Getting acquainted with Forex trading, beginners usually go to the terminal, where they try to understand at random the principle of its operation. They don’t realize that the terminal will be “silent” if nothing happens on the financial market itself. Meanwhile, the market is a living organism, subject to price movement, its cycles and direction. Getting to know Forex begins with mastering such simple exchange concepts as “price”, “level”, “trend line”. These are the basic elements on which the theory of stock trading is built.

Today we will talk a little about price and its movement, find out what a trend is and how you can determine it. We will find out what the expression “support and resistance levels” . You will learn to find them yourself and indicate them on the graph.

Graph and tools for its analysis

Today, without a chart, it is no longer possible to imagine the process of trading on the stock exchange. The graph simultaneously reflects the behavior of the market price of currency pairs and the actions of market participants in relation to them. By the way, currency pairs in Forex are called “currency instruments” . With its help, exchange players carry out their transactions.

Previously, exchange participants relied on rumors, news feeds, and worked on fundamental forecasts. Today you can analyze the state of the chart and determine entry points using a variety of tools. Some of them are included in the terminal tools package, others can be found on the Internet. For a modern trader, the chart, support and resistance levels are the key elements in analyzing the market situation.

In trading, you can use trading robots, use ready-made trading strategies, or develop one yourself. However, why waste time on something that has already existed for a long time? If a terminal with a real account is open in front of you, the curve of the graph is moving, the price is reaching new lows and highs, then it’s time for you to make money.

We offer you a fast, uncomplicated way of trading - the Sniper strategy. It is simple, understandable even to a novice trader, and reliable. The chart is easy to read without oscillators and indicators, and does not require any mathematical calculations. One click on the link below and we will send you this unique trading system that works based on levels!

Get a complete special course on the Sniper trading system here.

It should be noted that support and resistance levels, as one of the important basic trading tools, are the basis of almost all trading robots and strategies. For Forex to become a stable source of income, you need to understand the psychology of the market and the behavior of its participants. Based on support and resistance levels, you can determine the mood and activity of players and their impact on price movement. Levels are a powerful tool for technical analysis. Entering the world of Forex, everyone starts working in the terminal by identifying trend lines and levels.

Basic nuances of construction

It is believed that the number of traders in the world coincides with the number of different ways to build levels . It is always important to consider the number of touches, the width of the zone, the beginning and confirmation of the price area. But there are always exceptions - this is due to the trading strategy.

The main nuance is to eliminate the subjectivity of drawing levels . Constructions must occur according to certain rules.

Number of touches

The number of price touches is a level strength factor. But many traders use it in completely different ways :

- Only fresh levels are traded . The concept of disposability says that the second and subsequent approaches are not suitable for trading. This is a kind of filter for skipping bad entry points.

- Maximum number of touches - maximum force . The rule is suitable for bounces from above and below.

Drawing from the tails of candles and zones

When determining an extremum, it is important to understand how the zone will be drawn:

- Line or rectangle . The width of the level is the length of the shadow, a few points or none - this is an issue that needs to be dealt with.

- The construction occurs according to the shadows or bodies of candles . Shadow drawing takes into account the maximum point of the graph and is the preferred option. For volatile fundamental movements with large tails, it is recommended to draw levels by bodies due to news errors.

What are levels and how to find them?

When they talk about support and resistance levels, they mean two straight lines that pass through two maximum and two minimum values (extrema) of the price . The first ones lie at the upper values of the graph curve, the second ones should be looked for at its minimums.

- The support level is looked for at the lowest price levels – troughs.

- The resistance level is determined by its highest values – peaks.

All minimum points on the graph cannot belong to the same straight line, just like all maximum points. They are in a certain range of values, where the price moves with an amplitude of units or tens of points. The accumulation of such marks in a certain price range is called a price level.

How to recognize

It is not always easy to accurately determine the level on a price chart, so every trader must initially understand what traders mean by this term. By level we mean the trading zone, in which there is a struggle between buyers and sellers. The further direction of the price depends on its result. That is, observing quotes in the zone of such trading already allows us to say in which direction the market is most likely to move.

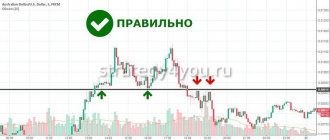

To make it easier to assimilate the material, you need to seek help from visual examples. The chart below shows a certain upward trend and an attempt is made to mark all the significant levels that are constructed and used in exactly the same way on Forex or any exchange platform.

That is, the chart shows all the moments where the price turned, but at the same time you can see that in the upper part the quotes slowed down and began to trade in a narrow range, and this is also a sign of a good level. Therefore, we will also mark it with a red stripe.

Now all levels of resistance and support are marked on the chart, and as some may have already guessed, this term does not mean a thin line, but a certain area in which prices can consolidate. That is, it would be more correct to depict the levels as follows.

When studying the graphs, you can see that some of the extremes will be on one perfectly straight line, but some are located slightly above or below it. Since price forecasting is not an exact science, such deviations are completely natural and that is why the level should be defined as a small zone.

A few words about trend lines and levels

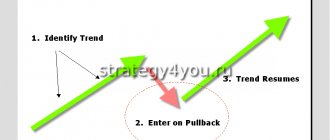

The market price moves unevenly. Therefore, the graph curve can be directed to the side, down or up. Draw two straight lines through 2-3 extreme points below and above the curve - these will be trend lines. On the chart they clearly determine the direction of price movement - the trend. The price itself moves according to the laws of supply/demand in Forex.

- A line drawn through 2-3 upper extrema is called a resistance line.

- The line passing through the lower extremes is called the support line.

Example of lines on a graph.

Attention! You should not confuse trend lines with support/resistance levels, despite the similarity of their construction techniques.

The first ones pass through 2-3 points of maximum/minimum price. The latter cover points across a whole price range. In addition, trend lines can have a slope, and support and resistance levels are always drawn horizontally. The first ones show the direction of the trend, and the second ones show the current price levels.

Difference between levels and lines.

50% correction levels

While I (Nial Fuller) do not use traditional Fibonacci retracements and all their many extension levels, there is a proven phenomenon that over time markets stop at half their possible move (about 50% - 55%) where the market makes giant moves. retreats and then bounces back in its original direction.

This is partly a self-fulfilling event and partly simply the result of normal market dynamics.

Look at the chart below, which shows a large upward price movement. Then the price rolled back by 50% (twice), at these points there is a high probability of entering a trade (especially the second point).

Building support and resistance levels

Now we can formulate the rules:

- The resistance level is a horizontal line that passes through the minimum price extremes and indicates the dominant position of sellers over buyers.

- The support level is also a horizontal line, but it passes through the maximum extremes. In its price range, buyers dictate their terms to sellers.

Remember!

1. Graphically, support and resistance levels should only be positioned horizontally.

2. The level line must touch at least 2 extreme points:

- max+max – to build resistance;

- min+min – to build support;

- max+min or min+max – for building mirror levels.

3. When trading intraday, it is better to build these levels on higher (W – week, D – day, H – hour) timeframes and transfer them to smaller timeframes. Trading on short time periods does not require building additional levels for them.

When considering levels, you should understand them as hypothetical lines, to which the price has risen or fallen more than once, hesitantly marking time. “Trampling” it within one level is associated with the confrontation between bulls (buyers) and bears (sellers). If the bulls win at the support level, the price turns around and moves towards the winner – towards the resistance line. If the bears win, it continues its movement, breaking through the support line.

An example of breaking a line.

It is worth noting here that trend line breakouts can be false or true. With a true breakout, the trend changes and the breakout line changes its quality. For example, if a breakout is recorded on a resistance line, it turns into support. If the price breaks through the support line, it turns into a resistance line.

The price breaking through the level is schematic.

Thus, moving in the price range, the chart curve approaches the resistance/support line. Then it can move within the range of support and resistance levels, moving without breaking through trend lines, but bouncing off them and returning to them again. Or it can break through the trend line and, having gained a foothold, go deeper in the current direction.

To make sure the trend is changing and predict the price direction, you need to use additional tools. For this, it is also important to be able to identify characteristic setups and “talking” figures of technical analysis. There are many ways and tools to confirm that the price is likely to change its direction.

How does identification occur?

When searching for levels, you should first of all focus on local maxima and minima. If, for example, we mark only such extremes, the graph will look like this.

Here you need to pay attention that the level line in Forex should be drawn through the maximum density of the candlesticks on the chart. What does it mean? Let's look at an example for help. On the chart below you can easily detect a local high, through which we will draw a red line.

However, if you carefully study the chart, you can see that a whole series of previous candles seemed to be resting against an invisible wall, not allowing the price to move up. Therefore, it would be wiser to draw the resistance line not along the tip of the tail, but through the value to which most of the candles approached. The level on the price chart will then be depicted as follows.

Such a display will bring much more accurate information, and the level line is drawn through the largest cluster of candles. At the same time, we need to remind you once again that the level is a zone, not a strict band, so resistance can be depicted as follows.

And you also need to understand that after finding a level, you should not expect the price to touch it the next time you approach it, since quotes can, for example, make a reversal even close to it.

The meaning of support and resistance levels

The foreign exchange market operates according to its own laws and price behavior is subject to certain patterns. It is extremely important for a trader to know this in order to understand in which direction the price is moving, what the trend is and the strength of the trend. The curve of the graph reflects all market events - from price behavior to the relationship between market players.

Analysis of the chart will help the trader to easily determine support and resistance levels, which will become a reliable assistant for him in trading:

- If the price does not encounter any obstacles along the way, it breaks through the level and redraws the extreme points. This event confirms the market reversal trend.

- If the price cannot break through the level, it bounces off it and goes in the opposite direction. Price extremes confirming the level are also redrawn.

This situation occurs every time the price approaches support and resistance levels. It either breaks through the level or bounces off it . At first glance at the graph curve, one gets the impression that the market movement is chaotic. You can visually structure this picture based on support and resistance levels. With their help, you can also identify some patterns in the behavior of the prices of different currency instruments on the chart.

Trading from support and resistance levels in itself is a good trading strategy. Drawing these levels on the chart will help the trader understand why the price rebounded or, having broken through the level, moved on unhindered.

Based on support and resistance levels, a trader can:

- predict price behavior;

- increase the chance of profitable trading;

- reduce the level of risks (due to stop losses).

To set stop losses, you need to take into account the significance of these levels. Remember that when working with volatile currency pairs, false breakouts at levels appear more often. Setting stop losses here is possible only after identifying additional signals confirming the current market trend.

How to use levels in Forex trading?

To begin with, it’s worth remembering that levels are a fulcrum. If you have a buy signal somewhere and you see that the price is at the level, then this means that the signal has a foothold. You can take it with more confidence.

For example, we had a buy signal at this point in the middle of the chart:

It has no pivot, so it is less significant than the next signal at the support level in the blue box.

In addition, levels are used to determine stop losses and profit taking targets. As for the goals, I think everything will be clear to you. The target is the nearest level.

Stop losses are placed just below the level if it acted as a support. Let's imagine that we entered the market somewhere in the area marked with a blue rectangle:

We would set the stop loss just below the level, giving some freedom to the price:

This is all determined by eye. There are no clear criteria for this.

Price reaction to support and resistance levels

Price movements reflect the general sentiments of market players. The graph and its curve show their interaction and reflect their desire/reluctance to enter into transactions. If there is demand, but there is no supply (or vice versa), the price, having reached a certain level, begins to fall/rise. Against this background, there is a drop in trading volumes, the market behaves “flat”.

Price fluctuations are not enough to cause the chart to move up or down. It will creep in a sideways trend until an imbalance arises in the supply/demand ratio - an indispensable condition for the “revival” of the market.

An army of millions of traders trades at support and resistance levels. Some open trades at levels, others close their positions at this time. This explains the activity of traders precisely at these levels. As a result of their struggle, either a breakdown or a price rebound and correction occurs.

How to determine the area value

If you mark all the ups and downs on the price chart, then there will be quite a large number of levels, and since not all of them are equally important, you need to understand how to determine the importance of each individual one.

The first thing that allows you to weed out some of the unnecessary levels is the number of candles by which they are built. Beginners often like to rewind the chart and look for all the significant trading areas, but in reality this only gets in the way. It is considered optimal to search for significant areas on the chart using those candles that fit on the screen. This is about 200 candles/bars that can be taken into account.

When choosing time intervals, you do not need to make them very small. For intraday trading, you should focus on daily Forex levels, hourly and 5-minute. If you work on daily timeframes, then significant places on the price chart should be monitored on the monthly, weekly and daily timeframes.

When finding levels, you need to focus on those that are clearly visible at the first glance at the chart. In this case, you need to focus on the cluster of candles, paying less attention to those areas on which the bars/candles rest with their shadows.

If the levels are located nearby, then those at which intensive trading took place or a sharp change in trend deserve greater importance. Now everything you read should be applied to the chart. For example, having set all the peaks and troughs, the chart began to look like this.

Next, we will remove unnecessary levels and leave only the most significant of them. The screening process will take place from the bottom up. The first lower level can be left, since this is a local level where the trend changed from downward to upward.

We will also leave the second level from the bottom, since it indicates the area where active trading took place. This means that here buyers and bears measured their strengths, and these are very important areas for practical use.

Next comes the level drawn through the end of the shadow of the candle. But the price did not go down from this area, there was no trading here, so such a line can be removed from the chart.

The next line is located under a new local minimum, from which the price bounced off, went up and made a new maximum. This is an important level and must be left.

The next line is drawn through three points that the price touched on a pullback from the upward movement, which gives an idea of the buyer interest located here. Therefore, it is worth leaving this support as well.

The next line passes through points that the price touched several times, but quotes do not give any significant reaction in these places - neither local minimums nor local maximums are established here, so this level can be ignored.

We also leave the last two levels, since one of them is noticeable and useful for predicting the future situation, and the other passes through the local extremum, which is the highest at the moment.

Entry from support and resistance levels

This strategy is very simple and focused on the actions of large market players. When one of them closes their positions, collected in advance, the market tends to reverse. Therefore, for example, if you are selling, and the price is confidently approaching the resistance level, you should hedge your bets with a stop loss set slightly above the resistance line itself. If this line is suddenly broken, your loss will be insignificant.

Remember!

1. On higher timeframes, support and resistance levels are stronger.

2. Most often, false breakouts occur on news. If the news is not confirmed soon, the breakout should be regarded as “false”.

3. The rebound of the curve from the levels confirms and strengthens the level. At the same time, new extremes are formed, from which you can buy (from support) or sell (from resistance).

4. The price testing the level several times in a row on high timeframes confirms its strength. Breaking through it during the next price approach shows its potential and continuation of movement in the intended direction.

5. The price breaking through the support or resistance level is considered confirmed if:

- Japanese breakout candle closes behind the level;

- the body of the new candle appears completely behind the broken level;

- Beyond the breakout level, several complete new candles appear, including their shadows.

6. If the levels are falsely broken, the price returns to the old trend without forming new candles outside the level that it tried to break through. The chart with Japanese candlesticks demonstrates false breakouts especially clearly.

Difference between false breakouts and true ones.

7. Like strong trend boundaries, support and resistance levels can change their quality when broken. If support is broken, it becomes resistance and vice versa. After a trend is broken, the price often returns to the breakout level only to bounce back with renewed vigor and break through the latest low/high.

Remember that support and resistance levels are not characterized by a specific price, but rather indicate a price range. The chart curve may not reach the level by several points or go deeper into it. This means that the price does not have sufficient potential to break through the levels and change the trend. For successful trading, it is important to understand how the price behaves on the chart.

Trader-teachers at the Forex Academy online will teach you how to recognize and build support and resistance levels. They will share their experience in matters of correct entry/exit into the market and minimizing risk. You will learn how to predict price movement at levels, what signals to look for in order to correctly set goals. Leave us your contact information so that the manager can contact you.

Sign up for a free test lesson with a Forex Academy trader here.

False level breakout

This situation is sometimes also called “traders’ remorse.” Its essence is that the price first breaks through the price level, and then, not finding sufficient support from market players, returns back.

When a resistance level is broken, traders wonder whether the new price corresponds to the true value of the financial instrument being traded? And when most of them come to the conclusion that the price is clearly too high, massive sales begin, and the price, accordingly, moves down, back beyond the level that was broken earlier. This scenario is called a “bull trap”, since after breaking through the resistance level, many traders entered long positions, and after the price returned back, almost all of them suffered losses, closing in stops.

A similar situation may arise after a breakdown of the support level. In this case, traders think about whether the price is too low? When most players come to the conclusion that the price is indeed quite low, and therefore a very attractive buying opportunity, the price begins to rise, moving back behind the support level. This scenario is called a “bear trap”, for the reason that the bears, who opened short positions after breaking through the level, then (after the price returned back) suffered losses.

The surest way to make sure that the breakout was not false is to wait until the level changes to the opposite (that is, until support turns into resistance or, conversely, resistance into support). To do this, after breaking through the level, you should wait until the price rolls back to it, and then reflects from it (thus confirming the truth of the breakout). But it should be borne in mind that in the event of a breakdown of strong levels, it is not uncommon that the price rushes in the direction of the breakdown, without even thinking about rolling back. Thus, you can miss quite powerful price movements that could potentially bring huge profits.

Let's sum it up

For many traders, the ability to trade support and resistance levels is enough to remain profitable. This is a completely informative and reliable tool that helps you track important market signals. The ability to see these signals, recognize them and differentiate them is trading skill. For a novice player, support and resistance levels will help indicate a trend. The ability to analyze it correctly and open profitable positions on time depends on the person.

Let's move on to the next lesson: “Analysis of Forex market news.”