Disclaimer. Forecasts and analytics of financial markets are the private opinion of ru-crypto.com. The current analysis does not constitute a recommendation, trading guide, or investment research.

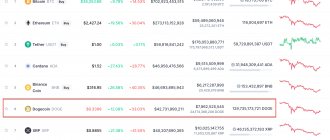

The crypto market moved into greed territory starting in October of this year and spent the next couple of weeks alternating between greed and extreme greed.

On October 7, 2022, in block 74240 of the Ethereum 2.0 network, the Altair hard fork was carried out, the main purpose of which was to improve the mechanism for calculating validator rewards.

Ethereum price forecast in November 2021

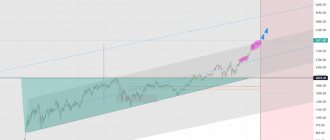

Locally, since September 30, Ether has been moving in an ascending channel, bouncing off the lower and upper boundaries of the channel.

At the moment, Ethereum has rebounded precisely from the upper border of the channel and to continue the rapid growth, Ethereum must concentrate near the upper border of the channel, break through it with an impulse, consolidate above ~$4700 (it is possible to do a retest from above), which will instantly send Ethereum to test $5000. This is the most bullish scenario and is depicted by the orange arrow on the chart.

Source: Tradingview

Continued movement of Ethereum within the channel.

According to another scenario, Ethereum, in the event of a breakout and consolidation below the blue dynamic line, will fall to the area of ~$4300, repeating previous tests of the lower border of the channel. After which a rebound from the lower border of the channel is expected, as in previous times, again with an approach to the upper border of the channel.

As we see, both options are in fact bullish with targets at the top. Therefore, you can buy back from the lower border of the channel, with a stop beyond the border of the channel.

What will affect the rate

Ethereum has long been assigned the status of the second coin by capitalization. Therefore, despite the fact that it, like other cryptocurrencies, is completely dependent on Bitcoin, it still has a special status.

And this must be taken into account when forecasting the Ethereum price for 2022. In addition, more and more investors perceive the coin as a separate, independent cryptocurrency, due to which its value is only growing.

According to experts, next year the price of ETH will be determined by the following factors:

- positive movement of Bitcoin (after its rate increases, Ethereum’s position will also begin to increase);

- high level of inflation, crisis in traditional financial markets and, as a result, changes in investor preferences;

- possible transition of Ethereum to the PoS algorithm;

- development and continuous improvement of developments and decentralized applications that are built on the basis of ETH;

- high attractiveness of the coin for miners.

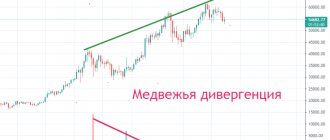

Double top and bearish scenario

Ethereum reached $4,644, eliminating the possibility of a double top and a bearish scenario. Which suggests that traders will continue to buy the deflationary asset.

That is, they will buy when they are sure that there will not be a double top. If the weekly candle closes above the previous ATH, then the price increase could even be up to $6,000 in a few weeks, which is fully consistent with our expectations for the Ethereum rate in November 2021.

According to IntoTheBlock, since the beginning of 2022, the number of ETH holders has increased by 28.29 percent. We are talking about 14.34 million new addresses.

By the way, the Ethereum network now has 63.44 million addresses in the black. This is more than the total number of BTC holders - this figure is 38.62 million units.