Nadezhda Zakharova 07/06/2019

1 comment

Recently, ICOs have been in high demand among investors.

This is due to the fact that users want to take part in the development of interesting projects and receive certain benefits from this.

As a result of the ICO, investors receive tokens, which can then be used within an existing project or sold at a higher price if the ICO is successful.

But what about those who want to do something interesting and useful, but do not have enough funds for this?

You can launch your own ICO. The article describes how to carry out this procedure and what to pay attention to.

What is ICO

Initial Coin Offering – initial coin offering. This is something in between crowdfunding and IPO (Initial Public Offering - an initial public offering from the world of securities).

As part of an ICO, companies usually raise money for the development of a particular technology, as well as for brand promotion to increase its awareness.

Ethereum can be considered the first successful ICO in history. It was carried out back in 2014. The company managed to attract 35,591 bitcoins. At the same time, more than 60,000,000 units of Ethereum were transferred to users. Today, each coin costs more than $800, the benefits for investors are obvious. And for the company it is also clear.

go

Where to begin

The first thing to do is to think through and formulate the idea correctly.

Moreover, this can be done immediately on specialized forums, where the project team or its representative will subsequently be able to look for investors.

All ICOs are somehow related to blockchain technology. Accordingly, the idea must be completely within the framework of this concept.

If you look closely at those ICOs that have already taken place and brought some success to their team, they were either talking about some kind of innovative technology, or about a project that made it possible to significantly speed up transactions and reduce transaction costs on the blockchain network.

It is important not only to come up with something interesting and unique, but also to properly format the idea so that it can be gradually launched on the relevant forums and checked the reaction of users.

go

The cost of bringing an idea to a token sale

Now a little about how to make a financial calculation and how much it costs to conduct an ICO. No one will tell you the exact amount, since there are too many variables in this matter. The cost of a relatively simple project depends on the qualifications of the team and, according to some data, can fluctuate within such limits.

- 100-150 thousand dollars - if the team has specialists who can handle the technical part. In this case, the breakdown is approximately this: 100 thousand USD – writing the technical component, 20 thousand – legal and organizational support, 10-30 thousand – bounty campaigns and marketing.

- 200-300 thousand dollars - if there are no strong programmers, and you need to seek outside help from specialized companies.

If the initiative is larger-scale and technically complex, is not related to the current activities of the company and is being implemented from scratch, then the price tag can be up to 500 thousand and even up to 1 million USD. Therefore, in order to properly promote a project going to a token sale, you should consider options for uninterrupted financing.

Reviews and discussions

Platforms where you can open an ICO (create your own blockchain project)

- Ethereum;

- OmniLayer;

- NextCoin;

- NEO;

- CounterParty;

- Waves;

- Nem.

go

Competitor analysis

Sometimes you don't need to invent anything to achieve success.

Just look at how competitors implement this.

Almost every day new ICOs appear and websites are launched.

It is recommended to carefully analyze them and select something interesting from there that could be implemented in your own project.

Another important point is the uniqueness of the proposed technology. It is quite possible that one of our competitors has already implemented something similar. In this case, the task becomes somewhat more complicated, since a similar project is already on the market. It is necessary to find vulnerabilities in competitors and try to describe as much as possible the advantages of the technology that the team offers, but taking into account amendments.

go

Whitepaper preparation

The main document of the project is the Whitepaper, which should be of interest to investors. Its development is very important, it takes a lot of time and often requires the involvement of additional specialists. The document describes in detail the essence of the initiative, the time for its implementation and the necessary investments.

It is important to describe all technical nuances in detail so that experts do not suspect you of unprofessionalism or fraud. It is advisable to place a video at the beginning of the Whitepaper, after watching which the investor can immediately decide whether this topic is interesting to him or not. If possible, create slides, tables and diagrams for all key points; they will catch the investor’s eye. The services of an organization that can professionally proofread a document and point out its weak points would also be useful.

The standard document structure includes the following sections:

- Background – the emergence of an idea.

- Introduction – the possibility of using this blockchain product in the described market.

- Market Analysis – an analytical overview of the market, the presence of competitors and a forecast regarding the occupation of your niche and potential growth.

- Introduction to product – a specific description of the product or service being offered.

- Product specific section – additional materials that more fully reveal the idea (tables, graphs, economic calculations).

- Technical – the most complete descriptions of the technical features of the product.

- Use cases – the possibility of using the product in practice.

- The pre-ICO – is compiled in the case when a preliminary fundraising is carried out.

- The ICO is the financial aspect of the undertaking, real ways to make a profit and benefits for the investor.

- Roadmap of development – a step-by-step list of tasks (already completed and planned) with approximate completion dates.

- Financial Projections – cost areas (development, salaries, Bounty campaigns).

- Team – presentation of the project initiators, team and partners, indicating their experience and successful endeavors.

- Conclusion – general conclusions about everything mentioned above.

It is also recommended to provide step-by-step instructions (tutorial) on important issues that can cause difficulties (methods for purchasing tokens, transferring funds from different wallets, etc.). It is considered good practice to create and regularly update a “FAQ” section, where frequently asked questions will be answered. Here you can place links to your pages on popular social networks.

Creating a team

The success of any ICO is a team effort.

At first glance, it may seem that only those who proposed the idea and those who implemented it, that is, programmers, work here. However, such a team has practically no chance of success.

If the project really wants to make a statement, in addition to programmers, it is also necessary to gather those who understand marketing, including SMM, copywriters, designers and consultants.

Naturally, all team members must have fairly serious training in terms of knowledge in the field of blockchain technology. The same copywriters who are poorly versed in the topic are unlikely to create the required effect. On the contrary, they can only scare off potential investors if they see amateurism.

Most likely, members of the new team will want to receive some kind of advance. To do this, you can use your own funds or make a closed pre-sale (Pre-ICO). The second option is preferable for those who are not ready to make capital investments. However, it requires certain costs.

For pre-sale, you will need at least a presentation, or better yet, a ready-made website.

In addition, the founder of the project must have communication skills and already at this stage try to sell the product to as many investors as possible.

The fact is that the latter take a lot of risks at this stage and are unlikely to agree to part with money if they do not see specific prospects for the project.

go

Risks for investors

ICOs are not regulated at the legislative level, although a number of countries are already making attempts to correct this situation. In the United States, for example, there have been cases where, after an ICO, the financial regulator SEC ordered companies to return all funds received back to investors.

Therefore, investors investing in ICOs face the following difficulties:

- Tighter regulation by regulatory authorities may lead to the investment not being justified;

- the activities of a startup’s management cannot be controlled, so most ICOs are a regular scam;

- By buying tokens, investors cannot influence the company’s decisions, so if there is a change in the course of development that they do not agree with, they will have to put up with the situation.

To summarize, in the event of a negative scenario, investors have nowhere to look for justice, since the legislation does not contain rules protecting the rights of investors in ICOs.

Company registration

You can assemble a team, analyze the market, and conduct a pre-sale without official registration.

But it will be needed later.

Therefore, when all these steps are behind us, it is necessary to pay attention to those regions where the attitude towards cryptocurrencies is the most loyal.

There are not many countries like this. These include Singapore, UK, Switzerland, Hong Kong, Cyprus, USA and Japan. True, the last two countries are a rather risky option. Japan already regulates the cryptocurrency market. As for the US, if coins are recognized as securities, this will create great difficulties for any company operating in this area.

go

Where is the token sale taking place?

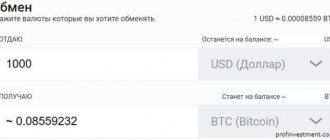

You can conduct an ICO of a cryptocurrency or product on special blockchain platforms. The platform serves for issuing tokens, purchasing them by investors for cryptocurrencies, converting cryptocurrencies into fiat currencies to pay for necessary work. The most famous platform is Coinlist, which selects projects as strictly as possible. Among the second echelon we can highlight DuckDAO.

To create their own tokens, they usually use ready-made blockchains. They are usually done in the following networks.

- Ethereum. It has been operating since 2015, serves for the exchange of resources and makes it possible to organize an ICO smart contract. It uses its own digital coin, Ether, whose capitalization exceeds 67 billion USD. A number of specialized applications operate on the platform (platform for crowdfunding, decentralized investment fund, Backfeed platform).

- Waves. Using this platform, operating since 2016, you can raise money both for projects related to IT technologies and for initiatives from the real sector of the economy. This resource was created to raise funds for startups through the ICO procedure; it does not require smart contracts and is suitable for beginners. Capitalization – $550 million.

Another important issue is the jurisdiction for the ICO. When conducting it, a number of legal problems may arise due to the transfer of money in different currencies and from counterparties in different countries. There are also difficulties with taxation and currency legislation. Therefore, legal support for ICOs should not be relegated to the background; you can hire a consulting company for this. When choosing a place of jurisdiction, you need to pay attention to the following points:

- whether operations with digital currencies are prohibited by state legislation;

- fiscal policy and taxes;

- expenses for processing the necessary documents;

- complexity of procedures and general business climate;

- maintaining confidentiality.

It is not recommended to register in countries such as Romania, Iceland, China, Kyrgyzstan, Taiwan. It is best to attract investments using the token sale method in Singapore, Hong Kong, Canada, USA, Malaysia, Estonia, Great Britain, and Japan. Russia today is not the best option, since the legislation on this issue is not regulated.

Preparation of documents for ICO

In order to attract the maximum number of investors, it is necessary to correctly draw up all the documents and white paper, which is the “face” of the company.

Here the goals and objectives of the project, its prospects are usually written down, and technical explanations are given.

The more details are revealed, the higher the chances of collecting the required amount.

In practice, there have been many ICOs with good advertising, but the investor gradually learns and pays more attention to the documents, and not to advertising. Competitors can help in this process. It is enough to study their white paper to understand what is generally written in such documents and get an almost ready-made structure. The fact is that this documentation is prepared almost according to a template. But the content is, of course, completely different.

Some recommendations for preparing a white paper:

- Structure. The document must be clearly structured. Otherwise, investors will find it difficult to read and are unlikely to invest money.

- Argumentation. When preparing this document, it is necessary to provide a competent argument. The investor must make sure that he is investing in a potentially successful project.

- Maximum accessibility for the reader. Among the investors there are both very technically literate users and those who have never heard of blockchain or cryptocurrencies before, but want to invest money in this promising industry. Accordingly, all texts should be prepared in the most understandable language for a wide audience. If the investor does not understand anything from what he reads, the likelihood that he will bypass the project is high.

- Text volume. Another important point. The investor wants to receive as much information as possible, but in the most optimized text possible. Large volumes are intimidating. Therefore, if there is no need, it is not worth increasing this or that section of the whitepaper simply in order to create the appearance of its importance.

- Required editing. High-quality semantic content of a whitepaper is 80 percent of success. But if the text is illiterate in terms of Russian or English, there is a chance that investors will leave. Especially if the project is more aimed at an English-speaking audience.

go

Product Description and FAQ

When preparing a company, you should focus on “speaking out” the idea - describing the product in the White Paper. This is the fundamental document of the ICO, and the more complete and voluminous it is, the better. The description is complex, it takes a long time to prepare, using the help of experts, but the costs of engaging them are not unnecessary. Perhaps the entire document will be read by a few of the most meticulous investors, but information about errors and inconsistencies in the White Paper will quickly become known to the public.

Criticism from crypto enthusiasts, whose opinions carry weight, can seriously damage a marketing campaign, so much so that it has to be started all over again. Therefore, read carefully:

- background and description of the product - where it started and what its essence is (briefly);

- analysis, description, market growth potential, applicability of the field of activity to blockchain (not all companies make sense to launch an ICO);

- description of competitors;

- detailed information about the product - technical aspects, application practice, graphs, tables and figures;

- conditions for investors, preliminary attraction of investments for the withdrawal of the company and the purposes for which they will be spent;

- “road map” - the timing of the ICO, what has been accomplished and what is planned to be done;

- clearly formulated findings and conclusions.

To make it easier for potential investors to read the document, illustrate it with infographics, pictures, and highlight important blocks. It is worth resorting to one-time expert support - proofreading a White Paper usually costs $300-400 per hour, but you will quickly receive a guaranteed high-quality description for the ICO.

Before organizing a marketing and PR campaign, take care of the FAQ section with full answers and tutorials with step-by-step guides on performing complex actions - working with your personal account, receiving tokens, transfers from wallets. This is “good form” for an ICO, and the more questions you reveal, the more content you will have for communication channels and the higher the loyalty of investors.

Advertising Aisio

As you know, “advertising is the engine of progress.” This is especially true when it comes to ICOs.

The fact is that investors themselves are unlikely to know that there is some team that has developed an innovative solution in the field of blockchain and is offering participation in the project.

The team should have a strong PR person or even several such employees who will present the product on various platforms, including the so-called ICO trackers.

These are sites that collect information about the initial coin offering and, if the project inspires confidence, post it and recommend it to investors.

The main goal of the PR campaign is to reach the maximum number of users and present the project in the best possible light. There are cases where Aisio's goals were achieved in less than a minute.

Some ICO experts highlight website creation as a separate stage. Yes, this is really necessary. But most likely, it should be ready immediately after the company is registered.

The resource should initially contain all information on the product, as well as the development team. As documents appear, a white paper, an offer, and so on will also appear here.

The website will play a big role in the advertising process, as it is a kind of “magnet” that collects investors.

Accordingly, the web resource must be impeccable both in terms of design and in terms of filling with useful content.

Bugs, poor page loading speed and other negative aspects must be eliminated even before the official launch of pages on the Internet.

As part of the advertising campaign, as well as subsequent project activities, it is necessary to create pages on social networks and ensure that the content there is constantly updated.

At the present stage, many projects are implementing their bounty campaigns. This is an incentive for active users to promote their brand. The fact is that it is no longer possible to cope with the active promotion stage with the help of one team, especially when the goals are ambitious.

go

Website, newsletter and social media

Before running an advertising campaign, you will have to create a starting platform for it - the ICO website. One-page landing pages are the most convenient; it’s easy to get acquainted with the information in them. Check that the landing page is displayed correctly on all devices. If your advertising campaign is large-scale, consider hosting requirements. It must withstand a sharp surge in traffic at the start of sales, DDos attacks, spam phishing links and other threats.

Check whether all the necessary sections are on the site - among them:

- descriptive block for the product, subscription form;

- “road map”, preferably with a quarterly breakdown of stages;

- information about the founders, team - photo, biographical information, links to accounts on social networks;

- documents and cases;

- information about partners;

- contacts - including social media.

It is worth adding videos about the project and a newsletter subscription form to the site. Subscribers should receive news, safety content, and step-by-step guides. Send reminders about the date and time of the start of investments at certain intervals, a month, a week, a day before the start.

Launch of ICO

After the release of tokens, you can launch an ICO.

The success of this campaign depends entirely on how well the preparation was carried out.

There are some points that will allow you to collect investments faster. In particular, you can limit the number of coins.

This is a standard advertising technique. But there is also a logic here. Usually the project states exactly how much money it plans to raise. Therefore, further release of coins may be met with distrust by investors.

The second method is the redemption of part of the coins by the organizers. On the one hand, this will speed up the fundraising process, as it will create the appearance of demand for tokens; on the other hand, if the ICO is successful, team representatives will be able to receive additional bonuses in the form of profit from the resale of tokens on the exchange. Finally, you can use a bonus system to reward early investors.

go