Bitfinex is a cross-platform cryptocurrency exchange that operates on its own blockchain. Since 2013, it has been headed by Jean Louis Van der Veld, a co-owner of several IT companies and a university teacher in Taiwan.

The exchange supports 145 cryptocurrencies and tokens, which are traded mainly in pairs with Bitcoin, Ethereum, US dollar, Euro, and USDT token. Active trading allows cryptocurrency traders to carry out transactions without delays, at the current market price and for almost any amount.

History of the exchange

Bitfinex is a cross-platform platform for trading cryptocurrencies. It is owned and operated by iFinex, a company registered offshore in the BVI and headquartered in Hong Kong. It started operating at the end of 2012, initially being developed as a platform for trading Bitcoin. Subsequently, other digital assets were added to the crypto exchange.

In 2022, Bitfinex became the leader in daily Bitcoin trading volumes, reaching $500 million. Today, the average daily trading volume on this site is more than 200 million US dollars.

Since 2015, when one and a half thousand BTC were stolen from accounts, the exchange has constantly become the target of hacker attacks. The largest hack occurred in August 2016. 120 thousand BTC were stolen from user accounts, which was the equivalent of 70 million US dollars. This was reflected in the Bitcoin market rate - it fell by more than 20% within a few hours. The owners of the exchange eventually compensated for the stolen funds.

In 2022, the management company iFinex planned to re-register in Switzerland.

Mirror

In the fall of 2022, exchange clients from Russia encountered a problem: bitfinex does not work, the site is blocked and does not open.

“I haven’t been able to log into the crypto exchange for several days.”

Messages of this kind from exchange users were on all specialized forums.

As it turned out, Roskomnadzor included the Bitfinex website in the register of resources prohibited in Russia and blocked access to the trading platform.

Fortunately, even a schoolchild knows how to use VPN and TOR and bypass such blockings.

Main characteristics

| Official site | https://www.bitfinex.com |

| Social media | |

| Location | Hong Kong |

| Supervisor | JL van der Velde |

| Beginning of work | 2012 |

| Deposit/withdrawal method | Cryptocurrency, fiat |

| Available cryptocurrencies and tokens | More than 140 |

| Number of trading pairs | More than 200 |

| Own token | LEO |

| Commissions | 0.1-0.2%, discounts available |

| Languages | |

| Verification | Yes, for working with US dollars |

| Mobile app | Android, iOS |

How to register on the Bitfinex exchange

On the Bitfinex exchange, registration is similar to similar platforms and occurs within a few minutes:

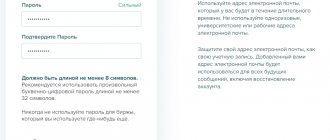

- On the main page https://www.bitfinex.com, in the upper right corner, you must click the “Registration” button, in the pop-up window you must fill in your login, email address, password (at least 8 characters, including upper case and special characters) , set the time zone, read the rules and conditions of work on the site and click the “Open account” button.

- After this, a welcome message will appear with instructions to follow the link in the registration letter in the mail.

- After the transition, the account will be activated, as reported in the system message on the website.

- Next, you need to log in using the data specified during registration. Each time you log in, the system reminds you to check that a secure connection has been established and that the address is spelled correctly.

Before starting work on the exchange, it is recommended to install two-factor authentication. This can be done in your personal account settings by selecting the Security tab. Two-factor authentication can be done using GoogleAuth, and owners of a physical key for Fido authentication can configure this device.

It is recommended to use it for the following actions:

- authorization on the site;

- withdrawal of funds;

- changing your account password;

- changing the API key;

- making changes to security settings.

After this, you can fund your trading account and start working on the Bitfinex exchange.

Account verification

For transactions with the US dollar, you need to undergo an identity check - verification. This can be done in your personal account in the section – Verification. In this section you need to indicate your country of residence and tick the items necessary for work.

Next, you need to select the type of account – individual or corporate. Next, you need to familiarize yourself with a number of conditions for passing the test and proceed to verification.

The system will prompt you to fill out personal information and upload scans of several documents:

- two valid photo IDs;

- a bank account statement confirming the owner from whom the transfers will be made;

- an invoice (no more than three months old) for payment of utilities, containing the user’s address.

Uploaded scans must contain information written in Latin letters. Otherwise, you need to make a notarized translation into English. Verification may take up to two months.

Replenishment and withdrawal of funds

To replenish your internal balance for trading, you must select the “Top up account” tab. Deposits are available in several fiat currencies:

- pounds;

- U.S. dollars;

- Euro;

- Japanese yen.

You can also transfer assets in any supported digital currency, as well as in the form of the Tether USDT stablecoin, which is equivalent to the US dollar, as well as EuroT, which is pegged to the euro.

Topping up your balance with an amount over the equivalent of 1000 US dollars is free, and for smaller amounts an additional fee is charged. This is due to the complexity of processing microtransactions.

After selecting the desired deposit currency, you must select the target Bitfinex wallet where the funds will be credited. The Bitfinex exchange uses three separate target accounts:

- Exchange wallet – used for exchange trading with your own funds.

- Margin wallet – used for trading with odds.

- Investment wallet – used for investment work on the stock exchange.

After selecting the target wallet, you need to generate a deposit address and complete the transaction. Crediting to the internal account occurs through several network confirmations, for example, bitcoins are credited to the internal balance after the transaction is included in three blocks.

Depositing funds in fiat currency or Tether stabcoins is available only after user verification. This procedure can take 6-8 weeks. Any bank transfers, regardless of currency, can take up to three business days to clear.

To withdraw funds in cryptocurrency from your internal wallet, you need to go to the “Withdrawal” tab located in the top menu and select the desired asset from the list.

Next, you need to select the target wallet for debiting money, indicate the recipient’s address and the amount in digital currency or equivalent, agree to the terms of the site and select “Request withdrawal.” The withdrawal fee depends on the currency used.

If the user does not use two-factor authentication, the application will take some time to process.

To withdraw fiat funds or the Tether stablecoin from your internal account, you must undergo user verification.

Withdrawals occur automatically if:

- Two-factor authentication is configured or the user’s IP addresses are included in the list, and the wallets where the cryptocurrency funds will go were added at least 5 days ago.

- An alert about logging into your account by mail has been activated and the withdrawal function has been set to track IP, which has not changed in the last 24 hours.

Withdrawals of large amounts in any digital or fiat currency are processed manually by the operator. Manual processing of transactions with any cryptocurrency and Tether can last no more than twelve hours, urgent withdrawal to bank accounts - no more than a day.

Disadvantages of Bitfinex

Bitfinex has an impressive list of advantages, however, there are also some negative qualities. The disadvantages include:

- Complex, time-consuming verification. To have a deposit in fiat currencies and take advantage of additional features of the Bitfinex platform. The main difficulty that Russian-speaking clients are forced to endure is providing a notarized translation of the necessary documents. In this case, the lawyer must have a special certificate.

- A large amount for the initial deposit replenishment.

- Relatively high commission fees. For example, you can withdraw and deposit fiat currency only in the form of dollars. If you operate with small amounts, the exchange will charge about $20 per transaction. On Poloniex, Binance, HitBTC and EXMO the percentages are significantly lower.

Nuance! Such an impressive limit must be overcome once. Then the main part of the capital can be withdrawn and a small amount left in the account for trading. Lending or investing!

- Some sentences or individual words are extremely incorrectly translated. For experienced traders, this does not present any difficulties, since you can generally understand the essence of the information.

Deposit and withdrawal fees

For replenishing the internal balance with amounts less than the equivalent of 1000 US dollars, the exchange charges a commission, the amount of which depends on the selected currency:

Fees for depositing and withdrawing cryptocurrencies:

| Cryptocurrency | Deposit/withdrawal fee |

| Bitcoin | 0.0004 BTC |

| Ethereum | 0.00135 ETH |

| Eos | FOR FREE |

| Litecoin | 0.001 LTC |

| Ripple | 0.1 XRP |

| Iota | 0.5 IOTA |

| Neo | — |

| Ethereum Classic | 0.01 ETC |

| Omise Go | 0.16637 OMG |

| Monero | 0.0001 XMR |

| Dash | 0.002 DASH |

| Tron | 1.0 TRX |

| Zcash | 0.003 ZEC |

For depositing and withdrawing fiat funds, the platform charges a commission of 0.1% of the amount, but not less than 60 US dollars or Euro. Express application – 1% of the amount, but not less than 60 US dollars or euros.

Trading commissions

Trading fees are 0.1% for the maker (who adds liquidity to a trade) and 0.2% for the taker (who takes liquidity). Commission fees for withdrawing cryptocurrencies may vary depending on network congestion.

Discounts for large volumes:

| Transactions made in the last 30 days | Maker fees | Taker fees |

| $0.00 trades made | 0.100% | 0.200% |

| $500,000.00 trades completed | 0.080% | 0.200% |

| $1,000,000.00 trades completed | 0.060% | 0.200% |

| $2,500,000.00 trades completed | 0.040% | 0.200% |

| $5,000,000.00 trades completed | 0.020% | 0.200% |

| $7,500,000.00 trades completed | 0.000% | 0.200% |

| $10,000,000.00 trades completed | 0.000% | 0.180% |

| $15,000,000.00 trades completed | 0.000% | 0.160% |

| $20,000,000.00 trades completed | 0.000% | 0.140% |

| $25,000,000.00 trades completed | 0.000% | 0.120% |

| $30,000,000.00 trades completed | 0.000% | 0.100% |

| $300,000,000.00 trades completed | 0.000% | 0.090% |

| $1,000,000,000.00 trades completed | 0.000% | 0.085% |

| $3,000,000,000.00 trades completed | 0.000% | 0.075% |

| $10,000,000,000.00 trades completed | 0.000% | 0.060% |

| $30,000,000,000.00 trades completed | 0.000% | 0.055% |

Bargaining

As soon as you log into your account on the exchange, you will find yourself on the trading page by default. In order to start trading on Bitfinex, you must:

Step 1. Select a cryptocurrency pair for trading

To do this, look at the “TICKERS” table in the left corner of the page:

1 – here we select the trading method (the selected method will be underlined):

- “Trade” - regular trading (from your own funds)

- “Financing” - margin trading (with leverage)

2 – select from the list the currency in which we will trade. You can choose: ANY (any), USD (if you have passed verification), BTC, EUR, JPY, ETH, GBP.

3 – select a pair to the main currency from the list

4 – this is “Balances”, that is, all your balances (wallets) on the exchange are shown

Step 2. Fill out the order

After you have chosen a cryptocurrency pair, you need to fill out an order

the system will not allow you to do this and will not even show the order form if you did not initially enter an amount equivalent to 1,000 US dollars into the exchange

1 – again, select the trading method:

- "Exchange" - regular trading

- “Margin” - margin trading

2 – select the type of order (we wrote about what they are above)

3 – set the price (the default is the current market price – you can decrease or increase this amount)

4 are special types of orders (read about them also above)

5 – click “buy” or “sell” depending on the set price (if you buy, it’s more profitable to set the price lower, if you sell, it’s more profitable) and the selected currency That’s it! You have created an order and now all you have to do is wait for someone to buy or sell it to you.

LEO token

In April 2022, the Bitfinex crypto exchange announced the release of its own LEO token, the full name is UNUS SED LEO. After conducting an IEO, the platform raised more than one billion US dollars. At the end of May, margin trading of currency pairs with the internal LEO token was launched on the platform.

At the moment, the management company has begun repurchasing its own tokens, followed by burning. More than 27% of profits will be allocated to this. Redemption and disposal will continue until the token disappears completely. Bitfinex has opened a website where you can watch the destruction of LEO tokens online.

How to trade on the stock exchange

After replenishing your internal balance, you can move on to learning how to trade on the stock exchange. To do this, you need to select the “Trade” tab of the top menu, select the required currency pair on the left, familiarize yourself with the provided analytical tools, namely the rate chart, with the ability to fine-tune and “Depth”.

The Bitfinex exchange allows traders to choose different types of trading orders. In addition to the main types, the site uses a number of other orders that allow you to maximize a trader’s profit, especially on large amounts.

Interface, menu, features

The interface of the Bitfinex cryptocurrency exchange is available in Chinese, English and Russian. Additional convenience is the ability to switch the site design from light to dark. In addition, the user can independently arrange the control panels and exchange windows in a way that is convenient for him. The exchange alert system may be accompanied by sound.

The exchange website menu consists of the following main sections:

- Possibilities . Contains subsections describing the capabilities of the platform. Exchange – transactions with cryptocurrency and fiat;

- Margin trading – transactions with leverage (with borrowed funds);

- Margin market – the assets for which margin trading is available are listed, and the rules for securing financing are also listed;

- Customizable interface – description of the possibilities for individually customizing windows;

- API platform – description of trading automation;

Placing orders

To conclude a trade transaction, you must place an order. This can be done in the “Trade” section. First you need to select a trading pair, the type of trading - exchange or margin trading. Next, select the type of order to be created and the amount.

The following types of orders are available on the Bitfinex exchange:

- Limit – the deal is closed at the set or better price.

- Market – the transaction is carried out at the market price.

- Stop order - a transaction is carried out when a certain level of the market rate is reached.

- Trailing stop. An improved version of a Stop order.

- Fill or Kill – the transaction is completed completely or completely cancelled.

- Hidden order - not visible to other participants, used to make large transactions.

- Scalable order. Allows you to create many limit orders according to a given algorithm in a certain price range.

- Mutually cancelable. A pair of orders; when one of them is triggered, the other is canceled.

Beginners are advised to start by creating limit and market orders.

Types of accounts/wallets: Exchange, Margin, Funding

In the previous step, we saw that there are three types of accounts on Bitfinex. Let's figure out what they are for.

Exchange wallet is a wallet for regular trading without leverage, that is, without borrowed funds.

Margin wallet is a wallet for margin trading, where the trader uses leverage. This wallet is also used for trading derivatives – perpetual contracts.

Funding wallet is a wallet from which you can lend your funds to other traders for a certain period and percentage that is currently in effect on the market.

Cryptocurrency can be quickly moved between wallets using the quick transfer feature in the main wallets section.

Transfer 0.01 bitcoin between wallets

The separation of accounts serves for the convenience of accounting for cryptocurrencies. For example, you always know how many assets you have in your trading account, and how many assets you have lent to other traders.

Margin trading

Margin trading allows you to make transactions in amounts exceeding your own funds. The exchange provides borrowed funds, which must subsequently be returned. The main indicator is margin leverage; this coefficient indicates how many times larger the amount can be operated in comparison with one’s own funds. On the Bitfinex exchange you can trade with a leverage of 3.3. This type of trading is recommended only for experienced traders.

The Bitfinex exchange provides the opportunity to earn additional income through margin financing. The user creates an offer on suitable terms and receives income.

Mobile app

So that traders can trade anytime, anywhere, the developers have created the Bitfinex mobile application for Android and iOS devices .

Bitfinex mobile application in the AppStore

Smart mobile trading features on Bitfinex:

- Trading: exchange and margin trading, order and position management;

- Wallets: transfer between internal wallets and check the latest account movements;

- Login: secure account access using API keys and PIN/password protection;

- Margin provision: management of status, rates and offers;

- GUI settings settings;

- Notifications about completed transactions and price dynamics.

To start using the Bitfinex mobile app:

- Download the application (app) for Android or iPhone;

- Create your own API key ;

Instead of using a username and password to log into the application, Bitfinex suggests creating an API key and importing it into the application. - Read QR code .

After creating the API key, a QR code will appear in the browser (only 1 time). Scan this QR code to import your API key and login.

Safety

Due to its large sales volumes and popularity among users from all over the world, the Bitfinex exchange has repeatedly become the target of hacker attacks and hacks. The first serious theft of user funds occurred at the beginning of 2015. In total, more than 1,500 BTC were stolen. The next attack resulted in the disappearance of funds equivalent to $70 million. The management of the exchange was forced to issue internal tokens in the amount of stolen funds, which were gradually purchased from the affected users.

These events forced management to reconsider its security policy. At the moment, the user is given the opportunity to configure the following parameters:

- API with extended functionality;

- PGP mail encryption;

- white lists of IP addresses;

- access to transactions and accounts only from the specified IP;

- two-factor authentication;

- notifications by mail.

Many of these functions are disabled by default; they must be activated in your personal account settings.

Regulation

The Bitfinex crypto exchange is owned by iFinex Inc., which is headquartered in China (Hong Kong) and registered in the British Virgin Islands. The company operates in accordance with the current legislation of the country.

According to the legislation of the regulatory country, the exchange is obliged to:

- ensure security of work on the platform (two-factor authentication, encryption of letters, restricting access to an account by IP address, use of cold wallets, etc.);

- guarantee the confidentiality of users' personal information;

- prevent any illegal actions of users (AML, CTF standards, monitoring transactions, user actions, storing information about users, etc.);

- support the Cookie Policy, Law Enforcement Requests Policy, and Anti-Space Policy.

By using the resource, clients agree to the Terms of Service and are responsible for all actions on the platform. The Bitfinex administration does not inform about the license to carry out activities with cryptocurrencies.

Bitfinex plans to move the legal and financial departments of the exchange to Switzerland .

“We want to become the most transparent exchange out there and follow the requirements of the Swiss regulator”

—Bitfinex team

To do this, the company must obtain official approval from the Swiss Financial Market Supervisory Authority.

Trader reviews

The main drawback noted by users is the long and complex process of verifying a user in order to be allowed to work with fiat currencies. The main stream of negative reviews appears after contacting platform support. A response to the ticket may take two weeks.

Many cryptocurrency traders believe that Bitfinex and Tether are controlled by the same owners. This creates opportunities for manipulation of the exchange rate on this trading platform.

In addition, the lack of a referral program often causes confusion among traders.

| Average rating: 4 / 5 | Average rating: 5.25 / 10 |

Support

If you have any questions or technical problems while using the platform, the platform offers several solutions.

First, you can look for the answer in the Bitfinex Knowledge Base, which contains all the information about working with the platform and is structured into sections: Introduction, Security, Verification, Trading, Commissions, Order Types, Margin Funding and others. The knowledge base is available in 4 languages, including Russian.

If you can’t find what you’re looking for, you can easily contact representatives from the support team, having previously indicated the reason for your request. You can write to support using the feedback form on the website.

The support service works around the clock and speaks Russian. ✅