Image: Unsplash

The ability to select assets for investment is a key skill for making a profit on the stock exchange. To solve this problem, investors need to analyze their own psychological portrait, set realistic investment goals and learn how to correctly distribute different types of assets within a portfolio.

Investopedia has published educational material that talks about how to build and maintain a high-quality investment portfolio. We have prepared an adapted version of this useful article.

Total

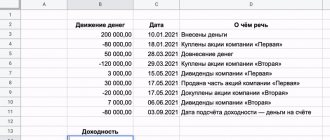

And at this stage we will receive profit from investments and constant replenishment of the deposit due to the investment culture (10% of revenues). At the same time, we will improve efficiency by reinvesting dividends and selecting the best stocks (dividend aristocrats), as well as through quarterly portfolio rebalancing.

In fact, there are many methods for increasing profits, the main thing is not to stop in your investment education. Work on yourself, learn from other earning investors, adopt only the best experience - this is the key to your success as an investor.

In conclusion, I want to emphasize that the sooner you start managing your portfolio, the faster you will become wealthy. Big money is made on long time intervals. As the legendary Jesse Livermore said: “Big profits are not calculated, they are hatched.”

Thank you for your attention and dacha investments!

What principles should you follow when choosing investment instruments?

We have already discussed the key points that you should pay attention to when compiling a portfolio, but this is not enough. In order to consciously choose investment instruments and achieve the necessary results, it is important to know a few more rules:

- Don't spend all your money buying stocks. For novice investors, this approach can be very risky, since the value of shares is highly dependent on changes in the economy and can change dramatically.

- Don't trust everything they say. Shares that are talked about everywhere and everywhere may be overvalued, that is, sold much higher than their real value. We advise you to independently study the company’s financial indicators: the dynamics of revenue and net profit, the amount of funds in the company’s account, the presence of debts and growth factors.

- There's no point in speculating. Speculation involves generating income through changes in the value of an asset in the short term. For example, you bought a share for 10 rubles and expect that in a couple of days its price will rise to 12 rubles. However, in practice, the security may “sag” greatly, and then you will have to close the deal at a loss or wait an indefinite amount of time until it recovers and possibly grows. Speculation requires a lot of effort, time and special knowledge and is suitable for more experienced investors.

- Read analysts and trusted sources of information, follow the news. You can trust the opinion of experienced investors and find current ideas and selections of promising securities on the broker’s website. So, based on forecasts and various reviews, you can decide to invest in a particular asset. However, it is important to remember that only you are responsible for your decision and no one can guarantee you 100% future results.

- Determine your risk profile before you start trading. This is necessary to understand which investment instruments are right for you. The risk profile can be, for example, conservative, rational or aggressive. You can undergo risk profiling with a broker.

Selecting the best of the best stocks

But, of course, we won’t take 50 companies. Firstly, our deposit will not be enough for us (as we wrote above, we now have $500-1000), and secondly, in the CFD listings of a regular dealing center, as a rule, there is no complete set of shares from the group of dividend aristocrats. Although even if there are many securities we need, it is better for us to reduce our portfolio.

This can be done without losing diversification or increasing profits. To do this, we need to select a portfolio of aristocratic stocks that belong to different sectors. These companies are present in 10 sectors of the stock market, so we can select one stock from each sector, and our portfolio will consist of 10 elite securities.

But this is ideal when the DC presents a wide range of CFDs on shares. As a rule, the list of available tools is quite small, and there are even fewer aristocrats in it. I did a little analysis and selected for you the stocks that are the most common among the available instruments. These are securities represented by tickers KO, PG, WMT, MMM, JNJ, MCD, XOM and T.

Which dealing center should you choose?

So, since we come to technical issues, I will talk about some important points when choosing a dealing center. So, your DC must support CFD operations, and, of course, be reliable. For investments to be effective, it is better to open a swap-free account, because over the long term, swaps will take a fairly large part of the profit.

Another important factor is that your DC must pay dividends on CFDs. At first glance, these are not large amounts, but over time, due to the effect of compound interest, income from reinvesting dividends grows progressively. The effect of dividends on the growth of the trading portfolio can be seen in the graph below.

Other indicators, for example, commissions or deposits, are not particularly important to us, since we have a long-term trading strategy, and we will not have many transactions.

How to select securities

When the principles of forming an investment portfolio are clear, you can begin to fill it. The stage of analyzing and selecting papers takes the most time and requires painstaking work.

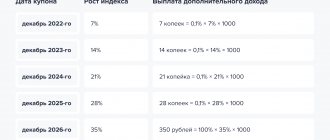

For example, when choosing a bond, it is important to take into account the size of the coupon, its type, maturity date, type of bond, credit rating of the company that issued the paper (issuer), and the key rate of the Central Bank. During periods of rising refinancing rates, you should not buy long-term bonds, as they may lose their attractiveness over time.

Exchange-traded funds can be compared based on fees, tracking errors, fund asset volumes, lot prices, and management companies.

When purchasing shares, you need to pay attention to several factors:

- the reputation of the company, the quality of its product, the state of the sector in which it operates;

- sufficiency of assets for the continuous operation of the company for the next 5-10 years;

- revenue and net profit, which should grow over the past few years;

- dividend policy, stability of payments;

- company performance—return on assets and capital. In general, the higher they are, the better, but each industry has its own standards;

- the amount of debt, its ratio to profit.

Portfolio analysis and its role in strategic management

Portfolio analysis

– this is the most important

strategic element of business

(SEB). It is a method by which a firm's strategic business units (SBUs) are analyzed collectively to identify the key activities that define the company's mission.

Portfolio analysis of a business gives a clear picture of the company’s field of activity and the interconnection of parts of the business, presenting it as a single whole. With its help, economic activity is identified and assessed, and the most promising areas are determined. Subsequently, this is where funds are invested, and investments in ineffective projects are reduced or stopped altogether. Portfolio analysis also makes it possible to assess the relative attractiveness of markets and the competitiveness of an enterprise in each of them.

The company's portfolio is supposed to be balanced, that is, there must be the right mix of divisions or products that need capital for growth with business units that have some excess capital. With the help of portfolio analysis, such important business factors as risk, cash flow, renewal and attrition can be balanced.

Types of portfolios

The structure of an investment portfolio largely depends on the owner’s willingness to take risks. Securities are conventionally arranged in the following order by increasing risk and, accordingly, profitability: government bonds (OFZ), corporate bonds, shares, derivatives (options, futures, forwards, swaps).

Depending on their attitude to risk, investors form different types of investment portfolios:

1. Conservative . Designed to maximize capital preservation and includes only the safest assets, such as bonds and gold. The share of blue chip stocks is about 10%. The owner expects to receive income in excess of deposit rates, usually from 4% to 7% per annum.

2. Moderate . Used by investors who tolerate a small degree of risk. Contains from 35% to 50% of shares, no more than 10% of which can be investments in startups or high-risk areas of the economy. The investor expects a profit of 12% to 20% per annum.

3. Aggressive . Involves a high level of risk and is almost 100% equities. Securities of large enterprises account for no more than 30%. The main share is distributed among fast-growing companies, for example, from the IT sector. Expected profit is about 45% per annum.

The goals of forming an investment portfolio also influence its format, for example:

- buying an apartment or car;

- pension savings;

- tuition fees;

- journey;

- creating a strong financial cushion.

The duration of the investment portfolio directly depends on the purpose of the investment. For example, a large purchase usually requires several months to a year of investment. Saving for retirement or building wealth for passive income can take decades. By term, we can distinguish types of investment portfolios:

- short-term (from one to 3 years);

- medium-term (from 3 to 10 years);

- long-term (from 10 years and above).

Jensen ratio

This measure is calculated using the CAPM (Capital Asset Pricing Model), in Russian it is also called the long-term asset pricing model.

Its essence is that the amount of required return on invested funds is determined not so much by the specific risk of the asset, but by the general level of risk of the entire market as a whole. The Jensen ratio ultimately calculates the excess return that a portfolio produces in excess of its expected return. This measure of return is called alpha.

Simply put, the Jensen ratio measures how closely a portfolio's return is related to the portfolio manager's ability to generate returns above the market average, taking into account risk. The higher the ratio, the better the risk-adjusted return. A portfolio with consistently positive above-expected returns will have positive alpha, and vice versa.

The calculation formula looks like this:

Where

PR=portfolio return CAPM=risk-free interest rate + β(market risk-free interest rate return)

Assuming the risk-free interest rate is 5% and the market return is 10%, what is the alpha of the following portfolios?

| Manager | Annual return | Beta |

| D | 11% | 0,90 |

| E | 15% | 1,10 |

| F | 15% | 1,20 |

Calculating the expected return of portfolios looks like this:

| ER(D | 0,05 + 0,90 (0,10-0,05) | 0.0950 or 9.5% yield |

| ER(E) | 0,05 + 1,10 (0,10-0,05) | 0.1050 or 10.5% yield |

| ER(F) | 0,05 + 1,20 (0,10-0,05) | 0.1100 or 11% yield |

Alpha is calculated by subtracting the expected return from the actual return:

| Alpha D | 11%- 9,5% | 1,5% |

| Alpha E | 15%- 10,5% | 4,5% |

| Alpha F | 15%- 11% | 4,0% |

Which portfolio and its manager showed the best results? Manager E was the best performer because, although Manager F produced the same level of return, E's expected return was lower and the portfolio beta was significantly lower than that of Portfolio F.

Important point: The assessment of return and risk for stocks and portfolios will change over time. The Jensen ratio requires the use of different risk-free rates for each interval. That is, to evaluate performance over a five-year period using annual intervals, you would also need to examine the annual return minus the risk-free return for each year and relate it to the annual return of the market portfolio minus the same risk-free rate.