From this article you will learn:

- What is trading in simple words?

- How does the trading process work?

- Leverage and Margin

- Trading tools

- Types of trading

- Trading principles

- Skills needed for trading

- How to become a trader

What is trading in simple words?

So, trading in simple words is the process of trading any asset on the stock exchange. The word “trading” itself comes from the English trade – “trading”, and “trader” – from the word trader, i.e. "dealer".

The broad concept of trading includes any transactions in general, i.e. purchase of stocks, bonds, and currencies. If you want to buy shares of Gazprom or Apple, then you will have to resort to trading, i.e. purchasing this security for rubles or foreign currency.

In a narrow sense, trading is short-term speculation aimed solely at making a profit. A speculative trader is of little interest to the company itself, the securities of which he trades - it is more important to him that quotes change more often during the trading session: then he can earn more.

However, in reality, speculators usually rarely trade stocks, preferring more profitable and volatile futures or currency pairs.

The classic image of a trader is a forex speculator, trading currency pairs intraday and using technical analysis to open positions.

Traders are usually opposed to investors. The latter invest using fundamental analysis data, i.e. They buy not just paper, but a share in the business. If the business is good, then investors can buy shares at literally any price, without using technical analysis at all.

In the trading process, on the contrary, finding the optimal entry and exit points is the most important task. The speculator uses so-called “timing”: he calculates when an asset should rise or fall, and acts in accordance with his conclusions.

Trader - who is it?

A trader is involved in trading operations in financial markets. If translated literally from English, then a trader is a trader. In relation to financial markets, a trader of financial instruments. In other words:

A trader is a person who carries out trading operations with securities, currencies, and exchange commodities on the exchange and over-the-counter markets.

A trader can carry out trading operations with his own funds, or with the client’s funds, or with the funds of the company whose interests he represents. Thus, a trader is a market participant who carries out trading operations with financial instruments in order to make a profit.

How does the trading process work?

- The essence of trading comes down to the fact that a speculator extracts maximum profit in a short time, using the volatility (changeability) of the price of an asset. At the same time, it does not matter to him exactly where the asset will move: a trader can make money both on an increase in the price of an asset (by opening a long position - long) and on a fall (by opening a short position - short).

- The trader uses technical analysis for trading, which includes many techniques: building levels, waves and moving averages, using indicators, etc. It is important to analyze the chart of an asset, presented as a set of Japanese candlesticks.

- Thus, the trader draws conclusions by analyzing Japanese candlesticks and technical indicators on various timeframes.

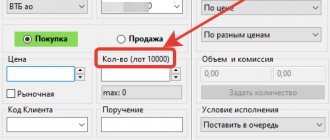

- The trader performs his work using the trading terminal. As a rule, most brokers already have all the necessary tools for a trader built into their terminal. At the same time, some platforms allow traders to use their own programs and developments, incl. bots for automated trading.

In the process of work, a trader buys (or sells) an asset, waits for a certain price to be reached, and then closes the transaction.

Leverage and Margin

Leverage is important in trading. With it you can significantly increase profitability using relatively small amounts. So, when using a leverage of 1:100, you can get a profitability that is 100 times greater than simply when buying/selling an asset.

Example: a trader decided to make money on Gazprom shares. He buys 5 lots of shares for 300 rubles each (there are 10 shares in a lot, so the total purchase amount is: 5 * 10 * 300 = 15,000 rubles). If the share rises in price to 325 rubles, then his position will increase to 5 * 10 * 325 = 16,250 rubles. Net profit will be: 1250 rubles.

But the trader decided to use leverage of 1:100. Now, instead of 5 lots for the same 15,000 rubles, he buys 500 lots. The total position size is: 500 * 10 * 300 = 1,500,000 rubles. If the price of Gazprom shares rises to 325 rubles, the cost of the position will be: 500 * 30 * 325 = 1,625,000. Profit: 125,000 rubles.

However, the price of the asset may go down. So, if in the same transaction the stock falls in price to 275 rubles, then the price of the position will be: 500 * 10 * 275 = 1,375,000, and the trader’s loss if he closes the position: 125,000 rubles.

The greater the leverage, the greater the risk of loss . Therefore, traders use either small leverage (up to 1:25) or instruments with already “built-in” leverage (for example, futures).

Another argument against trading with leverage is the need to pay the broker. The fact is that leverage is essentially a loan that a trader takes from his broker. For each day you use the broker's money, you need to pay a commission - usually 10-15% per annum.

In addition, the broker must be sure that the trader has enough money to cover a trade with a loss. Therefore, it requires the trader to have sufficient amounts in his account to trade with leverage. This amount is called “margin” (hence margin trading).

In the example above, the broker will require the trader to deposit a minimum of 125,000 rubles into the account to cover a possible loss. This is called a margin call. If the trader ignores the broker, then the broker has the right to close the unprofitable transaction and debit the necessary money from the client’s account. If the trader had profitable positions, they will also be closed to compensate for losses.

I also recommend reading:

Martingale calculator - for binary options, forex and sports betting

The Martingale method is called a surefire way to lose your deposit, but this only applies to beginners. If a trader understands what […]

Russian market - I recommend

And finally, I’ll sum it up. If you have just started trading, it is better to start your journey from the Russian market. Trading is carried out on the Moscow Exchange. In order to get on the exchange you need to open an account with one of the Russian brokers.

The list of assets that are traded on the Moscow Exchange is quite large. To begin with, you can choose to trade futures (the futures section of the Moscow Exchange) and shares (the stock section).

You can read more about the Forts derivatives market, as well as the advantages and disadvantages of trading stocks and futures in this article.

I wrote in this article about what you should study and which broker to choose before opening an account.

There is enough market liquidity to operate with very large sums. Since January 2015, it has become possible to open an individual investment account (IIA), which will allow you to receive a personal income tax deduction and trade without paying tax.

I hope this article will be useful to many. Good luck to everyone. Bye!

Sincerely, Stanislav Stanishevsky.

Do you want to learn how to trade? You can sign up for individual training courses here.

Trading tools

The most popular trading tools are the following:

- Currencies _ The trader buys and sells currency on the corresponding section of the exchange. Since the currency rate changes literally every second, this is an ideal tool for a trader. Currency purchased on the exchange can be used for further speculation, withdrawal to an account or acquisition of other assets. However, you need to take into account that the minimum lot is 1000 units of currency, so traders with small capital have nothing to do there.

- Currency pairs . This is the most popular tool for traders in the Forex market. Unlike currencies, currency pairs are used only for speculation. An investor can use a variety of pairs to make a profit, but the most popular are pairs with the dollar as the main currency: EUR/USD, GBP/USD, AUD/USD, NZD/USD, USD/JPY, USD/CHF, USD/CAD. In Forex, leverage is used “by default”, so you can trade even with a small amount - literally from 10 dollars or 100 rubles. However, sufficient margin is still required to secure trades.

- Futures and options. Derivatives are perhaps the most beloved instruments of investors. “Built-in” leverage allows you to receive more income, but at the same time, much less margin collateral is required. In addition, according to experienced traders, price movements in derivatives are more predictable than in currency pairs. This means that there are more chances to make money on futures and options. Most often, traders trade settlement futures (i.e. without delivery of a real asset), making a profit on price differences. The most popular instruments are futures for commodities (oil, gas, wheat), precious metals (gold, silver, platinum), currencies (dollar, euro, yen), indices (IMOEX, S&P500, VIX).

- Shares (or CFDs on Forex). Stocks, especially American ones, are quite volatile instruments: intraday movements of 5-10% are often observed. The price of shares depends, first of all, on the state of the business of the issuer itself, and secondly, on market sentiment. You can make money on stocks through classic speculation (buy cheaper and sell at a higher price - or, on the contrary, sell at a higher price and buy back at a lower price) or through the medium- and long-term long purchase method, allowing the stock to grow. Dividends are a nice bonus to owning a good stock.

Bonds as a trading instrument are unattractive due to low volatility: their price changes little, since it is more a tool for saving than increasing funds. In addition, the fall in the price of the bond is compensated by the increase in the income tax - as a result, it is generally unprofitable to use this asset for speculative purposes.

Types of trading

There are several main types of trading:

Scalping, or short-term speculation

The trader opens trades for literally a few minutes (or even seconds), trying to make money on the smallest price movements. There is no question of a full-fledged analysis here at all: the trader evaluates exclusively the candlestick chart and sometimes connects some indicators. As a rule, most scalping strategies are fully automated, since it is physically impossible to manually open and close dozens of transactions within a minute.

This type of trading can bring almost unlimited profits if the trader manages to find his own approach. But this is also the riskiest type of trading, since you can lose your capital in a matter of minutes. On average, scalping profitability is 60-70% per month, but the trader will have to endure drawdowns of up to 50-60% of capital.

As a rule, a scalper works only with one type of asset from a broker with minimal commissions or a fixed commission per month (since you have to pay to open each trade) on a 1- or 5-minute time frame.

I also recommend reading:

Autochartist for MT4 - plugin for auto-searching for chart patterns

Today there are a huge number of different chart analysis tools. Indicators are being created that can greatly reduce a trader’s time […]

Intraday trading (or intraday)

The trader holds positions for one trading session. This is the most popular type of trading - almost 90% of all transactions (not counting scalping) are carried out intraday.

There are many strategies for intraday trading. As a rule, market participants rely on chart analysis and technical indicators (moving averages, waves, levels, stochastics, RSI, MACD and other oscillators) to decide whether to enter a trade.

Fundamental analysis is not usually used. Traders often trade on news when the movement of an asset can be predicted.

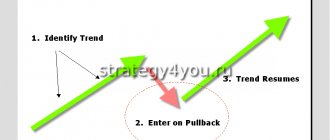

Intraday trading is relatively calm (compared to scalping). A trader can hold several transactions at once and make an informed decision on each. In addition, it is often practiced to add to a position if the trader was able to catch a trend (one of the sayings of market participants: Trend is your friend, i.e. “Trend is your friend”).

Trading is usually carried out on 5- and 30-minute timeframes, occasionally on 1-hour ones.

The profitability of such a strategy is usually 10-25% per month with fairly moderate risks.

Day trading (medium term trading)

A trader can hold a position for several days or even weeks. In this case, the position usually increases when the trend is correctly guessed.

In medium-term trading, many strategies are used, based on both fundamental and technical analysis, and a mixture of both. For example, a trader, having studied the business of Gazprom, comes to the conclusion that the shares have growth potential, but at the moment, according to all technical indicators, they are oversold - therefore, it makes sense to open a long position. Or, on the contrary, a trader understands that the business of a certain company is bad, but the stock is overbought - and he opens a short position, expecting the quotes to fall.

With medium-term trading, a trader can simultaneously open many transactions on a variety of instruments, incl. by hedging positions. For example, he buys a share of Gazprom, but at the same time hedges the position by selling futures.

The profitability of medium-term strategies is usually 10-15% per month with a relatively low level of risk.

Long-term trading

A trader can hold a trade for weeks or even months. As a rule, in his work he adheres more to fundamental analysis, and uses technical analysis to find the optimal entry point.

Unlike a long-term investor, such a trader is not interested in owning a stock forever, preferring to get rid of it after reaching a certain price (while the quality of the business is rarely the determining factor).

The profitability of long-term trading is usually 5-10% per month, and risks are minimized.

Where to open a trading account - review of the TOP 3 brokerage companies

There are many good brokers, but I highly recommend one of the three described below.

These are companies with many years of experience, proven and reliable.

1) Alpari

]Alpari[/anchor] is deservedly in first place. Only here traders are provided with free in-depth training on various aspects of trading in the foreign exchange market.

The broker does not work with stock exchange instruments with rare exceptions (there are metals, two futures). Technical equipment is at its best.

2) Opening Broker

Interesting company. Offers to speculate on the stock market of the Russian Federation and foreign countries. The analytics department at Otkritie Broker regularly publishes interesting reviews that you can use to trade even without serious knowledge about the market.

The company's traders often appear on television and make very good forecasts. Stock trading has a number of significant differences from currency speculation; it is impossible to say which is better.

Before you start trading, be sure to undergo training and understand all the details.

3) BCS Broker

BCS combines instruments from both the foreign exchange and stock markets. It works for about the same time as Alpari and is not inferior in reliability. The training is mostly paid; only the basic course is publicly available.

In BCS you will be able to enter transactions not only into Russian, but also into foreign markets - there are many more opportunities. If you have questions about cooperation with a particular broker, ask in the comments, I will answer.

Trading principles

Trading on the stock exchange involves following several mandatory principles:

- Follow a single strategy . You should not jump from scalping to long-term fundamental trading: this way the trader will not achieve anything, but will only get confused and lose money.

- Follow the signals strictly . You need to enter a trade only when there are all signals to buy/sell an asset. Trading by intuition or half the signals is a road to nowhere.

- Don't jump into the last car . In other words, you should not enter into a trade when the news and the trend it caused have played out.

- Use risk management . Thus, you cannot use more than 5% of your capital in one transaction, and you must also set stop losses so as not to lose your capital in an unfavorable situation.

- Limit the shoulder . No matter how tempting margin trading may be, it is better to limit the size of your leverage, otherwise you could lose all your money. It is considered optimal to use a leverage of no more than 1:25.

- Restrict trade . If a trader makes 3 unprofitable trades and loses more than 5% of his capital, then he should stop. No “acting out” and “you’ll definitely be lucky now.” If trading does not go well, it is better not to work in the market.

- Don't be greedy. If the trade turns out to be positive, it is better to close it (or, as a last resort, place a trailing stop). It often happened that a trader kept a trade open in the hope of further growth, but then the trend changed and the profit fell sharply - or the trade became unprofitable altogether.

- Don't be led by emotions . When a trader suffers failures, he has a desire to randomly open trades at random. If he is lucky, he may lose his caution. Thus, it is necessary to keep emotions under control and trade strictly according to the system.

- Don't sit out losses . It is better to close a losing trade immediately than to constantly lose money. Of course, sometimes the price of an asset begins to go in the right direction, but if the trend has changed, then this will not change the situation. The trader needs to limit possible losses and safely close the trade with a stop loss.

I also recommend reading:

Live chart for binary options and Forex – features, settings and functionality

Live chart from Trading View for binary options and forex is an ideal solution for situations when it is not possible to use the main […]

In addition, it is recommended to keep a trader’s diary, in which all transactions are recorded and it is noted on what principles were used to enter and exit a transaction. If a trade was unprofitable, you need to analyze it and understand what caused the failure in order to avoid making mistakes later.

Where to trade

To trade on the stock exchange, you don’t have to go to Wall Street and crowd into the trading floor, shouting information about the deal. Thanks to the Internet, you can trade almost anywhere in the world.

There are special trading platforms for this, the most popular of which remains MetaTrader 4. It is easy to install on a personal computer, smartphone or tablet. So in this regard, the advertising posters that show a trader trading under palm trees do not lie.

Access to the world's leading platforms on which you can carry out transactions must be obtained through a brokerage company. As an individual, you will not be able to enter the stock exchange for trading. But thanks to the conditions of margin trading offered by brokerage houses for work, you will need much smaller amounts of starting capital.

Skills needed for trading

Experienced traders list the following skills as essential:

- computer literacy – you need to be able to use terminals in order to avoid “technical” errors;

- knowledge of the English language (at least at a minimum level) - it is needed, at a minimum, to work with the terminal, and at a maximum - to read foreign literature on trading;

- self-discipline and self-control - you cannot give free rein to emotions, transactions must be opened with a clear head;

- perseverance and patience (even scalpers need it);

- desire to constantly learn new things;

- logical, systematic and at the same time flexible thinking;

- ability to adapt to changing situations;

- stress resistance.

In addition, a trader needs to be able to manage his time. Trading is a way of life that combines work with rest and study. You need to be able to prioritize in order to get everything done.