Most traders are accustomed to thinking that Forex advisors are necessarily automatic robots designed for trading without human intervention. However, there is a certain cohort of advisors who are classified specifically as assistants, and not as automatic programs that open transactions offline. In this article we will talk about the “Trailing Stop” advisor, look at how to set it up, and how to use it in trading.

In general, the MT4 terminal has a trailing stop tool. It allows you to take a significant part of the price movement thanks to a floating Take Profit. But our Trailing stop advisor was created to automate the process of moving stop loss as the price moves.

Trailingator Forex advisor settings

Installing the Trailingator Forex robot is very simple. Move both files to Experts and restart the terminal.

It has quite a few settings:

- Trailing Stop – set the distance in points to the current price, behind which the Stop Loss will move;

- ProfitTrailing – this option is active by default. Therefore, the trawl will be activated only if the order is in the black;

- MagicNumber – if you set the value to “1”, then only those orders that were opened manually will be trailed;

- TrailingStep – sets the trawl step.

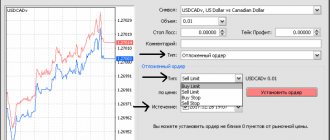

Here are the settings for the Trailingator Forex robot:

Figure 4. Setting up the Trailingator Forex advisor.

Kinds

The most common types of trailing stops are absolute and percentage. However, trailing is a flexible tool, and there are many other options. Let's go through some of them.

Absolute and percentage trailing

The first, trailing by absolute values, we looked at in the example above. The second, percentage trailing, corresponds to the name - the distance here is measured not by specific numbers (for example, $200), but by percentages.

Percentage trailing is considered more stable in the face of price fluctuations, which is important for traders playing in the volatile crypto market. However, it all depends on what goals the user sets for himself.

ATR Trailing Stop

This type of trailing is based on the ATR, and has been known in the forex market since the 1980s.

ATR is an indicator of market volatility. In Russian its name sounds like “Average true range”.

ATR is one of the most effective indicators for stop loss, so using it in trailing is the right decision.

The average true range is based on three metrics:

- the difference between the current minimum and maximum;

- the difference between the previous closing price and the current low;

- the difference between the previous closing price and the current high.

ATR Trailing Stop is part of a large group of trailing stops based on indicators. Among others, the most famous are trailing stops for fractals and parabolics. Both use similar mechanisms, so let's look at just one of them.

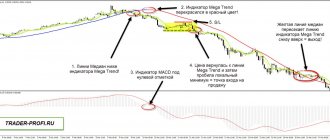

Parabolic trailing stop (PSAR)

Parabolic SAR, or simply PSAR, is an indicator similar to the moving average MA. Its peculiarity is the ability to change the position relative to the asset price. When an asset grows, it is located below prices, and when it falls, it is located above.

Example:

If a growing asset begins to decline, crossing the PSAR line, then a “reversal” of the indicator occurs. During a reversal, the indicator moves exactly to the opposite side of the price.

A PSAR reversal signals the end of the previous trend, in this case an uptrend, and the transition to a correction phase.

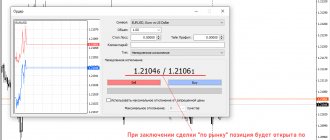

In MetaTrader 4 (MT4) and other programs used by traders, there are only two settings for parabolic trailing:

- Distance Points: sets the distance for the stop loss;

- Allow Loss: optional. If you enable this option, the trailing stop will continue to move even in a losing market.

Read more: Parabolic SAR - theory and practical application of the indicator.

When is it appropriate to use

Using a trailing stop order is effective when a trader cannot constantly monitor the movement of quotes online. In this case, it is advisable to use trailing in conjunction with take profit. Then, even if the target level is not reached, most of the profit on the transaction will be retained.

If a player monitors the market manually, he will be able to quickly react to the appearance of a reversal signal, but here the human factor comes into play. In many cases, trading automation is preferable to manual control.

Trailing stop works well in a trending market with high volatility. When quotes change by 3-5% per day, there is no point in trying to catch the price peak or bottom of the market. The main thing is to take the most part of the movement, while reliably controlling the risks.

A trailing stop is also appropriate when trading inside channels. In this case, the order must be placed so that it is triggered when the trend line that forms the price channel is broken.

- An example of using trailing on news:

How does a Trailing Stop order differ from a regular Stop Loss?

Having understood what a Trailing Stop is in Forex, let’s consider the order of its placement.

1. Find in the “Terminal” table in the “Trading” tab an open position to which we want to assign a Trailing Stop. 2. Right-click on this line and find “Trailing Stop” in the context list. 3. In the new context menu, select the trailing stop value from those proposed. We can also enter it ourselves by clicking “Set level”.

As you can see, it has a different installation method, but this is not the main distinguishing feature from the usual Stop Loss. Firstly, a trailing stop is an algorithm for moving a stop loss after the price. Secondly, in contrast to standard stop orders, it works not on the server, but in the trading terminal, so it is relevant only when MetaTrader 4 or MetaTrader 5 is enabled.

IMPORTANT!

If a stop loss has already been set using trailing, when you turn off the terminal it will protect your transaction, but will not move behind the price. If a stop loss has not yet been set according to the trailing conditions, then when you turn off the terminal, your transaction remains unprotected.

Cryptobots for working with orders

The following trading bots work with a trailing stop:

- RevenueBOT - the order will not be placed immediately after the primary order is executed, but when the distance condition is met. If this condition is not met, Take Profit will not be set. That is, first you need to specify the activation price; when it is reached, the process of monitoring the current price on the exchange is activated, followed by placing an order. In addition, it is necessary to indicate in percentage the following distance of the current price, the value of which will be compared with the difference between the maximum/minimum price.

- GUNBOT - it is possible to trade on several pairs from the list, for each of which you can set individual settings. Trading using signals from TradingView is also available.

Psychology of trailing

Important points:

- Trailing stop is a tool that protects the trader from losses. This removes the feeling of uncertainty and anxiety, which is why trailing is in such demand.

- Beginners believe that their losses are irreparable, and not everyone is ready to fix the loss on their own. The more unprofitable a trade is, the more difficult it is to close it due to the trader’s desire to “win back.” In this case, trailing also comes to the rescue.

- If you couldn’t avoid unsuccessful transactions, then a little advice: allocate only a few percent of your deposit for each operation, so that it is easier to “say goodbye” to the minuses.

- The ability to rely on the system and stop constantly monitoring the market is not just a nice bonus to trailing. This also helps to protect the trader from unnecessary decisions that he may make on emotions, constantly watching the market and wanting to withdraw profits as quickly as possible.

- And in order to feel even more confident, it is better to first figure out what trailing distance is more comfortable for you, taking into account your temperament and risk appetite (or lack of such inclinations).

When is it appropriate to use Trailing Stop?

We have dealt with two nuances of Trailing Stop: what this algorithm is and how it works. Now let's look at the cases in which it should be used:

1. In case of high volatility, when quotes change quickly and the power reserve is unclear. Here, a trailing order allows you to take the maximum from the directional price movement and timely fix the result in the transaction when the quotes reverse. 2. When trading on economic news. Again, due to increased price dynamics. In addition, such a surge, as a rule, does not last long (no more than a few hours, or even less), so it is quite possible to keep the terminal open while watching the movement of the trailing stop. 3. In some scalping strategies.

It is worth noting that the operation of a trailing order only when the terminal is turned on is a serious inconvenience for long-term transaction support. To overcome it, various advisors have been created that work on the trailing stop principle.

Analysis of their testing on historical data did not show any significant advantages compared to installing protective stop loss and take profit orders.

Automation

To automate work and ensure greater reliability, robots with support for trailing stops are used. For the Binance exchange, Signal helps automate the installation of the tool.

For the securities market, some robots are integrated with MetaTrader and QUIK terminals.

QUIK is a trading terminal with access to national exchanges: London Exchange, Moscow Exchange, Ukrainian PFTS and others. Most popular in Ukraine and Russia.

Feature of QUIK: the presence of its own QPILE language, with which you can program trading robots.

Trading advisors are popular in the market today. The difference between advisors and robots is that the former only gives recommendations to the trader, leaving the right of choice to him, while robots make decisions instead of the user.

Whether you use hints, rely only on your own experience, or trust robots, it will be useful to learn about the disadvantages of trailing. And even such a reliable tool has them.

Flaws

The trailing stop was created primarily for ideal trends - that is, a completely stable movement up or down, which is not so often observed in the volatile cryptocurrency market.

Using trailing, an investor can protect himself from losses. At the same time, trailing, which is “caught up” by prices, can lead to the trader receiving less profit than expected.

We looked at the advantages and disadvantages of trailing from a “technical” point of view. But the human factor in trading plays an equally important role.

About us: Admirals

Admirals is a global, award-winning, regulated Forex and CFD broker offering trading in over 8,000 financial instruments on the most popular trading platforms in the world: MetaTrader 4 and MetaTrader 5. Start trading today!

This material does not contain, and should not be construed as containing, investment advice, recommendations or an offer or solicitation for any transactions in financial instruments. Please note that such trading analysis is not a reliable indicator for any current or future trading as circumstances may change over time. Before making any investment decisions, you should seek the advice of independent financial experts to ensure you understand the risks.

Separating positions using a trailing stop

When opening several positions, you can set a trailing stop with different parameters depending on volatility and timing. Thus, for high-risk positions, the time frame method or Fibonacci ratio is suitable, and for pairs with moderate volatility, the moving average method is suitable. Such diversification will balance the risks and allow you to get maximum profit.

For example, the GBP/USD pair is characterized by serious pullbacks, so it is advisable to set a trailing stop between the take profit and the expected rollback using the Fibonacci ratio. And for the USD/JPY pair, which is characterized by moderate volatility, it is more convenient to use the moving average method, as shown in the figure above.