Earning Bitcoin is of interest to people for whom purchasing this cryptocurrency in large quantities is not practical. And today there are quite a lot of ways that allow the average person to get a certain amount of Bitcoin with or without investments. Each of these options has its own advantages and disadvantages, but in general the principle is the same - methods where practically nothing needs to be done, like crypto faucets, bring in little income; and methods with greater labor costs or monetary investments result in more tangible profits.

Without investments, you can earn Bitcoin through faucets, referral programs, games, and freelancing. With investments - through trading on exchanges, investments, mining, lending, arbitrage. The editors of the Profinvestment.com website reviewed and analyzed all of the listed methods.

For your information. You can buy Bitcoin in the following ways:

- In exchange offices. Verified: ProstoCash, Xchange, Platov, Ramon Cash, 60cek. There you can purchase cryptocurrency for fiat.

- On cryptocurrency exchanges and p2p platforms: Currency, Binance, Bybit, Localbitcoins, Cryptolocator, Crex24, Livecoin, EXMO and others.

- Using electronic payment systems. For example, Payeer, Advcash, Capitalist.

Bitcoin faucets

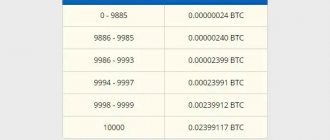

Bitcoin faucet is a way to earn BTC, which is a reward distribution system. Accruals are made as a reward for simple actions like solving a captcha and are calculated in satoshi (one hundred millionth of a bitcoin). Even the most generous faucets offer a very small income, but over time, if you use them regularly, you can accumulate a more or less noticeable amount and store it in the hope that the cryptocurrency rate will rise.

Popular Bitcoin faucets:

- FreeBitcoin. Perhaps the most frequently used BTC faucet in the world. Pays fairly well; in addition to the usual accruals for tasks, it pays bonuses, allows you to play lotteries and gambling, with the help of which you can theoretically triple your balance. Thus, FreeBitcoin is an excellent gaming and lottery platform.

- Bonus Bitcoin. This site differs from others in that it unites several faucets under its own brand. This is convenient for the user - all resources are collected in one place, there is no need to constantly switch between sites. The project allows you to earn up to 5000 satoshi every 15 minutes. There is a daily bonus and a referral program.

- Moon Bitcoin. One of the oldest faucets, which is also one of the highest paid. In addition to Bitcoin, it supports Ethereum and Litecoin, so it is suitable for people who prefer flexible fund management options. In addition, Moon Bitcoin has many different bonuses, including a loyalty bonus - if you use the site every day, your potential winnings will increase by a certain percentage.

Advantages and disadvantages

Pros:

- Ease of earning money from scratch and without investments.

- Simple registration, no identity verification.

- Numerous bonuses and lotteries.

- Most faucets support automatic payments to your wallet.

Minuses:

- Low profitability.

- Low chances of winning lotteries and receiving generous bonuses.

Conclusion

New BTC faucets appear every day. Competition is growing, website owners are adding more and more interesting features. With all the variety of choices, it is recommended to first look at old and proven resources, and also, in order for the earnings to be tangible, to choose a total of at least 5-10 resources. By switching between them, completing tasks daily and receiving bonuses, you can regularly withdraw profits to your external wallet.

Trading

One of the most common ways to earn BTC is trading, trading on cryptocurrency exchanges. There are two main forms of it:

- Spot. Buying or selling cryptocurrency with its instant transfer to the buyer/seller.

- Derivatives (options, futures). They are contracts for the purchase/sale of Bitcoin at a certain price and within a specified period; are also indefinite.

Almost all cryptocurrency exchanges support spot trading, but now most of them are also adding derivatives trading functionality, since traders also find this option very promising.

Popular crypto exchanges – BitMEX, Currency, Binance, EXMO, Localbitcoins, Bybit, Cryptolocator, Bitpapa, Crex24, Livecoin, Basefex, Kraken. They support work with all top cryptocurrencies, and also provide extensive additional functionality - lending, margin trading, staking, exchange for fiat currencies.

Exchanges serve an important function in the ecosystem, acting as portals between fiat and cryptocurrencies. A crypto exchange resembles a stock exchange in interface and functionality, but with a focus on cryptocurrency tokens rather than traditional markets. The main goals of its use are to make the trading process as convenient as possible for beginners, to find the most competitive price, and to provide a platform for professional crypto traders.

Advantages and disadvantages

Pros:

- The opportunity to make good money with the high volatility of Bitcoin if you buy and sell in time.

- A large selection of platforms, among which everyone can choose suitable conditions and a comfortable interface.

- Small exchange commissions. Many exchanges also allow you to save on them by using an exchange token (for example, BNB from Binance).

- Some sites provide a demo account where you can practice trading without the risk of losing real money.

Minuses:

- The need for careful study of technical and fundamental analysis to predict the exchange rate.

- Beginners often lose significant amounts of money for various reasons - from ignorance of technical details to excessive emotionality.

Conclusion

If you choose the right strategy, trading can bring you multiple returns. But if you make a mistake with the strategy or follow it incorrectly, you can lose all your capital. A beginner should not rush headlong into the pool; it is better to start with small amounts and observe the tactics of experienced traders.

Earnings on Bitcoin exchange (arbitrage)

There is another interesting way to earn bitcoins, which I recently learned about - arbitrage!

Its essence is that there is no single price for bitcoins. Each exchange sets its own Bitcoin exchange rates, which can vary significantly.

And there are a huge number of exchanges on the Internet that allow you to sell/buy bitcoins.

So how can you make money on arbitrage?

- To make money on arbitrage, firstly, you will need to register on 3-10 major bitcoin exchanges.

- Next, you will need to periodically monitor the purchase/sale price on these exchanges. By the way, this is easy to do with the help of special sites that compare rates online (for example, the bitkurs.ru/markets service).

- If you notice that the price on one exchange is noticeably higher, and on another lower, then on one exchange we buy at a low rate, and on the other we sell at a high rate.

Examples of different rates for buying/selling bitcoins on exchanges

To make it completely clear, I will give an example!

⭐️ An example of making money on arbitration! For example, you noticed that on the Bitfinex exchange it is possible to buy bitcoins at a rate of $5,782, while at the same time on the LiveCoin exchange bitcoins can be sold for $5,847.

First, you buy bitcoins for $5,782, and then we sell the purchased bitcoins on a second exchange for $5,847. In this case, the difference was $65 per 1 bitcoin!

As you can see, you can make money on arbitrage, but to make normal money from the difference in rates, more or less serious investments are required!

In addition, there are 3 important nuances that you need to know about:

- When exchanging, do not forget to take into account the commission that is charged for replenishing bitcoins on some exchanges!

- The Bitcoin exchange rate can change dramatically almost every second, which can either significantly increase your profit or seriously reduce it.

- Consider the volume of bitcoins available at the time of exchange on exchanges - it may simply not be enough!

Investment

This method of earning Bitcoin involves long-term investment in cryptocurrency. BTC coins are valuable and useful. Understanding the potential impact of Bitcoin, it is not difficult to understand why investing in it could be a good idea.

However, as in any market, it is impossible to say for sure when the price of an asset will go up and when it will go down. During its existence, Bitcoin either grew, then fell at a rapid pace, or stabilized. These fluctuations depend on many factors, including news - for example, news about a change in the attitude of the government of a country towards cryptocurrencies has a strong impact.

BTC rate changes over the past 7 years:

To invest in Bitcoin, you can use any exchange or exchanger. For example, Matby. Perhaps the best online exchanger also includes a crypto wallet for reliable and secure storage of cryptocurrency. The service has been on the market for more than 6 years, has experienced no rise or fall in the price of Bitcoin and has many positive reviews. In addition to Bitcoin, the service supports Litecoin, Dash and Zcash. Official website: matbea.com.

Examples of wallets:

- Blockchain A simple, convenient online service for storing private keys for accessing cryptocurrency.

- Exodus. A downloadable application that allows you to securely store your keys on your own computer.

- Ledger or Trezor. A hardware wallet is one of the safest options. Not connected to the Internet, while stored separately from the computer, so private keys are completely safe. And in case of loss of the device, a PIN code is provided.

Advantages and disadvantages

Pros:

- Potentially high profitability. Some experts predict that the value of 1 BTC will rise to $100,000 in the next few years.

- Growing interest in cryptocurrencies. No matter how much the authorities resist, Bitcoin and altcoins are increasingly penetrating people’s lives. It never hurts to have this powerful asset.

- Convenience, speed and security of online payments, including cross-border ones.

Minuses:

- Risks comparable to investing in stocks.

- Possible shortage of resources associated with limited currency issue.

Conclusion

It is impossible to say for sure whether it is possible to earn bitcoins by investing. Crypto investors can be divided into “Bitcoin evangelists”, who are convinced of the growth of the main cryptocurrency, even if this happens in a few years, and altcoin supporters, who see a lot of shortcomings in BTC and predict a collapse in the exchange rate. Difficulties are also created by numerous bans that the authorities of almost all countries continue to create. Nevertheless, the chances of Bitcoin growth in the coming years are still quite high.

Risks when investing in Bitcoin

Despite all the noise around cryptocurrencies, some experts are of the conservative opinion that Bitcoin is a bubble and a mirage. To form your opinion, it is worth at least considering certain risks that you need to be aware of before investing in Bitcoin:

- Experimental phase. The concept of cryptocurrency itself is innovative, it is only 10 years old. This is too short a time to assess how much you can trust her. Something unexpected can always happen. True, Bitcoin is already less in the experimental phase than newer cryptocurrencies.

- Technological risks. The development of the cryptocurrency world is proceeding at a rapid pace, and there is a possibility that a currency more economically and technically advanced than Bitcoin will soon appear or has already appeared. As a result, it may lose value.

- Price volatility. The value of BTC in the short term is completely unpredictable. It is virtually impossible to predict exactly how much it will be valued tomorrow.

- Lack of consumer protection. The transaction cannot be canceled; all that remains is to convince the recipient of the funds to voluntarily return them if they were transferred by mistake. The investor should also be aware of this danger, although it is in the field of investment that the irreversibility of transactions is not so significant.

- Possibility of theft or loss. To do this, an attacker just needs to gain access to the private key. As practice shows, not everyone treats its safety with due care.

- Problems with legislation. Different countries have different approaches to regulating BTC. There is no single well-thought-out system, and therefore it is unknown what awaits cryptocurrency in the future.

Mining

One of the ways to earn Bitcoin cryptocurrency with investments is mining. This is the basis of the Bitcoin network; miners confirm transactions and ensure the security of the blockchain. If they were not there, the network would not be functional, it would be instantly hacked by attackers.

BTC mining is carried out on specialized equipment. Miners solve computational problems that make it possible to link transaction blocks into a single whole, and this is how a blockchain is formed. For this work, miners receive a reward in the form of new created cryptocurrency and transaction fees. New blocks are formed on average every 10 minutes.

Before purchasing equipment and starting mining, you need to decide how profitable Bitcoin mining will be. For this purpose, there are special calculators that take into account energy costs. You should also remember that profitability will constantly change due to changes in the coin price and mining difficulty.

If you want to take part in mining, but there is no way to purchase equipment, allocate a separate room for it, etc., then you should take a closer look at the existing sites of the so-called cloud mining. They allow you to buy a contract for a certain amount of computing power and for a limited period, after which you simply receive income from this capacity, giving a small percentage as a commission to the company that maintains the equipment in working order.

Examples of such sites for cloud mining:

- IQ Mining. Cloud mining of Bitcoin and several altcoins. Shows high efficiency - on average 30% more economical than competitors. The creators often hold competitions with drawings of expensive prizes among people who have purchased contracts for at least $100.

- CryptoUniverse. A relatively new service, operating since 2022, but showing great promise. The data center is located in Russia, near St. Petersburg. On the site you can purchase contracts for BTC or LTC for almost any period - from 30 days to 5 years.

- Bitluck. A service for cloud mining of only one cryptocurrency – Bitcoin. It has a large reserve of power, which is enough for all participants in the pool. Allows you to enter mining even with a small amount of funds thanks to low prices for contracts.

- Genesis Mining. A site that combines three types of functionality: cloud mining, proprietary software and algorithmic trading. It has been providing services since 2014. On the site you can buy contracts valid for 1–2 years and mine Bitcoin and Dash cryptocurrencies.

- Hashflare. The site has been operating since 2015 and allows you to mine 5 different cryptocurrencies, including BTC. True, almost always all capacities have been purchased; at the moment it is impossible to purchase a contract. To use the resource, identity verification is required.

Advantages and disadvantages

Pros:

- The emergence of a large number of cloud mining services, which allows you to mine cryptocurrency with a minimum of cost and hassle.

- Benefit for the crypto community, support for the blockchain network.

Minuses:

- High cost, high entry barrier.

- When purchasing equipment, there is a high risk of its depreciation in the event of a market decline.

- The problematic nature of mining at home is energy consumption, noise, and heat generated. You need a separate room and a complete change of wiring.

- The dubious benefits of mining. It is already very difficult to earn Bitcoin on it. Priority in this area has shifted to large corporations that can afford to purchase thousands of pieces of equipment.

Conclusion

If at the dawn of the development of cryptocurrencies, mining was easy and profitable, now its complexity and the volatility of the BTC exchange rate have made this activity quite problematic. Fewer and fewer ordinary people are entering this area with their equipment, preferring to turn to cloud mining. But even that does not always promise a high level of profit. The instability of the value of the currency leads to the fact that the profitability of the purchased contract can be only a few percent.

Risks and possible problems

- Gradual trend towards centralization of cryptocurrency.

- Despite the fact that no one knows the recipients of bitcoins, the information itself about the amount of transactions is made publicly available. As a result, it becomes possible to manipulate the price.

- Cryptocurrency is not backed by anything. At any moment the rate may collapse to zero, but this investment risk is minimal.

- In Russia, all of the above is compounded by the lack of a clear regulatory framework. It is still unclear how the state treats Bitcoin in general and cryptocurrency in particular, which destabilizes the market.

Bitcoin games

All Bitcoin games included in this list are completely free and no deposit is required. Here are a few examples of games that are fun to play. Some of them require a certain skill, while others depend only on luck.

- Altcoin Fantasy. Gives you the opportunity to try yourself as a trader without investing a penny of real money. You can win real Bitcoins in this game through weekly and monthly competitions. These competitions are held by sponsors and participation is free. The essence of the game is that you need to increase the initial amount (10,000 virtual dollars) to the maximum value among all participants in the competition in order to win.

- Blockchain Game. This mobile application allows you to earn real Bitcoins simply by playing various arcade games. Earned funds are automatically sent to your wallet.

- Numerous online casinos with Bitcoin support. There are two main types - those that simply add BTC to the list of accepted currencies, and those that operate in a decentralized manner and provide all the economic benefits of Bitcoin technology. Examples of popular casinos of the second type: Mars, 24VIP, CryptoWild. Many of these sites provide free attempts from which you can win real cryptocurrency. But you need to remember that playing in an online casino is always based only on luck.

Advantages and disadvantages

Pros:

- Entertainment aspect.

- Most games do not require downloading and can be played online.

- Lots of options for phone apps so you can play anytime, anywhere.

Minuses:

- Extremely low income.

- Strong dependence on randomness, not on skills.

Conclusion

It is possible to earn BTC on games, but the amounts will be small. This method is suitable if earning cryptocurrency is not the primary goal, but you want to play and get a little extra income from it.

Why is Bitcoin more expensive than gold?

The price of any product or service in the world depends on only two factors - supply and demand. If the price rises, it means supply is not keeping up with demand. That is, there are many more people who want to buy bitcoins than there are these same bitcoins.

That is, to answer the question why these virtual, fake coins are so expensive, we need to answer two questions:

- Why do they have such a small offer?

- Why such high demand?

By the way, we have already dealt with the proposal above. The system cannot issue more than 3600 coins per day and 21 million coins in total. This is actually a brilliant solution. If bitcoins were issued without restrictions, they would never reach such a value.

The situation with demand is much more interesting. Why more and more people want to buy these bitcoins even for crazy money. Get ready, it's going to be hot.

Why are people buying all the bitcoins?

I’ll say right away that the demand for bitcoins is actually not that great. That is, of the total number of people on Earth, only a very small percentage buys, stores and resells these bitcoins. But in relation to the meager supply (3600 coins per knock) - yes, the demand is simply gigantic. That's why the price is gigantic.

And the demand is so great for three reasons. And you won't like any of them.

Reason #1 – Beautiful legend

Any program has a creator, a living person, made of flesh and blood, with his own sins and shortcomings. But the Bitcoin system does not have it. More precisely, of course he exists, but no one knows exactly who it is.

There is only the mythical “Satoshi Nakamoto”, who first launched the system in 2008. But no one knows who this is, whether it is a person or a group of people, or a huge corporation. Accordingly, such mystery gives the whole system a very attractive ambiance. Judge for yourself.

The Legend of Satoshi

There is a very cruel and unfair world around us. Normal boys (like you and me) are forced to work every day to feed themselves. While bankers, financial magnates, and owners of foreign exchange funds are fattening simply due to the fact that they have a money dispensing tap in their hands.

They control everything and rip off each of us. They also control all our money, and we are completely dependent on them. They said - pay 25% for the loan, we will pay. They said that a dollar today will cost 70 rubles - and we can’t do anything about it.

And now the Chosen One comes to this terrible world. He rebelled against the system. He taught people to make money themselves, bypassing all these financial bloodsuckers.

There is no single control center for bitcoins, which means no one can take them away from you. The money now belongs to the people, not to the ten richest families in the world. This is a new financial and economic system that will free people from constant “running on a wheel” and make them free and happy.

And no one knows the true name of the Chosen One. Nobody knows what he looks like. He does this not for his popularity and his own good, but for the sake of Humanity. He, like Neo, fights against the Matrix for the sake of our happiness.

This is such a beautiful idea. I don’t know about you, but it probably gives “miners” goosebumps. They see themselves as the future rulers of this new economy.

Imagine the computer nerds who spent all of high school with their heads in the toilet. Now imagine that they are offered a new system of world control, where they are the stars of the first magnitude. They will try to make it so.

Such a beautiful legend increases the motivation of miners, and makes the idea of Bitcoin popular “among the people” (even if no one there understands what it is). But there is a second, even more prosaic reason.

Reason #2 – Get rich quick

What do you think happens to a product whose price rises quickly and can be quickly resold at a higher price? That's right, more and more people want to buy it in order to sell it at a higher price later.

That is, the true value of the product does not play any role here. It all depends solely on how many new people are willing to repurchase and then resell at a higher price. This rise in prices is called a financial bubble.

Financial bubbles have always arisen in all ages. Back in 1636 there was the so-called “tulip mania” or “tulip fever”. There, prices for tulip bulbs grew even faster than today for bitcoins.

And also simply because a lot of people wanted to buy them, not in order to benefit from their purchase (to grow for their own pleasure or to eat), but in order to resell them at a higher price the next day.

The same thing occurs when the price of any currency begins to rise sharply. The dollar was 30 rubles. - grew to 50 rubles, everyone ran to buy dollars, and as a result it grew to 100 rubles, everyone ran to buy even faster. And so on until the price reaches its peak.

There is a limit above which people will not pay for either tulip bulbs or bitcoins. At a certain point, some part of the currency holders will decide that the price is already high enough and they need to sell. But there will be no buyers. This always happens.

Then they will lower the price a little so that they buy. Then a little more. And as a result, the financial bubble will burst in an instant. Bulbs no one needs will float along the waters of the Julian Canal, merchants will litigate among themselves, and those who did not manage to get rid of the bulbs will lose their money forever.

All this is called in a simple word - “acquisitiveness”. And buying something with the expectation that the price will rise further and we will be able to sell it for more than we bought is called the game of “last one is the fool.”

Reason #3 – Network Marketing

How did you even know about the existence of Bitcoins? Most likely, one of your “friends” on social networks posted a post about such a cool thing - a new world currency. And what he has already bought, and now you can become incredibly rich by following his link and buying yourself a whole bitcoin or part of it.

Networkers immediately really liked the idea of distributing bitcoins for commissions. There is no need to deliver anything, meet anyone, or “recruit” anyone. Just spread the word that Bitcoin is already more expensive than gold, and that this is just the beginning - that's all. The human thirst for easy money will do the rest for them.

By the way, the most angry comments under this article, like “the author is an asshole who doesn’t understand anything and is deceiving people, and he’s a fraudster!!!!!!111” will be left by networkers. They earn their bread by attracting new customers. And believe me, they are trying very hard.

Accordingly, the information that Bitcoins are the future of the whole world is spreading very quickly through thousands and thousands of voluntary heralds.

To be fair, I will say that not all networkers like such “pyramids”. And in general, network marketing is actually a very good thing. I wrote about this in the article “Internet business from scratch - where to start step by step.” But we need to distinguish between “networkers” and “hype people”.

It is for these three reasons that the demand for bitcoins is so huge. On the one hand, there is a beautiful legend that inspires miners to great deeds. On the other hand, there is greed and the desire to “snatch” and earn money without doing anything. Add to this a very limited supply and the spread of ideas “by word of mouth” by networkers, and you get “virtual coins” at a price higher than real gold.

And in conclusion, let’s put together a small “FAQ” on Bitcoin.

Freelancing

For designers, web developers, copywriters and people with other talents that allow them to earn money online, the best option is freelancing platforms where you can earn bitcoins online without investment. Cryptocurrencies are in great demand today, so it’s quite easy to find people willing to pay for any work in BTC. Knowledge of English is welcome to greatly increase the chances of successful cooperation.

Examples of popular freelance platforms with the opportunity to earn Bitcoin:

- BitGigs. The site has several categories - tasks related to video, graphics, entertainment, programming, audio, technology, advertising. You can either provide services and receive bitcoins for it, or find a contractor for your needs. There are quite a lot of tasks, on average 100–200 in each category, so there is plenty to choose from.

- Boontech. This is a blockchain-based freelance exchange. Entrepreneurs and freelancers meet here to facilitate work interactions that include cryptocurrency rewards. Moreover, this project allows not only the contractor to receive a reward for his work, but also the employer for using the platform. Tasks are divided into 15 categories - from writing content for websites to marketing.

- FreelanceForCoins. Allows freelancers to earn Bitcoin, Ethereum and other cryptocurrencies. The site is a convenient marketplace that includes a chat and an advertising platform. The payment goes directly from the employer to the freelancer; FreelanceForCoins does not provide escrow services and does not act as a mediator in disputes.

Advantages and disadvantages

Pros:

- An opportunity to earn money on your knowledge and skills.

- Almost unlimited possibilities for the amount of earnings, it all depends on the type of work and the generosity of the customer.

- A large selection of platforms that support payments in both BTC and altcoins.

- Constant demand for outsourcing services on the Internet.

Minuses:

- Volatility of cryptocurrencies. Everything that has been earned through back-breaking labor can depreciate in a few days if the Bitcoin exchange rate falls.

- Blockchain payments are not instantaneous. This can be inconvenient if you need money urgently or if there are concerns about whether the chosen platform is operating fairly.

Conclusion

On average, there are 30-40% of freelancers in the world, which means more and more work is being outsourced. This is convenient for everyone - employers who do not need to keep an employee on staff, and ordinary people who can earn money without leaving home. This area will definitely grow and expand. English-speaking freelance exchanges pay quite decently, so that you can ensure a comfortable life for yourself if you have the appropriate skills. But this can also become a part-time option, an alternative to investing real money in cryptocurrencies.

Cryptocurrency for training

There are currently 3 cryptocurrency education platforms that pay you for your education in the cryptocurrency you are learning. Okex and Coinmarketcap joined Coinbase's first educational program.

You need to watch a video on each cryptocurrency and answer a few questions to prove that you actually watched and listened. The video is of course in English.

Coinbase. Not available to residents of the CIS, but you can take classes and get on the waiting list. Verification required.

Coinmarketcap. To receive cryptocurrency, you will need a Binance account. This program is not available for residents of Belarus.

Okex. Every day there are 5 questions available, for each correct answer you get 80 satoshi. You must go through verification and confirm your phone number.

Naturally, all the answers are available on the Internet.

Referral programs

Referral and affiliate programs on various sites can help you earn Bitcoin without costs. Almost every blockchain project has such a program - somewhere it’s a lifetime commission from the service’s income, somewhere it’s one-time referral bonuses, somewhere it’s multi-level referral programs that provide passive income for life.

The principle of operation is simple - when you register on any of these sites, you are given a unique link or promotional code. Then you can start distributing them on your social networks, websites, forums, mailing lists, among friends and family. For the fact that people register and actively use the site, they will receive one-time or ongoing accruals.

An example of the terms of the referral program on the Coinbase cryptocurrency exchange:

Advantages and disadvantages

Pros:

- No cash investment required.

- If there are platforms from which you can attract a lot of people, you will get significant passive income from cryptocurrency.

Minuses:

- Referrals must be active. It is prohibited to register independently from multiple accounts.

- Creating an effective affiliate network can take a lot of time and effort.

Conclusion

To attract new users, all exchanges, exchangers, cloud mining services and other resources must create a referral program. This is a good incentive for users to spread information about the project. It is possible to earn significant money from an affiliate link if there is one or more sites with a large number of visitors.

What makes Bitcoin a good investment asset?

Bitcoin is most often perceived as an option for making quick money at a rising rate. And often the strategy for using it comes down to playing on the cryptocurrency market: buy on the fall and sell on the rise. However, a decentralized cryptocurrency can be regarded as a reliable investment in the long term.

Currently, the economies of all countries are going through difficult times. Experts everywhere note the depreciation of national currencies and the reduction of gold and foreign exchange reserves. In addition, rates on bank deposits are constantly falling, and some European banks place deposits at negative interest rates.

There is also no stability in the Russian economy, and the reduction in the key rate of the Central Bank led to a large-scale reduction in interest rates on deposits both in rubles and in foreign currency. In addition, the statement by Russian President Vladimir Putin on the introduction of a tax on bank interest made deposits an unattractive proposition.

Additionally, the situation is complicated by fluctuations in the price of oil, so experts do not rule out that by the end of 2022 the ruble will become significantly cheaper and the dollar exchange rate will reach 90-100 rubles. Therefore, savings in rubles cannot guarantee not only the receipt of profit, but also the protection of funds from inflation.

Against this background, Bitcoin looks attractive for investment in the long term. The cryptocurrency created by Satoshi Nakamoto is not controlled by the financial regulators of any country, which makes it completely independent. At the same time, concerns that cryptocurrency cannot be considered money contradict economic theory, according to which money has a number of functions.

You will be surprised, but all these functions are implemented in Bitcoin:

- Measure of value - many goods and services on the global web have a value expressed in military-technical cooperation (real estate, works of art, exclusive cars;

- Medium of circulation and payment - the purchase operation for BTC does not take much time and immediately after the funds arrive in the seller’s wallet, the funds can be used at their discretion;

- World money is an opportunity for international settlement. According to this indicator, Bitcoin is the undisputed leader, since its owner avoids the need to exchange national currency for another to pay with foreign counterparties. For example, there is no need to exchange rubles for dollars to pay a supplier from Kazakhstan;

- A store of value - Bitcoin can be accumulated by investing free funds in it, and, if necessary, converted into other instruments, for example, rubles, foreign currency or securities.

Thus, Bitcoin fully complies with all the characteristics of traditional money. However, unlike most national currencies, the volume of Bitcoin cannot be unlimited. Almost any country in the world can afford to “start the printing press” and put into circulation a money supply of any volume, without backing it with anything. All this accelerates inflation and leads to the depreciation of money and an economic crisis.

The number of bitcoins is limited; new coins are created by solving complex mathematical problems. It is impossible to artificially increase the mass of cryptocurrency, so Bitcoin can be considered a deflationary monetary unit. This ensures that the value of the cryptocurrency is not subject to inflationary processes and will increase in the long term. For this reason, funds invested in it can bring significant income.

Note that numerous statements that cryptocurrency is a “shadow market” tool are not supported by statistics. The share of this cryptocurrency in illegal transactions is insignificant; much more criminal payments occur using rubles and dollars. Fears of using Bitcoin for investment because someone is buying drugs with it are unfounded. Every day we learn from the news about the arrest of drug dealers from whom hundreds of thousands of rubles are confiscated, but this does not force us to give up making payments in foreign currency.

Let us add that, contrary to the prevailing and widespread belief, Bitcoin is by no means an anonymous currency, therefore, if necessary, the origin and movement of funds can be tracked.

How to earn Bitcoin from scratch

The following methods allow you to earn Bitcoin cryptocurrency without investing real money:

- taps;

- games;

- performing freelance tasks;

- partnership programs.

You can do whatever you want with the received bitcoins - leave them as an investment in the hope of further growth in the exchange rate, now start making money through trading, or spend the currency on goods/services presented in abundance on various Internet sites. For example, the Spendabit website allows you to find many products from different stores that can be purchased with BTC.

Accept bitcoins as payment for services or goods provided

If you sell a product or service, you can accept bitcoins as payment.

Advantages:

- Receiving cryptocurrency for your goods/services

- No additional fees

- You set the price yourself

Flaws:

- There is no government regulation of cryptocurrency turnover

- Paying for anything with cryptocurrency is not very common in Russia

Bitcoin at interest (landing page)

This method of earning Bitcoin is in many ways similar to a bank deposit. When fiat funds are deposited into a bank account, the bank lends the deposit to another party at a higher interest rate. In exchange, the client receives a reward in the form of interest. The same lending method applies to BTC.

Sites where you can invest your bitcoins and make a profit:

- Binance Lending. Not long ago, the exchange introduced such a service. Today it allows you to make a permanent deposit in BTC with a yield of 0.25% per annum. Interest on the current deposit is accrued every day.

- BTCPOP. A P2P platform where some users can lend their bitcoins at interest, while others can take out a loan. Everyone sets their own conditions.

- Nebeus. Allows you to make deposits in BTC or ETH with a yield of up to 13.25% per annum. In addition, each owner of BTC or ETH wallets receives a monthly reward in EUR as a percentage of the average daily balance of funds in their accounts at the end of the month.

Advantages and disadvantages

Pros:

- Opportunity to earn money by investing in a highly profitable market.

- A way to make things work that are just sitting idle.

Minuses:

- Risk of fraud when working on unverified sites.

- Risk associated with the instability of BTC value.

Conclusion

In general, cryptocurrency landing is a convenient, easy and, in most cases, safe way to receive passive income from your investments. The main thing is to choose truly proven sites whose conditions are suitable. And when you’ve decided on a platform, don’t hesitate and invest while it’s relevant.

Arbitration

The way to earn Bitcoin through arbitrage is based on an ancient financial strategy: if an asset has a different price in two places, then you need to buy it in a cheaper place and sell it in a more expensive one, making a profit from it. The arbitrage method is sometimes called risk-free, but this is not entirely true: time delays can play a cruel joke. During the time required for the transfer, the arbitrage opportunity may disappear. With this in mind, the following basic strategies should be followed:

- "Be ready". The point is to create a position that allows you to act as quickly as possible under any circumstances. For example, hold BTC and fiat stocks on multiple exchanges to capture arbitrage opportunities between them and not wait for transfers between accounts.

- "Know where to look." The strategy involves monitoring the top of the order list on exchanges in order to find arbitrage opportunities there. And for a complete picture, you can look into the deeper part of this list.

Advantages and disadvantages

Pros:

- A fairly easy method of earning money, accessible even to beginners.

- Minimal risk.

- A useful tool for understanding trading principles.

Minuses:

- It is necessary to take into account the costs of commissions from each site.

- The method requires a lot of dedication, especially with the tightening of conditions on exchanges, the introduction of identity checks and lengthy withdrawals of funds.

Conclusion

Some arbitrage opportunities, indeed, used to be a “gold mine”, but today the popularity of this method has significantly decreased. The return is too small considering how many actions you have to perform and what deep analysis you have to conduct every minute. However, arbitrage does not have a number of risks inherent in other methods of earning Bitcoin, and therefore deserves attention.

Purchasing BTC on the over-the-counter market

This option for investing in bitcoin is similar to buying through LocalBitcoins, but the difference lies in the minimum volumes and the purchase mechanism. Typically, the OTC market is chosen by large investors, their goal is to purchase BTC at a fixed price.

If an investor buys BTC, for example, for $100 million through the exchange, then it is unknown what the average execution price of the position will be. Liquidity will be absorbed at different levels and, as a result, the transaction may be concluded at a price unfavorable for the investor. In the OTC market, the price is usually slightly higher than the exchange price, but the buyer collects the entire volume at a fixed rate. The benefit of this is felt only with significant volumes; investments of a couple of thousand dollars are best made in the standard way.

Examples of such platforms are Genesis Trading, Circle Trade. Exchanges also organize similar services; Binance and Coinbase have an OTC market for whales. But it makes sense to enter OTC only when investing significant capital, when a direct purchase on the exchange will lead to a strong increase in the rate.

I also recommend reading:

How to buy Alibaba shares? Company overview, history, quotes. Is it worth investing?

Alibaba Group Holding Ltd. – one of the largest B2B platforms in the world, net profit amounts to tens of billions of dollars. Sphere, […]

How to earn bitcoins on an Android phone or iPhone (iOS)

Today, quite a lot of mobile applications are being released for Android and iOS - from mining programs to games that allow you to earn Bitcoin on your mobile phone.

Selecting applications on Google Play:

Among them are games, exchanges, wallets. As for mining programs, it is irrational to use them. The device gets very hot and fails, while earnings are minimal due to the low power of the equipment.

Buying cryptocurrency directly through EPS wallets

A number of EPS allow clients to invest in Bitcoin directly through their wallets. There is no need to bother with registering on the stock exchange or online exchangers; the purchase of cryptocurrencies is carried out through the personal account of the corresponding EPS.

However, the approach to buying crypto may differ:

- EPS can introduce an internal token with a fixed link between its rate and Bitcoin.

- The wallet can directly store BTC tokens.

An example of the first approach is WMX tokens from WebMoney, the accepted rate is 1 WMX = 0.001 BTC. You can buy crypto directly from your wallet by exchanging for WMX, for example, WMZ or WME tokens.

True, with such an exchange the rate is quite unfavorable. At the time of preparation of the material, the rate 1 WMX = 62.46 WMZ was offered in the WebMoney personal account, which means that 1 BTC, according to the EPS version, costs $62,460. At the same time, the market rate of military-technical cooperation at the same moment is $57,374. The difference is 8.86%, which is quite a lot; in standard exchangers in a number of areas the difference compared to the exchange rate does not exceed 2-3%.

Another drawback is the relatively small reserve of the exchange machine. It is inconvenient and unprofitable to collect a large volume.

The second approach is well implemented in Payeer. There are no separate internal tokens with a rigid fixed rate to Bitcoin; instead, you can trade crypto directly through EPS. The rate is almost the same as on the exchanges.

Below I will list some payment systems through which you can invest in Bitcoin with the function of storing coins:

- Payeer

- Capitalist

- Webmoney

.

FAQ

Is it possible to really earn bitcoins without investments?

- Yes, but the earnings in most cases are small. The exception is freelancing, where wages can be quite high if the skills meet the customer's requirements.

How to earn 1 bitcoin per day or month?

- To achieve this, you need to be a large investor or trader who initially invested a large amount of money in cryptocurrency. You also need significant skills in fundamental and technical analysis to help accurately determine the future course.

Is it possible to make money on the Bitcoin exchange rate?

- Yes, methods such as trading and investing are based on this very goal. But for a beginner without practical training, this can be difficult. To begin with, it is better to use a demo account on any exchange in order to try trading without risk and gain initial skills.

Is it possible to earn Bitcoin by mining on a computer?

- No, this was possible at the start, when the created cryptocurrency had a low mining difficulty. Today, the power of a conventional computer is not enough to even recoup the electricity consumed.

How to earn bitcoins with a video card?

- BTC is also no longer mined on video cards. Effective mining requires one, or preferably several, ASIC devices based on integrated circuits specialized for a specific hashing algorithm.

How to make money by exchanging Bitcoin?

- Using stock exchanges and online exchangers. You can use the arbitrage method - buy BTC in one place cheaper and sell it in another at a higher price.

How to collect bitcoins for free?

- There are Bitcoin faucets and games for this. They do not require much effort, but do not provide significant profits either.

Where should a newbie start?

- First, you need to get a reliable cryptocurrency wallet, write down or save its private key in a safe place. Then start making money - first you can try working with faucets, then gradually increase your capital through trading/arbitrage/investing. The main thing is to choose the right strategies and stick to them without giving in to emotions.

Purchasing military vehicle directly from the seller

This Bitcoin investment option is convenient because you negotiate the deal directly with the seller. You can discuss the rate, transaction volume, payment option and procedure. The method is suitable for small and medium investment amounts.

There are 2 ways to organize this type of transaction:

- Search for a person involved in the sale of cryptocurrencies, for example, on specialized forums . The administration can act as a guarantor, but the deal can be concluded without this. Options include a meeting with the seller.

- Buying BTC through Local Bitcoins . This is a non-standard crypto exchange, which does not have the usual trading terminal, and the emphasis is on p2p trading. The buyer selects a region, currency, convenient payment options and simply selects from a list of sellers that match the specified filters. Local Bitcoins acts as a guarantor that both parties will fulfill their obligations.

The LocalBitcoins option is safer. If for some reason the scenarios of buying crypto through an exchanger or on a crypto exchange are not suitable, then LocalBitcoins is the ideal solution to the problem.

How to create a wallet for earned bitcoins

Of all the proposed options, we will highlight the following ways to open a Bitcoin wallet for storing and conducting transactions with them. For security purposes, you need to store passwords in safe places, set additional security settings and do not forget to make backup copies of your wallet. We recommend that you first transfer a small amount to it and, if everything goes well, carry out transactions with large amounts.

- First, let's highlight the way to create a wallet using the bitcoin.org website. On it you can find a lot of information about Bitcoin, how it was created and is currently developing. This is the official website of the developers of the Bitcoin Core wallet program.

In the “Resources” section, you can immediately select “Bitcoin Core” and download the program of the same name. Today it is the most popular and reliable. You just have to take into account that there must be at least 150 GB of free space on your computer - this is the size of the downloaded blocks of the transaction chain in the Bitcoin network for its entire existence. Synchronization and downloading of information starts immediately after starting the program. Therefore, it is worth freeing up space on your computer or it makes sense to buy an external hard drive and install a program for storing bitcoins on it.

You can see your Bitcoin wallet address for receiving cryptocurrency in the “File” – “Receiving Addresses” section. For each operation, you can create a new one with or without a label. To copy, select the line and click “Copy”.

Or click “Receive” and create a wallet address (“Request payment”), you can additionally specify a label and the exact amount:

To view and copy the address, you need to select the line and click “Show”:

For security purposes, you need to encrypt your wallet by going to “Settings”. The password must be at least 10 characters or 8 words. You should definitely write them down and save them in several places, for example on a piece of paper and a flash drive, which will not be used for other purposes.

Next, you need to make a backup copy of your wallet in the “Browse” menu, name the file wallet with the dat extension and save.

We recommend making a backup and updating the wallet.dat file in this way after each transaction performed with a new address.

Wallet.dat is the most important file, it stores all the information about bitcoins.

In addition to saving via “Browse”, you can find this file if you enter %appdata% in the “Search” menu of the operating system. After searching, you will find the “Roaming” folder. You need to go to it, find the “Bitcoin” folder and then the wallet. Copy and save it in a safe place. To restore your Bitcoin Core wallet, simply copy and paste the saved Wallet.dat file into this folder on your personal or any other computer. Using the above methods, you can keep your earned Bitcoins safe.

- The second method is to register on online sites that offer the opportunity to create a Bitcoin address and make transactions with it. Let us describe an example of registration on the Blockchain website.

After going to the site, you need to click “Get free wallet” and fill out the registration form: enter your email and come up with a good password. It is important to indicate only a real mailbox, as it needs to be confirmed. In the future, it is required to enter the wallet:

The received letter will contain the wallet ID. It must be written down in a safe place along with the password - they are required to log in. After entering them into the form, click “Login”, go to your email box, be sure to open a new tab and confirm your entry by clicking on the link. After that, go back to the page with the original Bitcoin wallet login form.

After which the user will be taken to his wallet. By the way, since 2017, the Blockchain service can store Ethereum and make an exchange between them in the “Exchange” section.

In order to receive Bitcoin on it, you need to go to “Receive” and copy your address. They may change, but all the old ones will work, and you can get bitcoins with them.

In the “Settings” sections, you can set additional settings for protecting your account from hacking and in case you lose your password.

As you can see, the wallet works online; there is no need to download the blockchain, which saves time.

- Create an account on a cryptocurrency exchange where you can trade, buy and exchange bitcoins and other altcoins.

Let's show it using the example of one of the exchanges, EXMO.

You need to register your wallet by creating a username, password and entering your real email.

An email will be sent to your inbox confirming your registration. Login to the exmo.me website is carried out using a login and password.

The “Wallet” section presents all possible accounts that can be opened. In addition to traditional (dollar, ruble, euro, hryvnia) currencies, 9 cryptocurrencies are available: Bitcoin, Ethereum, Dash, Litecoin, Dogecoin, Ripple and others. Inactive accounts can be hidden.

To see the wallet address, you need to click “Top up”

Continuing the review: Ethereum wallet

How to buy bitcoins and make money on the growth of its value

make money on bitcoins by investing and purchasing this cryptocurrency in order to sell it at a higher price after a certain period of time. This is quite realistic, since the value of the asset is constantly growing and, according to the most conservative estimates, will reach 10,000 US dollars per 1 Bitcoin in a few months. And this is the most pessimistic forecast; some analysts see the price of a virtual coin at 50 thousand or more dollars in the coming years.

These forecasts have every chance of coming true, since the emission is limited (only 21 million BTC, 16 million have been mined to date), all coins will soon be mined, and the price will go up.

The fastest way to buy cryptocurrency is to use exchangers. You can exchange your existing currencies for popular coins. Choosing a reliable Bitcoin exchanger is the main difficulty when using this option for receiving BTC into your wallet.

The exchange algorithm is as follows:

- Transfer money from your account to an online exchanger account

- After receiving the money, the exchanger transfers bitcoins from its account to the user’s wallet.

- Once the transaction is confirmed on the network, the user will receive bitcoins.

We recommend the ProstoCash service - one of the reliable electronic currency exchangers.

Buying cryptocurrency is very simple - you need to select the exchange currencies, enter data and your address to receive BTC.

For example, buy bitcoins for rubles:

Then enter your card details and indicate the Bitcoin address of the wallet to receive (where to get them was written above). Make an exchange following detailed instructions from ProstoCash.

Thus, you can exchange cryptocurrencies: bitcoin, litecoin, ethereum, dash, zcash, peercoin, namecoin and other popular virtual coins and make money on the increase in their value. If the desired direction is not available, then you can use other cryptocurrency exchangers.

How to earn bitcoins by trading on a cryptocurrency exchange

Another real way to earn bitcoin is to trade on a cryptocurrency exchange. The BTC/USD exchange rate is very volatile; daily changes can amount to several percent. The trading principle is simple and clear: “buy cheaper, sell more expensive.” Thus, buy from the support area, sell from the resistance.

You can trade short-term - intraday, medium-term - transactions last several minutes, or long-term - several weeks or months. The principle is very similar to Forex trading.

How to trade on a cryptocurrency exchange and make money

Consider the exmo.me exchange. After registration, you need to top up your balance in the “Wallet” section. For an account in RUB, replenishment is possible from the Yandex.Money, Qiwi, AdvaCash, Payeer and others wallets. If there is no convenient input method, we recommend purchasing an EX-code from an exchanger and then cashing it out on the exmo website.

For example, for Sberbank rubles, purchase EXMO-code in the exchange service prostocash.com:

You should always look at the reserves: if you need to buy a code for a larger amount than is available in the exchanger, then you should contact online support.

To purchase crypto, you can simply exchange fiat currencies, that is, rubles, hryvnias, dollars, euros, for any coin in the “Exchange” section. For example, buy Ethereum for rubles:

After the value of an asset has increased, it can be exchanged back into fiat money, thereby fixing a profit: for example, convert bitcoins to rubles:

In the above method, the purchase is carried out according to the market.

To place limit orders, just go to the “Trading” tab on the exmo.me website and select the required trading pair, for example BTC/USD:

Next, analyze the Bitcoin versus dollar chart. We see that you can sell from the area of 6000–6100 - this is the maximum value of its value (high), which may be updated. The purchase limit is around 5600–5750. You can set 5000, 4000 and other favorable values, but it is not a fact that the rate will drop to these goals.

Next, place the order itself, for example, buy 3 BTC at a price of 5,700 US dollars and click “Buy BTC”. Once the required price is reached, a limit order will be triggered.

Then, in order to make money, bitcoins need to be sold at a price higher than the price purchased. Accordingly, you need to place a limit sell order and click “Sell Bitcoins (BTC)”. In our example, 3 BTC sells for $6,050. As soon as the price rises to the specified level, the order will be triggered.

Thus, you will be able to make money on the difference in the Bitcoin rate - $1050 excluding commission. The commission on exmo is low - 0.2% of the transaction amount and in our example will be about $70.

In order to withdraw bitcoins, any cryptocurrency or traditional money from the exchange, just go to “Wallet” and click “Withdraw” in the line opposite the desired currency account. You can also create an EX-code and withdraw it through an online exchanger. Continuing review article: How to cash out bitcoins.

Trading on cryptocurrency exchanges and purchasing from exchangers

Cryptocurrency is traded on specialized exchanges, just like on regular dollar and ruble exchanges. Those who purchased a decent amount of bitcoins 2-3 years ago are now millionaires. But this does not mean that the rise will continue.

But to make money from fluctuations in the exchange rate of cryptocurrencies relative to each other, you need a lot of knowledge and constant immersion in the life of the market and monitoring news. One thing is certain: trading on Forex or special Bitcoin exchanges without initial preparation is extremely risky.

Therefore, if you just want to buy cryptocurrencies for a long time, it is much easier and more convenient to use exchangers. If you choose reliable and verified exchangers, then the likelihood of fraud is reduced to zero because thousands of transactions go through them every day, and if someone is deceived, this will almost instantly become known in the rating of cryptocurrency exchangers and they will be excluded from the list of verified ones.

We have selected the most reliable cryptocurrency exchangers with a brief description of their features and nuances of operation; to familiarize yourself, follow the link.

Here we provide only the most current information on options for depositing funds for conversion to Bitcoin and other cryptocurrencies:

- Qiwi;

- Sberbank;

- Visa and MasterCard cards;

- Perfect Money;

- Yandex money;

- PayPal;

- Webmoney;

- and more than 10 options.

Let us only note that if you want to invest in some little-known cryptocurrency not from the top 10, you will still have to use cryptocurrency exchanges because exchangers support only the most popular coins, such as:

- Bitcoin;

- Ethereum;

- Litecoin;

- Zcash;

- Dash;

- Monero;

- Ripple.