The term “swap” is often found in conversations among traders, financiers, and economists. From English the word is translated literally as “transfer”. The term is widely used in the financial market.

Previously, swap-type transactions were carried out in a banking environment, where participants tried to exchange currencies profitably for themselves. Simple financial transactions for trade transactions were not convenient for both parties, since not all buyers needed currency at a given time and not everyone had a large amount of cash with them that needed to be spent on trading.

How is a swap formed?

When completing a transaction for the purchase and sale of an asset, participants undertake to make final payments on a valued date (pre-agreed). For example, if a position was opened on Tuesday, then the closing date for payments will be Thursday. If an open position is transferred to a day later, the next day will be considered the valued day.

Swap transactions begin at the highest levels of the financial market, then the results spread down the hierarchical system. Swap difference is the ratio of quotes between two currency denominations. It is more profitable for the participant when the interest rate for purchasing currency is higher than for selling it. As a result, the user either remains in a winning position or loses. The minus difference will be debited from your personal account.

What is “swap” in simple terms?

In simple words, a swap is a transaction to exchange an asset for time. Example: two friends are planning to go abroad. Ivanov went to America, and Sidorov to England. The first friend only has dollars with him, and the second friend has euros. Just in case, they decided to exchange a certain amount of money, you never know. That is, the exchange takes place in different currency denominations. Upon arrival, the money taken must be returned based on who borrowed how much.

Due to currency exchange, the risk was reduced. That is, the occurrence of an uncomfortable situation due to a lack of money is unlikely. But if one of your friends managed to spend the borrowed money, and the exchange rate changed at that time, then the resulting difference in the exchange rate change will have two results - plus or minus. For those who do not make money using Forex and do not have the relevant knowledge, an understanding of the term swap will be needed to improve their erudition. Now you can have a basic idea of what smart people talk about.

Why do we pay to transfer a position to the next day?

The main reason for charging swaps is the use of margin trading technology, when a trader uses a broker's credit to open positions with a volume larger than his own funds allow. Swap is actually a daily payment for using borrowed funds

With zero leverage (working only from the funds in the account), as, for example, when trading directly on the Moscow Exchange when opening an individual investment account, no swap is charged.

Kinds

Swaps are classified into various categories. It all depends on the type of asset that is involved in transactions and the terms of the contract. Currently the swap is divided:

- Foreign exchange. With this type, two types of transactions are carried out for the purchase and sale of foreign currency money. Currency exchange occurs on two different dates. Profit is achieved due to the difference in quotes. Currency swap is the most popular method in the financial market. Used as a speculative method in differentiating interest rates.

- Promotional. Such a swap implies a transaction to exchange shares in the future. Currently, the investor's securities portfolio is increasing. As an advantage, the net value of the portfolio is added to investors, which allows them to preserve their own assets.

- Precious metals swap. A financial purchase and sale transaction occurs simultaneously in two stages: the purchase or sale of one precious metal and the reverse transaction.

- Percentage. This is an agreement drawn up between the parties to a transaction to replace interest payments of various forms.

Credit default swaps are most popular in the Russian financial market. Their significance is associated with the possible occurrence of default (depreciation of money) during the period of fulfillment of loan repayment obligations. The possibility of finding yourself in a crisis situation may arise for both the borrower and the credit institution. Much depends on the choice of the specific currency of the loan provided, the external and internal situation in the country’s economy.

Foreign currency is highly dependent on exchange rate fluctuations and also does not guarantee security against risks. The cost of such swaps is more favorable, in contrast to conventional insurance. Not only insurance companies, but also other banks, investment funds, and individuals can be involved in hedging potential risks.

Where to look?

The main source of information about currency swap is information from the central banks of countries whose assets are used in trade. However, this approach requires processing of settlement data when concluding a transaction.

For traders, information about swaps is provided by brokers with whom accounts are opened. At the same time, the information is convenient to use - the fee for transferring a long and short position is indicated in points, which allows you to quickly assess additional profit/loss.

As a rule, the necessary data is posted in the trading conditions section on the broker’s official website. For example, the Alpari company publishes them on (https://alpari.com/ru/trading/contract_specification/) - section “FOREX, metals and CFDs” - “Contract Specifications”.

Information about the current swap level can be found directly in the trading platform, for example in the MetaTrader terminal.

Where to find it in MT4: table

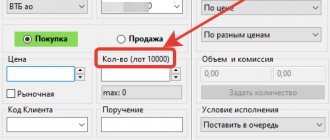

In the MetaTrader terminal (in the popular current version of MT4), information about swap is provided in the “Market Watch” (window with current quotes next to the price chart).

Read more: Wave analysis is a powerful tool for understanding Forex financial markets

To access it, you need to select a currency pair and right-click. In the context menu, select the “Specification” item, which contains a complete overview of the conditions for the selected instrument, including swaps in points for a long and short position and the day of accrual of the triple payment (this amount is charged for transferring a position during the weekend - from Friday to Monday). As a rule, such calculations are made on Wednesday or Thursday.

CDS VS: insurance

Providing a credit default swap is a type of guarantee insurance for the organization that issued the loan against possible default of the client. A good example: a client approached the bank with a large requested loan amount. He agrees to all annual interest rates from the bank. The director of the credit institution was very happy about this deal, but at this moment we should not forget about the potential risk of non-payment of the loan amount by the client. This may happen due to the bankruptcy of the latter. If the amount of the approved loan can significantly affect the bank’s activities in the event of non-repayment, then it is worth considering taking out a credit default swap from another banking organization that has stable and large capital. In the event of non-payment, the other bank will serve as an insurer and cover the costs. The service is provided on a paid basis. But as a result, the bank that buys the swap insures itself against possible risk in the future.

CDS in the financial crisis

Credit default swaps are especially popular among speculators. The demand for loans is rapidly increasing among consumers. All banking structures are involved in the loan issuance service. In this regard, credit institutions need insurance. With the onset of a crisis period, organizations lose the ability to service obligations. There is a risk of increasing default. Requests from insurers for obligatory fulfillment of powers are increasing.

When the crisis affected the insurance company AIG, which managed to make swaps worth a multi-billion dollar amount, only the state saved the situation. Five years ago, the European Union brought serious charges against the largest banking structures. The EU complained that they were blocking the functioning of the CDS. Credit default swaps continue to be opposed by most investment professionals and speculators.

Disadvantages of CDS

The government is increasingly tightening legislation in the area of credit default swaps. In the event of a crisis, the bank will suffer enormous losses if it provides these services. This leads to default on loan repayment obligations.

During a crisis, the responsibility for repaying loans falls on the shoulders of banks. They begin to demand fulfillment of obligations primarily on swap transactions. Next, insurers, in order to correct the situation, try to sell off assets, which further aggravates the problem.

Let's sum it up

So, a swap is a commission that is charged for transferring a trader’s position to the next day. Swap can have either a negative value (when you pay the commission) or a positive value (when the commission is charged to you). We looked at several strategies with which you can try to make money on pure swaps and learned how to analyze swaps using the MyFxBook website.

If our article was useful to you, leave your comment below on the topic: is swap important for you in trading?

That's all, good luck to everyone!

Swap-free accounts

These accounts do not contain swaps - this is the main distinguishing feature from others. For transferring an open position to days ahead, a commission in the form of a swap is charged. This creates unnecessary costs when trading. Swap-free accounts allow you to trade over a long period of time and at a convenient time. The preservation of funds in the personal account is achieved due to the absence of commission.

Such deposits are popular among traders who are accustomed to leaving positions open for a long time. Thanks to the creation of swap-free accounts, transactions on the financial exchange take place in a calm atmosphere, participants can make informed decisions and not rush to conclusions. A deposit can be opened in any currency: dollar, euro, ruble. Accounts without swap appeared not so long ago. Their appearance is associated with the ban on Muslims participating in foreign exchange transactions. Religion did not allow participation in trading activities that required payment of interest.

In order not to lose a potential client base, special centers have opened a new type of account - without swap. The second name is Islamic. To pass the registration stage, it was enough to present a passport and prove adherence to Islam. After a short period of time, accounts without swap began to be used by ordinary trading participants. Most brokers allow you to open them.

Is it worth using such strategies?

Each trader must decide this issue for himself. The fact is that in addition to the obvious advantages, such strategies also have their significant disadvantages. For example, for most currency pairs, positive swaps are currently insignificant. And spreads can reach 5-20 points and even higher.

Accordingly, even if you manage to get some income, it will be comparable to working with risk-free instruments, such as bank deposits or federal loan bonds. At the same time, you will spend significantly less effort, since by investing in a bank or buying bonds, you receive passive income. And when trading such strategies, you will have to regularly analyze swaps and look for windows for competent arbitrage.

In addition, swaps are constantly changing, they are dynamic. Swap can turn from positive to negative. In this case, you will have to close the deal and look for new opportunities.

In addition, the deposit reserve on trading accounts during arbitrage must be impressive so that one of your orders is not closed by Margin Call if you hold the position for a long time during a strong trend.

We recommend not to rely too much on these trading systems and use proven trend or correction strategies, as well as advisors that allow you to make a profit from the operation of the algorithm. And use knowledge about swaps in order to understand how much extra you can get with a positive swap or lose with a negative one, and where the conditions for such commissions are better.