Hello, dear readers!

Today we will talk about securities trading. Beginners in trading consider this type of trading a passive way to earn income. For them, everything looks simple: you buy shares of a steadily growing company and shovel money.

But not every such security makes a profit. In this article I will tell you how to determine their profitability, what the free float coefficient is and how to use it for smart investments.

What is it and what is it for?

Not only shares are traded on the stock market: bonds, bills, certificates, etc. are traded. Each of them has its own characteristics and trading strategies. Therefore, you should not take into account the differences between the bond market, for example, and any other segment.

Shares are increasingly popular among tools for making money on the stock market. But they are subject to constant price fluctuations, so you cannot work with them without basic knowledge of technical and fundamental analysis.

The liquidity of securities is affected by 2 factors:

- Demand.

- Volume available for purchase.

The second factor is characterized by the concept of free float. Literally translated from English, this term means “free floating.” Not all company shares are listed on the stock exchange. Part is owned by its founders, the state, large shareholders (holders of more than 5% of the total), under arrest or in pledge. These categories cannot be bought on the stock market.

The Free float indicator displays the share of shares in free float, i.e. They can be purchased by absolutely any stock market entity in any quantity.

The fact is that the more securities are publicly available, the more difficult it is for large market participants to influence their price. A large number of transactions in shares with a high free float will not significantly change their value. At that time, even single speculation in securities whose free float is small will lead to a sharp jump in price.

Free float is expressed as a percentage or as a coefficient, where 1 = 100%. The most attractive for investors is the free float rate ranging from 40 to 80%. Such securities are stable and not subject to sharp price fluctuations.

How to find out the free float of Russian stocks

The current free float value of companies listed on the Moscow Exchange at listing levels 1 and 2 is published on the exchange website at: moex.com/ru/listing/free-float.aspx. But shares that are in level 3 (the non-quoted part of the list of securities) are also traded on the stock exchange. To find out the approximate free float value of third-tier issuers, you should refer to the company’s quarterly reports. Typically, the necessary information is published in section 6.2. It contains data on the majority shareholders and participants of the joint-stock company owning at least 5% of ordinary shares or at least 5% of the authorized capital. The approximate share of securities in free float is obtained by subtracting from 100% the amount of shares of majority shareholders.

As an example, consider PJSC Zvezda. According to the report for the 3rd quarter of 2022 according to RAS, shares of more than 5% of ordinary shares are owned by:

| Shareholder | Percentage of ordinary shares |

| EuroInvest LLC | 19,55% |

| Dealing LLC | 21,94% |

| LLC Accent" | 25% |

| LLC "UDMZ" | 25% |

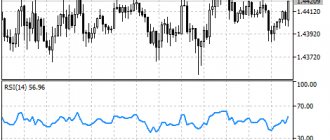

Thus, the share of free float shares certainly does not exceed 8.51%. Since this does not include units of less than 5% owned by the company's management, as well as funds and other professional market participants, the actual value may be much lower. It is logical to assume that the shares of PJSC Zvezda are subject to high volatility, are not liquid and are not of interest for long-term investment. The graph confirms this assumption: the annual amplitude of quotes is hundreds of percent, and, after the publication of the results of the first half of the year, the shares are actively growing, but then they lose 2/3 of the accumulated growth.

What does the coefficient depend on and what is affected by it?

It should be understood that the number of securities does not affect the free float. I'll give you this example: there is a company that issued 1000 shares worth $5 per share. Its market value is $5,000. The securities are distributed as follows: 30% is held by the founders, 15% by the state, 55% in free circulation. After some time, the company's value increased to $10,000, and one share now costs $10.

Let's say that no one can buy them at this price, and management decides to reduce the cost by 2 times, while increasing the quantity. Those. we get 20,000 shares at $5. But even with an increase in the number, their distribution remained the same: 30% from the founders, 15% from the state and 55% in free floating.

An increase in the number of securities while their value decreases is called a “split”.

A reverse split is a decrease in the number of securities, accompanied by an increase in their price. Both of these cases do not affect the change in the free flout coefficient. Therefore, to understand the floating of shares, distinguish between the concepts of their number and share - the first does not affect the second.

Thus, the free flout coefficient depends on the share of shares in free float and affects the degree of investor confidence in a particular company.

The meaning of the free float coefficient

Free float (literally “free floating”) is a part of a company’s shares owned by minority private shareholders, or, as they say, in free circulation. This value is expressed in percentages or hundredths. Currently, according to the rules of the Moscow Exchange, all shares are classified as free float, except for packages owned by:

- The founders of the company, its management and members of their families;

- To the state and state funds;

- Large shareholders owning more than 5% of all securities each;

- Private pension, investment and hedge funds;

- Insiders and long-term professional shareholders;

- Packages that are pledged, under arrest, etc.

A few years ago, private foundations were not mentioned on this list. But the methodology for calculating free float on the Moscow Exchange is constantly changing, which in some cases can greatly influence the result. Meanwhile, the free float value is used as a criterion for including a company’s shares in the Moscow Exchange index calculation base (formerly the MICEX index). For example, according to the rules in force since November 2022, shares can be added to the calculation base that have a free float coefficient at the time of the decision of at least 10%. If, after inclusion in the database, it drops below 5%, even if all other conditions are met, the company will be removed from the database. In the previous version of the rules, the initial free float threshold for shares to participate in the Moscow Exchange index was 5%. Now the indicator is less dependent on the actions of speculators.

Despite the fact that free float does not relate to indicators of a company's economic performance, it is of great importance for making investment decisions. The greater the share of shares traded on the market, the higher their liquidity, the less the price depends on surprises. The more predictable behavior of a security is indirectly taken into account in its liquidity ratio, which is equal to the ratio of the annual trading volume to the free float. A new security can be added to the Moscow Exchange index calculation base only if its liquidity ratio is at least 15%, and if it then drops below 10%, the security will be excluded from the base.

The range of free float of Russian shares, attractive to investors, can be in the range of 20–80%. At the same time, the large fragmentation of the company's ownership structure makes it difficult to manage and make strategic decisions, which affects financial performance. Therefore, the most liquid shares of companies are those in which over 50% of the capital belongs to 1–2 large shareholders, and about 35–45% of the securities are traded on the market. Typical examples: Gazprom (more than 50% of shares belong to the state, 46% in circulation) and Norilsk Nickel (V. Potanin’s Interros - about 34%, O. Deripaska’s structures - about 28%, and 38% are free float).

I also recommend reading:

What does it mean to cut shares and what are its consequences?

Stock splits: should investors worry?

Why does the coefficient change?

The free float value can increase or decrease over time. We figured out that only a share can influence these changes.

To reduce the free float, the company's owners resort to the buyback procedure - it consists of repurchasing shares from free circulation. At the same time, the share unavailable for purchase increases. Buy back is necessary in the following cases:

- Maintaining market value.

- Control packet interception warning.

- Investing excess funds.

- Receiving a profit.

The procedure for increasing the free fleet coefficient is called additional emission. It consists of increasing the company’s capital, for example, by raising additional funds. This adds the number of shares and puts them into free circulation.

Not long ago, the restaurant “Rake” opened in Moscow. Among the mass of other new projects, it stands out due to the mysterious name of the concept - “free-flo”, as well as solid investments - about $2 million, which is rare for a middle-segment restaurant aimed at consumers with an average income level. Its owners - Moscow restaurateur Roman Rozhnikovsky ("Nostalzhi", "Shater") and his wife Irina Rozhnikovskaya - are confident that "Rake" has a fairly high competitive potential. The new establishment is a pilot within the framework of a network project; the owners plan to open two restaurants a year.

Free movement

“Free flow” or free flow means “free movement”. In the case of restaurants, this means free movement of both visitors and food. Signs of the concept: preparation of all dishes in front of visitors, absence of waiters, presence of an open kitchen, large and varied assortment, low prices.

The Rozhnikovskys first became acquainted with this format in Rome in 1997, visiting one of the establishments of the Autogrill chain. But at that time, they considered, it was impossible to create a similar project in Russia, since the middle class practically did not exist. However, five years later, the idea of a democratic restaurant became relevant again. During this time, the couple of restaurateurs had the opportunity to get acquainted with a number of other similar establishments - the French chain Casino, the Latvian chain Lido, the Swiss Movenpick, and the Yekaterinburg Sunday. It should be added that the term “free-flo” itself was invented by the Rozhnikovskys specifically for “Rake”. Before them, no one had identified this type of restaurant with a special designation.

Despite all the statements of the owners of "Rake", it is worth noting that the first steps towards the "free movement" format were made by the "Mu-Mu" restaurant, where part of the products is prepared in front of the client's eyes. It was the success of Mu-Mu that showed the Rozhnikovskys that a mass restaurant in the middle price segment was more than in demand.

According to the technological equipment expert who was involved in the technical support of the Rake and design work, Alexander Nikiforov, “the essence of the free flow concept lies in the most democratic system of working with the consumer. Ideally, it makes it possible to avoid queues even with a large number of visitors, which is facilitated by the multi-format nature of the catering establishment, which is ensured by the so-called “separate islands” principle. According to Nikiforov, this feature makes such a restaurant the most democratic establishment possible, attracting clients from various social strata, since it can satisfy a variety of tastes. On the ground floor of the Rake, in addition to the coffee shop and beer hall, there is a hot food distribution line, where the visitor can order the first, second and third dishes separately (while communicating with different chefs who prepare the dishes directly in front of the customers). On the second floor there is a restaurant with the code name “Attic” (which owes to the “attic” design style). But the principle of self-service does not apply there; orders are taken through waiters. If lunch on the first floor costs 200 - 250 rubles, then dinner on the second floor costs about 600.

“We will be friends at home”

“Rake” is located in the Alekseevskaya metro area next to “Sbarro”, “Mu-mu” and two “Elki-Palki” at once. The neighbors have already sensed the arrival of a new player. According to Maxim Efimkin, director of development, which owns the Elki-Palki taverns, the number of visitors has decreased. But, according to him, nothing critical is happening: “On Alekseevskaya there is one of the most profitable points of the network, and this position remains unchanged, despite the appearance of competitors in the area. When Mu-Mu opened, there were fewer customers. However, later everything returned to normal. The same thing is happening now - due to the appearance of “Rake”, attendance has decreased. But the taverns will not be empty,” says Efimkin.

The general director of Rake, Irina Rozhnikovskaya, also sees no reason for a tough fight: “We have no competition with our neighbors - there are enough clients for everyone. There are several research institutes in this area, the premises of which are rented out as offices. According to our estimates, about 8-10 thousand people work there. Now, with our appearance, they have more room for maneuver and opportunities for choice,” Irina is sure.

According to market players, the new establishment promises to be very competitive. In terms of the number of seats and capacity, "Rake" significantly exceeds all other establishments of the same level. According to Maxim Efimkin, the largest taverns in the Elki-Palki chain can accommodate 150 visitors at a time. The Mu-Mu restaurants are somewhat more spacious, however, according to the data, the maximum traffic of both the first and the second does not exceed 600 people per day. While the "Rake", designed for 350 seats, has now almost reached the profitability threshold with 2000 customers per day (attendance is growing by 20% per day), and their owners are not going to stop there, setting themselves the goal of achieving cruising performance, a certain at the level of 4 thousand visitors. The amount spent on the construction of the Rake restaurant - $2 million - is quite significant for such a project. For example, equipment of a Rostix restaurant similar in capacity and area would cost approximately $500 thousand.

But, according to Irina Rozhnikovskaya, it is not always possible to apply the formula “minimum investment - maximum profit” to the restaurant business. Success is determined largely by the atmosphere of the establishment and the quality of products. In "Rake" the emphasis is placed precisely on this - design, technical equipment, space planning - the owners of the establishment tried to think through everything. Equipment from leading companies was purchased for the restaurant - Rational combi steamers, refrigerators Sagi, Zanotti, Emainox, electro-mechanical equipment Robot Coupe, Sirman, DITO SAMA, etc., designed for a long service life. Maxim Efimkin, however, expressed doubts about the advisability of such a policy: “It is much more sensible to use domestic equipment, it is easier to repair - the manufacturing enterprise with its service department is closer. Plus, you don't have to wait for your order to be delivered. Therefore, the construction of one of our taverns takes about two months.” However, the Rozhnikovskys preferred to trust foreign technologies. The cost of purchasing them amounted to about $300 thousand, the same amount was spent on the ventilation system.

The design concept for “Rake,” embodied by architect and decorator Alena Tabakova, was to create a warm atmosphere of a country house in retro style, sending the visitor back to the 50s. This era, according to Rozhnikovskaya, should be reminded to visitors by the “Rake” menu, which also includes Wiener schnitzel, steamed cutlets, stuffed chicken thighs, borscht, soups, jelly with puddings, popular half a century ago.

Background

Restaurants operating under the “free access” system could have appeared in Moscow a little earlier than actually happened. And the first to open was not “Rake”, but the Latvian “Lido”. At the end of 2002, a delegation of the Moscow Government headed by Yuri Luzhkov, which visited Latvia on an official visit, visited the Lido shopping and entertainment complex. After this, the Moscow mayor said that such a restaurant should definitely appear in the Russian capital. He promised to allocate a plot for development, and even offered equity participation in the project. However, the Latvians eventually abandoned plans to expand into the Moscow market, considering it too troublesome. Minsk seemed more attractive to Latvian restaurateurs - this summer an agreement was concluded to begin construction of the first establishment in the Belarusian capital, with the presidential administration as a partner on the Belarusian side. And on the basis of franchising, the network began to develop in Lithuania. In Vilnius Akropolis, one of the largest supermarkets in the Baltics, the restaurant is already successfully operating.

The Latvian restaurant chain “Lido” is a successful model of national fast food with homemade food. Now there are already 11 chain establishments in Latvia, the largest of which was opened in 1998. It is located on Krasta Street and is a local landmark: the restaurant occupies 2 hectares, and construction continues on another 3 hectares. The Lido on Krasta Street is a three-story wooden structure - the largest in Europe. The restaurant can accommodate up to 10 thousand people—that’s about how many people come here on weekends. For Latvians, this is not just an economy-class restaurant (the average bill there is approximately $10), but also a kind of ethnographic museum, since it is decorated like a traditional village house, or even an entire village. However, at its core, the Lido network is a very successful business model. In the 15 years that have passed since the appearance of the first Lido bar, the chain’s annual turnover has reached $20 million. 20,000 people visit the chain’s restaurants every day. “Lido” was the first establishment in the territory of the former USSR in which a new system of working with clients appeared - an open kitchen, free movement of visitors from counter to counter, the ability to choose products for preparing a dish.

And the founder of this concept can rightfully be called Marche Movenpick. Businessman Ueli Prager, who later came up with the concept, started his business with an ordinary bistro. In 1948, he opened his first restaurant, calling it Movenpick, which quite accurately reflected the essence of the establishment. This translates as “a seagull in low flight, picking a berry from the crown of a tree.” The restaurant was conceived as a place for business people, where they could quickly drop in and at the same time have a delicious meal. The establishment turned out to be quite successful. Soon new points opened in Bern and Geneva. In 1960, its own company was founded, engaged in purchasing, delivery and logistics, and its own “factory-kitchen” was built. In 1963, Prager crossed the Swiss border with the Movenpick concept and began expansion into Germany. The first restaurant opened in Munich, and in 1970 Movenpick wine cellars opened in Germany and Switzerland. Then Prager decided to go into the hotel business. Today Movenpick is an international corporation specializing in gastronomy, wine trading, hotel and restaurant business in Central Europe, the Middle East, Asia, Canada and the USA.

The corporation employs 13,000 people and owns 113 restaurants around the world: 46 Movenpick Restaurants, 61 Marche Movenpick and 6 Cindys Diner. Restaurants operate in 10 countries around the world. 83 of them are owned by the company, and 27 operate under license. The company's restaurants serve 60,000 people every day. In the early 1980s, Prager invented two completely original restaurant concepts: Caveaux Wine Bar and Marche Movenpick. In these restaurants, guests walk between colorful, mouth-watering food stations and watch their food being prepared. In Marche restaurants there is no closed kitchen - everything is prepared in front of the customers. The ingredients are laid out on counters, and visitors themselves choose the pieces from which the dish will be prepared. Counters in Marche are divided according to the type of product offered: grill, seafood, soups, salad bar, oriental cuisine, pasta, pizza, fruit, bar, wine bar, pastry shop. On average, the company invests from $800 thousand to $1.2 million in opening one Marche restaurant, designed for 200 seats.

It was by analogy with the Swiss Marche that the Yekaterinburg restaurant Sunday was created, which opened in December 2002. Unlike “Rake”, where there is a single serving line separating customers from the kitchen, in Sunday a different way of organizing the space, more consistent with the essence of the idea, was chosen. In this restaurant, the principle of “free movement” is taken to an absolute level: at the entrance to Sunday, a person receives a magnetic card, which is a kind of purchase counter. Approaching the food station, he takes food, receives a note about the order made and a preliminary receipt. There are many counters in the restaurant and they are arranged according to the nationality of the cuisine - Russian, Japanese, European, as well as by position - meat, vegetables, soups, pasta, drinks, etc. And right at the exit from the hall, after unlimited approaches to the counters, the total amount of the bill is read off the client’s card. As Pavel Kukarskikh, the owner of Sunday, believes, “such a system is more playful and youthful than a system with a common counter and cash register.” Sunday is popular among representatives of various social groups. Both students, who, buying the right to unlimited access to a buffet for 90 rubles, can eat quite thoroughly, and wealthier people have at their service a sushi bar, hot dishes, and a bar with alcohol. The average bill at Sunday is 180 rubles. The restaurant has 240 seats, the average daily traffic is 1,500 people. In the near future it is planned to open a second point with 500-600 seats. If $1.5 million was invested in opening the first establishment, then $2.5 million is planned to be spent on opening the second.

According to Pavel Kukarskikh, “with a large number of seats, the owners may have a problem with the full and constant occupancy of the restaurant. In this case, additional marketing steps are required. In particular, “Lido” promotes its complex, including as a restaurant for families with children: a large children’s playground was built at the restaurant for children, thanks to this “Lido” is perceived not only as a restaurant, but also as a popular leisure center, which ensures its constant influx of visitors. Sunday, like Marche, has a children's room, the new restaurant will even have two, and we attract the youth audience with music and fashionable videos on the screens. In “Rake,” in my opinion, this point is not very well thought out - there are no special offers for children.”

One way or another, any restaurant in this concept is doomed to success, says Pavel. “This concept is very successful everywhere, because, firstly, it is democratic, and secondly, it is a kind of interactive show, when the client becomes part of the atmosphere, the process.”

In Russia, according to researchers, there has been a clear trend towards the growth of the middle class and the strengthening of its position in society. According to the Independent Institute of Social Policy, about 20% of Russians in the country can already be classified as this stratum, and in the foreseeable future, subject to economic stability, its number may reach 50% of the population. According to the director of the marketing research department, Peter Zalessky, “the middle class has become “fashionable” - often today products that are positioned as “products for the middle class” are much more successfully promoted. In the restaurant business, fashion is manifested in the activation of the middle segment. At the same time, democratic restaurants are really necessary, since in the capital, more than 20% of residents fall into this category based on their socio-demographic and economic status.” According to restaurant critic and publisher of the restaurant guide “Chernovik” Sergei Chernov, now the niche of establishments designed for representatives of the middle class is filled in Moscow by at most 10%.

As a rule, the area of inexpensive restaurants is developing more successfully in the context of chain projects. Practice shows that brand recognition significantly increases consumer confidence in an establishment, providing it with an additional influx of visitors. If we turn to foreign experience in branding in the restaurant business, naturally, the first thing that comes to mind is McDonald's. In the ranking of the most valuable brands compiled by Business Week magazine in 2003, it ranks 8th, and its value is estimated at $24 billion.

Of course, domestic chains still lag behind McDonald's in terms of popularity, but brands, albeit only on a national scale, have already appeared. In the fast food segment, Rostix is coming on the heels of McDonald's. Both networks are developing at rates above the market average. At the end of this year, McDonald's growth should be 25%, and Rostix plans to record as much as 56% in its assets. If we characterize the situation in this segment, then there is no other word other than “boom” to describe it. It is caused, according to Andrei Petrakov, a specialist in the restaurant market of the consulting company, by the readiness to accept this format and the increased solvency of the population: “Eating in fast food has finally ceased to be felt by Russians as a kind of sophistication and luxury, having become an ordinary thing.”

According to Petrakov, in the near future we should expect a similar boom in the segment of democratic restaurants: “growth in the segment is stable and good - 15 - 20% per year, but this no longer satisfies the needs of the market. I think business will quickly respond to increased demand, and growth rates will increase.”

The largest chain among middle-segment restaurants is Elki-Palki, which includes 21 Moscow restaurants (another is located in Rostov-on-Don). Among exclusively Moscow chain projects one can highlight “Drova” (7 establishments), “Kish-Mish” (5 establishments), “Shesh-Besh” (5 establishments), and also “Mu-Mu” (5 establishments). The average check at all these restaurants is from $10 to $15.

Several online players operate in St. Petersburg. This year, the St. Petersburg chain of teahouses “Chainaya Lozhka” (7 permanent establishments and 8 kiosks, the average bill for two is 120 rubles) is beginning to expand into the regions. The Blin-Donalts fast food system, owned by , is aggressively conquering the market. By the end of the year, the BlinDonalts restaurant chain will increase to 5 outlets. The average check at Blin-Donalts is from 50 rubles, while daily visits to each establishment are expected to be from three to five thousand people. Another popular network project in the city is “Mother-in-Law for Pancakes” (4 points have already been opened, the average bill is 150 rubles).

Among the regional players, one can note the Novosibirsk holding Foodmaster, whose plans include adding 20 fast food restaurants throughout Siberia next year to the existing 9 establishments in Novosibirsk, Krasnoyarsk and Alma-Ata. As a base, “Foodmaster” chose the “Fork-Spoon” concept - a trend of democratic fast foods with traditional Russian home cooking. The minimum cost for lunch is 30 rubles. In the coming year, Foodmaster intends to invest about $8 million in the network.

Where to look for free float companies

How to find out the free float coefficient of the investment you are interested in? This information is publicly available, companies do not hide it. For Russian stocks, use the Moscow Exchange website - the data there is reliable, it is updated every day. Here are the first ten items on the list as of 02/15/2019.

The table shows that Rostelecom and Surgutneftegaz have a high free float ratio, which means they are in demand among investors.

There are websites that provide information on the performance of foreign securities. I prefer Finviz.com and the Nasdaq stock exchange site.

general information

The float as a technique is especially effective against players who are constantly aggressive on the flop, but are willing to give up the pot if that aggression doesn't work. The most vulnerable players to float are players who frequently place a continuation bet, but are willing to give up the pot if that bet doesn't work out.

When using a float, you should also pay attention to your opponent's playing style. We must have enough fold equity to float a full bluff, and our opponent must not be overly aggressive. The size of the bank and bets are also important - you should bet at least 2/3 of the bank, and better - 3/4 or the size of the bank.

Adding a float to your arsenal can significantly increase your win rate at mid-stakes. At low limits there is not enough fold equity for this technique, but at high limits most players are familiar with this technique and know how to successfully deal with it.