Ripple XRP cryptocurrency

Over the past five years, digital currencies have been gaining popularity day by day. Along with Bitcoin and Ethereum, XRP (Ripple) was one of the three giants of the cryptocurrency market for a long time, but with the development of the DeFi sphere it was supplanted by other coins.

But despite this, XRP is still one of the most popular cryptocurrencies. This fact alone makes us take a closer look at the Ripple project and try to study its history, features, strengths and weaknesses, as well as evaluate the prospects of Ripple. A detailed review of the Ripple cryptocurrency in this article.

- What is Ripple cryptocurrency (XRP)

- XRP cryptocurrency technology

- XRP rate

- How to Buy Ripple XRP Binance

- Bitstamp

- Kraken

- Cex.io

- Exmo

- Exchangers

History of creation

The history of the creation of the Ripple cryptocurrency begins in 2012. However, the first steps towards the emergence of the project were taken back in 2004. Canadian programmer Ryan Fugger has set the goal of creating a new electronic payment system, Ripplepay, in which people can create their own money. In 2005, the main work was completed, but due to a lack of interest from society, Rippleplay did not gain success.

The developers did not abandon their idea and worked on its development for 6 years after the failure until the end of 2011. They designed an electronic payment system in which purchase and sale transactions are confirmed by agreement (consensus) of the participants, and not by mining (as was the case in the Bitcoin system based on the blockchain). Also, the advantages of Ripple were based on the fact that it uses less electricity to operate, and transactions are completed many times faster.

In 2012, the famous programmer Chris Larsen, the founder of the credit companies Prosper and E-Loan , who later became the director of Ripple Labs, joined the team. He approached Fugger with the idea of creating his own cryptographic currency within the Ripple platform, although initially there was no talk of his own virtual currency.

In 2012, the development team founded the OpenCoin Corporation and launched a new cryptocurrency platform, Ripple, with the internal currency of the same name (XRP). The first investors in the project were Google Ventures, Jed McCaleb - founder of the MtGox , Andreessen Horowitz.

Important: In the fall of 2013, a rebranding took place, and the OpenCoin company began to bear the name Ripple Labs.

In 2014-2019, Ripple Labs Inc. focused on the banking market. The first bank to use Ripple was Fidor Bank in Munich. Then the technology began to be used by American banks Cross River Bank, CBW Bank, and the Earthport payment service (works in 65 countries, including with banks). In 2022, the Ripple protocol began to be used for international payments between the US and the UK (American Express and Santander), as well as between Japan and South Korea. In 2022, the system was integrated into one of the largest eastern banks, NCB in Saudi Arabia.

Today the company has a BitLicense and offices in the USA, Australia, Great Britain, Luxembourg, Mumbai, and Singapore. Also, a Ripple Labs virtual office has been operating in Ukraine since 2022.

BitLicense is a license for activities in the field of virtual currency, which is issued by the authorities of the State of New York (USA).

Characteristics and features

Most altcoins differ from the “ancestor” Bitcoin in certain nuances - work with smart contracts, increased transaction speed, increased requirements for security and anonymity. But there are systems that go much further. This is what the Ripple cryptocurrency (XRP) is today.

- Most alternative cryptocurrencies and Bitcoin itself operate on Blockchain technology, which is a distributed database. Protection by a cryptographic code, which guarantees anonymity and security, is the essence of all virtual money. However, Ripple was given a more ambitious goal. It operates as a global free payment network with its internal coin XRP. The system is based on payment gateway technology. This system is attractive for banks.

A gateway is any organization or person that allows other users to borrow or deposit money into Ripple's liquidity pool. In practice, gateways resemble the work of banks, but they are united by one global register - the Ripple protocol.

- XRP currency has a legal entity, representative office and headquarters in the United States. This point is attractive for investors from the point of view of the reliability of investment.

- Ripple cannot be mined. The developers abandoned the idea of mining coins and immediately released 100 billion coins. Each coin is divided into a million parts - a “drop”. In this case, coins are no longer issued.

- High transaction speed.

For comparison: 600 seconds for operations with Bitcoin and 4 for operations with Ripple.

- It is worth distinguishing between the RippleNet system and Ripple tokens. Most banks work with the payment system, and cryptocurrency is tied to the “Liquidity on Demand” project. Therefore, the development of Ripple does not always entail an increase in the value of XRP.

- The Ripple token differs from the classical understanding of cryptocurrency. One of its main functions is a payment bridge. XRP can be used by users in cases where the exchange of the desired assets is not available.

These are the main features of the altcoin in question, now let’s talk about its characteristics.

| Parameter | Meaning |

| Emission | One-time release of 1 billion tokens. To prevent inflation, the developers reserved 62% for themselves and decided to periodically throw coins controlled by them onto the market. |

| Commission | 0.00001 XRP per transaction. This is a very small value. Its purpose is anti-spam protection, not a payment fee. At the same time, the commission fee is “burned”, which in the long run will reduce the number of coins. |

| Scalability | Up to 1,500 financial transactions per second, which significantly exceeds the performance of other cryptocurrencies. |

| System openness | The entire transaction history can be checked using a special service. |

| Conversion | XRP can be converted to any currency. |

| Confidentiality | Information about transactions is publicly available, but information about payments is hidden. Therefore, it is difficult to associate information about the transfer with a specific user. |

| Weak decentralization | The main complaint of all critics is about the currency, because most of the tokens belong to the creators of the platform. |

basic information

Ripple belongs to the category of peer-to-peer ecosystems with an expanded network of gateways. The protocol does not use blockchain technology, which makes it significantly different from its competitors.

The translation of the word ripple from English means “ripple”. By naming the protocol this way, the creators wanted to emphasize the features of the platform:

- uninterrupted operation;

- cooperation with fast and reliable channels;

- performing complex financial transactions in real time.

The main purpose of the protocol is to improve the functions of the banking sector. It is known that the service supports different types of financial instruments:

- tokens;

- fiduciary money;

- live goods;

- mobile minutes or airline miles.

The cryptocurrency is called XRP, it exists within the Ripple system and is defined by unique units called drops. Users can do without XRP. But each account requires 20 units to protect against hacking and spam.

The XRP cryptocurrency received the highest rating from Wiste. The tool is called capable of competing on equal terms with the international interbank system Swift.

How much does ripple cost?

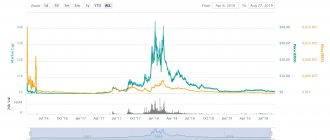

In 2013, the initial price of the Ripple coin at launch was $0.0059. The rapid rise in prices began in May 2022. In just 2 months, the rate increased 20 times.

The peak price was recorded in December 2022 – $3.65 per token. The reason for this growth was the big surge in the cryptocurrency market as a whole. However, in January 2022 there was a maximum drawdown of 68%.

As of April 2022, the XRP cryptocurrency rate is relatively stable, growing at a slow pace and quoted in the range of 0.17...$.

Course schedule

Today, banks increasingly prefer the Ripple system. The demand for services does not in any way affect the development of internal cryptocurrency. The coin is completely independent. The cost did not decrease even after a lawsuit was filed regarding the use of unconventional business patterns.

Just a year ago, the token cost less than $0.5. If you compare the price of XRP with the price of Bitcoin and Ethereum, the huge difference is obvious. This situation is explained by emission restrictions.

The cryptocurrency cannot be mined, unlike Bitcoin and Ethereum, since the tokens were issued with a warning about the emission limit. 100 billion is already in circulation. The Ripple protocol owns 61 billion coins, the rest have been released for sale.

RippleNet

We mentioned earlier that it is necessary to distinguish between the system and the tokens (XRP) of Ripple.

Speaking about the system, we mean RippleNet - a global payment system that makes it possible to carry out payments and exchange processes (transfers) in more than 40 currencies and serves more than 300 financial institutions around the world. Previously (until the fall of 2022), Ripple Net included three products: xVia, xCurrent and xRapid.

| xVia | An API-based product that is used by banks and other similar service providers to interact on a single payment platform (without the need to resort to integrating different payment networks). With xVia, financial institutions can make transfers through other partner banks that are connected to RippleNet and share any documentation regarding transactions carried out. |

| xCurrent | This solution serves for instant settlement and tracking of international payments between RippleNet users. It does not use the XRP cryptocurrency and is aimed primarily at working with fiat currencies. The system: provides instant communication between financial organizations participating in RippleNet; coordinates the movement of funds through the network; monitors transactions and the status of accounts of transaction participants; determines settlement rates. |

| xRapid | A system that uses XRP coins as a “bridge” to facilitate exchange between multiple fiat currencies. In the chain of transfer, for example, $100 into Russian rubles, Ripple coin (USD – XRP – RUB) appears, which significantly reduces the commission for the transfer operation and increases the speed of the transaction. |

In October 2022, Ripple rebranded and divided its products into two separate projects. The name RippleNet now covers two existing products: xVia, xCurrent. The xRapid product, tied to the promotion of the XRP cryptocurrency, is called “Liquidity on Demand”.

“Instead of purchasing xCurrent or xVia, customers will connect to the RippleNet network on premises or in the cloud, and instead of purchasing xRapid, they will use on-demand liquidity. These are not new products, but rebranding of existing products. This is a small change that will not affect our customers in any way,” company representatives said.

How to register a Ripple wallet

The developers have not created an official wallet for storing Ripple. Previously, it was possible to store XRP coins on the Ripple Trade trading service, but it closed in 2016.

Cryptocurrency representatives suggest storing Ripple on other well-known wallets, but do not give advice on which ones.

IMPORTANT

When creating a wallet for storing Ripple on any service, you must purchase at least 20 coins to activate your account in the Ripple system. These kyons will act as a reserve amount and cannot be withdrawn from the account.

Where to store XRP

The company’s official website states that Ripple does not support or give preference to any of the digital wallets. This choice is the user's responsibility. The company advises to conduct your own verification before entrusting your funds to third-party technologies.

You can store XRP in the following wallets:

- desktop, for example, Toast Wallet - is a special program for PC;

- online: Exarpy, GateHub, Toast, Guarda, Bitpanda – created on the corresponding web resource;

- in special applications: CoolWallet, ZebPay, Toast Wallet is a special mobile application for iOS/Android;

- on the wallets of exchanges and investment platforms: Binance, Kraken, Bittrex, etc. - most of these platforms have their own wallets for storing digital coins;

- paper - printout or manually written down address and secret key (the ability to generate a new address and print out a paper wallet is offered by the XRP explorer Bithomp website).

- hardware: CoolWallet, Keepkey, Trezor, Ledger - are not related to the operation of any electronic device or service.

Hardware wallet – serves for “cold” (without constant access to the Internet) storage of coins. Coins are not hosted on the network or on a server, but are located on a special device that looks like a regular flash drive.

How to work with ripple cryptocurrency

We have already noted that it will not be possible to obtain Ripple using mining. Tokens can be used for trading transactions by buying, selling or exchanging them on special trading platforms and exchanges. We recommend purchasing tokens on the Binance platform. There you can pay for tokens in rubles using a bank card.

How to buy XRP for rubles on the Binance exchange:

- register on the platform using your email address;

- undergo passport verification;

- on the “Buy Cryptocurrency” page, enter the required number of RXP tokens;

- Click the “Continue” button and select a bank card for payment.

How to exchange Ripple

With cryptocurrency, you can perform not only purchase and sale operations, but also exchange. For example, on Binance you can exchange XRP directly for any of the coins available on the platform. To lock in profits if Ripple's price falls, you can exchange it for the US dollar stablecoin Tether USDT. In addition to well-known cryptocurrencies such as Bitcoin and Tron, you can exchange XRP for tokens of new popular projects such as Solana or Polygon (Matic Network).

Mining XRP

Mining the Ripple cryptocurrency, in the traditional sense of the process, is not available. The reason is that XRP is a pre-mine coin (the developers have already released the required number of tokens). However, there are alternative methods for obtaining cryptocurrency. The latter include the following:

- Extraction of other digital assets through the use of available computing power of the equipment, followed by the conversion of cryptocurrency into XRP.

- Earning money through “faucets” - services that offer payments in cryptocurrency for completing certain tasks (for example, entering a captcha).

- Participation in giveaway (distribution of tokens). Announcements about the latter can be found on thematic forums, including bitcointalk.

It is noteworthy that previously giveaways were organized by Ripple representatives themselves.

Reviews about Ripple cryptocurrency

More than 85% of reviews about the XRP coin are positive. Traders call the currency “the future of transactions”, “the future of the cryptocurrency market”, “an up-and-coming cryptocurrency”, “a great investment”, etc.

Enthusiastic comments from investors are based on the following:

- This cryptocurrency is not like other digital money, it promises income in the future (growing slowly but surely), i.e. it is really possible to make money on it in the long term;

- Ripple is not anti-banking, which means it is a safe investment;

- fast transfers between countries with negligible commission;

- there is a prospect of using the coin in bank transfers from Visa, MasterCard;

- there is a risk of depreciation, but the owner loses little;

- unique transaction protection.

However, you should not ignore the negative reviews about XRP. A number of traders believe that Ripple has no future, because the XRP coin and the Ripple system are different things. Banks are not interested in switching to xRapid, so there is no need to expect an increase in the cryptocurrency rate.

Earlier we said that Ripple has 3 systems. Most banks work with xCurrent, and the coin is based on xRapid.

Also added to the arguments of negative or skeptical commentators are doubts about the decentralization of the currency (more than 60% in the hands of developers) and the presence of strong competitors.

Conclusion

Ripple, although remotely, is a decentralized system that has its own cryptocurrency. It is beneficial for an ordinary user to use Ripple to transfer funds to other cities and countries, but it is unlikely to be possible to use Ripple as a speculative element when playing on the exchange rate. Ripple is still designed for the banking system, and not for the average user. Therefore, the system itself is stable and secure, which is a big plus and inspires trust.

Against this background, the rate of the system’s coins – RXP – will grow steadily. You can invest in it, but don’t expect a high value of the coin in the future: the coin was created to pay transaction fees, and the main goal of creating the entire Ripple system is transfers with a minimum commission.

Prospects and forecast for 2022 for the ripple cryptocurrency

Analysts say that the prospects for the development of the XRP token are more than rosy. Soon this currency will push such powerful systems as SWIFT and Western Union out of the market.

- More than 40 international financial organizations cooperate with Ripple, saving about $4 on each transaction using the system.

- There are ample opportunities to pay XRP in many online stores (for example, Google Express, eBay, Amazon) or book hotels and airline tickets using coins.

- Active developments are underway to introduce Ripple into the field of law and games.