Hello, dear readers of the AFlife.ru blog! The international payment system Payeer is not so popular in Russia, although its figures are impressive - more than 9 million user accounts. Our own free payment cards are issued in cooperation with English banks and MasterCard. It is probably difficult for the service to compete with national payment platforms (for example, Yandex.Money), but it has still won its share of the Russian market. One of the reasons for not very high interest is the additional fee for withdrawing money. We’ll look at how to withdraw electronic money from Payeer without commission in our article.

About the Payeer payment system

The Internet service has been operating since 2012. It was created in Georgia and currently has representative offices in the UK and Russia. What operations can be performed using the Payer e-wallet:

- Receive money and transfers around the world, often without commission;

- Instant exchange transactions at the rate of the service’s own exchange;

- Top up your e-wallet account;

- Organizing payment acceptance on your website;

- Earnings from an affiliate program;

- Payment for various services, goods, online orders, etc.

The main advantage of the Payeer system is the ability to anonymously use an electronic account and make payments by providing only an email. It is not necessary to provide your name, passport details and address. However, an unverified e-wallet has restrictions on transactions. Registration in the system takes only a couple of minutes, after which you can immediately start making money transactions.

There are several ways to withdraw money from your Payeer wallet, but none are completely free. The payment system cooperates with banks, other electronic payment services, mobile operators, etc. Let's consider the conditions for withdrawing money using each of them and find the most profitable option to withdraw virtual funds, with a minimum commission.

Create a Payeer wallet

Payeer wallet reviews about earnings

While reviewing Payer, I counted 3 ways to earn money without investments:

- Free bonus money (pennies) from many “faucets” on the Internet.

- HYIP projects to double the amount in your Payeer account.

- Affiliate program.

Distributing money (cryptocurrency) from faucets

For general information about ways to make money using a Payer wallet, I’ll tell you about bonus faucets.

Sites that give money to visitors for clicking, solving a captcha, or any other simple action are called faucets.

There are a huge number of them on the Internet. The amounts that faucets pay are very small, about 1-4 kopecks per minute. There are also those that promise from a penny to 10,000 rubles per action. But the chance to get more than 2-3 kopecks can be compared with chance of winning Jackpot in the lottery

Faucets can pay out rewards in rubles and cryptocurrency. If you decide to give it a try, here is a list of some such faucet sites:

- CoinFaucet;

- Bonusio;

- Pay-us;

- Free-Doge;

- FreeCardano;

- Payeerfree;

- BtcBux;

- Payeer-gift;

- DutchyCorp Final AutoClaim;

- Peath.

I don’t recommend wasting your time on such sites. There are many more profitable ways to earn money on the Internet without investment.

Hype projects

HYIPs (HYIP-High Yield Investment Program) are investment projects that attract users with high interest rates.

An example of hype is the well-known MMM pyramid.

The earning scheme is simple, attracting investors, payments to whom are made from the money of new investors. When a certain amount is reached, HYIPs close their activities. Money payments stop, the support service does not respond.

It is possible to make money in such projects if you are among the first to invest, and not with too large sums. As a rule, HYIPs make payments to the first investors to create the appearance of an honest project.

To clearly understand what such pyramids look like, you can visit several new HYIPs that accept deposits through Payeer.

List of new hype projects:

- Yacht-Company.com.

- IQDraigon.com.

- Bit-Investments.com.

On average, they promise unrealistic interest rates. For example:

- 10% per hour;

- 25% per hour for 10 hours;

- 1000% in 24 hours;

- 4500% after 2 days;

- 15000% -3 days;

- 20000% -4 days;

- etc.

Does it look tempting?

There are proven and stable ways to make money online with investments, unlike hype projects.

Transfer to electronic wallet

The Payer payment system allows you to withdraw funds to other electronic wallets. Money is transferred instantly. In 2022, transfers are made to the following virtual accounts:

- Another Payeer wallet . The commission is 0.95% of the amount. Transaction limit – from 0.10 rubles;

- Qiwi wallet . The transfer will cost more – 3.9%. You can send from 10 to 15 thousand rubles;

- Yandex.Money and ADVCASH . To send the amount to these wallets, you will have to pay 2.9% of the amount. In Yandex.Money there is a limit - from 10 to 15 thousand rubles, in ADVCASH - from 1 to 500 thousand rubles.

Commissions for transferring funds in Belarus, Ukraine, Kazakhstan

In Belarus, most transactions with Payeer are made through third-party exchangers, such as Cash-Exchanger, Bestchange or the EasyPay system. Thus, commissions for withdrawing funds depend directly on the rate of any exchanger: although selecting a profitable deal takes time, it saves a certain amount of money. You can top up your Payer e-wallet in exactly the same way. Otherwise, transfers are carried out at standard rates of the Payer system. However, it is worth keeping an eye on possible conversions of the Belarusian ruble or additional commissions: it is recommended to use wallets and cards that use rubles, dollars or euros as the main payment currency, so as not to risk your funds.

Residents of Ukraine are in a similar situation - the vast majority of transactions are carried out through third-party exchangers, which allow the user to save money. Cooperation with them follows exactly the same pattern as in Belarus. The commission for withdrawals in Ukraine is 2.99% for bank cards (in this case, you need to link your bank card to the Payeer electronic wallet and pay an additional 13 hryvnia for each transaction), as well as 4.9% for payment services Yandex.Money and Qiwi- wallet. It is also possible to register an account in the Ukrainian payment system W1. Using this tool, you can both deposit and withdraw money from your Payeer account. The best option for virtual exchangers for Ukrainians, in turn, will be the bestchange service.

In Kazakhstan, the situation is such that the only really good method is to use third-party exchangers. It is possible to exchange funds between the Payeer wallet and the Webmoney service, but these systems do not cooperate with each other. Another option would be the SWIFT system, but when using this tool, the transaction can take a very long time - up to several days or even a week. There are a number of exchangers offering their services for exchanging funds between the Payeer system and cards of Kazakh banks: they can also be monitored on the bestchange website.

Thus, the only relatively convenient way to replenish and withdraw funds from a Payeer wallet in Belarus, Ukraine and Kazakhstan is to use virtual third-party exchangers: their functionality allows you to carry out transactions with the lowest possible commission. However, the user will have to spend time selecting a profitable commission.

Cryptocurrency

Transfers to cryptocurrency accounts are carried out without commission, but the user will still have to pay a fixed amount for the operation itself:

- Bitcoin – 0.001 BTC. You can transfer from 0.001 to 30 BTC;

- Bitcoin Cash – 0.01 BCH. Limit – from 0.01 to 1000 BCH;

- Dash – 0.01 DASH. Departure is available from 0.01 to 10,000 DASH;

- Tether – 7.5 USDT. You can transfer from 10 to 100 thousand USDT;

- Ethereum – 0.01 ETH. Transaction limits – from 0.001 to 1000 ETH;

- Litecoin – 0.05 LTC. Possible transfer amount from 0.01 to 10,000 LTC;

- Ripple – 0.25 XRP. Transfer is available from 10 to 100 thousand XRP.

This method of withdrawing money cannot be called free, but it is more profitable than others. For example, you want to top up your account with 1 Bitcoin, whose market value is now about 600 thousand rubles. The commission size will be only 0.001 BTC, or about 600 rubles. It’s a pity that this transfer option is not suitable for all users of the Payeer system.

Transfer of money occurs in real time. In just a couple of minutes, the funds will appear in your cryptocurrency account.

Login to your Payeer personal account

How to log into your Payeer personal account

In order to log into your personal account, a Payeer client needs to:

- Go to the official website of the payment service provider.

- Click “Login” in the central part of the interface.

- Enter the data requested by the system.

- Click “Login” again.

Logging into the Payer system should not cause problems for the user. The system only requests the login and password generated during registration. If the user has not changed them at this stage, then these combinations of numbers and letters will be the key to the Payeer account.

☝️

Important! In addition to your login and password, the Payeer system will generate a secret word, which may be useful in the future if you need to restore your account.

Let's look at the process of logging into the payment system in more detail.

At the first stage, after entering the Payeer main page, select the “Login” button located next to the “Create account” button.

Login to Payeer account

In the next window, the system will ask you to enter your login, password and security code, in other words captcha.

Login to Payeer account

If the password was forgotten under any circumstances, this does not mean that access to the funds is lost forever.

Typically services take such cases into account. For this purpose, in the form, next to the field requesting a password, there is a “Forgot your password?” button. This function will help the user restore access to their own account, as well as directly to funds.

Click on the button and go to the recovery page, where you enter your login, secret word, and captcha code. Let us remind you that the secret word was generated along with the login and password at the stage of account registration.

Password recovery in Payeer

After logging into Payer has been successfully completed, it is advisable to familiarize yourself with all the capabilities provided by this system.

Personal account in Payeer

Payeer has an intuitively simple interface, which, accordingly, creates more comfortable conditions for interacting with the service.

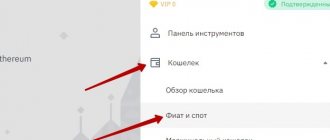

On the right side of the Payeer personal account page there are the following sections:

“Balance” reflects the amounts stored in the accounts of the payment system (as in the picture above).

“Transfer” is necessary to carry out settlements between the parties.

“Exchange” - for trading between cryptocurrencies and fiat currencies Payer.

“Exchange” is used for instant currency conversion.

“History” is used to view the history of completed transactions with the ability to export to CSV (a delimited text file created to simplify work with large volumes of information).

"API" is useful in case of integration with online services.

Now let's go over the top panel. Thus, in the right corner of the interface the total amount of funds in the user’s accounts in US dollars is displayed.

On the right are:

Notifications and news tab. In it you can find all the information on your personal account, as well as news from the payment system.

The account number contains information about its status. Here you can set up additional account protection by checking your IP and activating SMS notifications.

Interface language selection tab. O supports only 2 languages: Russian and English.

Theme selection tab: dark or light, whichever you like best.

Tab for contacting support.

Exit tab.

Settings tab. In it you can change your password, login, track referrals, as well as information about cards from which payments were previously made.

And also confirm your personal information. In the section, go to “Profile”, where a form will immediately appear that you need to fill out to pass verification.

Payeer personal data verification

Here we select the account type, enter the full name, date of birth, country, address. We confirm all this data by uploading an international passport or national identity card into the system along with any document confirming the address. This could be a utility bill or a bank statement.

☝️

The main requirement is that the document must be issued within the last 3 months.

Once the documents are uploaded, click “Submit for review” and wait for confirmation. Please note that the document verification process can take up to 7 business days. There are times when the process has to be repeated.

Withdrawing funds to a bank card

The transfer option from Payeer to a card is quite expensive, but it is the one that is especially popular. You can send funds to card accounts of payment systems VISA, MasterCard, Maestro/Cirrus and MIR. The commission size is the same - 3.9% plus another 45 rubles for each transaction. Please note the limits: for one transfer – from 100 to 75 thousand rubles, per day – up to 525 thousand rubles per card.

Funds are credited to bank cards instantly, except for MIR plastic cards. We discussed earlier how the MIR payment system differs from Visa and MasterCard. You will have to wait up to 7 business days for the money transferred to arrive.

The commission is really high, but there is a way to reduce it at least a little. If you enable automatic transfer of money to any VISA or MasterCard card (for example, Sberbank), you will receive a 40% discount on the regular payment. In this case, a card account can be opened in rubles, dollars or euros. The current transaction cost if there is an automatic withdrawal of money is 2.9% plus 45 rubles for each transaction.

Commissions and interest for the transfer and conversion of funds from a wallet to the Payeer exchange

For trading on the exchange, a separate commission is provided in the Payeer wallet. Thus, for each trading operation on its internal exchange, the system asks for 0.095% of the total transaction amount (which, by the way, is even lower than the average commission for similar exchange transactions on the market), and currency conversion starts from 0%. However, the minimum conversion fee on the exchange is $0.5. Since trading on the exchange is carried out only using cryptocurrency accounts, you will still have to transfer funds for trading from rubles, dollars or euros. Still, the Payeer Exchange is more of an additional bonus than an independent tool: the trading functionality is limited and does not provide as many opportunities as a full-fledged exchange machine does.

Through international payment systems

This refers to VISA and MasterCard, the difference between them can be seen in this article. They are the most expensive when withdrawing from Payeer and cost 4.9% of the transfer amount plus $5 for the transaction. The only advantage of this method is the instant transfer of money anywhere in the world. However, here too the service warns us that sometimes we have to wait up to 10 working days for enrollment.

Please note the existing restrictions in Payer. You can send from 3 to 2,500 dollars (euros) per transaction. The maximum transfer amount to one card is 4,800 dollars (euros) per day, 20,000 dollars (euros) per month.

Please note that there are a number of countries where transfers are prohibited. This includes Argentina, Cuba, Hong Kong, Japan, Syria, USA, Russia, Ukraine and some others. The full list can be viewed on the Payeer website in the “Withdraw Funds” section.

Payer wallet new user registration

The first thing I want to say about Payer wallet is that registration is no different for residents of different countries. Citizens of Russia, Ukraine, Belarus, Kazakhstan and other countries follow the same procedure for filling out data.

Payer wallet registration step by step

- Follow the link to the main page of the official Payeer website https://payeer.com/ru/ and select “Create an account”.

- We indicate a real email.

- You will receive a code that you must enter in the specified field.

- I recommend immediately writing down or saving the received password and login. When entering your wallet, you will need to enter them manually. Automatic memorization in the browser does not work. I store it in a regular text document on a PC.

- Enter your first and last name (not necessarily your real name), the country is selected automatically.

Done! For the ease of registering a Payer wallet, the reviews are positive

To Payeer card

The information in this section applies only to residents of the European Union. That is, those who have continuously resided in EU countries over the past 5 years. Since 2022, Russians will no longer be able to obtain a Payeer Mastercard. All cards previously issued to residents of our country are blocked and unavailable for use.

If you still have such a card or you have the right to order it, information on the use of plastic in Russia may be of interest. Logically, your own service card should give its owners advantages in use around the world. But, as we have already said, it is issued by a foreign bank, and in Russia you will only receive expenses from it.

Although the Payeer Mastercard is indeed free to use - you don't have to pay for issuance or an annual fee - it is not very profitable. For example, the cost of delivery will cost almost 10 dollars, and it will take about 3 months. Want faster? You will have to pay $35 for express shipping.

Another important point is that plastic and virtual card accounts are available to Payeer Mastercard only in dollars and euros. This creates an additional conversion fee for each transaction in Russia or a country with another currency. After all, almost all ATMs and terminals work only with national payment symbols. So commissions when withdrawing money cannot be avoided. In addition, back in 2022, a limited number of banks worked with Payeer Mastercard cards, mainly in Moscow and St. Petersburg. These are VTB, Raiffeisen Bank, Alfa-Bank, Binbank and some others.

Another thing is cash withdrawal in the EU at ATMs with the Mastercard icon. You can often receive funds without a fee, but it is better to carefully read the information on the screen before confirming the transaction.

It is worth noting that the Payeer payment system promises to establish cooperation with foreign financial organizations, which will still issue bank cards for non-EU residents. Representatives of the service made this statement at the beginning of 2018. But, apparently, an agreement has not yet been concluded.

How to make money?

Payeer offers you to top up your wallet in more than 150 ways in three currencies to choose from - dollars, rubles or euros. Replenishment methods can be divided into:

- Payment systems (Qiwi, One Wallet, OKPAY, Paxum, Yandex Money)

- Bank cards (Visa, MasterCard)

- Various banks (SWIFT, Svyaznoy, Promsvyaz, TKS, Alfa Click, Sberbank Online, Transfer in rubles)

- Cash (Svyaznoy, Alt Telecom, Euroset, etc.)

- Mobile payment (Beeline, MTS, Megafon, Tele 2)

- Payment terminals (Payment terminals of Russia)

- Exchangers (Web Money, LIQPAY, Perfect Money, EPAY, Western Union, VTB24, Privat24, etc.)

The company’s website says that you can top up your wallet for 0% using some systems. But in fact, only through OKPAY you can transfer money without commission, as well as for 1% with Paxum. Other replenishment methods require a commission of 3 to 8%.

Some users offer cunning schemes for transferring money from different systems and banks through their wallets, but I do not recommend using the services of strangers.

Interestingly, exchanging Webmoney for Payeer is still possible using exchangers, a list of which can be found here, although the Payeer website says that Webmoney is no longer available in the system and users are highly discouraged from using Webmoney, due to the constant blocking of accounts.

Payeer limits for replenishment could not be found on the site, but many users write that receiving and paying for services is not limited by the system, unlike transfers and withdrawals.

The upper limit is most often explained by the anti-money laundering policy - 15 thousand rubles for unidentified users, and up to 50 thousand rubles for verified transactions.

Click to expand instructions for replenishing your Payeer wallet

In order to enter money into the system, click the “Top up” button in your personal account, on the left.

Next, you need to select a currency and enter the amount you want to top up your account with. Click "Top up". On the next page, the system will offer you an invoice and several ways to pay it. Select the payment system and currency with which you want to top up your wallet.

Now, by clicking on the “Confirm” button, Payeer will transfer you to the portal of the selected payment system, where you will need to pay the invoice issued by Payeer.

Collapse instructions

What is the best way to top up Payeer?

However, despite all the variety of options for depositing money, the best one is through an ATM using a specially issued plastic card. Like this? - I’ll tell you now.

Recently, Payer has been developing well and now it is possible to issue a real plastic MasterCard card linked to your account. It is thanks to her that you will be able to deposit cash into your wallet interest-free!

The cost of issuing a card today is free, the cost of service for the first 36 months (3 years) is also 0. The only thing you have to pay for is the delivery of the card. Moreover, there are two options to choose from:

- Delivery by regular mail will cost $9. A letter with a card will arrive within 3 weeks

- Delivery by DHL express courier already costs $35, but the delivery time will be reduced to 3 days

To order such a card, click on the “My Cards” button in your personal account. Next, simply fill out all the fields, pay for card delivery and wait for the letter. Limits on card transactions can be seen in the screenshot below.

Payeer bonus program

Payeer offers the opportunity to earn extra money through a 6-level referral program.

Firstly, the Payer partner receives a bonus upon the referral’s first deposit. Secondly, he has a certain percentage from each of his transactions. Thus, you can receive up to 25% of the service’s profits and instantly withdraw funds using many withdrawal methods.

You can also make money by opening your own exchanger using the payment system API. You can open an exchanger from scratch or connected to an existing site, which will immediately allow you to monetize traffic.

Withdrawal process

The easiest way to withdraw from Payeer to PrivatBank is to use the built-in automatic exchange service. To do this, you need to use one of the points on the authorization page:

- Exchange - when you select this option, a form will open that you can easily understand. Payment is processed quickly and without difficulties.

- Translate is a similar service in which everything goes through an exchange. To do this, you need to select the payment currency, enter the amount and payment system. Fill in the card details and click “Transfer”.

If you need to withdraw funds from Payeer, then you can use the following methods:

- Exchange for a bank card - any bank is suitable for this, including the most popular PrivatBank today.

- Using other electronic payment systems - Yandex or Qiwi.

- Top up your mobile operator account.

Output to card

This method of withdrawing money involves linking an electronic wallet to the banking system of accounts. First you need to open a payment card. Next follow the steps:

- Log in to the system.

- Go to the “My cards” item.

- Add a card - enter personal data and payment currency. You can open a hryvnia or foreign currency account at PrivatBank. A transfer from a Payeer ruble account to a hryvnia card will be calculated based on the exchange rate on the day of the operation.

After receiving a Payeer card, the owner has the opportunity to use it in other organizations working with the international MasterCard system.

Transfer to electronic wallets

You can withdraw funds from Payeer to Qiwi or Yandex wallet. The procedure is performed as follows:

- Log in to the site.

- Go to the “Translate” section.

- Select a currency in the window and select a wallet. In the case of an exchange on Qiwi, the phone number is indicated, on Yandex - the wallet identification number.

- Complete the transfer and confirm the payment.

Using exchangers

Clients can use third-party services that provide the Payeer to Privat24 exchange service. You can find such exchangers on the Internet. Most sites provide complete information about the operation, so before using it, you need to study the following:

The withdrawal process itself is not complicated. You need to select the currency that will be withdrawn, and also indicate which currency you want to receive (Payeer and Privat24, respectively). After this, you need to fill out a form indicating the details of the wallet for withdrawing funds and the card number for replenishing it.

Support

To contact a support specialist, in your personal account on the top menu bar, select the icon with the image of a person.

To create a new ticket, you first need to select a question from the list. For example, an email with a verification code does not arrive / funds are missing or your account has been hacked / how to connect mass API payments, etc. If your question is not in the list, select I have another question .

If there is not enough information, select Answer did not help you and fill out the feedback form, indicating the subject, operation ID, write a message (attach files if necessary).

Support operators respond within 1-24 hours.