Fiat currencies emerged during the process of transforming the economic system, when the exchange of goods was replaced by the use of a universal means of paying for something - money.

At first, coins made of valuable metals were used as currency - their cost was high in itself. And because of the unstable value of coins and the limited ability to produce them, fiat money was created - the bills that we use in the modern world.

So, if we give a general definition of this term, then it will sound like this: fiat money is symbolic currencies (most often paper), the denomination and issue of which are regulated with the help of government authorities (the central bank).

With the development of Internet technologies, it has become possible to transfer fiat money into digital fiat money - these are the same dollars, only they are stored in a bank account or in another payment system.

Currently, many types of currencies are known - dollars, euros, francs, rubles, yuan, etc. Cryptographic currency, similar to fiat currency, comes in many types, about the most popular ones, read the article: Types of cryptocurrencies and their features

But the next step in the development of commodity-money relations was the emergence of cryptocurrencies. This money is not tied to any bank - and this is its great advantage.

However, the connection between these methods of paying for goods and services is, of course, established. Let's take a closer look at how you can exchange fiat for crypto and vice versa.

Spot wallet on the Binance exchange: what is it?

Spot transactions (from the English spot - on the spot) first appeared in the era of VGO, in the first joint-stock companies. So this contract was concluded at the time of exchange, and with the advent of the Internet, trading from such a wallet means instant transfer of funds.

Binance does not participate in spot trading. Only the owner of the cryptocurrency or the buyer can publish an order (order) to buy or sell cryptocurrency. In this case, two requirements are met:

- The seller remains the holder of the asset only until the transaction is completed.

- The buyer receives rights to the asset after the pair closes.

The exchange rate is called the spot price. It does not change during the transaction.

In the securities market, only fiat currencies (rubles, dollars, euros) are used for the purchase and sale of shares and bonds. On Binance you can top up with cryptocurrency and exchange it for another token, for example, BitCoin for Binance Coin.

Starting a wallet and going through verification: instructions for dummies

Spot deposit is available after registration. To do this, go to the main page and click on the “ Registration ” button:

Select your country (can be changed). This will affect the currency and language:

This window will appear after clicking the button

On the page that opens, enter your email and create a password:

Complete the captcha and confirm your email.

I recommend using Gmail: letters arrive in Yandex.Mail and Mail.ru with a delay of 5–10 minutes. If you need webmoney, then read the article.

The created account is limited: you cannot buy or withdraw tokens from it. To unlock these functions, you need to provide your full name, date of birth, place of residence:

Then select a document to confirm and upload its photo:

Within 10 days after uploading the photo, your account will be approved and you will begin bidding.

Register a fiat wallet on Binance

Fiat is the usual money we use to pay in the store. Cryptocurrency is purchased for them. On Binance they are stored in a spot wallet. Topped up without verification and available immediately after payment.

How are fiat and cryptocurrency related?

Today, more and more people are starting to invest in cryptocurrency. Many make money on digital money exchanges or develop their own startups in this area. But this does not mean that these people have already completely switched to a more modern system of payment for goods and services - perhaps every user has a need to use fiat money.

Therefore, in order to carry out various types of transactions, there are special services that perform exchanges. Today, any Internet user can create a digital wallet and transfer fiat money to it. Then, using additional services or cryptocurrency exchanges, convert, for example, American dollars into bitcoins. Moreover, this can be done in a few minutes and you will not have any problems with it.

So, in order to make a profitable exchange, you should use the following transaction options:

- Using exchangers . Today you can find various online services on the Internet - you can find out more about them here. In addition, if you live in a large city, chances are that there are offline companies where you can transfer fiat to cryptocurrency and vice versa;

- Digital currency exchanges. Be careful if you want to make an exchange through an exchange - not every such resource supports fiat. Therefore, when choosing a platform, you need to check the availability of this function. Good options would be, for example, YoBit or Exmo;

- P2p services . These types of platforms allow you to buy any cryptocurrency for fiat money from other users. Or sell it. Among such resources we can highlight PerfectMoney or Payeer;

- Webmoney . This payment system has recently made working with digital money available. You can make conversions directly within the service itself, without withdrawing money outside. Among other similar payment resources, Advcash can also be distinguished.

To make a profitable transaction, it is better to look and compare different options. This will allow you to choose the best exchange rate and not lose a single extra cent on conversion.

How to top up a spot wallet

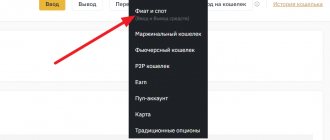

There are three deposit methods: cryptocurrency, fiat and peer-to-peer. All sections are located in the “ Buy Cryptocurrency ” drop-down menu.

Using a stablecoin

Stablecoins differ from standard crypto in that they are tied to a physical asset: fiat currency or valuable resources. As a rule, the rate of such tokens is more stable.

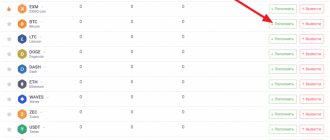

The control panel for your wallet (in the English version of wallet) and coins is located in the “ Wallet ” > “ Fiat and Spot ” menu:

The spot panel has three sections:

- Balance. Four values: total, fiat, cryptocurrency deposit and PNL (the difference between the wallet for yesterday and today, calculated by the formula).

- Fiat. Detailed statistics on the number of official currencies with their equivalent in Bitcoin.

- Crypt. Dashboard of purchased cryptocurrency.

The screenshot shows an example with Monero (XMR), the equivalent of the token for convenience is displayed by Binance in BTC. To deposit coins, click on the “ Enter ” button next to the trading pair:

Afterwards, a window will open with the address for transfer and instructions. Fill in the fields and confirm the withdrawal with an SMS code.

We top up with fiat

Crypto is purchased through fiat gateways (acquiring companies) Binance, Simplex or Mercuryo. In the interface of the exchange itself, you just need to enter and save the card once.

Receiving via P2P

This method is only available to verified Binance users.

P2P (short for Peer-To-Peer) is a direct market where traders directly exchange tokens without commission, for example, to withdraw Ethereum, Ripple or LiteCoin to a cash (USD or USDT) exchange you need to pay a commission, and exchangers will do it for free.

The only negative is fraud: the transaction can be interrupted by appropriating all the coins. For security, you need a guarantor; for Binance, this is the company itself. You can also identify scammers by negative reviews.

To withdraw directly to the card, I advise you to look for buyers on forums (the industry is well developed) or the crypto exchange itself:

What is Peer2Peer

The P2P market is only available after basic verification.

Available balance withdrawals on Binance

Users who have not passed KYC can withdraw money from the exchange only in cryptocurrency; the maximum withdrawal threshold is equivalent to two bitcoins, which is more than enough for many small traders.

Upon completion of identity verification, the client has the opportunity to deposit and withdraw funds in 16 fiat currencies, including Russian rubles. You can withdraw rubles both to a bank card (Visa/MC/MIR) and to electronic wallets Advcash, Payeer and Yoomoney (Yandex Money).

Fiat Transfer ” (+ 0% Fee) appeared

Important! For unverified users, it is blocked and next to it, in the “Information about withdrawal of funds” column, there is a reminder about the need to complete KYC and a “Pass verification now” button.

How to withdraw and transfer from a spot wallet

You should not save money in a spot account. It is better to immediately transfer them to another asset or withdraw them: the exchange account can be hacked and the savings stolen.

To spot and fiat wallet

In the PU, click on “Withdraw” next to the currency:

The translation window will open. For fiat, this is the choice of a bank card, for crypto – a wallet:

The coins will be sent automatically.

Binance charges a minimum commission, and daily withdrawals are limited to 100 BTC.

Transfer to P2P

We return to the user market. Select “ Sell ”, set the exchange currency and payment method:

Further:

- We create an order and indicate a fixed price.

- We select a buyer and provide the details.

- We confirm receipt of money and transfer the crypto.

The exchange amount should not be less than 0.01 and more than 5 BTC.

Frequent problems with withdrawals from Binance?

1. The seller made the payment via P2P, but the money did not arrive on the card. Solution: wait another 10 minutes, if there is no money, then click the appeal button and attach all the evidence. Support will sort it out within 2 days.

2. The card was entered incorrectly. In this case, it will not be possible to return the money.

3. When withdrawing money from Binance, there is no Card (Visa / Mastercard) . In this case, you will have to use P2P withdrawal.

Types of orders on Binance

The spot wallet allows 4 types of transactions.

Limit

You place an order to buy or sell an asset at a specific price, after which it goes into the general screener (selection) and is available to all traders.

The transaction is closed automatically when the amount is paid in full. If only a part is closed, the application continues to be displayed.

Market

The request specifies only the amount of crypto: the transaction is instantly closed at the current market price. If there is no lot with the required amount of currency, then several small offers are accepted (sometimes with a fluctuating price).

Stop Limit

In the stock market, this strategy is called “Take Profit”.

The offer is issued when the set peak value is reached. In contrast to the “Limit”, a new “ Stop ” indicator appears: the upper threshold at which the order will be sent to the order book. I advise you to read about the TOP cryptocurrencies on binance.

CCA

A combination of the “Limit” and “Stop-Limit” types: an order is placed with the initial price and the maximum price at which the price will be changed (“Stop”). If you closed a limit type request, then “Stop Limit” will not work, and when the peak is reached, the first request will be closed.

How to transfer cryptocurrency from wallet to wallet

Transferring cryptocurrency between wallets is not a very complicated operation, but you need to take a couple of nuances into account. First, let's look at the basic concepts that will be useful for completing a transaction.

Address

A cryptocurrency address is an alphanumeric code that performs the function of details, that is, it must be transferred to the person or service from whom you expect the transfer. The first address is generated at the time the wallet is created, and then after each new incoming transaction a new one is generated (but the old ones also remain valid). This only applies to HD wallets and is intended to enhance privacy.

Examples of addresses:

- Bitcoin – 1HuCoA44g8yJFLwn9sNK58bmSKuEGbQDy8

- Ethereum – 0x8E60b055656Beb228dd78b843358517BE4e100a1

- Polkadot – 14Kazg6SFiUCH7FNhvBhvr4WNfAXVtKKKhtBQ1pvXzF1dQhv

- Cardano – 01e8fd95f243f08b4ae6f79e7962e661f8460b9e11965530cd0c133725e8fd95f243f08b4ae6f79e7962e661f8460b9e11965530cd0c133725

- Binance Coin – 0x6BBad7Cf34b5fA511d8e963dbba288B1960E75D6

In a cryptocurrency wallet, the address can always be found in the Receive or Receive section, copied in one click, or used using a QR code.

To anonymize transactions, special Bitcoin mixers are used - these services break payments into many small ones and mix them, so no one can match a specific address with your identity even if they try.

Commissions

Unlike traditional financial institutions, commissions in the blockchain do not go to any centralized company or founder, but to miners or stakers, that is, the people who keep the network running. Miners and stakers confirm the validity of transactions, form blocks from them and add them to the blockchain. For this they receive a reward from the network, as well as commissions from all transactions included in the block.

From this brief educational program it follows that miners benefit when the transaction fee is high, and they will process such a payment as a priority.

Some wallets allow you to adjust the size of the commission, others automatically set priority so that the payment goes through as quickly as possible. You should not set a low commission, otherwise the transaction may hang in the queue for a long time.

Translation process

Transferring cryptocurrency from a wallet to another address involves several basic steps:

- Go to the wallet section called Send or Send.

- Insert the recipient wallet address.

- Enter the amount of currency to be sent.

- Set up a commission if your wallet allows it.

- Carefully check the entered data and confirm the operation.

Using a mobile wallet, you can also send cryptocurrency by scanning a QR code.

Transferring cryptocurrency via Atomic Wallet

How the spot market differs from other types of trading

The spot market is the basis for other markets. The objective is established only on it thanks to the turnover of assets owned by traders. The rest of the trading is carried out using credit money or contracts.

Margin transactions

This is a highly rewarding, but very risky type of trading. Analysis of each contract is important.

Unlike spot orders, where it is mandatory to own the asset, it uses borrowed funds to increase earnings. So a user, having $100, will use up to $1000, that is, the margin leverage (in simple words, a multiplier) is x10. At the same time, you will not be the full owner of the currencies you are buying and selling.

Futures

The futures market (from the English futures - futures contract) market is very different from the margin market. On it you purchase not tokens, but contracts, that is, you bet on a decrease or increase in price. Each futures contract obliges you to purchase or sell crypto in the future.

The use of leverage is also allowed. Futures transactions focus on short (short-term) positions, so credit is used much more efficiently than in margin transactions.

Options

The same futures with a difference in obligations: when an option is concluded, only the seller is obliged to buy the asset, and the buyer may not fulfill the terms of the contract.

Taxation of cryptocurrencies

In different countries, the government has different views on cryptocurrencies and their regulation. Thus, in the Republic of Belarus until 2023 this area is not subject to tax. As for the Russian Federation, in mid-February 2022, the Tax Committee of the State Duma approved a bill on the taxation of cryptocurrencies, including the following main provisions:

- Cryptocurrency is property. Income from it is subject to personal income tax (NDFL) or profit tax.

- VAT (value added tax) is not provided.

- Tax authorities have the right to demand statements of transactions on the accounts of individuals in case of suspicion of violation of tax laws.

- You need to declare turnover over 600,000 rubles.

- Fines for violating the law are 10% of the unpaid amount. +50,000 rubles for individuals and companies that have not confirmed their right to use cryptocurrency.

The document has already been approved by the State Duma in the first reading. If adopted, the corresponding amendments will be made to the basic law “On Digital Financial Assets”, which has been in force since the beginning of 2021.