The modern economy is a complex structure in which investments have a special place. The latter, in turn, with the simplest classification, can be divided into risky and relatively risk-free. Risk investments are also called venture investments, and here venture funds play a separate important role.

This article explains in detail what a venture fund is, how it works, how it differs from a venture capital company, and which funds are included in the TOP 10 by investment size in 2022.

- What is a venture fund

- A venture fund and a venture company are not the same thing.

- Types of venture funds

- How does a venture fund work?

- How to create a venture fund

- How to raise money from a venture fund

- Best Venture Funds in 2021

Runa Capital

Founded by Russian entrepreneur Sergei Belousov in 2010. The foundation's headquarters are located in Palo Alto, California, USA. The fund manages $340 million. The average share of participation in startups is from 20 to 40%, the average contribution is $3 million.

In total, the fund invested in 35 startups, the most successful projects of the fund are the Rolsen household appliances brand, the Parallels cloud service platform, as well as the Internet services Nginx, Jelastic, LinguaLeo.

Homepage

Europe vs USA, a world without borders

Europe in 2022 became the leader in attracting financing, ahead of the United States and Asia. In the first half of 2021 alone, it added 72 new “unicorns” to the existing 296, and this growth will continue, according to Ruslan Sarkisyan and Alexey Menn, managing partners of the London-based Begin Capital fund. In their opinion, the European market is becoming more attractive to investors: the valuations of tech startups here are not yet as high as in the States.

More and more good startups are appearing not only in London or Berlin, but also, for example, in Prague and other cities, says Tropko from Digital Horizon. “Founders no longer need to go to a big city to create a cool project and attract investment. There are more and more successful remote-first companies whose teams have never met in person,” he explains.

A striking example of this trend is the service for holding remote events Hopin. Its founder, Johnny Bofarhat, cannot leave the house due to a rare type of allergy, while the startup’s valuation increased from $43 million in 2022 to $7.75 billion in 2022, Tropko gives an example.

Material on the topic

The speed of spread of new technologies around the world, despite restrictions due to the pandemic, has increased, according to Begin Capital. And before, a service that was successfully launched in the USA instantly appeared in China. Today, this trend has intensified even more: if an interesting business model appears in one part of the world, its analogues immediately appear in all other countries, the managing partners say.

“In 2022, we made an exit from Samokat (one of the pioneers of 15-minute delivery) and thought about repeating this experience in other countries. But the speed of the trend, rising valuations and competition turned out to be so fast that we decided not to enter the sector, despite several quite attractive opportunities,” explained Sarkissian and Menn.

ru-Net Ventures

Founded by Leonid Boguslavsky in 2000. The company's headquarters is located in Moscow. The average share of participation in startups is 30-40%.

The fund's investment focus covers almost the entire IT segment of the global market. The company invests in startups at early stages of development, with high potential and leading positions. The most successful projects are DeliveryHero.ru, Made.com, Tradeshift. The fund participated in the financing of Yandex and Ozon. In total, the company's portfolio includes 20 projects.

https://rtp-global.com/

What is a venture fund and why is it needed?

A venture fund is an investment company that directly finances the activities of organizations at various stages of business development. From English venture is translated as “risky undertaking”.

Hurry up to take advantage of the doubling of the tax deduction until December 31, 2022.

Thanks to such financial institutions, companies can raise funds for high-risk projects when other types of financing are limited or often unavailable.

The structure of such investment firms is the consolidation of funds from the list of fund participants and their distribution among promising business projects through the formation of special portfolios.

Mangrove

The Luxembourg venture company, created by David Waroquer, with a capital of about 750 million dollars, is actively working in the Russian market. The share of participation in startups is 20%-35%, the fund is ready to invest in projects starting from $1 million.

The fund invests in various innovative projects; in total, the company's portfolio includes 70 startups. In Russia, the venture capital company has invested in such well-known projects as the hotel booking service Oktogo, online stores KupiVIP and HomeMe.ru, and the computer game developer Drimmi.

www.mangrove-vc.com

Development of venture funds in Russia

The venture capital investment market in Russia developed with large participation of the state. More than 25% of organizations from the list of private equity representatives operating in the local market operate with the participation of state capital.

In Russia, historically, most venture capital comes from foreign participants. This dependence gives rise to a rather ragged development of the direct investment market in the Russian Federation: restrictions imposed by Western countries have a negative impact on the local market.

Some of the largest foreign funds are leaving Russia or reducing their investment activity.

However, there is another trend. The list of local venture companies is increasingly being supplemented by structures of large Russian corporations. State corporations VTB, KamAZ, Sberbank, Russian Railways, Russian Helicopters and others have become active participants in this market. Among the list of private companies, the joint-stock financial holding Sistema is in the lead.

How is the situation today?

If we talk about the general list of funds operating in Russia, the numbers are as follows:

- There are 189 organizations involved in direct investment.

- In 2022, investments were made in 185 fairly large startups, and 20 companies that had previously received funding exited with good profits.

- Venture capital in Russia currently amounts to almost $4.2 billion.

Russian ventures

The fund was created in 2008 by Evgeny Gordeev. The investor uses an unconventional approach to investing: they select projects, adapt them to domestic realities, find a team and create a company in which they already invest money. In addition, the fund is developing another direction: it invests in a startup at the stage of prototype and idea development, buying a share of 15%-20% with a contribution from $35,000 to $500,000. The fund specializes in high-tech solutions in the Internet sphere. In total, the fund’s portfolio includes 25 startups, the most successful projects are the iBrand banner network, the Ogorod community of large sites, and the Pluso social network integration service.

https://www.rusve.com/

How to attract investment

If you are an entrepreneur with innovative ideas, you may be wondering how to attract the attention of venture capital funds to your business.

Here's what you need to do:

- Analyze the market for venture capital companies and select suitable funds . Which of them work with enterprises in your area and provide investments in the amount you need. Always give preference to professionals with a long history in the market, and you will not have to doubt their reliability.

- Present your project . The presentation should not go into technical details and details. Your task is to describe as clearly as possible the benefits that an investor can receive. The key components here are the team, the idea and the confidence to achieve the goal.

- Talk to investors in person . Be prepared to answer provocative questions, do not lose confidence in your idea and do not hesitate. It is on the basis of a personal meeting with the project manager that the fund’s decision will be made.

- Provide a statement of expenses and income for the next three years . Don't forget to note how the expenses will help you make the most profit in the future.

- Make a deal . At this stage, the help of lawyers will not hurt. Agreeing on all clauses of the contract may take several months. A limited partnership agreement is drawn up.

Cool deals: from TikTok to Russian dark stores

The largest megaround in the global market, Orlovsky points out with reference to Pitchbook data, was the deal between the Chinese ByteDance, the creators of TikTok: in February 2022, the social network raised a round of $5 billion. The top five other megarounds (more than $1 billion), according to Pitchbook, also included mostly Asian startups: Indian online retailer Flipkart, Chinese online food delivery platform Xingsheng Selected, Swedish electric vehicle battery maker Northvolt and Indonesian postal service J&T Express.

Among Russian companies, the most impressive deal - if it is confirmed, should be a new round of Miro, Medvedev believes. In early December, the Financial Times, citing its sources, reported that this company, founded by immigrants from Perm, could soon raise $17 billion. Otherwise, according to Medvedev, the main deal will still be the Trading View round ($298 million). “This is a deal that proves that the main thing in venture is patience,” the investor explained.

Material on the topic

Large rounds in the global market this year were also raised by the Russian founders of the system solutions developer Acronis ($250 million), the taxi service Indriver ($150 million) and the Borzo company ($35 million), says Phystech Ventures principal Anna Grishko. In Russia, Borzo operates under the Dostavista brand, which is a one-day courier delivery service.

Overall, the most attractive companies in 2022, according to investors surveyed by Forbes, were startups in the fields of fintech, blockchain, biotech, EdTech, and fast food delivery. Trust in fintech services has become unprecedented during the pandemic, Begin Capital notes. According to the fund’s managing partners, many fintech companies seem to be greatly overvalued, but it is impossible not to note the trend towards trust in new services.

“Perhaps the generation that crossed themselves before every transaction with a reliable Swiss bank, just in case, has been replaced by those who are comfortable sending $10 million through a new crypto exchange in 1 click, but the level of trust and growth of new Fintech services is amazing,” says Menn.

Advertising on Forbes

Blockchain technologies will experience another takeoff in 2022, says Tropko from Digital Horizon. Among the transactions on the Russian venture market, in his opinion, one can note the purchase by MTS of the blockchain platform for financing Factorin suppliers, estimated at 1.7 billion rubles. This was the largest DeFi deal (DeFi is financial instruments in the form of services and applications created on the blockchain. - Forbes

) in Russia, he pointed out.

2021 was also the year of expansion of Russian food technology around the world, almost all investors surveyed by Forbes indicated. Several teams attracted significant funding at once: Buyk, Jiffy, FridgeNoMore, Getfaster, explained Begin Capital.

The most interesting exits: how not to burn investors' money

The past year was rich in exits and megarounds. The largest exit of a technology company in the world, according to Tropko, was the purchase of the Australian fintech startup Afterpay by payment provider Square for $29 billion (the startup's capitalization reached $32 billion). Afterpay previously became the largest BNPL provider in the US. Such companies, operating on the “buy now, pay later” (BNPL) principle, have become especially popular during the pandemic.

One of the most interesting exits was also the takeover of the email newsletter service Mailchimp by Intuit, notes Polekhin. According to him, firstly, Intuit is a fintech company that previously only acquired fintech startups. Secondly, Mailchimp is a self-funded company that has grown to a valuation of $12 billion. Thirdly, on the way to acquisition, it itself bought six different startups.

“This is an excellent case for entrepreneurs around the world, how you can grow exponentially without burning investors’ money, and get into the top 10 exits in a year,” says Polekhin.

Material on the topic

Besides Mailchimp, one of the most impressive exits on the global market, according to Orlovsky from Fort Ross, belongs to Tesla's competitor, the American manufacturer of electric cars Rivain. “Rivain is, to some extent, a terrifying exit when a company without revenue is valued at its peak at $12 billion,” Orlovsky noted.

In its IPO filing in October, Rivain reported a loss of $1 billion.

The two best exits for Russian companies are the purchase of the social network for traders TradingView (exit for Itech Capital) and Ecwid, says Maxim Medvedev, managing partner of the AddVenture fund. TradingView raised $278 million in October of this year; the social network was valued at $3 billion. Since the start of the pandemic, the number of platform visitors has more than doubled: by 237%.

In the Russian tech market, the most significant ones can also be called the entry to the stock exchange of the gaming studio Nexters and the manufacturer of electric vehicles Arrival, Begin Capital indicated. Both transactions, according to the fund’s managing partners, “went through a merger with a SPAC and opened a new path to liquidity for the Russian market.”

Advertising on Forbes

Definition, classification and basic operating principles

Venture funds are those investment funds whose activities are aimed at working with various innovative projects and newly created enterprises that, according to preliminary estimates, have quite a large potential in terms of future profits.

Investments are made in the purchase of shares of enterprises (either directly or through the purchase of shares). The calculation takes into account the fact that about 80-90% of all enterprises supported in this way will ultimately fail, but the remaining 10-20% should more than recoup all investments.

The state is interested in the activities of venture funds, and therefore provides them with all possible support. In particular, at the legislative level they are given permission to make much more risky investments (than, for example, ordinary mutual funds) without particularly bothering with the issue of diversification. In addition to purchasing shares of companies, they are also allowed to engage in lending activities (including through the purchase of promissory notes of companies that have become the object of their attention).

As a result of the activities of venture funds, theoretically, all parties involved remain satisfied. Project developers receive the funds they need, investors receive their profits, and the state receives modern innovative developments.

But there are also some restrictions. For example, venture funds are legally prohibited from investing in enterprises engaged in banking, insurance or investment activities.

Often closed-type mutual investment funds (closed-end mutual funds) act as venture capital funds. The threshold for joining this kind of fund is very high and consists of numbers with five or six zeros. Such a high bar greatly helps to weed out ordinary amateur investors, leaving only professionals who know how to take risks and assess their risks.

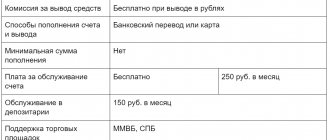

All funds of this kind can be classified according to such basic characteristics as sources of financing, direction of investment activity (within the country or abroad) and the size of capital investments (see classification in the picture below).

Basic operating principles of venture funds:

- Participants in such a fund can be both individuals and organizations (pension funds, banks, etc.);

- Investments can be made either directly by depositing a certain amount of money or through a commitment**;

- The fund invests money in the shares of enterprises included in its portfolio (as a rule, their number fluctuates between 10-15), then actively participates in their development (including through the voting rights that the acquired share gives it), and after several years (usually no more than 10 years) sells its share;

- The main criterion when choosing an investment object is its potential ability to generate a profit comparable to the entire capital of the venture fund. Only thanks to this can the huge risks of venture investments be justified.

** A commitment in this case is an oral or written obligation to contribute a certain amount of money at the moment when it is needed as part of the development of an enterprise that has become the object of attention of a venture fund.

Where can an investor look for projects for venture investments?

A good businessman always works with several startups because he understands that venture capital investment is a risk. According to statistics, out of 10 companies only one achieves success.

That is why the expected profitability of a startup should exceed the amount of investment by at least 10 times. A businessman who is focused on making a successful investment does not wait to be found. He constantly monitors the market in search of profitable investment options.

Ways to find a successful project in Russia:

- By acquaintance. Probably everyone around them has someone looking for money to develop their business. The average resident of Russia will ignore the information, but a true businessman will become interested, carefully study the project and decide to invest.

- On the Seliger forum, one of the shifts is called “Entrepreneurship”. Investors often come here in search of interesting startups with an entry threshold of up to $50,000.

- Project Exchange. In Russia there are platforms where young scientists post quite interesting projects.

- Share exchanges. These are platforms that regulate relations between startups and venture investors. A businessman acquires a stake in a company through the stock exchange.

The main thing that an investor in Russia should remember is that you need to constantly keep your finger on the pulse and monitor the market. It is unknown when a proposal will appear that can turn the world upside down, as Apple did in its time.