In 2022, the price of the SOL cryptocurrency of the Solana blockchain platform increased in price by 45 times. Moreover, in the last month alone, the cost of SOL has increased 2.6 times, and on August 17 it reached its historical maximum at $74 per coin. As a result, the Solana project entered the top 10 by capitalization on CoinMarketCap.

Against the backdrop of this rally, we decided to understand the reasons for the increase in the value of the SOL token, and also found out what the features of Solana are and what are the prospects for the development of this project.

What is unique about Solana and how is the project developing?

Solana is a high-speed open-source blockchain platform for running decentralized applications (dApps) and smart contracts, one of the main competitors of Ethereum.

Solana's key competitive advantage is its high scalability and low fees. During the tests, it was found that the network throughput ranges from 50,000 to 191,000 transactions per second , the block generation time is from 400 ms, and the average transaction fee is $0.00025 . In the future, the developers promise to achieve speeds of over 700,000 transactions per second. For comparison, in Ethereum the throughput is 30 transactions per second, and the block generation time is 12.5 seconds.

Already now, anyone can verify the high speed of Solana by playing a special game.

Work on Solana began in 2022. Then, former developer of Qualcomm Corporation and Dropbox, Anatoly Yakovenko, first published the white paper of the Solana project. In the document, he described the Proof-of-History consensus algorithm he developed, which will be discussed below.

Soon Yakovenko, together with his former colleague from Qualcomm Greg Fitzgerald, now the chief technology officer of Solana, and Doctor of Physical Sciences Eric Williams, opened the company Solana Labs, which began developing the project.

The project got its name in honor of Solana Beach near San Diego, which Yakovenko often went to. The project team is based in San Francisco, California. It includes former employees of Qualcomm, Google, Apple, Microsoft and Dropbox.

In April 2022, the developers launched the first version of the Solana testnet. At the same time, Solana Labs conducted a seed round of investment, and in July 2019, it raised more than $20 million from venture investors in a Series A round.

Solana developers launched a beta version of the test network with basic transaction capabilities and smart contract functions in March 2022. That same month, the Solana team conducted an initial coin offering (ICO), during which they managed to raise $1.76 million.

In June 2022, the non-profit organization Solana Foundation was created, which began developing the project’s ecosystem and popularizing it, as well as attracting third-party developers.

A year later, in June 2021, Solana Labs raised another $314.15 million as part of a private round of coin sales. The round was led by Andreessen Horowitz and Polychain Capital.

Today, the Solana platform is still in beta, but that doesn't stop the fact that it already has over 350 projects running. The largest of the DeFi projects: the automated market maker Raydium, the decentralized exchange Serum, owned by the youngest crypto billionaire Sam Bankman-Fried, and the aggregator Solfarm.

Solana also powers such dApps as the cross-chain aggregator O3Swap, the Launchpad platform for Solana projects SolStarter, the Arweave decentralized data storage protocol, and the Oxygen broker protocol.

Since March 2022, Solana has partnered with blockchain oracle Chainlink to develop an ultra-fast and low-cost oracle. And in September, the USDT stablecoin was launched on the Solana blockchain. In October, a cross-chain bridge between Solana and Ethereum was developed, allowing the transfer of assets from one blockchain to another. At the same time, in partnership with Circle, the issuer of USDC, USDC was launched on the Solana blockchain.

What is Solana? Scalable decentralized network for DApps

Solana boasts impressive speeds and a growing DApps ecosystem, but it's still in beta.

Briefly

- Solana is a blockchain designed to support scalable decentralized applications (DApps).

- It has a maximum throughput of over 50,000 TPS and a block time of only 400ms .

Content:

- Introduction

- What is Solana?

- How does Solana work?

- What's special about this?

- Who develops on Solana?

- SOL token

- Where is Solana heading?

Click on a title in the table of contents to jump to that item.

Introduction

Back to contents | Skip item

Decentralized applications are widely seen as one of the key use cases for blockchain technology.

DApps have grown by leaps and bounds over the past few years, with DApp developers launching everything from games to decentralized finance (DeFi) platforms on the blockchain.

But there is one problem. The vast majority of these DApps run on Ethereum, which is struggling to keep up with rampant demand, leading to network congestion and skyrocketing transaction fees.

Now Solana, a blockchain platform that was founded in 2017, is aiming to succeed where Ethereum currently struggles.

What is Solana?

Back to contents | Skip item

Solana is an advanced open-source blockchain project that aims to leverage several breakthrough technologies for the next generation of DApps.

The project aims to create a scalable, secure and highly decentralized platform that can support potentially thousands of nodes without sacrificing throughput, helping to avoid some of the problems faced by competing systems.

The project was founded in 2022 during the ICO boom and has raised over $25 million in various rounds of private and public sales. The platform launched its mainnet in March 2022, but is still operating as a beta version.

How does Solana work?

Back to contents | Skip item

Proof of Stake consensus system , which is backed by something called Tower Consensus . This variant of the system, known as Practical Byzantine Fault Tolerance (PBFT), allows distributed networks to reach consensus despite attacks from malicious nodes.

Solana's PBFT implementation provides a global source of time on the blockchain using a second new protocol known as Proof of History (PoH). Essentially, this provides a chronicle of previous events on the blockchain, ensuring that there is a common record of what happened and when.

Tower Consensus uses these synchronized clocks to reduce the computational power required to validate transactions, since timestamps of previous transactions no longer need to be calculated. This helps Solana achieve throughput that surpasses most of its competitors (more on this later).

In addition, Solana includes a number of other innovations that help it stand out from its competitors. Among them is a transaction parallelization technology known as Sealevel . It allows for a parallel smart contract execution environment that optimizes resources and ensures that Solana can scale horizontally across CPUs and SSDs.

What's special about this?

Back to contents | Skip item

When it comes to decentralized applications, speed matters. This is evidenced by the problems that the Ethereum network is currently facing. However, Solana currently does not suffer from these problems due to its high-throughput architecture.

Solana claims that its blockchain is capable of supporting more than 50,000 transactions per second (TPS) at peak load, making it perhaps the fastest blockchain currently running. For comparison, this is almost 1,000 times faster than Bitcoin (~5-7 TPS) and over 3,000 times faster than Ethereum (~15 TPS).

Moreover, Solana claims that the average block time is between 400 and 800 milliseconds, and the average transaction fee is 0.000005 SOL (or a tiny fraction of one cent). This, combined with enormous scalability, makes it suitable for serving decentralized applications that can potentially support tens of thousands of concurrent users without sagging under load.

Solana achieves this scalability without resorting to layer 2 technologies or off-chain solutions, and does not use any form of sharding. This makes it one of the few layer 1 blockchains capable of achieving over 1,000 TPS.

Unlike some platforms, virtually anyone can run a Solana validator and help secure the network. This process is completely permissionless, although users will need to maintain some basic hardware to participate, namely a server that meets the minimum specifications outlined here. Currently, the network boasts nearly 1,000 validators, making it one of the most widely adopted blockchains.

Who develops on Solana?

Back to contents | Skip item

Like many smart contract-enabled platforms in 2022, Solana already has a well-developed and rapidly growing ecosystem of DApps, many of which fit squarely into the DeFi niche. Solana currently includes some of the most popular applications:

- O3Swap: Cross-chain aggregator compatible with Ethereum, Binance Smart Chain, NEO and Huobi Eco liquidity sources.

- SolStarter: Upcoming IDO launch pad for projects built on Solana.

- Arweave: A decentralized data storage protocol that offers persistent file storage with massive redundancy.

- Oxygen: The main DeFi brokerage protocol that allows users to benefit from their untapped assets.

SOL token

Back to contents | Skip item

Solana, like the vast majority of smart contract platforms, has its own gas token called SOL . All transactions and smart contract operations on Solana will consume SOL.

The SOL token can also be staked to help maintain the security of the network and receive a portion of the inflation as a reward. Although this feature is not currently available, SOL tokens will eventually also be used for on-chain governance.

The token was first launched on the Solana beta network in March 2022 and is currently ranked among the top 20 largest cryptocurrencies by market capitalization.

Where is Solana heading?

Back to contents

Although Solana has been in development since 2022, it has only been running in its mainnet beta since March 2022, and there is no clear timetable for when this beta tag will be removed.

As for what's next for Solana, the platform will be hosting a hackathon season from May 15 to June 7, 2022, where teams can compete to win a share of up to $1 million in prizes.

In addition, five new crypto funds recently pledged $20 million each to support the development of Solana-based projects in China, which will help the platform strengthen its global reach.

In our Telegram channel we help beginners, talk about other interesting projects and blog about investing in cryptocurrencies.

How does the Solana blockchain work?

Solana's ultimate goal is to solve the scaling trilemma: create a decentralized network that is simultaneously fast, scalable, and secure.

The Solana blockchain has 8 major innovations that differentiate it from other networks.

1. Proof-of-History. Solana uses a combination of two consensus algorithms: Proof-of-Stake (PoS) and Solana-specific Proof-of-History (PoH). In the latter, different nodes operate in parallel and independently of each other, but at the same time synchronize with each other to ensure security. This allows the network to support thousands of nodes simultaneously, scaling its throughput proportionally. Unlike other similar projects, such as Polkadot, Solana has only a single blockchain without the addition of child blockchains (sidechains or parachains).

Formally, Proof-of-History is not a consensus algorithm, but a blockchain synchronization algorithm that allows nodes to agree on the time order of events in the chain without exchanging data with each other.

It is worth noting that node synchronization is one of the main problems of decentralized networks. To confirm transactions, nodes must record a block with them in the blockchain. To do this, they exchange data, verify transactions and synchronize (reach consensus). The catch is that this takes a long time, and as a result, network throughput suffers. For example, the maximum speed of Bitcoin is 7–10 operations per second. Proof-of-History allows nodes to synchronize much faster.

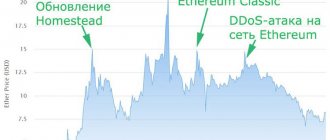

At the same time, blockchains have a built-in clock that allows you to set a timestamp - a timestamp for block recording (date and time). But they are imprecise—there is no central clock to refer to. As a result, nodes may synchronize incorrectly and a new block will appear before the previous one.

In centralized systems, the entire system uses a single internal clock. For example, in Google, database synchronization occurs using an atomic clock, in Yandex - using a central NTP server. But in Proof-of-History, time is measured in hashes.

So, if in other blockchains consensus is achieved by agreement of miners or validators, then each validator in Solana has its own clock. Proof-of-History is a decentralized clock that synchronizes time across all nodes. Using Proof-of-History proves that a transaction occurred at a specific moment. At the same time, blockchain nodes operate according to a single schedule (Leader Schedule).

This is how synchronization occurs between nodes in Proof-of-History:

- The validator becomes a leader according to the Leader Schedule. He will be there for a strictly allotted time - 1,000 hashes (4 blocks or 1.6 seconds);

- Gulf Stream and Turbine solutions (discussed below) break transactions into batches;

- The leader validator verifies and confirms transactions and transmits parts of the data (parts of transactions - batch) to two random validators;

- Two validators verify their portions of transactions using digital timestamps as a reference, merge the transactions, and pass them on to the remaining validators;

- Then another validator becomes the leader. He will be them for the next 1,000 hashes.

This scheme reduces block mining time to just 400 ms and eliminates the risk of orphan blocks (mined but not included blocks for which the validator does not receive a reward). A similar mechanism is used in database solutions from Google and Intel. But Yakovenko found a way to apply it to decentralized systems. It is expected that in the future Proof-of-History will be able to be used by centralized systems.

2. Tower BFT. This is a Proof-of-History optimized version of practical Byzantine fault tolerance (pBFT), a variant of the Proof-of-Stake (PoS)-based consensus algorithm. Therefore, formally Solana works on PoS, but based on the “decentralized clock” Proof-of-History. This allows consensus to be achieved without wasting time and resources on calculating timestamps of previous operations and exchanging messages between all validators.

3. Gulf Stream Protocol. It is a protocol that forwards transactions to the next leading validators before the previous set of transactions has completed, without moving them to the mempool (the list of transactions awaiting confirmation). As a result, future leaders may start collecting transactions before they start producing blocks. This increases the speed of work and also reduces the size of the mempool and the blockchain itself.

4. Turbine Protocol - breaks information about operations into several parts.

5. Sealevel algorithm - allows you to execute several smart contracts in parallel.

6. Pipelining - acceleration of transaction verification at the GPU core level. This allows you to quickly check information about transactions in all network nodes.

7. Cloudbreak Account Database - optimizes memory usage on validators' devices by preventing data from taking up too much space.

8. Archivers - distributed storage. Validators upload data to a special network of nodes - so-called Archivers. Archivers do not participate in reaching consensus, since each of them stores part of the data (batch), and not all of it. Periodically, archivers must prove that they are still storing their data. This system is similar to the one used in Filecoin. For archivers, simple devices such as laptops or PCs are sufficient.

Large migration of blockchain applications

Solana is a blockchain project that promises speed and scale. The official website says that it can process 50 thousand transactions per second, while the commission is only $0.00025. Meanwhile, according to Dune Analytics, Ethereum processes an average of 15 transactions per second with a median price of $3.97.

In this context, statistics on activity on alternative platforms may indicate that projects are moving to cheaper blockchains. Other Ethereum competitors such as Cardano, Fantom, Terra, Kusama and Avalanche are also on the rise.

Cryptocurrency SOL

SOL is the internal cryptocurrency of the project. It is used to pay transaction fees on the Solana blockchain and operations with smart contracts. In the future, it is also planned to use SOL to vote on changes to the project.

SOL is a popular coin for staking. Unlike other PoS cryptocurrencies, to be a validator on the Solana blockchain, you do not need to lock a minimum stake. But the more coins in the stake, the greater the profitability, and also the higher the chances of becoming a leading validator. You can also provide coins to one of 1,342 validators - then the profitability will be higher. You can stake through a native or third-party crypto wallet, such as Ledger.

Now the average return on staking is about 6% per annum. The rate may be higher if you stake coins through an exchange. For example, the profitability of SOL staking on Binance depends on the freezing period and the size of the stake and ranges from 24.5% to 43.8% per annum.

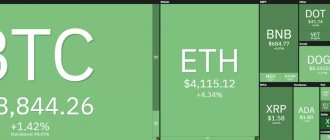

SOL trading started in April last year. During this time, the price of the coin increased 88 times - from $0.77 to $72. Currently, the cryptocurrency is among the top 10 digital assets by capitalization - $21.2 billion.

Last year, the coin was not in strong demand among investors - its price fluctuated from $0.5 to $4.8. The growth was fueled by the news that popular crypto derivatives exchange FTX had launched the Serum decentralized exchange on the Solana blockchain.

As a result, a rapid SOL rally began from the beginning of the year - from January to May, the price of the coin grew from $1.84 to $55.9. After May 18, following the fall of Bitcoin and the entire crypto market, the asset fell by half in just a few days, after which it unsuccessfully tried to reach the $40 mark for two months.

A new rally began on July 20 after reaching a local low of $23.49, also along with the growth of Bitcoin and the entire market. Over the past month, the coin has grown 2.6 times - from $25.77 to $72.74.

Prospects for Solana (SOL) cryptocurrency in 2022

Solana's ability to act as a serious competitor to Ethereum has made it a mainstream cryptocurrency. The Solana network provides sophisticated smart contracts that give the platform an edge over ETH. Recently, the total network value locked (TVL) increased by US$660 million and spanned over 40 decentralized applications, reaching an all-time high of over US$11 billion. These are just some of the factors that could push Solana coin prices higher in 2022.

- Like Bitcoin, Solana is also gaining institutional appetite. Leading decentralized application Etherium has over 188,200 active users, while Solana's NFT marketplace, Magic Eden, has over 58,400 active addresses per week.

- Despite the sudden drop in Solana's price in November, SOL continues to hold the 5th position in the ranking of cryptocurrencies by market capitalization.

- Solana is constantly increasing activity in its portfolio. The network's TVL has increased 15-fold over the past six months, and the number of users of Solana's dApps is almost half that of the Ethereum network.

- Solana also recently partnered with Forte and Griffin Gaming to open its doors to game development. The collaboration is expected to provide end-to-end solutions for the gaming economy based on tokens and NFTs.

Reasons for the current SOL rally

The current rally began along with the general growth of the crypto market. Also, the rise in SOL quotes was facilitated by the fact that by mid-August the growth of other popular cryptocurrencies had slowed down, and investors switched to large, but undervalued projects that lagged behind the leaders in growth rates. So, along with SOL, XRP, ADA and DOGE have been growing well in recent weeks.

The SOL rally also has objective factors:

- At the end of July, Solana Labs sponsored the Lollapalooza music festival;

- On August 4, the Star Atlas metaverse launched the NFT marketplace Galatic Marketplace on the Solana blockchain;

- On August 9, Wormhole (translated as “Wormhole”) was launched - a decentralized bridge protocol between Solana and other leading DeFi projects, including Terra, Ethereum and Binance Smart Chain;

- On August 12, Mango Markets, a platform for spot markets, lending and perpetual futures built on Solana, raised $70.46 million in a token sale. Mango Markets receives liquidity from its own pools and the decentralized exchange Serum, also powered by Solana;

- On August 15, a new NFT project, Degenerate Ape Academy, was launched on the Solana blockchain. A collection of 10,000 unique cartoon monkey images sold out in just eight minutes on the Solanart marketplace. Currently, the monkeys are only available on the secondary market, such as the OpenSea NFT marketplace. The highest price for characters already exceeds 100,000 SOL - more than $6.8 million at current prices.

Prospects for Solana

Solana is a promising project that attracts the attention of both partner companies and investors. Solana is suitable for resource-intensive systems and applications focused on a large number of users and transactions: exchanges, marketplaces, file storages.

The alpha version of the network has not yet been launched, but the project is already in the top 10 in terms of capitalization - this is an excellent indicator.

Solana doesn't have a clear roadmap right now. In March, Anatoly Yakovenko noted in an interview that almost everything that could go wrong with the development of the project went wrong. The project team has an ambitious goal of attracting a billion users and is confident that Solana will cope with this load.

Near-term technical goals include reducing block generation time to just 80ms, and the trading timeframe (the timeline for displaying stock quotes) on the DEX to just 1ms (by comparison, Binance's smallest trading timeframe is 1 minute). Yakovenko also noted that when DEXs become more efficient than centralized exchanges, the latter will switch to using a decentralized blockchain, which ensures this higher efficiency.

But having the most innovative technologies is not everything in the crypto sector. Solana's bright future is far from guaranteed. Even with all its advantages, the project is unlikely to displace Ethereum from the throne of the king of tokenization. Moreover, competitors, for example, Algorand, Cardano or Polkadot, are hot on its heels and have already launched mainnets.

Time will tell whether Solana will be able to solve the scalability trilemma and attract the desired billion users to its ecosystem.