An indicator such as Enterprise Value is used rather as a basis for calculating other indicators. One of these derivative instruments is the EV/EBITDA multiplier

; this is a good indicator for assessing the return on investment of a company if it is purchased.

It is suitable for comparing businesses operating in the same sector and can be used to rank companies by investment attractiveness. Below is a detailed description of the multiplier, its calculation and a brief description of services where you can find out the finished EV/EBITDA value. From this article you will learn:

- The physical meaning of the EV/EBITDA multiplier

- Methodology for calculating EV/EBITDA

- Example of EV/EBITDA calculation

- How EV/EBITDA is used

- Services for working with the EV/EBITDA multiplier

- Conclusion

What EV/EBITDA shows

This ratio shows the company's payback period due to its profit before deduction of mandatory payments: interest, taxes and depreciation.

To explain what EV/EBITDA is in simple language, let’s look at what it consists of:

- EV – Enterprise Value. Translated from English - the value of the enterprise.

- EBITDA is an abbreviation that stands for Earnings before interest, taxes, depreciation and amortization.

Analysts also use the abbreviation Ltm EV/EBITDA, which stands for Last Twelve Months, which means “Last 12 months,” that is, the value of the indicator for the year before the current date.

Multipliers - everything you need to know!

Outline of this article:

- Understanding Multipliers

- P/E – the simplest and most universal

- EV/EBITDA: advantages and disadvantages

- DEBT and the multipliers that value it

- Profitability multipliers

- What I realized after 3 years of counting multipliers for all companies

Understanding Multipliers

Multipliers are derived financial indicators that allow you to evaluate a company's business and compare it with its competitors.

The essence of multipliers is that we bring the market valuation (share price) of a company and its business valuation (profit, revenue, etc.) to a single denominator.

Relatively speaking, from two (or more) numbers, we get one. And this one figure is easy to evaluate and compare with a similar figure from other companies.

Let me explain with an example:

1. Profit of company A – 100,000 rubles

2. Profit of company B – 1,000,000 rubles

Question: Which company's shares are best to buy?

Another example:

1. Capitalization of company C – 1 billion rubles

2. Capitalization of company D – 5 billion rubles

Question: Which company's shares are best to buy?

Actually, in both cases there is no answer to the question, since there is not enough data for an assessment - in the first example we do not know the purchase price, in the second the business indicators.

The mere fact that company B's profit is greater than company A's profit does not mean anything.

But let’s say the relationship between the company’s capitalization and its profit is already enough for assessment. We simply choose the company with the best ratio.

This ratio is our multiplier. And there are many such various ratios (capitalization/profit, capitalization/revenue, etc.) - each of them represents a separate multiplier.

This is where the valuation of companies comes from, an understanding of whether a company is expensive or cheap.

After all, you can calculate a certain multiplier for all companies in the same industry, and then calculate the arithmetic average.

And then it’s simple - if the multiple of a particular company is higher (lower) than the industry average, then the company is overvalued (undervalued) by the market.

In the same way, you can easily compare companies with each other and at the same time you no longer care if company A is 100 times larger in capitalization than company B - the multipliers are reduced to a single denominator.

P/E multiplier

The P/E multiple is where everyone always starts. And that's why:

P/E simple

P/E = Capitalization / net profit. Everything is really simple - it’s clear what capitalization is and what net profit is. It is very difficult to make a mistake when calculating such a multiplier.

P/E universal

P/E can be calculated for any company, regardless of its type of business. This is a really useful property, since companies in the financial sector (banks, management companies) have different reporting from companies in the real sector and a number of multipliers are not applicable to them. P/E applies to everyone

P/E is unbeatable

P/E can be calculated in any scenario, even if the company has a loss. In this case, the P/E is simply marked as 'negative', which clearly tells us that the company has a loss. There cannot be any other connotations here (capitalization cannot be negative).

P/E is understandable

Another important factor is that P/E is logical and understandable to anyone. We divide the entire value of the company (capitalization) by its annual profit and get the number of years in which the company's business will pay for itself.

The easiest way to understand the meaning is to imagine yourself as a business buyer. So they tell you - there is a ready-made business, a car wash - it annually brings in 1 million rubles in profit. They want to sell it to you for 5 million rubles. You immediately figured in your mind that you would make your money back in 5 years if you bought the company. 5 – this is P/E = 5 million (capitalization) / 1 million (profit).

This works exactly the same way for you when you buy shares (share in a company!)

P/E multiplier of IT companies from NASDAQ – data from financemarker.ru

But there are also disadvantages!

P/E superficial

Do you really think that P/E valuation is enough to make an investment decision? Net profit can be manipulated; it is affected by any amendments that are not related to the operating business, distorting it (for example, fines or, conversely, payments from the insurance company, which have nothing to do with the business, but affect P/E)

P/E doesn't know everything

Sometimes P/E can be high not because profits are low, but because the market values the company at a premium. For example, a company shows excellent growth rates and can become a super-giant. Everyone, hoping for huge growth, wants to buy shares and because of this, capitalization grows (even faster than profit) and P/E grows. But this does not mean that the company is bad; on the contrary, it is so good that the market is ready to overpay for it.

EV/EBITDA multiple: advantages and disadvantages

We said that P/E is such a basic, simple and understandable assessment of a business, which at the same time has disadvantages, for example, a company’s profit can be affected by many adjustments that do not relate to the business itself (sudden fine). There is another drawback from the same series:

The company's capitalization may differ from its real value

Let's take a car wash for 5 million rubles. Imagine, you bought it, but it turns out that the company has loans for another 2 million rubles and you need to pay them. It turns out that the real value of the company for you is now not 5 million, but 5 + 2 = 7 million rubles.

EV/EBITDA – fair P/E

This is where EV/EBITDA arises, which must take into account all these P/E injustices. Then in the new formula we have:

EV – fair value (fair P)

EBITDA – fair profit (fair E)

I personally prefer to remember this way, through the connection with P/E, because this way you don’t need to memorize the formula, but simply understand the meaning.

EV – fair value

EV = capitalization + debt – cash.

Debt comes with a “+” because it increases the value of the company for us (we will have to pay more), and cash with a “-“ because it reduces the value for us.

Both of these figures can be found on a company's financial statements, in the form of a balance sheet.

If company A has a capitalization of 100 million rubles, debts of 10 million, and money in the account of 3 million, then EV = 100 + 10 -3 = 107 million rubles.

EBITDA – fair profit

This is easiest to remember if you know English, as EBITDA is a common acronym.

EBITDA – Earnings Before Interest, Taxes, Depreciation, Amortization

that is

EBITDA – Earnings before interest, taxes, depreciation and amortization (in IFRS reports, the last two items usually go together as depreciation)

The point of calculating EBITDA is to remove all profit adjustments that do not relate to the business itself.

The simplest example:

– Company A is located in the USA and pays 40% tax on profits

– Company B is located in Russia and pays 13% tax on profits

It turns out that these companies are not very fair to compare in terms of P/E, since the first one may bring more operating profit, but in the end have less net profit, etc. We, as investors, want to evaluate the business itself.

EBITDA helps us with this, excluding these amendments.

Important:

EV is not a multiplier

EBITDA is not a multiplier

Both the first and the second are financial indicators that are expressed in specific currency units (dollars, rubles, etc.). Accordingly, there is no point in comparing them with each other from different companies. Just like we do not compare profit or capitalization separately.

We need this data to calculate the EV/EBITDA multiplier. He is our ultimate goal.

EV/EBIDA multiplier of IT companies from NASDAQ – data from financemarker.ru

EV/EBITDA Disadvantages

There are enough of them and even more than P/E

Not universal

EV/EBITDA is not applicable for companies in the financial sector, since the concept of debt in their reporting has a completely different meaning.

Not clear

What I mean by this is that a negative EV/EBITDA won't tell you what's going on in the company. Both the numerator and denominator in the calculation formula may be negative. Moreover, they can both turn out to be negative and then the result will be positive. And there are such examples - take Surgutneftegaz.

If you see a negative P/E, you know the company is losing money. If you see negative EV/EBITDA, you don't know anything.

Questions about the methodology itself

“Do managers really think that the tooth fairy will incur capital expenditures?” Warren Buffett.

That's what Buffett, one of the critics of EBITDA, tells us. Translated into Russian, his indignation relates to the fact that EBITDA does not take into account depreciation and Buffett’s fair question - what the hell?)

Example

If a company spent 99 million rubles on the purchase of new computers for its employees and decides to write off these expenses over three years in a straight-line manner, then in the first year the “expenses” indicator will take into account a third of the real costs of purchasing computers - 33 million rubles, which means will reduce the profit indicator.

In the next two years, the “profit” indicator will also be reduced taking into account a third of the costs of purchasing computers. EBITDA does not take these write-offs into account!

DEBT and the multipliers that value it

Here we will talk about liabilities, debt, net debt and NetDebt/EBITDA multiplier

First, let's define that a company has obligations and debt. You can find both in the form of balance. Here, debt is one of the points in the section on obligations.

The company has not yet completed services to clients? It's a commitment. Didn't pay your salary? It's a commitment. But if (and only if) the company took out a loan and must repay it - this is a debt! (well, an obligation too).

So we are interested in debt.

The difference between debt and net debt is the cash we have in our accounts. Conventionally, we owe 100 rubles, but we have 50 rubles free in our pocket. Our debt is 100 rubles, and our net debt is 50 rubles.

By the way, both debt and liabilities are divided into short-term and long-term. Therefore, the final formula for net debt is:

Net debt = Short-term borrowings + long-term borrowings – cash and equivalents

Paradoxically, a negative net debt value is considered a negative indicator.

The absence of debt (the excess of cash and liquid assets over debt) indicates that the company is using money inefficiently, because the use of borrowed funds allows for production growth (the effect of financial leverage).

NetDebt/Ebitda multiplier of IT companies from NASDAQ – data from financemarker.ru

NetDebt/EBITDA multiple

This multiplier shows the ratio of net debt to EBITDA. It tells the investor how many years the company's business will need to pay off all its debt. A NetDebt/EBITDA value above 3 indicates a high debt load. And the higher the indicator, the worse.

Profitability multipliers

ROA (Return On Assets) – Return on assets

ROE (Return On Equity) – Return on equity

ROS (Return On Sales) – Return on Revenue

ROIC (Return On Invested Capital) – Return on invested capital

At one time I wrote on my blog about each of these multipliers (attached links). So here I’ll tell you in general.

As you have already noticed, these multipliers evaluate profitability (business efficiency). Everywhere in the formulas the ratio of the company’s profit to any of its indicators is examined.

What part of profit is from revenue?

What part of the profit comes from equity capital?

From assets?

With these questions we want to understand: how effective is the company’s business?

There are 2 banks with the same profit. The first bank (of course, Tinkoff) makes a profit, having an equity capital of 100 million rubles, and the second generates the same profit, having an equity capital of 200 million rubles

So it turns out that the return on equity (ROE) of the first bank is 2 times higher.

ROE multiplier of IT companies from NASDAQ – data from financemarker.ru

Profitability is a relative indicator of economic efficiency. Profitability reflects the degree of efficiency in the use of material, labor, monetary and other resources.

Profitability multiples are especially useful when analyzing banks. Partly because many value multipliers are not applicable for banks.

Therefore, in my recent analysis of Sberbank, Tinkoff and BSP, I made a lot of reference to profitability multipliers.

What I realized after 3 years of counting multipliers for all companies

3 conclusions that I made for myself:

1. It is better to have at hand not only current multipliers, but also the dynamics of their changes over the historical period. One inadequate report can change the whole picture, while in dynamics you will see the real state of affairs.

2. Companies need to be assessed comprehensively using several multiples at once, and not just one.

3. It is better to calculate the multipliers of different companies using their own identical formulas than to take values already calculated by the companies themselves. This way you will bring all the data to a single denominator, they can be compared with each other and you will know how all these numbers turned out.

Thank you!

PS I first published this review in my telegram channel @financemarker. There is a weekly analysis of one or another investment topic. I will also publish everything on the smart lab, but with a delay.

How to calculate EV/EBITDA

EV/EBITDA is the ratio of the cost of earnings (EV to EBITDA).

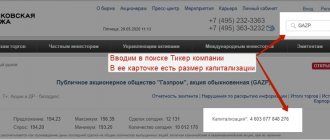

The EV indicator is made up of two values:

- Market capitalization of a company = price of 1 share x number of shares outstanding.

- The market value of a company's debt = the volume of long-term and short-term debt + financial leasing (less cash and cash equivalents).

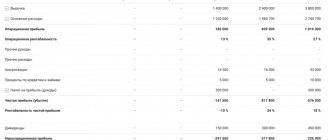

EBITDA can be calculated using formulas using two methods:

- Top to bottom (simple)

\[ EBITDA = OP + AmOS + AmNma \ , where: \]

\(OP \)– operating profit; \( AmOS \) – depreciation of fixed assets; \( AmNma \) – amortization of intangible assets.

- "Bottom up" (more complex)

\[ EBITDA = PE + PrD + N + AmOS + AmNma \ , where: \]

\( PE \) – net profit;

\( PrD \) – interest income;

\( N \) – profit tax.

Market capitalization

This multiplier has an absolute value, so companies can only be compared based on them conditionally.

Market capitalization formula:

Market capitalization = [Share price] × [Total number of shares]

The market capitalization indicator shows how much it costs to buy the entire company at the last price on the stock exchange. Of course, this is only a convention, since stock quotes are constantly changing and it is impossible to draw an unambiguous conclusion from them.

When calculating market capitalization, outstanding preferred shares, bonds, debt and other securities are not taken into account.

- EPS (earnings per share);

- ROE (return on equity);

- ROA (return on assets);

- ROS (return on sales);

Where to find the calculated EV/EBITDA ratio

In its finished form, this multiplier is not found in the official financial statements of enterprises, because it is not a standard accounting measure.

Sometimes financial managers of companies analyze its value to internally assess the state of the business, but such data is rarely published in open sources.

In addition, there are many services on the Internet where, in subscription mode, you can find the necessary analytical data, comprehensive financial results and company multipliers, selections and ratings by industry and period, collected according to various parameters.

Interpretation and standards

There is no single EV/EBITDA standard. Its meaning depends on the company's field of activity. If the industry is developing dynamically, then the coefficient value will be above average. Issuers with stable financial results most often have EV/EBITDA in the average range. A too low indicator indicates that the company is undervalued.

The average EV/EBITDA multiplier for domestic enterprises is 6 points.

- If its value is lower, most likely we see an undervaluation of the business. But this does not guarantee a rapid increase in the value of securities of such an issuer.

- If EV/EBITDA is negative, it means that the company is suffering losses and its financial condition for the reporting period leaves much to be desired.

- EV also reflects investor expectations, so a high EV/EBITDA does not necessarily mean that the company has exhausted its resources for growth. High dividends also affect capitalization, which leads to an overestimation of the indicator.

Comparison of companies by Debt/EBITDA

The Debt/EBITDA multiple compares a company's total debt obligations (short-term and long-term) without taking into account how much cash it has at its disposal. It is sometimes also referred to as Liabilities/EBITDA to avoid confusion with Net Debt/EBITDA. For example, the above-mentioned Surgutneftegas has huge reserves of free cash, but at the same time it is not the most favorable multiplier.

I also recommend reading:

Foreign brokers - their pros and cons

Investing through a foreign broker: pros and cons

The disadvantages of this ratio include the fact that it does not take into account expectations for future profits. If a company is at the stage of launching a new product or modernizing production, it can dramatically improve its performance in the next period. This aspect will be missed by an investor relying only on basic multiples. Another disadvantage is the complexity of calculating the denominator, which was already mentioned earlier.

The Debt/EBITDA ratio is important for investors pursuing a dividend strategy. The higher a company's debt relative to its earnings, the more money will be spent servicing it rather than paying out shareholders.

As with the EV/EBITDA comparison, the company for which this multiple is lower is considered preferable. The optimal value is no more than two. In this case, allowances should be made for the industry in which the business is conducted. The IT sector traditionally involves a lot of debt. A number above four is a bad indicator. At the same time, there are companies on the Russian market that are many times larger than it.

Negative multiplier values indicate that the company has no debt. However, in business this is not considered an ideal situation: perhaps the company is simply not able to take out and service bank loans.

How to use EV/EBITDA in investments

The ratio allows you to compare several companies in the same industry and find among them undervalued ones, which in the future can give good growth. And the lower the value, the more return the investor will receive from the amount of his investment.

This is especially true for non-public companies that do not disclose their financial statements. However, some show their pre-tax profits. If you compare it with the average EV\EBITDA for a specific market sector, you can estimate the fair value of the business.

In a similar way, you can also estimate the value of individual non-public assets to predict further growth of financial potential.

P/E multiplier

The most popular and simple multiplier is considered to be “P/E” (price to earnings), “Price/Profit”.

Formula for calculating P/E

P/E = [Price] / [EPS] = [Share Price] / [Earnings Per Share] or P/E = / [Earnings] = [Total Capitalization] / [Company Earnings]

P/E shows how many years it will take the company to recoup its investment while maintaining current profits.

The lower the P/E ratio, the cheaper the stock. The optimal P/E value is considered to be up to 20 (for the IT sector up to 30).

Through P/E, investors can indirectly understand the fair value of a company, or more precisely, how undervalued or overvalued its shares are.

For example, the utility sector is compared. One company has P/E=10, the other P/E=25. The overestimation of the second one immediately becomes visible. In this case, the investor should conduct a little research into what causes this situation.

The paradox of the market is that often investors simply do not notice forgotten companies with low P/E. This is due to an amazing pattern on the stock exchange: the more expensive the price of a business, the greater the chance that it will rise in price even more. Investors like to make profits here and now, rather than wait for revaluation. Therefore, they massively buy what is growing, pushing the price even higher. This approach is more reminiscent of a speculative view.

For example, in 2022, traders bought Tesla shares with P/E=1400, this is simply fantastic. They either don't know anything about investing or they just want to make a quick buck on growth.

P/E cannot be used to value unprofitable companies.

E/P ratio

The inverse of E/P shows the annualized return as a percentage. You can compare risk-free yields on government bonds when choosing companies.

It is worth making a reservation: high P/E ratios can only be justified in the case of high business growth rates, or rather profits. For this purpose, the PEG ratio is used.

PEG = [Future P/E] / [5 Year EPS Growth Rate]

EV/EBITDA peers

In some areas of business, analog coefficient options are used, tailored specifically to the specifics of the industry.

- EV/EBITDAX

Used in the oil and gas industry. X (exploration expense) – costs of exploratory drilling and other research.

- EV/EBITDAR

Used in the retail business, where R (rent expense) - rental costs, play a significant role. Investors and analysts can evaluate the fixed cost structure qualitatively if they are able to classify rental costs as a separate category.

Instead of EBITDA, the denominator of the multiplier sometimes also contains:

- OIBDA

- EBIT

- EBITA,

- NOPAT.

All of the abbreviations listed are variations of operating profit, adapted to a particular sector of the world market.

Advantages and disadvantages of the EV/EBITDA multiple

Advantages:

- Makes it possible to fairly evaluate different types of businesses with differentiated taxation methods and the share of debt in the total capital of the company.

- Allows you to compare companies with different financial leverage and depreciation levels.

- It is not affected by structural changes in the company's capital, unlike the same P/E.

Flaws:

- You have to calculate the coefficient yourself, since companies are not required to submit it to public reporting.

- It is impossible to calculate the indicator for financial market companies, because there the concept of debt has a different meaning.

- Does not include capital expenditures, which in some market sectors can represent a significant portion of a company's expenses.

Examples of using EV/EBITDA in investments

When you understand how the ratio works and correctly interpret its values, you can fairly assess the prospects of certain stocks in the future.

Comparing the value of the multiplier calculated using , with the average values in Table 1, we see that its value is higher than the average. Theoretically, this means that the company has already exhausted its resources for growth, and it is better to purchase shares of undervalued companies, for example, Lenzoloto and Polymetal, which can provide good growth in the future.

But we should not forget that EV/EBITDA reflects the expectations of investors, who for Norilsk Nickel can be more than optimistic. After all, the company has steadily growing profits and an excellent dividend policy. Therefore, there is a chance to get a good profit by purchasing its securities.