From the article you will learn:

Good afternoon, my good traders! Today I will delight you with a topic about the background market. In particular, we will talk about how to place a trailing stop in Kwik, also called a trailing stop. In general, you will have the opportunity to master such a difficult specialization as risk management and will be able to confidently issue this order.

The fact is that anyone who takes up Kwik after Metratrader is guaranteed to encounter difficulties associated with the peculiarities of working in this new terminal. There is nothing unusual about this, however, it will take some getting used to.

I would also like to note that trailing stops in Quik are also something unusual for us Forex traders. I was really surprised when I figured out how everything worked. At first nothing was clear. In general, I made a lot of mistakes. But then, when the logic of this order became available to me, I made several successful trades using stop orders, which include trailing stops, which are called take profits. Well? Have I already confused you? Then let's figure it out together!

How trades work in general on Quik

I will be glad to tell you that the deal you make in Quik to buy or sell will practically not differ in any way from the deals you make in MetaTrader, until you decide to open a second deal without closing the first.

When might such a need arise? The simplest example is when the market has been flat for a week, you clearly see levels that, although they change slightly, have been working out for several days now. You enter a sell trade 70% up from the lower border of the corridor.

On topic: Trailing stop in Quik

Download

After some time, you discover that the market goes against you exactly to the horizontal level, which has already been worked out today. You have an idea to average, in other words, increase the Martingale lot and open a trade in the direction of the previous one. So that by the time the market is at its level, you will already be in good profit. It's possible! You simply do this in Quick, but suddenly you discover that you no longer have a second trade, and only one is visible on the chart.

How did this happen!? And it's very simple! Similar to how Metatrader 5 works, Quik does not keep two trades in memory, it recalculates the new price taking into account the two trades and opens a new one at the zero level. I think this is neither good nor bad, it’s just Kwikovsky. It takes some getting used to. I can say one thing. It seemed to me that this method of calculating new transactions pushes the trader to thoughtless averaging, as a panacea for losses.

I draw your attention to the fact that no matter how well this method shows itself, sooner or later, on time or at the most inopportune moment, such a recoilless movement will come on which you will merge. No matter how experienced a trader you are, you need to be very careful with this trading system.

Trading terminals

Currently, with the development of personal computing systems and widespread Internet access, stock trading has become available to a wide range of investors. Access to trading is possible only through the mediation of a broker, who allows the investor to enter the exchange using a trading terminal. There is a wide selection of terminals on the market, but the most common and studied are QUIK and Metatrader.

High technologies have affected not only access to trading, but also the subject of trading itself: securities no longer have a paper format and exist exclusively in electronic form. Recently, mobile versions of trading terminals, available to users of smartphones and tablets, have also become widespread.

Investors use trading terminals for the following purposes:

- submitting applications;

- market analysis.

The huge volume of data processed in real time requires sufficient performance from the device and from the terminal itself. Transactions on the stock exchange are made every second, so normal operation of the program is only possible with stable Internet access.

In the trading terminal, a trader can build charts, turn on indicators, and customize the type of program for the convenience of technical analysis. A large group of investors works exclusively with data from the trading terminal window, making money on speculative trading. They use technical capabilities to make money on minimal market fluctuations. The speed of transactions does not allow this to be done manually.

The main purpose of the terminals is to provide traders with the opportunity to place orders on the exchange. It is with the help of terminals that brokers carry out their functions of intermediary between the investor and the exchange. The trading terminal allows you to place orders in real time with a set of specified conditions.

What I learned about take profit

I'm sorry that I'm starting from afar, I just think that once you start trading in Kwik, you will definitely encounter this kind of trade behavior, and I would like you to learn about it for the first time from me.

Topic: Quik or Metatrader which is better

So, my task was to find out how the trailing stop works in this new terminal. Imagine my surprise when I simply did not find such an order. I started scouring the Internet in search of an answer to the question of how to set a trailing stop. I ran into a couple or three unfortunate traders who, although they said that here you need to use take profit, nevertheless, the examples they gave were so clumsy that I only became even more confused.

Then I went to Quik Help. Guys! Of course, I understand that those who created the help for Kwik are smart guys! But not everyone is as smart as you. I got lost in the wording. No, this did not push me away, but only piqued my interest even more. Now I was already sure that take profit in Kwik works and both the order itself to limit profits and can be used as a trailing stop.

I continued my search and found on one of the sites an explanatory explanation with an illustration of how everything works here. As a result, I tested the take profit as an order to stop losses and now, I believe, there will be no need to doubt that the trailing stop will work. Now, when I explain how everything works, you will see for yourself.

Benefits of using TP and SL

Using the orders necessary for trading activities, traders have a number of significant advantages of using them:

- simplicity and convenience in concluding transactions;

- control of losses and profits;

- carrying out transactions in the absence of the trader;

- use of advisors or robots in trading.

I think, friends, that the topic of setting profit and stop is covered and you understand how to determine and how to calculate the level of your losses and income using the indicated opportunities.

Watch the video to reinforce the material.

In conclusion, I would like to add that in trading, as in life, those who succeed are those who have a large amount of knowledge, skills and practice. My publications will help increase your knowledge and deposit.

That's all for me, if you have interesting thoughts and questions, write in the comments and subscribe to my blog - in return you will receive new, interesting materials.

How take profit works

Here's a look at how that profit works. It has a certain number of settings. The first and most important setting is that you choose to buy or sell you open it.

Topic: Open interest on the stock exchange

Let me go into more detail here. The fact is that in MetaTrader, take profit and stop loss are components of the transaction. You cannot open a take profit separately from a transaction, but in a quick you can. Moreover, it will act as a pending order, and take profit with stop loss in quick are separate independent orders. That is, if you simply open a take profit, then it may well play the role of a pending order: sell stop, buy stop, sell limit or buy limit.

On topic: Rating of Moscow Exchange brokers. Stock exchange as it is

Now let's talk about how take profit is set, which is a moving stop if configured correctly.

Topic: Stock exchange demo account

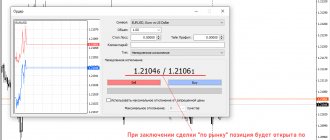

You can call it in different ways. From the order book, from the table of deals, orders or stop orders. After clicking the right mouse button, select the new stop order item. After this, if necessary, indicates the name of the company whose securities we will trade.

Watch video review about sliding foot

A window opens in which you can determine the type of stop order. We set take profit. Next, it is very important that if we have a buy transaction open, then we determine the take profit for sell and vice versa. That is, so that the reverse transaction is completed.

Topic: How to buy shares of a foreign company

The next step is to determine the order activation price. At this price, the order will become active, and then it will work according to the scenario we need. By the way, the lot must correspond to the lot of a previously opened transaction if you want the entire deal to be closed at take profit.

Topic: How to buy Eurobonds for an individual

So then take profit will monitor market rollbacks; if they are less than the “distance from max” value in price units or percentage, then the order will not be executed, and as soon as it exceeds it, the deal will be closed. The protective spread guarantees that the transaction will be closed during strong races. It's some kind of slippage, as far as I understand.

Topic: Open an account on the stock exchange

So, if you set the offset from max to 0.01 on Sberbank, for example, the price of which is now around 132.5 rubles per share, then with a protective spread of 0.01, the transaction in a calm market will close without problems and immediately after reaching the activation price. If we set a larger offset from max, then this order will look for the moment when the rollback will correspond to this setting and the order will turn into a trailing stop. So that's how it's presented.

Conditional order Stop Limit and Take Profit

This stop order includes two more orders. One is Take Profit, and the second is Stop Limit.

After one application is triggered, the second one must be deleted. That is, when Take Profit is triggered, the trader will be in profit. When the Stop-Limit order is triggered, then a loss is observed. There is no point in the second application if the first one has been activated. It will be removed automatically.

If one order is partially triggered, the number of lots in the second order is reduced by the number of triggered lots.

Robot AutoTralingStop

For those who want a more familiar trailing stop, I have prepared information about the AutoTralingStop robot.

Topic: Invest money in the stock market

It works only on the Forts derivatives market. Where we trade vanilla options, futures and forwards. It will already work like a trailing stop loss in Quik, which will close trades if the price deviates by a specified number of points against the forecast.

Topic: Where can I buy shares?

If the conditions that you define are met, the robot will close all open positions, as well as stop orders.

Please note that the robot does not draw any line on the graph; it simply monitors the situation and reacts as appropriate.

- Platform : Quik.

- Tools : All that are in the Forts market.

- Timeframe : Any.

- Trading hours : During business hours of the exchange.

- Accounts : Any.

- Minimum deposit for min. risk : Not defined, since the robot is auxiliary.

- Note : When performing its task, the Advisor will close all trades and stop orders for the instrument. Cannot work simultaneously with other robots.

To install the robot, you need to unpack it anywhere and run the file with the .exe extension, and then configure it. Tick, instrument (enter a code, for example RIZ6) and Stop-Loss in points.

On topic: Zerich. Customer Reviews

After which AutoTralingStop.luac is launched in Quik Services –> Lua scripts. If you have a checkbox on. in the exe file, the robot will immediately start looking for conditions for closing transactions on the instrument.

conclusions

As a result, even though at first it seemed to us that we would have to work in Quik without a trailing stop, we have several ways to set it up. As you can see, there is a built-in function and robotic capabilities.

All this makes Kwik more trader friendly. And what could be better than a good friend in the service when it comes to taking risks!

Previous

Russian stock market Screener for Russian stocks, MICEX, American, NYCE. An example of searching for liquid assets. NCAV parameter. Looking for underrated tools

Next

Russian stock marketNews stock screener Nice, formulas, tools in Russian, Hamaha and the maximum that has not yet been said