- home

- Investments

Anton Subbotin

5

Article navigation

- What mutual funds promise in Russia: level of profitability and risk

- Methodology and example of profitability calculation

- Profitability ratings of mutual funds for 2022

- The level of reliability of a mutual fund and the risks of shareholders

Mutual investment funds in Russia are a popular financial instrument that allows you to earn money passively. Let us immediately note that profit is not guaranteed, since mutual funds invest in different markets, and profitability depends on the success of the acquired assets. For example, if a portfolio manager of a closed-end real estate fund management company made a bet on commercial properties, but rental prices have dropped significantly, then the price of the share will decrease.

Despite the large volume of offers, it is difficult for a novice investor to make a choice, since he does not know which mutual fund to invest in in 2022. We'll take a quick look at the top-rated funds that have demonstrated excellent long-term performance. An independent opinion will help you focus primarily on the shortcomings.

Mutual funds can actually bring more than a deposit in any top bank. If you assemble a portfolio of several assets and diversify risks, you can create an additional source of income that will not be tied to the mood of the employer.

The rating of the best mutual investment funds by reliability and profitability highlights not only the impressive growth in recent years, but also highlights such important points as the size of the commission, the reputation of the management company and investor reviews.

How to choose the most reliable mutual fund that will generate income?

Before applying to a specific fund, the future investor must independently set certain goals for himself and take into account the following aspects:

- What amount is planned for investment?

- Duration

- Possible risks

- Expected income amount.

All factors are closely related to each other and therefore are taken into account together. When planning to invest for a short period of time, it is advisable to turn to an open-end mutual fund. For significant investments, mutual funds are interval or closed. But you need to be vigilant - the larger the expected income, the higher the expected risk.

Sberbank mutual fund - profitability, depositor reviews

Sberbank offers three programs for investing in mutual funds, which differ in the degree of risk.

Sberbank mutual funds - asset management:

- Bonds Ilya Muromets . The period is at least three years. Expected profit 34.32% The program is optimal for those who want to protect themselves as much as possible from inflation rates and receive profits above the size of the open deposit. The risk in this case remains minimal

- Balanced . Investment finances are distributed in equal shares among shares and securities in different issuers. The investment duration is also from 3 years. Expected profit 44.15%. The main difference from the first program is investing in stocks

- Nikitich . Despite investing in shares with high liquidity and only in reliable companies, the risk remains at a high level. The minimum term remains the same - 3 years, but has increased by 50.08%.

According to user reviews, the programs help to earn a good income. This is a reliable bank that works with trusted companies. However, in order to get the desired profit, each client independently decides where he wants to invest.

Foreign IT shares. "RAIFFEISEN - INFORMATION TECHNOLOGIES"

Raiffeisen Capital in Russia was founded in 2003 and is a 100% subsidiary. When choosing assets, the management company relies on fundamental analysis and adheres to long-term investments. Portfolios are compiled using a bottom-up method, that is, from an assessment of the business of an individual company.

When choosing foreign instruments, the management company uses the experience of colleagues from the international Raiffeisen group.

Mutual Fund "Raiffeisen - Information Technologies" uses the strategy of investing in global shares of high-tech corporations. The portfolio contains predominantly American companies, which have shown the highest growth rates of financial indicators in recent years. There are also companies from China, India and Taiwan.

Since the fund’s currency is ruble, if the national currency is devalued, the fund can receive additional profitability.

Fund structure by industry:

Commissions:

- 3.9% Management remuneration

- 0.7% Depository

- 0.6% other expenses

Asset structure by company (03/31/2021):

The management company relies on leading American IT companies. The revenue growth rate of these companies is about 20-25% per year, and a low debt load with a large reserve of cash on the balance sheet allows companies to invest in new promising projects.

Below is a comparative table of funds with similar assets.

| Name of mutual fund | NAV, RUB million | Number of years of the formed fund | Minimum contribution, rub | Infrastructure costs (total), % | Profitability of mutual funds for 5 years, % | NAV growth over 5 years, % |

| RAIFFEISEN - IT | 8 763 | 14 | 1 000 | 5,2% | 213% | 2 888% |

| Otkritie - leaders of innovation | 2 464 | 8 | 1 000 | 5,5% | 179% | 7 536% |

| Promsvyazbank - IT | 1 866 | 17 | 1 000 | 4,5% | 179,85% | 7 734% |

| Alpha capital - Technologies | 13 437 | 14,5 | 100 | 4% | 169,75% | 1 786% |

| Sber - Global Internet | 11 679 | 10,5 | 1 000 | 3,85% | 125% | 380% |

| Nasdaq-100 Index | — | — | — | — | 217% | — |

Companies invest in the same issuers, and the main difference is the size of the stake in a particular stock. For example, Mutual Fund - Sberbank Global Internet holds 12% in an ETF that manages IT companies in China; others do not have this fund. Such small differences can affect the returns of the funds, but in general they are the same in structure.

If we compare the returns of funds with the global Nasdaq-100 index, in which there are mainly technology-based companies, they are closest to the index values. It is worth considering that funds have management fees, which are directly proportional to the overall return.

Alfa Capital mutual funds - ratings, profitability

The management company announces good investment conditions: the opportunity to receive an income of 36.11% throughout the year, the user can actively sell shares at any time. The website contains a special calculator that calculates the expected profit. This helps the potential client calculate the expected income and make a decision on cooperation.

For each of the current programs, the profitability indicator is calculated:

- Brands - expected increase 30%

- Resources . The figure is higher - 33%

- Technologies . For those who want to take risks - 38%.

Where to buy shares

Units can be purchased in two ways:

- from management companies;

- from management agents - banks, investment companies and other financial institutions.

Buying from a management company will cost the investor less, because agents take their own commission for the transaction, which reduces the return on investment.

The process of buying a share in a simplified form looks like this:

- visiting the management company office;

- filling out a form and application for account maintenance;

- concluding an agreement with a management company;

- transfer of funds from a bank account to the account of the management company;

- purchase of shares.

From the moment your funds are credited to the management account, you become a shareholder. Remember that any investor can lose their entire investment, so read the agreement in advance and make a sound assessment of how much you are willing to lose.

Mutual Funds of Gazprombank "Bonds Plus"

In accordance with the policy of investing in mutual funds, Gazprombank invests only in proven domestic enterprises. Among the main tasks are the preservation of depositors' funds and ensuring a decent income. To date, the Bonds Plus program is the largest in terms of assets and has surpassed the 10 billion ruble mark.

The following conditions apply:

- The minimum investment deposit is from 5,000 rubles

- Maintenance fee 2.6% annually

- If the investment period is more than three years, the investor is automatically exempt from paying commissions .

Types of IF

The classification of investment funds in the Russian Federation and the world is different depending on their structure, goals and objectives.

mutual fund

A mutual investment fund is a mutual investment fund. In it, everything that the fund has is divided among investors in the form of shares. The management company of such an organization is obliged to invest savings in any project.

In such an investment fund, the common property is distributed among investors in the form of shares. The share confirms that the investor has ownership rights to a certain part of the funds. The essence of a mutual fund is that the team invests funds in a specific project. For example, shares, bonds, depository, loans, real estate rental. The operation of the mutual fund is enshrined in the laws of the Russian Federation.

The investor enters into an agreement with the management company for trust management, for which the management company receives a commission from transactions.

Management can be collective and individual. In a collective investment fund, the management bodies of the investment fund combine the savings of shareholders into one portfolio, then distribute them according to the share. With individual funds, each investor's funds are accumulated separately.

IF of Russia

The Investment Fund of the Russian Federation was created so that our state could invest in various projects.

The budget of the Investment Fund of the Russian Federation is formed from the funds of the external debt and Stabilization funds, a quarter of the budget consists of contributions from private investors.

Investment projects are selected according to the following scheme:

- Part of the ownership of the invested project is registered in favor of the state.

- Funds are sent from the investment fund to the authorized capital of the organization selected for investment.

- Commercial investors enter into an agreement with the Russian Investment Fund for a period of no more than 5 years and pay for participation in the project.

- Projects must be economically and socially beneficial to the state, meet its requirements and, if they cannot be implemented without state support.

- The cost of the project is more than 5,000,000,000 rubles.

- Other indicators are also determined.

The project is selected on a competitive basis by a commission under the Ministry of Economic Development of the Russian Federation.

Mutual IF

A mutual fund attracts a huge number of investors through cheap stocks, which allows for small deposits. And at the same time losses are reduced.

Hedge

There are very few of these in the Russian Federation, since they attract only professional investors with large investments. They try to get the maximum benefit for their deposits and in a short period of time, thereby exposing themselves to unjustified risks. Investment funds buy securities very quickly and sell them just as quickly. Mostly distributed in North America.

Check

Check investment funds were actively created in the Russian Federation in the early 90s of the 20th century and have now been abolished.

Their goal was the transition from state ownership to private ownership. They collected vouchers that were in circulation in the Russian Federation, and then used them to purchase shares of enterprises from the state.

Exchange traded

Such an investment fund has its own shares, which also participate in transactions on the stock markets of the Russian Federation. Their quotes change from the opening to the closing of the exchange. The shares are calculated daily after the end of trading.

What is the difference between a venture fund and direct investment?

PEFs usually try to get quick results by investing in companies that have been on the market for a long time and where the risk is minimal. Moreover, investments are made for a short period, but large amounts at once.

The venture fund is invested in various enterprises in the Russian Federation, including numerous startups, which may not develop, and therefore the money will be lost.

Such investment organizations must have a large income; the venture fund receives it from less risky projects.

What is the difference between a private foundation and a non-private one?

| Properties | Private | Not private |

| Owners | Private investors and legal entities within a limited group of persons | Investors, both individuals and legal entities, without restrictions |

| Tasks | Manages deposits for the benefit of individuals and companies, for example for one family or close friends | Entering the securities market, attracting investors and multiplying their profits |

| View | Closed | Open |

| Registration | Not approved by government agencies of the Russian Federation | In the Central Bank of the Russian Federation and the tax office, as a legal entity |

| Asset control | Produced by the founder, who is represented by a single person | Managed by a management company |

| Anonymity | Information about the investment fund is not publicly available. The owner's name may not appear on documents | The documents contain the details of the legal entity; information about shareholders is not indicated anywhere. |

| Asset Allocation | Not all funds can be used for investment; some can be used for your personal needs | The assets are entirely located in the investment fund and cannot be used otherwise than for activities within the framework of projects |

| Business continuity | With the death of the founder, the organization continues its work. | Does not depend on the death of one of the members of the management company, works until the license expires |

| Inheritance scheme | The owner himself determines the rules for the distribution of assets and the heir | Only shares of the investment fund are inherited; each investor determines the rules of inheritance. If there is no will, the action takes place within the framework of the legislation of the Russian Federation. |

| Composition of the investment fund | May be: founder, board of directors, guarantor, shareholders | Management company, shareholders |

Features of foreign funds

Foreign investment funds help invest funds in international projects and the economies of other countries.

Are divided into:

- Investment funds of one country. Investing only within one state.

- Regional. They can capture one continent, for example, Europe or Asia.

- International. Investment in several countries.

- Developed countries. Savings are accumulated in specific countries with stable economies.

- Global. They invest not only in other states, but also in Russian enterprises.

"Raiffeisencapital" - mutual funds from Raiffeisenbank

Investment conditions at Raiffeisen Bank look no less attractive. The share price is updated every day. However, the initial contribution for an individual must be at least 50,000 rubles, and for subsequent replenishments - 10,000 rubles. It is worth noting that the investment period can be from 3 months, while in other banks it is from three years.

There is a bonus program, the size of which depends on the investment period. 3% is due if the shares are held for three months or more. More than a year - 2% and not subject to VAT.

What to pay attention to

Before choosing a mutual fund for investment, the client needs to decide on a management company. She will be engaged in purchasing shares and redirecting investment flows. The management companies of large banks are considered the most reliable. The profitability rating from their activities is easy to track on the banki.ru website. But at the same time, they are the most massive and clumsy market players. Conservatives or beginners who want to get a stable income should work with large management companies that have already proven themselves.

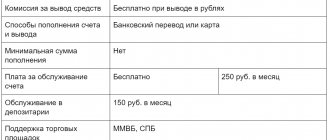

In addition to the rating of the management company itself, you should pay attention to the percentage it charges for transactions. Commissions are made up of two indicators:

- Allowances. Its size is about 1.5% of the share value. It is withheld when purchasing a share.

- Discounts. The value of this indicator is about 3%. Deducted from the value upon redemption of the share.

The same fund can apply different amounts for discounts and allowances. Most often it depends on the agent through whom transactions are concluded. High commissions are set by unpromoted management companies. Those management companies that are firmly established in the market earn more due to turnover, and not at the expense of investors. But this is not an axiom, so compare the percentages specified in the contract. Your income depends on their size.

Fund "Ilya Muromets" from Sberbank - positions and profitability

For novice investors who do not want to risk their money, the mutual fund program from Sberbank “Ilya Muromets” is the best option. As noted, among the available offers, the yield is the lowest - 34.32%. However, this is offset by minimal risk, since assets are invested in bonds of proven companies.

The main goal of the fund is to organize a rapid increase in capital and exchange rate growth.

Income is at a fixed rate and loan portfolios remain low. Investments are made in ruble equivalent.

How to make money on Ruble Bonds?

To make money on ruble investments, first of all, the investor must decide what risk he is willing to take.

There are two strategies by which you can make money on ruble bonds:

- Yield from coupons . The average annual growth is 10%, which is a good indicator. However, the expected amount depends on the size of the investment.

- Speculation . Since the price of bonds is constantly changing, the difference can play into the hands of the investor. By buying bonds at a minimum cost, they can be resold at a more favorable price.

- Each investor chooses independently the path he plans to take in order to increase his capital.

Summary

Which mutual fund to choose in 2022? It is extremely difficult to formulate unambiguous advice, just as it is difficult to choose a universally correct method for flawlessly determining the directions of correct investments. However, when making a decision, it is recommended to take into account the rating presented above. After all, the place of each position is determined by the amount of funds of the mutual fund (its capitalization). That is, by focusing on this rating, you are automatically based on the “paid” opinions of a very large number of investors. As a result, the likelihood of error is significantly reduced.

Igor Titov

Economist, financial analyst, trader, investor. Personal interests – finance, trading, cryptocurrencies and investing.

Ruble bonds from Transfingroup

The main object of the management company is the acquisition of bonds. The company sets the minimum contribution at 300,000 rubles. The average cost of one share for the last period is 302.7 rubles. The minimum investment period is three years.

Recommended reading: Top 10 credit cards you can order by mail. VTB 24 cards - main types of cards, conditions for receiving and servicing. See information here.

How to find out the balance of a bank card - https://wikiprofit.ru/finances/cards/balans-karty.html