P/S multiplier (English: Price to Sales ratio, analogue: P/Revenue, translation: Price / Revenue) is the ratio of a company’s capitalization on the stock market to its revenue. In other words, the indicator reflects how much an investor pays per unit of revenue. This criterion, along with such multipliers as: P/E, P/BV, EV/EBITDA, EPS, ROE, is used in value investing as a tool for searching for undervalued shares.

Value investing is widely developed and widespread in the American stock market. The founder of this approach was B. Graham and D. Dodd back in the 40s of the 20th century. Now his ideas are being actively implemented by Warren Buffett. The essence of value investing is to find stocks that are undervalued by the market but have high intrinsic value and that have long/medium term growth potential.

Take our proprietary course on choosing stocks on the stock market → training course

Formula for calculating P/S

Let's look at what the P/S ratio shows and what formulas exist for calculating the balance sheet.

Option #1. The formula for calculating the P/S multiplier is as follows and obvious:

Capitalization is the value of all issued shares on the company's stock market. It can be found on the official websites of companies, on the MICEX exchange or in the Tradingview service.

Revenue is the volume of sales of products (services). Reflected as line 2110 in the “Income Statement”.

Option #2. Variation of calculating the coefficient using return on sales:

Shows a direct relationship between ROS - return on sales and the P/E multiplier (Capitalization / Net profit).

Advantages of using the “Revenue” criterion in P/S

One of the advantages of P/S in relation to other indicators (for example P/E) is the use of revenue as the denominator. Its use reflects:

- A measure of the company's influence . Using revenue in ratio calculations as an overall performance indicator reflects how dominant a company is in its industry and how much cash it receives from sales.

- Potential for growth . Revenue is the amount of money a company received from sales. If we use net income, we exclude the impact of costs on production costs, management and operating expenses. As profitability increases and costs decrease, revenue becomes a potential driver of net profit.

Applying Price to Sales Ratio

The P/S ratio shows a company's efficiency in generating earnings given its outstanding debt. It is important to remember that it is most useful when compared to businesses in the same sector. Without proper context, statistics can seem abstract and lose significance.

The P/S ratio is based on publicly available data. The price of shares, the number of securities issued, and total earnings data are publicly known and are not “released” by the corporation for publication in the market. By comparison, the price-to-earnings ratio, or P/E, depends on the application of a company's specific accounting practices to determine the net earnings divisor. Typically, due to the statistics used in each calculation, the P/S ratio is not easy to manipulate.

The P/S ratio is especially useful when evaluating cyclical companies or those that are not currently profitable. As long as the company does not face immediate bankruptcy problems, there is the possibility of making a profit in the future.

For example, in the case of a retailer, revenues often fluctuate depending on the season; a company may periodically incur losses while long-term profitability remains unchanged.

Standard P/S value

The key task of the indicator is to find those companies that are undervalued by the market and have potential for future growth. The higher the P/S value, the worse it is for the investor, because he has to pay more for every 1 unit of revenue.

| Meaning | Attractiveness |

| P/S < 1 | The company is undervalued and has potential for growth |

| 1 < P/S < 2 | The company is optimally valued by the market |

| P/S > 2 | The company is overvalued by the market |

| P/S1 2 | Company (1) is more investment attractive than (2) |

| P/S1 * | The company's P/S is less than the market average (*) The company can be purchased (absorbed) due to low capitalization |

There are no exact standards in the capital market; they are all advisory in nature. For example, Apple (AAPL) P/S >3. And despite its overvaluation, it still tends to grow.

Relationship between P/S and the stage of development of the company

The dynamics of the P/S ratio reflects the stage of development of the company . Changes in revenue show the stages of development: growth, stagnation, decline. In the growth phase, revenue volumes will decrease, and vice versa, when revenue decreases, the ratio will increase.

| Dynamics of P/S | Company development phase |

| P/S ↓ | Growth phase. The company increases sales, influence and dominance in its industry |

| P/S ↑ | Phase of decline or stagnation. The company reduces sales volumes, decreases market influence, decreases competitiveness |

Revenue, or how to evaluate the usefulness of a product

The most effective way to assess the usefulness of a product, service or business as a whole is the good old calculation of revenue.

If someone agreed to pay their hard-earned money for a particular product, it means that this product was useful to someone.

The higher the revenue, the higher the utility of the product. And, by the way, the company as a whole.

Revenue is the entire amount of money that customers gave in exchange for our goods or services.

From this perspective, the size of the revenue adds value to the company because a significant amount of revenue indicates the usefulness of the company.

High revenue tends to correlate with high profit (that is, it follows the dynamics of changes in profit: both increase or decrease at the same time).

The amount of profit for the same amount of revenue depends on the quality of corporate governance.

The more professional the company's management and the higher the corporate standards, the higher the company's profit margin, as a rule.

Keep in mind that since the tax legislation of most countries provides for the payment of income tax, entrepreneurs have a vested interest in ensuring that the amount of this profit is smaller (not actually, of course, but, so to speak, “legally,” that is, on paper).

As a result, profit data in financial statements may often be underestimated.

No one will underestimate the amount of revenue, therefore, confidence in this indicator is higher.

And the amount of revenue can tell no less about the potential profitability and prospects for business development than the same profit...

A practical example of calculating P/S for PJSC Gazprom

For a deeper understanding, consider a practical example of calculating the P/S multiplier for PJSC Gazmrom (GAZP). At the first stage, we calculate the company's capitalization. To do this, go to the Moscow Exchange → enter the ticker of the company “GAZP” in the search bar → the company’s card shows the size of capitalization.

Where to find the size of a company's capitalization on the domestic stock market (MICEX)

The second way to determine capitalization using the TradingViews service → go to the service.

Assess the size of a company's capitalization using the TradingView service

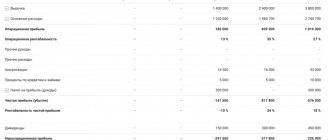

To calculate revenue, you need to use Gazprom’s quarterly financial statements from the official website. Reports by quarter and year can be viewed here → reporting. Revenue is reflected in the “Income Statement” as the first line (code 2110).

Final value P/S = 4609000 / 10858916 million rubles. = 0,42

This value signals that the stock is severely undervalued.

In the calculations, I used revenue data for 2022, because... There are no reports for the 1st quarter yet.

Examples

Educational example

For example, XYZ Company is listed at the current price of $5 per share. There are 200 million shares outstanding. Annual revenue is $400 million. Current P/S values can be calculated using any of the following methods:

Per share: share price / (annual sales / shares outstanding) = (5 / (400 / 200) = 2.5. By market capitalization: (share price * number of shares outstanding) / annual sales = (5 * 200 ) / 400 = 2.5.

Real example. TESLA

Let's take a closer look at the example of the exclusive company Tesla, CDF on shares, which are also traded in Gerchik & Co.

As you know, Tesla presented its quarterly report on October 21. The stock is currently listed at $429.92.

According to the formulas we know:

Price to sales (1) = Share Price / Total sales per share = price per share / (revenue / share) = 429.92 / (25.71 / 0.93) = 15.55. Price to sales = Market capitalization/ Total Revenue past 12 months = 402.07 / 25.71 = 15.64.

Now let’s look at this multiplier over 3 years. As you can see, the table and graphs show prices per security, revenue per share, PS ratio.

So, during the analyzed period, the share price increased by 215% (from $68.59 to $215.96). Sales increased by a total of 66%.

Consequently, over three years the company has become more valuable in terms of P/S multiple. In other words, as of 06/30/20, investors paid more for investments in it compared to the level of sales than 3 years ago.

In the first year, investors were willing to pay $4.22 for every dollar of sales per share. Third year: $7.99. There can be many reasons for this. For example, the company's superiority in the industry, speculation, etc.

Let's compare P/S of competitors as of October 22, 2020

- Tesla = 15.55.

- General Motors Company (GM) li/S = 0.45.

- NIU (NIU) = 6.21.

This suggests that Tesla is trading higher than its peers. And investors are willing to pay a higher price for its shares.

IMPORTANT!

It's worth remembering that a very high P/S ratio can be a warning sign.

[Service] Where to quickly view P/S for foreign shares

In order to find shares of foreign companies, we will use the service finviz.com → Screener. Go to the “Screener” section → “Fundamental indicators” → “Filter <1”. The figure shows the stages of working with the service to find undervalued stocks. Further analysis can be aimed at assessing the attractiveness of other company indicators P/E, P/B, P/C, current ratio, quick ratio, profitability (ROA, ROE, ROI).

Step-by-step instructions on how to estimate P/S for foreign stocks using the Finviz service

Explaining p-values for new Data Scientists

I remember when I did my first overseas internship at CERN as a trainee, most people were still talking about the discovery of the Higgs boson after confirming that it met the five sigma threshold (meaning it had a p-value of 0.0000003).

Back then, I knew nothing about p-values, hypothesis testing, or even statistical significance.

I decided to google the word “p-value” and what I found on Wikipedia made me even more confused...

In statistical hypothesis testing, the p-value,

or

probability value

, for a given statistical model is the probability that, if the null hypothesis is true, the statistical summary (for example, the absolute value of the sample mean difference between two comparison groups) will be greater than or equal to the actual observed results. - Wikipedia

Good job, Wikipedia.

OK. I didn't understand what p-value actually means.

As I delved deeper into the field of data science, I finally began to understand the meaning of the p-value and where it can be used as part of decision-making tools in certain experiments.

Therefore, I decided to explain the p-value in this article and how it can be used in hypothesis testing to give you a better and more intuitive understanding of p-values. Also we can't skip the fundamental understanding of other concepts and the definition of p-value, I promise I will make this explanation intuitive without subjecting you to all the technical terms I came across.

There are four sections in total in this article to give you the complete picture from constructing a hypothesis test to understanding the p-value and using it in your decision making process. I highly recommend you go through all of them to get a detailed understanding of p-values:

- Hypothesis testing

- Normal distribution

- What is P-value?

- Statistical significance

It will be fun.

Let's start!

Testing hypotheses

Before we talk about what a p-value means, let's start by looking at hypothesis testing, where the p-value is used to determine the statistical significance of our results.

Our ultimate goal is to determine the statistical significance of our results.

And statistical significance is built on these 3 simple ideas:

- Hypothesis testing

- Normal distribution

- P-value

Hypothesis testing is used to test the validity of a statement (null hypothesis) made about a population using sample data.

The alternative hypothesis is the one you would believe if the null hypothesis were false. In other words, we will create a statement (null hypothesis) and use sample data to test whether the statement is valid. If the statement is not true, we will choose the alternative hypothesis. Everything is very simple.

To know whether a claim is valid or not, we will use the p-value to weigh the strength of the evidence to see if it is statistically significant. If the evidence supports the alternative hypothesis, then we will reject the null hypothesis and accept the alternative hypothesis. This will be explained in the next section.

Let's use an example to make this concept clearer, and this example will be used throughout this article for other concepts.

Example.

Let's say a pizzeria claims their delivery time is on average 30 minutes or less, but you think it's longer than what they claim. So you perform a hypothesis test and randomly select a delivery time to test the claim:

- Null hypothesis

- average delivery time is 30 minutes or less - Alternative hypothesis

- average delivery time exceeds 30 minutes - The goal here is to determine which claim—null or alternative—is better supported by the data obtained from our sample data.

We will use a one-tailed test in our case, since we only care that the average delivery time is greater than 30 minutes.

We will not consider this possibility in the other direction, since the implications of the average delivery time being less than or equal to 30 minutes are even more preferable. Here we want to check if there is a possibility that the average delivery time is greater than 30 minutes. In other words, we want to see if the pizzeria has deceived us. One common way to test hypotheses is to use the Z-test. We won't go into detail here as we want to better understand what's going on on the surface before we dive deeper.

Normal distribution

The normal distribution is a probability density function used to view the distribution of data.

The normal distribution has two parameters - the mean (μ) and the standard deviation, also called sigma (σ).

The mean is the central tendency of a distribution. It determines the location of the peak for normal distributions. Standard deviation is a measure of variability. It determines how far from the average values tend to fall.

The normal distribution is usually associated with the 68-95-99.7 rule (image above).

- 68% of data are within 1 standard deviation (σ) of the mean (μ)

- 95% of data are within 2 standard deviations (σ) of the mean (μ)

- 99.7% of data are within 3 standard deviations (σ) of the mean (μ)

Remember the five-sigma threshold for discovering the Higgs boson that I talked about at the beginning?

5 sigma is about 99.99999426696856% of the data that had to be reached before scientists confirmed the discovery of the Higgs boson. This was a strict threshold set to avoid any possible false signals. Cool. Now you may be wondering, “How does the normal distribution relate to our previous hypothesis testing?”

Since we used the Z-test to test our hypothesis, we need to calculate Z-scores (which will be used in our test statistics), which are the number of standard deviations from the mean of the data point. In our case, each data point is the pizza delivery time we received.

Note that when we calculated all the Z-scores for each pizza delivery time and plotted a standard bell curve as shown below, the unit on the x-axis will change from minutes to a standard deviation unit since we standardized the variable by subtracting the mean and dividing it by the standard deviation (see formula above).

Studying the standard bell curve is useful because we can compare test results from a “normal” population to a standardized unit of standard deviation, especially when we have a variable that comes with different units.

The Z-score can tell us where the overall data lies compared to the population average.

I like how Will Cursen puts it: the higher or lower the Z-score, the less likely a random result will be and the more likely a significant result will be.

But how high (or low) is considered strong enough to quantify how significant our results are?

Climax

Here we need the last piece to solve the puzzle - the p-value, and test whether our results are statistically significant based on the significance level (also known as alpha) that we set before starting our experiment.

What is P-value?

Finally... We're talking about p-values here!

All the previous explanations are meant to set the stage and lead us to this P-value. We need the previous context and steps to understand this mysterious (actually not so mysterious) p-value and how it can lead to our hypothesis testing decisions.

If you've made it this far, keep reading. Because this section is the most exciting part of all!

Instead of explaining p-values using Wikipedia's definition (sorry Wikipedia), let's explain it in our context - pizza delivery time!

Recall that we randomly selected some pizza delivery times, and the goal is to check whether the delivery time is greater than 30 minutes. If the conclusive evidence supports the pizzeria's claim (average delivery time is 30 minutes or less), then we will not reject the null hypothesis. Otherwise, we reject the null hypothesis.

So the p-value's job is to answer this question:

If I live in a world where pizza delivery times are 30 minutes or less (the null hypothesis is true), how surprising is my evidence in real life?

The P-value answers this question with a number—a probability.

The lower the p-value, the more surprising the evidence, the more ridiculous our null hypothesis looks.

And what do we do when we feel ridiculous with our null hypothesis? We reject it and choose our alternative hypothesis.

If the p-value is below a given level of significance (people call it alpha, I call it the ridiculousness threshold - don't ask why, it's just easier for me to understand), then we reject the null hypothesis.

Now we understand what p-value means. Let's apply this in our case.

P-value in calculating pizza delivery time

Now that we have collected a few sample data on delivery times, we did the calculation and found that the average delivery time is 10 minutes longer with a p-value of 0.03.

This means that in a world where the pizza delivery time is 30 minutes or less (the null hypothesis is true), there is a 3% chance that we will see the average delivery time at least 10 minutes longer due to random noise .

The smaller the p-value, the more significant the result will be because it is less likely to be caused by noise.

In our case, most people misunderstand the p-value:

A P-value of 0.03 means that there is a 3% (percentage probability) that the result is due to chance - which is not true.

People often want a certain answer (including me), and this is why I was confused for a long time with interpreting p-values.

The p-value doesn't *prove* anything. It's simply a way to use surprise as a basis for making smart decisions. — Cassie Kozyrkov

Here's how we can use the p-value of 0.03 to help us make a smart decision (IMPORTANT):

- Imagine we live in a world where the average delivery time is always 30 minutes or less - because we believe in pizza (our original belief)!

- After analyzing the delivery time of the collected samples, the p-value is 0.03 lower than the significance level of 0.05 (assuming we set this value before our experiment) and we can say that the result is statistically significant.

- Since we have always believed the pizzeria that it can deliver on its promise to deliver a pizza in 30 minutes or less, we now need to consider whether this belief makes sense since the result tells us that the pizzeria is not delivering on its promise and the result is statistically significant.

- So what should we do? First we try to think of every possible way to make our initial belief (null hypothesis) true. But since the pizzeria gradually receives bad reviews from other people and often gives bad excuses that led to the delivery delay, even we ourselves feel ridiculous to justify the pizzeria and hence we decide to reject the null hypothesis.

- Finally, the next smart decision is to not buy any more pizza from this place.

By now you may have realized something... Depending on our context, p-values are not used to prove or justify anything.

In my opinion, p-values are used as a tool to challenge our initial belief (null hypothesis) when the result is statistically significant. The moment we feel ridiculous with our own belief (assuming the p-value shows that the result is statistically significant), we reject our original belief (reject the null hypothesis) and make a reasonable decision.

Statistical significance

Finally, this is the last step where we put everything together and check if the result is statistically significant.

It is not enough to just have a p-value, we need to set a threshold (significance level is alpha). Alpha should always be set before the experiment to avoid bias. If the observed p-value is lower than alpha, then we conclude that the result is statistically significant.

The general rule is to set alpha to 0.05 or 0.01 (again, the value depends on your task).

As mentioned earlier, suppose we set alpha to 0.05 before we started the experiment, the result obtained is statistically significant since the p-value of 0.03 is lower than alpha.

For reference, below are the main steps of the entire experiment:

- State the null hypothesis

- Formulate an alternative hypothesis

- Define the alpha value to use

- Find the Z-score associated with your alpha level

- Find the test statistic using this formula

- If the value of the test statistic is less than the alpha level Z-score (or the p-value is less than the alpha value), reject the null hypothesis. Otherwise, do not reject the null hypothesis.

If you want to learn more about statistical significance, feel free to check out this article - Statistical Significance Explained, written by Will Kersen.

Subsequent Thoughts

There's a lot to digest here, isn't there?

I can't deny that p-values are inherently confusing to many people, and it took me quite a long time to truly understand and appreciate the meaning of p-values and how they can be applied within our decision-making process as data scientists.

But don't rely too much on p-values, since they only help in a small part of the overall decision-making process.

I hope that my explanation of p-values was intuitive and helpful in your understanding of what p-values really mean and how they can be used in testing your hypotheses.

The calculation of p-values itself is simple. The difficult part comes when we want to interpret p-values in hypothesis testing. Hopefully the hard part will be a little easier for you now.

If you want to learn more about statistics, I highly recommend you read this book (which I'm currently reading!) - Practical Statistics for Data Scientists, specifically written for data scientists to understand the fundamental concepts of statistics.

Find out details on how to get a sought-after profession from scratch or Level Up in terms of skills and salary by taking paid online courses from SkillFactory:

- Training in the Data Science profession from scratch (12 months)

- Analyst profession with any starting level (9 months)

- Machine Learning Course (12 weeks)

- Course "Python for web development" (9 months)

- DevOps course (12 months)

- Profession Web developer (8 months)

(+ / –) Advantages and disadvantages of P/S

Let's look at the advantages and disadvantages of using the P/S ratio.

(+) Difficulty in manipulation . The revenue indicator that is included in the calculation formula is difficult to fake in financial statements (than net profit). It does not depend on accounting policies and directly reflects the company's performance. P/S manipulation option. One of the options for influencing the ratio is the use of share repurchases in order to increase market value.

(+) A unified form for comparing all companies . The ability to compare different companies, regardless of their industry, stage of development and size. Comparing companies by absolute values of fundamental indicators: net profit, revenue, size of assets, debt, etc. we would not be able to compare businesses due to the volatility of these indicators and their absolute values.

(+) Versatility in calculations . The ratio can always be calculated for any financial statements of the company. Since the denominator is revenue, which is always there, in contrast to net profit, which in some periods may be negative or equal to zero. This is an advantage over the P/E multiplier, which can take negative values in some periods (calculated as the ratio of the share price to net income).

(–) Large revenues may hide small profits . A company may receive a lot of revenue, but not have a net profit, which can be spent on expenses, costs, fees and taxes. Focusing only on this indicator will not provide complete information about the company.

Price-to-sales ratio restrictions

1. The price-to-earnings ratio has its limitations. For example, P/S varies across many industries, and it is not fair to compare companies in different sectors. Also, this multiplier cannot distinguish an organization that uses borrowed funds from one that does without them. The reason is that the company may report a low P/S ratio and be close to bankruptcy.

2. How can an investor notice the difference? In this case, enterprise value EV should be used in the calculation rather than capitalization (adding long-term debt to market capitalization and subtracting any cash). This approach eliminates the difficulty of comparing "polar" companies - those that rely on debt to grow sales and those that do not and have lower sales levels.

3. Additionally, the P/S ratio does not provide any information about profitability or costs, so it is important for investors to look at this ratio along with other financial indicators.

Open an account and start trading CFDs on shares of successful companies

Recommendations for use

A number of additional recommendations for using the multiplier:

- The P/S ratio reflects the undervaluation of the stock.

- It is better to compare companies of the same industry and segment. You cannot compare companies with high and low capital intensity: for example, Gazprom and Yandex.

- It is better to use the P/S indicator in conjunction with other multipliers (P/E, ROE, P/BV, EPS, Debt/EBITDA, EV/EBITDA, EBITDA.

- Poorly suited for assessing insurance and financial companies due to the peculiarities of revenue generation. Aswath Damodaran recommends use for the telecommunications industry.

| Business valuation | Financial analysis according to IFRS | Financial analysis according to RAS |

| Calculation of NPV, IRR in Excel | Valuation of stocks and bonds |

Time puts everything in its place

In practice, there are a large number of examples of acquisitions of companies with revenue margins lower than the industry average. We will not consider cases of raiding or simply corporate theft, since this is not entirely an economic component. As an example, we can recall the takeover of small and medium-sized Russian breweries by super-efficient global beer giants at a good premium. There are examples in the retail business (Wim-Bill-Dann, Kalina) and in the oil business (the takeover of small oil companies and refineries by TNK-BP). For investors, such events are always quite profitable - either the shares were bought back at a premium to the market, or their price increased due to an increase in the efficiency of the company itself. It is quite difficult to estimate the timing of such events (only insiders know them reliably, which is sometimes used, but let it be on their conscience, and let law enforcement agencies fight it), but it is important for an investor to keep this in mind.