An investment project is the first and most sure step towards the implementation of any idea with the attraction of additional funds from investors. The need to compile it is absolutely justified. A visual diagram with clear calculations allows you to assess the relevance and approximate final product at an early stage.

It can be created both for large-scale events (for example, as part of the state innovation policy) and for opening a small business. Regardless of the scope of application, any investment plan includes:

- justification of the feasibility of carrying out (goal, objectives, relevance, expected result);

- terms and stages of implementation;

- workload;

- cost at each stage, explanation of all costs;

- list of persons and organizations responsible for the implementation of the idea (their powers, functions);

- project documentation (the list is determined by Federal Law No. 39 of February 25, 199).

Simply put, this is a kind of business plan with the most approximate description of the sequence of practical actions.

Concept and types of investment projects

Topic 6. Investment project

6.1. Concept and types of investment projects

6.2. Life cycle of an investment project

Concept and types of investment projects

The concept of an investment project is interpreted in two ways:

1) as an activity (event) involving the implementation of a set of actions to ensure the achievement of certain goals. Close in meaning in this case are the concepts “economic event”, “work (set of work)”, “project”;

2) as a system that includes a certain set of organizational, legal, settlement and financial documents necessary for carrying out any actions or describing these actions. In this case we are talking specifically about an investment project.

The Federal Law “On investment activities in the Russian Federation, carried out in the form of capital investments” gives the following definition of an investment project: “An investment project is a justification for the economic feasibility, volume and timing of capital investments, including the necessary design estimates developed in accordance with with the legislation of the Russian Federation and duly approved standards (norms and rules), as well as a description of practical actions for making investments (business plan).”

Investment projects have various forms and contents. Investment decisions may relate, for example, to the acquisition of real estate, investment in equipment, scientific research, development, development of a new deposit, construction of a large production facility or enterprise. There are various classifications of investment projects. Depending on the characteristics underlying the classification, the following types of investment projects can be distinguished.

In relation to each other:

independent,

allowing simultaneous and separate implementation, and the characteristics of their implementation do not affect each other;

alternative

(mutually exclusive), i.e. not allowing simultaneous implementation. In practice, such projects often perform the same function. Of the set of alternative projects, only one can be implemented;

complementary,

the implementation of which can only occur jointly.

By implementation time

(creation and operation):

short-term

(up to 3 years);

medium term

(3-5 years);

long-term

(over 5 years).

By scale

(most often the scale of the project is determined by the size of the investment):

small projects,

whose action is limited to one small company implementing the project. Basically, they represent plans to expand production and increase the range of products. They are distinguished by relatively short implementation periods. Small investment projects are not large in scale, limited in investment volume and allow for a number of simplifications in design and implementation procedures;

medium projects—

These are most often projects for reconstruction and technical re-equipment of existing production facilities. They are implemented in stages, for individual productions, in strict accordance with pre-developed schedules for the receipt of all types of resources;

major projects

- projects of large enterprises, which are based on a progressive “new idea” of producing products necessary to meet demand in the domestic and foreign markets;

megaprojects

are targeted investment programs containing many interrelated final projects. Such programs can be international, state and regional. An example of industry megaprojects can be projects implemented in sectors of the fuel and energy complex (development of new oil and gas bearing areas, construction of trunk pipeline systems).

By main focus:

commercial projects,

whose main goal is to make a profit;

social projects,

focused, for example, on solving unemployment problems in the region, reducing the crime rate, etc.;

environmental projects,

the basis of which is the improvement of the living environment;

Depending on the degree of influence

results of the implementation of an investment project on internal or external markets for financial, material products and services, labor, as well as on the environmental and social situation:

global projects,

the implementation of which significantly affects the economic, social or environmental situation on Earth;

large-scale projects,

the implementation of which significantly affects the economic, social or environmental situation in a particular country;

national economic projects,

the implementation of which significantly affects the economic, social or environmental situation in the country, and their assessment can be limited to taking into account only this impact;

regional, city (industry) projects,

the implementation of which significantly affects the economic, social or environmental situation in a certain region, city (industry);

local projects,

the implementation of which does not have a significant impact on the economic, social or environmental situation in certain regions and (or) cities, or on the level and structure of prices in commodity markets.

A feature of the investment process is that it is associated with uncertainty, the degree of which can vary significantly. Depending on the magnitude of the risk

investment projects are divided into:

reliable projects,

characterized by a high probability of obtaining guaranteed results (for example, projects carried out under government orders);

risky projects,

which are characterized by a high degree of uncertainty of both costs and results (for example, projects related to the creation of new industries and technologies).

Risky projects, in turn, can be grouped according to the degree of risk as follows (see Table 6.1):

Table 6.1. Relationship between investment type and risk level

Contents and parameters

Although the investment project undergoes constant changes during its life cycle, its structure remains unchanged. The parameters involve determining time, cost, scale and a logical sequence of steps.

These stages have different depths of elaboration and the use of their own set of tools, but, in any case, design requires drawing up a scenario already at the start in order to define goals and objectives, name the expected results, and estimate the amount of necessary resources. In general, the design structure consists of the following components:

- Summary . It is a summary of the investment and project plan.

- Characteristics of the initiator . It is given to the investor and concerns his financial condition, position in the market or industry, and features of the management system. In addition, the main characteristics of the project participants on the part of the investor (initiator) are described.

- The main essence and ideological component, or description . Here the distinctive features of the idea, its advantages over similar ideas, principles and mechanisms for implementing ideas are determined.

- Manufacturing market analysis . At the same time, it is determined what share of this market the manufacturer will be able to occupy after the implementation of the project.

- Market analysis . The market for materials and raw materials, the market for labor and other resources is also fully assessed to determine the extent to which stable sales of products and stable access to the resource base are possible.

- Implementation plan . This is a listing of the stages of the process and organizational measures for their implementation.

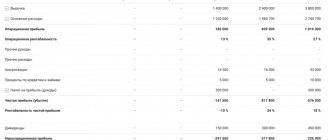

- Financial plan . It outlines how much money will be spent and how much will be received as an investment return in case of successful implementation, as well as within what time frame.

- Risk assessment . The degree of risks accompanying the process and the risk assessment based on the results of the project are calculated. At the same time, the optimistic and pessimistic pictures are considered enlarged.

The most capacious of the listed components (as well as their elements) should be considered in more detail.

Formal requirements for the plan

In one sense, an investment project plan (or business plan) is a strictly structured document justifying the attractiveness and viability of the project. To do this, planning provides an objective idea of the potential for production development, quantitative and qualitative performance indicators, identifying risk zones, ways to promote the product, etc.

At the same time, the plan should be concise, outlining the most essential aspects of each item, but accessible for study and complete enough to objectively inform all interested parties. For investment projects, an important component of the plan is its persuasiveness, and from this follows conciseness (that is, not overloaded with technical details), clarity in setting the goal and describing the steps to its implementation, and requirements for the language of presentation. In particular, you should not resort to professional slang in your business plan, which investors may simply not understand.

In order to interest investors, it is preferable to use visual tables, graphs, and pictograms.

The “Summary” part is considered as a mini-presentation that can be discussed separately to understand the essence and benefits, indicating the difference between what is on the market now and what will happen after the proposal is implemented. This difference is discussed in more detail in the market analysis section.

Description

The description of the investment project reveals its essence, which should demonstrate the difference between this proposal and similar ones. The difference can be demonstrated based on higher profitability, more efficient use of funds, higher consumer demand for the product, etc. In general, any idea should make one project stand out from the rest. But even in the case of proposing an innovative, non-trivial idea that is difficult to compare due to the lack of direct market competition, the description should still reveal the goals and advantages of the project, the prerequisites for its successful implementation and the potential volume of the product or service produced.

Efficiency mark

An economic assessment is carried out for each stage of the project. Estimates are of a forecast nature at the first stages (pre-investment and investment) and of a calculated nature in fact - at subsequent stages (operational, liquidation).

Since forecasts cannot have 100% certainty, they are made with assumptions that affect accuracy (including when assessing risks).

For investors, an indicator of the accuracy of forecasts is the transition of cash flows from the area of costs to the area of profit.

In this case, the degree of accuracy of forecasts increases, and with it the degree of investor confidence in the estimates increases.

In this regard, statistical and dynamic estimates are distinguished.

- Estimates based on statistics (statistical payback period, return on investment ratio) are simple and effective for preliminary forecasts, but do not take into account the dynamics of changes in the price of money over time.

- In dynamic assessments, these changes are taken into account by all indicators:

- NPV – net present value,

- PI – investment profitability index,

- IRR – internal rate of return and MIRR – modified internal rate of return,

- DPP – discounted payback period.

The choice of assessment type depends on the stage of the process.

What are investment projects? What is an investment project?

In this article I want to cover the topic of investment projects. At the end of reading, you will know what an investment project is, their main types, how to recognize efficiency and make an assessment, and I will also tell you a little about the risks that you may encounter while achieving your goals.

I have already written about what investments are Now it's time to dive into this topic a little deeper.

Very often, many people confuse the concepts of an investment project with a business plan. However, from what was written above it is clear that IP is a more global definition and includes a business plan in its composition, so to speak. In other words, a business plan is a part of an investment project, and a very important one, without which an individual entrepreneur is almost unthinkable.

The need to draw up an investment project is due to attracting investors . No one will ever want to invest their money in an unknown place . Every investor is only interested in numbers: how much money is needed, what profit will be at the end, how long it will take to pay off. It is also very important for investors to understand all the risks that may arise during the course of their work. The actual goal of an investment project is, with the help of numbers and preliminary calculations, to convince the investor that this proposal will be beneficial to him .

I would also like to mention the strategy of the investment project and its life cycle. In fact, these are two fundamental components of every individual entrepreneur. A strategy describes the intended results and processes that are carried out to achieve the goals. By the way, the strategy can, even needs to be, reviewed and updated throughout the implementation of the plan.

This will significantly reduce emerging risks that were not previously foreseen. Also, each investment project has its own life cycle, in other words, this is the period from the beginning to the end of its existence. In turn, each period is divided into phases, allowing the IP to be divided into smaller subgroups for effective management of the process as a whole.

Types of investment projects (classification)

Investment projects, like investments, can be divided into a large number of types . This is actually why you can see different classifications on every information resource, there’s nothing wrong with that, they’re all correct. After all, the investor considers each of them through the prism of his own criteria, which is where we get such a variety of types.

Depending on the timing of implementation, the types of investment projects are:

- short-term (up to 3 years);

- medium-term (3-5 years);

- long-term (more than 5 years).

Based on the scale or volume of invested funds, individual entrepreneurs are distinguished:

- small (up to $10,000), aimed at minor changes, for example, increasing the range of products offered;

- medium (from $10,000 to $500,000), usually funds are allocated for the reconstruction of an existing production;

- large (from $500,000 to $10,000,000), in this case the funds are aimed at modernizing large enterprises/factories;

- megaprojects (over $10,000,000), which include, for example, the grandiose construction of any industrial facilities of an international or national scale.

Based on the level of profitability, the following types can be distinguished:

- low-income - profitability is below the level of real inflation, or borders on it;

- average income - here the profit received usually varies above the inflation rate;

- highly profitable - a variety of which are HYIP projects . This type is the most risky, as it offers the highest profits, often in a relatively short period of time.

According to the type of focus, IPs are:

- social - intended to improve social objects, for example, education and medicine;

- economic - aimed at improving the economic performance of the system;

- organizational - the goal of this type is to improve the production management apparatus (stimulating personnel, improving product quality);

- scientific and technical - actual investments aimed at developing the scientific and technical base, research, etc.;

- environmental - designed to develop various methods and methods for preserving the environment;

- production - aimed at creating a product, for example, selection of plants and animals.

I repeat, the classification of investment projects is not strictly defined and there is no right or wrong option. I have presented to your attention exactly those species that I consider the most important, popular and simply necessary. You can make your own personal classification :-).

Required Documentation

To implement an investment project, the following documents are required:

- Project presentation. It is necessary in order to familiarize a potential investor with the project and interest him.

- Presentation of the project in brief form. It is needed to quickly familiarize investors with the project if time is limited.

- Summary for the investor. Contains information about the main participants in the project.

- Extended presentation for investors, revealing information about the project. It includes a financial forecast and proposals for investors.

- Financial model, including detailed calculations of all financial indicators.

- Project roadmap.

- Cost estimate. A document containing information about the current cost of a project. It is necessary to determine the investor’s share according to the volume of invested funds.

- The KPI system is a kind of investment scenario agreed upon in advance. Shows the effectiveness of each participant in the transaction.

- Media plan. Contains information about marketing expenses.

- Management model. A document that specifies the roles of participants in an investment project.

- Exit strategy. The document determines the best option for doing business.

Efficiency of the investment project

Speaking about an investment project, I think it is important to mention its effectiveness. From an economic point of view, efficiency refers to the ability to obtain the best results while spending a minimum of resources.

There are two types of efficiency:

- effectiveness in general - an assessment is made to demonstrate the attractiveness of the plan, in order to find participants and sources of funding;

- effectiveness of participation - includes the degree of interest of all participants and the possibility of implementing the investment project.

One way or another, the effectiveness of individual entrepreneurs is individual for each investor. So, for example, two investors may have different goals for the same project. Hence, there will be varying degrees of correspondence; what will be beneficial for one investor will be completely inappropriate and ineffective for another.

The analysis, as well as the resulting performance indicators, will help the investor answer the most important question for him: “What will I get, in what amount and when?” Typically, the procedure is carried out at a very early stage of familiarization with the project.

Participants

The composition of participants and their number depends on the goals of the project, the funds and resources attracted, as well as the citizens and legal entities involved in the process. Roles and tasks vary. The parties to the project can be classified depending on the form of their participation in it:

- Core team members are the most interested representatives. These include specialists and persons responsible for the development and creation of the project.

- Members of the extended team are persons who do not take part in the implementation of the investment project, but who help the members of the main team in solving the problems facing them.

- Stakeholders – these include citizens and organizations that are able to influence the project team.

This characteristic is generalized. If you look at the classic classification in the textbook, then the participants in the investment project are the following personalities.

- The initiator is the person whose idea was taken as the basis for the investment project, carrying out the development and creation process. Often this is the customer himself.

- Customer is a citizen or representative of an organization who is interested in implementing an investment project at the expense of his own funds or attracted funds from investors.

- Investor is an individual or legal entity that provided funds for the implementation of the project.

- The project manager is the person who directly develops and creates the project, a person who is personally responsible for its result and the work of the entire team.

- The project team is several specialists subordinate to the manager, who have their own responsibilities and solve the problems of the investment project for its successful implementation.

- Contractor - this is the organization with which an agreement has been concluded to perform work or provide services, that is, directly the person who performs the tasks assigned to him as a contractor.

- Subcontractor is an organization that can be engaged by a contractor to perform certain works or services.

- The project sponsor is an official who supervises the investment project for the customer and exercises control over the activities of the manager.

- Licensors are specially authorized organizations and institutions that ensure the issuance of licenses.

- Suppliers are organizations that facilitate the supply of necessary materials, equipment, products and other means necessary to solve problems.

- Consumers of final products are the persons who will ultimately purchase the products.

- Product manufacturers are the parties involved in the production and release of final products for sale.

Evaluation of investment projects

When it comes to evaluating investment projects, it is better to entrust this matter to professionals: highly qualified experts and economic analysts. After all, this is the most important part of the IP, which, by the way, is produced at the first stage of the life cycle. So, having the assessment results in hand, the investor makes a decision on investment.

There are certain methods with which you can evaluate absolutely any project:

- financial assessment - will help us determine the solvency of the individual entrepreneur;

- economic assessment - shows at what rate possible profits will increase.

Implementation stages

The life cycle of any business idea goes through four main stages. Each of them requires a clear distinction when analyzing investment projects.

Pre-investment

Of the total volume, it occupies a small part - no more than 1.5% of the invested funds. However, it requires maximum responsibility, since it is determined by the validity of the further proposal. The initiator must independently verify the possible success of the plan.

For this purpose, investment projects using various assessment methods confirm the feasibility of financing. The current market is examined, technical and economic calculations are made, and documentation is prepared.

Investment

After analysis and registration of investment projects, the second stage begins - contacting investors. It takes up about 70-90% of the total amount invested.

Initially, the total volume, order and priority of investments are determined. Next, the funds received are distributed among fixed assets.

Operational

At the operation stage, credits are made to working capital and employee wages. In general, it returns the investors' investments. When taking into account depreciation expenses, the payment period may be delayed for an indefinite period. Therefore, it is recommended to take a more careful approach to performance indicators.

Risks of investment projects

There were, are and will always be risks. It is impossible to completely get rid of them, but it is quite possible to notice and minimize them in time.

The main thing to remember is that during the implementation of any business plan, the risks of investment projects are more than possible. They consist, first of all, in not achieving the set goal, which entails financial losses.

To minimize them, you need to select the “right” assets with a high probability of success and understand this area as a whole. And this requires certain knowledge and experience, because there are pitfalls here too. You want to earn money, not lose money, right? Therefore, immediately prepare yourself that not everything is as simple as it seems at first glance, be prepared for possible financial losses. Well, or you can familiarize yourself with my investment portfolio, where I select decent, highly profitable individual entrepreneurs with passive income, and in the event of a force majeure situation, you will be insured .

What are the risks

The risk of an investment project implies the emergence of uncertainty in the results of its implementation. These include dissatisfaction with the results, more often than not receiving the expected income from the business. Risks may be:

- acceptable - not higher than the profit amount for one operation;

- critical - no more than the amount of gross income from one operation;

- catastrophic - loss of a large part of equity capital.

Methods for assessing risks arising during the implementation of investment projects can be divided into qualitative (for example, determining the conditions for the occurrence of risks) and quantitative (for example, reducing the amount of profit). To make the right decisions, you need to use both. We talked in more detail about their classification and evaluation in this article.

Conclusion

I hope I was able to explain the topic at least a little for you: what an investment project is. I tried to cover the most interesting and main issues related to this topic.

If you are interested in the topic of individual entrepreneurs, as an investor, then always prioritize its assessment, pay attention to financial performance indicators and remember the risks.

And if you want to act as a creator, you want to find sources of funding, take care not only of the maximum possibility of implementing the idea, but also of an effective, attractive presentation. A well-prepared and high-quality presentation will help attract more investors to your project. Good luck!

Average rating / 5. Vote count:

No votes yet! Be the first to rate this post!

Investment project

Investment project - justification of the economic feasibility, volume and timing of capital investments, including the necessary project documentation developed in accordance with the legislation of the Russian Federation, as well as a description of practical actions for making investments (business plan).

The same normative act voices another key concept.

A priority investment project is a project, the total volume of capital investments in which meets the requirements of the legislation of the Russian Federation, included in the list approved by the Government of the Russian Federation.

If simplicity is in words, then

An investment project is a process of investing money that contributes to the implementation of a specific investment idea. Any investment project must be carefully thought out, economically verified, justified and expedient, which is why it always implies the presence of a well-drafted business plan.

The payback period of an investment project is the period from the date of commencement of financing of the investment project until the day when the difference between the accumulated amount of net profit with depreciation charges and the volume of investment costs becomes positive;

A project is some kind of innovative idea, presented in the form of a package of documents. The project specifies the conditions, terms, cost and characteristics of implementation.

Practical implementation

The implementation of the investment project begins after it has been approved. A list of activities and a plan of tasks are drawn up, the implementation of which is necessary for the profitable, from an economic point of view, functioning of the project:

- Determination of the organizational and legal form;

- Determining the form of interaction with bodies and departments, interaction with which is necessary during the implementation of the project;

- Determination of persons responsible for the implementation of the project;

- Identifying the logistics needed for the project.

Project classification

- Solve economic problems of micro- and macro-scale

- Monitor social issues

- Eliminate environmental problems

- Expand the volume of production, sales of products, increase the range and volume of services.

This also includes the gradation of projects by purpose: scientific and technical projects, financial, socially oriented, production and environmental.

Classification of projects by scale

Scale implies the influence of the project on the environment, the level of market coverage, and the involvement of people in the project. Projects can be large, mega-large, medium and small.

Hundreds of billions of rubles are invested in megaprojects: such projects include the construction of large buildings and structures on a national scale, the construction of bridges, factories, and so on. Large projects are the modernization, reconstruction or construction of production facilities and factories that are of industrial importance for regions or cities. Up to a billion rubles are spent on such projects.

Both mega-large and major projects are divided according to the level of influence into regional, sectoral, local, and national economic ones.

Medium and small projects are valued at much more modest amounts and are implemented by private investors and companies.

Classification of projects by implementation time

- Long-term - terms vary from 15 years or more.

- Medium term - 5–15 years.

- Short-term - up to 5 years.

Project characteristics

When creating a project, it is important to work out all the basic parameters that can be used specifically in the future.

- It is important to evaluate the essence and composition of the project, its main idea, and draw up a summary of the project

- Characterize investors, investment volumes, plans and timing

- Assess risks

- Draw up a business plan and use mathematical models to evaluate the return on investment of the project

- Make forecasts of alternative ways of financing and minimizing risks

- Analyze the sales market and target audience that will benefit from the results of the project

- Draw up a detailed implementation plan and estimates for all types of expenses.

Investor characteristics describe their behavior in the market, level of influence, and financial situation. The content of the summary or plan shows everything about the project in a nutshell. The project plan does not include technical details. A resume is necessary for PR campaigns, demonstrating the project to interested parties and institutions (departments).

Documentation

As we have already found out, not a single project is complete without a business plan. This document is the basis and for the most part the beginning of his life.

The business plan of an investment project is a very important document, because it is on its basis that potential investors will decide whether your project is interesting to them or whether it is not even worth getting acquainted with it. It is the basis and beginning of the life of the project.

An equally important document for investors is the summary of the investment project. This is a document that briefly describes the essence and all the advantages of a business idea. It can influence the attraction of funds from public, private and other types of investors.

However, the correct and verified preparation of these documents does not provide a one hundred percent guarantee that the investor will want to invest funds. This will depend on a successful presentation.

Project structure

The plan of the proposed investment project includes five main elements, which are designed to explain in as much detail as possible its feasibility and attractiveness.

Summary

The summary in the investment project passport mainly serves as a PR function. The essence of a business idea, correctly described in a brief form, reflecting its advantages, can get more positive responses from potential investors.

This section is a document with a summary of all aspects and performance indicators of the investment project. It starts with a general description of the organization (individual) and the idea, and ends with estimated values and a presentation from top management.

Detailed description of the project

The description section provides detailed information that reflects:

- goals, objectives and entrepreneurial vision (mission);

- period of existence;

- persons responsible for implementation, their powers;

- Expected Result;

- list of stakeholders;

- differentiation of stages (from the kick-off meeting to the closing).

Financial model

The financial model of the project being implemented reflects all material aspects. This paragraph justifies the amount of funds raised. Expenses to support the activities of participants may be included:

- project office (salary);

- business trips;

- rental of premises.

An integral part of the financial model is also an estimate that justifies the costs of supplying and producing raw materials, launching production facilities, constructing facilities, etc.

Justification is made in terms of volume, cost, timing, and the main benefits of realizing the invested funds.

Calculation and assessment of economic efficiency

Of course, economic calculations and efficiency analysis are the basis for taking into account the proposed idea. As part of this aspect, information is provided on the payback period and the validity of investments. It is also important to reflect as fully as possible possible risks and ways to minimize them in order to instill confidence in actions.

When presenting investment projects, any assessment methods can be used.

Conclusion and conclusions

After passing the state examination, all received data is included in the passport of the current investment project. Business ideas using this form will be evaluated and selected on a competitive basis by potential investors.

What is an investment project

Investment projects are sites that require investments in order to further pay dividends, and in Russia they are becoming more popular every year. They are available in different types, differing in operating time, investment amounts, payback periods, and risks. What they all have in common is that they bring passive income to their investors.

This is often what is called a detailed plan for using investments, and the practical implementation of investing: receiving payments or a final material goal.

Examples of investment projects

The ranking of the most profitable online investments for 2022 includes mainly schemes related to the financial (in particular, cryptocurrency) and media (information) markets.

One of the current examples of an investment project is Cryptonode. It started just a year ago (November 2022), but is already considered a fairly promising platform. Low entry threshold - only $10, daily income ranges from 0.5 to 1.5%.

On the Russian market, among the successful programs is Ferrero Russia. In 2022, the confectionery factory launched an investment project to expand production (export). It is planned to invest more than 1.4 billion rubles for implementation. By 2022, production capacity is expected to increase to more than 50 thousand tons of confectionery products.

Types of investment projects

Every investor should have at least a minimal understanding of the classification of investment projects in order to invest money in 2018 or next year. Let me remind you that to minimize risks, it is better to choose several projects with different directions at once: this will allow you to receive money consistently and calculate income as a percentage. It’s worth understanding the classifications in detail before determining where and how to store money, and the best recipes are already on the blog.

Short term

Experts clarify that the maximum period of work is 12 months, while the project can work for less, the main thing is that it pays money profitably and stably. On average, such a site operates for 3–6 months. Among the popular representatives, I will highlight:

- trading on exchanges, including cryptocurrency ones;

- cooperation with HYIPs, and what HYIPs are, I talked about in the collected tips in my material;

- short-term deposits;

- typical financial pyramids.

Medium term

On average, this work lasts 1-2 years. If we talk about the hype direction, then these are investment projects on the Internet, the duration of which is about a month or two, although accruals can be made every day. Medium-term ones include bank deposits, business investments, and work with mutual funds.

Long-term

These are investment projects that bring profit 5-7 years after investment, and for Moscow this is a typical option for working with real estate. Some experts argue that the maximum payback period should not exceed 2 years.

Stages of project activities based on investment

The stages of an investment project are 3 main stages with different financial burdens on each of them and one more stage, which in a number of sources is considered as an integral part of the operational one:

- The pre-investment stage consists of a list of works included in the scenario from verification of the initial concept to the development of working documentation.

- The investment stage - the implementation of a list of works with investors - consists of determining the volume of financing, the order and sequence of depositing funds, selecting suppliers and delivery conditions, drawing up staffing and qualification qualifications, concluding contracts for the supply of raw materials, components, and energy resources.

- At the operational stage, the volume of investment in wages and working capital is regulated. Possible additional investments are also taken into account here in case the project does not make a profit at first. Non-profit operation may last for a certain period, but at the end of the overall period of the operational stage, all the goals pursued by the project authors and for which they are responsible to investors must be achieved.

- After the project has exhausted itself, the liquidation stage begins. The exhaustion of a project means a drop in profit or a predominance of expenses over income. This stage also occurs if it is necessary to attract new investments to reconstruct or modernize the process. The information component of the liquidation stage involves the analysis of methodological errors at all stages so that the participants in the process do not repeat them in future practice.

When implementing an investment project, its stages require different percentages of allocated funds:

- The pre-investment stage requires about 0.7-1.5% of the total investment.

- Investment (main cost) stage – 70-90% of the total investment.

- Operational – about 10%.

There is an exchange of investment projects, which in Russia is represented by a specialized information portal with project proposals for domestic and foreign investors.

Types of investments in projects

Strategically know what kinds of investments there are in investment projects by amounts. These are small, medium, large. Small investments do not always bring small returns, and too large investments provide huge returns. In my material about investment companies, published on iqmonitor.ru, I clarified and continue to insist that you can only invest what you can lose, and it is categorically unacceptable to work with your last savings, and especially those that are borrowed.

- in expanding own and non-own production;

- to create a new production;

- aimed at government authorities.

- straight;

- indirect.

- low-;

- medium-;

- highly profitable.

- low-;

- medium-;

- highly liquid;

- illiquid.

- primary;

- reinvestment;

- disinvestment.

- internal;

- external.

- private;

- government;

- mixed;

- foreign;

- joint.

Investment project assessment

I believe that it is necessary to take a comprehensive approach to the assessment of investment projects, be it an innovation from Sberbank or a hype with deposits at a high interest rate and a short period of work. There are several methods of effective analysis that are available to experienced and novice investors. Among the important points that I take into account when choosing a site:

- work deadlines;

- financial terms of investments;

- risks;

- expected return.

Let us consider in detail each individual method with a successful algorithm.

Conditional selection method

In this case, it is convenient to compare the main points of work in several projects: from the timing of the market to the personality of the administrator. It is important to highlight the key positions that are important in this particular area of investment. Sometimes, if the projects are the same and short, you can conditionally identify and predict work based on the reputation of former projects.

Change Analysis Method

The method works on the basis of vertical and horizontal views: quantitative and qualitative. Suitable for use when projects have been on the market for a long time and intermediate results of their work can be summed up. For example, you decide to choose investment projects available in the Moscow region for 2022. In this case, take into account and compare:

- direction;

- owner;

- reputation;

- working conditions;

- duration of activity;

- number of clients;

- amounts and frequency of dividends paid.

Merge method

The principle is simple: assessing your share against the background of the entire capital of the project. For example, you know how much the 2-room apartment you bought at the construction stage costs, and what the budget of the entire residential complex is. This is convenient when you use an open database of investment projects, in which one of the indicators is the share of participants, the general owner (if there is one) and the average size of investments.

Overlay method

This method is good when you need to select a project that is a child of an existing one. For example, investment funds offer their own conditions: the tariffs of the general company are imposed on the subsidiary and a comparison occurs. If the indicators are catastrophically different, we need to think about it. The method also works when the manager’s success from one project is transferred to another, or vice versa, disappointment, as in the case of cashbury.

Comparison method

The easiest way to choose a project: from a pair or more, we highlight the key conditions and compare: which is more profitable, more stable, less risky, evaluate the possibilities, how realistic the project will be to pay, how much you need to invest right away. It is also important to make decisions based on work deadlines and user reviews.

Efficiency mark

An important indicator for any investment is the return on investment, profitability. In this regard, an important criterion for approval is the possibility of recoupment. This is a key factor for assessing the effectiveness of an investment project.

Performance indicators

The assessment of investment projects is calculated using special formulas and indicators. Such an analysis allows you to make a decision about the feasibility of investing funds.

Profitability Index (PI)

The profitability index is mainly used to monitor investment projects designed for a short-term period. It is determined by the ratio of current cash flow to initial investments. As a result, we receive income per unit of invested funds.

The higher the index, the more attractive the plan. The threshold value for selection is 1. If the indicator is lower, we can assume that there is no profitability.

Payback period (PP)

Indicates the period during which investment costs will be covered by the net profit received, including depreciation (deductions for the restoration of worn-out fixed assets). The payback period of an investment project is calculated based on the ratio of primary investments to annual inflow.

An investment project according to this efficiency indicator is considered acceptable if the calculated period does not exceed the maximum allowable.

Internal rate of return (IRR)

By comparing the annual cash flow, investment flow and the life of the program, an internal rate of return is formed. Determines at what discount rate the net current flows will equal the cost of the investment.

In general, it is specified what the maximum cost of capital is required to invest in the planned activities.

Project Net Present Value (NPV)

NPV is a key indicator for assessing the effectiveness of investment projects in cash receipts. Here, the basic investment conditions are taken into account: cash flow in relation to the discount rate and discount period, minus the initial investment.

A positive decision can be made if the calculated value is greater than 0. Otherwise, the contribution to the idea is considered inappropriate.

Weighted average (accounting) rate of return (ARR)

A modified rate of return that takes into account net profit (average per year), starting investments and residual value. The feasibility of investments based on weighted average profitability is carried out by comparison with the accounting profitability of other alternatives and the market rate, actual profitability.

Modified internal rate of return (MIRR)

The index is used when it is necessary to monitor the annual reinvestment of an investment scheme at the cost of capital rate. Allows you to estimate the amount of profitability on starting obligations.

Create your own investment project

If you have decided to form and launch your own project, you should start by defining what investments are and how to work with them, and information on these issues has already been collected in my article. In order for a project to be properly implemented and bring profit to its authors and investors, it is important to go through 4 main stages from choosing an idea to its final implementation, including an advertising campaign. The key feature is to clearly formulate an investment scenario by choosing an object for each potential client.

Investment idea

This may be related to the provision of services, the sale of goods or investments in intellectual objects. It’s interesting, but there are directions that are conquering the country as a whole:

Investment projects that allow you to try your financial strength in construction do not lose their popularity: invest money in a house at the construction stage, and then live in this apartment yourself or rent it out. This applies to commercial housing and real estate abroad.

Risk assessment

When forming a project concept, it is worth understanding: how much money is invested and when you can get their return. For clients who want to find a successful investment site and go to different sites, for example, beking biz, the number of working days, the number of partners, and statutory documents can be considered a good indicator of low risk. Also, for risk analysis, I recommend paying attention to:

- reviews on different sites;

- financial intuition.

Team Search

You can find suitable people in 2 ways:

- among your close circle: relatives, friends, partners in previous projects;

- by advertisement among strangers.

Someone from the team must take on the technical part, someone on marketing, someone on advertising and working with clients, someone from the very beginning to come up with a reliable script and legend, bringing the hype to the market.

Implementation of the idea

The process of receiving funds from investors and paying them indicates that the project is up and running. It is important to initially determine how much time is given for the implementation of each stage. It is extremely important to monitor your competitors and analyze how their project differs from yours for the better and for the worse. In implementing an established strategy, determine who you are working with: a client who is interested in the long term, or someone who wants to make money quickly. And popular methods for this are collected on my blog.