What are blue chips?

The term “blue chips” is familiar not only to stock market players, but also to poker players. A standard poker set contains several types of chips that differ in color and value. Blue chips in this set are traditionally the most expensive. This is why the term “blue chips” is used by stock market players to refer to first-tier stocks and companies. Abroad it is pronounced like blue chips.

Shares of any of the world's stock exchanges are divided into three groups (echelons).

Third-tier shares are almost completely illiquid shares with the lowest price. They are also characterized by a low free-float coefficient, small trading volume, but high risks and a very wide spread. The free-float ratio is the share of shares in free float from the total of all issued shares of the company.

Spread (from English Spread, “spread”) is the difference between the prices for buying a stock and selling it at the same time.

Second-tier shares are shares of larger companies with a sufficient degree of liquidity, but less stable in the future. They are characterized by an average free-float coefficient, average trading volume, average risks and variable returns. However, the spread of such shares is quite wide.

First-tier shares are the most liquid shares from companies whose names are known worldwide. They are distinguished by a long history, high resistance to minor market changes, a high (up to 90%) free-float coefficient and a narrow spread. These stocks are called blue chips.

Advantages and disadvantages

Let's look at the advantages and disadvantages of buying blue chip stocks and bonds.

Pros:

- quotes for securities of companies from the top 15 depend more on business development than on the actions of speculators, and are growing in the long term;

- the likelihood of bankruptcy of companies is minimal; in a difficult situation, the state will come to the rescue, because the activities of market giants significantly affect the country’s economy;

- high liquidity allows investors to buy and sell the required number of shares and bonds at any time;

- large companies willingly share part of their profits in the form of dividends with the budget and private investors, therefore they are an excellent tool for creating passive income.

Minuses:

- quotes are growing slowly; for speculative investors, such securities may not be the most effective tool in trying to earn millions in a short time;

- Despite its reliability, this instrument cannot be considered for conservative portfolios, because investing in stocks is always a risk, especially over a short period of time.

Lists of shares

“Blue chips” as a term is used by the entire global exchange community (blue chips), however, the list of companies and stocks that are so called varies from country to country. Based on the prices of transactions in shares of the most liquid issuers, a blue chip index . This index influences the entire stock exchange of the state and is a kind of indicator for investors.

On the Moscow Exchange

Moscow Exchange calculates the blue chip index (MOEXBC) based on the share prices of the 15 largest companies, expressed in rubles.

Blue chips, according to this index, as of July 17, 2020 are:

- X5 Retail Group (FIVE)

- Alrosa (ALRS)

- PJSC Polyus (PLZL)

- Gazprom (GAZP)

- MMC Norilsk Nickel (GMKN)

- PJSC Lukoil (LKOH)

- Magnet (MGNT)

- MTS (MTSS)

- Novatek (NVTK)

- NK Rosneft (ROSN)

- Sberbank (SBER)

- Surgutneftegaz (SNGS)

- PJSC Tatneft named after. V.D. Shashina (TATN)

- Polymetal (POLY)

- Yandex n.v. (YADX)

- Buy in Finam

- Buy at BKS

- Buy at Tinkoff

- Buy at Alfa-Bank

For the current list of MOEXBC index companies, see the Moscow Exchange website

Weight of various companies in the blue chip index on the Moscow Exchange

On the American stock market

US blue chip stocks are collected in the Dow Jones Industrial Average (DJIA) and it contains 30 of the most liquid, largest and stable companies on the stock market. Today, the Dow Jones Industrial Average is calculated as follows: the sum of the stock prices of companies on the list is divided by a non-constant divisor, which changes depending on the split or combination of stocks from the list.

In the spring of 2022, the list of US blue chips included such well-known companies as Visa, American Express Co., Nike, Johnson & Johnson Inc., Procter & Gamble Co., Boeing Co., Apple Inc., Microsoft Corp. and others.

American blue chips

On the European market

There is a common list of EU blue chips (Euro Stoxx 50), which includes companies from all 12 countries of the Eurozone. Moreover, almost each of the European Union countries has its own private indices and lists of the largest companies.

The Frankfurt Stock Exchange Index (DAX) is the most important stock index in Germany and has a significant impact on the dynamics of the entire European market. This index is calculated as the average value of share prices of the largest issuers, taking into account capitalization and dividends received on the share.

Expert opinion

Dmitry Dunyashev

Blogger, private investor, project manager real-investment.net

When calculating the index, capitalization is calculated only on the basis of those shares that are in free circulation.

The Frankfurt Stock Exchange index for July 2022 includes 30 companies, among which are well-known internationally, for example, BMW AG St, Siemens AG, Adidas AG, Volkswagen AG Vz, Bayer AG.

European blue chips

On Asian exchanges

Asian exchanges, although quite closed to foreign investors and issuers, do not stand aside and also have lists of blue chips.

China has the Hang Seng Index (HSI), an index of the Hong Kong Stock Exchange, which is calculated as the average of the largest shares of 34 Hong Kong issuers. The list of blue chips on the Hong Kong exchange includes Geely Automobile, Galaxy Entertainment Group, Lenovo and others.

Chinese blue chips

In Japan, the TOPIX index serves as a list of blue chips. The index is calculated on the Tokyo Stock Exchange as the arithmetic average of the market price of shares of the largest companies on the Japanese exchange market. There is also a TOPIX Core 30 subindex - shares of the 30 largest and most liquid Japanese companies.

Japanese blue chips

Composition of the blue chip index on the Moscow Exchange

An investor does not have to look for blue chips on his own. The Moscow Exchange calculates a special index (ticker MOEXBC), which currently includes 15 companies. Let's consider their key parameters as of November 17, 2020:

| Issuer | Industry | Share price, rub. | Free-Float, % | Weight, % |

| Alrosa | Metals and mining | 86,48 | 34 | 1,84 |

| X5 Retail Group | Consumer sector | 2 718 | 41 | 2,57 |

| Gazprom | Energy resources | 182,9 | 50 | 15,53 |

| Norilsk Nickel | Metals and mining | 20 546 | 38 | 8,86 |

| Lukoil | Energy resources | 4 850 | 55 | 13,26 |

| Magnet | Consumer sector | 4 865 | 71 | 2,99 |

| MTS | Telecoms | 322,6 | 45 | 2,47 |

| Novatek | Energy resources | 1 251,8 | 21 | 6,79 |

| Pole | Metals and mining | 15 798 | 21 | 3,79 |

| Polymetal | Metals and mining | 1 703 | 45 | 3,07 |

| Rosneft | Energy resources | 439,65 | 11 | 4,36 |

| Sberbank | Finance and Banking | 246,58 | 48 | 18,3 |

| Surgutneftegaz | Energy resources | 36,935 | 25 | 2,81 |

| Tatneft | Energy resources | 508 | 32 | 3,01 |

| Yandex | Information Technology | 4 682,4 | 97 | 10,34 |

Industry structure of the index:

- energy resources – 44%;

- finance – 17.9%;

- metals and mining – 17.6%;

- information technology – 11.8%;

- consumer sector – 6.1%.

As you can see, the largest share in the index is occupied by shares of companies producing oil and gas. The profitability for 2022 was 15.5%, for 2019 - 31.8%, for 9 months of 2022 - minus 9%. Dividend yield: for 2022 – 5.9%, for 2022 – 6.4% and for 9 months of 2020 – 5.9%.

Dynamics of index changes over the past 20 years:

The difference between Blue chips

Issuers of blue chip stocks differ from others in several ways.

- Transparency . Being among the largest players on stock exchanges, blue chip issuers demonstrate to the public absolute transparency of their activities.

- Capitalization . The value of blue chip companies is significantly higher than the value of other exchange participants.

- Financial stability . Blue chips always belong to companies that demonstrate consistent profits. Even during a market crisis, such companies either suffer small losses or recover very quickly. At the same time, the company’s activities and its internal changes or crises may not at all affect the value of assets.

- High liquidity. The volume of blue chip stocks in circulation significantly exceeds the volume of second and third tier stocks.

- Stability . Quotes of blue chip stocks have been growing for a long time, the count can go on for years and decades.

Origin and meaning of the term

The term came to economics from poker - where blue chips are used for the most expensive bets. Along with the name, the essence also migrated: on the stock exchange, blue chips are shares and bonds owned by the largest and most reliable companies (as well as these organizations themselves) or the “first echelon”.

Interesting fact: while betting in poker involves risk, blue chips are considered the safest in the stock market.

How to become their owner?

To become the owner of blue chip shares on the domestic market, you can choose one of two ways:

1. Build a briefcase yourself

The corresponding index is always listed separately on the Moscow Exchange website, where the prices and indicators of stock dynamics are also given. To purchase shares of each company from the list of blue chips you will need at least 50,000 rubles.

2. Buy a ready-made investment. fund

Such funds (ETF, mutual fund, BPIF) include assets of different companies; you just need to find the one that includes blue chips. For example, FXRL from Finex, SBMX from Sberbank and VTBX from VTB Bank. This method is recommended for private investors.

To purchase shares of blue chips from foreign issuers, you need to open an account with a foreign broker (or have access to the St. Petersburg Stock Exchange) and be prepared to spend a significant amount, since shares of foreign companies are highly valued.

For example, you can pay ~$100 for one Apple share, and ~$200 for a Boeing share.

Choose a Russian broker:

How to invest in blue chips and how much money you need for this

In the previous section, I showed the main indicators of the index and the dynamics of its changes over several years. Based on the analysis of this data, an investor can answer the question of whether he should invest in blue chips. How I talk about this topic:

- Almost half of the companies included in the index belong to the energy sector (oil and gas). If I just buy all 15 stocks, I will be violating the principle of diversifying my portfolio. Too much of it will be allocated to one industry. 2022 has shown that the energy sector can suffer greatly from the influence of external factors. And it is still unknown how quickly the previous quotes will be restored.

- For a long-term portfolio, 3-year returns are not so important. Much more valuable than the value over 10, 15 or 20 years. For example, over 20 years the index grew from 907.38 to 20,212.97 points, i.e. by 2,127.6%. The profitability is impressive.

- Another indicator that is important for a passive investor is dividend yield. For blue chip stocks, it remains at an average level of around 6%. There are shares with more impressive figures, but to select them it is not enough to simply sort by the maximum value of dividends for the last year, but it is necessary to conduct a full analysis of the company and its performance indicators. Not all investors have the time, knowledge and desire to do this.

Dividend shares of Russian companies: selection criteria and TOP-20 best securities in 2022

For myself, I will draw the following conclusion: you should not buy the entire index; it is enough to select companies with good performance indicators and dividend history. Another reason for abandoning all 15 companies in the portfolio is that the share of the oil and gas industry is too large. I don’t like this, I’m not ready to tolerate the drawdown of my portfolio for several years. This argument does not matter to those who have 30–40 years left, but for me it is important.

If you have decided to buy blue chip stocks for your portfolio (all 15 or just part of the index), then the next question is how to do it. The algorithm of actions is as follows:

- Open an account with a broker, who is an intermediary between you and the stock exchange. The procedure is no more complicated than making a deposit in a bank. It takes no more than 5 minutes; the only documents you need are a passport (sometimes TIN and SNILS). A broker can be banks, management companies, brokerage organizations. A mandatory condition is the presence of a license from the Central Bank.

- As soon as you receive documents confirming your registration on the exchange and in the depository by email, you can deposit money into your account.

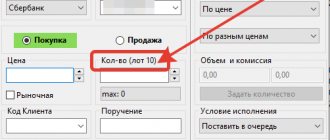

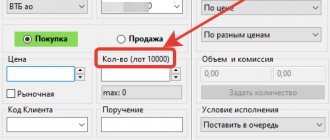

- If you decide to simply buy the entire list of 15 companies, then in the trading terminal, select each one in turn, set the purchase price and the number of lots. It will take about 74,000 rubles. Don’t forget that a lot can contain not 1, but 10 or 100 shares. For example, 1 lot of Surgutneftegaz includes 100 securities, and Sberbank - 10.

- If you are not interested in the entire index, you will have to spend time analyzing the company and choosing the one that is worthy of a place in your investment portfolio.

Shares can be purchased not only through a simple brokerage account, but also through an individual investment account. In this case, a pleasant bonus to dividends and growth of quotes will be an annual return of income tax on the invested amount or exemption from paying tax on profits received.

Cost over time

Companies that bring blue chips to market are characterized by their resilience to crises and their stable, but sometimes slow, growth.

The beauty of blue chips is that the likelihood of their sharp decline in price is less than that of 2nd and 3rd tier companies.

The disadvantage is that you have to wait years for significant income from such stocks. Although there are periods when blue chips show outpacing growth.

Therefore, for aggressive traders aimed at quick profits, such companies are of less interest, but they are excellent for long-term investments and investors who avoid large risks.

Chart provided by TradingView

- Buy in Finam

- Buy at BKS

- Buy at Tinkoff

- Buy at Alfa-Bank

There are two ways to receive income from a stock: play on the difference in purchase and sale prices, or invest “long term” and receive dividends.

Dividends are part of the company’s profit distributed among shareholders in the amount approved by the company.

In which countries to invest money

Above, I reviewed the list of the largest companies in different market segments: CIS, Europe + America and Asia. Let's take a quick look at the main advantages and disadvantages of each market.

First CIS:

- Blue chips show the highest level of income compared to other economies.

- Shares of top companies can rise or fall sharply in price.

- It is much easier to find information about the CIS market than about a foreign one. This is especially true for people who do not know English in the field of banking and financial terms.

The disadvantages of this market include:

- Investors receive income in rubles. The ruble, according to almost all global analytical reports, is an undervalued currency. Its real value is much higher than what we see on the market. But due to the country’s political activity, few people want a real strengthening of the ruble. Therefore, it remains a volatile currency.

- The CIS market is difficult to predict. This is especially true for Russia. The political situation is not the most stable, large companies do not show real profitability, funding goes “somewhere else.” All this complicates analytics.

In general, it is worth investing in the CIS market if you want to earn small profits over a long period of time, and also plan to monitor the investment situation in the country. The Russian stock market is now open to investments from small private investors.

The European and American stock markets and their TOP 50 companies are stable. Stocks rarely fall in price and constantly show positive dynamics, but the fall of the Dow Jones index makes investors around the world nervously freeze.

The main advantages of investing in this market:

- Income in dollars or euros. This is the biggest plus. These currencies are much more stable than the ruble. In the short term, this will not be so noticeable, but if you look at least 5 years ago, everyone who invested in stocks in Europe and America in 2014 did not make a mistake.

- Markets are transparent. Of course, there are various frauds that “ordinary people” do not know about, but most operations are in plain sight. You can easily understand how companies make money, what results can be expected in the next year and how much% investors will receive. This is clearly regulated by law.

- Strong economies of countries. This suggests that systemically important enterprises will be stable. If they benefit society and make money, then they won't close in the next 50-100 years. At most, there will be another rebranding, a major merger, but nothing more global. Most likely, we will follow the science fiction scenario, where large corporations gain more and more power over the years.

There are two disadvantages:

- Difficulty finding information. You will have to read foreign news reports, and this requires not ordinary English at the table conversation level, but specific knowledge of investment terminology.

- The income level is lower than that of Russian companies. This is visible at short distances, less noticeable at medium distances. If you do not plan to professionally invest part of your capital throughout your life, then most likely it will be more profitable to work with the CIS market.

Now to Asia. Initially, I wanted to add Japan and China to the TOP to complete the picture - for those who want to get acquainted with the leading Asian companies and nothing more. But upon deeper analysis, the advantages and disadvantages of this market became obvious.

Let's start with the positive things:

- Asian blue chips are the most reliable. Due to mentality and differences in culture, it is difficult for a European to understand what working in Asia is like. People there take up positions and work for the company for decades. And then they give the same position by inheritance. And companies have been around much longer. This means their reliability is much higher. This is not the European approach: make a profit, transfer the company - enjoy life. This is systematic and constant work.

- The Asian market is constantly evolving. It’s worth seeing where China was literally half a century ago. And now it is the second largest economy in the world. It's the same with Japan. India is now also trying to raise its systemically important enterprises to a new level. All this speaks about the prospects for development.

- Currency volatility. A controversial plus, but a competent investor will be able to take advantage of income in yuan and yen correctly. China and Japan are pursuing interesting monetary policies that significantly underestimate the exchange rate compared to the real value. This is done in order to better stimulate domestic production. The government spends a lot of money to make companies make even more profits. So the Asian currency is undervalued by the market today, and will only grow in the future.

Now to the disadvantages. Almost the same as in Europe and America:

- Even more complex search for information and analytics. If Western articles are still translated into Russian, and they are actively interested in investments in Europe and the United States, then with Asia everything is much more complicated. The language barrier is quite strong, and you will have to study the information yourself either on European investment sites or study Chinese.

- Relatively low income (at the level of stable European companies) . This is not the level of income that I would like to receive in Russia.

In general, the following picture emerges: the Russian stock market is suitable for all investors who want to receive money in Russia and the CIS countries. Average level of income, not so high risks and constant price dynamics due to global events. Unless something out of the ordinary happens, such investments will generate money for many years.

Europe and Asia are designed for even longer-term cooperation. Income in rubles there will be significantly less. But if the currency exchange rate gradually falls, it will turn out that in 10 years, income in euros will be much higher than income in rubles, even with investments in the Russian stock market.

For investors who have not yet received sufficient qualifications for trading, I would advise working in their home market first. Incomes are slightly higher and it is easier to find information.