Hello, dear readers of the AFlife.ru blog! Electronic wallets are indispensable when you need to quickly receive money not to a bank account. Their choice is quite large - WebMoney, Yandex.Money and others, and each has its own characteristics. What is a Qiwi wallet, how to use it and how convenient it is, we will tell you in our review.

About the Qiwi payment system

QIWI is the largest payment service created in Russia more than 10 years ago. As of 2022, it has more than 20 million electronic wallets registered and more than 149 thousand payment acceptance points, including its own terminals. This means that you can send not only virtual money, but also cash.

Since 2012, Qiwi has been cooperating with the international payment system Visa, and the full name of the service is Visa QIWI Wallet. From now on, QIWI clients have the opportunity to open cards for personal use.

Qiwi is an international service, but it is most popular in the Russian segment of the Internet. What opportunities open up for e-wallet owners:

- Payment of utility bills, mobile communications, Internet, fines, etc.;

- Issue of debit plastic and virtual Visa cards;

- Repayment of loans;

- Transfers to card accounts and other electronic wallets;

- Payment for orders from online stores;

- Receiving cashback from the QIWI system when paying for goods on AliExpress, Yulmart and others;

- Creating a savings account through social networks;

- Search and payment for air and railway tickets, hotels;

- Registration of a citizen as self-employed and further tax reporting.

Deposit and withdrawal

Replenishing your wallet and withdrawing funds are operations that any user uses more often than others. The developers have provided their clients with a wide range of opportunities - from using bank cards from various banks to interacting with a mobile phone account. Of course, given the number of countries in which the service is presented, some regional peculiarities may arise, but in general, the list of methods is extensive enough to satisfy the needs of any user.

How to open an electronic wallet

Creating a Qiwi virtual account takes just a couple of minutes. You need to go to the payment system website and register in it using your mobile phone number. How to do it:

- Click on the “Create wallet” button;

- Enter your contact number;

- Confirm that you are not a robot by checking the required box. By the way, registration is possible through social networks VKontakte, Facebook and others. If you have an active profile, you can use it;

- A confirmation code will be sent to the specified mobile number. Enter it in the special field;

- Next you need to create a password. It’s worth coming up with a combination of numbers and letters that is difficult to hack, because this is where your money will be stored. Then click “Register” and you will immediately be taken to your personal account.

Further login to Qiwi takes place using the mobile phone number and code that you specified during registration. After authorization, you should set up an account for yourself so that it is convenient to use.

Can bailiffs seize a Qiwi wallet?

Since electronic title units are not legal funds, users often have a question: can bailiffs seize a Qiwi wallet?

According to Art. 128 of the Civil Code of the Russian Federation, virtual currency cannot be classified as an object of civil law. Therefore, she is not subject to arrest. If we consider it as a derivative of non-cash or cash currency, then for inventory and seizure, bailiffs need a clear evidentiary basis for recognizing the fact that electronic money is property.

To do this, they need to make sure that personal documents and client data were used when creating the account.

Fill out the form with your information and click “Search”.

If a payment system participant has any doubts about the reason for blocking Qiwi Wallet, it is recommended to check the existence of debt on the official website of the Federal Bailiff Service. To do this, just enter your data in the “Find out about your debts” form located on the main page of the resource.

How to set up a profile

As a rule, this point does not cause difficulties. The service interface is intuitive, unlike WebMoney, which has a complex login and transaction system. However, there are important nuances in setting up a profile that the user must take into account.

To significantly expand the capabilities of your personal account, you need to increase your status. To do this, provide your passport details, INN and SNILS. After confirming your identity, you will receive an increased limit on payment and other transactions in the service.

What statuses can be opened in your QIWI personal account:

- By default, when you open a virtual wallet, you will be assigned Minimum . You can keep no more than 15 thousand rubles on the account, payments - up to 40 thousand rubles per month, up to 15 thousand rubles per transaction. Withdrawal of money – up to 5 thousand rubles per month. Only electronic payments are available;

- The basic level is given upon confirmation of the last name, first name and patronymic, and passport data. You can keep up to 60 thousand rubles in your wallet and transfer up to 200 thousand rubles per month. The limit for one transaction is 60 thousand rubles. You are allowed to withdraw up to 5 thousand rubles per day and no more than 40 thousand rubles per month. After assigning the main status, you will have access to payments on websites, transfers to cards and current accounts;

- The highest is professional status . It can only be obtained if you provide a passport to link it to an account at the Qiwi office or with payment service partners. Please note that confirmation of a document through third-party organizations is paid, for example, in Euroset they will charge you 300 rubles for this operation. The status allows you to keep 600 thousand rubles in your account, make payments and transfers without restrictions, but not more than 500 thousand rubles per transaction. You are allowed to withdraw up to 100 thousand rubles per day and up to 200 thousand rubles per month.

Choose the use option that is convenient for you. If you regularly receive funds into your email account, you should sign up for basic status. Professional is more suitable for Internet entrepreneurs operating large sums.

QIWI Features

The international payment platform QIWI was developed in 2007. Over the years, it has become widely popular and has gained a huge customer base. The wallet allows you to carry out various operations: pay for various types of services, buy, repay loans, and so on.

Operations are carried out by terminal, Internet or mobile application. So that you can understand what Kiwi is, I want to introduce you to its advantages. Let me start, perhaps, with the opportunities that are available to owners:

- Free service.

- Cashback 25% on goods in online stores.

- Replenishment without commission.

- There are no hidden transfer fees.

- You can get a bank card.

- Special promotions and bonuses.

- More than 15,000 services.

- Transactions are confirmed by SMS if there is no Internet access.

To register and use a wallet, no specific knowledge is required, everything is extremely simple. Well, more on that later. The service guarantees complete protection of your savings.

Like any system, Qiwi has its downsides. Of course, I didn’t notice any critical ones, but I’ll give you a few nuances as an example: interest on withdrawals,

limited withdrawal options, incompatibility with other payment systems, the system is oriented only to its limits.

Perhaps some of you will find other shortcomings. I just gave an example of those that I personally got acquainted with. Share your opinion in the comments. Perhaps the most significant drawback in this regard is the restriction on the ability to withdraw money, but not so significant.

Replenishment of an electronic wallet

To make payment transactions, you need to have a certain amount in your account. Replenishment of a virtual wallet occurs in several ways:

- From a mobile phone linked to your personal account. The commission will range from 7.5% to 12% of the amount;

- Through Qiwi terminals and service partners. Their location can be clarified in your personal account in the “Top up your wallet” section. When paying through Svyaznoy, MTS, Euroset and CONTACT stores, there will be no additional fees. Qiwi payment acceptance devices transfer money with a commission of up to 500 rubles, above – without it;

- From a debit card. The transfer is carried out without commission from 2 thousand rubles;

- Bank transaction. There will be no fees from the Qiwi payment system, but your bank may withdraw money according to its own tariffs;

- From another virtual account.

You can top up your electronic account with a bank card or from a mobile phone here, in your Qiwi account. To transfer money through Internet banking, you need to log in and make a payment. The amount of the commission is determined by the bank where your debit card is opened. Please note that Qiwi has signed agreements with many Russian banks on free transfers of money (for example, with Alfa-Bank).

Finding out your wallet number is easy - it matches your phone number linked to your personal account. For another person to send you money to Qiwi, he only needs to know your mobile phone.

How to work with Qiwi?

The payment system covers all areas - from replenishing a mobile phone account to paying fines, transfers to a bank card, repaying loans and paying for goods in partner stores.

Through Qiwi wallet you can:

- top up your mobile account;

- make transfers to wallets inside the EPS and to WebMoney and Yandex Money wallets;

- transfer money to Visa, Mastercard, Mir, American Express, Diners Club, Union Pay, Maestro cards;

- transfer money directly to a bank account. Supported banks include Tinkoff, Sberbank, Renaissance Credit, Raiffeisenbank, Otkritie, VTB and others. In total, the list on the Qiwi website includes more than 100 destinations in this section;

- pay for the services of Internet providers;

- make in-game purchases. All popular online games such as World of Tanks, League of Legends and others are supported. Qiwi wallet is also suitable for purchases on Steam and other digital gaming stores;

- repay loans;

- make transfers abroad;

- shopping on social networks;

- pay for TV services;

- shopping in stores;

- pay for telephony;

- pay utility bills;

- buy tickets and passes for all types of transport;

- pay for government services, including traffic police fines, parking, and pay debts through bailiffs.

You can set up regular payments. This is suitable, for example, when paying for utilities, loans, and communication services.

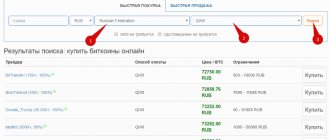

How to transfer money from a qiwi wallet?

This is one of the most common scenarios. All clients of the payment system, without exception, can make such transfers. The options are as follows:

- sending to another wallet using mobile number. To pay, it is enough to know the phone number of the recipient of the money (this is the wallet number), indicate the amount, confirm the transaction with the code from the SMS message, and in a couple of seconds the money will appear in the recipient’s account;

- by nickname - the principle is the same, only instead of the wallet number, a nickname, a unique name of the wallet, is indicated.

All translations are stored in history. The commission depends on the chosen method; from a bank card you will have to pay 1%, from a mobile phone account - from 1% (depending on the operator). When transferring from wallet to wallet inside the EPS, the commission is also 1%.

Sending money to a bank card follows the same procedure. We indicate the card number and confirm the payment with the code from the SMS message.

You can also transfer money from your Qiwi wallet directly to WebMoney and YandexMoney wallets.

How to top up your Qiwi account?

You can deposit money to Qiwi wallet:

- via bank card. For replenishment amounts over 2000 rubles. the commission will not be written off, otherwise Qiwi will take 1%. Please note that this is a payment system commission; the bank whose card you own will also write off a few percent;

- from a mobile phone account - an extremely unprofitable option, commissions will be 7.5-12% depending on the operator;

- using Internet banking – Qiwi commission 0% regardless of the bank used;

- through a Qiwi terminal with zero commission for replenishment amounts from 501 rubles;

- through a bank branch by transfer to the Qiwi Bank details, payment can take up to 3 working days. Replenishment is possible only in rubles from the accounts of individuals;

- by applying for a loan from one of the payment system partners. Consider this option as an emergency; the interest rates are not the same as those of ordinary microfinance organizations, but still quite high. Qiwi has partnerships with 8 loan providers.

Account replenishment is also possible through communication shops, ATMs, Contact points and other terminals. Almost every self-service terminal has a point for replenishing Qiwi and other payment systems.

Withdrawal of funds

In this case, there are fewer directions; you can withdraw money from your Qiwi wallet:

- to a bank card;

- to a bank account. Moreover, you can transfer funds to your account and other accounts;

- through a money transfer system;

- directly to the account of a legal entity or to the account of an individual entrepreneur.

Small amounts can not be cashed out, but sent, for example, to a mobile phone account or bought some small change in a store. Current withdrawal methods are enough for everyone, even if you don’t have a bank card, you can get money even through Russian Post.

additional services

In addition to the above, EPS offers:

- Qiwi piggy bank - an analogue of ordinary crowdfunding platforms, you can organize a joint fundraiser for a “dream, gift or good cause.” You can collect money through instant messengers, social networks and other sites. Several thousand piggy banks are opened per month;

- cashback when purchasing goods in a partner store and paying through Qiwi. It has its own browser extension. As for the cashback itself, the situation is standard - you can get a 10+% return on small items worth a few dollars. For major purchases, cashback drops by an order of magnitude;

- Qiwi Teamplay – tournaments from the payment system with real prizes for the winners. Only citizens of the Russian Federation can participate. Professional eSports players will not be interested in this event (the prize fund is not serious by their standards), others can receive modern computer components or something else for the points they accumulate. True, scoring points is difficult;

- travel – the same cashback, but it is paid for booking hotels, purchasing tickets for various types of transport and other expenses related to recreation and tourism;

- platform for self-employed people. The EPS user needs to log into the Qiwi wallet and go to the section for the self-employed. After this, he will be able to generate checks and send them for payment, accepting money from both individuals and legal entities. Tax on the income received is paid monthly (also remotely), the rate depends on who transfers the money to you. If individuals, then 4%, if legal entities - 6%.

There are good solutions for business. You can organize mass payments, and issue bank cards.

Qiwi card

This card has all the attributes of a regular bank card, but is linked to your wallet balance. The usage scenarios are the same as for regular bank plastic.

Qiwi offers:

- virtual card – suitable for those who often buy online;

- a real plastic card - suitable for those who, in addition to using a Qiwi wallet online, plan to withdraw money from ATMs and pay for purchases in regular stores.

The virtual card is free, but others will have to be paid for. The amount does not exceed 249 rubles, the service is free. Qiwi also offers to issue a Rocketbank card with the same functionality, an additional 5.5% per annum is charged on the account balance, cashback is enabled, and money can be transferred to cards of other banks for free in amounts up to 30,000 rubles per month. This is discussed in more detail here.

There are also cards with a connected credit line. They can be used like regular credit cards, just remember to repay the debt on time so that interest does not start accruing.

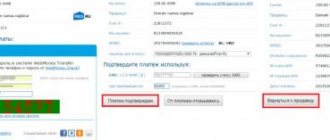

Withdrawal of funds

There are several ways to receive money from an electronic wallet:

- Transfer to another virtual account. For example, send funds to another person who has a Qiwi wallet. You can make a transfer instantly and without commission;

- To a bank card or current account. You need to indicate your bank card number and the amount to be withdrawn, and then confirm the operation. The term for crediting money differs depending on the receiving bank - from a few minutes to 3-5 business days;

- To other electronic accounts or through payment systems. For example, on Yandex.Money, WebMoney, Elexnet and others.

How to withdraw money in cash? Open a QIWI plastic card linked to an electronic account, or transfer them to an existing card of any bank. Before sending money, the system will prompt you to familiarize yourself with the size of the commission. Please note that transfers to third-party services often involve additional fees.

Registration in the system

It’s worth noting right away that the process of registering a QIWI wallet is simple and convenient and is unlikely to cause difficulties even for the least experienced user. However, QIWI does not work in all countries. Therefore, before proceeding with the registration process, you should find out whether the service works in your country. In addition to the Russian Federation, the payment system is represented in the CIS countries and some others: Georgia, Panama, Great Britain, Tajikistan, Lithuania, Israel, Kyrgyzstan, Turkey, Ukraine, Armenia, Latvia, Thailand, Moldova, USA, Japan, Uzbekistan, Kazakhstan.

You need to understand that the service is constantly developing, expanding the boundaries both within the system (new functions appear) and outside it - the list of countries is increasing.

Electronic payments

In Qiwi you can make various transfers, including for mobile communications, housing receipts, and the Internet. Repayment of loans from various banks is available, but the transfer takes into account a commission. Electronic wallet users are given the opportunity to transfer almost any payment, similar to Internet banking.

Each operation must be confirmed by entering a one-time password, which will be sent to your contact phone number. The only exceptions are selected transactions and payment for a mobile number linked to a virtual account. Additionally, the system will ask you to explain the purpose of the transfer, for example, “payment of utilities.”

If you make the same payments every month, you can automate them by creating a template. For example, set the system to repay the loan on the due date for a certain amount. You can cancel auto payment at any time. When completing a transaction, a commission will be charged, as if you were transferring money without a template.

Transfers and bill payments

In the payment section you can pay for absolutely any service, mobile communications, utility bills, online stores.

The transfer is carried out through an account, of which you can create several within the system. There are interesting options such as vouchers. They are a certificate for a certain amount, which are sent on social networks or by email. Account owners who know how to use it can request some of the services for free and pay for goods online through a personal wallet. These include air tickets, utilities, housing and communal services, and fines.

Safety regulations

Increased attention should be paid to the security of using an electronic service, because any of its owners can become a victim of hacking. To prevent attackers from using your virtual account, you must follow simple rules:

- When registering, use only the number you plan to use. Make sure that it is not blocked and is registered specifically to you;

- Connect SMS notifications about completed operations;

- Set up the option to confirm all transactions by entering a one-time code from a mobile message;

- Link an email to your personal account so that duplicate letters about payments will be sent to it;

- Increase your status by confirming your identity, at least to the Basic level;

- Create a password that is difficult to crack. Don't use your date of birth or your pet's name. It’s better to apply a random combination using a code generator, so your account will be safe;

- Do not share passwords received from Qiwi, because payment system employees never ask for them. Only scammers do this;

- Do not give anyone access to your electronic wallet, because fraudsters use a virtual account to carry out dubious transactions. And you, as the owner of your personal account, will have to answer for them.

If you follow these recommendations, using Qiwi wallet is completely safe. But just in case, do not store large amounts in a virtual account.

Login problems

If the browser does not enter the QIWI wallet, but instead the loading icon constantly hangs, this may be due to technical work. The system is constantly updated, so the site is sometimes under reconstruction. In this case, you just need to try again later.

The account is linked to a mobile number, so if you don’t have access to the phone number, you won’t be able to log into the system. The exception is when you remember your personal account password.

If you cannot log in, check that your Internet connection is working and that you entered the password correctly.

Problems with logging in occur when your account is blocked. This can happen when limits are exceeded, suspicious activity occurs, or the rules for using the system are violated. If you have not made illegal transactions, call technical support and explain the situation. The operator will remove the lock in a few minutes. In some cases, verification before unlocking takes several days.

EcoPayz

The electronic payment system began operations in 2000. The office is located in the UK, and the company's activities are controlled by the Financial Conduct Authority, which guarantees the safety of using funds.

In recent years, the system has begun to develop rapidly, and today it is a worthy competitor to the popular services Neteller and Skrill - only, unlike them, ecoPayz continues to issue cards for clients from Russia. The virtual payment system offers very favorable conditions in the segment of online wallets for managing digital money.

Clients of the system can issue a special ecoCard MasterCard card. The prepaid card works internationally. Thanks to it, you can pay for goods and services at a variety of retail outlets around the world. The multicurrency card is accepted not only for online but also offline payments.

Issuing a card is instant and free. The client's credit history is not checked for issuance. EcoCard guarantees convenient electronic money management and secure purchases.

A virtual ecoVirtualcard is also available. It is a one-time payment card that works directly with the client's ecoPayz account. You can pay over the phone and online, while maintaining the confidentiality of personal data or financial details.

A virtual card is issued quickly, without a bank account or credit history check. It is universal and works with three currencies:

- US dollars;

- Euro;

- pounds sterling.

Due to the fact that its expiration date expires after the first transaction, fraudsters will not be able to gain access to it, and the client will not lose it under any circumstances.

How to choose a virtual wallet

Having realized the need for such a payment instrument and wondering which electronic wallet is better to open, when choosing, we advise you to pay attention to such important criteria as the presence of a license, the amount of commissions, the presence of a Russian-language interface, etc.

So, which e-wallet should you choose?

Availability of a license

With a valid license, which indicates that the company operates in accordance with the requirements of the regulator.

Payment systems and electronic money are licensed activities and are under close attention from government control authorities, since uncontrolled activities can harm the financial system.

Thus, obtaining a license in any member state of the European Union gives the opportunity to work throughout the EU. For example, the RBK Money wallet is licensed by the Central Bank of the Russian Federation and the FCA UK.

Minimum requirements to obtain a license in the EU:

- impeccable financial reputation; company, management and founders;

- limitation of monthly turnover, in accordance with the requirements of the regulator;

- presence of an office in the country in which the application is being submitted;

- the company’s activities must not violate the laws of the country in which licensing is carried out and the EU;

- one of the company's managers must be a resident of the regulatory country.

Possibility to issue a card

Some e-wallets allow you to create a payment card to pay for purchases offline. For example, in a supermarket through a POS terminal.

All the wallets discussed above allow you to issue a plastic or virtual card. Popular among Russian-speaking users are YuMoney (Yandex.Money) and QIWI cards.

Bank cards YuMoney (Yandex.Money)

Commissions

As a rule, the fees of payment systems are much lower than those of financial institutions, which must pay salaries to huge staffs, maintain large office space and incur other expenses.

Electronic payment systems are deprived of such responsibilities, therefore they are able to provide not only faster, but also cheaper transactions .

Tariffs depend on the specific EPS and payment method. It is logical that the lower the service commission, the more profitable the deal for the client.

Safety

When dealing with any money, security is important. And if we are talking about virtual funds, then users need to take doubly care of their electronic wallets in order to protect them from all kinds of cyber attacks.

For example, on some services, identity verification is not a requirement. But for your own safety, it is better to identify your account. This will not only secure accounts, but also expand the available functionality of the service. ✅

Reviews

Reviews, reviews, reviews. When choosing an electronic payment, they are as important as in any other matter related to finance. Do not rush to give your money to the first service you come across, falling for advertising or a fictitious rating. Take the time to study reviews from different users and on different resources. As a rule, a client who is dissatisfied with the quality and result of the “payment” leaves a negative review about it in order to warn other potential “lucky ones”.

Real experience is more valuable than any theoretical knowledge.

Mobile app

It’s stupid to deny that our reality is becoming digitized every day and we spend more and more time online.

And in order not to tear themselves away from our new virtual reality, e-wallet developers are creating mobile applications for owners of iOS and Android devices. Thanks to this, all the functionality of the wallet is always at hand and you can make instant transfers and payments at any time from anywhere in the world.

Mobile application PAYEER

Help Desk Operations

The client of any service must be sure that, if necessary, he will receive competent technical support. Moreover, when we talk about monetary transactions, it is important that technical support specialists promptly get in touch promptly and solve customer problems as quickly as possible. Because time is money.

Russian-language interface

For most Russian-speaking users, the presence of a Russian-language version of the wallet is almost the main feature when choosing. The absence of a language barrier makes working with the wallet faster and more convenient.

All e-wallets discussed in the review work in Russian.

YuMoney (Yandex.Money)

This service is the most popular in Russia. With its help, users have the opportunity to pay for goods and services online.

Having issued a plastic or virtual card in addition to the wallet, in addition to Internet payments, opportunities are also opened for using money in offline establishments. The client can withdraw cash from any ATM, regardless of which country he is in.

Yandex.Money awards cashbacks to customers who pay by card or from a wallet. Since 2022, the “Multi-currency cards” package has been launched to order a single card that supports rubles and plus 10 international currencies - it also provides cashback. The Yandex search engine service is so far the only one in Russia that has issued a card with a dozen accounts, capable of independently recognizing in what currency a person makes a payment.

Can be ordered:

- a bright or black plastic Yandex.Money card;

- Witcher card;

- virtual card;

- instant MasterCard card without a name.

The Yandex wallet and card complement each other perfectly. Although they have different numbers, they have a common balance. If you top up your wallet, the money becomes available on the card. And vice versa.

An instant card can be ordered at the company’s office or purchased at Svyaznoy. A personalized card is available for order on the website or in the application.