What is margin trading on the stock exchange

Let's start with the simplest. Margin trading is the use of borrowed funds from a broker in order to increase your own working capital on the exchange. Otherwise it is called “leveraged trading”.

For example, an investor or trader wants to profit from a rise in the price of stock X, which costs $100. At the same time, there is only $500 in the account. With these funds you can buy five shares. If they grow to 120 dollars, then the profit from each of them will be 20, and the total income will be 100 dollars.

However, a trader can borrow funds from a broker and buy assets worth 5 times more. In this case, he will earn $500 on the same market movement.

When lending funds to a client, the brokerage company records collateral in his account - margin. These funds cannot be used in trading. When the trade is closed, the margin amount is released.

If something goes wrong: margin call

It is clear that investing with borrowed funds is a rather risky activity in itself.

Therefore, it is necessary to understand what happens in the event of unsuccessful developments in the market. If the price of a stock or other instrument purchased using a margin loan does not go in the direction the investor expected, or if the value of other instruments in his portfolio falls, the account balance may decline too much. Then the broker sends the client a so-called margin call.

A margin call is a warning from the broker that the client’s funds are no longer enough to open new positions and secure current ones. Upon receipt of such a notification, the investor must additionally deposit funds into the account to restore the ability to secure their transactions.

If the client is confident that the market situation will change soon, then he can ignore the margin call for some time. However, if this does not happen and the assets continue to lose value, the broker will automatically close the positions - that is, sell shares, currency, etc. at the current market price. This will allow the broker to fully return the loan issued to the investor.

How does margin trading work?

Increasing capital in the described way is not the only possibility of this instrument. It also helps you make money by lowering prices or, as traders say, short trading (open short positions).

For example, when analyzing the market, you understand that a security will become cheaper. And if you sell it now, you can make money on the fall. How?

With margin trading, the stock is borrowed from the broker and sold at the current price, say $120. A security was borrowed, so the trader must return it, not the money. After the price has dropped, the stock is bought cheaper, for example, for $90, and returned to the broker. The $30 difference is a profit.

What is leverage and what determines its size?

Usually, when talking about a margin loan, they use the concept of leverage, a kind of financial leverage.

In simple words, leverage is how many times the actual amount in a trader’s account differs from the funds with which he can operate. With a leverage size of 1:10, you can trade 10 times the amount of your personal funds. Which means you can earn more.

Leverage is offered by brokerage companies for trading on the stock or forex markets. The most commonly used options are 1:2, 1:3, 1:4 and higher. By understanding how leverage works, you can figure out how much borrowed capital a trader receives.

How is margin trading different from futures? In the derivatives market (security for security) when trading futures there is no leverage as such, but, in fact, margin trading is also used. When opening a transaction on futures or options contracts, their full value is not withdrawn from the account, but the amount of collateral is reserved - usually 20-25%.

How to use leverage correctly in trading

The main problem with huge leverage is the difficulty in calculating risks. My advice is to learn to count money and possible losses on a transaction. Now you know that you should only risk 2%, but you need to select the exact lot for this. There are several options on how to do this:

1. calculate on a calculator - quite long and tedious, but effective; after all, trading is work, not fun; 2. install an advisor that automatically calculates the risk - very convenient, it just needs to be checked and controlled sometimes; 3. open a trade in parts - this is what I usually do, if I’m too lazy to count, I just open a small lot first, see what the risk is based on the stop loss, and then, by multiplying, I understand how much needs to be added.

A small step-by-step example for a deposit of 5,000 USD.

Step 1. We calculate the risk in points on the chart. Let's say we want to open a trade on EURUSD on D1 and place a stop loss behind the local top. We use the crosshair tool in MetaTrader 4, hold down the left mouse button and draw a line as in the image below to determine the distance in points.

The same can be done without the crosshair - if you subtract the current price from the stop loss level, but this is not so convenient.

Step 2. We carry out the calculations. If we open 1 lot, then the risk will be 1 × 1513 = $1513. Since we only have $5,000 and we want to risk no more than 2% ($100), then we need to divide 100 by 1513, and we will get approximately 0. 06, this will be our lot size.

Step 3. Open a trade and check by hovering the cursor over the stop loss line.

As a result, we ended up with a risk of $90. If we increase the lot to 0.07, it will already be about $105.

When trading, I usually do things a little differently:

- I open a deal for a minimum lot of 0.01;

- I move the stop to the place I need and see how much the loss will be (using the above example, $15);

- Now I’m figuring out how many such transactions at 0.01 can still be opened in order to meet the risk management (100/15 = 6.6, i.e. another 5-6 transactions or 0.05-0.06 lots);

- I open another second deal at 0.05 and get the same as in the example above.

Benefits of Margin Trading

By understanding how margin conditions work and what leverage is on the exchange, you can use this tool to increase profits.

Firstly, it is an opportunity to increase profitability and earn multiple times more on the same market movement. If the leverage is 1:10, then ten times, if 1:100, then a hundred times.

Secondly, a trader can start making money on the market, even if his net worth is small. By receiving leverage from a broker, you can use it as a lever to increase the amount of your own funds or, as they say in the market, to disperse your deposit.

Thirdly, you can make money both on rising prices and during periods when the asset becomes cheaper. An exchange instrument can be traded down. This is why traders often earn a lot during crises.

When is margin lending used?

It is very easy to start investing on the stock exchange today - a brokerage account is opened online, and you do not need significant amounts of money to purchase many stocks, derivatives or currencies.

But it is difficult to get significant profits with minimal investments. If you buy one share for a thousand rubles, which then increases in price by 50%, you will receive 500 rubles in income. In percentage terms, all this looks good, but in reality there will be very little money.

To get around this situation with a small amount of initial assets, so-called margin lending is used. Its essence is that the investor receives from the broker, in fact, a loan to make an investment. In this case, the client must leave collateral to secure the loan - this can be shares, currency and other assets.

As a result, traders can carry out transactions with stocks, currencies, derivatives (futures, etc.) without physically owning them or without depositing the full amount of money needed for the purchase into the account.

How to Protect Yourself from Potential Loss When Trading on Margin

- Competently analyze the market and find entry points into a transaction at which the likelihood of a movement against the trader is minimal.

- Limit risks by setting a stop loss. This is a tool that allows you to close a position with a small loss if the forecast does not come true. This scenario is better than losing all your money.

- Carefully calculate the volume of entry into a trade, taking into account leverage. It is important to leave a reserve in case of temporary drawdowns. Then, even if the price rolls back, the account will not be closed forcibly due to the inability to maintain open positions.

Margin trading and leverage are a profitable tool in capable hands. And if you still have questions on the topic or are interested in investing, we suggest you contact for help.

A guide to trading with shoulders. Important information!

Good day, colleagues!

Today I would like to look at important material, some of which is not even simple, which was asked earlier - margin trading or trading with leverage. The article will contain definitions, calculations and much more, things that you may not have known about.

I tried to fill the article with truly important information that will help you in your work, so it turned out to be quite voluminous. Let it serve as your assistant in trading and investing.

From my own work experience, I can say that many clients have no idea what leverage is, how it is calculated, how it is displayed in tables, what REPO/SWAP is, etc., but at the same time they actively use it and are indignant when They can’t understand why they wrote off the money, and in general... what happened?!

Let's figure out what a shoulder is? Leverage is the opening of a position on the Stock/Forex Market (examples will be with these sites) using borrowed funds from the Broker. In other words, you automatically take out a loan.

For example, you have 100,000 rubles. 1 share of Gazprom costs 142 rubles. How many securities can you buy with your own money? It's simple. 100,000/142 = 704.22 pieces. There are 10 securities in a lot, so we always round down to a lower value. It turns out that in this example there are 700 pieces or 70 lots (calculations are carried out without taking into account commissions for transactions).

If you also want to purchase Lukoil shares, you will get the following situation. Let's imagine that you bought 700 shares of Gazprom for 100,000 rubles and want to buy an additional 5 shares of Lukoil for 4,450 rubles. It turns out that you will have leverage for 5 Lukoil shares.

You bought 100,000 Gazprom and 5 shares of Lukoil for 4,450 rubles each = 100,000 + 4,450*5 = 122,250 rubles. That is, leverage = 22,250 rubles.

There is a common misconception that (for example, in this case) the shoulder is open according to Lukoil. This is wrong. The shoulder is open for money. This needs to be understood. What does this mean? This means that the Broker does not care what you bought; it is important for him to cover your minus when transferring the position to the next day. And he covers the minus precisely by money. It turns out that in this example the minus can be covered by both Gazprom shares and Lukoil shares. Or both. A deal called a repo is concluded.

In this example (let’s imagine that the minus will be covered only by Lukoil shares) you make a REPO transaction overnight (1 calendar day of REPO, if it’s a weekend, then 3 days). A REPO transaction (from the English repo - repurchase agreement) is a transaction in which securities are sold to the Broker (if you are long, if you are short - a reverse transaction) and at the same time an agreement is concluded to repurchase at an agreed price. In simple words... The broker buys Lukoil shares from you. Gives you money. With this money you cover the minus overnight, and the next day, at the opening of trading, your securities are returned to you, and you, in turn, give the Broker his money. This exchange is called a repo transaction.

We will not now go into the specifics of calculations, etc. It is important for us to understand why this is done and how. Let's move on.

Let's look at another not unimportant example. You have 150,000 rubles. You bought 1 share of Transneft. It costs 162,000 rubles. That is, you have opened a leverage of 12,000 rubles.

It is important to understand here that the Broker covers the minus in terms of money with your assets, respectively, in this case, of your assets, you only have one share of Transneft, therefore, the repo transaction is concluded for the volume of the value of the Transneft share. IT IS IMPORTANT! That is, you will pay a commission not for 12,000 rubles, but let’s assume for the closing price of Transneft. Let it be equal to 162,500 rubles.

In the example with shares of Lukoil and Gazprom, you could also pay commissions not equal to the minus amount. This needs to be understood. But most often the differences are minimal.

In the example of the Foreign Exchange market, the situation is similar. Only there, when buying with/without leverage, you focus on the lot size; on the Moscow Exchange, 1 lot = 1000 USD. (For example, 1000 dollars, 1000 euros, etc.) Now many Brokers allow you to trade not in full lots. In the foreign exchange market, the operation of transferring an unsecured position (minus account) is called a SWAP transaction - the operation is similar to that performed on the Stock Market. For example, a SWAP transaction can be concluded for $1, $3, $152, etc.

Let's now move on to Quick's tables.

Table Client Portfolio. It must have main columns. The rest you can not use at all.

Min. Margin (minimum margin) is the value of money at which Margin Call occurs. Margin Call is a forced closure of part of your portfolio by the Broker. As a rule, the Broker closes your positions up to the initial Margin value.

Beginning Margin (initial margin) is the value of money at which leverage/withdrawal of money against collateral (to leverage) is no longer available to you. Minimum Margin is approximately 50% of Initial Margin

Portfolio Value – Valuation of your portfolio.

FAS (funds adequacy level) – mathematically ranges from – 9.99 to 9.99.

A little life hack:

Longs – the amount of money in longs. Please note that only margin securities are displayed there! We'll talk about this a little later.

Shorts – the amount of money in shorts. All shorts are displayed, because non-margin securities cannot be shorted! =)

Incoming funds are money at the beginning of the day. Or rather, the assessment of your portfolio (Money+Shares/Currency)

Current Funds – market valuation of your portfolio

Profit/Loss – everything should be clear here

Percentage change - % change relative to the previous trading session.

I note that the UDS can be lower than 9.99 without using leverage. For example, it could be 4.87. This is due to the fact that the portfolio contains the least marginal securities. A value less than 9.99 does not mean that you have 100% open leverage. This needs to be understood.

Let's move on slowly to margin and non-margin securities. What is this anyway?

In other words... margin paper can be called that paper that can be bought with leverage or shorted. Depending on the liquidity and risk of the security, it has different leverage. Leverage is calculated using discounts. Don’t be alarmed, now we’ll sort everything out on the shelves.

Discounts can be viewed in Quick, in the Buy/Sell table. Double-click on any row in the Client Portfolio table and open it.

The Purchase column tells us how many PAPER pieces there are. (not lots) we can buy taking into account the maximum leverage. If leverage is disabled, then the value will be 0 or much less than with leverage (in other words, the amount for which you have free funds left).

Selling is the same. It also includes shorts (i.e. you can sell what you don’t have or even more).

D long – Discount. It can be used to calculate leverage. REMEMBER! In order to calculate leverage using discount, you need 1/discount=leverage. For example, Aeroflot D long=0.51. How to calculate leverage? 1/0.51= 1.96. What does this number mean? This is the leverage value.

How do you know how much money you can open a position with, taking into account the maximum leverage? 100,000 rubles * 1.96 = 196,000 rubles.

D short – a similar discount to D long, only for the sale of securities.

D min long/short values are used to calculate call margins or minimum margins. D long and D short for Initial Margin calculations.

Accordingly, the values in the Buy and Sell fields are calculated relative to D long and D short.

I would also like to note the following:

Example 1:

Portfolio Value > Initial Margin

This means that you can open margin positions.

Example2:

Initial Margin > Portfolio Value > Minimum Margin

This means that you can no longer open margin positions.

Example 3:

Minimum Margin > Portfolio Value

This means that the broker is forced to forcibly close part of your positions.

If any of you would like to calculate the values yourself, I have attached the formulas below. But in general, Quick calculates everything automatically and correctly:

UDS = (Portfolio Value - Min. Margin)/(Start Margin - Min. Margin)

Initial Margin = ΣMoney in each share*D long (or D min short)

Minimum Margin = ΣMoney in each share*D min long (or D min short)

A short summary:

— Margin paper = Paper that has discounts. Let me remind you that they are the ones that are displayed in the Longs/Shorts columns.

— Non-margin securities/Almost non-margin securities reduce UDS.

I can also offer the following formulas that will help you calculate (more in the foreign exchange market) margin call prices.

To calculate the closing price on the Foreign Exchange or Stock market, if the position consists of one instrument, you can use the following formula:

Margin call price = — DS/(position*(1-Dmin long) DS – current cash balance

Position - amount of purchased currency

Example:

You have 50,000 rubles in your account, a purchase transaction takes place at the rate of 60 rubles per dollar, the transaction volume is $3,000, D min long = 0.078046 (as an example) DS = 50,000- 3000*60= -130,000

Margin call price (Long) = - ( -130,000)/(3000*(1-0.078046))=130,000/0.921954*3000=130,000 /2765.86= 47 rubles

price (Short) = - DS/(position*(1+D min long)

Example:

You have 50,000 rubles in your account, a sale transaction takes place at the rate of 60 rubles per dollar, the transaction volume is $3,000, Dmin long 0.072381 (as an example) DS = 50,000+ 3000*60= 230,000

Margin call price (Short)= - (230,000)/(-3000*(1+0.072381))= -230,000/0.921954*3000=-230,000/-3217.43= 71.48 rubles

If you have a delivery and the currency is displayed in both TOD and TOM (T1 or T2), use the total volume.

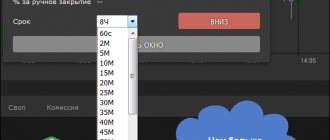

For shares, leverage is calculated on the planned date when the securities are actually delivered (for example, for T+2 shares), for TOD currency you need to have time to close the leverage before 17:45, if TOM, then on the day of purchase no commission is charged for leverage. It starts accruing the next day if you do not close your TOD positions.

In general, I would not recommend using leverage, as it increases risks, and if you invest with leverage, then the % for using it reduces your profitability.

As a rule, the Broker displays % in annual terms. If you want to understand how much you will pay for 1 calendar day, you need to divide the annual % by 365 days. Some people calculate in terms of 360 days. The value will not change much.

If you want to independently calculate the commission that you pay to the Broker, then all the formulas are on the Brokers’ websites in the Documents section. Formulas for calculations can be found either in the Tariffs or in the Regulations.

I hope the article was useful! Thank you very much for your attention!!! See you again! =)