Lazy Investor Blog > Stock Exchange

For novice investors, not only issues related to the choice of assets and strategy are relevant, but also the choice of a reliable broker. And this task is inextricably linked with what kind of trading and analytical software he offers to clients. Individual articles describing trading platforms are easy to find, but comparative reviews are rare. I tried to fill this gap to some extent in this article. So, let’s compare the most popular trading terminals that are suitable for working with Russian securities.

QUIK

Perhaps this is the most popular trading terminal used in Russia. Almost every broker is connected to it. Despite the fact that purely visually QUIK is already obsolete, the platform is the most functional and in demand of all existing ones.

Its undeniable advantages:

- high degree of protection of personal data (a cryptographic key is used for encryption, which can be stored on a separate medium);

- the highest operating speed - Kwik instantly exchanges data with the broker and the exchange; no other terminal can boast of such performance;

- access to trading on the largest international exchanges is provided - NASDAQ, NYSE, LSE, CBOE, Eurex, as well as Russian ones - the Moscow and St. Petersburg exchanges;

- the ability to trade in a single window on the stock, foreign exchange, derivatives and over-the-counter markets;

- information is displayed promptly in real time;

- you can work with several brokerage accounts simultaneously;

- the ability to conduct margin trading with automatic limit calculation;

- placing any types of orders: market, limit, with stop loss, with trailing stop loss, tied, etc.;

- built-in chat and news receiver;

- If you wish, you can connect a robot for automatic trading or write your own.

In short, a gentleman's set for a trader. QUIK is suitable for scalpers, strategic investors building long-term portfolios, and active day traders. This terminal is the choice for those who need everything at once.

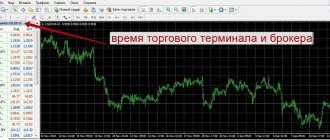

Exterior view of the Kwik terminal

The only downside worth noting is the confusing and outdated interface. The fact is that the program was developed in the 2000s, and it was from there that QUIK took its appearance. The terminal is being improved in terms of reliability and functionality, but the interface remains the same - everyone is used to it.

In general, if you bother and customize the interface for yourself, then there will be no problems using the terminal. Another thing is that setup may take up to 2-3 weeks, and after updating the software, all saved parameters may be reset. Especially if the broker has made changes to the configuration. To prevent this from happening, the saved settings need to be exported to a separate file from time to time.

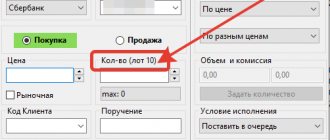

Investor portfolio Kwik

The second well-known disadvantage of the program is that pending orders are not registered with the broker, but immediately on the exchange, and are reset in the evening. As a result, on the second day, orders have to be reissued. If there are a lot of applications, then this is inconvenient and takes a lot of time.

In any case, it is worth downloading the demo version of QUIK - the so-called QUIK Junior, which is offered by most brokers. Functionally, “Junior” is no different from “big brother”, but provides access to a limited number of shares, and only those listed on the Moscow Exchange, and the rates do not coincide with real ones. You could say it's a simulator. You can’t work out a real strategy on it, but you can learn how to work with the terminal: set it up, place orders, create portfolios, etc.

Types of trading terminals

The rapid development of trading in the foreign exchange and stock markets, as well as the growth in the number of brokerage and IT companies, has led to the creation of many software products. Each trading terminal presents its own system of productive and comfortable work. From a variety of terminals, three most common groups can be formed:

1. Standard terminals - distributed and installed on a computer as a separate program. Typically, such terminals have the most complete functionality and have virtually no restrictions on its expansion. Most often, these solutions are designed to work on the Windows operating system, but in some cases there are versions for Linux.

The group of standard terminals includes the most popular MetaTrader 4 and MetaTrader 5. They are rightfully considered the gold standard in this area and have the widest capabilities. Also quite well known are such terminals as Mirror Trader, NinjaTrader, ProTrader and others, many of which we will talk about in separate materials.

2. Mobile terminals - this segment began to actively develop with the spread of communicators and smartphones. The first mobile terminals ran the Windows Mobile operating system. Today there are many solutions for Android and iOS. At the moment, the rather young Windows Phone platform has been somewhat neglected, but it is likely that trading terminals will appear for it in the near future.

As is the case with standard trading terminals, the most popular mobile platforms are MetaTrader products, which have more limited functionality compared to desktop solutions. There are also other terminal options, but their market share is significantly smaller.

3. Web terminals are a local product of a certain brokerage company, which is provided online on the official website. This type received its development due to the growth of standards and capabilities of browsers. Recently, the functionality provided by web terminals has become significantly closer to that of standard programs, which makes them a very interesting alternative. But for now they are used more for force majeure cases, when there is no access to the usual program. Web solutions are most widespread in the field of binary options, where very complex operations are not currently required.

As you can see, you can trade in any way. Depending on the place and time, one or another solution may be more appropriate, which undoubtedly gives more comfort and convenience.

TRANSAQ

This is the second most popular terminal, one might say, an alternative to QUIK. TRANSAQ has become popular thanks to the largest brokers who use it as their main trading platform - Finam and VTB.

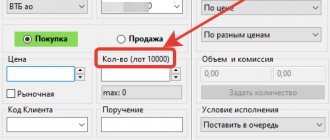

In terms of its functionality, TRANSAQ completely duplicates Kwik, but at the same time it has a friendlier interface and convenience. For example, pending orders are stored by the broker and are automatically posted to the exchange at the start of a new trading day. As a result, the trader no longer needs to waste time on this.

In addition, TRANSAQ's depth of market includes more positions, which will appeal to scalpers who make many trades. In general, QUIK is more suitable for long-term investors who buy long at prices close to market prices. TRANSAQ is more tailored for active trading, including between days. If an investor plans to make a lot of trades, then TRANSAQ will most likely appeal to him more.

Transac

TRANSAQ also offers more technical analysis tools than Kwik. This allows you to use the platform for full-fledged trading based on technical data, which is especially important when trading derivatives and currencies.

Thomson Reuters Eikon

The main competitor of Bloomberg's terminal is Eikon from Thomson Reuters. It is also a professional system for monitoring and analyzing financial information. Traders use Eikon to access real-time financial market data and analytics.

One of the interesting features of the terminal is the built-in analysis of investor sentiment. The system analyzes messages on Twitter on given topics and looks for indicators of positive or negative audience sentiment. Based on this information, traders can build hypotheses about further movements on the stock exchange.

The Eikon developers used a modular approach, so the cost depends on the final functionality of the terminal. The fully charged version costs $22 thousand, and the basic one is available from $3600.

SmartX

Developed by ITI Capital. Positions itself as a “new generation trading terminal”. The statement is indeed loud, but on the whole it is true.

Compared to SmartX, QUIK and TRANSAQ terminals look like dinosaurs. In terms of ease of use, Smart is ahead. Indeed, the menu structure is logical and simple, the workspace is organized conveniently, in the quotation table the tools are not piled up in one pile, as in Kwik, but there is convenient sorting for selecting the necessary assets. In general, you can understand all the features and customize the terminal for yourself in just a couple of hours.

Smart X

The basic functionality is expanded with additional plugins:

- quotes – you can create several windows with different sets of tools;

- easy trading – configures the possibility of trading in one click;

- deal feed – for placing multiple orders;

- order time – allows you to write off an order at a certain time if it has not been fulfilled.

There are separate modules for more convenient trading of options and bonds.

There is also an online version of SmartX and a mobile application. For example, QUIK and TRANSAQ have mobile versions, but web terminals do not.

Alor-Trade

Alor-Trade is another terminal written for a specific broker – Alor. Historically, this is the first terminal on the Russian stock market. There was already a separate article on the blog about the broker itself, so it is worth briefly mentioning what tools an investor who chooses this company will receive. He will have the QUIK and Alor-Trade platforms at his disposal. Despite the obsolete and cumbersome design of QUIK, Alor-Trade seems like a real dinosaur. This is what the program looks like after launch:

I also recommend reading:

AFK Sistema shares: brief overview and analysis of prospects

My view on AFK Sistema shares

There is essentially no menu as a phenomenon, so all modules have to be called using icons.

In general, an excess of pictograms, abbreviations and an acute lack of tips and explanations immediately catch the eye. By default, tables have a huge number of parameters, half of which may never be needed. The table of trading instruments is compiled completely without any system. In addition, the full name of the instrument can only be read if you select it with the mouse. Only abbreviated names are available within the table.

Futures are not sorted by underlying asset or delivery date. You won’t be able to quickly find the tool you need by name. After completing all the settings, the terminal takes on a more functional appearance, but it is still far from QUIK and TRANSAQ:

This problem is partly due to the slow progress in improving the terminal: the latest version was written in 2012. In addition, there is the task of maintaining compatibility at the operating system architecture level with all the nuances of object-oriented programming. The 32-bit version of the terminal can work in the Windows 2000 environment, which few people are willing to boast about. Another interesting feature of Alor-Trade is the presence of an open architecture and an SDK (software development kit) library. It allows you to develop custom add-ons and integrate them with the basic version of the terminal, which significantly expands its functionality and allows you to improve the interface. The relevance of this problem is obvious. For example, unlike market leaders QUIK and TRANSAQ, Alor-Trade does not have a built-in check of the available margin, and instead it is proposed to use a primitive calculator:

For lovers of trading robots, a cross-platform library ALOR.ATENTIS has been developed. This is a kind of gateway through which trading robots can work with the broker’s server directly, and not through the terminal. Judging by customer reviews, it is Alor that has brought this functionality to perfection in terms of speed and reliability. Thus, the platform is clearly targeted at users with deep knowledge of information exchange protocols. As for the basic features, there is nothing outstanding here. In many ways, the terminal does not meet modern standards. For example, it does not allow you to set related and mutually cancelable orders, and you have to view transaction reports in your personal account. Today, Alor-Trade remains not so much a full-fledged trading and analytical platform, but rather a “designer” with great capabilities, but requiring serious preparation.

MetaTrader

A legendary platform, more suitable for trading currency pairs and CDFs on Forex. There are two main versions - 4 and 5. Most traders choose the 4th, despite the fact that the 5th is considered more advanced. The fact is that the new version has significantly reduced functionality, and not all traders are ready to relearn and get used to the new terminal. Especially scalpers, for whom the cost of a technical error is especially high.

MetaTrader is a light version of professional terminals like QUIK. Thus, it presents a shorter and simpler Depth of Market, a limited set of instruments (only currency pairs and, for some brokers, contracts for difference), a smaller number of different charts, additional (reference) information is not shown, etc.

But at the same time, the terminal traditionally includes a huge number of different indicators for technical analysis. You can configure different modes for displaying quotes of the selected asset, time intervals, compare currency charts with each other, etc.

MetaTrader

MetaTrader is also optimized for fast transactions. Therefore, it is usually chosen by scalpers and day traders.

It’s easy to integrate robots and advisors into the terminal, which will help you trade using technical signals – or even trade instead of a person.

Intrade Bar

Also a new company registered in Scotland. It differs from its competitors in its great loyalty to users. There are no blocks, far-fetched write-offs or other difficulties. Although the company did not pass certification, it placed its main emphasis on quality and speed of service.

Go to website

Trading Opportunities

Intrade Bar does not have wide functionality for available quotes. Clients are given the opportunity to:

- Trading major currency pairs.

- Raw materials.

- A small block of shares.

Today it is not possible to trade crypto coins, but it is possible to deposit and withdraw funds in these currencies.

The main advantage of a broker is providing quotes. Trading is carried out 5 days a week. There are 3 types of trading conditions:

- Classic option. Trading is carried out for up to 5 minutes with accrual of up to 77% of the transaction amount.

- Sprint. Trading time varies from 3 minutes. The accrual percentage is 80%.

- Random. More advanced and profitable type. Expiration time starts from 5 seconds. The percentage of accruals reaches 90%.

These conditions make the broker very profitable. For ease of trading, there is a separate tab with news about leading trading pairs and the level of interest in them.

Financial side

When opening an account, the user can top up in rubles or dollars. The minimum amount for replenishment is 10 dollars or the equivalent of this amount in rubles. Minimum withdrawal is $5. Trading is carried out with a minimum threshold of $1. The following options are available for depositing and withdrawing funds:

- AdvCash, Webmoney, Payeer, Yandex Money, Qiwi.

- Cards: MIR, Visa, Master Card.

- Cellular operators of Russia.

- Cryptocurrency.

There is a commission policy. There is no fee for withdrawals of more than $100. Less than $100 is taxed at 1%.

Terminal

The company's terminal differs little in its functionality from other platforms. There are 30 types of indicators, graphical tools, and the ability to open 3 different charts at once. The main difference is stability and speed of operation.

There is the possibility of early repayment of the transaction, the presence of a news clicker in the form of a separate program built into the terminal. There is also a parameter for the start of the trading day. Without providing quotes on weekends, the company does not work.

Affiliate program

Intrade Bar gives its clients the opportunity to earn money in passive mode. To attract a new client, the broker pays 1% of the new user’s turnover and up to 55% of the company’s turnover.

Advantages

The company stands out strongly among its competitors. Mainly by the policy of attitude towards the client. This greatly hinders the broker in many ways, making him suspicious in the eyes of new clients. Be that as it may, the main advantages are as follows:

- No verification.

- No blocking.

- Fast withdrawal of funds.

- Availability of news clicker.

- Wide functionality of the platform.

The broker is quite young, constantly updated and supplemented with new features. Sometimes there are problems with maintenance and freezing, but these problems do not affect the trading itself. The only downside is the lack of a mobile version of the terminal.

Alfa-Direct

This is the case when a broker takes a standard terminal and modifies it to suit his needs. The result is an application tailored for trading with a specific broker, as convenient as possible and meeting the needs of investors.

This is exactly the terminal offered by the Alfa-Direct broker. Moreover, it is available in both mobile and desktop versions. In terms of functionality, the two versions are practically no different.

Alpha Direct

Currently, traders have access to the 4th version of the Alfa-Direct terminal, which, unfortunately, is quite buggy. Many investors therefore prefer the previous version – 3.5.

The Alfa-Direct terminal provides access to foreign and Russian assets - stocks, bonds, currencies and futures. Various graphs and tables are used to display information. The appearance of the terminal and the number of windows can be customized and adjusted as you need.

Pros of the terminal:

- the ability to write, test and launch your own robot for algorithmic trading;

- display of the cash flow on the bond separately from the price, which allows you to make more informed trading decisions;

- the ability to form portfolios and identify the leaders of decline and growth among the assets included in them;

- placing multi-orders with different types of order execution.

Another plus is that there is encryption. This slightly slows down the terminal, but provides additional protection.

Risk management functions

Trading software should provide the ability to configure risk management parameters that will allow you to control risk, minimize possible losses when trading, and also more reliably record profits on transactions.

For example, it is good if the program allows you to configure a ban on placing new orders and opening new positions on a specific account if the established conditions are violated.

It is also important that the software has the ability to use orders such as stop loss, take profit and trailing stop orders. Such orders are used to protect open positions - if the price goes down sharply, losses will be limited and profits will be locked in. The SMARTx terminal has the ability to place bundles of such orders (and there is also a module that prohibits transactions if the conditions are violated).

Comon and Finam Trade

Comon is a special trading terminal from Finam. In fact, this is a service for repeating trades made by professional traders. By connecting to it, the investor will simply automatically copy the transactions that another person makes.

At the same time, in the terminal you can make independent transactions, and double-check copied ones and, if necessary, cancel them - all tools are provided for technical analysis. You can also copy transactions not in full, but in accordance with your own capital. For example, not 10 lots, but 1.

Comon

The ability to communicate directly with traders via chat has been implemented. You can ask questions about strategy or discuss an investment idea.

Subscription to strategies is made in a special Trade Center. The number of subscriptions is unlimited. But it is better to choose literally 2-3, since with a large number of copied operations the trader may not have enough margin.

In general, at Finam, in addition to Comon, you can connect QUIK or TRANSAQ terminals for independent work.

There is also its own trading program – Finam Trade. It is based on QUIK, but significantly improved. The menu has been completely redesigned, the logic for presenting assets has been changed, and the graphics have been improved. The application looks modern. But you still have to understand the program - not everything is intuitively clear. However, those who switched to Finam Trade from Kwik will find it easy to get used to.

Finam Trade

The platform provides access to all sections of the Moscow Exchange. You can trade independently, connect robots or auto-follow. There is a demo mode and a mobile application.

According to traders, there are not enough technical indicators in Finam-Trade, but for trading on a schedule, especially between days, it’s just right.

Universal

Some universal trading platforms are below.

TradingVIew

Information resource with the ability to place trade orders. More than 50 world exchanges. Mobile applications through AppStore, Google Play. Social network functionality. Analytics, news feeds.

Etoro

In one program there is a social network and a trading platform for stock trading. Developed in Israel, the first program started working in 2007.

Works like a mobile offer. Installation via Google Play and AppStore. Provides access to universal trading. Trading stocks, currencies, Forex, CFD contracts. Cryptocurrencies were added in 2022. A year later, crypto trading appeared on the American market.

Russian language is available upon registration. Licensed by the Cyprus Securities Commission - CySEC. The standard limit on the amount deposited for trading is 2000 euros. The minimum deposit is 100 euros, the minimum transaction is 50.

After entering the client's data, verification occurs, after which the limit of 2000 is removed. The client's securities are stored in the depository. In case of problems with the broker, the papers will not be lost. An additional guarantee is that clients’ money is stored in separate accounts.

Social network for communication between traders. Subscribe to a specific user. Tracking transactions of other traders.

Tinkoff Investments

If difficulties arise with all platforms, then you can choose a simplified web terminal from the Tinkoff Investments service. In fact, there is no terminal here. Buying and selling assets is done directly on the website.

An investor just needs to open a brokerage account with a Tinkoff broker, top it up (most conveniently using a Tinkoff Black card) - and you can trade. To purchase, you need to select the desired asset, the number of lots and click “Buy”. No more difficult than placing an order in an online store.

Tinkoff

Sales are carried out in the same way. Simply select an asset and click “Sell”.

If the purchase is made in dollars, then the broker will automatically change the currency at the Moscow Exchange rate - that is, foreign shares can be purchased from a ruble account without unnecessary movements.

Available for purchase:

- shares – Russian and foreign (from Nasdaq, NYSE and LSE);

- corporate bonds and OFZ (no Eurobonds);

- ETF from FinEX.

There is also a robot advisor, which, after a short survey, will create a set of tools suitable for the investor. You will need to buy each of the proposed assets one by one. There are also ready-made solutions - portfolios tailored to a specific investment strategy. They can be bought at once.

There is a convenient mobile application, which in some ways even surpasses the web version in functionality.

In general, the service is suitable for long-term investors who decide to buy long. There is simply no opportunity to open a short position in Tinkoff Investments, and placing pending orders will not work either. The broker offers the purchase and sale of assets at market prices.

Suitable for initial acquaintance with investments. If you plan to engage in trading professionally, it is better to choose a full-fledged terminal.

Performance

Performance is important for a trading terminal.

The program should work equally well on old or weak computers/tablets, when making tens or hundreds of transactions per day, and with large-scale movements in the market. On days when important economic news is released, the amount of market data sent by the server to the terminal can increase tenfold in a short time. If the program is not optimized enough and is launched on a weak device, it may simply freeze at the most crucial moment, which can result in the user losing money.

In addition, there is a whole class of active traders in the market (for example, “scalpers”, arbitrageurs and high frequency traders) who, even on a regular trading day, carry out a large number of orders and transactions. Such traders rarely use GUI terminals for direct trading, but often use such software to control their positions, however, even a powerful computer cannot “digest” the large amount of data they generate.

A trader must be able to handle all such cases. Therefore, we are constantly working to increase the performance and speed of the SMARTx terminal. In this article a couple of years ago we talked about this work in more detail.

conclusions

Thus, there are many trading programs for working in the stock market. In general, they all meet their goal: they allow active trading, opening short and long positions, assigning pending orders, limiting losses and profits. The only thing that stands out is the web terminal from Tinkoff Investments and MetaTrader, which is designed for trading currency pairs.

The most used and popular terminal in Russia is QUIK. This is a universal solution for all types of traders - both speculators and long-term traders. Most other programs are developed on its basis. Kwik's main competitor is TRANSAQ. It is a little more convenient, but it has fewer functions.

Many brokers offer their own developments. In overwhelming cases, it is better to use a specialized program from a broker - it will be much more convenient. For example, Finam has Finam Trade, ITI Capital has SmartX, Alfa-Bank has Alfa-Direct. They already have the necessary functionality built in to work with this particular broker.

WebTrader - introduction using FxPro as an example

Almost every self-respecting broker today has a terminal for trading from a browser. The platform makes it possible to enter the foreign exchange market from anywhere in the world where there is Internet access. All you have to do is open the platform in your browser, enter your login and then your password, and you can open trades. Security for this type of trading is ensured by a secure connection.

Modern web platforms have almost the same capabilities as their desktop counterparts. Using them, traders can examine charts, view account statements, set internal trading signals, and receive financial and economic news. In addition, users are offered a large number of orders to open and close positions.

We will talk more specifically about the capabilities of the average WebTrader using the example of the FxPro platform, which is the brainchild of the broker of the same name.

In the central part of the platform there are graphics, the color schemes of which users can adjust to suit their needs. Traders are also given the opportunity to choose the type of chart. The terminal is equipped with trading indicators, which are divided into categories.

You can trade directly from the charts by clicking on the current quotes, which are located on top of the charts. Below the charts there is a toolbar, and below there is a window that displays all trading positions and orders open at the time of viewing.

In addition to the main features of the terminal, traders and users have the following:

- receive detailed trading reports;

- watch news information;

- select and set viewing modes;

- communicate with other platform users.

FxPro, as well as other web terminals, are equipped with all the capabilities of desktop platforms, with the exception of algorithmic trading.

Next, we would like to present to you ten universal stationary platforms that are in greatest demand among traders.

Libertex

In 2014, this platform was awarded the title of the best; its advantages were appreciated not only by experts, but also by ordinary users:

- a simplified trading process that makes the terminal accessible to beginners;

- You can trade a wide variety of assets from one account;

- both independent trading and trading with the participation of managers are possible;

- compatibility with all popular operating systems.

A special feature of Libertex is that before using the platform you need to open an account with Forex Club.

Working with charts

To build it, you need to select the appropriate item in the context menu.

By default, it is plotted in the form of Japanese candlesticks . In addition, options are available in the form of a line, bars, histogram, and dotted line. Fans of graphical analysis will not find anything new here. Through the context menu – Draw, you can use standard tools (trend line, horizontal and Fibo levels).

To add an indicator, click on Insert or select the corresponding icon on the toolbar. These are mainly standard algorithms; approximately the same set is available in MetaTrader and other trading platforms.

One of the features of QUIK is the ability to obtain horizontal volumes . Standard indicators are not capable of this, but there are several good LUA algorithms on the Internet; you need to install them in the terminal and then add the indicator to the chart.

LuaIndicators folder in the directory where QUIK is located and copy the downloaded file there. The terminal does not need to be rebooted; a custom tool should appear in the list of indicators. The figure above shows one of these custom algorithms.