A cash flow statement is a company's report on the sources of funds (loans, equity capital, bond borrowings, etc.) and their use in a given time period in three types of activities: operating, investing and financing. This statement directly or indirectly shows a company's cash receipts, classified by principal sources of capital, and its cash payments, classified by principal uses, during the period. [sam_ad id=»7" codes=»true»]

The cash flow statement is one of the main accounting reports, which is prepared according to the approved Form No. 4 (form code according to OKUD 0710004). The report reflects the organization's cash flow in the national currency of the Russian Federation and in foreign currency. Data on cash flows are provided for the reporting and previous year. According to RAS, the cash flow statement is generated by the direct method (the receipt and direction of cash are shown in the context of current, investment and financial activities). The Russian cash flow statement form does not provide for the use of the indirect method. According to Russian standards, it is not necessary to provide data on cash equivalents. The definitions of operating, investing and financial activities in IFRS and RAS are not identical.

Cash equivalents are highly liquid financial investments that can be easily converted into a known amount of cash and are subject to an insignificant risk of changes in value, usually with a maturity period of no more than three months.

Purpose and scope of application The report is used by managers and external users. In this report you can see real income and expenses, as well as obtain the following information:

- Volume and sources of funds received;

- Directions for using funds;

- The company’s ability, as a result of its activities, to ensure that cash receipts exceed payments;

- The company's ability to fulfill its obligations;

- Information about the sufficiency of funds to conduct activities;

- The degree of self-sufficiency of investment needs from internal sources;

- Reasons for the difference between the amount of profit received and the amount of cash.

[s[sam_ad id=»7" codes=»true»]p>

During the preparation of the report, the inflow and outflow of funds for the main (production, operating or other activities), financial and investment activities of the company are identified:

- Operating activities are the main type of activity, as well as other activities that generate the receipt and expenditure of funds of the company (with the exception of financing and investing activities);

- Investment activity is a type of activity that is associated with the acquisition, creation and sale of non-current assets (fixed assets, intangible assets) and other investments not included in the definition of cash and cash equivalents;

- Financing activities are activities that result in changes in the amount and composition of a company's capital and debt. Often such activities are associated with attracting and repaying loans necessary to finance operating and investment activities.

This classification is intended to enable users of financial statements to assess the impact of these three areas of activity on the financial position of the company and on the amount of its cash.

Table 1. Classification of cash flows by type of activity

| Kind of activity | Cash inflows | Cash outflows |

| operating room | 1. Proceeds from the sale of goods and provision of services; 2. Receipts of rental payments for the provision of rights, remunerations, commissions; 3. Receipts and payments from insurance companies on insurance premiums and claims. | 1. Payments to suppliers of goods and services; 2. Payment of wages to employees; 3. Payments of income taxes, except for taxes related to financial or investment activities. |

| Investment | 1. Proceeds from the sale of fixed assets, intangible assets and other non-current assets; 2. Proceeds from the sale of shares of other companies, as well as shares in joint companies; 3. Proceeds in repayment of loans provided to other parties. | 1. Payments for the acquisition of fixed assets, intangible assets and other non-current assets; 2. Payments for the acquisition of shares or debt instruments of other companies, as well as shares in joint ventures; 3. Lending to other parties. |

| Financial | 1. Proceeds from the issue of shares or the issue of other equity instruments; 2. Proceeds from the issue of bonds, bills, mortgages, loans, as well as from other financial instruments. | 1. Payments to owners upon redemption or redemption of company shares; 2. Payments to repay loans; 3. Payments by the lessee to satisfy the finance lease obligation. |

Net Cash Flow (NCF) is the difference between positive cash flow (cash inflow) and negative cash flow (cash outflow) in the period under consideration in the context of its individual intervals (by month, quarter, year).

NCF = CF+ - CF- , where “CF+” is positive cash flow “CF-” is negative cash flow

Typically, payments within a cash flow are grouped by time periods. For example, by month, quarter, year. In this case, the formula for net cash flow can be presented as follows:

NCF = NCF1+ NCF2 + NCF3 + … + NCFN or NCF = (CF1+ - CF1-) + (CF2+ - CF2-) + (CF3+ - CF3-)+...+ (CFN+ - CFN-)

Factors that influence the volume and nature of cash flow generation over time can be divided into external and internal.

[sam[sam_ad id=»7" codes=»true»]

External factors: a) commodity market conditions; b) stock market conditions; c) the system of taxation of enterprises; d) the established practice of lending to suppliers and buyers of products; e) a system for carrying out settlement transactions of business entities; f) availability of financial credit; g) the possibility of attracting gratuitous targeted financing.

Internal factors: a) enterprise life cycle; b) duration of the operating cycle; c) seasonality of production and sales of products; d) urgency of investment programs; e) depreciation policy of the enterprise; f) operating leverage ratio; g) financial mentality of the owners and managers of the enterprise.

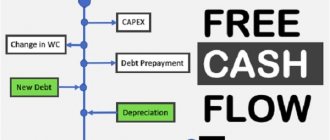

Free Cash Flow to the Firm (FCFF) is the after-tax cash flow from its operating activities minus net investment in fixed and working capital available to investors (creditors and owners). Free cash flow is defined as operating profit after taxes plus depreciation and amortization minus investments. Asset cash flow is the flow that is generated by a firm's production or operating assets.

Detailed FCFF formula: FCFF = EBIT*(1-Tax Rate) + DA - CNWC - CAPEX · Tax Rate – income tax rate; · EBIT – earnings before interest and tax; · DA – depreciation of tangible and intangible assets (Depreciation & Amortization); · CNWC – change in net working capital; · CAPEX – capital expenditures (Capital Expenditure).

Free cash flow gives a clearer picture of a company's ability to generate cash and, therefore, profit. Negative free cash flow in itself is not always a bad indicator. If its value is negative, it could, for example, mean that the company is making a large investment. If these investments generate high returns, this strategy has the potential to pay off over the long term.

The direct method is based on the calculation of positive cash flow (inflow), consisting of proceeds from the sale of products, works and services, advances received, and negative cash flow (outflow) associated with the payment of supplier bills, the return of short-term loans and borrowings received. The starting element is profit.

Advantage of the direct method It shows the total amounts of receipts and payments and concentrates attention on those items that generate the largest inflows and outflows of funds. Having such information for a number of reporting periods, it is possible to determine the trend in the structure of inflows and outflows and predict them for the future.

Disadvantage of the direct method : It does not reveal the relationship between the amount of the financial result and the amount of change in funds. For example, the method does not answer the question: “Why can a profitable enterprise be insolvent?” Table 2. Accounting for cash flows using the direct method.

| Index | Period | |||

| 1st quarter | 2nd quarter | 3rd quarter | 4th quarter | |

| 1. Cash balance at the beginning of the period | ||||

| 2. Receipts, including | ||||

| · sales revenue and advances | ||||

| · loans, borrowings and other borrowed funds | ||||

| · dividends, interest and other income | ||||

| 3. Payments, including | ||||

| ·payment for goods, works, services, advances and accountable funds issued | ||||

| ·salary | ||||

| · calculations with the budget | ||||

| ·payment of fixed assets | ||||

| ·financial investments | ||||

| repayment of loans | ||||

| 4. Cash flow (receipts - payments) | ||||

| 5. Cash balance at the end of the period | ||||

[sam_a[sam_ad id=»7" codes=»true»]p> The indirect method is based on the identification and accounting of transactions related to cash flows and other balance sheet items, as well as on the sequential adjustment of net profit. The initial element is profit.

The advantage of the indirect method when used in operational management is that it allows you to establish a correspondence between the financial result and your own working capital. In the long term, the indirect method allows us to identify the most problematic “places of accumulation” of frozen funds and, based on this, develop ways out of the current situation. The information basis for analyzing cash flows using the indirect method is the balance sheet; the methodological basis is the balance sheet method of analysis, which links cash inflows and outflows.

| Flow of funds | Period | |||

| 1st quarter | 2nd quarter | 3rd quarter | 4th quarter | |

| Current (main activity) | ||||

| Increase (sources of funds): | ||||

| · Net profit | ||||

| · Depreciation | ||||

| · Increase in accounts payable | ||||

| · Decrease (use of cash) | ||||

| · Increase in accounts receivable | ||||

| · Increased inventory and costs | ||||

| Cash flow from core activities | ||||

| Investment activities | ||||

| · Acquisition of fixed assets | ||||

| · Sale of fixed assets | ||||

| Cash flow from investing activities | ||||

| Financial activities | ||||

| · Increase in bills | ||||

| ·Increase in loans and credits | ||||

| · Payment of dividends | ||||

| Cash flow from financing activities | ||||

| TOTAL cash flow | ||||

| Cash at the beginning of the period | ||||

| Cash at the end of the period | ||||

Ratio analysis is an integral part of cash flow analysis. With its help, the levels and their deviations from the planned and basic values of various relative indicators characterizing cash flows are studied, and the efficiency ratios for the use of the organization’s funds are also calculated.

An important point in the coefficient method of analysis is the study of the dynamics of various coefficients, which makes it possible to establish positive and negative trends that reflect the quality of cash flow management of an organization, as well as to develop the necessary measures to make appropriate adjustments to optimize management decisions in the process of carrying out business activities.

Cash flow ratio analysis combines the following indicators: 1. Net cash flow adequacy ratio - an indicator that determines the sufficiency of the net cash flow generated by the organization, taking into account the financed needs 2. Cash flow efficiency ratio is used as a general indicator 3. Reinvestment ratio - one of the private performance indicators cash flows of the organization 4. Cash flow liquidity ratios are calculated to assess the synchronicity of the formation of various types of cash flows for individual time intervals (month, quarter) within the period under consideration (year) using the formula

The efficiency of using funds is also assessed using various profitability ratios: 1. Profitability ratio of positive cash flow in the analyzed period 2. Profitability ratio of the average cash balance in the analyzed period 3. Profitability ratio of net cash flow in the analyzed period

Cash flow profitability indicators by type of activity are examined separately: 1. Cash flow profitability ratio for current activities - the ratio of sales profit for the analyzed period to positive cash flow for current activities. 2. The profitability ratio of cash flow from investment activities in the analyzed period is the ratio of profit from investment activities to the positive cash flow from investment activities for the analyzed period. 3. Cash flow profitability ratio for financial activities in the analyzed period - the ratio of profit from financial activities to positive cash flow for financial activities for the analyzed period.

Risk is the probability that predicted events will not occur (promised explicit payments will not be made, cash flows received will be less than predicted). Cash flow risk is the probability of adverse consequences occurring in the form of a decrease in incoming and an increase in outgoing cash flows in a situation of uncertainty in the conditions of financial transactions, leading to a loss of financial independence and the threat of bankruptcy.

Three-level system of financial risks of an industrial enterprise

Main cash flow risks by type of activity

| Types of economic activities | Cash flow risks |

| Operating activities | · Commercial risk · Tax risk · Inflation risk · Currency risk · Risk of decreased financial stability · Insolvency risk |

| Investment activities | · Investment risk · Inflation risk · Risk of decreased financial stability · Insolvency risk |

| Financial activities | · Credit risk · Interest rate risk · Deposit risk · Inflation risk |

[sam_ad [sam_ad id=»7" codes=»true»]Under the influence of various external and internal risk factors, various methods of risk reduction can be used, affecting certain aspects of the enterprise’s activities. The variety of risk management methods used in business activities can be divided into 4 groups: 1. Methods of risk avoidance (rejection of unreliable partners, refusal of risky projects, risk insurance, search for guarantors) are the most common in business practice, they are used by people who prefer to act for sure. 2. Methods of risk diversification (distribution of responsibility between project participants, diversification of types of activities and areas of management, diversification of sales and supplies, diversification of investments, distribution of risk over time and across stages of work) consist in the distribution of general risk. 3. Methods of risk compensation (strategic planning of activities, forecasting the external situation, monitoring social- economic and regulatory environment, the creation of a reserve system) are associated with the creation of hazard prevention mechanisms. These methods are more labor intensive and require extensive preliminary analytical work to be used effectively. 4. Risk localization methods (creation of venture enterprises, creation of special structural divisions, conclusion of agreements on joint activities) are used in rare cases when it is possible to quite clearly identify risks and the sources of their occurrence. By separating the economically most dangerous stages or areas of activity into separate structural units, you can make them more controllable and reduce the level of risk.

The concept of net cash flow

Net cash flow is the company's financial turnover (inflows and outflows) . In simple terms, cash flow represents all the receipts and expenses of a company over a certain period of time.

Take our proprietary course on choosing stocks on the stock market → training course

Foreign companies use such a concept as CF. It is divided into several types: pure DP, financial turnover for owners and shareholders. In Russia, the indicator in this form is rarely calculated. Most often, it is calculated for presentations designed to demonstrate the results of the company's activities.

Financial statements of Russian enterprises include net cash flow. It can be found on the cash flow statement. The document shows to what extent the company is provided with finances to carry out its main and additional activities.

| Business valuation | Financial analysis according to IFRS | Financial analysis according to RAS |

| Calculation of NPV, IRR in Excel | Valuation of stocks and bonds |

How to prepare a financial model

During the modeling process, various factors can be taken into account, including not only personal management needs, but also banking requirements that are relevant in situations where it is necessary to present a detailed investment project. The lack of practical skills and the availability of sufficient free time is a reason to independently master such an effective analytical tool as Excel. However, in situations where a report is required quickly and must meet strict criteria, it is better to seek help from specialists.

Purpose of the cash flow indicator

Cash flow is calculated to identify the efficiency of the company's distribution of finances . It helps to estimate the volume of inflows and outflows for the reporting period. The CF ratio is also determined for the purpose of presenting the company’s activities to potential and actual investors. In this case, the actual, causal and planned indicators are calculated.

Thus, calculating cash flow has the following goals:

- assess the financial position of the enterprise;

- analyze the volume of outflows and inflows;

- explore the efficiency of resource allocation;

- show the real position of the company.

Important! Russian companies are required to calculate only the net cash flow from core, financial and investment activities, which is reflected in the statement of financial turnover.

Approaches to automating the generation of reporting forms.

The formation of CF is quite labor-intensive and requires significant time resources, even when formed using the direct method. You can’t do without automation in this matter. You will likely need the help of IT professionals to develop CF reports tailored to your company's specific needs.

The Checkbox service allows you to configure any reports, and you can do this yourself. Indirect CF is now no more difficult to do than direct CF. And with the Checkmark, this method of forming CF will have no disadvantages. You will receive the required report without much effort.

Cash flow classification

Before classifying cash flows, financial turnover must be divided into negative and positive. Under no circumstances should these concepts be confused. Negative and positive cash flow represent the outflows and inflows of a firm over a given period. And financial turnover denotes the value expression of the activity of an enterprise, which includes the company’s income and expenses.

| Classification feature of cash flows | Type of financial turnover | Description |

| From the activities of the enterprise | Operating | Financial turnover from the main activities of the company |

| Financial | Inflows and outflows of the company associated with the implementation of financial work | |

| Investment | Expenses and income of the enterprise from investment activities | |

| By integrity | General | Financial turnover of the entire company for a certain cycle |

| Workshop | Cash inflows and outflows by departments, workshops, divisions | |

| In relation to the company | Interior | Finance to meet the internal needs of the company, for example, to acquire assets |

| External | Cash for meeting external obligations. For example, for settlements with suppliers and contractors. | |

| According to definition option | Clean | Cash flow net of expenses |

| Total | All financial turnover of the company | |

| Discounted | Financial flow of the future period | |

| By volume | Excess | Cash flow sufficient to carry out the activities of the enterprise |

| In short supply | Negative value of the final result of the company's activities | |

| By period | Short | Financial turnover calculated over a short period of time |

| Long term | Cash flow determined over a long period of time | |

| By time | Current | Financial turnover that exists today |

| Future (planned) | Future cash flow |

Important! To determine a company's financial position, net and free cash flow are assessed.

Net cash flow

Net cash flow represents the company's financial turnover, cleared of costs. It shows how much money an enterprise can allocate for development, payment of dividends, storage or other needs.

Cash flow indicators

Cash flow indicators are divided into two types: net and free cash flow, they are also called Net Cash Flow, Free Cash Flow, respectively. The second coefficient is also divided into financial turnover for the owners of the company and shareholders. Cash flow for business owners is calculated by three methods, each of which shows a different coefficient value that has its own purpose:

- Determining financial turnover using the primary method helps assess the overall financial cycle of the company.

- The calculation of cash flow by the causal option reflects the factors that influenced the dynamics of funds spent and received.

- Calculating financial turnover using the forecast method helps to establish an indicator for the future period.

FCFE (cash flow for shareholders) is defined as the difference between the primary financial turnover and the company's obligations to pay loans, as well as interest on them.

Discounted Cash Flow

Discounted cash flow represents the financial turnover of the future period. It is determined taking into account the discount rate.

Important! Discounted financial turnover and forecast cash flow are different indicators.

Check changes in significant balance sheet items and make appropriate adjustments.

This step is for truly conscientious and hardworking people. You can skip it if you want, but it's recommended for obvious reasons: You'll be pretty sure you've made all the significant non-cash adjustments to your cash flow without leaving out anything important.

If you are confident that you have all the information you need from the various departments of your company, that's great. But if you are not sure about this, then it is advisable to take this step.

It's pretty easy. Simply take your largest or most important balance sheet items and see if every move on them is included in your cash flow.

For example, fixed assets.

You may find that the change in fixed assets was as follows:

outgoing balance of fixed assets = initial balance of fixed assets + acquisition of fixed assets for money + acquisition of fixed assets under lease - depreciation - loss from the sale of fixed assets - sale of fixed assets for money.

Which transactions in this formula are non-monetary? Probably the following: acquisition of fixed assets under lease, depreciation and loss from liquidation of fixed assets. For each of these non-cash transactions, an adjustment must be made.

Cash flow calculation

Formulas are used to determine cash flow. Indicators of net financial turnover are reflected in the cash flow statement, and cash flow ratios are used to make presentations about the economic activities of the enterprise.

Formulas for determining net cash flow

Net cash flow to be reflected in the statement of financial turnover is classified depending on the type of activity of the enterprise: main, financial, investment. The calculation of each indicator consists of clearing income from expenses. To do this, use the general formula:

D – R, where

D – income from one of the types of activity of the enterprise;

P – expenses from one of the company’s activities.

The arithmetic expression for determining net cash flow is considered universal. The thing is that it adapts to calculate different indicators. For example, to find net cash flow from core activities, the calculations take into account revenues and costs from production. And if there is a need to calculate investment financial turnover, expenses of the same name are subtracted from income associated with investment activities.

Formulas for calculating cash flow indicators

The cash flow indicator is a type of cash flow determined for additional assessment of the final results of the enterprise. To calculate them, use the formulas:

| Index | Formula | Decoding the formula |

| Net Cash Flow (net DP) | Sd - Sz | Сд – the amount of the company’s income; Sz – the amount of company costs |

| FCFF (free DP for owners) | ChDP - Kz | NDP – pure DP; Kz – capital costs |

| FCFE (free cash flow for shareholders) | FCFF – Pu – ZP – ZV | FCFF – primary cash flow; Pu – interest on loans (paid); ZP – repaid debt; SV – issued debt. |

| Causal DP (FCFF) | P – CH – KZ – Doc | P – receipts; CH – amount of taxes; Кз – capital costs; Doc – dynamics of working capital |

| Planned FCFF | P *(1 – NSSR) + SA – Kz – Doc | P – receipts (before deduction of depreciation, interest on loans, taxes); TSSR – tax rate (average); CA – depreciation amount; Кз – capital costs; Doc – dynamics of working capital |

| Discounted DP | 1 / (1 + DS) * PV | DS – discounted rate; PV – time period |

Important! To evaluate the company's performance, primary, causal FCFF, FCFE and NCF are calculated.

Development of company budgeting in Excel

When maintaining management accounting, it is necessary to collect data from different departments into dozens, and more often, hundreds of tables with a large number of bookmarks in an Excel file. The program is simply technically not capable of processing such a volume of data; it cannot cope with so many connections in Excel formulas and tables.

If we talk about budgeting, then making adjustments to the budget using Excel and keeping them up to date is very difficult, or rather, almost impossible. If something changes in the budget, if you make an edit to the table, then subsequently it will be extremely difficult to understand why some figure has changed, where it even came from.

Using Excel spreadsheets for budgeting can only be recommended for small firms. It is very problematic for medium and large companies to maintain a cost budget in Excel.

Why is cash flow analysis important?

If a company does not pay due attention to the analysis and management of cash flows, then it is very difficult for it to predict possible cash gaps. This leads to the fact that at the end of the month she may not have money to pay current bills for supplies of goods, office rent, employee salaries, and even taxes.

The regular occurrence of cash gaps leads the enterprise to problems both with suppliers of goods and services, and with clients. Suppliers, dissatisfied with payment problems, cancel discounts and suspend shipments of goods. There is a shortage of goods, customers cannot receive the goods in demand, and for this reason they are in no hurry to pay bills for shipments already made and services provided. Accounts receivable are growing, which further aggravates financial problems with suppliers. A “vicious circle” arises. This situation has a dramatic impact on the company’s turnover, reducing its profitability and profitability.

Thus, the insolvency of a company occurs at the moment when cash flow becomes negative. It is important that such a situation can arise even if the enterprise formally remains profitable. This is precisely what causes the problems of profitable but illiquid companies on the verge of bankruptcy.

How to calculate cash flow: example

To better understand the procedure for determining cash flow, let’s define the indicators using the example, which has the following operating results:

- Net operating DP – 7.8 million rubles.

- Capital costs – 0.8 million rubles.

- The company's income before deduction of depreciation, interest on loans, taxes - 12.6 million rubles.

- The amount of taxes is 1.8 million rubles.

- Dynamics of working capital – 4.1 million rubles.

- The average tax rate is 0.171.

- Interest paid – 0.2 million rubles.

- Debt repaid and issued 0.9 million rubles. and 1.1 million rubles. respectively.

- Depreciation – 0.65 million rubles.

- The company's total income and expenses are 12.6 million rubles. and 4.2 million rubles. respectively.

To calculate DP from investing, core and financing activities, data from the cash flow statement are used. The calculation is made according to the lines of the document.

Indirect method of compiling a DDS report and its analysis

This technique is applicable only to the assessment of the operating circuit. It is based on establishing the relationship between the volume of net income/expenses (NI) and the delta (change - ∆) of VA balances, between working capital and the company’s net profit/loss, as well as understanding why, even if there is a profit, the company has a shortage of VA.

The assessment using the indirect method is carried out as a determination of the value of the net profit from operating activities and depreciation charges (AM), adjusted by the value of the delta of accounts payable (KZ) and receivables (DR) of debts and production inventories (PPR).

To calculate the delta (change) in the value of current and non-current assets, the following is used here:

- Accounting balance;

- Report on financial results;

- Transcripts for reporting.

According to the formula, the change in DS is calculated when estimating the DDS using the indirect method:

∆DS=BH (loss)-AM+∆KZ-∆DZ-∆ZPpr

In the 1C:ERP, 1C:UH, 1C:Finansisit systems, the indirect method uses the mechanism of standard (regulated) reports, ODDS, BBL and BDDS. Let's consider the construction of ODDS (section “Payments\Receipts for current activities”).

- Based on the financial reporting data (Form - 1, balance sheet), we calculate the change in the volume of DDS in the context of balance sheet items.

- Using financial statements (section “Regulated Accounting” - “Regulated Reports” in 1C:ERP), we manually calculate ∆ balance sheet asset and liability indicators using the formulas indicated above.

Fig.6 Accounting statements in 1C:ERP

To record the result, you can manually fill out the final table with the calculation results. To automatically calculate the delta of indicators, set up the “Budget Copy” document in the “Budgeting and Planning” section, which is filled out according to the actual data.

Fig.7 Calculation of changes in financial reporting indicators

Based on the data received, you can fill out the ODDS report itself. For example, the amount from the “Capital” line of 18,000 thousand rubles will go to the “Net profit (+)” line; Uncovered loss (-) – with a positive sign. We distribute all other data in the same way. Based on the information received, a DDS report on the operational circuit is compiled.

Fig.8 DDS report using the Budgeting system

Having filled out the ODDS, we realized that the change in the value of the VA for the period amounted to 500 rubles, which is comparable to the accounting data. Using the “Budgeting” subsystem, you can plan the movement of DS and obtain information about actual data, as well as perform a plan-fact analysis of the movement of DS. 1C:UH and 1C:Financier provide similar mechanisms for analyzing DDS using the indirect method - regulated reports within the budgeting and planning subsystems.

Operational consultations without prepayment from 1C: Competence Center for ERP solutions