Despite the fact that the first few years of the history of the Ethereum cryptocurrency were marred by hacks, rollbacks and network forks, this did not prevent it from becoming one of the market leaders, including in terms of price records. If we count from the 2015 minimum of $0.44 to the ATH of $2040 recorded in February 2021, the Ethereum rate has increased by more than 4600 times.

Until 2022, things were not going so well - the price of ETH dropped significantly more than that of other top altcoins. However, in the fall of 2020, a new powerful round of growth began, which made it possible to update the historical maximum of the second cryptocurrency.

- Ethereum to dollar rate

- Ethereum to ruble exchange rate

- Ethereum price forecast 2021

- Ethereum price forecast 2020

- Ethereum price history 2015. Ethereum's first steps

- 2016. DAO, hackers and Ethereum Classic

- 2017. Grand bullrun

- 2018. Year of the bears

- 2019. First signs of recovery in Ethereum value

- 2020. The beginning of a new round of growth

- 2021. New ATX and only upwards

Ethereum to dollar rate

Ethereum to dollar rate

Today, the Ethereum to dollar rate is the main way to measure the value of this cryptocurrency. The ETH/USD trading pair is present on most major exchanges that support trading with fiat currencies, such as Coinbase, Bitfinex, Kraken, Bittrex, etc. And where it is not there, there are definitely alternative options in the form of trading with USDT, BUSD, TUSD and other stablecoins.

The Ethereum to dollar exchange rate is formed based on the existing supply and demand relationship.

☝️

Since this asset is quite liquid, it is almost impossible to find significant differences in its price on different sites - there is a natural correlation with the average market value.

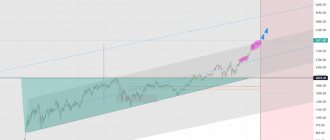

Ethereum to dollar rate (2021)

Since the beginning of 2022, the Ethereum price has been changing as part of a steady upward trend and at the time of writing this material reached $1,828.

☝️

You can track the Ethereum to dollar rate on the CoinMarketCap website

Ethereum exchange rate is set for a breakthrough due to the widespread use of blockchain

Everyone associates blockchain technology with only a few concepts. For example:

- Cryptocurrency: the most famous are Bitcoin, Ethereum, Monero and even their numerous forks.

- Confidentiality and the ability to transfer funds without any control, without even paying taxes for it. No bank, fiscal or other service will know that the user has cryptocurrency in his account or has made transactions with it.

- ICOs are investment projects related to the release of a new cryptocurrency or tokens based on blockchains.

- Speculation, trading, the opportunity to quickly make a profit.

- Mining.

That's all. Many people don’t even have such associations, and only the names of currencies and mining come to mind. Everyone is trying to quickly get rich, invest in cryptocurrencies, including Ethereum, in order to later receive their profit. But few see blockchain as a future that could change the world.

Ethereum exchange rate is set for a breakthrough due to the widespread use of blockchain

Independent applications and programs are already being created based on the blockchain and Ethereum smart contract technology. They are uncontrolled, decentralized, and financial transactions in them are also carried out using cryptocurrencies. If there are such applications, then their number will only increase in the future. Perhaps even the Internet itself will free itself from the influence and control of search engines and become decentralized. Of course, this cannot be done without blockchain.

Even the same tokens are now perceived as a means of investment and further profit. But in the future they may become an integral part of online trading, concluding independent blockchain transactions, etc. People like that blockchain smart contracts allow them to avoid incurring additional costs and let their finances shine.

Ethereum is destined to succeed if the blockchain is used everywhere. Of course, this will not happen in 2022 or even in 2022, but very soon. If there is no intermediary, regulatory body, or service, then there are no unnecessary problems. And where there is a blockchain, there is no third party, no control, no intermediary markups. And the blockchain itself can be used everywhere: from creating independent databases to preserving your copyrights.

The Ethereum rate depends on the number of projects with it

Ethereum to ruble exchange rate

Ethereum to ruble exchange rate

Today, the Ethereum to ruble exchange rate is not very often of interest to traders. Mainly due to the fact that ETH/RUB trading pairs are present on a very small number of exchanges, and there is very little liquidity in them.

Of the major international platforms, the only place where you can buy and sell ether for rubles is Binance. Otherwise, Ethereum trading against the national Russian currency can only be found on crypto exchanges aimed at users from the CIS - Currency.com, Exmo, YoBit and Kuna.

Ethereum to ruble exchange rate (2021)

As of the beginning of 2022, 1 ETH was worth about 52,490 rubles. Now, almost two months later, the Ethereum to ruble exchange rate exceeded the level of 136,685 rubles, that is, it increased by 160.75%.

☝️

You can track the Ethereum to ruble exchange rate on the CoinMarketCap website

The history of bull runs 2013, 207 will repeat itself in 2021

As the history of previous bull cycles shows, October, November and December are the most profitable months for all cryptocurrencies.

Source: Twitter

October ended at +40%. We are waiting for +50% in November

Let's keep pace with 2022, there in September we fell by -7.44%, and in 2021 by -7.03%. Then in October 2022 they grew by +47.81%, and in 2021 by +39.93% (almost 40%, if rounded).

In 2022, November brought +53.48% and if everything goes as it goes, then in November 2022 you can expect ~$95,000 per 1 BTC. By the way, this is exactly as much as PlanB expects (>$98K). Coincidence?

Ethereum price forecast 2022

Ethereum rate 2021

Most analysts predicted that the Ethereum rate would rise to $2000 in January 2022, which ultimately happened. Great hopes were also pinned on the launch of Ethereum futures on the CME exchange, but nothing significant happened that day - the rate simply remained firmly entrenched at $1,780, which it had reached a few days earlier.

Unlike Bitcoin, analysts and other financial experts rarely give specific figures on the growth of Ethereum, repeating that the second cryptocurrency will continue to repeat the movement of BTC. In general, this is true, but in 2022, Ethereum shows attempts to get rid of the main cryptocurrency.

If we talk about specific individuals, earlier the managing partner of the Moonrock Capital fund, Simon Dedich, called the price of Ethereum at $3,000 after reaching a historical maximum.

In general, great hopes for the growth of the Ethereum rate are pinned on the development of Ethereum 2.0 and the launch of the main phase, however, the developers have not yet announced specific dates and are delaying the development of the project.

See the latest Ethereum forecast for 2022:

Ethereum Forecast 2021

Ethereum price forecast 2022

Ethereum price forecast

In the winter of 2022, it became known that the transition to Ethereum 2.0 should begin this spring, and the launch of the Beacon Chain network was supposed to take place on July 30, 2022, the birthday of Vitalik Buterin’s brainchild. However, the launch was delayed and this did not significantly affect the Ethereum rate.

In addition, a reduction in the block reward from 2 ETH to 0.22 ETH could also contribute to the growth.

And when promises about the transition to PoS, sharding and instant free transactions are fulfilled, Ether will have the opportunity to bypass not only competitors on the blockchain, but also world-famous payment systems. It is clear that in this case, the cost of ETH may even go to heaven.

Now about more specific forecasts that involve graph analysis and mathematics. According to calculations based on logarithmic regression by YouTuber Benjamin Cowen, the next price peak for Ethereum will be between $9,000 and $46,000 in 2022:

Ethereum price forecast from Benjamin Cowen

So far, these forecasts do not look very realistic, but given that by that time the price of Bitcoin is expected to rise to $100,000, the Ethereum rate may well rise to $9,000, or even higher. And in addition to the correlation with the growth of the main cryptocurrency, the plans described above to improve the Ethereum blockchain can contribute to this.

Ethereum price history

Ethereum exchange rate history

The first version of the Ethereum cryptocurrency protocol, called Frontier, was launched on July 30, 2015. At that moment, there was essentially no such thing as the value of Ethereum. Yes, it was possible to draw certain conclusions about the value of Ether coins based on data from pre-sales conducted from July to September 2014 (~$0.3–0.45 per 1 ETH).

But it was too early to talk about the price, which is formed on the basis of the exchange supply/demand ratio. There was one week left before the first listing on the cryptocurrency exchange.

2015. Ethereum's first steps

Ethereum price chart (2015)

According to the website Etherscan.io, the first surviving historical records regarding the value of Ethereum date back to August 7th. On this day, ETH was added to the Kraken crypto exchange and was valued at $2.77 per coin. Over the next three days, the price dropped 4 times to $0.68, most likely under the influence of rapid sales organized by early investors.

By August 13, thanks to the expression of interest in a new promising asset, the Ethereum rate rose to the level of $1.8, where it remained for three days (the next time the price of Ethereum will return to these heights only after six months).

August 18 marks the first significant event for the ether network - the first 100,000 blocks were mined. At this point, the rate drops to $1. Then, over the course of two months, there is a systematic decrease in the price of ether. This stage is typical for a cryptocurrency that is added to the exchange for the first time and is actively mined by miners. In addition, Ethereum investors continue to drain their coins from the pre-sale stage.

The local downtrend ends at $0.43 per 1 ETH at the end of October. This is followed by a rise to the level of $1.3 and a three-month consolidation in the range of $0.8–1.

During this period, more and more crypto enthusiasts are learning about ether. A particularly significant contribution to its popularization was made by the developer conference Devcon-1, held from November 9 to 13. The ways of developing Ethereum were actively discussed at it in the presence of representatives of IBM, Microsoft and UBS.

2016. DAO, hackers and Ethereum Classic

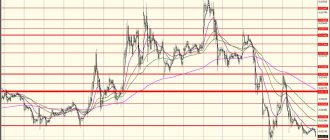

Ethereum price chart (2016)

On January 11, 2016, the price of Ethereum finally breaks through the $1 mark again and rushes up, never to return to it again (at least that’s the case at the time of writing this article).

Over the course of two months, the Ethereum rate has been growing rapidly against the backdrop of information about the previous replacement of the network protocol with a more stable version (Homestead) and reaches its first serious high ($15) on March 13.

At this moment, the capitalization of Ethereum goes beyond $1 billion for the first time. And the very next day there is a clear demonstration of the popular trading proverb “Buy on rumors, sell on news!”: On March 14, when the mentioned hard fork took place, a sharp correction began, as a result of which By the end of April, the price of ether is halved - $7.3 per coin.

The next event that brought the price of Ethereum to its highest value for the entire year ($20.6) was widespread media coverage of the successes of the DAO project, which collected more than 12 million ETH (~$150 million) as part of the token sale. It was one of the pioneers of the upcoming ICO era, choosing Ethereum to raise funds from investors.

However, what happened next was that the ether price was knocked out - taking advantage of a vulnerability in the DAO code, on June 16, 2016, hackers stole about $50 million in ETH from the project. Panic began in the market, due to which Ethereum fell in price by almost half in 2 days - to $11. It was known in the crypto community that Ethereum co-founder Vitalik Buterin strongly supported DAO, and this was one of the reasons why the ETH rate suffered.

Ethereum founder Vitalik Buterin

Over the course of a month, there were heated discussions about Buterin’s proposal to return the stolen funds by conducting a hard fork to restore the network to the state it was before the attack. Amid these discussions, the price of Ethereum fluctuated seriously: reaching $14.3 a week after the incident, it subsequently went even lower - on July 7, 1 ETH was given $10.

On July 20, the controversial hard fork went through, thus giving birth to the Ethereum Classic project, which was followed by supporters of a censorship-free and interference-free blockchain. 2 days after this, the Ethereum rate, which had recovered to almost $15, again went into a steep dive and reached $8 by the beginning of August.

A few days later, the price of Ethereum recovered to $11 and within a month and a half consolidated in the range of $10–12.25.

In mid-September, amid news of the addition of Ethereum support to the Ledger Nano S hardware wallet, growth resumed, bringing the rate to $15 for the last time this year.

On September 22, it became known about a DDoS attack on the Ethereum network, as a result of which its work slowed down significantly. This news triggers the start of a local downward trend, which lasts 2.5 months and ends on December 5 at $6. Until the end of the year, the rate will consolidate in the range of $7–9.

2017. Grand bullrun

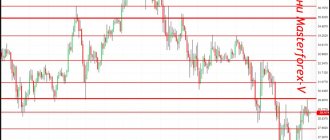

Ethereum price chart (2017)

This year for Ethereum starts at $8. Throughout January and February 2/3, there is a smooth growth, as a result of which the price of Ethereum comes to the level of $13. From this point, more rapid growth begins against the backdrop of the fact that on February 23, Ethereum was added to the social platform for traders eToro.

On the same day, the number of unconfirmed transactions on the Bitcoin network reaches 100 thousand - more and more crypto investors, who consider Bitcoin slow and outdated, are looking for alternative options for investing their funds. A considerable part of them turn their attention to the airwaves.

In the first ten days of March, the rate makes several unsuccessful attempts to break through the $20 mark and, having returned to the $16.5 level for the last time, makes a breakthrough that within a week brings Ethereum to the $45 mark (on some exchanges $55). Daily ether trading volumes reach $450 million.

In the twentieth of March, Ethereum rises in price to $53–59 and then consolidates in the range of $40–50 during the month.

On April 26, a new price push occurs, which in 10 days leads to an almost twofold increase in the price of ether - on May 5, 1 ETH costs $95. Around the same days, the number of unconfirmed Bitcoin transactions exceeded 200 thousand - the network of the main cryptocurrency became even slower. One of the reasons is that many miners switched to ether mining.

However, Bitcoin is also in the preparatory stage of growth, setting the direction for the market. Many coins are responding to this direction with stunning growth. Ether, which was added to the AVATRADE trading platform on May 18, also rushes to new heights - in less than a month its price increases 4 times (June 12, 1 ETH = $400).

☝️

Investors who bought ether six months ago have the opportunity to sell it for 50 times more expensive!

Ethereum's dominance in the market reaches its ATH - 31.5% (at the beginning of the year it was 4%).

Ethereum rate growth

In addition to the above-mentioned reasons, such successes are explained by the widespread popularization of Ethereum in the crypto community and among dApps developers. ICO hype also contributes to the increased demand for ether - thousands of projects choose ETH as the main currency for accepting payments during their token sales.

After such rapid growth, a natural correction follows, which begins after a failure in the Ethereum network due to the increased excitement around ICO Status. The local downtrend lasts about a month and ends on July 16 at $150.

From here begins a new wave of growth, which by September 1 again brings the price of Ethereum to the $400 mark. The subsequent two-week correction coincides with the general decline of the market against the backdrop of news from China about the ban on ICOs and cryptocurrency trading, and ends at $200.

Until mid-October, against the backdrop of news about the upcoming update of the Byzantium network, the rate was gradually recovering. On October 15, immediately after activating this update, the same smooth correction begins.

Until mid-November, the price of Ethereum consolidates in the $275–350 corridor, and on the 23rd it breaks through the $400 level, which becomes support for 2.5 weeks.

All this time, the ICO bubble continues to inflate, in which ether is still the main means of payment. In addition, Bitcoin’s movement towards “that same ATH” ($20,000) is accelerating, continuing to drag the entire crypto market up with it.

On December 11, the price of Ethereum enters the last phase of growth in 2016, during which it reaches the level of $800. Further, like most cryptocurrencies on the market, Ether is adjusted in parallel with the 80% decline in the Bitcoin rate and temporarily drops to $500–600. The year is ending with attempts to break through the $750 level.

2018. Year of the bears

Ethereum price chart (2018)

From the very first day of the new year, the Ethereum rate rushes up and on January 13 reaches the absolute maximum in its history - $1,400. During this period, most altcoins also update their highs.

At this point, the euphoria begins to gradually fade away, mainly due to Bitcoin going into correction. On January 28, the price of Ethereum makes another leap upward, touches the $1250 mark and goes into a rapid correction. Further movements in the Ether price are mainly a reaction to the movements of Bitcoin, which will follow a bearish trend all year.

On February 5, the first rebound occurs from the $700 level (on some exchanges $600), which results in a recovery to the $900 mark. On February 14, the developers announced the upcoming release of the Ethereum Go Iceberg client - on this news, the rate continues to grow slightly and on February 18 reaches $1,000.

From this moment until the beginning of April there is a systematic descent to the level of $380. From this mark comes the last significant local reversal in the ether exchange rate in 2018, which intensifies on Cosmonautics Day (April 12), reaching $500.

This impulse triggers a wave of growth, which ends on May 5 at $830, from where the price of Ethereum goes into a stable decline until mid-September (with small rebounds).

ICO on Ethereum

The era of ICOs, which provoked the rapid growth of Ethereum in 2017, has come to an end. Throughout 2022, its echoes play a cruel joke on ether - thousands of ICO projects sell their savings in ETH, pushing its rate down much faster than the value of other TOP coins falls during the general market downtrend.

The decline slows down in early September at $180 and consolidation between the $200–300 levels occurs until mid-November. The community hopes for a reversal from these values and perceives this period as cumulative. Positive sentiment is supported by news about the Constantinople hard fork expected in November.

However, the network update is postponed, and what happens next is that the entire crypto market is sent in search of the bottom for another six months - on November 14, Bitcoin breaks through the $6,000 level and within a month the price drops by almost half.

During this time, the ether exchange rate manages to drop to $85. At this point, it has already been displaced from 2nd place in the ranking of cryptocurrencies by capitalization for a month now—XRP holds this position.

This is followed by a rise in the rate to the level of $130–140, where 2018 ends for Ethereum. This means that from its January ATH ($1400), ether fell in price by 10 times (and at the time of the maximum drawdown to $85, by 16).

2019. First signs of recovery in Ethereum value

Ethereum price chart (2019)

In the first week of January, Ethereum returns to 2nd position in the CoinMarketCap ranking, and its price reaches $160. By this point, the rates of almost all coins had ceased to make independent movements and were simply synchronized with the movements of Bitcoin - the crypto community, exhausted by the bear year, still did not believe in the possibility of a reversal and expected further drawdowns.

And since Bitcoin went into a slight correction again, Ethereum followed suit and dropped to the $100 level by February 7th. From this moment, a three-month consolidation of Ethereum price in an ascending channel begins. Local maximums during this time are $160 and $180. On February 28, the Constantinople hard fork finally takes place on the Ethereum network, but the price does not react to this event.

At the beginning of April, the Bitcoin rate jumps by $1000, but Ethereum, like most other TOP coins, does not follow it and continues to move in the mentioned channel.

Finally, on May 11, during another wave of Bitcoin growth by another $1000, the market believed in a reversal and the price of Ethereum began an energetic upward movement, which resulted in reaching $280 five days later (at this moment Bitcoin was trading at $8000).

After a month-long consolidation below this level, Ethereum continues to grow rapidly and reached $365 on June 26. This value ultimately becomes the absolute maximum price for the entire 2022.

Blockchain Ethereum

Next, a growth correction begins, which in just two weeks leads to a drop in the Ethereum rate to $190. From this level, a more stable, but, unfortunately, downward trend begins, within which rare rebounds occur, repeating similar movements on the chart of the main cryptocurrency.

The only noticeable increase in the Ethereum rate - from $175 to $225 - occurred over the course of several days in mid-September amid news of the addition of ETH to the BitPay processing service. However, this success is offset by an unexpected collapse in the value of Bitcoin (by almost $2,000), which provokes a sharp decline in the price of the entire cryptocurrency market.

Without becoming an exception, Ethereum went in search of a local bottom. It turned out to be the $150 mark, which over the next month acted as a support level, but was still broken.

Then the decline in the Ethereum rate continues down to $125, which was reached by mid-December. As a result, six months after the yearly high of $365, the price of ether has decreased by almost three times. Throughout 2019, it only dropped lower in early February (to $100).

Overall, in the second half of the year, ETH showed itself to be a rather weak asset, despite a lot of news about the Istanbul hard fork that took place on December 8 and other upcoming updates on the way to the implementation of Ethereum 2.0.

2020. The beginning of a new round of growth

Ethereum price chart (2020)

2020 can be considered a preparatory stage for serious growth, which began in 2022. The beginning of the year was very optimistic for the second cryptocurrency - quotes continued the growth that began in December and increased for several weeks in a row until almost mid-March. At this stage, the maximum price that Ethereum reached was a little more than $290.

March 12 became a “black” day for Ethereum, as for other altcoins, Bitcoin and the entire stock market, when the ETH rate was $88 at the moment. However, coins at this price were quickly bought back and within two weeks Ethereum returned to stable growth again.

At the end of May, the rate again surpassed the $200 mark, after which a flat movement followed for almost two months.

Since August, a new wave of growth began - Ethereum rose from $240 to $490 at the moment. After this, the price adjusted to $320 and was in a flat until the beginning of November. From that moment on, the second cryptocurrency began a serious “race” - in nine weeks the price increased by more than 170% - from $370 to $1014, getting closer and closer to the historical maximum of $1400.

2021. New ATX and only upwards

Ethereum price chart (2021)

Not even two months have passed since the beginning of 2022 (at the time of publication of the article), and the Ethereum rate during this period managed to give HODLers a 130% profit.

On January 1, the price for one ether was about $730, and a week later the rate was $1,190. January 25th will go down in history as the day Ethereum rewrote its previous all-time high of $1,400. But the second cryptocurrency did not stop there and continued to grow.

At the time of publication (end of February 2021) ATX is $2040.

According to the forecasts of most crypto market experts, 2022 promises to be very promising in terms of growth in the value of cryptocurrencies, including Ethereum.

Average prices table

- by month

- by days

- on years

| Month | Price, USD |

| January 2022 | 3 350.865 |

| December 2021 | 4 025.8050000000003 |

| November 2021 | 4 416.72 |

| October 2021 | 3 785.895 |

| September 2021 | 3 353.3775 |

| August 2021 | 3 164.535 |

| July 2021 | 2 133.16 |

| June 2021 | 2 396.3275000000003 |

| May 2021 | 3 203.755 |

| April 2021 | 2 213.485 |

| March 2021 | 1 758.7800000000002 |

| February 2021 | 1 694.3375 |

| January 2021 | 1 222.23 |

| date | Price, USD |

| 13.01.2022 | 3 350.865 |

| 12.01.2022 | 3 311.69 |

| 11.01.2022 | 3 159.24 |

| 10.01.2022 | 3 054.9300000000003 |

| 09.01.2022 | 3 135.08 |

| 08.01.2022 | 3 123.79 |

| 07.01.2022 | 3 248.27 |

| 06.01.2022 | 3 424.71 |

| 05.01.2022 | 3 636.21 |

| 04.01.2022 | 3 803.115 |

| 03.01.2022 | 3 766.665 |

| 02.01.2022 | 3 786.465 |

| 01.01.2022 | 3 726.105 |

| 31.12.2021 | 3 718.08 |

| 30.12.2021 | 3 678.96 |

| 29.12.2021 | 3 716.1 |

| 28.12.2021 | 3 899.745 |

| 27.12.2021 | 4 079.46 |

| 26.12.2021 | 4 057.3 |

| 25.12.2021 | 4 082.56 |

| 24.12.2021 | 4 076.1000000000004 |

| 23.12.2021 | 4 025.8050000000003 |

| 22.12.2021 | 4 007.9300000000003 |

| 21.12.2021 | 3 987.665 |

| 20.12.2021 | 3 869.3450000000003 |

| 19.12.2021 | 3 960.145 |

| 18.12.2021 | 3 883.925 |

| 17.12.2021 | 3 848.1800000000003 |

| 16.12.2021 | 4 033.585 |

| 15.12.2021 | 3 873.3 |

| 14.12.2021 | 3 785.215 |

| 13.12.2021 | 3 908.795 |

| 12.12.2021 | 4 084.83 |

| 11.12.2021 | 3 967.42 |

| 10.12.2021 | 4 059.81 |

| 09.12.2021 | 4 283.6 |

| 08.12.2021 | 4 342.584999999999 |

| 07.12.2021 | 4 346.08 |

| 06.12.2021 | 4 149.85 |

| 05.12.2021 | 4 147.5 |

| 04.12.2021 | 3 965.26 |

| 03.12.2021 | 4 374.3 |

| 02.12.2021 | 4 536.16 |

| 01.12.2021 | 4 654.8 |

| 30.11.2021 | 4 554.27 |

| 29.11.2021 | 4 372.555 |

| 28.11.2021 | 4 134.245 |

| 27.11.2021 | 4 109.405 |

| 26.11.2021 | 4 239.07 |

| 25.11.2021 | 4 401.985000000001 |

| 24.11.2021 | 4 271.355 |

| 23.11.2021 | 4 226.295 |

| 22.11.2021 | 4 171.805 |

| 21.11.2021 | 4 338.13 |

| 20.11.2021 | 4 323.33 |

| 19.11.2021 | 4 144.875 |

| 18.11.2021 | 4 153.425 |

| 17.11.2021 | 4 185.79 |

| 16.11.2021 | 4 341.9400000000005 |

| 15.11.2021 | 4 656.085 |

| 14.11.2021 | 4 605.9400000000005 |

| 13.11.2021 | 4 646.530000000001 |

| 12.11.2021 | 4 659.09 |

| 11.11.2021 | 4 680.32 |

| 10.11.2021 | 4 677.075 |

| 09.11.2021 | 4 775.5599999999995 |

| 08.11.2021 | 4 720.29 |

| 07.11.2021 | 4 572.860000000001 |

| 06.11.2021 | 4 431.455 |

| 05.11.2021 | 4 510.03 |

| 04.11.2021 | 4 515.995 |

| 03.11.2021 | 4 563.375 |

| 02.11.2021 | 4 445.610000000001 |

| 01.11.2021 | 4 268.505 |

| 31.10.2021 | 4 283.129999999999 |

| 30.10.2021 | 4 337.555 |

| 29.10.2021 | 4 364.174999999999 |

| 28.10.2021 | 4 095.745 |

| 27.10.2021 | 4 115.31 |

| 26.10.2021 | 4 194.795 |

| 25.10.2021 | 4 152.625 |

| 24.10.2021 | 4 074.535 |

| 23.10.2021 | 4 054.8 |

| 22.10.2021 | 4 030.285 |

| 21.10.2021 | 4 194.225 |

| 20.10.2021 | 3 999.345 |

| 19.10.2021 | 3 811.0699999999997 |

| 18.10.2021 | 3 785.895 |

| 17.10.2021 | 3 784.715 |

| 16.10.2021 | 3 886.2349999999997 |

| 15.10.2021 | 3 818.6549999999997 |

| 14.10.2021 | 3 707.865 |

| 13.10.2021 | 3 513.34 |

| 12.10.2021 | 3 476.55 |

| 11.10.2021 | 3 498.545 |

| 10.10.2021 | 3 507.325 |

| 09.10.2021 | 3 586.57 |

| 08.10.2021 | 3 602.725 |

| 07.10.2021 | 3 563.13 |

| 06.10.2021 | 3 485.92 |

| 05.10.2021 | 3 456.34 |

| 04.10.2021 | 3 359.58 |

| 03.10.2021 | 3 416.6949999999997 |

| 02.10.2021 | 3 364.805 |

| 01.10.2021 | 3 151.66 |

| 30.09.2021 | 2 943.53 |

| 29.09.2021 | 2 866.88 |

| 28.09.2021 | 2 880.835 |

| 27.09.2021 | 3 045.935 |

| 26.09.2021 | 2 929.565 |

| 25.09.2021 | 2 887.17 |

| 24.09.2021 | 2 953.0 |

| 23.09.2021 | 3 107.2749999999996 |

| 22.09.2021 | 2 914.51 |

| 21.09.2021 | 2 890.635 |

| 20.09.2021 | 3 135.45 |

| 19.09.2021 | 3 369.21 |

| 18.09.2021 | 3 456.115 |

| 17.09.2021 | 3 474.0299999999997 |

| 16.09.2021 | 3 579.195 |

| 15.09.2021 | 3 489.7799999999997 |

| 14.09.2021 | 3 354.8450000000003 |

| 13.09.2021 | 3 275.17 |

| 12.09.2021 | 3 351.91 |

| 11.09.2021 | 3 274.575 |

| 10.09.2021 | 3 331.495 |

| 09.09.2021 | 3 481.705 |

| 08.09.2021 | 3 389.4 |

| 07.09.2021 | 3 559.01 |

| 06.09.2021 | 3 922.34 |

| 05.09.2021 | 3 909.2799999999997 |

| 04.09.2021 | 3 902.465 |

| 03.09.2021 | 3 869.495 |

| 02.09.2021 | 3 780.8050000000003 |

| 01.09.2021 | 3 613.42 |

| 31.08.2021 | 3 335.41 |

| 30.08.2021 | 3 247.675 |

| 29.08.2021 | 3 221.0299999999997 |

| 28.08.2021 | 3 250.435 |

| 27.08.2021 | 3 170.1400000000003 |

| 26.08.2021 | 3 155.45 |

| 25.08.2021 | 3 164.535 |

| 24.08.2021 | 3 255.375 |

| 23.08.2021 | 3 306.6400000000003 |

| 22.08.2021 | 3 202.265 |

| 21.08.2021 | 3 259.73 |

| 20.08.2021 | 3 240.295 |

| 19.08.2021 | 3 075.635 |

| 18.08.2021 | 3 039.38 |

| 17.08.2021 | 3 143.25 |

| Data is provided for the dates on which the auction took place. Therefore, there is no data for weekends and holidays. | |

| The table is too large to display on the screen. | |

| Year | Price, USD |

| 2022 | 3 350.865 |

| 2021 | 2 586.945 |

| 2020 | 242.8475 |

| 2019 | 173.35500000000002 |

| 2018 | 454.725 |

| 2017 | 239.095 |

| 2016 | 10.895 |

| 2015 | 0.90075 |