Net profit and entrepreneurial activity are considered inextricably linked concepts, because making a profit is one of the main goals of any business. Making a profit is necessary not only for the management and owners of the enterprise. Good net profit figures can attract new investors, influence the adoption of a positive decision on issuing loans to an enterprise, and also strengthen the company’s authority in a market economy.

With the correct calculation of net profit, it is possible to determine both the profitability of the enterprise and the strategy for its further development. Only its positive value indicates the successful growth and development of the enterprise, namely its effective operation and cost recovery. A negative value indicates a lack of net profit and unprofitability of the enterprise.

It is net profit that contributes to the development of the material base, investment in the expansion of production, modernization of technology and the development of advanced working methods. In this regard, sales volume expands, the company enters new markets and subsequently there is an increase in net profit.

What is profit

Profit is the difference between the revenue received and the costs of obtaining it (utilities, rent of premises, purchase of raw materials, etc.).

It can be calculated using the formula:

Profit = Income – Expenses

Types of profit

You can make a profit in various ways, for example:

- Marginal profit is a certain income of an enterprise that ensures its operation without losses. This does not include VAT and expenses for force majeure circumstances.

- Gross profit is calculated using the formula: cost of production minus income from its sale. This also includes tax contributions. Gross profit is a strong indicator for determining a company's break-even point.

- Operating profit : total profit minus all operating expenses, including expenses for depreciation of equipment and other expenses.

- Net profit is the money remaining after paying off loans, production costs, and paying taxes.

- Retained earnings are the money that remains after paying all current expenses (paying taxes, loans, paying dividends). This amount is kept in the company's accounts.

- Book profit is the total amount that is used to calculate taxes.

- Economic profit is net profit minus implicit costs (for example, unplanned expenses or lost income).

- Accounting profit is calculated using the formula: confirmed income of the company minus expenses. This concept is used when reconciling the balance sheet.

When calculating the balance sheet, the concept of “financial result” is also used, which represents total funds minus all operating expenses.

Other types of profit

Ultimately the profit could be:

- maximum or minimum permissible,

- planned,

- unprofitable or negative.

Profit can be obtained in different ways, for example, by investing funds on favorable terms or income from working with finances. Also, profit is a product of production and sales of products, the result of investments and investments in securities.

Depending on the frequency of receipt, profit is:

- excessive,

- seasonal,

- normalized

- marginal or additional.

There are several main types of profit that are used in calculations; we will consider them in more detail.

Methods of analysis

| Way | Description |

| Factorial | The main purpose of compiling this calculation is to determine the reasons for changes in profit. A decrease in net profit indicates a possible depreciation of money or changes within the company. All factors on which the amount of net profit depends are divided into two categories: external and internal. External factors include:

The category of internal factors includes:

When conducting factor analysis, it is necessary to take into account the cost of the product itself, the amount of associated costs, additional costs and the amount of revenue received from the sale of products |

| Statistical | This method of analysis is carried out in order to study the structure and amount of profit received by an enterprise over a certain period of time. In addition, using statistical analysis you can:

|

To determine the financial condition of the enterprise and assess its profitability and payback, a profitability analysis should be performed. At the same time, it is necessary to take into account that the profitability of an enterprise is not about calculating the amount of money, but about measures to obtain maximum profits with minimal costs. Using this analysis, you can determine how effectively all the resources of the enterprise are used: monetary, material, production, etc.

Why and how to calculate profit

Calculating profits is necessary in order to understand in which direction the business is developing. Some companies earn enough money, but they do not have enough funds to develop and scale their business.

Calculations help to understand the profitability of a company, but they must be calculated using different methods:

- Horizontal (time) analysis is a comparison of profits over different periods of time, for example the first quarter of 2020 with the first quarter of 2022. The numbers will help you understand whether the business is growing. This analysis helps to see the decline in revenue early and prevent further decline.

- Vertical (structural) analysis allows you to sort out all the revenue, where and how much it goes: loan fees, taxes, cost, indirect expenses and fixed expenses.

- Competitive analysis allows you to compare a company with its competitors. But everyone obtains information about competitors in their own way. For example, you can talk to business consultants who often have such information because they lead several clients in the same direction. Of course, they won’t reveal competitors’ data, but they will tell you what numbers you should strive for. You can also use Rosstat statistics, which annually report industry averages.

Calculating profits will help you understand where the company is losing and what it is earning. For example, if gross profit is normal, but marginal profit is falling, then indirect costs need to be reconsidered.

If the profit as a whole is not up to par, then you need to reconsider it completely, modernize it, or simply close it without waiting for bankruptcy.

Functions of profit received

The main function of profit is to reflect the company's economic activity in monetary terms.

There are other functions:

- The assessment can show the level at which the company is currently located; it gives an assessment of the work of the enterprise as a whole.

- The stimulating function pushes the company to increase its efficiency.

- Reproductive helps to understand the difference between the income and expenses of an enterprise.

- The control allows you to evaluate the criteria of the company's activities.

- The fiscal is responsible for transferring profits to the state budget.

Profit is an indicator of the level of quality, popularity and success of product sales. The profit received should go towards scaling, improving working conditions, and encouraging employees and business owners.

Remember

- Profit is the main component of any business. Without it, the meaning of entrepreneurship is lost, if you do not take into account the first steps of commercial activity. A negative result is possible at the very beginning of the project; in the future, it is an indicator of making incorrect management decisions and the inappropriateness of spending material resources and financial assets of the company.

- Every owner strives to achieve economic solvency and freedom to dispose of profits. But to do this, you first need to get it, and then learn to count.

- The calculation of business profitability indicators is based on revenue, that is, those incomes received from the sale or production of products, as well as associated costs. These expenses must be directly related to the activities of the company, be justified and documented.

- There can be a great variety of both income and expenses in a company. Based on these differences, gross, balance sheet, accounting, economic, operating, net and other types of profit are determined.

- Each of them can be used by the head of the enterprise, its owners and investors, and shareholders of the company. Inspectors and regulatory authorities, contractors and partners of the company can understand how effective the business is, how to build a strategy for further development, whether the dividends will be high, whether the reporting is transparent and whether it is worth maintaining partnerships with this company.

- Every entrepreneur is required to make income tax payments to the budget on time. This is usually 20%, but reduced rates apply.

- The formation of profitability is influenced by various factors, both internal and external. Instability of the political or economic situation, high inflation, the introduction of legislative initiatives that limit or support business development, competition, technological innovations - this is not a complete list of factors affecting the company’s activities. By correctly using changes and fluctuations in the internal and external environment, the owner or manager of a business can achieve maximum profit.

Video for dessert: 15 Most Unlucky Athletes

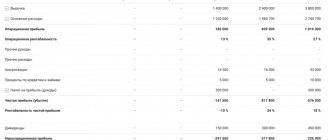

Profit before and after taxes

Based on the above, we can conclude that profit is the main indicator of a company’s success. This is the difference between a company's income and expenses. A company's revenue or income is never zero or negative, but profit is. In this case, the company operates at a loss.

All revenue, except for production costs, is reflected by the “Gross Profit” indicator. Revenue after taxes is “Net Profit”. If the net profit is zero or negative, then something needs to be done with the company.

Ways to enlarge

Net profit is an important economic indicator that clearly demonstrates the level of profitability of an enterprise. An increase in profits during the reporting period indicates high demand for products in the market. Many large companies work with special agencies that develop various strategies aimed at increasing income. But small manufacturing enterprises do not have the required amount of financial resources that could be used to cooperate with such agencies. Based on this, the relevance of the question of ways to increase profits increases.

First, it is necessary to conduct an internal analysis of the production process, after which the work of the marketing department is assessed. Then you need to develop a strategy that will help reduce production costs and increase the volume of products sold. Carrying out such preventive measures is practiced by all entrepreneurs. However, many owners of private organizations do not pay attention to invisible factors that influence the amount of income.

You can increase the profitability of an enterprise by reducing staff and lowering employee wages. In addition, it is necessary to optimize inventory and increase margins. By improving the quality of goods and reducing production costs, the production capacity of the enterprise can be increased, and this, in turn, will have a positive impact on profit margins.

To increase the amount of profit received, it is necessary to increase labor productivity and introduce new technological processes. Also, in addition to all of the above, the management of the enterprise must take measures to develop new markets and expand the distribution network.

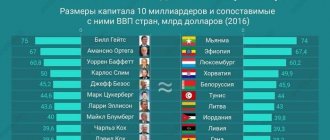

Interesting facts about profit

In Japan they know how to count profits. Therefore, if an employee finds an opportunity to switch to remote work and work from home, the employer increases his salary. He allocates this amount from the profit that appears as a result of savings on office rent and workplace equipment.

Buying a ready-made business is more profitable than starting from scratch. Does it seem more expensive? In fact, you are paying for the experience and mistakes of the former owner. They are difficult to calculate economically, but they are obvious. Otherwise, you will have to “get things done on your own” and pay for it with your time, health and, of course, profit.

Finally, we present one interesting calculation. If you put 1 gram of gold in a bank at 4% per annum (the interest must be in gold) and constantly reinvest the profit for two thousand years, you will get a piece of gold larger than the size of our planet.

FAQ

They say that profitable businesses are not sold, is this true? Is it worth buying if it is a truly profitable business?

Not this way. They can also sell a profitable business when they want to invest in something new or simply leave the market. Unprofitable businesses are also being sold. Moreover, a profitable business can go bankrupt in a few months, while an unprofitable one can be pulled out in a few months if you have the knowledge and experience. When buying a business, you should not be guided by this, but only by calculations. If you cannot calculate all the details yourself, then it is better to hire a business consultant.

Do I want to buy non-residential real estate on credit? Is it profitable?

Non-residential premises are a liquid asset that can be rented out at a profit. Before you take out a loan, you need to calculate the amount of overpayments, taking into account interest. If you can sell this property at a higher price and make a profit, then go for it. The loan can be repaid through rental payments.

Is it possible to buy dollars to make a profit?

You can invest in dollars, but it is better to buy them not through an exchanger, but through an exchange. The commission there is much lower. You should not buy dollars with all your money; it is better to keep part of your savings in rubles and part in dollars. Dollar savings can be deposited in a bank account at interest to get even more profit.

What is the profitability?

Profitability can be calculated for anything - we simply take the profit and divide it by the cost of any resource. For example, to evaluate a company, such indicators are usually considered.

- Return on Assets —finds out how well a company uses real estate, machinery, equipment, cash, and other assets.

- Profitability of fixed assets - consider the efficiency of use of resources that a business uses for production, but which are not consumed, but worn out. This includes premises and various machines, but not raw materials.

- Return on current assets is, on the contrary, the efficiency of using expended resources. For example, raw materials or money.

- Return on investment is how profitably the company uses the money raised. This indicator is needed to calculate the return on investment.

There are other types of profitability - for example, they consider the efficiency of the project, equity capital, and production.

Conclusion

- Income is all the finances that go to the accounts of the enterprise. It is customary to distinguish between the main income and the accompanying (non-operating) income, for example, from renting out real estate.

- Revenue is the part of the income that the company received from its main activities. It is customary to distinguish between gross and net revenue (after taxes). Revenue can be less than or equal to income.

- Profit is the company's income minus all expenses. This criterion is an indicator of the company's success. It can be positive, zero or negative.

- Calculating profits is necessary in order to know how the business is developing and what its prospects are.

Results

The methodology for calculating operating profit is not complicated and, if there is reliable data on the organization's economic activities, should not cause any difficulties for interested parties.

At the same time, understanding this methodology is equally important for both the potential investor and the company’s management. The success of attracting the necessary investments (on the part of business), as well as the feasibility and profitability of investments (on the part of the investor), largely depends on the correct calculation of the indicator. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.