Crypto trading is both a business and a gambling game at the same time. This is probably why it is very attractive, but a person with weak nerves and poor analytical skills is better off staying away from trading platforms, or at least using them only for exchanging cryptocurrency for fiat, and not trying to make money on exchange rate fluctuations.

Well, if you have already taken your first steps on the spot market and are planning to try your hand at futures in the near future, then read this review to the end. Today we will talk about the multi-asset mode on Binance Futures. I must say right away that this is a very useful feature. Probably every practicing trader at least once in his life felt like a gambler who bet on the wrong horse. It would seem that the coin you have chosen should, by all indications, show growth or, on the contrary, fall in price, but this does not happen.

It happens that the market suddenly turns in the opposite direction, or trading is too weak and the dynamics of exchange rate changes is very low. But another coin suddenly begins to rise in price and the trader begins to reproach himself for making the wrong choice, but nothing can be done. Yes, this usually happens, but not on BINANCE Futures. Here, thanks to the multi-asset mode, the trader can compensate for his losses. Now we will tell you about everything in more detail.

What is multi-asset mode

Multi-asset futures trading provides the ability to spread funds across multiple USD?-M futures contracts using leverage. Currently, on Binance Futures, traders can work with pairs on USDT-margin and BUSD-margin, which are available as part of this line of futures products.

Activating the multi-asset mode makes it possible to use the income received on one of the pairs to prevent a margin call on another, unprofitable position, but only if you work with cross margin. The system only records the dry PnL indicators in each of the markets, but does not take any action to close a position going into the minus as long as you are in a fairly high positive position on the second pair. But if you want to work with isolated margin, you will have to abandon the multi-asset mode.

When betting all your money on one pair, you can choose isolated margin or cross, but the multi-asset mode on Binance Futures is only available for cross-margin traders. We have briefly talked about the new option, now we will explain how to use it.

Where can I get the voucher code?

Many thematic public pages post voucher codes for 500 USDT, 1000 USDT and other denominations. To use it, you need to go to the rewards center and enter the voucher code in the appropriate field. If no one has used it before you, then you will receive coupon funds according to its type. Below are some Binance vouchers, check the codes and use them for your purposes.

| 10% discount on trading commissions | Voucher code: AHJUCEJW |

| 5% discount on spot trading | Voucher code: TNEARYXP |

Switch between single asset/multi-asset modes.

To use Binance Futures, we recommend downloading and installing the latest version of the Binance desktop trading app. Now we will not talk about how to create an account on Binance or how to transfer money from a spot wallet to a futures wallet; there are separate articles for this on our website. Now we will only show where the button for switching between asset modes is located.

- Open the Binance trading app.

- Go to the futures section. The switch button is on the left.

- Select the pair in the USD?-M .

- Open the Binance Futures options adjustment panel. To do this, click the mouse cursor on the icon on the right in the “ Settings ” section.

- Select " Asset Mode ". By default, trading is configured for one pair; you need to switch to “ Multi-asset mode ” by clicking the yellow circle next to the selected item and confirm your choice.

A notification “ asset mode has been successfully changed ” will appear, and after that you can start trading. If you were unable to switch the mode, then perhaps you still have unclosed positions with isolated margin or orders in grid trading. In this case, a corresponding notification will appear. Sometimes the mode does not switch due to excessive loads on the platform servers, and you just need to try again.

If a trader chooses a coin that is incompatible with this trading mode, the system will exchange it for another. We recommend that you carefully familiarize yourself with the operating principles of the automatic sharing margin exchange system and the futures trading guidelines.

Instructions for blocking the sender

If SMS messages with verification codes are sent to a person who is not a Binance client, he should block the sender in the most convenient way. You can add the recipient of the sending message to the “black list” using the tools built into Android and IOS OS, or install one of the special mobile applications on your smartphone:

- SMS Spam Blocker. Blocks text messages from unknown numbers using the advanced KeyMessages algorithm, which identifies spam by keywords, expressions, headers and other parameters. Allows you to create backups to your own Google Drives.

- Call Blocker – Blacklist. The application has its own community called Community Blacklist. Its users share contacts of spammers and scammers with each other. Using Call Blocker - Blacklist, you can create personal black lists to protect yourself from debt collectors and other intrusive callers.

- Call Blocker – Call blocker. Automatically identifies numbers belonging to spammers, scammers and companies engaged in aggressive telephone marketing. Allows you to block private and hidden numbers and create not only black, but also white lists.

- Black List (from Vlad Lee). Blocks phone calls from unknown numbers and SMS spam. Google Play Pass subscribers can access the app free of ads and paid content for 1 month.

You need to download and install blockers only from official game and application stores.

Your account's margin ratio in multi-asset mode

When working in this mode, you must control the margin ratio. If this indicator reaches 100%, the system will automatically close all positions for him. It’s easy to follow; the widget is located in the lower right corner, immediately below the order filling form. When working in multi-asset mode, a notification will appear to the right of the margin ratio.

The margin ratio when enabling the multi-asset option is calculated by dividing the maintenance margin by the total equity balance of the margin account. Maintenance margin is calculated by adding up the indicators for all positions. Assets are converted into US dollars at the current exchange rate.

Balance of your assets

To check how much money is in your futures account, open the appropriate branch of your wallet. The button is located on the right, in the upper corner between the order and notification icons.

The futures wallet balance on Binance Futures can be viewed by clicking the “ Assets ” button, which is located under the rate chart, next to the transaction history.

Verification for professionals

Since Binance is a universally recognized leader in the field of digital money, the service is used by many successful traders, including very wealthy ones. They transfer millions of dollars, hundreds of bitcoins, which is why they need the ability to quickly and seamlessly withdraw both fiat money and digital money.

Verification for professionals involves a personal conversation with a company representative. You will need to meet and provide documents. In this case, you will be able to deposit and withdraw at least a million dollars daily, trade crypto, futures, fiat, and so on.

Calculation of margin ratios

This indicator depends on the prevailing market rate of the USDTUSD and BUSDUSD exchange pairs.

For example, we have the following pairs of assets and the coefficient corresponding to each of them:

| Pair of assets | Asset index | Bid Buffer Index | Buffer index ask | Bid rate | Ask rate |

| USDTUSD | 0,99 | 0,01 | 0,005 | 0,9801 | 0,99495 |

| BUS/USD | 1 | 0 | 0 | 1 | 1 |

If a trader opens a position on two perpetual contracts BTCUSDT and ETHBUSD_210326 with a margin of 100x and 50x, then the maintenance margin ratio will be 0.8% and 1%. It doesn’t matter which mode is activated, isolated margin or cross, the account status and changes in calculations of various parameters will look like this:

There are no open positions:

| Exchange pair | BTCUSDT | ETHBUSD_210326 |

| Margin assets | USDT | BUSD |

| Wallet balance | 200 | 220 |

| Remainder | 200 | 220 |

| Maintenance Margin | 0,008 | 0,01 |

| Initial Margin | 0.01 (100x) | 0.02 (50x) |

| Unsold PnL indicator | 0 | 0 |

When starting the single asset mode, the available funds will be USDT=200 BUSD = 220.

In multi-asset mode, the overall balance will be slightly smaller. The calculation is as follows: 200/0.9801+220/1 =416.02

If there are no open positions, the initial cross margin and maintenance margin, and therefore the account margin ratio, are equal to zero.

The trader has opened positions, but there is no unrealized PnL yet:

| Exchange pair | BTCUSDT | ETHBUSD_210326 |

| Margin assets | USDT | BUSD |

| Wallet balance | 200 | 220 |

| Remainder | 200 | 220 |

| Maintenance Margin | 0,008 | 0,01 |

| Initial Margin | 0.01 (100x) | 0.02 (50x) |

| Positions | 0,5 | 20 |

| Opening price for a position with leverage | 20,000 USDT | 600 BUSD |

| Marking price | 20,000 USDT | 600 BUSD |

| Unsold PnL indicator | 0 | 0 |

Maintenance margin is calculated by dividing the number of each position by the entry price and the initial margin base rate, the ask rate. In this case, its indicator will be 199.596.

Initially, there is no outstanding P/L and the account balance will remain the same, and the margin ratio determined by dividing the maintenance margin by the total balance will be equal to 47.98% (199.596 / 416.02 = 0.47977 = 47.98%).

Positions are open and there is an unrealized PnL:

| Exchange pair | BTCUSDT | ETHBUSD_210326 |

| Margin assets | USDT | BUSD |

| Wallet balance | 200 | 220 |

| Remainder | 200-500 = -300 | 220+400 = 620 |

| Maintenance Margin | 0,008 | 0,01 |

| Initial Margin | 0.01 (100x) | 0.02 (50x) |

| Positions | 0,5 | 20 |

| Opening price for a position with leverage | 20,000 USDT | 600 BUSD |

| Marking price | 19,000 USDT | 620 BUSD |

| Unsold PnL indicator | 0,5/(19 000 — 20 000) = -500 | 20 /(620 — 600) = 400 |

The account's maintenance margin is 199.61. Due to unrealized PnL, the balance will be reduced to 321.515, and the margin ratio will increase to 62.08%. And the higher the unrealized PnL, the closer you will be to bankruptcy. All indicators are displayed by the system and you do not need to make calculations yourself; this information is presented for informational purposes only. Source link https://www.binance.com/ru/support/faq/29b45c485d664028b9ca1cdf90b24f6f.

How to top up a margin wallet

After activating margin trading, the user has two types of wallets at his disposal:

- The main one (spot) is the one that was used for all operations immediately after registration on the exchange.

- Marginal.

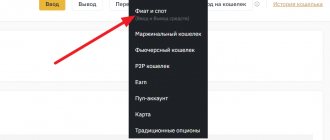

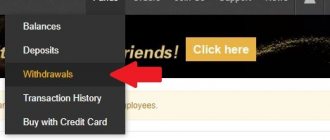

Funds can only be transferred to a margin account from a spot wallet. If there are no funds in the latter yet, you must first top it up with cryptocurrency (menu “Deposit and withdrawal of funds”).

If you already have coins in your main wallet, they can be used for leveraged trading. To do this, go to the “Margin Wallet” page.

Select the desired coin from the list. For example, let’s replenish the margin account with bitcoins. Click the "Transfer" button in the line with the BTC ticker.

Enter the amount you want to transfer from the spot wallet to the margin wallet. Click "Confirm Transfer".

Funds are instantly credited to your margin account.

Advantages and disadvantages

Trading futures in multi-asset mode seems very attractive at first glance. Margin requirements are reduced, because if one pair goes down, the second one can save the situation. However, if there is a sharp jump in the price of one of the pairs, the level of unrealized PnL may become too high and then your positions will still be liquidated. Trading in the multi-asset mode requires a thorough analysis of the state of affairs in the market; you cannot trade relying only on luck.

Reviews

I don’t deal with cryptocurrency, so it’s unclear why I constantly receive SMS from the Binance exchange with confirmation codes. I blocked senders several times, but messages are starting to arrive from other numbers.

Evgenia, Krasnadar

I'm already pretty fed up with constant SMS messages from wrong numbers. For two days in a row, I received messages from Binance on my phone. I had to go to the Play Market and install an application to block SMS messages.

Oleg, Yaroslavl