The daily functioning of any organization involves the performance of actions that act as generators of multidirectional transactions. The vector can be different, depending on the specifics of a particular operation, and, as a result, increase or decrease the current balance of the enterprise. To control income and expenses, a variety of analytical tools are used, allowing not only to track actual receipts and payments, but also to predict future profits and losses, assessing their impact on the company’s position. One of the significant indicators, from the point of view of assessing profitability, is operating cash flow, which characterizes the financial condition and creates the conditions necessary for making competent management decisions.

General overview

In accordance with the concept adopted within the framework of scientific doctrine, OCF (or OCF - operating cash flow) is a set of money received by an organization as a result of its core functionality. The methods used to analyze the current economic situation and overall liquidity of the enterprise are relevant both when considering potential projects and for operational management. A high level of value reflecting cash flow from operating activities indicates opportunities for business diversification, investing in the development of new products, reducing debt obligations, and paying dividends to owners and shareholders. On the contrary, a low, permanently negative indicator indicates that the company needs to constantly attract borrowed resources to allow it to stay afloat.

In accordance with the established classification used by experts and analysts, it is customary to distinguish three streaming categories:

- Investment funds aimed at developing the enterprise.

- Cash flow from core operating activities.

- Financial activity, including the formation and repayment of loans and debt obligations, issue of securities, etc.

Their combination creates a pure analytical value, the so-called NCF (Net Cash Flow). ECT, in turn, is considered as the ratio of income and expenses directly related to the operation of the company, and used, among other things, to pay off most of the debts.

We can say that this indicator reflects the profitability of the enterprise more accurately than the conditional rate of profit, and is suitable for assessing not only the quantity, but also the quality of income items. It is no secret that for some organizations the practice of “aggressive accounting” is common, when, despite the formally high turnover, there is constantly not enough money in current accounts. Potential investment risks should be assessed in advance to avoid unpleasant consequences. By conducting an OCF analysis, you can understand whether the external image of a successful business really corresponds to reality, or whether management is simply trying to put on a good face on a bad game.

Cash flow of operating, investment and financial activities

Direct and indirect reports:

- The direct report contains information about cash flow by item;

- An indirect report contains only final data without clarification;

The Cash Flow Statement is divided into three components:

- Operating activities (operating cash flow, CFO);

- Investment activity (cash flow from investing, CFI);

- Financial activities (cash flow from financing activities, CFF);

Based on this, you can rewrite the formula for net cash flow as follows:

CHKF = CHKFO + CHKFI + CHKFF

Where:

- CHKFO – total flow from operating activities;

- CHKFI – total flow from investments;

- CCFF – total flow from financial transactions;

1 Operating is the flow of profits and expenses from a firm's core business.

Formula for calculation:

[Operating Cash Flow] = [Net Income] – [Depreciation] – [Interest on Loans] – [Income Tax]

What is included in operational activities:

- Receiving revenue from the sale of goods and provision of services;

- Payment of bills;

- Calculations with the budget;

- Payment of wages;

- Obtaining short-term loans and borrowings;

- Repayment (receipt) of interest on loans;

- Payments of income tax;

Operational risks:

- Commercial;

- Tax;

- Inflationary;

- Foreign exchange;

- Decrease in financial stability;

- Insolvency;

- OIBDA indicator;

2 Investment is the money received from securities, as well as the costs of investments.

What is included in the receipts:

- Sale of fixed assets, intangible assets and other non-current assets;

- Sale of shares of other companies;

- Repayment of loans;

What is included in the outflow:

- Acquisition of fixed assets, intangible assets and other non-current assets;

- Purchase of shares and debt instruments;

- Lending;

Risks of investment activity:

- Inflationary;

- Decrease in financial stability;

- Insolvency;

3 Financial - these are all large monetary transactions (loans, dividends, share repurchase). Can be classified based on the following parameters:

- Directions;

- Scale;

- Time of operations;

- Determination method;

- Level of sufficiency;

Receipts include profits from the issue of shares or other issues of securities (bonds, bills, mortgages, loans).

Risks of financial activity:

- Credit;

- Percentage;

- Deposit;

- Inflationary;

An example of a Sberbank Cash Flow report by year:

Key points

The income portion of cash flow from operating activities consists of funds received as revenue for goods sold or services provided related to the main profile. But the cost category includes several types of expenses, which include:

- Payment transactions related to the organization of production processes - from the purchase of consumables to payments for the supply of energy resources.

- Employee wages, which are taken out of brackets in certain methods.

- Administrative and economic costs, including rental, insurance, and other payments.

- Advertising budgets, tax fees and deductions, repayment of loan obligations.

Adjustments made after deducting expenses from the period's income allow us to isolate the net cash flow from operating activities - this calculation formula, which determines the final OCF indicator, is based on data from the statement of cash flows (CFS).

What is Cash flow in simple words

Cash flow (from the English “Cash flow” - “cash flow”) is the totality of cash in a company, which includes all inflows (profit) and outflows (costs). Compiled according to approved form No. 4 (form code according to OKUD 0710004).

To determine a company's performance, cash flow can provide a lot of useful data for investors. The most commonly used simple indicator is “net cash flow”:

Net cash flow (from the English “Net Cash Flow”, NCF) is the difference between receipts and expenses in a particular period. This value can be either positive or negative.

Net cash flow formula:

NCF = ∑CFi+ - ∑CFj-

Where:

- CFi+ - receipts to the company’s account;

- CFj- — debits from the company’s account;

A positive NCF value means that the company is doing well: there is free money, which means the business is working in plus.

Well-known investor Warren Buffett considers the Cash Flow indicator to be one of the key indicators when evaluating a company's shares.

- Free Cash Flow - what is it;

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

Understanding financial significance

The analysis of the criterion under consideration, which characterizes the liquidity of an organization, its economic stability and development potential, seems significant for many reasons. First of all, it provides the opportunity to check the receipts and expenditure of resources, take measures to increase incoming volumes, as well as maintain a stable situation that excludes the critical influence of external and internal negative factors.

Detailed information on how the operational flow of payments is formed is contained in the ODDS reports included in the structure of quarterly and annual reporting. OCF characterizes the potential for generating additional financial traffic resulting from core activities. A positive balance indicates successful management and is an objective indicator, as significant as net profit or EBITDA.

Cash flow statement

Standard reporting for an organization involves the use of three key analytical tools, which include the balance sheet, analysis of profitable and unprofitable items, and cash flow accounting. The structure of the latter is formed from three elements: operating, investment and financial flow, the totality of which details all sources of income and channels of expenditure, as well as changes in indicators in selected periods.

When considering the investment section, the costs associated with the enterprise's acquisition of fixed or long-term assets, the use of which is planned for an extended period of time, and are associated with supporting core activities, are taken into account. Incoming receipts arising from the partial sale of the company's funds are also subject to accounting.

Within the financing category, the key criteria are the sources of cash injections, the company's capital, maintenance costs and loan payments. The income structure also includes income resulting from the issue of securities and IPO - public offering of shares on the stock exchange, sale of bonds, payment of dividends or interest on loans, since all of these actions are characterized as financial activity.

Studying ODDS from the investor’s perspective allows us to determine the main channels of inflow and outflow. It is important to consider that inflow from operating activities is a key factor. It is this that is a priority for the organization and is of a permanent nature, while financing and investment are usually not systematic tasks and are implemented mainly from time to time.

FCFF (Free Cash Flow to the Firm) indicator

The “Free Cash Flow to the Firm” (FCFF) indicator literally translates as “free cash flow of a firm” - this is cash flow minus taxes and net investments in fixed and working capital.

The formula for a firm's free cash flow is:

FCFF = EBITDA × (1-Tax) + DA - CNWC - CAPEX

Where:

- Tax — income tax rate;

- EBITDA - earnings before interest and tax;

- DA - depreciation of tangible and intangible assets (Depreciation & Amortization);

- CNWC - change in net working capital;

- CAPEX - capital expenditures (Capital Expenditure);

Cash flow can be calculated using the following types of prices:

- Current;

- Forecast (take into account inflation and forecast of production levels and other factors);

- Deflated (taking into account inflation at current prices);

Discounting Cash flow

Since money depreciates every year, the cash flow today is not as solvent as tomorrow. To make adjustments to the future value of money, a cash flow discount factor is used:

CF = 1/(1 + DS) × Time

Where:

- DS – discount rate;

- Time – time period;

I recommend checking out:

- Discount rate - formula;

Calculation methods

To determine numerical indicators, various methods can be used, but the most common among them are direct and indirect methods. They differ from each other in several parameters, including the specifics of the source data reflecting the movement between current accounts. It is worth noting that in this case, criteria not taken into account in the process of determining profit are also taken into account, such as depreciation, amortization, tax deductions, capital expenditures, as well as debt and penalty obligations.

Direct method

To get the desired result, the company needs to register all cash transactions associated with receipts and deduct from the resulting amount of revenue the costs that arose in the process of supporting core activities. Expense items include cost of goods sold, payroll, rent and utilities, and interest payments. In turn, total income may also include money received as a result of third-party activities: both investment and financial in nature.

OCF is operating cash flow, the formula for which is straightforward to calculate. As an example, we can take a conditional organization, the work of which in the reporting period is characterized by the following indicators:

Income:

- revenue - 700 thousand rubles;

- sale of bonds - 50,000.

Expenses:

- rent - 45 thousand.

- Payroll - 120,000.

- social contributions - 40,000.

- purchase of products - 330 tr.

Thus, the gross cash flow will be 215 thousand rubles. (700+50-45-120-40-330).

Indirect method

In this case, the basis of the methodology is the calculation of the net profit value, and the calculation is carried out in the reverse order, allowing one to determine the value of the monetary base. Sales revenues are taken into account as they are received, but are not always associated with actual crediting to current accounts. This is a more complex method, but it allows you to get a clear understanding of the specifics and effectiveness of the business, even in cases where the organization is one of the most complexly structured. In particular, the indirect method is used by public companies in the process of forming ODDS.

To “clean” profitable indicators, not only expense items are subtracted from the amount, but also other income, including those related to the enterprise’s third-party activity in the investment market. In addition, the costs include related expenses that are not related to the monetary category - depreciation of fixed assets, depreciation, accrued taxes. The growth or reduction in the volume of inventory, accounts payable and receivable, calculated in relation to the previous period, are also subject to accounting.

Let's consider an example of an indirect assessment of OCF for an organization that did not receive income from investments, whose profit for the reporting period amounted to 200,000 rubles. The applied adjustments are as follows:

- +35,000 - depreciation and amortization of assets;

- +20,000 — deferred tax payments;

- -30,000 — increase in accounts receivable;

- +10,000 - reduction of debt obligations on the loan.

Thus, the total amount of edits is +35,000 added to the original value. The final CCT figure will be 235,000 in net terms, which suggests effective business management in terms of revenue generation.

Direct and indirect method: which is better to choose for calculating operating cash flow

The preference for the second option, characteristic of most accountants, is determined by the ease of obtaining the necessary information from the standard reporting of the enterprise. Many companies use the accrual method, so in the profit and loss analysis you can take the values required for substitution into the formula using the indirect method.

It is worth noting that the American Accounting Standards Board (FASB) in its recommendations indicates the advisability of using the direct method, stipulating it with a more detailed representation of the movement of funds in both directions. At the same time, an additional requirement is the disclosure of the reconciliation of net income and OCF, which must also be reflected in the reporting form. This procedure makes it possible to determine the accuracy of the indicators, and is implemented in a manner similar to the indirect method, starting with the presentation of profitable items, to which adjustments are subsequently applied to take into account changes in balance sheet transactions and the state of accounts.

Calculation formula

So, generalizing the methods for determining the analytical value, we can imagine the following options. An option specific to an indirect method would look like this:

OCF = net income + depreciation + non-recurring adjustments + changes in opening debt, working capital, internal liabilities and inventory.

The second option is EDP = B + AVP + PVP - FOT - SMC - PRVOD - NALPL, where:

- B - the amount of revenue received from the sale of goods, provision of services or performance of work;

- AVP - advance payments received from clients and customers;

- PVP - other incoming receipts;

- SMC - funds used to purchase goods and material assets necessary to support production processes;

- NAPL - tax payments and social contributions;

- Payroll - the amount of wages to staff;

- PROVOD - other payments.

Let's look at the indicators used in more detail.

Net profit

The required value is taken from the organizational income and loss statement. Formally, it is an accounting metric, the structure of which contains elements that do not affect current assets, which necessitates the need to make changes to the flow figures.

Depreciation and amortization

A gradual decrease in the value of tangible assets associated with their operational wear and tear reduces the value of the previous criterion within the framework of similar reporting. At the same time, in the ODDS the parameter is used as an adjusting one, since it relates to costs that are not directly related to the monetary category.

One-time adjustments

Also extracted from the cash flow report. Various related expense items may be included in the structure, including deferred taxes, gains and losses from investing activities, etc.

Changes in working capital

The difference between assets and liabilities, any deviations from the underlying value have an impact on OCF. Adjustments to the structure are reflected in the reporting. Thus, the acquisition of assets by an organization leads to their increase, but inevitably affects the amount of net profit, which is the main criterion - since there is an actual reduction in the money available to the business.

A similar result is observed with an increase in accounts receivable that accompanies an increase in sales volumes - a situation arises in which part of the registered income has not yet been paid by customers. But growing accounts payable, despite increasing debts, leads to an increase in the funds available for disposal.

Free Cash Flow. What is it and how to count it

Almost all companies in their presentation of financial results for the reporting period indicate such an important indicator as “free cash flow”. Understanding how it is calculated and what it is used for is essential for every investor.

What is FCF

By definition, FCF (Free Cash Flow) is the cash for a certain period that a company has after investing in maintaining or expanding its asset base (Capex). It is a measurement of a company's financial performance and health.

There are two types of free cash flow: free cash flow to the firm (FCFF) and free cash flow to shareholders (FCFE).

Free cash flow (FCF) is the cash flow available to all investors in a company, including shareholders and creditors.

This indicator is not a standardized accounting indicator, i.e. you won't be able to find it in the company's reporting. Company management can calculate FCF separately and uses it to visualize the company's financial position. Most often, the calculated FCF can be found in a company presentation, press release, or management's analysis of the company's financial condition and results of operations (MD&A).

There are 3 main methods for calculating FCF

The choice of calculation method depends on how deeply you want to analyze the company’s cash flows and on what data the indicator is calculated (historical or forecast).

Method 1 is the simplest, designed for the initial assessment of the company’s cash flows based on actual data:

FCF = Net cash flows provided by operating activities - capital expenditures (Capex).

That is, from the money received during the period from core activities, we subtract capital costs for maintaining or expanding production.

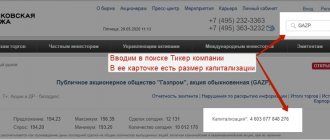

Let's calculate free cash flow for the first quarter of 2022 using an example.

We can take all the calculation values from the company's cash flow statement.

We can find capital expenditures in the investment activity report. In this case, they consist of two articles - Acquisition of fixed assets + acquisition of intangible assets.

(The figure corresponding to the line in the reporting above is signed in brackets).

Method 2 is more complex, which reveals in more detail the reasons for changes in free cash flow:

FCF = EBITDA - income tax paid - capital costs (Capex) - changes in working capital (NWC, Net working capital change)

That is, we clear the “dirty indicator” of cash flow (EBITDA) from taxes and changes in working capital. Please note that the calculation takes into account the actual income taxes paid, which are reflected in the company’s cash flow statement. This is due to the fact that FCF shows real money that remains in the company, while paid and paper taxes can diverge several times.

In terms of change in working capital, a company must maintain net current assets each period to carry on its operating activities. If it wants to increase revenue, it will be forced to increase working capital, which in turn requires raising additional cash from operating flow to purchase additional assets.

The change in working capital is also taken from the statement of cash flows, however, companies do not always report it there. Then we can calculate NWC change independently from the company’s balance sheet, by calculating changes in current assets and liabilities relative to the previous period.

Calculation of FCF in the second way for:

The result was greater than in the first case. Don't forget that EBITDA may contain non-cash items for which free cash flow must be adjusted.

Method 3 is similar to the second method, but is used for forecasting purposes:

FCF = EBIT*(1-tax) + depreciation - capital costs - changes in working capital

This method differs from the previous one solely by taking into account taxes. Since it is used for forecasting purposes, we do not know what taxes actually paid will be. Then the method uses the effective average tax rate (tax), calculated on historical data.

The listed formulas are basic formulas in the classical sense. In practice, the FCF calculation is adjusted for non-recurring or non-cash items. Examples include deductions related to contributions to a company pension fund, or the purchase of other businesses (which are not part of capital expenditures).

Thus, for each company it is necessary to modernize the standard formulas to take into account all aspects related to the company, as well as country or industry characteristics.

In the presentation you can find a detailed calculation of the FCF indicator:

Company management deviates from the classic formula and deducts interest paid, as well as other adjustments. So in a theoretical sense, it's more like the FCFE metric, which we'll talk about next.

Why do we need FCF?

Now let's figure out why everyone needs this FCF indicator so much and why most Western companies tie dividend payments to it.

Free cash flow reflects the amount of money a company earns from operating activities. Unlike profit, FCF shows how much a company can generate cash flows (excludes paper income), which can be used for the following purposes:

1. Payment of dividends

2. Buyback of shares from the exchange (Buyback)

3. Paying off debt

4. M&A transactions, purchase of non-core assets

5. Saving money on your balance sheet

Let us remind you that one of the ways to estimate the fair value of a company is the DCF model (discounted future cash flows of the company). That is, FCF and its dynamics determine the market value of the company's shares, since the more significant the cash flows, the more reasons investors have to expect larger dividends (there are exceptions).

However, many companies stick to the latter option because they are afraid that if they start increasing dividend payments, they will soon face liquidity problems.

Do not think that FCF is a Western indicator that is not suitable for Russian realities. It is conceptual and its meaning is not lost under any circumstances. However, if the company reports only according to RAS, it will be much more difficult to calculate it.

FCFE (Free cash flow to equity) indicator

FCFE is a type of free cash flow that shows how much of the FCF goes to shareholders. This value is a rather conditional estimate, since shareholders receive only dividends.

The main difference between FCFF and FCFE is that the lender's portion of the money is deducted from the FCFF. The formula for this indicator is as follows:

FCFE = FCF - interest paid - (debt repaid for the period - debt issued for the period)

That is, if a company has increased debt over a period, then it has increased free cash flow, which shareholders can dispose of. The FCFE indicator shows the amount of money for a period that shareholders can use for their needs (payment of dividends, buyback) without harming the company's operating activities.

We can also find the interest paid in the cash flow statement. The change in debt is either in the financial activity section of the general income tax balance, or is reflected as a change in total debt from the company’s balance sheet to the previous period.

For the FCFE indicator is equal to:

However, free cash flow attributable to shareholders has its drawbacks:

1. FCFE is much more volatile over time, and therefore less predictable in financial modeling.

2. The change in debt over the period has a great influence on the FCFE indicator. The problem is that most often a company cannot use debt for any purpose (except for lines of credit). Typically, there are strict conditions that limit company management from using raised money, for example, to pay dividends. Otherwise, creditors have veto power.

Although the FCFE indicator is more theoretical, it is also useful as FCFF for analyzing the financial performance of a company.

Open an account

BCS Broker