For money transfers via the Internet, an electronic payment system is provided. Unlike standard banking transactions, such transactions are not controlled by financial institutions. To store money, special cells are used - identified electronic wallets.

Electronic wallet – what is it?

An electronic wallet is a program designed for storing electronic money and conducting financial transactions on the Internet. This is analogous to a bank account, the difference is that paper bills are not used for payments.

Each client has his own wallet with an ID. It stores finances for further disposal by the user. The mechanism is similar to the principle of operation of plastic bank cards.

Reference!

You can open an account in electronic payment systems (EPS) in any currency. In your profile, you can create separate accounts for different monetary units. Conversion between them takes place at the bank's rate.

Electronic money is a currency that can only be used on the Internet. But it can be exchanged for real money after withdrawal to a card or bank account.

Cashing out funds

All conversions of virtual funds into cash require payment of a commission. Tariffs for this vary and range from 2.5 to 5 percent. There are also restrictions on the withdrawal amount for different wallets. Some anonymous accounts do not carry out such an operation at all.

The most common ways to withdraw money:

- Withdrawal to a bank card

Usually this is not profitable, but it is fast. By linking your bank card to your account, you can easily withdraw funds within the possible limit.

- Transfer to bank account

This option takes longer, from 1 to 7 days. However, some choose it. The main thing is to carefully check the transfer details.

- Through exchangers

This method is the most difficult and unreliable. Exchangers charge from 5 to 7% for transfers. They can be used if other methods are not available for some reason.

In addition to the ones presented, there are also other, less popular translation methods.

Functions of electronic wallets

Business and trade on the Internet are carried out using electronic payments. Electronic wallets are intended not only for purchases on online platforms or payment for services. They allow you to earn money and withdraw it through bank cards. EPS has a function for depositing and withdrawing money. It is intended for replenishing a wallet or transferring electronic amounts into real ones.

An electronic wallet is used for a number of financial transactions.

- Payment for work of freelancers or remote employees.

- Earning money by transferring funds from one payment system to another (for example, from Yandex.Money to WebMoney).

- Earning money from advertising content – funds will be sent to the specified wallet number after viewing promotional offers.

- Purchasing goods and paying for services via the Internet.

- Mobile phone account replenishment.

Electronic money is convenient to use both for payment and for receiving payments. Sellers do not need to send their data to buyers and ask them for bank card information.

Congratulations!

You are now a member of the WebMoney System.

Show

Your WMID number is your address in the system for correspondence with system participants and invoicing. To obtain payment details, open wallets of the required type.

Hide more details

There are a number of restrictions for your WMID; you can find out more about all types of restrictions and how to change or cancel them on the Financial restrictions

.

What to look for when choosing a wallet?

Before registering with EPS, the user needs to become familiar with its capabilities and advantages. When choosing an electronic wallet, you should pay attention to the following parameters.

- Prevalence – it is recommended to choose a wallet that is supported by many online resources.

- Functionality - the more tools for work are provided, the more opportunities the user receives. Preference should be given to wallets in which you can open an account in several currencies, perform various financial transactions, and pay for services.

- Easy registration - this will allow you to quickly access your profile, top it up and start conducting financial transactions.

- Scope of use - for use on foreign and domestic sites, it is worth registering wallets on different web resources.

Reference!

There is no charge for creating and servicing EPS wallets.

Opening a personal account on Paypal

The PayPal payment system was created in the USA. Previously, it could only be used by Americans, but over time, this resource expanded the range of its services, allowing residents of other countries, including the Russian Federation, to make payment transactions.

Registration on PayPal , step-by-step instructions:

- go to the official website and click the button in the upper right corner “register”;

- on the page that opens, select the account type (personal or corporate account);

- Next, we note the country of residence;

- enter your email address and password to log into the site;

- move on, on the new page you need to enter personal data in Cyrillic (indicated in the passport);

- check the box to confirm;

- You also need to indicate your agreement with the license agreement;

- the next step is to enter the bank card details, where the currency will be withdrawn in the future;

- We complete registration and wait for confirmation.

When your application is reviewed, an email will be sent to the specified email address notifying the new PayPal of successful registration! Also read - How to withdraw earned money from PayPal?

How to register an electronic wallet?

Once the user has selected a suitable EPS, the registration process can begin.

- Go to the official website, find the “Register” or “Create wallet” item.

- Enter personal data - last name, first name, patronymic, passport details, current phone number, email address.

- Click on “Create”. After a few minutes, you will receive a message on your phone with a confirmation code, enter it in the field.

- Registration is completed, the user is assigned a unique wallet number. You can make transactions through it after topping up.

Before using payments, it is recommended to familiarize yourself with the amount of commissions for transferring money.

World leaders

If you want to use a world-class payment system, it is recommended that you familiarize yourself with the characteristics of the leaders - this will help you determine which payment system to choose:

The best sites for freelancing and remote work via the Internet. - there is more useful information here.

- PerfectMoney is a system officially registered in Panama and opened in 2007. Registers wallets only for working with 3 currency issuers, offers interest at the rate of 4% on the remaining amount. Offered for use in many exchangers located in Russia.

- Payeer - was registered in 2012, offers an affiliate program that allows you to receive up to 40% of the profit from ongoing transactions. It assumes linking to a bank card, but does not issue your own.

- AdvCash - the presented payment system is used by the majority of Russians who work abroad. There are no commissions for internal transfers; there are a huge number of currency issuers that can be used everywhere.

These are the three most famous world leaders who are popular among Russians. They work everywhere – in almost all countries of the world. You can find a money exchange office in any city in Russia or in a sparsely populated area.

Payment by electronic wallets

After funds are credited to the virtual wallet, they can be used to pay for goods and services. It fits:

- for payments in an online store;

- mobile account replenishment;

- making monthly loan payments;

- payment of utilities, etc.

Conduct financial transactions without personal presence in the bank and without its control. You can make payments from home or any other point where you have access to the Internet.

How to withdraw money from an electronic wallet?

Money can be withdrawn completely or partially from an account with electronic currency. There are several ways to do this.

- To a bank card. In order for funds to arrive within a few minutes, you need to link your plastic card to your EPS account. If the system provides a card confirmation function, then a small commission will be charged for each transfer.

- To a bank account. The method is economical - the commission is 1%. For such a withdrawal of funds, the user needs to create a payment order in which he or she must indicate the account details. The money does not arrive immediately: it takes three days to process the application, and another seven are spent on the process of transferring funds to a bank account.

- Stationary electronic payment points and terminals. The commission is 3–5%; you need to obtain a password in advance to complete the transaction in your personal account.

- Cashing out at the EPS office. The service is available only to residents of large cities where there are offices of the electronic payment system. The official website provides a list of point addresses.

You should choose a withdrawal method based on the size of the commission and convenience.

Qiwi mobile app

The mobile application for Qiwi exists in three versions:

- For iOS version 8.0 or higher. The application is compatible with iPhone, iPad and iPod touch.

- For gadgets based on Android OS.

- For smartphones with Windows operating system higher than version 8.

Applications are free. The link to official sources is located in the lower left corner of the main page of the payment service. It is not recommended to download applications from third-party resources to avoid hacking.

Reviews of the best virtual wallets

There are several payment systems for conducting payment transactions on the Internet.

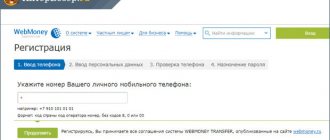

How to create an electronic wallet in WebMoney?

The international WebMoney system has been operating since 1998. "WebMoney" works with virtual monetary units that correspond to real ones (WMZ - US dollar, WMR - Russian ruble).

Features of WebMoney

- The user has access to transfer money to a bank account, withdrawal to other payment systems, and the ability to receive funds in cash.

- You can work with wallets for several currencies and transfer money between them.

Advantages of WebMoney

- Quick identification - you need to send a scan or photo of your passport without visiting the office.

- Additional services – debt, credit.

- The ability to obtain several types of certificates to expand the functionality of the electronic wallet.

To register with the EPS, you need to go to the official website, fill out the necessary data, confirm your account via a code via SMS or email. You can complete the registration procedure after providing your passport data - you need to attach scans in a special field.

How to create an electronic wallet in Yumani?

"Yumani", the old name "Yandex.Money" operates on the territory of the Russian Federation. The only available currency is the ruble, no others are provided. You can use virtual currency to pay for utilities and purchases in stores - service partners do not charge a commission.

Algorithm for opening a Yoomoney wallet.

- Go to the website, find the “Open wallet” item.

- Enter your login, password, and current phone number. You will receive an SMS message with a confirmation code.

You can create an anonymous wallet, but it will function with restrictions. The user cannot store an amount of more than 15,000 rubles; all transactions will also be carried out taking into account the limit.

To expand the capabilities, you need to go through user identification - enter your passport data. It will take one business day to check them.

Standard methods are provided for depositing funds:

- online replenishment via Internet banking;

- depositing funds through the terminal;

- replenishment at an ATM with cash or card;

- transfer from another user's wallet;

- making a bank transfer.

You can withdraw funds in the following ways:

- to a bank card of a Russian bank. The commission is 3%, another 15 rubles are charged for the service. The term for receipt of funds is up to 3 working days;

- through a money transfer system;

- to the Yumani payment card. You can withdraw funds from any ATM that works with the MasterCard payment system. A plastic card is issued for three years, the cost is 149 rubles;

- transfer to a bank account, accrual period – 3 working days;

- accelerated transfer to partner banks. Ya.Money cooperates with Otkritie, Tinkoff, Alfa-Bank.

The disadvantage of Yumani is that it can only work in ruble currency.

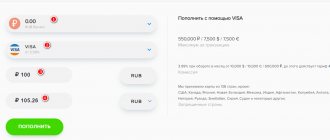

How to create a wallet in QIWI?

You can use the international wallet from QIWI through the desktop version of the site and the mobile application. The wallet allows you to:

- pay for housing and communal services, Internet;

- top up your mobile phone account;

- pay for the use of online services;

- open your own Visa QIWI Wallet card, it is linked to your wallet and phone number;

- work with four currencies - rubles, tenge, euros and US dollars;

Registration in QIWI is quick. The user needs to go to the official website, enter the phone number, and then the confirmation code received on it. To authorize, you need to use the linked phone number - this is the login from your personal account.

You can top up your wallet balance using standard methods:

- bank plastic card;

- in self-service terminals that support EPS. In Russia they can be found in supermarkets and shopping centers;

- at ATMs - by plastic card or cash;

- via Internet banking;

- payment order;

- in mobile phone stores;

- through other electronic wallets;

- bank transfer system;

- transfer funds from your mobile phone account.

You can withdraw funds from QIWI in the following ways:

- to a bank account or card. Commission – 1.5% and 2% respectively. There is a limit of up to 15,000 rubles;

- cash – a bank transfer system is used;

- “Russian Post” – postal transfer of funds;

- transfer to a plastic card with the Visa QIWI payment system, which can be issued by all EPS clients.

How to create a wallet in PayPal?

PayPal is a large payment system operating worldwide. The wallet has the following functionality:

- payment for purchases in foreign online stores;

- money transaction;

- input and output of currency.

Registration on the site is carried out in two ways - as a personal or corporate account. The first is suitable for shopping in online stores, the second is for doing business. For personal use, just fill out the requested information, click on “I Agree” and open an account. For corporate, you need to fill in information about the company.

Funds are deposited into the wallet through a bank card or exchange offices. You can withdraw to plastic cards with payment systems American Express, Visa, MasterCard, Discover.

Customer support via account

In the top menu bar of your Personal Account there is a “Help” section. Clicking on it opens a page with frequently asked questions. If the user does not find an answer there, then he clicks on the message “Contact support.” Then the client selects the topic of the request and fills out a form where he enters his contact information and describes the problem in detail.

There is also a 24/7 multi-channel technical support telephone:

8

The waiting time for an operator response can range from 2-3 minutes to half an hour. For users with a connected “Priority” package (799 rubles per year), the wait will take only 10 seconds. On weekdays from 10am to 8pm the lines are very busy, so you should not call during this time unless absolutely necessary.

Virtual cards

To perform financial transactions on the Internet, you can issue a virtual card. Funds are withdrawn from electronic wallets to it, then used as a regular bank card. They use it to pay in stores, pay for purchases on the Internet, and withdraw money from ATMs.

Reference!

Virtual cards allow you to cash out electronic currency.

Virtual cards are issued by the following EPS and banks.

- "Yandex money". A ruble card, which requires a mandatory user identification procedure to expand its functionality. Issued on the basis of the MasterCard payment system. There is a system of bonuses for purchases from partners.

- QIWI Visa card. The debit card is linked to a mobile phone number and provides cashback of up to 20% when purchasing from partners. It cannot be used in offline stores.

- Sberbank digital card. This is a full-fledged payment card that can be linked to a phone number and used to pay in offline stores. Supports NFC technology through the installed application.

- Debit card from Rosbank. It can be linked to a bank account and is suitable for payment in offline stores. Cashback is 1% on all purchases, and up to 10% in certain categories.

- From AB Rossiya Bank. The only virtual card that can be issued on the territory of the Republic of Crimea. Produced on the basis of the Mir payment system, it is not suitable for use in foreign online stores.

You can apply for virtual cards online or by visiting a bank branch in person.

Popular payment systems in Russia and the CIS

For a simpler choice, it is necessary to provide an overview of payment systems popular in Russia and the CIS countries.

Yandex money

The most popular payment systems are the leader in the form of Yandex.Money. The advantages include the following:

- main currency is ruble;

- the ability to make payments and transfers throughout Russia;

- the possibility of replenishing an account from an individual;

- convenient and simple functionality.

Among the shortcomings, it is enough to highlight the lack of possible transfer of funds to recipients abroad. Similarly, purchasing from foreign stores becomes impossible.

WebMoney

Webmoney is an international payment system that involves conducting electronic money exchange operations, as well as transferring funds to recipients from all over the world. The advantage is the opportunity to make purchases in foreign stores.

The disadvantage of the system is its complex interface, as a result of which most Internet users and electronic money exchangers turn to other services.

To register your own electronic wallet in WebMoney, you will need to place a photocopy of your passport to verify your own data.

Without the presented actions, using an electronic wallet is impossible.

PayPal

The presented payment system was developed back in 1998 and has currently affected about 190 countries for interaction and money transfers. In the system you can exchange rubles for currencies of 24 varieties.

Users actively use the system to pay for goods purchased in foreign stores.

The advantage of the system is its simple functionality, but the disadvantage is the inability to enter personal data. Some regard the ban as a positive thing, while others prefer to identify an electronic wallet with personal data.

WORLD

As a result of the imposed sanctions, in 2014 Russia created the MIR payment system, which is independent of Visa and MasterCard. This payment system belongs to the Central Bank and helps to exchange electronic money, payments and transfers to all residents of Russia.

The advantage of the system is to protect identification data, payments and transfers from external influence.

Visa

The Visa payment system is used by more than 70% of the bank's plastic card holders. Their creator Visa offers users the opportunity to register an electronic wallet and instantly transfer funds from a bank card to an electronic issuer.

The advantage of Visa is the ability to make payments for purchasing goods in stores from 200 countries.

TOP 3 electronic wallets without identification. Video:

How to cash out?

There are several ways to cash out funds from electronic wallets.

- Transfer the amount to a plastic card.

- Submit an application for withdrawal to a bank account.

- Make a transfer through Unistream, Western Union, Contact, American Express or other services.

- Use the postal transfer service of Russian Post.

- Request an expedited transfer to a partner bank.

When withdrawing funds from an electronic wallet, a commission is charged. Before submitting an application, you should read the terms and conditions of the EPS.

An electronic wallet is a system designed to pay for services and goods on the Internet. Virtual currency can be cashed out - it is withdrawn to bank cards, accounts, and the amount is received in cash. The systems QIWI, WebMoney, PayPal and Yandex.Money operate on the territory of the Russian Federation. The last e-wallet remains fully ruble; the rest allow you to open accounts in different currencies.

How to use Qiwi - accounts, transfers, payment verification

The anonymity of QIWI is both a positive and negative feature of this system. Of course, it will not become the Russian analogue of Payer Wallet with its real anonymity and non-entry into the legal framework of the United States and other countries, but you can still disable SMS confirmation in it, and hiding your IP address is not at all difficult for an experienced fraudster.

Changing the status of your wallet from anonymous to identified makes sense to increase the withdrawal limits and the balance on the balance (for an anonymous account these limits are quite low). You can do this again in the settings on the “Wallet Settings” tab:

commission for transfers to the wallets of other users in this system. Actually, like for many other translation methods:

Moreover, for the transfer it will be enough to indicate only the recipient’s cell phone number, which, in general, may not be registered in Qiwi. An SMS will be sent to his mobile phone indicating the transfer amount and the address of the site where he can receive it by going through the simple registration procedure described just above:

You can work with your money not only through the web interface or mobile application, but also by sending an SMS to the short number 7494. Just above I mentioned changing the password for logging into Wallet by sending an SMS, and on this page you can find out about all SMS teams to manage your Qiwi account and make simple payments.

This way you can recover your password and PIN code (to access your personal account from the terminal), put money on your cell phone, top up your WebMoney wallet (ruble only), block your QIWI Visa Plastic card and much more.

Payment verification on the Qiwi.ru website is possible on this page. If you took a receipt from a payment terminal, then it will be enough to fill out the fields of the verification form provided. If the receipt was not taken or it died in the bose, then in this case the issue is resolved through the support service.

Well, if you bothered to create a Qiwi wallet before, then no one is stopping you from going to the “Reports” :

As I said at the beginning of the article, there are several options for paying bills through this payment system:

- Through the terminal in cash. When choosing a payment method, you just need to issue an invoice for payment for goods or services, and then find the address of the nearest payment terminal to your home and, logging into your personal account using the existing PIN code, find the invoice issued for payment and enter the money into the bill acceptor. The change can be transferred to the balance of your mobile phone. But it’s better to see once than to hear a hundred times:

- The invoice can be paid with virtual money a bank card linked to it or from the balance of your cell phone , in case there are no virtual funds left, there is no card or there is no cash on it, and the nasty weather outside does not allow even think about going to the nearest payment terminal. This is done quite simply:

- I don’t communicate very much on social networks, but nevertheless there are applications for social networks: Vkontakte, Odnoklassniki and Facebook, which in theory also allow you to pay bills, in addition to the fact that with the help of them you can purchase their social currency in these networks: