yearn.finance is a protocol that provides the opportunity to use decentralized financial services (DeFi) - lending, earning interest, trading. Immediately after its launch, the project caused a stir around itself - today over $730 million is blocked in the protocol and every day this amount is growing by an average of 10%. And the cost of the native YFI token exceeds the cost of Bitcoin.

The decentralized ecosystem aims to maximize profits from user investments.

It is connected to the DeFi protocols Aave, Compound, Dydx, which allows you to search for the best option for placing tokens at any given time. When a user deposits their cryptocurrency, it is converted into yTokens, such as yDAI or yUSDC. These are yield-optimized tokens that will be used to earn money. YFI is an ERC-20 token used to govern protocols within the Yearn Finance DeFi platform.

By interacting with protocols, you can earn income in YFI. The editors of Profinvestment.com have prepared an overview of the project and its functional token. On August 10, 2020, the token was added to the Binance crypto exchange and is available for trading in YFI/BNB, YFI/BTC, YFI/BUSD, YFI/USDT pairs.

general information

[bsfp-cryptocurrency-table style=»style-2" scheme=»light» coins=»selected» coins-selected=»YFI» currency=»USD» title=»Characteristics of the Yearn.Finance (YFI) cryptocurrency» show_title=» 1" icon="" heading_color="" heading_style="default" bs-show-desktop="1" bs-show-tablet="1" bs-show-phone="1"]

| Name | yearn.finance |

| Ticker | YFI |

| Token type | ERC-20 |

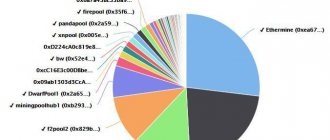

| Blockchain | Ethereum |

| Total emissions | 30,000 YFI |

| Current issue (as of 08/21/2020) | 29,962 YFI |

| Rate (as of 08/21/2020) | 14 564 $ |

| Market capitalization (as of 08/21/2020) | 407 719 514 $ |

| Official site | https://yearn.finance/ |

| https://twitter.com/iearnfinance | |

| Documentation | https://docs.yearn.finance/ |

| Source | https://github.com/iearn-finance |

| Crypto exchanges | Binance, Uniswap, Balancer, BiKi |

Cryptocurrency cost

Recently, the value of cryptocurrency has been gradually falling. But compared to the analogue token TrueFi, YFI's development is progressing well. Even taking into account the current decline. Currently, the price per token ranges from $27,200 to $31,420. And in rubles, the exchange rate at the end of September 2022 is about 2,000,000.

Price statistics

Forecast for 2022

Today traders are actively investing in the project. Moreover, in the summer of 2022, the rate of the Nash cryptocurrency successfully overtook Bitcoin. As of September 24, 2022, the market capitalization is about 76,572 million, and the trading volume is close to 10 billion rubles. Although forecasts note that the record growth in the chart will be followed by a fall in price with a period of long-term consolidation.

yearn.finance ecosystem

yearn.finance is a protocol system that runs on the Ethereum blockchain and helps users interact with several well-known DeFi protocols. In this way, participants can maximize interest income from invested cryptocurrencies. The ecosystem's core protocol automatically moves user funds between lending pools (Dydx, Aave, Compound).

There are other protocols in the system:

- ytrade.finance . Trading stablecoins with leverage up to 1000x.

- yliquidate.finance . Use Aave flash loans to quickly liquidate your investments.

- yswap.exchange . An exchange service through which you can deposit funds into various protocols and move them from one to another.

- iborrow.finance . The ability to tokenize your loan using Aave and apply it for use in additional DeFi protocols.

Not all services are now fully operational; some operate only in test mode. Another protocol has been announced to launch in the next few weeks: yinsure.finance .

This is an insurance service where users will be able to insure their assets (initially only USDC) by paying a small percentage. Liquidity providers will act as insurers. Interaction with any of the protocols is carried out by connecting an Ethereum wallet, for example, Metamask.

How yearn.finance works

The main yearn.finance protocol, after which the entire system is named, moves funds between Compound, Aave and DyDx depending on which pool is currently generating the highest annual income.

Currently, it supports stablecoins DAI, USDC, USDT, TUSD, sUSD and cryptocurrencies BAT, ETH, LINK, KNC, MKR, REP, SNX, ZRX, WBTC. This list may change over time.

The tokens that the user sends to the protocol are converted into an equal number of yTokens (for example, USDC and yUSDC). yearn.finance takes the initial funds and distributes them to the pools with the highest returns. A portion of these funds is deposited into the yield.finance pool, which is available only to YFI token holders.

Origin of the project

Yearn.finance was launched in February 2022. At the time of launch it was called iEarn. The author of the project did not keep a single network token for himself, but received part of the emission while working with the project as an ordinary user.

Creator of YFI

The Yearn.finance project was created by one person named Andre Cronje. He is called a “robber programmer” for his non-serious attitude towards the field of cryptocurrencies. He believes that cryptocurrencies are too volatile to invest in, but he has always been passionate about the field of decentralized finance. Cronje was attracted by the profits that DeFi projects pay out to their investors. He started investing his and his friends' money in decentralized finance.

Over time, Cronje decided to create a program to automatically monitor interest rates in decentralized applications. Later, this idea formed the basis of Yearn.finance.

Why do you need the YFI token?

It is an ERC-20 token created to give users the right to participate in the governance of the protocol. YFI can be earned by interacting with the ecosystem, and it is also traded on several exchanges, including Binance and the decentralized Uniswap.

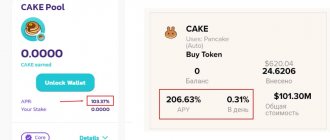

The maximum supply is 30,000 YFI, there was no pre-mining or ICO. To continue to further stimulate users, yearn.finance has released a new token - YFII - with an emission of 40,000. Its rate is currently $837. This is a fork of YFI. The entire supply is planned to be distributed within 10 weeks.

The previously mentioned yTokens can be sent to Curve Finance, which allows you to trade stablecoins at decent exchange rates. Working with this tool helps liquidity and the user is rewarded with income in yCRV tokens. But initially the tokens are “locked” in the Curve protocol. The YFI token allows users to use their accumulated yCRV.

There are three ways to earn YFI and YFII, which are described in detail by the creator on Medium:

- Depositing yCRV into the yearn.finance pool.

- Depositing DAI and YFI into balance sheet liquidity In exchange, BAL tokens are provided, which are then exchanged for YFI through the yGov governance pool.

- Deposit YFI and yCRV in Balancer in exchange for BPT tokens. BPT is then also transferred to yGov and contributes to the accumulation of YFI.

All this seems complicated, but you can look at it from another angle - Proof-of-Stake. This is a bit like regular staking, but instead of staking cryptocurrency and receiving rewards for a block of confirmed transactions, the participant stakes Curve Finance and Balancer tokens and receives management rights to yearn.finance.

Technical analysis of defi YFI

yearn finance's decentralized ecosystem of aggregators uses services such as Aave, Compound, Dydx and Fulcrum to streamline token lending. When you deposit your crypto assets with yearn finance, they are converted into yTokens, which are periodically rebalanced to select the most profitable lending services. The goal of the Yearn project is to identify promising DeFi services for mutually beneficial synergy. It turns out that by bringing several DeFi together, Andre Kponje and his team have created a completely new effective platform for decentralized finance.

One of the most famous yTokens integrators is Curve.fi . This is a platform that creates AMM (Automated Market Maker) between yDAI, yUSDC, yUSDT, yTUSD.

YFI is the platform's governance token. The asset is only distributed to users who provide liquidity using yToken. That is, you place bets and receive interest. The YFI project aimed to release the most decentralized digital asset, with no pre-mining, pre-sale or distribution to the team. Any changes are made through online proposals and voting. Every YFI token holder has voting rights.

Interesting news about the project

The success of Andre Kronje's project inspired other blockchain programmers to create clones. YFII) token appeared YFFI was launched . The developer of another copy of yEarn, Asuka Finance, was accused of exit scam. The original yEarn Finance coin ( YFI ) maintains growth amid the collapse of imitators.

By the way, Cronje himself did not receive a single cent for his leading role in developing the protocol. He was forced to borrow money to start the project and now has an outstanding loan of approximately $20,000.

After the statement of the popular crypto blogger Hasu that the head of YFI has sole access to $40,000,000 of user assets, the level of control over the wallet was immediately changed. Now the consent of at least six people is required to move funds.

After this, Andre Kponje said that he was tired, overwhelmed and on the verge of quitting. But he soon retracted his words and wrote on his Twitter: “Back in March, I decided to continue working, regardless of the circumstances. The blockchain space will not get rid of me until something else can be created here.”

Where to store YFI

Almost any wallet that supports ERC-20 tokens is suitable for storing the yearn.finance token, for example:

- Mobile – Coinomi

- Desktop – Exodus

- Hardware – Ledger

If you do not intend to trade YFI in the near future, we recommend choosing a cold storage wallet, this will protect your assets.

YFV(YFValue)

YFV is another fork of YFII. The project was announced in this post on August 17, 2022. YFV is the governance token of the YFValue protocol. The project is aimed at wider inclusion and aims to make funding for liquidity mining (yield farming) truly valuable and accessible to all users. Unique to YFValue is inflation supply voting and a referral system with automatic burning done entirely on-chain. YFV allowed small players to join DeFi Yield Farming.

YFV has a maximum supply of 15,750,000 tokens. YFValue has been successfully audited by Arcadia Group's cybersecurity experts, and is one of the first YFI clones to pass a third-party security audit.

YFV website: https://yfv.finance/

Where to trade and buy YFI

You can purchase yearn.finance (YFI) tokens on the Binance cryptocurrency exchange. How to do it:

- Log in to the exchange and make sure that your account is replenished with one of the following currencies: BNB, BTC, BUSD, USDT.

- Go to your spot wallet, use the search to find the desired token and click “Trade”.

- Select the market that interests you.

- Going to the trading terminal, create a buy or sell order. If you just need to sell at the market rate, then select the “Market” order type.

Purchased YFI tokens will immediately be credited to your account:

After which they can be used in further circulation or withdrawn to an external wallet, indicating the recipient's YFI address and quantity:

Features and capabilities

Within the ecosystem, several separate blocks of functions are implemented at once, among which the following stand out:

- The main block of functions of Yearn Finance provides the opportunity to receive passive income after investing your own funds in investment pools. Also includes a function for converting tokens into Yearn Finance coin (yTokens) for storing savings.

- Ytrade.finance is a decentralized exchange for buying and trading stablecoins.

- Yswap Echange service , aimed at instant exchange between all supported tokens.

- Iborrow Finance is a service that allows you to take out a loan in a stablecoin secured by Ethereum or another coin implemented using the ERC-20 standard. Yinsure Finance is a service for insuring assets for a small percentage of their value.

The ecosystem is launched and operates using smart contracts that exclude the human factor and any negative interference. Experts' forecasts confirm that after most of the features leave beta testing, the project can expect significant growth. Perhaps this will happen very soon, at the end of 2022.

Advantages and disadvantages

Pros:

- One of the most promising financial protocols and tokens today.

- A wide range of decentralized financial services.

- Management is completely given to users (token holders).

- Rapid development and increased liquidity.

Minuses

- Difficulty in mastering for beginners - the documentation provides only the most general information, the Russian language is not supported, in general, the ecosystem at the current stage is clearly intended for professionals and DeFi enthusiasts.

- There is no specific roadmap.

Project prospects

The yearn.finance network has been well received by the cryptocurrency community, with many liking the idea of an “aggregator” of financial protocols. Cronje hit the nail on the head when he said decentralized finance has become too complex and users need an accessible tool. The project also created a scheme for almost complete community management, which reflects the very principle of operation of cryptocurrencies and blockchain. At the same time, the high profitability of user cryptocurrency investments is maintained at a relatively low risk.

In the roadmap, the team promises only “releasing new products” and “working on better offers”

The project fulfills all its stated functions, truly making participation in decentralized finance simple. The team is constantly expanding its functionality; as of February 2022, the 3rd version of YFI is current.

Great article 2