Main Hide

- International Business Machines Corp. (IBM)

- FedEx Corp. (FDX)

- Philip Morris International, Inc. (PM)

- Target Corp. (TGT)

- Johnson & Johnson (JNJ)

- PepsiCo, Inc. (PEP)

- AT&T, Inc. (T)

- Crown Castle International Corp. (CCI)

- eBay, Inc. (EBAY)

- Kimberly-Clark Corp. (KMB)

- Results

For the American stock market, 2022 promises to be a year of steady recovery after the economic disaster caused by the coronavirus. Now is a great time to build a dividend portfolio in the US:

- the unemployment rate dropped to 6% (compared to 14.7% in April last year);

- coronavirus has pushed the market to rapid growth in certain industries - e-commerce, technology and biotechnology are sharply rising in price;

- America's major corporations have adapted to business conditions during the pandemic - blue chips provide stable income.

Below, find the best US dividend stocks for 2022. We have collected the top 10 profitable US stocks with an eye on long-term income.

International Business Machines Corp. (IBM)

Dividend amount: $1.63

Dividend yield: 5.3%

IBM is one of the pioneers of the computer technology market, but in recent years things have not been going smoothly for the company. With the development of the Internet, customers lost interest in centralized computer systems, and the manufacturer had nothing to offer in the network segment. This led to a sharp drop in annual income and, accordingly, the share price.

For brokers speculating on price differentials, the current negative trend is reason enough to stay away from IBM stock. However, long-term income investors have good reasons to add IBM to their dividend portfolio:

- Regular increase in dividend payments. Dividends may fluctuate over time throughout the year, but when compared year-on-year, it is clear that there has been a consistent positive trend that the company has maintained over the past 10 years.

- Company policy regarding dividends. IBM is an American “conservative”: the company provides a gradual increase in income for long-term investors, regardless of market fluctuations.

- Big restructuring. IBM is moving away from the production of desktop computers towards cloud technologies and user services.

The transition to cloud services is not cheap for IBM: over the past 9 years, the company has invested more than $120 billion in restructuring and industrial research. But with big expenses comes big profits - and shareholders willing to wait a little will get them first.

How to invest in all US dividend aristocrats at once

To get immediate exposure to these reliable dividend stocks, you can buy the ProShares S&P 500 Dividend Aristocrat Index ETF, which includes 64 stocks. The second option is to invest in a broader ETF, which is built on the basis of the S&P 1500 Composite index and includes large companies that have been regularly paying dividends for more than 20 years.

| ETF name | Ticker | Description |

| ProShares S&P 500 Dividend Aristocrat | NOBL | Includes 64 diva stocks. Aristocrats from the S&P 500 index. Pay regularly for more than 25 years |

| S&P High-Yield Dividend Aristocrats | S.D.Y. | Includes 111 Dividend Aristocrat stocks from the S&P 1500 Composite Index. Pays over 20 years (includes 53 S&P500 companies) |

In addition to American indices from dividend aristocratic companies, there are others. For example, the S&P Europe 350 Dividend Aristocrats - which includes 350 European companies that have been consistently paying dividends for more than 10 years.

| Name | Ticker | Description |

| iShares S&P/TSX Canadian Dividend Aristocrats Index ETF | CDZ | Canadian companies paying dividends consistently for more than 7 years |

| S&P Europe 350 Dividend Aristocrats | SPYW | European companies paying dividends for more than 10 years |

Dividend Aristocrat stocks include many ETFs to increase their reliability and attractiveness. For example, there are target funds whose goal is to outperform the dividend yield of the S&P 500 index. Below are some of them ↓

| Name | Ticker | Description |

| CBOE Vest S&P 500 Dividend Aristocrats Target Income | KNG | In addition to dividend aristocrats, the ETF includes options and stocks from the S&P500. The goal is to create returns higher than the S&P 500 index |

| Vanguard International Dividend Appreciation ETF | VIGI | Stocks from the NASDAQ index do not include REITs. Dividend payments for more than 7 years |

FedEx Corp. (FDX)

Dividend amount: $0.65

Dividend yield: 0.93%

The main US postal and courier company was included in the list of corporations that managed to increase in value during the pandemic. The boom in e-commerce and the sharp rise in popularity of online shopping has allowed FedEx to rise to a new level of popularity. This is now more than the available high dividend US stocks:

- net income over the past year has tripled - from 315 to 892 million dollars;

- in 2022, analysts expect an increase of at least 20%;

- in 2022 – at least 5%.

Despite the fact that the explosion in demand for FedEx services is obviously temporary, experts note the growing prospects for the largest American delivery service. Even as FedEx's "unprecedented peak season" comes to an end, e-commerce will continue to grow and so will the company's dividend yield. Since 2011 alone, payments for company shareholders have increased 6 times; analysts advise investors who want to catch the next one to buy shares now

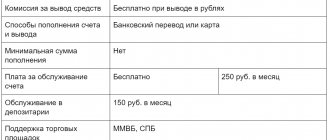

Pros and cons of investing in US dividend stocks

The main advantage of high-dividend US stocks is that you will receive a profit that does not depend on the ruble and the imposed sanctions.

There are other positive aspects of investing in American dividend stocks:

- payments are made quite often - at least once a year, maximum - once every three months;

- stability. The investor receives money annually;

- brokerage account insurance, which is not available in Russia.

As for the cons, I can only say one thing here. Often, novice investors are lured by high-risk US dividend stocks, which is a mistake.

High risks mean that the company does not invest money in development, but uses it for payments. As a result, the price of shares of such organizations will not grow, so it will not be possible to buy securities at a lower price and sell at a higher price.

Taxation

Initially, the investor’s account receives the amount already with 10% tax deducted, since this rate on dividend shares is valid for residents of the Russian Federation in America. Since the rate there is 10%, and here it is 13%, you must pay an additional 3% of the profit to the tax service of the Russian Federation. Thanks to the agreement between the United States and Russia, this approach avoids double taxation.

Philip Morris International, Inc. (PM)

Dividend amount: $1.20

Dividend yield: 5.41%

The history of the American tobacco giant includes more than 10 years of stable dividend growth. Contrary to global trends of declining interest in tobacco, Philip Morris shares continue to grow. In the next few years, the company expects about a 40% increase in the enterprise's income due to profits from the sale of smoke-free products: electronic cigarettes, IQOS tobacco heating systems, cartridges and accessories.

In the last quarter of 2022, the company was included for the first time in the Dow Jones Industrial Average, one of the oldest American stock indexes that includes the 30 largest companies in the United States. Despite the obvious growth of Philip Morris, shares remain affordable, with many investors passing up the lucrative offer for ethical reasons. The company has not yet been able to discover a completely harmless way to consume heated tobacco, so IQOS - the main source of growth for Philip Morris in 2022 - is considered “unclean” income. Analysts advise shareholders who do not suffer from unnecessary prejudices to take advantage of the profitable opportunity and buy profitable shares before it is too late - even if they belong to the “scary” tobacco company.

European selection of aristocrats

To obtain the title of dividend aristocrat in Europe, it is enough to consistently share profits with shareholders for 10 years. The 2022 European index includes 39 stocks.

TOP 6 European companies with stable payments

- Navios Maritime Acquisition (NNA) - Monaco. Sea transportation of oil by tankers, own flotilla. DD - 26.09%. Payment period - 10 years

- Capital Product Partners (CPLP) - Greece. Type of activity: sea transportation, own fleet. DD - 6.26%. Payments exceed 12 years.

- Sponda Oyj (SDA1V) - Finland, construction company. Dividend yield: 3.96%. The period of continuous payments is more than 10 years.

- Union Financiere De France Banque (UFF) - France - investments, real estate, insurance, banking and consulting services. Capitalization - 301 million €. Dividends - 6.71%. The payment period is over 20 years.

- EDR (Energias De PortuGal) (EDP) - Portugal, the largest energy company in Portugal with a dividend yield of 4.08%, stable payments to shareholders for 18 years or more.

- REN (Redes Energeticas nacionals) (RENE) - Portugal - a corporation engaged in the construction of utility networks, oil storage facilities and their operation. Return on assets - 7.13%. The period of annual payments is over 11 years.

Target Corp. (TGT)

Dividend amount: $0.68

Dividend yield: 1.5%

The network of American discounters is less familiar to investors from Russia than the legendary Walmart stores. However, it is Target that offers high-dividend shares with annual increases in payments - by 2022, dividends have risen to an unprecedented 35%.

Target is a worthy addition to any investment portfolio. The company annually tops US ratings for stability of economic growth. This trend, set since 1972, is not abating even during the pandemic: in 2022, while other companies were tightening the knots, Target's payout grew by 3%. Analysts expect average annual growth of 14% over 3-5 years.

In addition to traditional retail, Target offers investors attractive prospects in the field of online commerce. While e-commerce is only a small segment of Target at the moment, the segment grew 150% last year before doubling during the holiday season. 2022-2023 could be a period of unprecedented economic growth for one of the oldest US retailers paying large dividends.

Dividend Champions

Under the term dividend champions

) refers to companies that have increased shareholder compensation for the last 5 consecutive years. At the same time, there is no strict restriction on a company’s inclusion in the S&P 500. The requirements are soft, so the list of champions is quite wide. The risk of adjusting the payment policy is higher compared to aristocrats or kings.

To track the current list of dividend champions, use the resource dripinvesting.org

.

Enthusiasts David

Fish and

Law

. There are more than 140 champions recorded in the US market.

If the investor's goal is dividend stability, it is better to give priority to aristocrats. If this type of income fades into the background, you can work with champions.

Where to see updated data and lists

The list of aristocrats is adjusted over time. Not everyone is able to maintain dividends at a stable level or increase them for decades. In the event of a crisis, unsuccessful management decisions and deterioration of financial performance, the dividend policy may be revised towards reducing payments.

The composition of companies can be tracked through baskets of relevant indices. In the US, the S&P 500 Dividend Aristocrats index is suitable for this. The top ten baskets are published on the index provider’s website in the Constituents section (ranking is done by “weight”).

The Dividend Aristocrats list is rebalanced quarterly, so the list is always up to date.

Similar indices have been developed for Europe - S&P Europe 350 Dividends Aristocrats.

In addition to index baskets, useful information can be found at:

- dividend.com

– here companies paying dividends are classified by the size of payments and the sector in which they operate. There are separate lists for companies that increase payments over 10 and 25 years. Information is updated more frequently than the index basket is rebalanced. There is also a watchlist, the ability to set up alerts that are triggered when a stock reaches a certain price or the payment date arrives, and there is also its own screener; - dividendinvestor.com

. The site does not classify companies according to their affiliation with the list of aristocrats. The developers have placed a dividend calendar here, which allows you to calculate the theoretical income when purchasing shares, there is an alert system, your own screen, and the main dates are indicated (cut-off and direct payment of remuneration to shareholders). There is also a history of payments in past years; - https://www.dripinvesting.org/Tools/Tools.asp

- a resource suitable for tracking dividend champions. There are also templates in Excel format for manual reporting; - dividendmax.com

. The resource is good because it gives dividend forecasts and helps investors select shares in various categories. There are several services, OptimizerMax - selects the best companies with potentially maximum dividend yield. GeneratorMax is used to plan income receipts; the tool predicts it taking into account expected payments. Dividends Notification – used to notify about payments. The Our Portfolios section displays dividend portfolios created by dividendmax.com experts.

These resources are sufficient to track the composition of European and American dividend aristocrats and to forecast income potential. The services make the investor’s work easier - there is no need to manually maintain a report, recording each date; you can set up notifications so that notifications are received automatically.

Profitability

In the case of a group of aristocrats, the standard rule applies - the higher the reliability of payments, the lower their value. For companies that do not belong to this group, the amount of shareholder remuneration can fluctuate within a very wide range; it can grow by 100+% per year - it all depends on financial performance and the adopted development strategy.

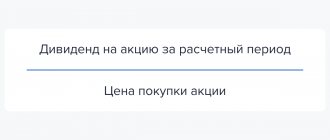

As for the total income, payments are always indicated per 1 share. Payments are most often made quarterly, the annual yield is the amount of payments during the year.

As for long-term profitability, reinvesting dividends has a cumulative effect and, with a planning horizon of 10-20 years, significantly increases income.

A small equilibrium portfolio (LOW, JNJ, CARR, TGT, MDT, ABT, CTAS, PG, EXPD, LEG) over the period from 2000 to 2022 gives a 6.22 times increase in the starting $10,000 if dividend income is not reinvested.

If, under the same conditions, payments are directed to the additional purchase of shares of the corresponding companies, then at the same distance the capital will increase by 9.44 times. The profit in this case is 51.80% higher compared to the first option due to the fact that the number of securities in the portfolio is constantly growing.

A side effect is increased stability of the investment portfolio. Aristocrats become those companies that have already reached a high level of development, their business is stable and well diversified, and therefore payments to shareholders are growing. During periods of crisis, their shares also fall, but in general not as much as those of other companies (there are exceptions if the crisis affects a specific sector of the economy).

The presented portfolio of the Dividend Aristocrats of America at a distance of 20 years gave a negative result only for 3 years. In 2002 - a drop of 9.51%, in 2007 and 2008 (global crisis) - a decrease in the value of the portfolio by 1.50% and 15.86%, respectively.

Impact of crises

During periods of crisis there can be 3 scenarios:

- Due to declining profits, the company is revising its dividend policy and falls out of the category of aristocrats;

- Despite some deterioration in indicators, the shareholder remuneration policy does not change, payments at least remain at the same level;

- Despite the crisis, the company's performance is improving, and payments to shareholders in foreign currency are increasing.

In 2008, the global crisis hit the banking sector the hardest; aristocrats in this category began to cut payments to shareholders. For example, Synovus Financial

entered the list of aristocrats in 2006, but stayed on it for only 2 years;

Regions Financial, BoA, US Bancorp, Comerica, KeyCorp

.

Due to the crisis, Bank of America's dividend dropped to 1 cent per share. The increase to 5 cents per security occurred only in mid-2014, but even in 2022, payments did not return to pre-crisis levels. The same was the case with KeyCorp

and other financial institutions.

The technology sector was doing relatively well at the time. General Electric only

significantly reduced shareholder compensation.

A crisis can have the opposite effect and provide support, ensuring an increase in the value of shares and revenue, which may also affect payments to shareholders. A good example is Walgreens Boots Alliance.

(pharmacy chain), like other companies in this sector, its financial performance has improved due to the pandemic.

A similar situation with AT&T, Essex Property Trust, Altria, AbbVie

. All of these companies are doing well despite the crisis and have no plans to cut shareholder compensation.

Pros and cons of dividend aristocrats

Strengths include:

- Reinvestment of dividends, which allows you to scale your income over a distance. With a planning horizon of 7-10 years, due to this, income will most likely overtake a portfolio made up of securities of companies that do not reward shareholders;

- Higher dividend income. Over a 20-year period (from 1999 to 2022), the aristocrats showed a dividend yield of about 2.5%, while in the broad market an investor could receive only 1.8%;

- Company sustainability. In order to increase shareholder rewards over decades, a business must be as sustainable as possible. The likelihood that a company will go bankrupt during a crisis is low;

- Relatively low volatility of the corresponding shares.

There were also some drawbacks:

- The structure of dividend aristocrats has a strong bias towards industry and consumer goods. It is significant that in the S&P index basket, IT accounts for only 1.4%. At the same time, the IT direction shows strong growth and remains promising in the future;

- Due to the relatively small number of companies of this type, the portfolio will be less diversified compared to investments in the broad market. Dividend champions solve part of the problem;

- There is no guarantee that the Dividend Aristocrats' business will be as stable in the future. Such companies are conservative; explosive growth should not be expected from them;

- The portfolio turns out to be low-tech.

Conclusion

Dividend Aristocrats are a good choice for building a portfolio that provides stable, spread-out income. Alternatively, you can reinvest dividends and over a period of 7-10+ years the portfolio will outperform investments in ordinary companies. At the same time, the likelihood of explosive growth in the dividend portfolio is reduced to almost zero.

#shares #dividends

Author: Stanislav Gorov Author of articles, trader and investor. “Trading for me is a source of inspiration and a good time. There are more than 20,000 assets here, but even any one of them can open up greater horizons of activity, knowledge and opportunity.”

Johnson & Johnson (JNJ)

Dividend amount: $1.01

Dividend yield: 2.47%

Investors who bought J&J stock before the pandemic saw record profits, but there's still time for new players to get on board. The company, founded in 1886, owns more than 250 subsidiaries producing drugs, hygiene products and medical devices. This is a safe investment option: no matter what happens to the US economy, international profits from the medical and personal care products sector will grow. J&J, as a shareholder-oriented company, raises its dividend every year without skipping a beat. The only difference is the amount of dividend increases - and they depend on business growth.

In the second quarter of 2022, experts recommended Johnson & Johnson shares as the best candidate for rapid growth. In 2021, hopes for increased income from the shares of the medical giant are associated with the production of a vaccine against COVID-19. Regardless of the outcome of the year, it is already clear that J&J remains on the list of the best blue chips in the United States: whatever the situation in the country, the company annually increases its revenue by at least 5%.

TOP 10 US Dividend Aristocrats by Yield

Unlike Russian companies, American companies try to pay increasing dividend payments to maximize their value and investment attractiveness. Thus, AbbVie Inc. makes maximum dividend payments. (ABBV) – 5.65% per annum, which is slightly less than what domestic ones pay.

US Dividend Aristocrats Yield Ranking

Another important aspect of American companies in relation to Russian ones is the regularity of payments, which are prescribed in the dividend policy.

PepsiCo, Inc. (PEP)

Dividend amount: $1.0225

Dividend yield: 2.89%

Comparing the profitability tables of Coca-Cola and Pepsi over the past few years reveals an unexpected trend: Pepsi appears to be winning this war, and has been for quite some time. The company has captivated the world with its impressive geographic and commercial diversity.

While Coca-Cola's stock performance has been declining as demand for sugary sodas has fallen, PepsiCo has managed to grow. Among the company's flagships are the Doritos snack chain, Tostitos, Rold Gold credels and other young but successful fast food brands. Even the pandemic has not shaken the demand for salty snacks: PepsiCo expects annual profitability growth of 6.8% in the next 3-5 years.

Considering that PepsiCo shares have been steadily rising in price over the past couple of years, experts do not advise waiting for a better moment - they will not be affected by market fluctuations in 2021.

S&P 500 vs Dividend Aristocrats Portfolio

If you compare the growth in profitability of an investment portfolio of dividend aristocrats and shares from the S&P500 index, you will notice that a significant difference will accumulate over time. Investing in Dividend Aristocrat stocks not only provides exchange rate growth, but also dividend payments. The figure below shows the dynamics of changes in profitability over 30 years.

Comparison of investment portfolios

AT&T, Inc. (T)

Dividend amount: $0.52

Dividend yield: 6.8%

Among profitable telecommunications ]AT&T[/anchor] ranks only second - Verizon Communications consistently holds the first place. However, AT&T's investment power goes beyond its monthly TV subscription fees. The company owns a huge media empire, which includes:

- CNN news channel;

- American cable television network Cinemax;

- the largest film production concern in the United States, Warner Bros;

- DC comics is the most popular comic book publisher in the world;

as well as other US and international media giants. Experts associate positive forecasts for 2022 with the release of the expected blockbusters: “The Matrix 4”, “Space Jam: The Next Generation” and the prequel to the series “The Sopranos”. Upcoming box office hits will be released simultaneously on AT&T's HBO Max platform, attracting new subscribers.

The company currently pays a 6.8% dividend, which is good for a new investment portfolio. In the next few years, payments will only grow due to the expansion of the client base of numerous media services, the capitalization of creative franchises and the development of promising 5G technologies.

Crown Castle International Corp. (CCI)

Dividend amount: $1.33

Dividend yield: 3.04%

CCI shares are often bought in addition to those of their big-name clients AT&T, Verizon Communications and T-Mobile, which share three-quarters of the US telecommunications market. Regardless of which of the “Big Three” is the first to succeed in mastering the new generation of 5G networks, Crown Castle International will make money on it – and will not forget to share it with investors.

The company has increased its dividend payments by an average of 8% per year for more than five years in a row. This is an excellent indicator even for the active American market: even in the context of a global pandemic, communications are rapidly developing. CCI has more than 40 thousand cell towers and about 130 thousand kilometers of optical fiber, as well as plans to build its own 5G network of the new standard. This “baggage” is a strong bid to maintain 25 years of leadership, so CCI shares are steadily rising in price.

List of 64 US Dividend Aristocrats by Industry

Below is a table of 64 American ↓

| Ticker | Name | Industry | Duration of payments | 10 year dividend growth | Profitability |

| ABBV | AbbVie Inc. | Healthcare | 47 | 13.99% | 5.65% |

| ABT | Abbott Laboratories** | Healthcare | 47 | 5.51% | 1.59% |

| A.D.M. | Archer-Daniels-Midland Co | Essential consumer goods | 44 | 9.60% | 3.16% |

| ADP | Automatic Data Processing | IT | 45 | 10.61% | 2.05% |

| AFL | AFLAC Inc | Finance | 37 | 6.79% | 2.06% |

| A.L.B. | Albemarle Corp. | Materials | 25 | 11.14% | 1.81% |

| AMCR | Amcor | Materials | 25 | 3.50% | 2.29% |

| AOS | Smith AO Corp | Production | 26 | 21.50% | 2.11% |

| APD | Air Products & Chemicals Inc | Materials | 38 | 9.85% | 2.20% |

| ATO | Atmos Energy | Public utilities | 36 | 4.96% | 1.96% |

| BDX | Becton Dickinson & Co | Healthcare | 48 | 8.91% | 1.14% |

| BEN | Franklin Resources Inc | Finance | 40 | 14.02% | 4.28% |

| BF.B | Brown-Forman Corp B | Essential consumer goods | 36 | 8.03% | 0.98% |

| CAH | Cardinal Health Inc | Healthcare | 24 | 17.52% | 3.57% |

| CAT | Caterpillar Inc | Production | 26 | 8.45% | 2.93% |

| C.B. | Chubb Ltd | Finance | 26 | 9.92% | 1.97% |

| CINF | Cincinnati Financial Corp. | Finance | 59 | 3.51% | 2.11% |

| C.L. | Colgate-Palmolive Co | Essential consumer goods | 56 | 7.11% | 2.45% |

| CLX | Clorox Co | Essential consumer goods | 42 | 7.72% | 2.68% |

| CTAS | Cintas Corp. | Production | 37 | 18.43% | 0.90% |

| CVX | PBCT | Energy | 33 | 5.99% | 3.81% |

| DOV | Dover Corp. | Production | 64 | 8.58% | 1.67% |

| ECL | Ecolab Inc | Materials | 28 | 12.63% | 0.95% |

| ED | Consolidated Edison Inc | Public utilities | 46 | 2.29% | 3.27% |

| EMR | Emerson Electric Co | Production | 63 | 4.05% | 2.61% |

| ESS | Essex Property Trust | Real estate | 25 | 6.49% | 2.52% |

| EXPD | Expeditors International | Production | 25 | 10.89% | 1.35% |

| FRT | Federal Realty Invt Trust | Real estate | 52 | 4.65% | 3.24% |

| G.D. | General Dynamics | Production | 28 | 10.35% | 2.20% |

| GPC | Genuine Parts Co | Consumer goods of 2nd necessity | 63 | 6.58% | 3.11% |

| G.W.W. | Grainger WW Inc | Production | 48 | 12.30% | 1.75% |

| HRL | Hormel Foods Corp. | Essential consumer goods | 54 | 16.03% | 1.97% |

| ITW | Illinois Tool Works Inc | Production | 45 | 12.62% | 2.43% |

| JNJ | Johnson & Johnson | Healthcare | 57 | 6.87% | 2.56% |

| KMB | Kimberly-Clark | Essential consumer goods | 48 | 6.01% | 2.98% |

| K.O. | Coca-Cola Co | Essential consumer goods | 57 | 6.91% | 2.77% |

| LEG | Leggett & Platt | Consumer goods of 2nd necessity | 48 | 4.44% | 3.14% |

| LIN | Linde plc | Materials | 26 | 8.14% | 1.67% |

| LOW | Lowe's Cos. Inc. | Consumer goods of 2nd necessity | 57 | 19.39% | 1.83% |

| MCD | McDonald's Corp | Consumer goods of 2nd necessity | 44 | 8.72% | 2.37% |

| MDT | Medtronic plc | Healthcare | 42 | 10.23% | 1.81% |

| MKC | McCormick & Co | Essential consumer goods | 34 | 9.04% | 1.44% |

| MMM | 3M Co | Production | 61 | 10.94% | 3.23% |

| NUE | Nucor Corp. | Materials | 47 | 1.27% | 3.20% |

| O | Realty Income Corp. | Real estate | 25 | 4.68% | 3.62% |

| PBCT | People's United Financial | Finance | 27 | 1.54% | 4.48% |

| PEP | PepsiCo Inc | Essential consumer goods | 47 | 7.96% | 2.67% |

| PG | Procter & Gamble | Essential consumer goods | 63 | 5.56% | 2.38% |

| PNR | Pentair PLC | Production | 44 | 0.54% | 1.65% |

| PPG | PPG Industries Inc | Materials | 48 | 6.40% | 1.62% |

| ROP | Roper Technologies, Inc. | Production | 27 | 18.81% | 0.54% |

| ROST | Ross Stores Inc. | Consumer goods of 2nd necessity | 25 | 24.95% | 0.88% |

| SHW | Sherwin-Williams Co | Materials | 41 | 12.28% | 0.76% |

| SPGI | S&P Global | Finance | 46 | 9.74% | 0.77% |

| S.W.K. | Stanley Black & Decker | Production | 52 | 7.58% | 1.66% |

| SYY | Sysco Corp | Essential consumer goods | 50 | 4.97% | 2.18% |

| T | AT&T Inc | Communication services | 36 | 2.21% | 5.40% |

| TGT | Target Corp | Consumer goods of 2nd necessity | 52 | 14.35% | 2.31% |

| TROW | T Rowe Price Group Inc | Finance | 33 | 11.76% | 2.32% |

| UTX | United Technologies | Production | 26 | 6.68% | 1.92% |

| VFC | VF Corp | Consumer goods of 2nd necessity | 47 | 12.36% | 2.27% |

| W.B.A. | Walgreens Boots Alliance Inc | Essential consumer goods | 44 | 13.63% | 3.52% |

| WMT | Wal-Mart | Essential consumer goods | 46 | 7.18% | 1.85% |

| XOM | Exxon Mobil Corp | Energy | 37 | 7.53% | 5.25% |

⇒

eBay, Inc. (EBAY)

Dividend amount: $0.18

Dividend yield: 1.13%

Ebay is expecting projected growth in 2022 due to increased demand for e-commerce services. In April last year, the company was taken over by former Wallmart executive Jamie Iannone, who managed to achieve net profit growth of almost 68%. Iannone is no stranger to Ebay, having worked with the marketplace for 8 years before taking the position of Vice President at Barnes & Noble.

Ebay's new priority is supporting online stores and promoting its own electronic wallet. His company plans to gradually popularize it in all countries after the end of agreements with PayPal - and the experience of the previous year shows that consumers perceive the Ebay payment system positively.

Analysts expect the former "conservative" stock to grow rapidly over the next few years. By adding Ebay shares to their dividend portfolio now, investors can expect at least a 16% gain this year, with continued positive momentum over the next 3-4 years. While the company's shares can still be bought cheaply, the price is consistently below $70 per share. But as the changes initiated by Mr. Ianonne are implemented, Ebay is growing in price: back in April last year, shares were trading at $30, and by next year the price may rise another 2-3 times.

Rating of the best American companies with the maximum dividends 2019–2020

| Place | Company name | Ticker | Average dividend yield, % |

| 1 | Telefonica Brasil SA | VIV | 9,69 |

| 2 | Cato Corporation | CATO | 9,42 |

| 3 | Saratoga Investment Corp. | SAR | 8,78 |

| 4 | Landmark Infrastructure Partners | LMRK | 8,46 |

| 5 | Gladstone Investment Corporation | GAIN | 7,2 |

| 6 | China Mobile Limited ADR | CHL | 6,99 |

| 7 | ING Group NV ADR | ING | 6,63 |

| 8 | Macy's Inc. | M | 6,49 |

| 9 | Invesco Plc | IVZ | 6,18 |

| 10 | PacWest Bancorp | PACW | 6,18 |

Kimberly-Clark Corp. (KMB)

Dividend amount: $1.14

Dividend yield: 3.28%

A safe choice for any US portfolio, this group of companies focuses only on the "boring" but inevitably profitable areas. The conservative allocation of funding means that Kimberly-Clark is not in danger of collapsing in an economic downturn. True, one should not expect sharp jumps in profits.

The world knows Kimberly-Clark primarily for Huggies diapers, Kleenex toilet paper and Scott paper towels. The company also produces masks and other personal protective equipment. Despite favorable conditions, experts predict annual growth of only 2.6% for the next 3-5 years. It's all about the professional segment: amid the pandemic, KC is losing large corporate clients. Office buildings, public restrooms, and fast food chains were a significant source of income for Kimberly-Clark - but in the context of COVID-19 they turned out to be an Achilles heel.

At the same time, KC continues to grow - in January 2022, the board of directors approved an increase in dividends by 6.5% for the quarter. The company has once again demonstrated loyalty to its shareholders. This rate has remained unchanged for Kimberly-Clark for 84 years in a row, making the company a must-recommend for investors focused on long-term income.

Advice for a novice investor

Past performance guarantees nothing - the main rule of any investor. Even if a US company pays large dividends for 5 years, there is no 100% probability of payments next year. An economic crisis, a drop in sales, corporate risks, an unsuccessful new product - all this can cancel out initial forecasts and lead to losses.

The easiest way to get started investing in US dividend stocks is to buy an 80/20 split. The majority of the portfolio should be occupied by blue chips, and the remaining resources can be distributed among high-risk issuers. Even at the expense of maximum profitability. At first, you need to hold out, gain self-confidence, and gain the necessary experience.

Management of risks

A trader will never know in advance whether the initial forecast will come true or not, but the best thing that can be done is to reduce risks.

This is achieved through diversification (purchasing assets from different sectors of the US economy) and reasonable capital management. And also developing a trading plan if something doesn’t go according to plan.

Results

The US stock market provides the best conditions in the world for building an investment portfolio. The unique economic conditions of America make it possible to choose profitable options for stable long-term income even during the difficult period of the global pandemic.

Experts do not recommend limiting your portfolio to shares of companies that have risen due to changes in consumer demand amid COVID-19. While there are companies among the US dividend leaders in 2022 that have revealed their potential in the crisis, such stocks should be combined with “conservative” options - at least if you are building a working portfolio and not planning to make quick money from stock trading.

Companies paying dividends this week – Dividend calendar

The best dividend stocks are those of American holdings that are developing several parallel directions. At the same time, their annual growth may be lower than that of the “one-time miracles” of 2020: this is the price for stability and regular increases in dividend income.

Disclaimer: This article is presented for informational purposes only and does not constitute an investment recommendation for the purchase, sale of securities, or making (or not making) any commercial or other decisions.

Dividend payment terms

The dividend payment period varies from one month to a year. It is not uncommon for the US stock market to make regular monthly payments to its shareholders. Nuveen Credit is transferring $0.1 per share to all holders. The amount is modest, but it adds up to 16% per annum over the course of a year.

Depending on the issuer’s dividend policy, payments in the United States are made at the following frequency:

- once a year (most often in summer);

- 4 times a year (quarterly accruals);

- 12 times a year (every month).

Register closing dates, cut-off dates

To receive dividends, you do not need to hold dividend stocks for an extended period of time or for life. It is enough that the trader owned securities on a certain date - the so-called cut-off date.

It is on this day that the issuer’s management closes the register and determines the list of its shareholders. You can purchase a dividend asset for a week, then sell it, but have the right to receive part of the company’s profit based on the results of the previous year (or quarter).

An important nuance is the “T + 2” trading mode. This means you need to buy high-dividend US stocks 2 days before the closing date (at the latest!).