The situation on Russian stock exchanges is constantly analyzed using special tools - indices. They are able to show the slightest changes in the market. These indices are calculated using special formulas and are able to express everything that is currently happening at the auction. Today, two equally important indices are used - the MICEX and the RTS. How are they similar and how are they different from each other? And what do they even represent? Let's figure it out.

What is an index

An index (any index, not just MICEX) is an important economic indicator. It represents the virtual value of a group of shares of different companies. The richest brands are always chosen for the indicator; they are also called “blue chips”.

If the prices of shares in this group fall, then the market is experiencing a financial crisis. And the indicator reflects this. That is why the index is also called the “barometer” of the economy.

Shares can be in any currency, but the index is always expressed in points. They open the index with 100 points, and then the natural growth of shares in price increases this number.

Main characteristics

To understand what blue chips are, there are their economic and statistical descriptions in numbers. Based on mathematical calculations and strategic models of the game on the stock exchange, a package of conditions and requirements has been formed, the presence of which allows us to classify the company and its securities (stocks, bonds, options) into this category.

Liquidity

An indicator of how quickly shares can be sold, i.e., assets can be converted into money. GFs are characterized by high liquidity, because even during a crisis and falling prices they are in demand on any exchange and among all investors. Reducing the risks of working with them ensures the execution of purchase and sale within a few seconds.

Small spread

A spread is the difference between the best price offers for buying and selling assets at the same point in time. The activity of a large number of participants in trading on both sides and the prompt execution of transactions creates conditions for keeping this indicator at a low level.

GFs are characterized by a narrow spread ranging from 0.0001 to 0.1% of value. For example, Sberbank shares at a cost of 120 rubles. have a difference in offers of only 2-3 kopecks.

Low volatility

Volatility is a measure of price variability.

Its calculation is based on statistical data on fluctuations in the value of a financial instrument over the period of interest. If a share cost 100 rubles, and deviations from it were up to 20 rubles. - this is considered high volatility, allows you to count on a successful transaction, but also threatens the same financial losses. The purpose of this indicator is to warn about possible risks when dealing with securities. The lower the volatility, the less chance you have of losing a lot of money on a trade. For GF this figure is 2-5%, which indicates that dangers are reduced to a minimum.

Trading volume

The profitability of investing in “first-tier” securities is confirmed by the number of transactions on the stock exchange and, accordingly, high liquidity. Not only passive investors and beginners who avoid the risk of loss are active in their purchase and sale, but also traders who follow an aggressive strategy. On some exchanges, GFs can account for up to 85% of all trading volume.

Capitalization

This criterion determines the value and sustainability of the enterprise, as well as its significance in the national and global economy. It is calculated by multiplying the cost of one share by the total number of shares on the market.

For example, the capitalization of Sberbank as of September 2022 was $73 billion, and Apple Inc. - almost 950 billion (which exceeds the entire stock market of the Russian Federation).

The share of assets issued by the issuing company for free circulation (free-float) can be up to 90% of the total volume of the GF. This makes the company open to investors and increases the level of trust in it.

Which companies are included in the MICEX index

Russia's economy is heavily dependent on oil and gas, and many fuel companies are partly state-owned. Therefore, the country’s largest brands are from the raw materials industry. They are also included in the MICEX indicator.

Banks also figure prominently among MICEX blue chips. The share of telecom operators and retail companies is much smaller.

Which shares are included in the MICEX index is reviewed by the Moscow Exchange committee every quarter.

There are restrictions for companies included in the MICEX:

- they must be listed on the Moscow Exchange;

- the asset of one company in the MICEX index cannot exceed 17%.

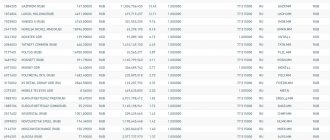

Composition of the MICEX index:

| EXCHANGE CODE | COMPANY NAME |

| SBER | PJSC Sberbank, JSC |

| SBERP | PJSC Sberbank, ap. |

| LKOH | PJSC LUKOIL, JSC |

| GAZP | PJSC Gazprom, JSC |

| NVTK | PJSC NOVATEK, JSC |

| GMKN | PJSC MMC Norilsk Nickel, JSC |

| TATN | PJSC Tatneft named after. V.D. Shashina, JSC |

| TATNP | PJSC Tatneft named after. V.D. Shashina, ap. |

| ROSN | PJSC NK Rosneft, JSC |

| SNGS | OJSC "Surgutneftegas", JSC |

| SNGSP | OJSC "Surgutneftegas", ap. |

| MGNT | PJSC "Magnit", JSC |

| MTSS | PJSC "MTS", JSC |

| ALRS | AK "ALROSA" (PJSC), JSC |

| FIVE | X 5 Retail Group N.V.i, DR of a foreign issuer for shares (DR issuer - The Bank of New York Mellon Corporation) |

| VTBR | VTB Bank (PJSC), JSC |

| CHMF | PJSC Severstal, JSC |

| NLMK | PJSC NLMK, JSC |

| MOEX | PJSC Moscow Exchange, JSC |

| YNDX | Yandex N.V., shares of a foreign issuer |

| IRAO | PJSC Inter RAO, JSC |

| POLY | Polymetal International plc, shares of a foreign issuer |

| MAGN | PJSC MMK, JSC |

| TRNFP | PJSC Transneft, ap. |

| PLZL | PJSC "Polyus", JSC |

| PHOR | PJSC PhosAgro, JSC |

| AFLT | PJSC Aeroflot, JSC |

| RUAL | United Company RUSAL Plc, shares of a foreign issuer |

| MFON | PJSC MegaFon, JSC |

| HYDR | PJSC RusHydro, JSC |

| RTKM | PJSC Rostelecom, JSC |

| FEES | PJSC FGC UES, JSC |

| PIKK | PJSC "PIK Group of Companies", JSC |

| AFKS | PJSFC Sistema, JSC |

| RNFT | PJSC NK "RussNeft", JSC |

| UPRO | PJSC Unipro, JSC |

| TRMK | PJSC TMK, JSC |

| SFIN | PJSC SAFMAR Financial Investments, JSC |

| DSKY | PJSC Detsky Mir, JSC |

| MTLR | Mechel PJSC |

| CBOM | PJSC "CREDIT BANK OF MOSCOW", JSC |

| UWGN | PJSC NPK UWC, JSC |

| MVID | PJSC "M.Video", JSC |

History of the MICEX

All indexes are created after someone said something like: “We need our own Dow Jones.” In Russia, this phrase was heard in 1995. Then the RTS index was created. And in 1997, the MICEX index came into force. Today these indicators have come together.

Contrary to tradition, they were created not by journalists, but by investors. The owners of the Moscow Exchange named their index Moscow Interbank Currency Exchange, abbreviated MICEX. The abbreviation concealed 50 Russian blue chips.

The MICEX report started with one hundred points. In the same year, the MICEX grew 11 times, but already in 1998 it collapsed to 19 points.

Types of index

The key indicator of the Moscow Exchange is called MICEX 10. It includes the most liquid shares of the country's largest companies. The formula for calculation differs from MICEX 50. It has more parameters, but the equation focuses only on stock prices.

The MICEX corporate bond index is calculated using three methods, so it well reflects the situation in the niche.

The indicator is trusted because the MICEX database includes only brands verified by world rating agencies.

All MICEX indices are created with one purpose: to provide information to analysts. For some, data on economic sectors is more important, for others - by region. Moscow Exchange has created a separate tool for each of its clients.

All its products are reflected in the diagram:

| Industry indices | |

| MICEX O&G | 13 fuel companies |

| MICEX PWR | 23 companies that deal with electrical engineering |

| MICEX TLC | 5 telecom operators |

| MICEX M&M | 21 companies from metallurgy and raw materials mining |

| MICEX MNF | Mechanical engineering sector |

| MICEX FNL | 8 banks and 2 exchanges |

| MICEX CGS | 9 retail brands |

| MICEX CHM | 5 pharmaceutical companies |

| MICEX TRN | 4 transport companies |

Cost and dynamics for all time

4 main events of the Russian economy

- In 1998, Yeltsin declared: there will be no default. But people still lose all their savings. Oil drops to $10 per barrel. The MICEX falls to 19 points.

- Meanwhile, the price of companies increases several times. The fate of Sberbank is noteworthy: the company generates returns of tens of percent per annum, collapsing only in 2008.

- The 2008 US mortgage crisis rocks the global stock market. For Russia, the consequences are catastrophic, the ruble will face an incredible devaluation, and the MICEX index drops to 500 points.

- In the summer of 2022, investors feel optimistic about relations between the United States and Russia. But Trump is not living up to expectations. Investors are withdrawing funds from the exchange, the MICEX has fallen by 23% since the beginning of the year.

Pros and cons of the MICEX index

MICEX is called an example of the eternal struggle between the bull and the bear. Behind this metaphor lies a simple observation: the fall of the MICEX ends with a rise.

The predictability of the MICEX indicator is a plus. But for whom? For speculators only. And economists call the domestic stock market itself speculative - the influence of government regulators is very weak.

The state controls the shares of many MICEX companies (a similar situation with the German DAX). This MICEX situation may be a disadvantage for some investors and an advantage for others.

And finally, all companies in the MICEX index have gone through a phase of active growth. Today they will no longer bring huge profits to investors. To do this, an investor can invest in startups or a 2-3 tier index.

Bidders

Here, in general, there are no differences from all other trading platforms.

The following categories of participants trade on the Moscow Exchange:

- Individuals. These are the most ordinary traders, independent investors and, of course, speculators. Representing the vast majority of all participants, physicists account for more than 3.5 million clients. There are also foreign individuals who are registered in the trading system, but there are very few of them - about 11 thousand. Despite the fact that individuals are numerous, in terms of their trade turnover they are, of course, inferior to the next group of trading participants. While the number may be large, many accounts remain dormant because owners may simply be waiting the required period of time to receive tax benefits under the Individual Investment Account program.

- Legal entities . These are companies, funds, in general, organizations that trade on the Moscow Exchange. There are not very many bidders of this type - only about 25 thousand. However, each of them has a fairly high trade turnover. Moreover, in reports on the progress of trading, many see signals that legal entities are trying to shake out individuals, in much the same way as we are used to hearing about large participants in the Forex market. In general, these are serious volumes, and some of the organizations are foreign, that is, they are also divided into “ours” and “not ours.”

Warning

I am often asked how to invest a little and get a lot. I always argue that if I had found a way to get rich quick myself, I wouldn’t have run that site. Why, if you can waste your life on a paradise island?

Then they tell me about binary options and the Forex market. Profit from 70%! With such numbers, one of the speculators was bound to get on the Forbes list. But none of them are there.

And that's why. Options and Forex have nothing to do with the stock market. At least in the form in which they appear in advertising.

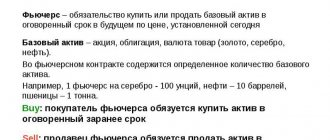

Yes, derivatives of securities (futures and options) are traded, but by millionaires or entire funds. This is a risky instrument that only a professional investor can afford to use.

How is it calculated?

To calculate IMOEX, it is necessary to calculate the ratio of the market capitalization of shares that are included in the calculation base to the total market capitalization of the same securities at the initial moment of calculation. The resulting value must be multiplied by the IMOEX value on the starting date.

This indicator is calculated online in ruble equivalent.

In 2022, the Central Bank of the Russian Federation revised the IMOEX calculation methodology and issued a new regulation. As a result, the requirements for the level of liquidity of shares that are part of the indicator were increased. This made it possible to move to a floating number of securities. These innovations were established in order to increase investor interest in stock indices. But, more importantly, it will contribute to a more complete reflection of the market situation.

What affects the index

The MICEX indicator base includes fuel and energy companies. Therefore, the prices of carbon raw materials - gas, oil, and so on - affect stock prices.

And fuel prices change more often under the influence of four factors:

- Political situation.

- Technological developments.

- State of the environment.

- Social pressure.

I will analyze each point that affects MICEX with examples.

Useful articles

Online chart and dynamics of the RTS index over the past ten years: what's next?

How to create the right passive investment portfolio Asset Allocation?

Review and reviews of 12 ETF funds from FinEx on the Moscow Exchange

Individual investment account “IIS”: a detailed overview of the instrument and reviews about it

About politics. Iran is one of the main oil exporters. The country is now under pressure from US sanctions. Production fell by 30%, oil prices reached $85 per barrel. Moscow Exchange shares are rising in price.

About innovation. Novatek launches a new industrial complex. Here the gas will be liquefied using patented technology. The manufacturer also plans to open a transshipment point for maritime transport in the Arctic. Once all the changes take effect, it will change the entire market.

About ecology. Shell planned to open a new offshore platform and increase production several times. Greenpeace sounded the alarm, and the company suffered losses on compensation payments. Sometimes such conflicts become spontaneous and affect stock prices.

About public pressure. Workers are deceived by contractors from time to time. They are not paid wages and go on strike. This leads to a decline in production and a drop in prices.

As the proverb goes, trouble never comes alone. Rarely do all four factors come into play at the same time, but two or three problems often come together and affect MICEX.

Other indices may avoid the influence of these factors on quotes, but the MICEX is sensitive to them.

OTC market

There are two areas of trading: over-the-counter and organized markets.

The first area involves direct transactions between buyer and seller through an intermediary - a commercial bank. Personalized and representative transactions are provided; in both cases, the amount, volume, procedure and terms of payment are determined before the conclusion of the transaction. Transactions on the over-the-counter market have quite serious associated risks; neither party is protected from the failure of the other party. A feature of operations in this area of the market is the presence of trust between the parties, therefore, most market participants are partners.

Forecast, analytics and prospects

Energy Minister Alexander Novak said: the OPEC committee will increase oil production. This will reduce prices, which will affect the MICEX. The MICEX index will lose value and stop growing.

Perhaps investor activity will increase in the fall and compensate for this. In summer, trading volume is lower than in other seasons.

There is another reason for optimism: the preservation of interest rates. This will help develop the country's commodity and money markets.

The US and China are negotiating tariffs. They are softening, and the global market is strengthening. This background has a good effect on the business of the MICEX blue chips: Russia has active economic relations with both countries.

conclusions

Analysis of Moscow Exchange indices is one of the key skills needed by every trader and investor. Before including any security in a portfolio, an asset manager should definitely study the chart of the MICEX benchmark and industry indices. They contain a large amount of data, including price dynamics and trading volumes.

All necessary information on key indices is on the official website of the Moscow Exchange. There is data on the latest indicator values, an archive of values, calculation bases and a candlestick price chart for the last quarter. Interactive charts can also be found on many special resources, for example, on the IFD financial forum for traders and investors.

Similar indexes

The main competitor of the Moscow Exchange and the MICEX is the analytical agency MSCI (Morgan Stanley Capital International). Its MSCI Russia index serves as the basis for futures and options on the European exchange. Plus, based on it, there is a fairly popular ETF (ERUS), by purchasing which a Western investor can participate in the growth of the Russian market.

Within the Moscow Exchange family, the MICEX index is similar to the “RTS standard index,” which includes 15 Russian blue chips. The MICEX chart for 10 years almost completely repeats the dynamics of the RTS standard. The reason is that even when these indices were calculated using different methods, Lukoil, Gazprom and Sberbank had an equally large impact on both indices.

Moscow trading session

The Moscow trading session starts at 10:00. The opening of trading is usually accompanied by very high activity and high turnover rates. This happens for two reasons:

- Prices for many instruments show a gap that forms during the non-trading period.

- Around the same time, the main European trading platforms open, that is, the overall turnover in the markets increases significantly.

Such high activity can be observed for 2 hours, then it begins to decline, trading progresses more calmly, and daily trends appear. This is followed by a decline in activity, which also coincides with the lunch break in Europe, after which trading accelerates again. This also happens for two reasons:

- The trading session of European exchanges is coming to an end, investors and speculators are actively closing their short-term positions, or opening new ones if there are prerequisites for high activity in the subsequent American session (this usually happens after strong news).

- American trading platforms are opening, resulting in a coincidence of work in three regions at once:

- America;

- Russia;

- Europe.

Intersection with the Americans leads to the fact that until the very end of the main part of the Moscow trading session, turnover remains at a high level. At 19:00 trading on the Moscow Exchange ends. In fact, they end a little earlier, depending on the sector, since the entire procedural part takes about 15 minutes.

an additional, evening Moscow trading session begins . It presents a shortened list of instruments - futures and options are available. This can be called a very big advantage, since any position on a stock can be further hedged on futures.

Thus, it turns out that on the Moscow Exchange, trading participants cover the most active part of the day - European and American. Trading in the additional session continues until 00:00, but in the same way as in the previous case, in fact until 23:45. The trading schedule on the Moscow Exchange includes 14 hours of trading time, and this is an excellent indicator, especially considering the geographical location. That is, out of all the time, only the period of work of the Asian region falls out, which does not move the markets very much.