in the international transportation market, the value of bonds may fall. High market risk.

If there is a need for long-term investments with minimal risks, the Eurobond portfolio will be as follows:

| Issuer | Denomination, $ | Investments, $ | Portfolio share |

| Lukoil | 1000 | 4000 | 20,00% |

| Alfa Bank | 1000 | 1000 | 5,00% |

| Norilsk Nickel | 1000 | 6000 | 30,00% |

| STLC | 1000 | 1000 | 5,00% |

| Ministry of Finance | 0,38 | 8000 | 40,00% |

Let's imagine it more clearly in the diagram:

With this portfolio structure, the investor:

- Receives a weighted average portfolio return of 7.003 over a 12-month horizon (until Alfa Bank maturity);

- Reduces the risks of investing in Lukoil and State Transport Leasing Company by investing in the growing Norilsk Nickel and the stable Ministry of Finance;

- Introduces long-term investments into the portfolio structure through Eurobonds of the Ministry of Finance;

- Diversifies the total portfolio by increasing the share of investments in the raw materials industry, while reducing the total risk in the industry (Norilsk Nickel).

Using a similar principle, you can create portfolios with different levels of risk and investment terms, subordinating the investment structure to the current investment strategy.

In addition to the bonds indicated in the table, VTB perpetual securities have a high yield (8.63%), but they are associated with a high level of risk: the debt is subordinated, that is, the claims of creditors will be satisfied after investors and holders of term bonds.

In addition to Russian companies, investments in bonds of foreign issuers are possible.

The buying and selling procedure remains the same. But there are taxation nuances. Typically, income tax is paid to the country in which the borrower is located.

If we talk about risks, the main one is the risk of issuer default. To reduce risk, you should contact rating agencies for information: Moody's, JCR (Japan), Dagong Global Credit Rating (China).

Comparisons of foreign currency deposits and Eurobonds

| Parameter | Eurobonds | Currency deposits |

| Investment terms | Up to 10-15 years | Up to 5 years |

| Average yield | About 7% | About 1% |

| Early repayment | Possibly without loss | Possibly with interest losses. For deposits with the possibility of early withdrawal, the rate is lower. |

| Reinvestment | Possible (self-reinvestment) | Possibly (deposit capitalization) |

| Minimum amount | From 1000$ | Not limited |

| Tax deduction | When purchasing through IIS | No |

| Insurance | Not insured | Insured by DIA |

Below are the main parameters of the most profitable foreign currency deposits in Russian banks:

What are high yield bonds

Investment options

In addition to the direct purchase of one or more Eurobonds, it is possible to invest in the following ways:

- Purchasing a unit of a mutual fund (for example, VTB Eurobond Fund https://www.vtbcapital-am.ru/products/pif/opif/vtbeurobonds/investment_strategy/). In this case, the contribution amount of each mutual fund participant is reduced, and the management company accumulates funds and invests them in the Eurobond market. The largest management companies of mutual funds: Sberbank, VTB, Alfa Capital, Aton, Otkritie. Investments in mutual funds reduce the risks of the shareholder, since the portfolio contains securities from different sectors of the economy that do not correlate with each other. The yield of mutual funds corresponds to the weighted average yield on the Eurobond market. For example, the dynamics of the value of a unit of VTB Mutual Fund:

Profitability of Sberbank Mutual Fund https://www.sberbank-am.ru/individuals/fund/opif-obligatsiy-sberbank-evroobligatsii/:

- Investing in ETFs. ETF is an index instrument that you can invest in through an account opened with a broker. On the Moscow Exchange they are represented by the FinEx index. It includes the following ETFs: dollar FXTB – investments in securities issued by the US Treasury;

ruble FXRU – investments in more than 25 Russian Eurobonds class=”aligncenter” width=”638″ height=”341″[/img]

An investor purchasing a share in such a fund does not need to invest in individual bonds, monitoring their risks and returns. At the same time, the ratio of securities in the fund may change depending on the dynamics of their yields. This maintains the profitability of the entire fund as a whole.

Advantages of investing in Eurobonds

- High level of profitability (on average about 7% per annum in foreign currency; given the volatility of the exchange rate, it can reach 20% in rubles);

- Optimal combination of profit and risk level;

- Possibility of reducing the tax burden (due to the absence of personal income tax on government bonds);

- Regular coupon payments;

- Pricing transparency;

- High liquidity.

Disadvantages of investing in foreign currency bonds

- Currency risk;

- Limited number of issuers on the market;

- Lack of insurance against possible losses;

- Relatively high entry threshold for individual purchase of bonds (not through a fund; the minimum entry threshold for most securities is $1,000, and through mutual funds - from 2,000 rubles).

Overview of Bond Investment Strategies

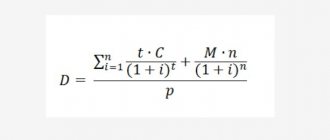

Bond yield calculation

In trading terminals, the bond yield is calculated automatically. You can approximately calculate profitability without taking into account currency risks using the formula:

D = ( (N - C) / P + (N * K) ) / ( (N + C) / 2 ), where

D - profitability;

N – denomination;

P – purchase price;

P – circulation period;

K – coupon rate.

You can also use calculators on the websites moex.ru https://www.moex.com/ru/bondization/calc or rusbonds.ru to calculate profitability.

Let's calculate the profitability for 2 options for investing in dollar securities:

- Government bonds for 10 years. Denomination $0.34. The selling price as of the date of this article was $0.38. The coupon rate is 7.5% with a payment frequency of 180 days (2 times a year). Coupon amount is $0.01 per bond.

That is, by buying 100 bonds (1 lot) today for $38, we will receive income 2 times a year for $1:

1 * 2/38 * 100% = 5.26% per annum

- 14-year Gazprom bonds with a par value of $1,000 will bring a coupon income of $43.13 (8.62%). They are currently trading at $1,478.5. That is, when buying 1 bond, we will get the yield:

43.13 * 2 / 1478.5 * 100% = 5.83% per annum.

Deposits in foreign currency for comparison

The maximum interest rate on foreign currency deposits is 3% per annum. That is, if you provide the bank with $1,000, then in a year you will get $1,030. That is, the final financial result is $30 per year.

True, not everyone will be able to get such profitability. For example, this offer is not available in some regions. In addition, this deposit does not provide for the possibility of capitalization, which is much more important than the interest rate in the long term.

Moreover, very often such offers require the use of a promotional code, which not everyone has. In general, the real interest rate will be about 2 percent without capitalization. There are also several other reasons why Eurobonds are better than foreign currency bank deposits:

- Limits.

The maximum amount of money that can be insured is 1.4 million rubles. This is a little less than 20 thousand dollars in wealth at the end of September 2022. - Conversion.

In the event of bank bankruptcy or revocation of a license, funds will be returned in rubles at the exchange rate on the day of bankruptcy. - Dollar inflation

in 2016 was 2.07%, and in 2022 - 2.4 percent per annum. Therefore, the purchasing power of the dollar will still be lost, even if you open a deposit at 2.3% per annum.